Global Hygienic Pipelines/Tubes Market Size, Trends & Analysis - Forecasts to 2026 By Product Type (Stainless Steel Pipelines, Plastic Pipelines, Others [Silver, Titanium, Composite]), By End-Use (Food & Beverage, Pharmaceutical, Chemical, Other Processing Plants) By Distribution Channel (Direct Sales, Distribution Sales), Competitive Landscape, Company Market Share Analysis, and Competitor Analysis

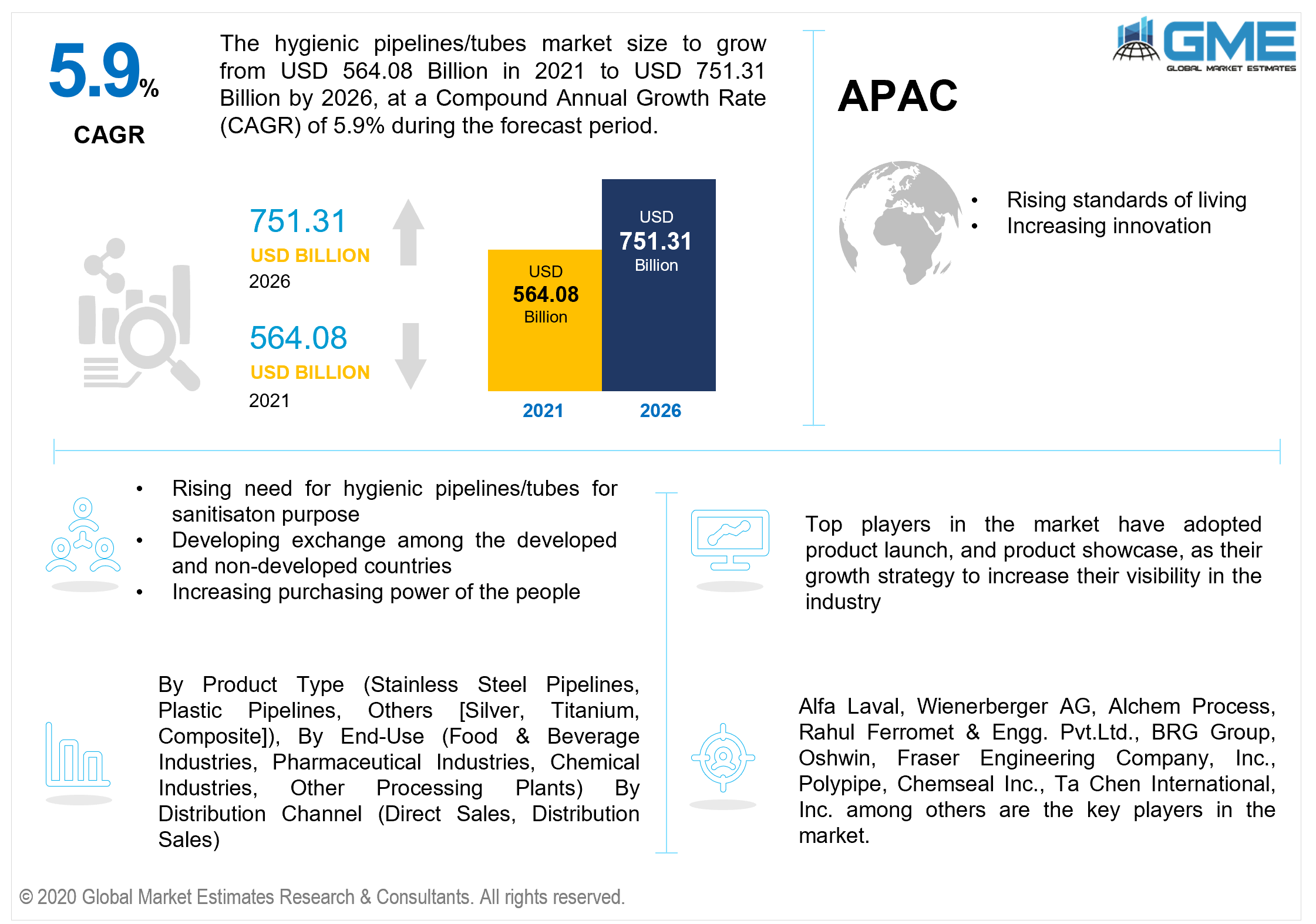

The hygienic pipelines/tubes market is estimated to be valued at USD 564.08 billion in 2021 and is projected to reach USD 751.31 billion by 2026 at a CAGR of 5.9%. Hygienic pipelines/tubes perform a significant function in many sectors because hygiene and sanitary are critical factors in the prosperous and efficient deployment of production and processing plants. In hygienic piping frameworks, the cleaning and sanitization measure represents 66% of the time and the leftover time is dedicated to processing designing. The market is assessed to develop at a critical CAGR over the forecast period because of the expanding applications in the pharmaceutical and food & beverage end-user sectors worldwide. Besides, innovations and creations in the market will reinforce the market development over the forecast period.

Additionally, developing trade among developed and developing countries has prompted large-scale monetary exchange in the global market, which aids in the expansion of the overall demand and market share. The exclusive standards of living are accompanied by high buying power, which is a key development factor for the market. This, simultaneously, is projected to set out a few growth prospects for the market. Moreover, the increasing research activities and soaring awareness across developed nations will support the overall market growth.

All the reachable surfaces of hygienic pipelines/tubes, which are in contact with items like fluid medication, food, or drink, should not be retained, caught, or relocated by the item and should be inert to the item under completely determined conditions. The inward centerline of the hygienic pipeline/tube is shielded from outside pressure and outer corrosion to extensively expand the existence of the pipeline. Such pipelines/tubes support the working pace and also the efficiency of the plant. Moreover, with such pipelines/tubes, the steady condition of fluids can be kept up by paying little heed to the environment or geography.

Hygienic pipelines/tubes ought to have standard highlights, for example, smooth surface completion and non-porosity so little media or liquid particles, insect eggs, and microorganisms are not moved or trapped on the minute surface of the piping as these unfamiliar particles are hard to dislodge and turn into a conspicuous wellspring of contamination.

There are two cycles for constant cleaning of hygienic pipelines/tubes, namely (Steam In Place) and CIP (Clean In Place). SIP systems are supposed to persistently steam the regions of contact, including stream ways, test ports, and vessels, though CIP is the way toward cleaning and sanitizing the inside surfaces of such pipelines/tubes, channels, hardware, and related fittings without dismantling the pipelines. Mostly, the process of CIP is refined with the assistance of extraordinary synthetics.

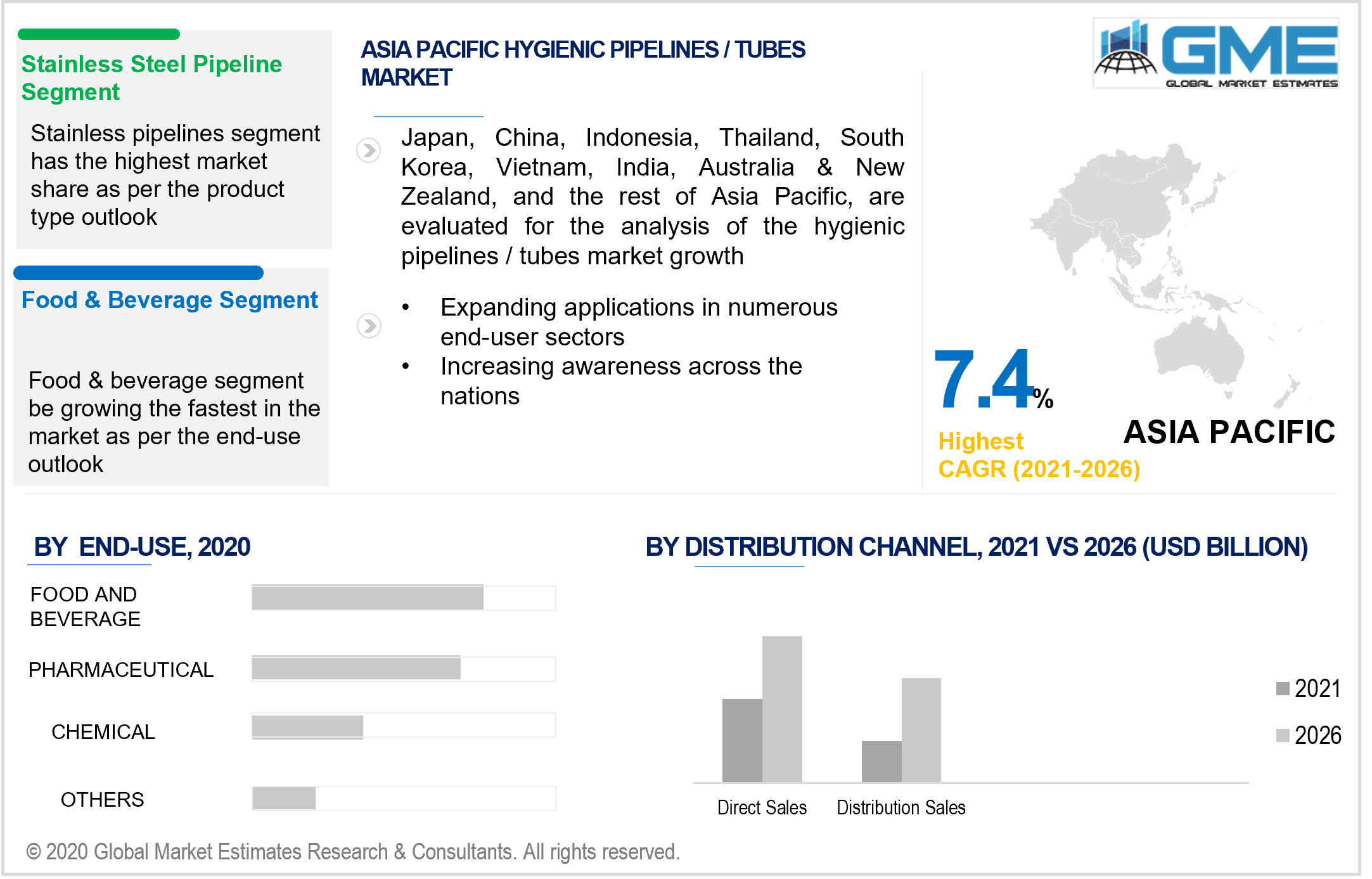

Based on the product type, the market can be segregated into stainless steel pipelines, plastic pipelines, and others. Others include silver, titanium, and composites. Stainless steel is observed to have an increase in market growth in the coming years as it adds helpful properties. For example, expanded corrosion resistance and improved formability since nickel and molybdenum are utilized. The advantages of utilizing stainless steel in various ventures due to its stylish appearance, phenomenal corrosion resistance, fire & heat resistance, simplicity of creation, supportability, aids in its supremacy.

Stainless steel isn't only a combination, however, a progression of various structures intended to give explicit properties and intended for various applications. It varies from carbon steel by the measure of chromium present. Stainless steel contains an adequate measure of chromium, so a layer of chromium oxides forms which prevents further corrosion.

A plastic pipeline is generally a roundabout cross-area, utilized mostly to pass on substances that can stream, for example, fluids and gases (liquids), slurries, powders, and masses of small solids. Plastic lines are ordinarily utilized for the ordinary movement of fluids and gases. Crude materials like Polyvinyl chloride (PVC), Polypropylene (PP), and Polyethylene (PE) are utilized in assembling plastic lines and shapes.

Based on consumer analysis or end-user analysis, the market can be segmented into food & beverages, pharmaceuticals, chemical, and other processing plants. The food & beverage segment is foreseen to predominate. Attributing to the increment in automation and innovation, online Clean In Place (CIP) has been in incredible demand interest in food & beverage areas. Hygiene pipelines/tubes assume a significant part in the above areas, as neatness and disinfection are the chief factors for effective sanitization maintenance and core functioning.

Most food and beverage processing sectors use sanitary pipelines/tubes to ensure the optimal operation of fluid inside a pipeline. The convenience of implementation and innumerable other advantages provided by such pipelines/tubes makes them a favored hydrodynamic transportation mode amongst the majority of end-use sectors, which operate as a significant driver for the global market.

Based on the distribution channel, the market can be segregated into direct sales and distribution sales. Distribution sales are presumed to predominate because they have low sales, marketing, and distribution costs. It aids in effective scaling and incurs a low cost for expanding into new markets.

As per the geographical analysis, the market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central South America (Brazil, Argentina, and Rest of Central and South America).

North America is presumed to hold a significant market share. Customers in this area have high living standards as well as elevated buying capacity, which is a pivotal expansion criterion for the pharmaceutical, food, and beverage sectors. As a result, the market in these areas is foreseen to grow significantly. Furthermore, increased commerce between advanced and developing countries has resulted in more favorable economic and financial environments in the market.

The Asia-Pacific region is presumed to report the highest CAGR because of the growing number of implementations in all end-use sectors. In addition, technological advances and discoveries in the market will drive overall growth over the forecast period. The forces influencing global business have resulted in a momentous development in regional commerce, contributing to the preconception that the world has shrunk and become more mutually dependent.

Alfa Laval, Wienerberger AG, Alchem Process, Rahul Ferromet & Engg. Pvt.Ltd., BRG Group, Oshwin, Fraser Engineering Company, Inc., Polypipe, Chemseal Inc., Ta Chen International, Inc. among others are the key players in the market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview And Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Hygienic Pipelines/Tubes Industry Overview, 2019-2026

2.1.1 Industry Overview

2.1.2 Product Type Overview

2.1.3 End-Use Overview

2.1.4 Distribution Channel Overview

2.1.5 Regional Overview

Chapter 3 Hygienic Pipelines/Tubes Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2019-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Rising Application In Various End-Use Industries

3.3.1.2 Ease Of Application And Numerous Other Benefits

3.3.2 Industry Challenges

3.3.2.1 Limited Study And Market Participants

3.4 Prospective Growth Scenario

3.4.1 Product Type Growth Scenario

3.4.2 End-Use Growth Scenario

3.4.3 Distribution Channel Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.7 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Hygienic Pipelines/Tubes Market, By Product Type

4.1 Product Type Outlook

4.2 Stainless Steel Pipelines

4.2.1 Market Size, By Region, 2019-2026 (USD Billion)

4.3 Plastic Pipelines

4.3.1 Market Size, By Region, 2019-2026 (USD Billion)

4.4 Others

4.4.1 Market Size, By Region, 2019-2026 (USD Billion)

4.4.2 Market Size, By Silver, 2019-2026 (USD Billion)

4.4.3 Market Size, By Titanium, 2019-2026 (USD Billion)

4.4.4 Market Size, By Composite, 2019-2026 (USD Billion)

Chapter 5 Hygienic Pipelines/Tubes Market, By End-Use

5.1 End-Use Outlook

5.2 Food & Beverage

5.2.1 Market Size, By Region, 2019-2026 (USD Billion)

5.3 Pharmaceutical

5.3.1 Market Size, By Region, 2019-2026 (USD Billion)

5.4 Chemical

5.4.1 Market Size, By Region, 2019-2026 (USD Billion)

5.5 Other Processing Plants

5.5.1 Market Size, By Region, 2019-2026 (USD Billion)

Chapter 6 Hygienic Pipelines/Tubes Market, By Distribution Channel

6.1 Distribution Channel Outlook

6.2 Direct Sales

6.2.1 Market Size, By Region, 2019-2026 (USD Billion)

6.3 Distribution Sales

6.3.1 Market Size, By Region, 2019-2026 (USD Billion)

Chapter 7 Hygienic Pipelines/Tubes Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2019-2026 (USD Billion)

7.2.2 Market Size, By Product Type, 2019-2026 (USD Billion)

7.2.3 Market Size, By End-Use, 2019-2026 (USD Billion)

7.2.4 Market Size, By Distribution Channel, 2019-2026 (USD Billion)

7.2.5 U.S.

7.2.5.1 Market Size, By Product Type, 2019-2026 (USD Billion)

7.2.5.2 Market Size, By End-Use, 2019-2026 (USD Billion)

7.2.5.3 Market Size, By Distribution Channel, 2019-2026 (USD Billion)

7.2.6 Canada

7.2.6.1 Market Size, By Product Type, 2019-2026 (USD Billion)

7.2.6.2 Market Size, By End-Use, 2019-2026 (USD Billion)

7.2.6.3 Market Size, By Distribution Channel, 2019-2026 (USD Billion)

7.3 Europe

7.3.1 Market Size, By Country 2019-2026 (USD Billion)

7.3.2 Market Size, By Product Type, 2019-2026 (USD Billion)

7.3.3 Market Size, By End-Use, 2019-2026 (USD Billion)

7.3.4 Market Size, By Distribution Channel, 2019-2026 (USD Billion)

7.3.5 Germany

7.3.5.1 Market Size, By Product Type, 2019-2026 (USD Billion)

7.3.5.2 Market Size, By End-Use, 2019-2026 (USD Billion)

7.3.5.3 Market Size, By Distribution Channel, 2019-2026 (USD Billion)

7.3.6 UK

7.3.6.1 Market Size, By Product Type, 2019-2026 (USD Billion)

7.3.6.2 Market Size, By End-Use, 2019-2026 (USD Billion)

7.3.6.3 Market Size, By Distribution Channel, 2019-2026 (USD Billion)

7.3.7 France

7.3.7.1 Market Size, By Product Type, 2019-2026 (USD Billion)

7.3.7.2 Market Size, By End-Use, 2019-2026 (USD Billion)

7.3.7.3 Market Size, By Distribution Channel, 2019-2026 (USD Billion)

7.3.8 Italy

7.3.8.1 Market Size, By Product Type, 2019-2026 (USD Billion)

7.3.8.2 Market Size, By End-Use, 2019-2026 (USD Billion)

7.3.8.3 Market Size, By Distribution Channel, 2019-2026 (USD Billion)

7.3.9 Spain

7.3.9.1 Market Size, By Product Type, 2019-2026 (USD Billion)

7.3.9.2 Market Size, By End-Use, 2019-2026 (USD Billion)

7.3.9.3 Market Size, By Distribution Channel, 2019-2026 (USD Billion)

7.3.10 Russia

7.3.10.1 Market Size, By Product Type, 2019-2026 (USD Billion)

7.3.10.2 Market Size, By End-Use, 2019-2026 (USD Billion)

7.3.10.3 Market Size, By Distribution Channel, 2019-2026 (USD Billion)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2019-2026 (USD Billion)

7.4.2 Market Size, By Product Type, 2019-2026 (USD Billion)

7.4.3 Market Size, By End-Use, 2019-2026 (USD Billion)

7.4.4 Market Size, By Distribution Channel, 2019-2026 (USD Billion)

7.4.5 China

7.4.5.1 Market Size, By Product Type, 2019-2026 (USD Billion)

7.4.5.2 Market Size, By End-Use, 2019-2026 (USD Billion)

7.4.5.3 Market Size, By Distribution Channel, 2019-2026 (USD Billion)

7.4.6 India

7.4.6.1 Market Size, By Product Type, 2019-2026 (USD Billion)

7.4.6.2 Market Size, By End-Use, 2019-2026 (USD Billion)

7.4.6.3 Market Size, By Distribution Channel, 2019-2026 (USD Billion)

7.4.7 Japan

7.4.7.1 Market Size, By Product Type, 2019-2026 (USD Billion)

7.4.7.2 Market Size, By End-Use, 2019-2026 (USD Billion)

7.4.7.3 Market Size, By Distribution Channel, 2019-2026 (USD Billion)

7.4.8 Australia

7.4.8.1 Market Size, By Product Type, 2019-2026 (USD Billion)

7.4.8.2 Market size, By End-Use, 2019-2026 (USD Billion)

7.4.8.3 Market Size, By Distribution Channel, 2019-2026 (USD Billion)

7.4.9 South Korea

7.4.9.1 Market Size, By Product Type, 2019-2026 (USD Billion)

7.4.9.2 Market Size, By End-Use, 2019-2026 (USD Billion)

7.4.9.3 Market Size, By Distribution Channel, 2019-2026 (USD Billion)

7.5 Latin America

7.5.1 Market Size, By Country 2019-2026 (USD Billion)

7.5.2 Market Size, By Product Type, 2019-2026 (USD Billion)

7.5.3 Market Size, By End-Use, 2019-2026 (USD Billion)

7.5.4 Market Size, By Distribution Channel, 2019-2026 (USD Billion)

7.5.5 Brazil

7.5.5.1 Market Size, By Product Type, 2019-2026 (USD Billion)

7.5.5.2 Market Size, By End-Use, 2019-2026 (USD Billion)

7.5.5.3 Market Size, By Distribution Channel, 2019-2026 (USD Billion)

7.5.6 Mexico

7.5.6.1 Market Size, By Product Type, 2019-2026 (USD Billion)

7.5.6.2 Market Size, By End-Use, 2019-2026 (USD Billion)

7.5.6.3 Market Size, By Distribution Channel, 2019-2026 (USD Billion)

7.5.7 Argentina

7.5.7.1 Market Size, By Product Type, 2019-2026 (USD Billion)

7.5.7.2 Market Size, By End-Use, 2019-2026 (USD Billion)

7.5.7.3 Market Size, By Distribution Channel, 2019-2026 (USD Billion)

7.7 MEA

7.7.1 Market Size, By Country 2019-2026 (USD Billion)

7.7.2 Market Size, By Product Type, 2019-2026 (USD Billion)

7.7.3 Market Size, By End-Use, 2019-2026 (USD Billion)

7.7.4 Market Size, By Distribution Channel, 2019-2026 (USD Billion)

7.7.5 Saudi Arabia

7.7.5.1 Market Size, By Product Type, 2019-2026 (USD Billion)

7.7.5.2 Market Size, By End-Use, 2019-2026 (USD Billion)

7.7.5.3 Market Size, By Distribution Channel, 2019-2026 (USD Billion)

7.7.6 UAE

7.7.6.1 Market Size, By Product Type, 2019-2026 (USD Billion)

7.7.6.2 Market Size, By End-Use, 2019-2026 (USD Billion)

7.7.6.3 Market Size, By Distribution Channel, 2019-2026 (USD Billion)

7.7.7 South Africa

7.7.7.1 Market Size, By Product Type, 2019-2026 (USD Billion)

7.7.7.2 Market Size, By End-Use, 2019-2026 (USD Billion)

7.7.7.3 Market Size, By Distribution Channel, 2019-2026 (USD Billion)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 Alfa Laval

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Info Graphic Analysis

8.3 Wienerberger AG

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info Graphic Analysis

8.4 Alchem Process

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info Graphic Analysis

8.5 Rahul Ferromet & Engg. Pvt.Ltd.

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info Graphic Analysis

8.6 BRG Group

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info Graphic Analysis

8.7 Oshwin

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info Graphic Analysis

8.8 Fraser Engineering Company, Inc.

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.9 Polypipe

8.9.1 Company Overview

8.9.2 Financial Analysis

8.9.3 Strategic Positioning

8.9.4 Info Graphic Analysis

8.10 Chemseal Inc.

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info Graphic Analysis

8.11 Ta Chen International

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info Graphic Analysis

8.12 Other Companies

8.12.1 Company Overview

8.12.2 Financial Analysis

8.12.3 Strategic Positioning

8.12.4 Info Graphic Analysis

The Global Hygienic Pipelines/Tubes Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Hygienic Pipelines/Tubes Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS