Global Imaging Chemicals Market Size, Trends & Analysis - Forecasts to 2028 By Product Type (Imaging Agents and Toners, Printing Inks, Image Developers, and Others), By Application (Medical, Packaging and Printing, Textile, Mining, and Others), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

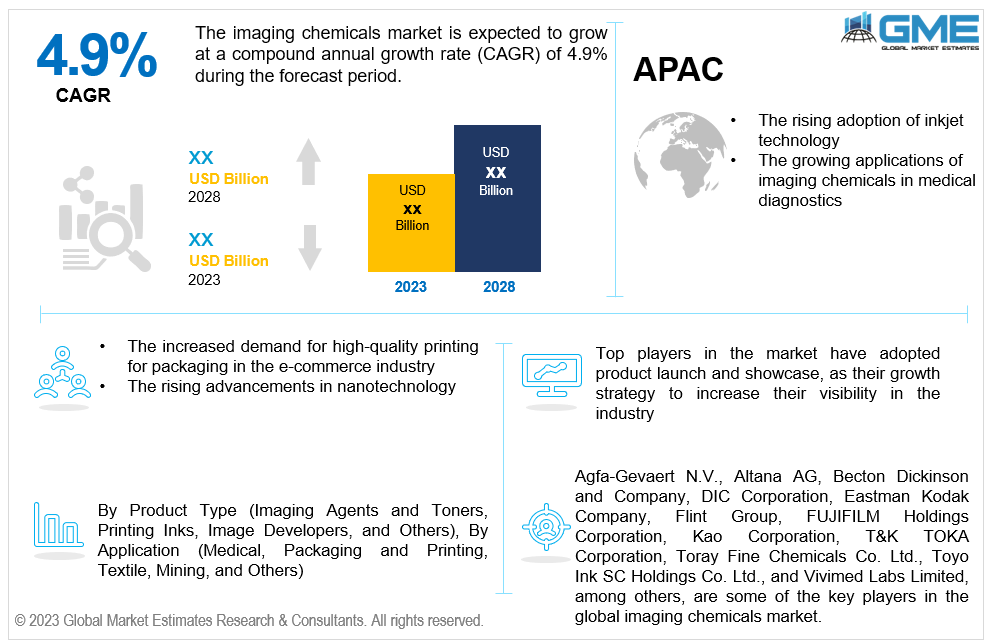

The global imaging chemicals market is estimated to exhibit a CAGR of 4.9% from 2023 to 2028.

The key factors propelling the market growth are the rising adoption of inkjet technology and the growing applications of imaging chemicals in medical diagnostics, including X-ray imaging, MRI, and other medical imaging techniques. Specialized imaging chemicals used for magnetic resonance imaging (MRI) are required due to the growing usage of MRI in medical diagnoses. MRI imaging chemicals, such as contrast agents and other related materials, are essential for improving the clarity and quality of pictures obtained during MRI scans. Moreover, the development and adoption of advanced chemicals for medical imaging contribute significantly to the market growth. These chemicals are designed to fulfill the unique demands of different medical imaging modalities, guaranteeing the best possible outcomes for contrast, sharpness, and precision of diagnosis. For instance, according to the Diagnostic Imaging Dataset Annual Statistical Release 2019/20, in England, 44.9 million imaging tests were recorded in the year ending in March 2019 as compared to 44.8 million the year before, a 0.3% rise.

The increased demand for high-quality printing for packaging in the e-commerce industry along with the rising advancements in nanotechnology are expected to support the market growth throughout the forecast period. The use of imaging contrast agents in packaging helps enhance the visual appeal of product labels, logos, and other graphic elements. By improving contrast and color brightness, these chemicals help increase packaging appeal to customers. Additionally, specialized industrial imaging chemicals are needed for the use of new printing technologies in industrial contexts, including packaging facilities for online retailers. These chemicals are formulated to work seamlessly with modern printing equipment, ensuring optimal printing quality. For instance, according to the US Department of Commerce Retail Indicator Division, in the United States, e-commerce sales reached $870 billion in 2021, up 14.2% from 2020 and 50.5% from 2019. The U.S., e-commerce accounted for 13.2% of total retail sales in 2021.

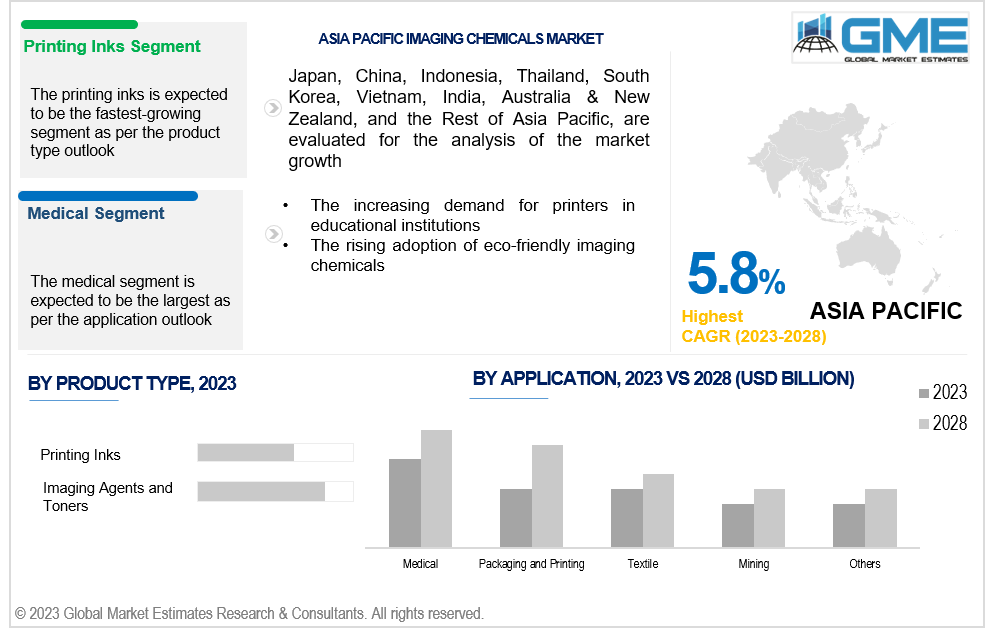

The increasing demand for printers in educational institutions and the rising adoption of eco-friendly imaging chemicals are propelling the global imaging chemical market growth. Comprehensive imaging chemical solutions that are specifically designed to fulfill the demands of producing educational materials are required due to the increased demand for printers in educational institutions. For textbooks, workbooks, and other educational materials, obtaining the best print quality requires the use of imaging chemical solutions. Moreover, printers are used at educational institutions for many purposes, such as research papers, handouts, administrative documents, and visual materials. Imaging chemical applications encompass various printing tasks within educational settings, ensuring versatility in meeting printing needs.

Continuous improvements in medical imaging technology, especially radiography, present opportunities. The demand for specialized radiographic imaging chemicals is expected to grow as medical institutions seek improved contrast agents for diagnostic imaging. Additionally, the increasing emphasis on sustainability presents an opportunity for imaging chemical suppliers to develop and offer eco-friendly formulations. Green solutions can fulfill industry demands for more environmentally friendly options. However, the higher cost of image printing and the adoption of paperless practices are hindering market growth.

The imaging agents and toners segment is expected to hold the largest share of the market. The use of imaging agents and toners has increased with the development of digital printing technology, such as digital presses. These substances are essential to digital printing processes, which meet the need for changeable data and on-demand printing. Moreover, imaging agents and toners are developed with a focus on imaging chemical safety compliance. Formulations follow legal requirements, guaranteeing that these substances can be utilized in imaging equipment without endangering human health or the environment.

The printing inks segment is expected to be the fastest-growing segment in the market from 2023-2028. Digital printing technologies are experiencing rapid growth across various industries. Since digital printing techniques provide flexibility, efficiency, and customization, printing inks especially those designed for digital presses are in great demand. Additionally, Packaging applications such as labels, cartons, and flexible packaging employ printing inks extensively. The rapid segment growth is partly fuelled by customer preferences, which are driving demand for visually appealing and educational packaging materials.

The medical segment is expected to hold the largest share of the market. The growing need for diagnostic imaging agents, such as contrast agents utilized in different medical imaging modalities including X-ray, MRI, CT scans, and nuclear medicine, is driving the medical segment growth. These substances are essential for improving tissue and organ visibility so that precise diagnoses can be made. Additionally, ongoing advancements in medical imaging technologies contribute to the growth of the medical segment. Specialized imaging chemicals are needed when highly complex imaging equipment and procedures are developed in order to maximize picture quality and diagnostic precision.

The packaging and printing segment is anticipated to be the fastest-growing segment in the market from 2023-2028. Companies from a variety of sectors, such as retail, food and beverage, and consumer products, place a strong focus on packaging branding. When used in the printing of logos, product labels, and other branding components, imaging chemicals help companies set their products distant in a competitive marketplace. Moreover, flexible and high-quality printing solutions are gaining demand due to consumer demand for personalized and customized products. Imaging chemicals facilitate package customization, allowing companies to create packaging that is suited to certain products and target markets.

North America is expected to be the largest region in the global market. The rising demand for functional and molecular imaging techniques in oncology is driving the imaging chemicals market growth in North America region. Healthcare providers can see the metabolic and molecular alterations linked to cancer by using imaging chemicals, such as radiopharmaceuticals for PET scans, which provide a more thorough diagnosis. For instance, according to estimates from the American Cancer Society, 1,918,0303 new cases of cancer were recorded in the U.S. in 2022.

Asia Pacific is anticipated to witness the fastest growth during the forecast period. The Asia Pacific region's growing e-commerce industry contributes to the need for attractive packaging. To create aesthetically pleasing packaging materials for items sold online, imaging chemicals are essential for increasing brand awareness and customer appeal. For instance, according to the World Economic Forum (2021), in China, e-commerce makes up over 50% of all online retail sales globally.

Agfa-Gevaert N.V., Altana AG, Becton Dickinson and Company, DIC Corporation, Eastman Kodak Company, Flint Group, FUJIFILM Holdings Corporation, Kao Corporation, T&K TOKA Corporation, Toray Fine Chemicals Co. Ltd., Toyo Ink SC Holdings Co. Ltd., and Vivimed Labs Limited, among others, are some of the key players in the global imaging chemicals market.

Please note: This is not an exhaustive list of companies profiled in the report.

In 2023, Toyo Ink SC Holdings Co. Ltd. announced the development of a silver nanoparticle paste for die-attach application. The paste can be sintered at low temperatures using pleasureless and pressure-assisted procedures.

In 2023, Becton Dickinson and Company announced the launch of the first spectral cell sorter in the world, which divides cells according to visual traits using high-speed imaging technology.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL IMAGING CHEMICALS MARKET, BY PRODUCT TYPE

4.1 Introduction

4.2 Imaging Chemicals Market: Product Type Scope Key Takeaways

4.3 Revenue Growth Analysis, 2022 & 2028

4.4 Imaging Agents and Toners

4.4.1 Imaging Agents and Toners Market Estimates and Forecast, 2020-2028 (USD Million)

4.5 Printing Inks

4.5.1 Printing Inks Market Estimates and Forecast, 2020-2028 (USD Million)

4.6 Image Developers

4.6.1 Image Developers Market Estimates and Forecast, 2020-2028 (USD Million)

4.7 Others

4.7.1 Others Market Estimates and Forecast, 2020-2028 (USD Million)

5 GLOBAL IMAGING CHEMICALS MARKET, BY APPLICATION

5.1 Introduction

5.2 Imaging Chemicals Market: Application Scope Key Takeaways

5.3 Revenue Growth Analysis, 2022 & 2028

5.4 Medical

5.4.1 Medical Market Estimates and Forecast, 2020-2028 (USD Million)

5.5 Packaging and Printing

5.5.1 Packaging and Printing Market Estimates and Forecast, 2020-2028 (USD Million)

5.6 Textile

5.6.1 Textile Market Estimates and Forecast, 2020-2028 (USD Million)

5.7 Mining

5.7.1 Mining Market Estimates and Forecast, 2020-2028 (USD Million)

5.8 Others

5.8.1 Others Market Estimates and Forecast, 2020-2028 (USD Million)

6 GLOBAL IMAGING CHEMICALS MARKET, BY REGION

6.1 Introduction

6.2 North America Imaging Chemicals Market Estimates and Forecast, 2020-2028 (USD Million)

6.2.1 By Product Type

6.2.2 By Application

6.2.3 By Country

6.2.3.1 U.S. Imaging Chemicals Market Estimates and Forecast, 2020-2028 (USD Million)

6.2.3.1.1 By Product Type

6.2.3.1.2 By Application

6.2.3.2 Canada Imaging Chemicals Market Estimates and Forecast, 2020-2028 (USD Million)

6.2.3.2.1 By Product Type

6.2.3.2.2 By Application

6.2.3.3 Mexico Imaging Chemicals Market Estimates and Forecast, 2020-2028 (USD Million)

6.2.3.3.1 By Product Type

6.2.3.3.2 By Application

6.3 Europe Imaging Chemicals Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.1 By Product Type

6.3.2 By Application

6.3.3 By Country

6.3.3.1 Germany Imaging Chemicals Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.1.1 By Product Type

6.3.3.1.2 By Application

6.3.3.2 U.K. Imaging Chemicals Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.2.1 By Product Type

6.3.3.2.2 By Application

6.3.3.3 France Imaging Chemicals Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.3.1 By Product Type

6.3.3.3.2 By Application

6.3.3.4 Italy Imaging Chemicals Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.4.1 By Product Type

6.3.3.4.2 By Application

6.3.3.5 Spain Imaging Chemicals Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.5.1 By Product Type

6.3.3.5.2 By Application

6.3.3.6 Netherlands Imaging Chemicals Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.6.1 By Product Type

6.3.3.6.2 By Application

6.3.3.7 Rest of Europe Imaging Chemicals Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.6.1 By Product Type

6.3.3.6.2 By Application

6.4 Asia Pacific Imaging Chemicals Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.1 By Product Type

6.4.2 By Application

6.4.3 By Country

6.4.3.1 China Imaging Chemicals Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.1.1 By Product Type

6.4.3.1.2 By Application

6.4.3.2 Japan Imaging Chemicals Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.2.1 By Product Type

6.4.3.2.2 By Application

6.4.3.3 India Imaging Chemicals Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.3.1 By Product Type

6.4.3.3.2 By Application

6.4.3.4 South Korea Imaging Chemicals Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.4.1 By Product Type

6.4.3.4.2 By Application

6.4.3.5 Singapore Imaging Chemicals Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.5.1 By Product Type

6.4.3.5.2 By Application

6.4.3.6 Malaysia Imaging Chemicals Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.6.1 By Product Type

6.4.3.6.2 By Application

6.4.3.7 Thailand Imaging Chemicals Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.6.1 By Product Type

6.4.3.6.2 By Application

6.4.3.8 Indonesia Imaging Chemicals Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.7.1 By Product Type

6.4.3.7.2 By Application

6.4.3.9 Vietnam Imaging Chemicals Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.8.1 By Product Type

6.4.3.8.2 By Application

6.4.3.10 Taiwan Imaging Chemicals Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.10.1 By Product Type

6.4.3.10.2 By Application

6.4.3.11 Rest of Asia Pacific Imaging Chemicals Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.11.1 By Product Type

6.4.3.11.2 By Application

6.5 Middle East and Africa Imaging Chemicals Market Estimates and Forecast, 2020-2028 (USD Million)

6.5.1 By Product Type

6.5.2 By Application

6.5.3 By Country

6.5.3.1 Saudi Arabia Imaging Chemicals Market Estimates and Forecast, 2020-2028 (USD Million)

6.5.3.1.1 By Product Type

6.5.3.1.2 By Application

6.5.3.2 U.A.E. Imaging Chemicals Market Estimates and Forecast, 2020-2028 (USD Million)

6.5.3.2.1 By Product Type

6.5.3.2.2 By Application

6.5.3.3 Israel Imaging Chemicals Market Estimates and Forecast, 2020-2028 (USD Million)

6.5.3.3.1 By Product Type

6.5.3.3.2 By Application

6.5.3.4 South Africa Imaging Chemicals Market Estimates and Forecast, 2020-2028 (USD Million)

6.5.3.4.1 By Product Type

6.5.3.4.2 By Application

6.5.3.5 Rest of Middle East and Africa Imaging Chemicals Market Estimates and Forecast, 2020-2028 (USD Million)

6.5.3.5.1 By Product Type

6.5.3.5.2 By Application

6.6 Central and South America Imaging Chemicals Market Estimates and Forecast, 2020-2028 (USD Million)

6.6.1 By Product Type

6.6.2 By Application

6.6.3 By Country

6.6.3.1 Brazil Imaging Chemicals Market Estimates and Forecast, 2020-2028 (USD Million)

6.6.3.1.1 By Product Type

6.6.3.1.2 By Application

6.6.3.2 Argentina Imaging Chemicals Market Estimates and Forecast, 2020-2028 (USD Million)

6.6.3.2.1 By Product Type

6.6.3.2.2 By Application

6.6.3.3 Chile Imaging Chemicals Market Estimates and Forecast, 2020-2028 (USD Million)

6.6.3.3.1 By Product Type

6.6.3.3.2 By Application

6.6.3.3 Rest of Central and South America Imaging Chemicals Market Estimates and Forecast, 2020-2028 (USD Million)

6.6.3.3.1 By Product Type

6.6.3.3.2 By Application

7 COMPETITIVE LANDCAPE

7.1 Company Market Share Analysis

7.2 Four Quadrant Positioning Matrix

7.2.1 Market Leaders

7.2.2 Market Visionaries

7.2.3 Market Challengers

7.2.4 Niche Market Players

7.3 Vendor Landscape

7.3.1 North America

7.3.2 Europe

7.3.3 Asia Pacific

7.3.4 Rest of the World

7.4 Company Profiles

7.4.1 Agfa-Gevaert N.V.

7.4.1.1 Business Description & Financial Analysis

7.4.1.2 SWOT Analysis

7.4.1.3 Products & Services Offered

7.4.1.4 Strategic Alliances between Business Partners

7.4.2 Altana AG

7.4.2.1 Business Description & Financial Analysis

7.4.2.2 SWOT Analysis

7.4.2.3 Products & Services Offered

7.4.2.4 Strategic Alliances between Business Partners

7.4.3 Becton Dickinson and Company

7.4.3.1 Business Description & Financial Analysis

7.4.3.2 SWOT Analysis

7.4.3.3 Products & Services Offered

7.4.3.4 Strategic Alliances between Business Partners

7.4.4 DIC Corporation

7.4.4.1 Business Description & Financial Analysis

7.4.4.2 SWOT Analysis

7.4.4.3 Products & Services Offered

7.4.4.4 Strategic Alliances between Business Partners

7.4.5 Eastman Kodak Company

7.4.5.1 Business Description & Financial Analysis

7.4.5.2 SWOT Analysis

7.4.5.3 Products & Services Offered

7.4.5.4 Strategic Alliances between Business Partners

7.4.6 FLINT GROUP

7.4.6.1 Business Description & Financial Analysis

7.4.6.2 SWOT Analysis

7.4.6.3 Products & Services Offered

7.4.6.4 Strategic Alliances between Business Partners

7.4.7 FUJIFILM Holdings Corporation

7.4.7.1 Business Description & Financial Analysis

7.4.7.2 SWOT Analysis

7.4.7.3 Products & Services Offered

7.4.7.4 Strategic Alliances between Business Partners

7.4.8 Kao Corporation

7.4.8.1 Business Description & Financial Analysis

7.4.8.2 SWOT Analysis

7.4.8.3 Products & Services Offered

7.4.8.4 Strategic Alliances between Business Partners

7.4.9 T&K TOKA Corporation

7.4.9.1 Business Description & Financial Analysis

7.4.9.2 SWOT Analysis

7.4.9.3 Products & Services Offered

7.4.9.4 Strategic Alliances between Business Partners

7.4.10 Toray Fine Chemicals Co. Ltd.

7.4.10.1 Business Description & Financial Analysis

7.4.10.2 SWOT Analysis

7.4.10.3 Products & Services Offered

7.4.10.4 Strategic Alliances between Business Partners

7.4.11 Other Companies

7.4.11.1 Business Description & Financial Analysis

7.4.11.2 SWOT Analysis

7.4.11.3 Products & Services Offered

7.4.11.4 Strategic Alliances between Business Partners

8 RESEARCH METHODOLOGY

8.1 Market Introduction

8.1.1 Market Definition

8.1.2 Market Scope & Segmentation

8.2 Information Procurement

8.2.1 Secondary Research

8.2.1.1 Purchased Databases

8.2.1.2 GMEs Internal Data Repository

8.2.1.3 Secondary Resources & Third Party Perspectives

8.2.1.4 Company Information Sources

8.2.2 Primary Research

8.2.2.1 Various Application of Respondents for Primary Interviews

8.2.2.2 Number of Interviews Conducted throughout the Research Process

8.2.2.3 Primary Stakeholders

8.2.2.4 Discussion Guide for Primary Participants

8.2.3 Expert Panels

8.2.3.1 Expert Panels Across 30+ Industry

8.2.4 Paid Local Experts

8.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

8.3 Market Estimation

8.3.1 Top-Down Approach

8.3.1.1 Macro-Economic Indicators Considered

8.3.1.2 Micro-Economic Indicators Considered

8.3.2 Bottom Up Approach

8.3.2.1 Company Share Analysis Approach

8.3.2.2 Estimation of Potential Product Sales

8.4 Data Triangulation

8.4.1 Data Collection

8.4.2 Time Series, Cross Sectional & Panel Data Analysis

8.4.3 Cluster Analysis

8.5 Analysis and Output

8.5.1 Inhouse AI Based Real Time Analytics Tool

8.5.2 Output From Desk & Primary Research

8.6 Research Assumptions & Limitations

8.6.1 Research Assumptions

8.6.2 Research Limitations

LIST OF TABLES

1 Global Imaging Chemicals Market, By Product Type, 2020-2028 (USD Mllion)

2 Imaging Agents and Toners Market, By Region, 2020-2028 (USD Mllion)

3 Printing Inks Market, By Region, 2020-2028 (USD Mllion)

4 Image Developers Market, By Region, 2020-2028 (USD Mllion)

5 Others Market, By Region, 2020-2028 (USD Mllion)

6 Global Imaging Chemicals Market, By Application, 2020-2028 (USD Mllion)

7 Medical Market, By Region, 2020-2028 (USD Mllion)

8 Packaging and Printing Market, By Region, 2020-2028 (USD Mllion)

9 Textile Market, By Region, 2020-2028 (USD Mllion)

10 Mining Market, By Region, 2020-2028 (USD Mllion)

11 Others Market, By Region, 2020-2028 (USD Mllion)

12 Regional Analysis, 2020-2028 (USD Mllion)

13 North America Imaging Chemicals Market, By Product Type, 2020-2028 (USD Mllion)

14 North America Imaging Chemicals Market, By Application, 2020-2028 (USD Mllion)

15 North America Imaging Chemicals Market, By COUNTRY, 2020-2028 (USD Mllion)

16 U.S. Imaging Chemicals Market, By Product Type, 2020-2028 (USD Mllion)

17 U.S. Imaging Chemicals Market, By Application, 2020-2028 (USD Mllion)

18 Canada Imaging Chemicals Market, By Product Type, 2020-2028 (USD Mllion)

19 Canada Imaging Chemicals Market, By Application, 2020-2028 (USD Mllion)

20 Mexico Imaging Chemicals Market, By Product Type, 2020-2028 (USD Mllion)

21 Mexico Imaging Chemicals Market, By Application, 2020-2028 (USD Mllion)

22 Europe Imaging Chemicals Market, By Product Type, 2020-2028 (USD Mllion)

23 Europe Imaging Chemicals Market, By Application, 2020-2028 (USD Mllion)

24 EUROPE Imaging Chemicals Market, By COUNTRY, 2020-2028 (USD Mllion)

25 Germany Imaging Chemicals Market, By Product Type, 2020-2028 (USD Mllion)

26 Germany Imaging Chemicals Market, By Application, 2020-2028 (USD Mllion)

27 U.K. Imaging Chemicals Market, By Product Type, 2020-2028 (USD Mllion)

28 U.K. Imaging Chemicals Market, By Application, 2020-2028 (USD Mllion)

29 France Imaging Chemicals Market, By Product Type, 2020-2028 (USD Mllion)

30 France Imaging Chemicals Market, By Application, 2020-2028 (USD Mllion)

31 Italy Imaging Chemicals Market, By Product Type, 2020-2028 (USD Mllion)

32 Italy Imaging Chemicals Market, By Application, 2020-2028 (USD Mllion)

33 Spain Imaging Chemicals Market, By Product Type, 2020-2028 (USD Mllion)

34 Spain Imaging Chemicals Market, By Application, 2020-2028 (USD Mllion)

35 Netherlands Imaging Chemicals Market, By Product Type, 2020-2028 (USD Mllion)

36 Netherlands Imaging Chemicals Market, By Application, 2020-2028 (USD Mllion)

37 Rest Of Europe Imaging Chemicals Market, By Product Type, 2020-2028 (USD Mllion)

38 Rest Of Europe Imaging Chemicals Market, By Application, 2020-2028 (USD Mllion)

39 Asia Pacific Imaging Chemicals Market, By Product Type, 2020-2028 (USD Mllion)

40 Asia Pacific Imaging Chemicals Market, By Application, 2020-2028 (USD Mllion)

41 ASIA PACIFIC Imaging Chemicals Market, By COUNTRY, 2020-2028 (USD Mllion)

42 China Imaging Chemicals Market, By Product Type, 2020-2028 (USD Mllion)

43 China Imaging Chemicals Market, By Application, 2020-2028 (USD Mllion)

44 Japan Imaging Chemicals Market, By Product Type, 2020-2028 (USD Mllion)

45 Japan Imaging Chemicals Market, By Application, 2020-2028 (USD Mllion)

46 India Imaging Chemicals Market, By Product Type, 2020-2028 (USD Mllion)

47 India Imaging Chemicals Market, By Application, 2020-2028 (USD Mllion)

48 South Korea Imaging Chemicals Market, By Product Type, 2020-2028 (USD Mllion)

49 South Korea Imaging Chemicals Market, By Application, 2020-2028 (USD Mllion)

50 Singapore Imaging Chemicals Market, By Product Type, 2020-2028 (USD Mllion)

51 Singapore Imaging Chemicals Market, By Application, 2020-2028 (USD Mllion)

52 Thailand Imaging Chemicals Market, By Product Type, 2020-2028 (USD Mllion)

53 Thailand Imaging Chemicals Market, By Application, 2020-2028 (USD Mllion)

54 Malaysia Imaging Chemicals Market, By Product Type, 2020-2028 (USD Mllion)

55 Malaysia Imaging Chemicals Market, By Application, 2020-2028 (USD Mllion)

56 Indonesia Imaging Chemicals Market, By Product Type, 2020-2028 (USD Mllion)

57 Indonesia Imaging Chemicals Market, By Application, 2020-2028 (USD Mllion)

58 Vietnam Imaging Chemicals Market, By Product Type, 2020-2028 (USD Mllion)

59 Vietnam Imaging Chemicals Market, By Application, 2020-2028 (USD Mllion)

60 Taiwan Imaging Chemicals Market, By Product Type, 2020-2028 (USD Mllion)

61 Taiwan Imaging Chemicals Market, By Application, 2020-2028 (USD Mllion)

62 Rest of APAC Imaging Chemicals Market, By Product Type, 2020-2028 (USD Mllion)

63 Rest of APAC Imaging Chemicals Market, By Application, 2020-2028 (USD Mllion)

64 Middle East and Africa Imaging Chemicals Market, By Product Type, 2020-2028 (USD Mllion)

65 Middle East and Africa Imaging Chemicals Market, By Application, 2020-2028 (USD Mllion)

66 MIDDLE EAST & ADRICA Imaging Chemicals Market, By COUNTRY, 2020-2028 (USD Mllion)

67 Saudi Arabia Imaging Chemicals Market, By Product Type, 2020-2028 (USD Mllion)

68 Saudi Arabia Imaging Chemicals Market, By Application, 2020-2028 (USD Mllion)

69 UAE Imaging Chemicals Market, By Product Type, 2020-2028 (USD Mllion)

70 UAE Imaging Chemicals Market, By Application, 2020-2028 (USD Mllion)

71 Israel Imaging Chemicals Market, By Product Type, 2020-2028 (USD Mllion)

72 Israel Imaging Chemicals Market, By Application, 2020-2028 (USD Mllion)

73 South Africa Imaging Chemicals Market, By Product Type, 2020-2028 (USD Mllion)

74 South Africa Imaging Chemicals Market, By Application, 2020-2028 (USD Mllion)

75 Rest Of Middle East and Africa Imaging Chemicals Market, By Product Type, 2020-2028 (USD Mllion)

76 Rest Of Middle East and Africa Imaging Chemicals Market, By Application, 2020-2028 (USD Mllion)

77 Central and South America Imaging Chemicals Market, By Product Type, 2020-2028 (USD Mllion)

78 Central and South America Imaging Chemicals Market, By Application, 2020-2028 (USD Mllion)

79 CENTRAL AND SOUTH AMERICA Imaging Chemicals Market, By COUNTRY, 2020-2028 (USD Mllion)

80 Brazil Imaging Chemicals Market, By Product Type, 2020-2028 (USD Mllion)

81 Brazil Imaging Chemicals Market, By Application, 2020-2028 (USD Mllion)

82 Chile Imaging Chemicals Market, By Product Type, 2020-2028 (USD Mllion)

83 Chile Imaging Chemicals Market, By Application, 2020-2028 (USD Mllion)

84 Argentina Imaging Chemicals Market, By Product Type, 2020-2028 (USD Mllion)

85 Argentina Imaging Chemicals Market, By Application, 2020-2028 (USD Mllion)

86 Rest Of Central and South America Imaging Chemicals Market, By Product Type, 2020-2028 (USD Mllion)

87 Rest Of Central and South America Imaging Chemicals Market, By Application, 2020-2028 (USD Mllion)

88 Agfa-Gevaert N.V.: Products & Services Offering

89 Altana AG: Products & Services Offering

90 Becton Dickinson and Company: Products & Services Offering

91 DIC Corporation: Products & Services Offering

92 Eastman Kodak Company: Products & Services Offering

93 FLINT GROUP: Products & Services Offering

94 FUJIFILM Holdings Corporation : Products & Services Offering

95 Kao Corporation: Products & Services Offering

96 T&K TOKA Corporation, Inc: Products & Services Offering

97 Toray Fine Chemicals Co. Ltd.: Products & Services Offering

98 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Imaging Chemicals Market Overview

2 Global Imaging Chemicals Market Value From 2020-2028 (USD Mllion)

3 Global Imaging Chemicals Market Share, By Product Type (2022)

4 Global Imaging Chemicals Market Share, By Application (2022)

5 Global Imaging Chemicals Market, By Region (Asia Pacific Market)

6 Technological Trends In Global Imaging Chemicals Market

7 Four Quadrant Competitor Positioning Matrix

8 Impact Of Macro & Micro Indicators On The Market

9 Impact Of Key Drivers On The Global Imaging Chemicals Market

10 Impact Of Challenges On The Global Imaging Chemicals Market

11 Porter’s Five Forces Analysis

12 Global Imaging Chemicals Market: By Product Type Scope Key Takeaways

13 Global Imaging Chemicals Market, By Product Type Segment: Revenue Growth Analysis

14 Imaging Agents and Toners Market, By Region, 2020-2028 (USD Mllion)

15 Printing Inks Market, By Region, 2020-2028 (USD Mllion)

16 Image Developers Market, By Region, 2020-2028 (USD Mllion)

17 Others Market, By Region, 2020-2028 (USD Mllion)

18 Global Imaging Chemicals Market: By Application Scope Key Takeaways

19 Global Imaging Chemicals Market, By Application Segment: Revenue Growth Analysis

20 Medical Market, By Region, 2020-2028 (USD Mllion)

21 Packaging and Printing Market, By Region, 2020-2028 (USD Mllion)

22 Textile Market, By Region, 2020-2028 (USD Mllion)

23 Mining Market, By Region, 2020-2028 (USD Mllion)

24 Others Market, By Region, 2020-2028 (USD Mllion)

25 Regional Segment: Revenue Growth Analysis

26 Global Imaging Chemicals Market: Regional Analysis

27 North America Imaging Chemicals Market Overview

28 North America Imaging Chemicals Market, By Product Type

29 North America Imaging Chemicals Market, By Application

30 North America Imaging Chemicals Market, By Country

31 U.S. Imaging Chemicals Market, By Product Type

32 U.S. Imaging Chemicals Market, By Application

33 Canada Imaging Chemicals Market, By Product Type

34 Canada Imaging Chemicals Market, By Application

35 Mexico Imaging Chemicals Market, By Product Type

36 Mexico Imaging Chemicals Market, By Application

37 Four Quadrant Positioning Matrix

38 Company Market Share Analysis

39 Agfa-Gevaert N.V.: Company Snapshot

40 Agfa-Gevaert N.V.: SWOT Analysis

41 Agfa-Gevaert N.V.: Geographic Presence

42 Altana AG: Company Snapshot

43 Altana AG: SWOT Analysis

44 Altana AG: Geographic Presence

45 Becton Dickinson and Company: Company Snapshot

46 Becton Dickinson and Company: SWOT Analysis

47 Becton Dickinson and Company: Geographic Presence

48 DIC Corporation: Company Snapshot

49 DIC Corporation: Swot Analysis

50 DIC Corporation: Geographic Presence

51 Eastman Kodak Company: Company Snapshot

52 Eastman Kodak Company: SWOT Analysis

53 Eastman Kodak Company: Geographic Presence

54 FLINT GROUP: Company Snapshot

55 FLINT GROUP: SWOT Analysis

56 FLINT GROUP: Geographic Presence

57 FUJIFILM Holdings Corporation : Company Snapshot

58 FUJIFILM Holdings Corporation : SWOT Analysis

59 FUJIFILM Holdings Corporation : Geographic Presence

60 Kao Corporation: Company Snapshot

61 Kao Corporation: SWOT Analysis

62 Kao Corporation: Geographic Presence

63 T&K TOKA Corporation, Inc.: Company Snapshot

64 T&K TOKA Corporation, Inc.: SWOT Analysis

65 T&K TOKA Corporation, Inc.: Geographic Presence

66 Toray Fine Chemicals Co. Ltd.: Company Snapshot

67 Toray Fine Chemicals Co. Ltd.: SWOT Analysis

68 Toray Fine Chemicals Co. Ltd.: Geographic Presence

69 Other Companies: Company Snapshot

70 Other Companies: SWOT Analysis

71 Other Companies: Geographic Presence

The Global Imaging Chemicals Market has been studied from the year 2019 till 2028. However, the CAGR provided in the report is from the year 2023 to 2028. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Imaging Chemicals Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS