Global In-Mold Labels Market Size, Trends, and Analysis - Forecasts to 2026 By Material (Polypropylene, Polyethylene, Polyvinyl chloride, ABS resins, and Others [Polyethylene Terephthalate, Polyvinylidene Chloride (PVdC), Polycarbonate, And Synthetic Papers]), By Technology (Extrusion Blow-Molding Process, Injection Molding Process, Thermoforming), By End-Use (Personal Care, Consumer Durables, Food & Beverage, Automotive, and Others [Medical And Laboratory, Paints, Etc.]) By Printing Technologies (Flexographic Printing, Offset Printing, Gravure Printing, Digital Printing, and Others [Screen Printing And Letterpress Methods]), By Printing Inks (UV curable Inks, Thermal Cured Inks, Water-Soluble Inks, and Others [High Melt-Resistant Inks]), By Region (North America, Europe, Asia Pacific, MEA, and CSA); End-User Landscape, Company Market Share Analysis, and Competitor Analysis

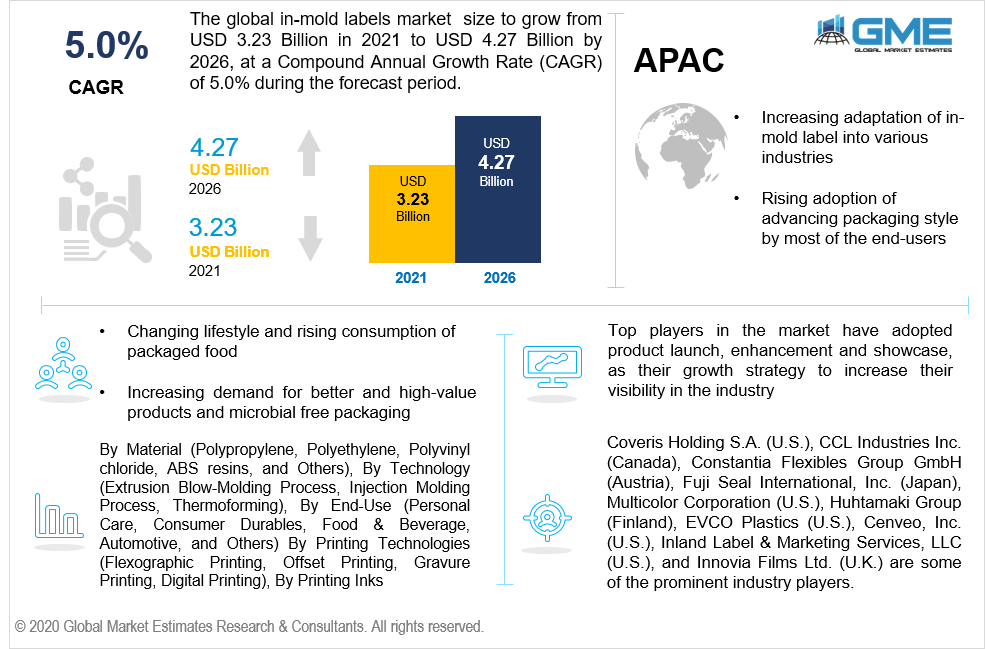

The global in-mold labels market is projected to grow from USD 3.23 billion in 2021 to USD 4.27 billion by 2026 at a CAGR value of 5.0% from 2021-2026.

In-Mold labelling is an entirely automated mechanism where the paper or the film used for printing is positioned inside the mold container or into the designed cavity before printing or molding it on the desired surface. The labelling process is prominently used in a wide range of applications of molding plastic containers. The in-mold labelling process enables the labels to efficiently get attached to the containers during the process of molding itself, reducing the requirements of adjustments, designing, or decorations post the molding process. This process of molding has replaced the traditional labelling process by bringing in more efficiency and productivity in the market.

The increasing adaptation of in-mold label into various industries and rising adoption of advancing packaging style by most of the end-users has brought tremendous growth in the in-mold labelling market. The need for the consumers for more attractive and catchy packaging styles and increasing demand for creative packaging to attract customers has boosted the demand and use of in-mold labelling techniques in the market.

The changing lifestyle and rising consumption of packaged food, increasing demand for better and high-value products and microbial free packaging, as well as high purchasing power among the consumers have drastically changed the manufacturer’s preferences towards more appealing styles of packaging. These trends have helped the market grow rapidly.

The increasing growth rate of the in-mold labels market is due to the features and benefits it facilitates to the end user industries and the consumers. The increased usage of 3D technology in in-mold labels enables high quality printing compared to the basic and traditional label printing techniques. This labelling process is also a more cost-efficient choice for the manufacturers, alongside providing increased outcomes in significantly less time. The molds' design also enables the printers to label the containers at any angle, side, or size. This kind of labelling technique also prevents wear and tear or any scratches and scrubs on the containers from excessive usage and strengthens the quality of containers, thus providing durability to the product.

With the augmentation of COVID-19, many industries faced both positive and negative impact on their revenues. However, for the in-mold labelling market, the scenario is different. For instance, the demand was positively high for packaged food due to the growing trend of at-home food services and rising need for creative packaging. Another major impact that was invited due to the pandemic crisis is the drastic decrease in the prices of the raw material which eventually decreased the global revenue in 2020. However, the market is expected to pick up the pace during the forecast period.

Based on material, the market is segmented into Polypropylene, Polyethylene, Polyvinyl chloride, ABS resins, and others. The others segment includes Polyethylene Terephthalate, Polyvinylidene Chloride (PVdC), Polycarbonate, and Synthetic Papers. Polyethylene is the most commonly used material in the in-mold labelling process and hence is the largest shareholder in the market. The rising usage of this material in the in-mold labelling market is because of its characteristics and properties that attract the manufacturer's attention. It also facilitates tremendous resistance to damages due to heavy usage.

Based on technology, the market is segmented into extrusion blow-molding process, injection molding process, and thermoforming. The injection molding process is the most widely used technology among the various end user industries and hence is the fastest growing segment in the market.

Efficient production is one of the prominent features of the injection molding process. Depending on the size and structure of the molds, this technology delivers the labelled products within 15 to 125 seconds. This technology is a highly automated and mechanized process, enables the industry owners to achieve profits on low labor costs. It ensures consistency in the design and quality of the labelling.

Based on the end-user, the market is segmented into personal care, consumer durables, food & beverage, automotive, and others [medical and laboratory, paints, etc.]. The food and beverage industry is the most significant end user of the in-mold labelling technique and hence is the largest shareholder in the market.

Considering the enormously increasing demand and preference for attractive packaging, growth rate of the in-mold labelling market is drastically increasing. The growing marketing strategies within the food and beverage industry contribute immensely to the increased need for in-mold labelling techniques. These marketing strategies work with creative and eye-catching packaging ideas, which require techniques like injection molding processes or blow-molding processes, which facilitate labelling on hallow round shaped or complex shape and size containers and bottles.

Based on the printing technology outlook, the market is segmented into flexographic printing, offset printing, gravure printing, digital printing, and others [screen printing and letterpress methods]. Flexographic printing technology is majorly used in the in-mold labels market and hence is the fastest growing technique in the market.

Flexographic printing enables the end users to use a wide range of substrates for printing purposes like foils, papers, films, and other substrates. This printing technology also ensures a quicker production process. It also assists the end users by accommodating numerous ink types from water-based solvents to U.V curable inks, which provide better outcomes and better application processes.

Based on the printing inks outlook, the market is segmented into UV curable inks, thermal cured inks, water-soluble inks, and others [high melt-resistant inks]. The water-soluble inks are most commonly used in various labelling verticals and hence have captured the largest share of the market.

The increasing awareness about environment conservation is promoting the use of water-soluble inks instead of solvent-based UV inks. The growth of this segment is mainly due to water-based inks' ability to have extremely low VOC levels, which causes fewer emissions and pollution when disposed. Compared to solvent-based UV curable inks, which are flammable and have high VOC levels, the water-soluble inks are the best choice for the manufacturers for marketing and promoting themselves as environmentally conscious companies and brands.

Based on region, the market can be segmented into various regions such as North America, Europe, Central and South America, Middle East and North Africa, and Asia Pacific regions.

North American region is analyzed to be the most dominant region in the in-mold labels market. North America is home for some of the biggest players in the food and beverage industry. The countries in the North American region like the USA or Canada are a prime center of high consumer demand for attractive and clean packaging labels, with clarity about the ingredients being used in the food items. The in-mold labelling industry has infiltrated its deep roots into the North American region, making it the largest shareholder of the market.

Asia Pacific region is analyzed to be the fastest growing segment in the market. The increasing per capita incomes of the consumers are supporting the changing preferences for food habits in this region. The increasing industry base in the countries like India, China, Japan, South Korea, with high investments in technology and massive machinery, is gradually boosting the demand for in-mold labels.

Coveris Holding S.A. (U.S.), CCL Industries Inc. (Canada), Constantia Flexibles Group GmbH (Austria), Fuji Seal International, Inc. (Japan), Multicolor Corporation (U.S.), Huhtamaki Group (Finland), EVCO Plastics (U.S.), Cenveo, Inc. (U.S.), Inland Label & Marketing Services, LLC (U.S.), and Innovia Films Ltd. (U.K.) are some of the key players in the market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 In-Mold Labels Industry Overview, 2016-2026

2.1.1 Industry Overview

2.1.2 Material Overview

2.1.3 Technology Overview

2.1.4 End-User Overview

2.1.5 Printing Technology Overview

2.1.6 Printing Inks Overview

2.1.7 Regional Overview

Chapter 3 In-Mold Labels Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2016-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Increasing adaptation of in-mold label into various industries

3.3.2 Industry Challenges

3.3.2.1 Lack of awareness related to latest printing technologies in developing and low-income countries

3.4 Prospective Growth Scenario

3.4.1 Material Growth Scenario

3.4.2 Technology Growth Scenario

3.4.3 End-User Growth Scenario

3.4.4 Printing Technology Growth Scenario

3.4.5 Printing Inks Scenario

3.4.6 Clinical Trial Phase Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Printing Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 In-Mold Labels Market, By Material

4.1 Material Outlook

4.2 Polypropylene

4.2.1 Market Size, By Region, 2016-2026 (USD Million)

4.3 Polyethylene

4.3.1 Market Size, By Region, 2016-2026 (USD Million)

4.4 Polyvinyl chloride

4.4.1 Market Size, By Region, 2016-2026 (USD Million)

4.5 ABS resins

4.5.1 Market Size, By Region, 2016-2026 (USD Million)

4.6 Others

4.6.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 5 In-Mold Labels Market, By Technology

5.1 Technology Outlook

5.2 Extrusion Blow-Molding Process

5.2.1 Market Size, By Region, 2016-2026 (USD Million)

5.3 Injection Molding Process

5.3.1 Market Size, By Region, 2016-2026 (USD Million)

5.3 Thermoforming

5.3.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 6 In-Mold Labels Market, By End-User

6.1 Personal Care

6.1.1 Market Size, By Region, 2016-2026 (USD Million)

6.2 Consumer Durables

6.2.1 Market Size, By Region, 2016-2026 (USD Million)

6.3 Food & Beverage

6.3.1 Market Size, By Region, 2016-2026 (USD Million)

6.3 Automotive

6.3.1 Market Size, By Region, 2016-2026 (USD Million)

6.3 Others

6.3.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 7 In-Mold Labels Market, By Printing Technology

7.1 Flexographic Printing

7.1.1 Market Size, By Region, 2016-2026 (USD Million)

7.2 Offset Printing

7.2.1 Market Size, By Region, 2016-2026 (USD Million)

7.3 Digital Printing

7.3.1 Market Size, By Region, 2016-2026 (USD Million)

7.4 Gravure Printing

7.4.1 Market Size, By Region, 2016-2026 (USD Million)

7.5 Others

7.5.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 8 In-Mold Labels Market, By Printing Inks

8.1 UV curable Inks

8.1.1 Market Size, By Region, 2016-2026 (USD Million)

8.2 Thermal Cured Inks

8.2.1 Market Size, By Region, 2016-2026 (USD Million)

8.3 Water-Soluble Inks

8.3.1 Market Size, By Region, 2016-2026 (USD Million)

8.4 Others

8.4.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 9 In-Mold Labels Market, By Region

9.1 Regional outlook

9.2 North America

9.2.1 Market Size, By Country 2016-2026 (USD Million)

9.2.2 Market Size, By Material, 2016-2026 (USD Million)

9.2.3 Market Size, By Technology, 2016-2026 (USD Million)

9.2.4 Market Size, By End-User, 2016-2026 (USD Million)

9.2.5 Market Size, By Printing Technology, 2016-2026 (USD Million)

9.2.6 Market Size, By Printing Inks, 2016-2026 (USD Million)

9.2.7 U.S.

9.2.7.1 Market Size, By Material, 2016-2026 (USD Million)

9.2.7.2 Market Size, By Technology, 2016-2026 (USD Million)

9.2.7.3 Market Size, By End-User, 2016-2026 (USD Million)

9.2.7.4 Market Size, By Printing Technology, 2016-2026 (USD Million)

9.2.7.5 Market Size, By Printing Inks, 2016-2026 (USD Million)

9.2.8 Canada

9.2.8.1 Market Size, By Material, 2016-2026 (USD Million)

9.2.8.2 Market Size, By Technology, 2016-2026 (USD Million)

9.2.8.3 Market Size, By End-User, 2016-2026 (USD Million)

9.2.8.4 Market Size, By Printing Technology, 2016-2026 (USD Million)

9.2.8.5 Market Size, By Printing Inks, 2016-2026 (USD Million)

9.2.9 Mexico

9.2.9.1 Market Size, By Material, 2016-2026 (USD Million)

9.2.9.2 Market Size, By Technology, 2016-2026 (USD Million)

9.2.9.3 Market Size, By End-User, 2016-2026 (USD Million)

9.2.9.4 Market Size, By Printing Technology, 2016-2026 (USD Million)

9.2.9.5 Market Size, By Printing Inks, 2016-2026 (USD Million)

9.3 Europe

9.3.1 Market Size, By Country 2016-2026 (USD Million)

9.3.2 Market Size, By Material, 2016-2026 (USD Million)

9.3.3 Market Size, By Technology, 2016-2026 (USD Million)

9.3.4 Market Size, By End-User, 2016-2026 (USD Million)

9.3.5 Market Size, By Printing Technology, 2016-2026 (USD Million)

9.3.6 Market Size, By Printing Inks, 2016-2026 (USD Million)

9.3.7 Germany

9.3.7.1 Market Size, By Material, 2016-2026 (USD Million)

9.3.7.2 Market Size, By Technology, 2016-2026 (USD Million)

9.3.7.3 Market Size, By End-User, 2016-2026 (USD Million)

9.3.7.4 Market Size, By Printing Technology, 2016-2026 (USD Million)

9.3.7.5 Market Size, By Printing Inks, 2016-2026 (USD Million)

9.3.8 UK

9.3.8.1 Market Size, By Material, 2016-2026 (USD Million)

9.3.8.2 Market Size, By Technology, 2016-2026 (USD Million)

9.3.8.3 Market Size, By End-User, 2016-2026 (USD Million)

9.3.8.4 Market Size, By Printing Technology, 2016-2026 (USD Million)

9.3.8.5 Market Size, By Printing Inks, 2016-2026 (USD Million)a

9.3.9 France

9.3.9.1 Market Size, By Material, 2016-2026 (USD Million)

9.3.9.2 Market Size, By Technology, 2016-2026 (USD Million)

9.3.9.3 Market Size, By End-User, 2016-2026 (USD Million)

9.3.9.4 Market Size, By Printing Technology, 2016-2026 (USD Million)

9.3.9.5 Market Size, By Printing Inks, 2016-2026 (USD Million)

9.3.10 Italy

9.3.10.1 Market Size, By Material, 2016-2026 (USD Million)

9.3.10.2 Market Size, By Technology, 2016-2026 (USD Million)

9.3.10.3 Market Size, By End-User, 2016-2026 (USD Million)

9.3.10.4 Market Size, By Printing Technology, 2016-2026 (USD Million)

9.3.10.5 Market Size, By Printing Inks, 2016-2026 (USD Million)

9.4 Asia Pacific

9.4.1 Market Size, By Country 2016-2026 (USD Million)

9.4.2 Market Size, By Material, 2016-2026 (USD Million)

9.4.3 Market Size, By Technology, 2016-2026 (USD Million)

9.4.4 Market Size, By End-User, 2016-2026 (USD Million)

9.4.5 Market Size, By Printing Technology, 2016-2026 (USD Million)

9.4.6 Market Size, By Printing Inks, 2016-2026 (USD Million)

9.4.7 China

9.4.7.1 Market Size, By Material, 2016-2026 (USD Million)

9.4.7.2 Market Size, By Technology, 2016-2026 (USD Million)

9.4.7.3 Market Size, By End-User, 2016-2026 (USD Million)

9.4.7.4 Market Size, By Printing Technology, 2016-2026 (USD Million)

9.4.7.5 Market Size, By Printing Inks, 2016-2026 (USD Million)

9.4.8 India

9.4.8.1 Market Size, By Material, 2016-2026 (USD Million)

9.4.8.2 Market Size, By Technology, 2016-2026 (USD Million)

9.4.8.3 Market Size, By End-User, 2016-2026 (USD Million)

9.4.8.4 Market Size, By Printing Technology, 2016-2026 (USD Million)

9.4.8.5 Market Size, By Printing Inks, 2016-2026 (USD Million)

9.4.9 Japan

9.4.9.1 Market Size, By Material, 2016-2026 (USD Million)

9.4.9.2 Market Size, By Technology, 2016-2026 (USD Million)

9.4.9.3 Market Size, By End-User, 2016-2026 (USD Million)

9.4.9.4 Market Size, By Printing Technology, 2016-2026 (USD Million)

9.4.9.5 Market Size, By Printing Inks, 2016-2026 (USD Million)

9.5 MEA

9.5.1 Market Size, By Country 2016-2026 (USD Million)

9.5.2 Market Size, By Material, 2016-2026 (USD Million)

9.5.3 Market Size, By Technology, 2016-2026 (USD Million)

9.5.4 Market Size, By End-User, 2016-2026 (USD Million)

9.5.5 Market Size, By Printing Technology, 2016-2026 (USD Million)

9.5.6 Market Size, By Printing Inks, 2016-2026 (USD Million)

9.5.7 Saudi Arabia

9.5.7.1 Market Size, By Material, 2016-2026 (USD Million)

9.5.7.2 Market Size, By Technology, 2016-2026 (USD Million)

9.5.7.3 Market Size, By End-User, 2016-2026 (USD Million)

9.5.7.4 Market Size, By Printing Technology, 2016-2026 (USD Million)

9.5.7.5 Market Size, By Printing Inks, 2016-2026 (USD Million)

9.5.8 UAE

9.5.8.1 Market Size, By Material, 2016-2026 (USD Million)

9.5.8.2 Market Size, By Technology, 2016-2026 (USD Million)

9.5.8.3 Market Size, By End-User, 2016-2026 (USD Million)

9.5.8.4 Market Size, By Printing Technology, 2016-2026 (USD Million)

9.5.8.5 Market Size, By Printing Inks, 2016-2026 (USD Million)

9.5.9 South Africa

9.5.9.1 Market Size, By Material, 2016-2026 (USD Million)

9.5.9.2 Market Size, By Technology, 2016-2026 (USD Million)

9.5.9.3 Market Size, By End-User, 2016-2026 (USD Million)

9.5.9.4 Market Size, By Printing Technology, 2016-2026 (USD Million)

9.5.9.5 Market Size, By Printing Inks, 2016-2026 (USD Million)

Chapter 10 Company Landscape

10.1 Competitive Analysis, 2020

10.2 Coveris Holding S.A. (U.S.)

10.2.1 Company Overview

10.2.2 Financial Analysis

10.2.3 Strategic Positioning

10.2.4 Info Graphic Analysis

10.3 CCL Industries Inc. (Canada)

10.3.1 Company Overview

10.3.2 Financial Analysis

10.3.3 Strategic Positioning

10.3.4 Info Graphic Analysis

10.4 Constantia Flexibles Group GmbH (Austria)

10.4.1 Company Overview

10.4.2 Financial Analysis

10.4.3 Strategic Positioning

10.4.4 Info Graphic Analysis

10.5 Fuji Seal International, Inc. (Japan)

10.5.1 Company Overview

10.5.2 Financial Analysis

10.5.3 Strategic Positioning

10.5.4 Info Graphic Analysis

10.6 Multicolor Corporation (U.S.)

10.6.1 Company Overview

10.6.2 Financial Analysis

10.6.3 Strategic Positioning

10.6.4 Info Graphic Analysis

10.7 Huhtamaki Group (Finland)

10.7.1 Company Overview

10.7.2 Financial Analysis

10.7.3 Strategic Positioning

10.7.4 Info Graphic Analysis

10.8 EVCO Plastics (U.S.)

10.8.1 Company Overview

10.8.2 Financial Analysis

10.8.3 Strategic Positioning

10.8.4 Info Graphic Analysis

10.9 Cenveo, Inc. (U.S.)

10.9.1 Company Overview

10.9.2 Financial Analysis

10.9.3 Strategic Positioning

10.9.4 Info Graphic Analysis

10.10 Others

10.10.1 Company Overview

10.10.2 Financial Analysis

10.10.3 Strategic Positioning

10.10.4 Info Graphic Analysis

The Global In-Mold Labels Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the In-Mold Labels Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS