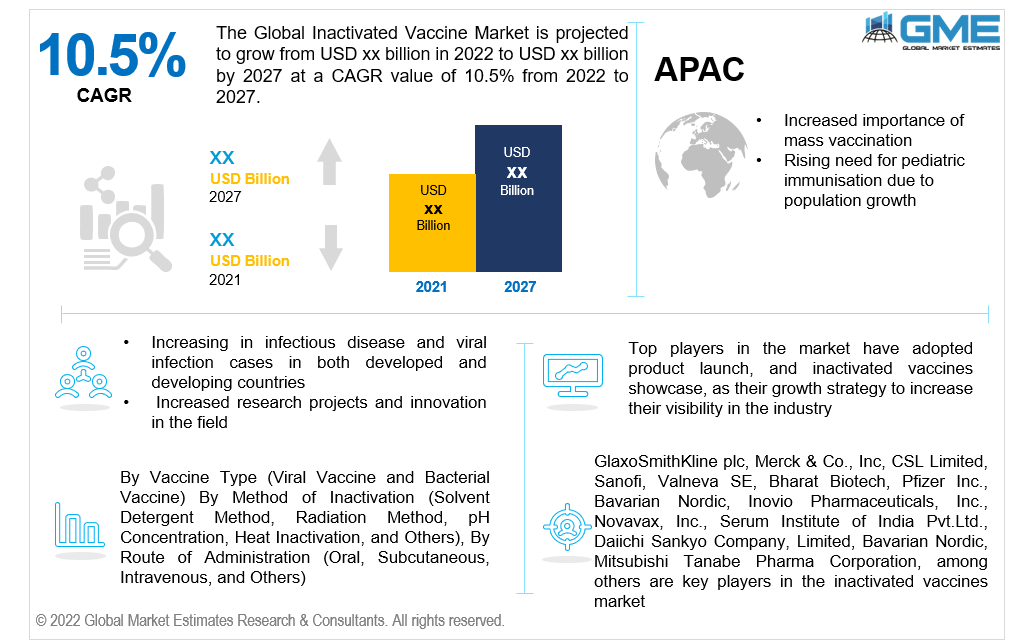

Global Inactivated Vaccine Market Size, Trends & Analysis - Forecasts to 2027 By Vaccine Type (Viral Vaccine and Bacterial Vaccine) By Method of Inactivation (Solvent Detergent Method, Radiation Method, pH Concentration, Heat Inactivation, and Others), By Route of Administration (Oral, Subcutaneous, Intravenous, and Others), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Company Market Share Analysis, and Competitor Analysis

The global inactivated vaccines market is projected to grow at a CAGR value of 10.5% from 2022 to 2027.

Inactivated vaccinations have been used to elicit protection against viral infections for over a century. The rising frequency of numerous viral and bacterial infections around the world has boosted demand for inactivated vaccines, which will drive the market forward. Annual influenza outbreaks, for one, were predicted to cause 3 to 5 million cases of serious influenza and 290,000 to 650,000 fatalities in 2018, as per a World Health Organization (WHO) report.

The disease-causing virus, especially sections of it, is still present in inactivated virus vaccinations, but its genetic content has been obliterated. As a result, inactivated vaccines are regarded to be safer and also more durable than live attenuation vaccines, as they can be administered to individuals with weakened immune systems, fuelling market expansion.

Furthermore, the rising importance of large-scale vaccination, the rapidly increasing need for paediatric immunization as a result of rapid urbanization, and a boost in nosocomial infection, and highly contagious infection cases in both developed and developing countries are all contributing to the market growth over the forecast period.

Growing health consciousness and government efforts to support vaccination, technological developments and infrastructure upgrades in the healthcare system, increased emphasis on research studies, and cooperation among various top research facilities in the domain to find a new methodology to enhance inactivated vaccines are all contributing to the market growth.

The market for inactivated vaccines is also being driven by an increase in the number of cases of acute illnesses, increased pollution levels, poor lifestyle choices, and changes in climatic conditions are all contributing causes to an increase in contagious disease occurrences, which could promote the market's growth.

The COVID-19 pandemic has had a significant impact on the inactivated vaccine market. Increased COVID-19 instances and the expanding prevalence of viral infections worldwide and the use of inactivated SARS-CoV-2 vaccines to significantly reduce the risk of symptomatic COVID-19 are important drivers for market expansion and the market is expected to rise upward post-pandemic.

In the coming years, inadequate vaccination coverage combined with exorbitant costs associated with vaccine shipping and storage will hurt the industry's progress. Furthermore, strict government requirements for product approval may delay the introduction of new products to the market, limiting the inactivated vaccine’s industry growth.

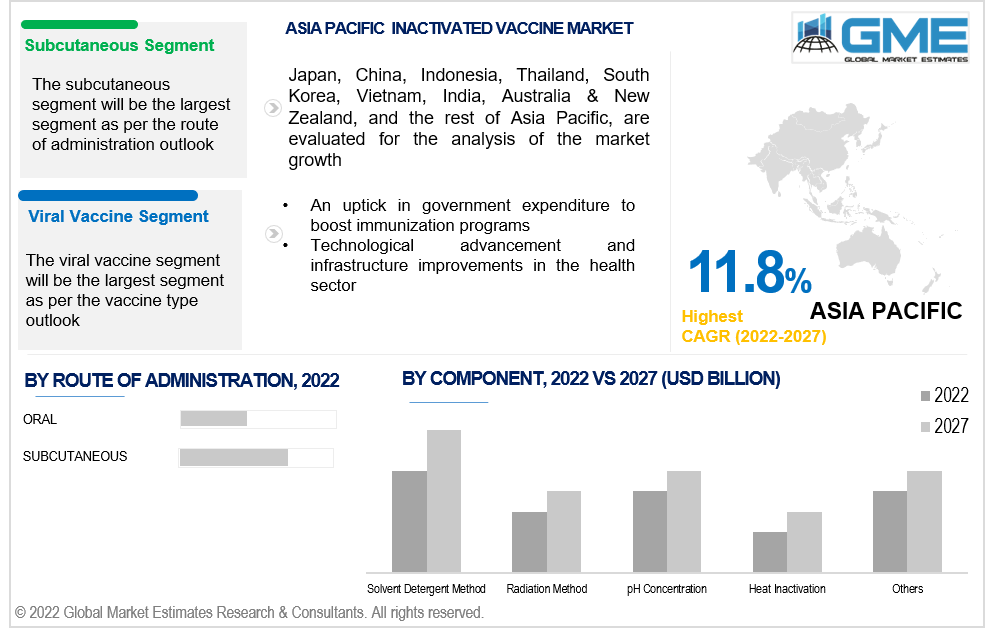

Based on the vaccine type, the market is segmented into viral and bacterial vaccines. The viral segment is expected to grow the fastest in the inactivated vaccine market from 2022 to 2027. This growth is owing to an increase in research and development on viruses, a rise in prevalence of several infectious and non-infectious diseases, as well as technological and infrastructural improvements in the health sector, which are anticipated to drive segment growth.

Based on the method of inactivation, the market is segmented into the solvent detergent method, radiation method, pH concentration, heat inactivation, and others. The solvent detergent method segment is expected to grow the fastest in the inactivated vaccine market from 2022 to 2027. The solvent/detergent treatment is a well-established virus inactivation technique that has been used in the pharmaceutical industry for about 30 years to produce plasma-derived therapeutic products. SD plasma has several benefits over fresh frozen plasma owing to the method’s extraordinary safety in terms of transplant pulmonary disease and a much-decreased risk of causing anaphylactic reactions.

Based on route of administration, the global inactivated vaccine market is segmented into oral, subcutaneous, intravenous, and others. The subcutaneous segment is expected to hold a larger share as compared to other segments. Since subcutaneous tissue contains few blood arteries, the injected medicine diffuses slowly and at a steady rate. As a result, it seems to be ideal for administering vaccinations, hormones and antibiotics, and diabetes, which need to be delivered in a steady stream at a low dose rate.

As per the geographical analysis, the inactivated vaccines market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central & South America (Brazil, Argentina, and Rest of Central and South America).

North America (the United States, Canada, and Mexico) will dominate the global share in the inactivated vaccine market from 2022 to 2027. A rise in infectious illness and viral infection instances, a robust health service, and an improvement of health consciousness among private agencies and government are the primary drivers driving market growth in this region throughout the forecast period.

Moreover, the Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific) region is expected to be the fastest-growing segment in the global inactivated vaccines market during the forecast period between 2022 and 2027. Rapidly growing population along with urbanization, the need for a robust healthcare delivery system, technical advances and infrastructural developments in the medical sector, an uptick in government expenditure to boost immunization programs, and sprouting health awareness through NGOs' campaigns are some of the forces influencing the regional market growth.

GlaxoSmithKline plc, Merck & Co., Inc, CSL Limited, Sanofi, Valneva SE, Bharat Biotech, Pfizer Inc., Bavarian Nordic, Inovio Pharmaceuticals, Inc., Novavax, Inc., Serum Institute of India Pvt. Ltd., Daiichi Sankyo Company, Limited, Bavarian Nordic, Mitsubishi Tanabe Pharma Corporation, among others are key players in the inactivated vaccines market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Inactivated Vaccine Industry Overview, 2022-2027

2.1.1 Industry Overview

2.1.2 Vaccine Type Overview

2.1.3 Method of Inactivation Overview

2.1.4 Route of Administration Overview

2.1.6 Regional Overview

Chapter 3 Inactivated Vaccine Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2022-2027

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Increased Importance of Mass Vaccination

3.3.1.2 An increase in infectious disease and viral infection cases in both developed and developing countries

3.3.2 Industry Challenges

3.3.2.1 Inactivated vaccines are expensive especially for poor people in developing countries

3.4 Prospective Growth Scenario

3.4.1 Vaccine Type Growth Scenario

3.4.2 Method of Inactivation Growth Scenario

3.4.3 Route of Administration Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Route of Administration Overview

3.11 Market Share Analysis, 2021

3.11.1 Company Positioning Overview, 2021

Chapter 4 Inactivated Vaccine Market, By Vaccine Type

4.1 Vaccine Type Outlook

4.2 Viral Vaccine

4.2.1 Market Size, By Region, 2022-2027 (USD Billion)

4.3 Bacterial Vaccine

4.3.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 5 Inactivated Vaccine Market, By Method of Inactivation

5.1 Method of Inactivation Outlook

5.2 Solvent Detergent Method

5.2.1 Market Size, By Region, 2022-2027 (USD Billion)

5.3 Radiation Method

5.3.1 Market Size, By Region, 2022-2027 (USD Billion)

5.4 pH Concentration

5.4.1 Market Size, By Region, 2022-2027 (USD Billion)

5.5 Heat Inactivation

5.4.1 Market Size, By Region, 2022-2027 (USD Billion)

5.6 Others

5.4.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 6 Inactivated Vaccine Market, By Route of Administration

6.1 Oral

6.1.1 Market Size, By Region, 2022-2027 (USD Billion)

6.2 Subcutaneous

6.2.1 Market Size, By Region, 2022-2027 (USD Billion)

6.3 Intravenous

6.3.1 Market Size, By Region, 2022-2027 (USD Billion)

6.4 Others

6.4.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 7 Inactivated Vaccine Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2022-2027 (USD Billion)

7.2.2 Market Size, By Vaccine Type, 2022-2027 (USD Billion)

7.2.3 Market Size, By Method of Inactivation, 2022-2027 (USD Billion)

7.2.4 Market Size, By Route of Administration, 2022-2027 (USD Billion)

7.2.6 U.S.

7.2.6.1 Market Size, By Vaccine Type, 2022-2027 (USD Billion)

7.2.4.2 Market Size, By Method of Inactivation, 2022-2027 (USD Billion)

7.2.4.3 Market Size, By Route of Administration, 2022-2027 (USD Billion)

7.2.7 Canada

7.2.7.1 Market Size, By Vaccine Type, 2022-2027 (USD Billion)

7.2.7.2 Market Size, By Method of Inactivation, 2022-2027 (USD Billion)

7.2.7.3 Market Size, By Route of Administration, 2022-2027 (USD Billion)

7.3 Europe

7.3.1 Market Size, By Country 2022-2027 (USD Billion)

7.3.2 Market Size, By Vaccine Type, 2022-2027 (USD Billion)

7.3.3 Market Size, By Method of Inactivation, 2022-2027 (USD Billion)

7.3.4 Market Size, By Route of Administration, 2022-2027 (USD Billion)

7.3.6 Germany

7.3.6.1 Market Size, By Vaccine Type, 2022-2027 (USD Billion)

7.3.6.2 Market Size, By Method of Inactivation, 2022-2027 (USD Billion)

7.3.6.3 Market Size, By Route of Administration, 2022-2027 (USD Billion)

7.3.7 UK

7.3.7.1 Market Size, By Vaccine Type, 2022-2027 (USD Billion)

7.3.7.2 Market Size, By Method of Inactivation, 2022-2027 (USD Billion)

7.3.7.3 Market Size, By Route of Administration, 2022-2027 (USD Billion)

7.3.8 France

7.3.7.1 Market Size, By Vaccine Type, 2022-2027 (USD Billion)

7.3.7.2 Market Size, By Method of Inactivation, 2022-2027 (USD Billion)

7.3.7.3 Market Size, By Route of Administration, 2022-2027 (USD Billion)

7.3.9 Italy

7.3.9.1 Market Size, By Vaccine Type, 2022-2027 (USD Billion)

7.3.9.2 Market Size, By Method of Inactivation, 2022-2027 (USD Billion)

7.3.9.3 Market Size, By Route of Administration, 2022-2027 (USD Billion)

7.3.10 Spain

7.3.10.1 Market Size, By Vaccine Type, 2022-2027 (USD Billion)

7.3.10.2 Market Size, By Method of Inactivation, 2022-2027 (USD Billion)

7.3.10.3 Market Size, By Route of Administration, 2022-2027 (USD Billion)

7.3.11 Russia

7.3.11.1 Market Size, By Vaccine Type, 2022-2027 (USD Billion)

7.3.11.2 Market Size, By Method of Inactivation, 2022-2027 (USD Billion)

7.3.11.3 Market Size, By Route of Administration, 2022-2027 (USD Billion)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2022-2027 (USD Billion)

7.4.2 Market Size, By Vaccine Type, 2022-2027 (USD Billion)

7.4.3 Market Size, By Method of Inactivation, 2022-2027 (USD Billion)

7.4.4 Market Size, By Route of Administration, 2022-2027 (USD Billion)

7.4.6 China

7.4.6.1 Market Size, By Vaccine Type, 2022-2027 (USD Billion)

7.4.6.2 Market Size, By Method of Inactivation, 2022-2027 (USD Billion)

7.4.6.3 Market Size, By Route of Administration, 2022-2027 (USD Billion)

7.4.7 India

7.4.7.1 Market Size, By Vaccine Type, 2022-2027 (USD Billion)

7.4.7.2 Market Size, By Method of Inactivation, 2022-2027 (USD Billion)

7.4.7.3 Market Size, By Route of Administration, 2022-2027 (USD Billion)

7.4.8 Japan

7.4.7.1 Market Size, By Vaccine Type, 2022-2027 (USD Billion)

7.4.7.2 Market Size, By Method of Inactivation, 2022-2027 (USD Billion)

7.4.7.3 Market Size, By Route of Administration, 2022-2027 (USD Billion)

7.4.9 Australia

7.4.9.1 Market Size, By Vaccine Type, 2022-2027 (USD Billion)

7.4.9.2 Market size, By Method of Inactivation, 2022-2027 (USD Billion)

7.4.9.3 Market Size, By Route of Administration, 2022-2027 (USD Billion)

7.4.10 South Korea

7.4.10.1 Market Size, By Vaccine Type, 2022-2027 (USD Billion)

7.4.10.2 Market Size, By Method of Inactivation, 2022-2027 (USD Billion)

7.4.10.3 Market Size, By Route of Administration, 2022-2027 (USD Billion)

7.5 Latin America

7.5.1 Market Size, By Country 2022-2027 (USD Billion)

7.5.2 Market Size, By Vaccine Type, 2022-2027 (USD Billion)

7.5.3 Market Size, By Method of Inactivation, 2022-2027 (USD Billion)

7.5.4 Market Size, By Route of Administration, 2022-2027 (USD Billion)

7.5.6 Brazil

7.5.6.1 Market Size, By Vaccine Type, 2022-2027 (USD Billion)

7.5.6.2 Market Size, By Method of Inactivation, 2022-2027 (USD Billion)

7.5.6.3 Market Size, By Route of Administration, 2022-2027 (USD Billion)

7.5.7 Mexico

7.5.7.1 Market Size, By Vaccine Type, 2022-2027 (USD Billion)

7.5.7.2 Market Size, By Method of Inactivation, 2022-2027 (USD Billion)

7.5.7.3 Market Size, By Route of Administration, 2022-2027 (USD Billion)

7.5.8 Argentina

7.5.7.1 Market Size, By Vaccine Type, 2022-2027 (USD Billion)

7.5.7.2 Market Size, By Method of Inactivation, 2022-2027 (USD Billion)

7.5.7.3 Market Size, By Route of Administration, 2022-2027 (USD Billion)

7.6 MEA

7.6.1 Market Size, By Country 2022-2027 (USD Billion)

7.6.2 Market Size, By Vaccine Type, 2022-2027 (USD Billion)

7.6.3 Market Size, By Method of Inactivation, 2022-2027 (USD Billion)

7.6.4 Market Size, By Route of Administration, 2022-2027 (USD Billion)

7.6.6 Saudi Arabia

7.6.6.1 Market Size, By Vaccine Type, 2022-2027 (USD Billion)

7.6.6.2 Market Size, By Method of Inactivation, 2022-2027 (USD Billion)

7.6.6.3 Market Size, By Route of Administration, 2022-2027 (USD Billion)

7.6.7 UAE

7.6.7.1 Market Size, By Vaccine Type, 2022-2027 (USD Billion)

7.6.7.2 Market Size, By Method of Inactivation, 2022-2027 (USD Billion)

7.6.7.3 Market Size, By Route of Administration, 2022-2027 (USD Billion)

7.6.8 South Africa

7.6.7.1 Market Size, By Vaccine Type, 2022-2027 (USD Billion)

7.6.7.2 Market Size, By Method of Inactivation, 2022-2027 (USD Billion)

7.6.7.3 Market Size, By Route of Administration, 2022-2027 (USD Billion)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2021

8.2 GlaxoSmithKline plc

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Info Graphic Analysis

8.3 Merck & Co., Inc

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info Graphic Analysis

8.4 CSL Limited, Sanofi

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info Graphic Analysis

8.5 Valneva SE

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info Graphic Analysis

8.6 Bharat Biotech

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info Graphic Analysis

8.7 Pfizer Inc

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info Graphic Analysis

8. Bavarian Nordic

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.9 Inovio Pharmaceuticals

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.10 Novavax, Inc

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info Graphic Analysis

8.11 Other Companies

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info Graphic Analysis

The Global Inactivated Vaccine Market has been studied from the year 2019 till 2027. However, the CAGR provided in the report is from the year 2022 to 2027. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Inactivated Vaccine Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS