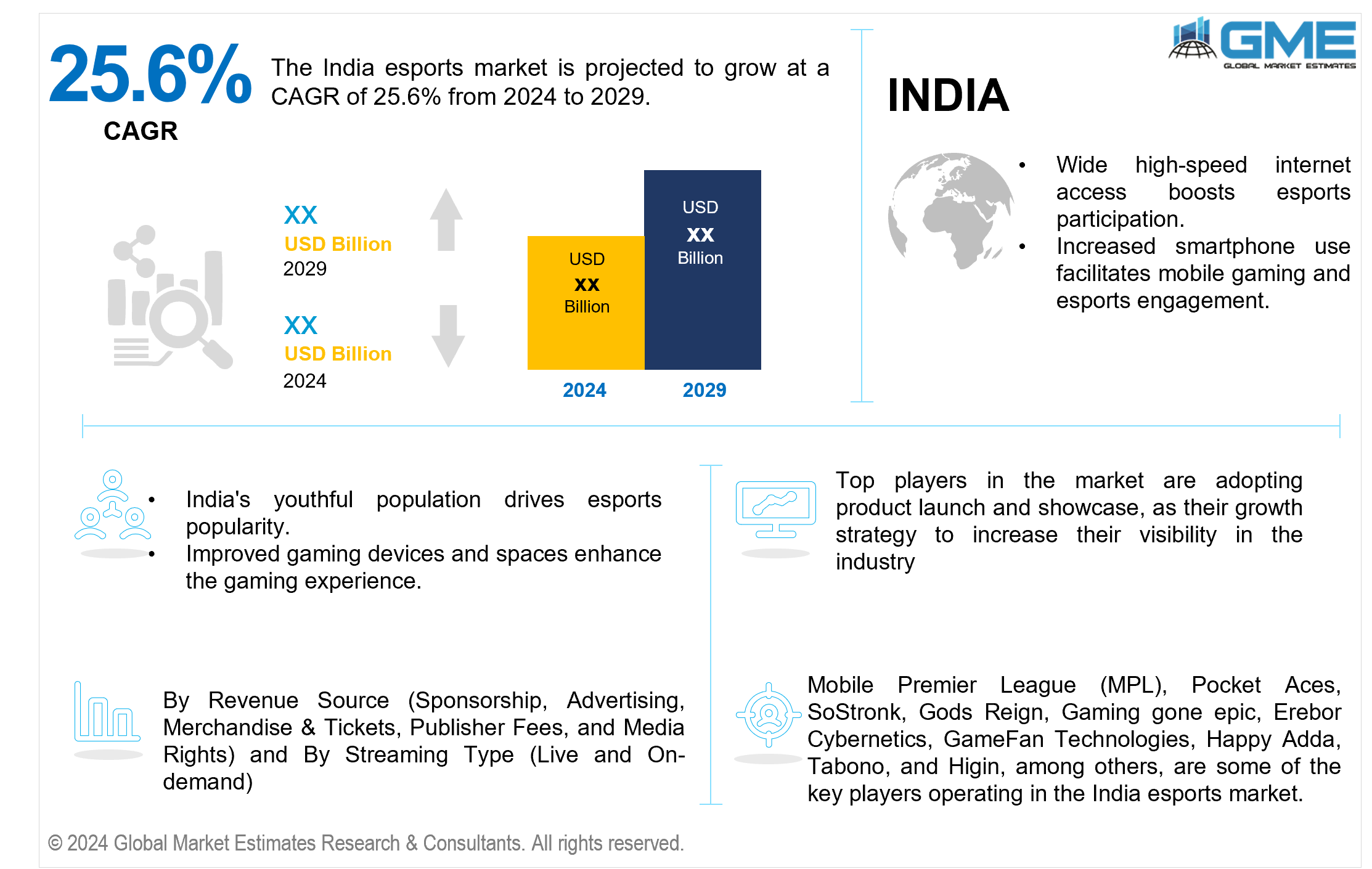

India Esports Market Size, Trends & Analysis - Forecasts to 2029 By Revenue Source (Sponsorship, Advertising, Merchandise & Tickets, Publisher Fees, and Media Rights) and By Streaming Type (Live and On-demand), Competitive Landscape, Company Market Share Analysis, and End User Analysis

The India esports market is projected to grow at a CAGR of 25.6% from 2024 to 2029.

The expansion of high-speed internet connection in both urban and rural areas of India has significantly contributed to the growth of the esports industry. This enhanced connectivity has allowed for greater involvement in online gaming and esports tournaments, making the business more accessible to a diverse demographic. As a result, the esports industry has grown by attracting a broader and more diverse audience. The neutral influence of increased internet access has democratized the esports ecosystem, allowing individuals from all locations to participate in competitive gaming while also adding to the overall development and diversity of the Indian esports sector.

The widespread use of smartphones facilitates access to esports material and involvement in mobile gaming, a significant segment of the esports business. As smartphones become more integrated into daily life, people find it easier to participate in competitive gaming. This trend has not only extended the esports audience but has also driven the rise of mobile gaming as a major and accessible area, helping the overall expansion and diversification of the esports industry.

The increasing youth population in India has emerged as a critical demographic for the growing esports sector. With a major proportion of the population being young, there is a strong interest in esports among the youth. This demographic trend contributes considerably to the growing popularity of competitive gaming, as younger generations actively participate in and contribute to the dynamic and evolving esports culture, influencing the industry's growth trajectory in the country.

Insufficient technological infrastructure, notably inconsistent internet connectivity in certain places, is a restraint to the growth of the India esports market. Limited access to a reliable online environment impedes the industry's growth by preventing smooth participation and watching, particularly in places with infrastructural issues.

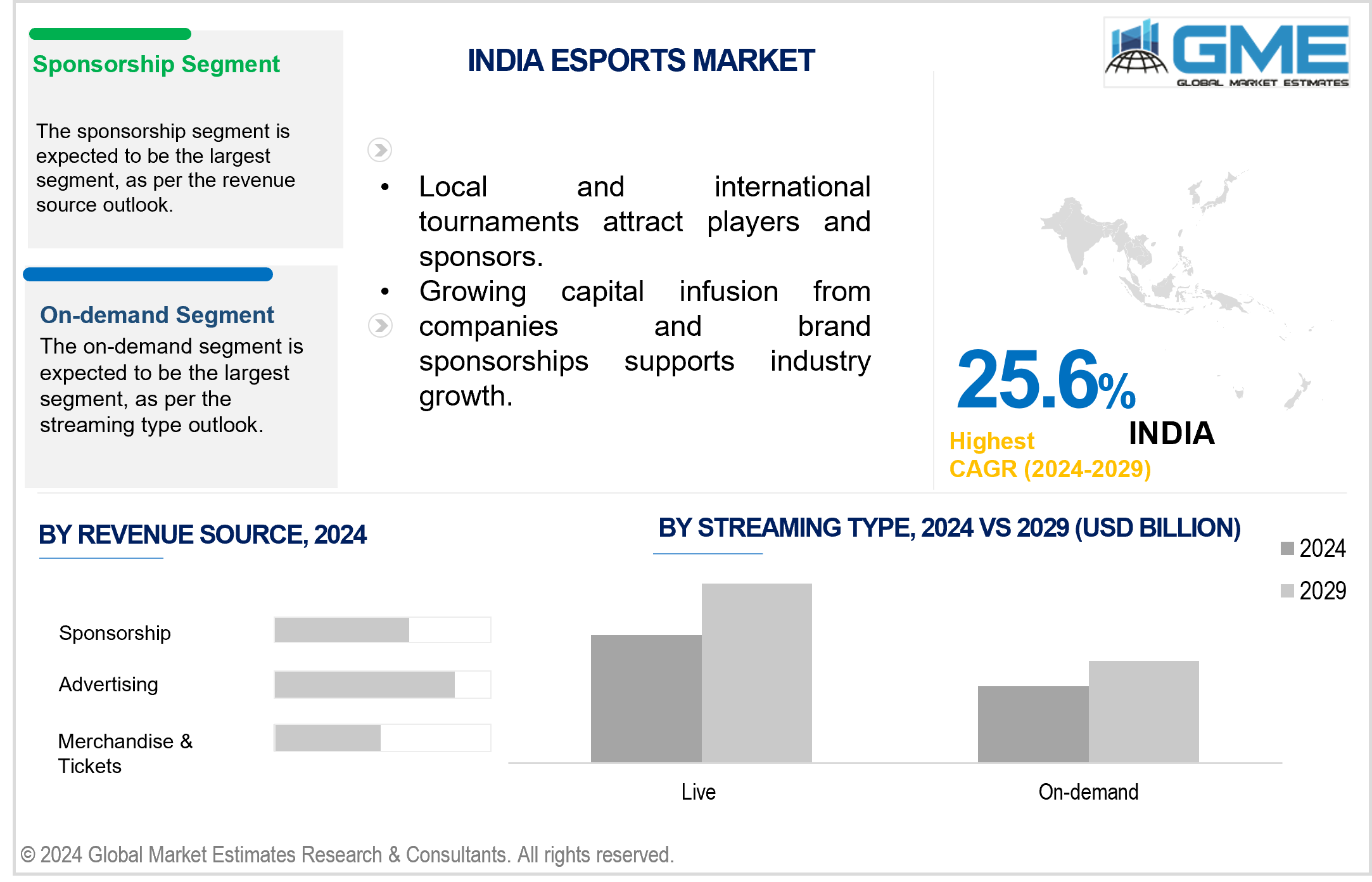

The sponsorship segment is expected to hold the largest share of the market. Companies understand esports' massive viewing and engagement potential and invest substantially in sponsorships to get awareness and connect with the wealthy gaming fanbase. Brands support teams, events, and individual players generate a significant portion of the overall revenue, further contributing to the segment's expected growth.

The media rights segment is expected to be the fastest-growing segment in the market from 2024-2029. The anticipated growth is due to the increasing demand for broadcasting rights. As esports become popular, traditional media sources and online platforms compete for exclusive broadcast rights to events and leagues. This increase in media rights deals indicates the growing awareness of esports as a profitable content category, garnering significant investments from broadcasters wanting to capitalize on the increased audience and participation within the esports community.

The live segment is anticipated to be the fastest-growing segment in the market from 2024-2029. This is due to its immersive and real-time engagement with audiences. Live streams give viewers quick access to competitive gaming material, creating a sense of excitement and community. The popularity of live streaming services such as Twitch and YouTube Gaming helps drive the segment's growth. Live streaming also improves fan contact by allowing viewers to join real-time debates, contributing to the segment's significant market share.

The on-demand segment is expected to hold the largest share of the market. The segment's anticipated growth is due to changing viewer preferences. As the popularity of esports grows, consumers want more control over their content. On-demand systems let viewers watch matches, highlights, and other esports content when most convenient for them. This development is consistent with changing consumption habits, making the on-demand sector the largest, as it meets the demand for tailored and flexible esports viewing options.

Mobile Premier League (MPL), Pocket Aces, SoStronk, Gods Reign, Gaming gone epic, Erebor Cybernetics, GameFan Technologies, Happy Adda, Tabono, and Higin, among others, are some of the key players operating in the India esports market.

Please note: This is not an exhaustive list of companies profiled in the report.

On March 1, 2024, Gods Reign partnered with LG Electronics. LG UltraGear will be the exclusive display partner for Gods Reign's Counter-Strike 2 lineup for the following year. The partnership involves strategic placements, with LG UltraGear featured on the jersey of Gods Reign's Counter-Strike 2 team.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Revenue Sources

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 INDIA MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Revenue Source Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 INDIA ESPORTS MARKET, BY REVENUE SOURCE

4.1 Introduction

4.2 Esports Market: Revenue Source Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Sponsorship

4.4.1 Sponsorship Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 Advertising

4.5.1 Advertising Market Estimates and Forecast, 2021-2029 (USD Million)

4.6 Merchandise & Tickets

4.6.1 Merchandise & Tickets Market Estimates and Forecast, 2021-2029 (USD Million)

4.7 Publisher Fees

4.7.1 Publisher Fees Market Estimates and Forecast, 2021-2029 (USD Million)

4.8 Media Rights

4.8.1 Media Rights Market Estimates and Forecast, 2021-2029 (USD Million)

5 INDIA ESPORTS MARKET, BY STREAMING TYPE

5.1 Introduction

5.2 Esports Market: Streaming Type Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 Live

5.4.1 Live Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 On-demand

5.5.1 On-demand Market Estimates and Forecast, 2021-2029 (USD Million)

6 COMPETITIVE LANDCAPE

6.1 Company Market Share Analysis

6.2 Four Quadrant Positioning Matrix

6.2.1 Market Leaders

6.2.2 Market Visionaries

6.2.3 Market Challengers

6.2.4 Niche Market Players

6.3 Vendor Landscape

6.3.1 India

6.4 Company Profiles

6.4.1 Mobile Premier League (MPL)

6.4.1.1 Business Description & Financial Analysis

6.4.1.2 SWOT Analysis

6.4.1.3 Products & Services Offered

6.4.1.4 Strategic Alliances between Business Partners

6.4.2 Pocket Aces

6.4.2.1 Business Description & Financial Analysis

6.4.2.2 SWOT Analysis

6.4.2.3 Products & Services Offered

6.4.2.4 Strategic Alliances between Business Partners

6.4.3 SoStronk

6.4.3.1 Business Description & Financial Analysis

6.4.3.2 SWOT Analysis

6.4.3.3 Products & Services Offered

6.4.3.4 Strategic Alliances between Business Partners

6.4.4 Gods Reign

6.4.4.1 Business Description & Financial Analysis

6.4.4.2 SWOT Analysis

6.4.4.3 Products & Services Offered

6.4.4.4 Strategic Alliances between Business Partners

6.4.5 Gaming Gone Epic

6.4.5.1 Business Description & Financial Analysis

6.4.5.2 SWOT Analysis

6.4.5.3 Products & Services Offered

6.4.5.4 Strategic Alliances between Business Partners

6.4.6 Erebor Cybernetics

6.4.6.1 Business Description & Financial Analysis

6.4.6.2 SWOT Analysis

6.4.6.3 Products & Services Offered

6.4.6.4 Strategic Alliances between Business Partners

6.4.7 GameFan Technologies

6.4.7.1 Business Description & Financial Analysis

6.4.7.2 SWOT Analysis

6.4.7.3 Products & Services Offered

6.4.8.4 Strategic Alliances between Business Partners

6.4.8 Happy Adda

6.4.8.1 Business Description & Financial Analysis

6.4.8.2 SWOT Analysis

6.4.8.3 Products & Services Offered

6.4.8.4 Strategic Alliances between Business Partners

6.4.9 Tabono

6.4.9.1 Business Description & Financial Analysis

6.4.9.2 SWOT Analysis

6.4.9.3 Products & Services Offered

6.4.9.4 Strategic Alliances between Business Partners

6.4.10 Higin

6.4.10.1 Business Description & Financial Analysis

6.4.10.2 SWOT Analysis

6.4.10.3 Products & Services Offered

6.4.10.4 Strategic Alliances between Business Partners

6.4.11 Other Companies

6.4.11.1 Business Description & Financial Analysis

6.4.11.2 SWOT Analysis

6.4.11.3 Products & Services Offered

6.4.11.4 Strategic Alliances between Business Partners

7 RESEARCH METHODOLOGY

7.1 Market Introduction

7.1.1 Market Definition

7.1.2 Market Scope & Segmentation

7.2 Information Procurement

7.2.1 Secondary Research

7.2.1.1 Purchased Databases

7.2.1.2 GMEs Internal Data Repository

7.2.1.3 Secondary Resources & Third Party Perspectives

7.2.1.4 Company Information Sources

7.2.2 Primary Research

7.2.2.1 Various Types of Respondents for Primary Interviews

7.2.2.2 Number of Interviews Conducted throughout the Research Process

7.2.2.3 Primary Stakeholders

7.2.2.4 Discussion Guide for Primary Participants

7.2.3 Expert Panels

7.2.3.1 Expert Panels Across 30+ Industry

7.2.4 Paid Local Experts

7.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

7.3 Market Estimation

7.3.1 Top-Down Approach

7.3.1.1 Macro-Economic Indicators Considered

7.3.1.2 Micro-Economic Indicators Considered

7.3.2 Bottom Up Approach

7.3.2.1 Company Share Analysis Approach

7.3.2.2 Estimation of Potential Product Sales

7.4 Data Triangulation

7.4.1 Data Collection

7.4.2 Time Series, Cross Sectional & Panel Data Analysis

7.4.3 Cluster Analysis

7.5 Analysis and Output

7.5.1 Inhouse AI Based Real Time Analytics Tool

7.5.2 Output From Desk & Primary Research

7.6 Research Assumptions & Limitations

7.7.1 Research Assumptions

7.7.2 Research Limitations

LIST OF TABLES

1 India Esports Market, By Revenue Source, 2021-2029 (USD Million)

2 Sponsorship Market, 2021-2029 (USD Million)

3 Advertising Market, 2021-2029 (USD Million)

4 Merchandise & Tickets Market, 2021-2029 (USD Million)

5 Media Rights Market, 2021-2029 (USD Million)

6 India Esports Market, By Streaming Type, 2021-2029 (USD Million)

7 Live Market, 2021-2029 (USD Million)

8 On-demand Market, 2021-2029 (USD Million)

9 India Esports Market, By Revenue Source, 2021-2029 (USD Million)

10 India Esports Market, By Streaming Type, 2021-2029 (USD Million)

11 Mobile Premier League (MPL): Products & Services Offering

12 Pocket Aces: Products & Services Offering

13 SoStronk: Products & Services Offering

14 Gods Reign: Products & Services Offering

15 Gaming Gone Epic: Products & Services Offering

16 Erebor Cybernetics: Products & Services Offering

17 GameFan Technologies : Products & Services Offering

18 Happy Adda: Products & Services Offering

19 Tabono, Inc: Products & Services Offering

20 Higin : Products & Services Offering

21 Other Companies: Products & Services Offering

LIST OF FIGURES

1 India Esports Market Overview

2 India Esports Market Value From 2021-2029 (USD Million)

3 India Esports Market Share, By Revenue Source (2023)

4 India Esports Market Share, By Streaming Type (2023)

5 India Esports Market, By Region (Asia Pacific Market)

6 Technological Trends In India Esports Market

7 Four Quadrant Competitor Positioning Matrix

8 Impact Of Macro & Micro Indicators On The Market

9 Impact Of Key Drivers On The India Esports Market

10 Impact Of Challenges On The India Esports Market

11 Porter’s Five Forces Analysis

12 India Esports Market: By Revenue Source Scope Key Takeaways

13 India Esports Market, By Revenue Source Segment: Revenue Growth Analysis

14 Sponsorship Market, 2021-2029 (USD Million)

15 Advertising Market, 2021-2029 (USD Million)

16 Merchandise & Tickets Market, 2021-2029 (USD Million)

17 Publisher Fees Market, 2021-2029 (USD Million)

18 Media Rights Market, 2021-2029 (USD Million)

19 India Esports Market: By Streaming Type Scope Key Takeaways

20 India Esports Market, By Streaming Type Segment: Revenue Growth Analysis

21 Live Market, 2021-2029 (USD Million)

22 On-demand Market, 2021-2029 (USD Million)

23 India Esports Market: Regional Analysis

24 India Esports Market Overview

25 India Esports Market, By Revenue Source

26 India Esports Market, By Streaming Type

27 Four Quadrant Positioning Matrix

28 Company Market Share Analysis

29 Mobile Premier League (MPL): Company Snapshot

30 Mobile Premier League (MPL): SWOT Analysis

31 Mobile Premier League (MPL): Geographic Presence

32 Pocket Aces: Company Snapshot

33 Pocket Aces: SWOT Analysis

34 Pocket Aces: Geographic Presence

35 SoStronk: Company Snapshot

36 SoStronk: SWOT Analysis

37 SoStronk: Geographic Presence

38 Gods Reign: Company Snapshot

39 Gods Reign: Swot Analysis

40 Gods Reign: Geographic Presence

41 Gaming Gone Epic: Company Snapshot

42 Gaming Gone Epic: SWOT Analysis

43 Gaming Gone Epic: Geographic Presence

44 Erebor Cybernetics: Company Snapshot

45 Erebor Cybernetics: SWOT Analysis

46 Erebor Cybernetics: Geographic Presence

47 GameFan Technologies : Company Snapshot

48 GameFan Technologies : SWOT Analysis

49 GameFan Technologies : Geographic Presence

50 Happy Adda: Company Snapshot

51 Happy Adda: SWOT Analysis

52 Happy Adda: Geographic Presence

53 Tabono, Inc.: Company Snapshot

54 Tabono, Inc.: SWOT Analysis

55 Tabono, Inc.: Geographic Presence

56 Higin : Company Snapshot

57 Higin : SWOT Analysis

58 Higin : Geographic Presence

59 Other Companies: Company Snapshot

60 Other Companies: SWOT Analysis

61 Other Companies: Geographic Presence

The Esports Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Esports Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS