India Generative AI in Agriculture Market Size, Trends & Analysis - Forecasts to 2029 By Technology (Machine Learning, Computer Vision, and Predictive Analytics) and By Application (Precision Farming, Agriculture Robots, Livestock Monitoring, Drone Analytics, Labor Management, and Others), Competitive Landscape, Company Market Share Analysis, and End User Analysis

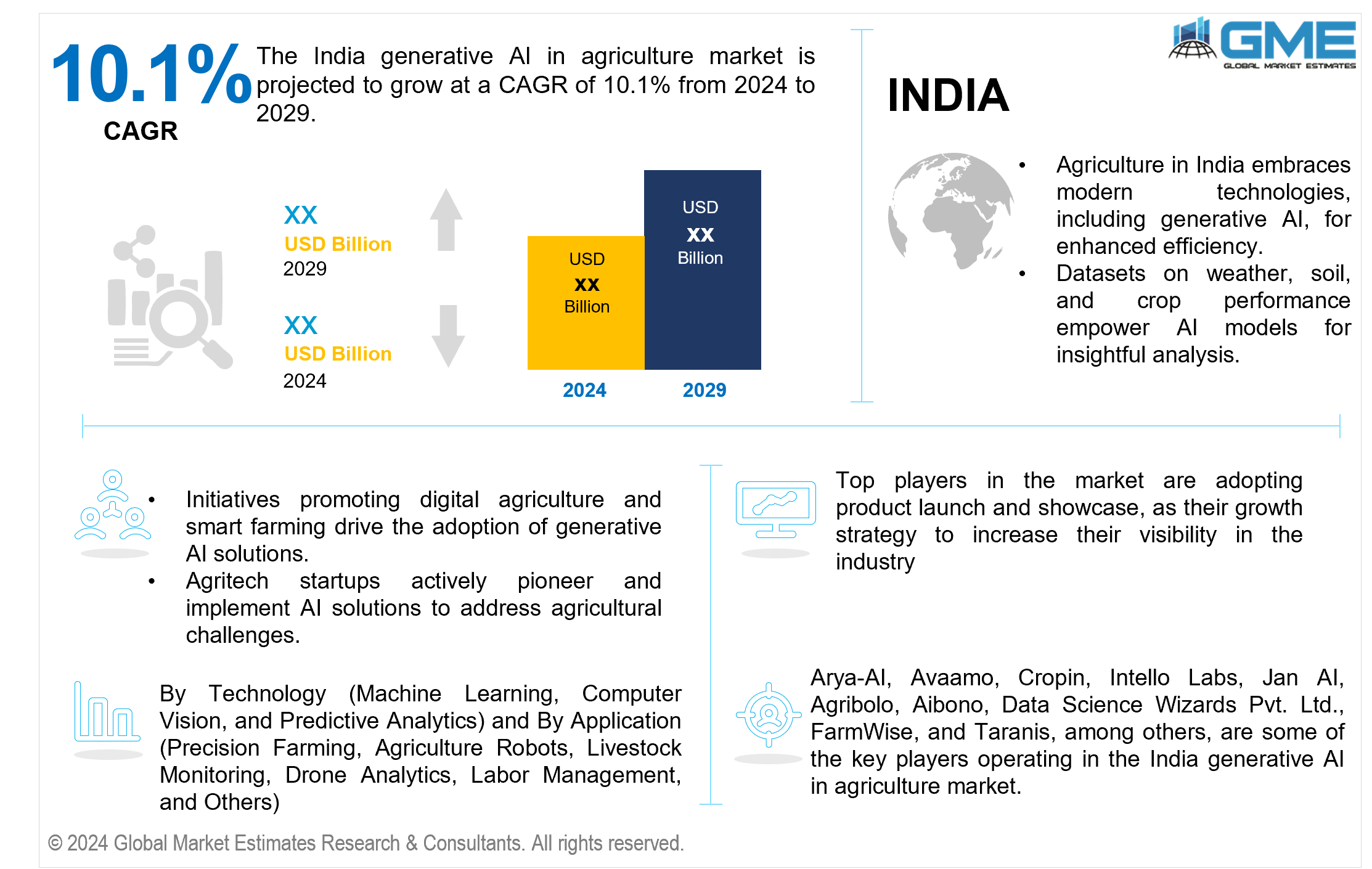

The India generative AI in agriculture market is projected to grow at a CAGR of 10.1% from 2024 to 2029.

India's agriculture sector is adopting advanced technology to increase efficiency. The increased availability of smartphones and enhanced internet connectivity in rural regions are helping the adoption of AI-powered solutions. This trend represents a transition toward more technologically advanced and data-driven agricultural practices, potentially improving farmer productivity and decision-making capacities. According to the World Economic Forum, as of January 2023, India had over 700 million smartphone users, with 425 million living in rural areas. The majority of the population now uses smartphones, and the number of active internet users has increased by 45% since 2019. This increase in connection makes rural India a key nation in the global smart revolution.

The increasing climate change in agriculture requires adaptable and resilient farming systems. Generative AI plays a vital role in providing predictive models to anticipate and mitigate the adverse effects of climate change on crops. These modern technologies can allow farmers to make more informed decisions, improving their ability to reduce risks, maximize resource utilization, and maintain sustainable agricultural practices in changing climate conditions.

The agricultural sector generates large amounts of data on crop performance, weather patterns, soil health, and others. This data is helpful for the development of AI models. By exploiting this data, AI systems may analyze and provide insights, improving the quality of agricultural decision-making. Farmers in India are using AI initiatives like AI4AI to address challenges such as climate change, pests, and financial issues. The "Saagu Baagu" project, part of AI4AI, has successfully enhanced yields and incomes for 7,000 Chilli farmers in Telangana. By implementing agritech solutions and effective data management, it doubled their earnings. Encouraged by this success, the initiative is expanding to potentially benefit 500,000 farmers across five value chains, showcasing AI's significant potential in the agricultural sector.

However, farmers' limited awareness and information on generative AI technology may restrict implementation. Education and training initiatives are critical to ensuring farmers properly use AI tools to improve agricultural operations.

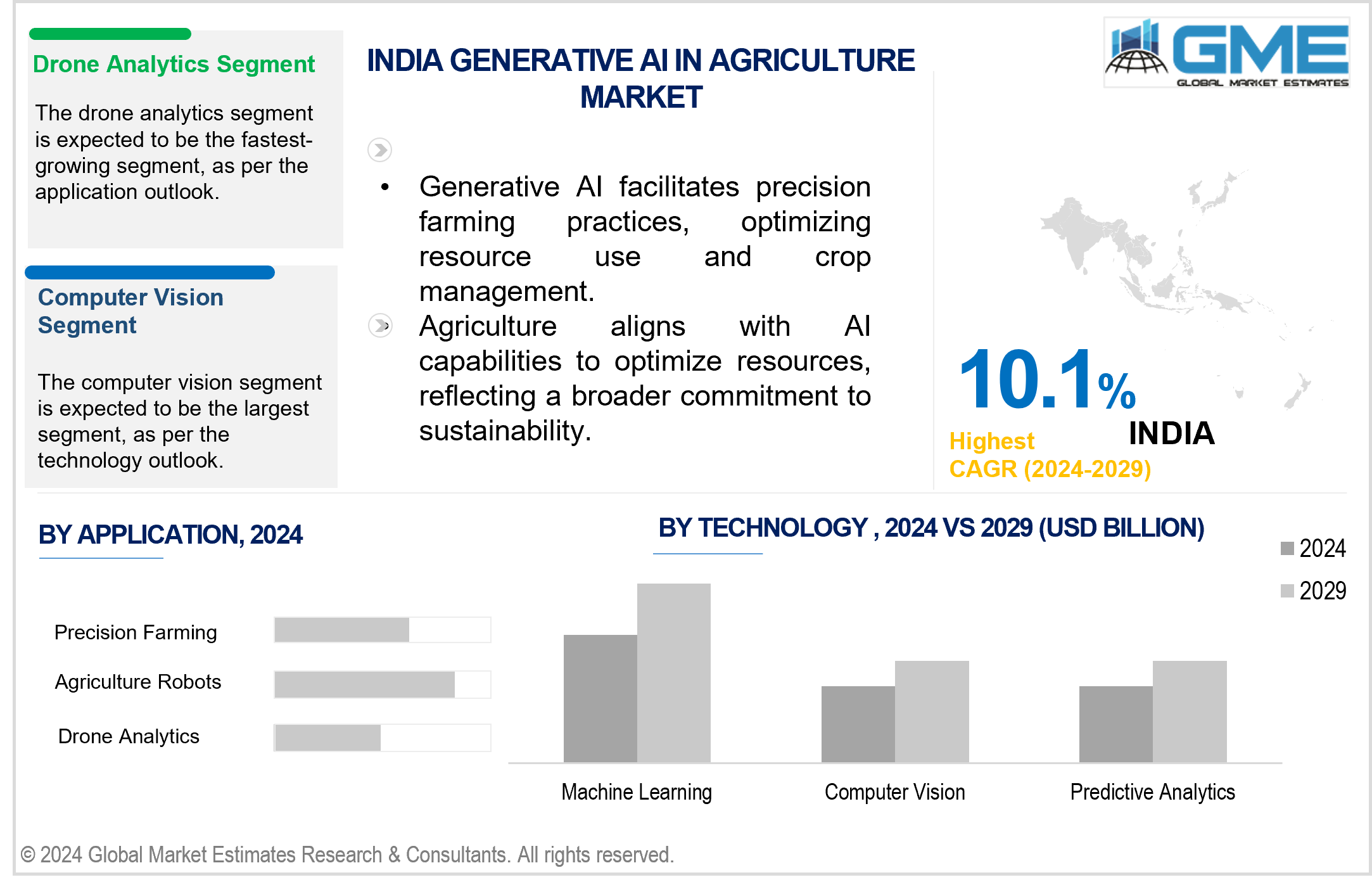

The computer vision segment is expected to hold the largest share in the market. The expected dominance of the segment is due to its transformative impact on crop monitoring. Computer vision uses visual data from drones and sensors to accurately analyze agricultural conditions, insect presence, and growth trends. This real-time data enables farmers to increase yields, optimize resources, and make more educated decisions.

The predictive analytics segment is expected to be the fastest-growing segment in the market from 2024 to 2029. This growth is attributed to its ability to foresee agricultural trends and optimize decision-making processes. Predictive analytics provides actionable insights to farmers by studying historical data and environmental conditions, enhancing crop management and resource allocation. The growing recognition of its potential to improve efficiency and productivity drives the expected quick expansion of this technology category in the market.

The drone analytics segment is anticipated to be the fastest-growing segment in the market from 2024-2029. Government support and investments in agriculture technologies, such as AI and drones, promote the development of drone analytics. Subsidies and incentives for adopting innovative agricultural technology drive market growth while fostering efficiency and sustainability without bias. The Government of India has taken significant steps to promote the use of drones in agriculture. For instance, on January 26, 2022, a certification scheme for agricultural drones was introduced, allowing them to carry payloads excluding chemicals or spraying liquids. Such substances can be applied in compliance with relevant regulations. To further support the adoption of drone technology in agriculture, the government announced a 100% subsidy, or a maximum of 10 lakhs, until March 2023 for Farm Machinery Training and Testing Institutes, ICAR Institutes, Krishi Vigyan Kendras, and State Agriculture Universities.

The precision farming segment is expected to hold the largest share of the market. The segment's anticipated dominance is due to its targeted approach to optimizing resource allocation and crop management. With the use of generative AI, precision farming can give farmers real-time insights regarding crop conditions, water use, and soil health. This meets farmers' evolving needs for data-driven, sustainable agriculture.

Arya-AI, Avaamo, Cropin, Intello Labs, Jan AI, Agribolo, Aibono, Data Science Wizards Pvt. Ltd., FarmWise, and Taranis, among others, are some of the key players operating in the India generative AI in agriculture market.

Please note: This is not an exhaustive list of companies profiled in the report.

In January 2022, an India-based agritech start-up, Arya, secured USD 60 million in funding, led by Asia Impact SA, Lightrock India, and Quona Capital. Arya addresses challenges faced by Indian farmers, such as inefficient storage and selling of produce and cash flow issues.

In August 2023, BharatAgri, a Bengaluru-based crop-input e-commerce start-up, incorporated generative artificial intelligence (GAI) into its platform, offering a transformative solution for farmers. Founded in 2018 by IIT Madras alumni Siddharth Dialani and Sai Gole, BharatAgri leverages GPT (Generative Pre-Trend Transformer) models to power its AI-driven bot. This bot provides accurate answers to farmers' queries, reducing error rates compared to human responses.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Technologys

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 INDIA MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 INDIA GENERATIVE AI IN AGRICULTURE MARKET, BY TECHNOLOGY

4.1 Introduction

4.2 Generative AI in Agriculture Market: Technology Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Machine Learning

4.4.1 Machine Learning Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 Computer Vision

4.5.1 Computer Vision Market Estimates and Forecast, 2021-2029 (USD Million)

4.6 Predictive Analytics

4.6.1 Predictive Analytics Market Estimates and Forecast, 2021-2029 (USD Million)

5 INDIA GENERATIVE AI IN AGRICULTURE MARKET, BY APPLICATION

5.1 Introduction

5.2 Generative AI in Agriculture Market: Application Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 Precision Farming

5.4.1 Precision Farming Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 Agriculture Robots

5.5.1 Agriculture Robots Market Estimates and Forecast, 2021-2029 (USD Million)

5.6 Livestock Monitoring

5.6.1 Livestock Monitoring Market Estimates and Forecast, 2021-2029 (USD Million)

5.7 Drone Analytics

5.7.1 Drone Analytics Market Estimates and Forecast, 2021-2029 (USD Million)

5.8 Labor Management

5.8.1 Labor Management Market Estimates and Forecast, 2021-2029 (USD Million)

5.9 Others

5.9.1 Others Market Estimates and Forecast, 2021-2029 (USD Million)

9 COMPETITIVE LANDCAPE

8.1 Company Market Share Analysis

8.2 Four Quadrant Positioning Matrix

8.2.1 Market Leaders

8.2.2 Market Visionaries

8.2.3 Market Challengers

8.2.4 Niche Market Players

8.3 Vendor Landscape

8.3.1 India

8.4 Company Profiles

8.4.1 Arya-AI

8.4.1.1 Business Description & Financial Analysis

8.4.1.2 SWOT Analysis

8.4.1.3 Products & Services Offered

8.4.1.4 Strategic Alliances between Business Partners

8.4.2 Avaamo

8.4.2.1 Business Description & Financial Analysis

8.4.2.2 SWOT Analysis

8.4.2.3 Products & Services Offered

8.4.2.4 Strategic Alliances between Business Partners

8.4.3 Cropin

8.4.3.1 Business Description & Financial Analysis

8.4.3.2 SWOT Analysis

8.4.3.3 Products & Services Offered

8.4.3.4 Strategic Alliances between Business Partners

8.4.4 Intello Labs

8.4.4.1 Business Description & Financial Analysis

8.4.4.2 SWOT Analysis

8.4.4.3 Products & Services Offered

8.4.4.4 Strategic Alliances between Business Partners

8.4.5 Jan AI

8.4.5.1 Business Description & Financial Analysis

8.4.5.2 SWOT Analysis

8.4.5.3 Products & Services Offered

8.4.5.4 Strategic Alliances between Business Partners

8.4.6 Agribolo

8.4.6.1 Business Description & Financial Analysis

8.4.6.2 SWOT Analysis

8.4.6.3 Products & Services Offered

8.4.6.4 Strategic Alliances between Business Partners

8.4.7 Aibono

8.4.7.1 Business Description & Financial Analysis

8.4.7.2 SWOT Analysis

8.4.7.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.8 Data Science Wizards Pvt. Ltd.

8.4.8.1 Business Description & Financial Analysis

8.4.8.2 SWOT Analysis

8.4.8.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.9 FarmWise

8.4.9.1 Business Description & Financial Analysis

8.4.9.2 SWOT Analysis

8.4.9.3 Products & Services Offered

8.4.9.4 Strategic Alliances between Business Partners

8.4.10 Taranis

8.4.10.1 Business Description & Financial Analysis

8.4.10.2 SWOT Analysis

8.4.10.3 Products & Services Offered

8.4.10.4 Strategic Alliances between Business Partners

8.4.11 Other Companies

8.4.11.1 Business Description & Financial Analysis

8.4.11.2 SWOT Analysis

8.4.11.3 Products & Services Offered

8.4.11.4 Strategic Alliances between Business Partners

9 RESEARCH METHODOLOGY

9.1 Market Introduction

9.1.1 Market Definition

9.1.2 Market Scope & Segmentation

9.2 Information Procurement

9.2.1 Secondary Research

9.2.1.1 Purchased Databases

9.2.1.2 GMEs Internal Data Repository

9.2.1.3 Secondary Resources & Third Party Perspectives

9.2.1.4 Company Information Sources

9.2.2 Primary Research

9.2.2.1 Various Types of Respondents for Primary Interviews

9.2.2.2 Number of Interviews Conducted throughout the Research Process

9.2.2.3 Primary Stakeholders

9.2.2.4 Discussion Guide for Primary Participants

9.2.3 Expert Panels

9.2.3.1 Expert Panels Across 30+ Industry

9.2.4 Paid Local Experts

9.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

9.3 Market Estimation

9.3.1 Top-Down Approach

9.3.1.1 Macro-Economic Indicators Considered

9.3.1.2 Micro-Economic Indicators Considered

9.3.2 Bottom Up Approach

9.3.2.1 Company Share Analysis Approach

9.3.2.2 Estimation of Potential Product Sales

9.4 Data Triangulation

9.4.1 Data Collection

9.4.2 Time Series, Cross Sectional & Panel Data Analysis

9.4.3 Cluster Analysis

9.5 Analysis and Output

9.5.1 Inhouse AI Based Real Time Analytics Tool

9.5.2 Output From Desk & Primary Research

9.6 Research Assumptions & Limitations

9.7.1 Research Assumptions

9.7.2 Research Limitations

LIST OF TABLES

1 India Generative AI in Agriculture Market, By Technology, 2021-2029 (USD Million)

2 Machine Learning Market, By Region, 2021-2029 (USD Million)

3 Computer Vision Market, By Region, 2021-2029 (USD Million)

4 Predictive Analytics Market, By Region, 2021-2029 (USD Million)

5 India Generative AI in Agriculture Market, By Application, 2021-2029 (USD Million)

6 Precision Farming Market, By Region, 2021-2029 (USD Million)

7 Agriculture Robots Market, By Region, 2021-2029 (USD Million)

8 Livestock Monitoring Market, By Region, 2021-2029 (USD Million)

9 Drone Analytics Market, By Region, 2021-2029 (USD Million)

10 Labor Management Market, By Region, 2021-2029 (USD Million)

11 Others Market, By Region, 2021-2029 (USD Million)

12 India Generative AI in Agriculture Market, By Technology, 2021-2029 (USD Million)

13 India Generative AI in Agriculture Market, By Application, 2021-2029 (USD Million)

14 Arya-AI: Products & Services Offering

15 Avaamo: Products & Services Offering

16 Cropin: Products & Services Offering

17 Intello Labs: Products & Services Offering

18 Jan AI: Products & Services Offering

19 Agribolo: Products & Services Offering

20 Aibono : Products & Services Offering

21 Data Science Wizards Pvt. Ltd.: Products & Services Offering

22 FarmWise, Inc: Products & Services Offering

23 Taranis: Products & Services Offering

24 Other Companies: Products & Services Offering

LIST OF FIGURES

1 India Generative AI in Agriculture Market Overview

2 India Generative AI in Agriculture Market Value From 2021-2029 (USD Million)

3 India Generative AI in Agriculture Market Share, By Technology (2023)

4 India Generative AI in Agriculture Market Share, By Application (2023)

5 India Generative AI in Agriculture Market, By Region (Asia Pacific Market)

6 Technological Trends In India Generative AI in Agriculture Market

7 Four Quadrant Competitor Positioning Matrix

8 Impact Of Macro & Micro Indicators On The Market

9 Impact Of Key Drivers On The India Generative AI in Agriculture Market

10 Impact Of Challenges On The India Generative AI in Agriculture Market

11 Porter’s Five Forces Analysis

12 India Generative AI in Agriculture Market: By Technology Scope Key Takeaways

13 India Generative AI in Agriculture Market, By Technology Segment: Revenue Growth Analysis

14 Machine Learning Market, By Region, 2021-2029 (USD Million)

15 Computer Vision Market, By Region, 2021-2029 (USD Million)

16 Predictive Analytics Market, By Region, 2021-2029 (USD Million)

17 India Generative AI in Agriculture Market: By Application Scope Key Takeaways

18 India Generative AI in Agriculture Market, By Application Segment: Revenue Growth Analysis

19 Precision Farming Market, By Region, 2021-2029 (USD Million)

20 Agriculture Robots Market, By Region, 2021-2029 (USD Million)

21 Livestock Monitoring Market, By Region, 2021-2029 (USD Million)

22 Drone Analytics Market, By Region, 2021-2029 (USD Million)

23 Labor Management Market, By Region, 2021-2029 (USD Million)

24 Others Market, By Region, 2021-2029 (USD Million)

25 India Generative AI in Agriculture Market Overview

26 India Generative AI in Agriculture Market, By Technology

27 India Generative AI in Agriculture Market, By Application

28 Four Quadrant Positioning Matrix

29 Company Market Share Analysis

30 Arya-AI: Company Snapshot

31 Arya-AI: SWOT Analysis

32 Arya-AI: Geographic Presence

33 Avaamo: Company Snapshot

34 Avaamo: SWOT Analysis

35 Avaamo: Geographic Presence

36 Cropin: Company Snapshot

37 Cropin: SWOT Analysis

38 Cropin: Geographic Presence

39 Intello Labs: Company Snapshot

40 Intello Labs: Swot Analysis

41 Intello Labs: Geographic Presence

42 Jan AI: Company Snapshot

43 Jan AI: SWOT Analysis

44 Jan AI: Geographic Presence

45 Agribolo: Company Snapshot

46 Agribolo: SWOT Analysis

47 Agribolo: Geographic Presence

48 Aibono : Company Snapshot

49 Aibono : SWOT Analysis

50 Aibono : Geographic Presence

51 Data Science Wizards Pvt. Ltd.: Company Snapshot

52 Data Science Wizards Pvt. Ltd.: SWOT Analysis

53 Data Science Wizards Pvt. Ltd.: Geographic Presence

54 FarmWise, Inc.: Company Snapshot

55 FarmWise, Inc.: SWOT Analysis

56 FarmWise, Inc.: Geographic Presence

57 Taranis: Company Snapshot

58 Taranis: SWOT Analysis

59 Taranis: Geographic Presence

60 Other Companies: Company Snapshot

61 Other Companies: SWOT Analysis

62 Other Companies: Geographic Presence

The Global Generative AI in Agriculture Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Generative AI in Agriculture Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS