India Industry 4.0 Market Size, Trends & Analysis - Forecasts to 2029 By Technology Type (Industry Automation, 3D Printing, Digital Twin, Artificial Intelligence (AI) and Machine Learning (ML), Blockchain, Extended Reality (XR), Industrial Internet of Things (IIoT), and Others) and By End User (Manufacturing, Automotive, Oil and Gas, Energy and Utilities, Food and Beverages, Aerospace and Defense, and Others), Competitive Landscape, Company Market Share Analysis, and End User Analysis

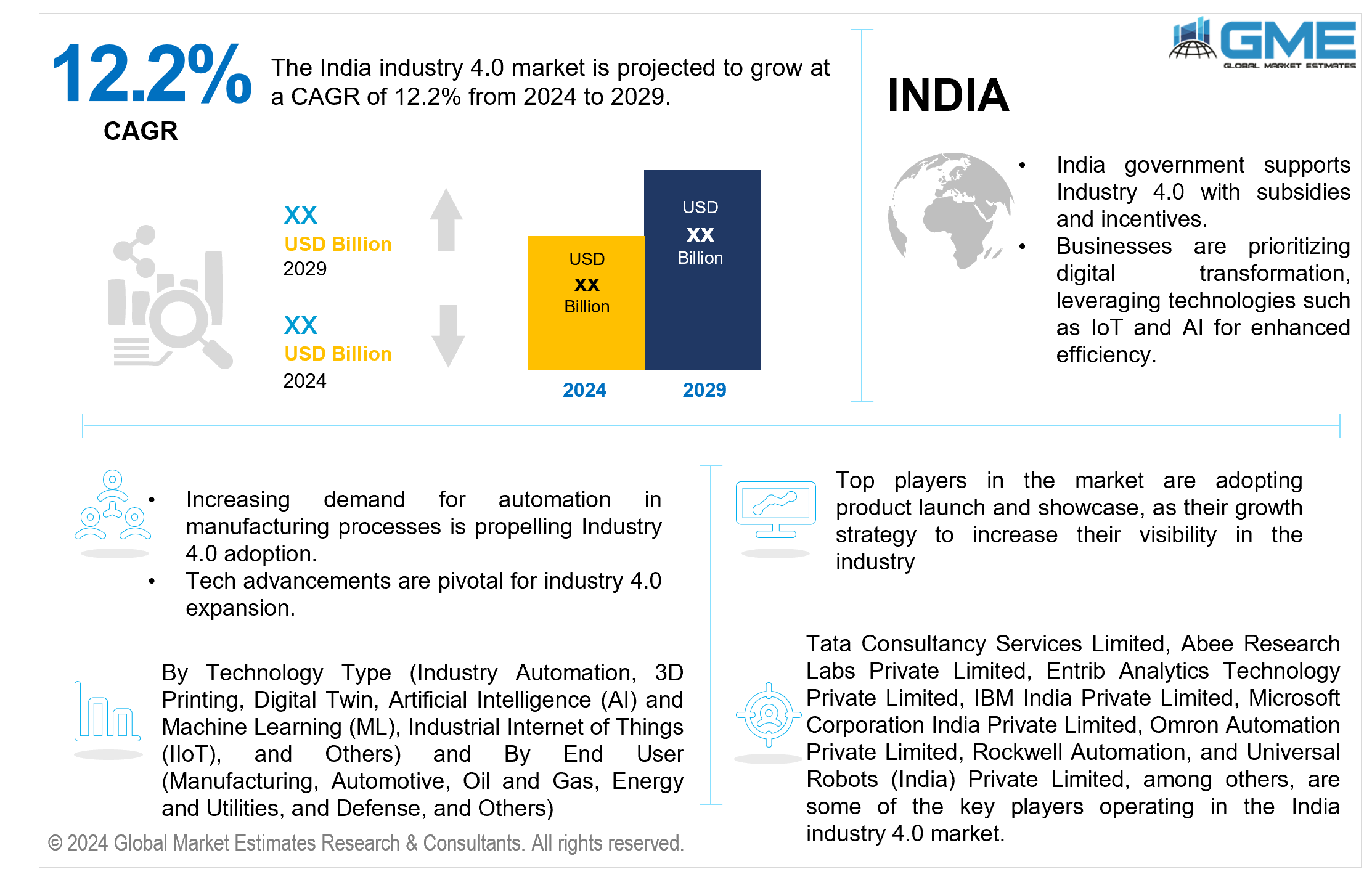

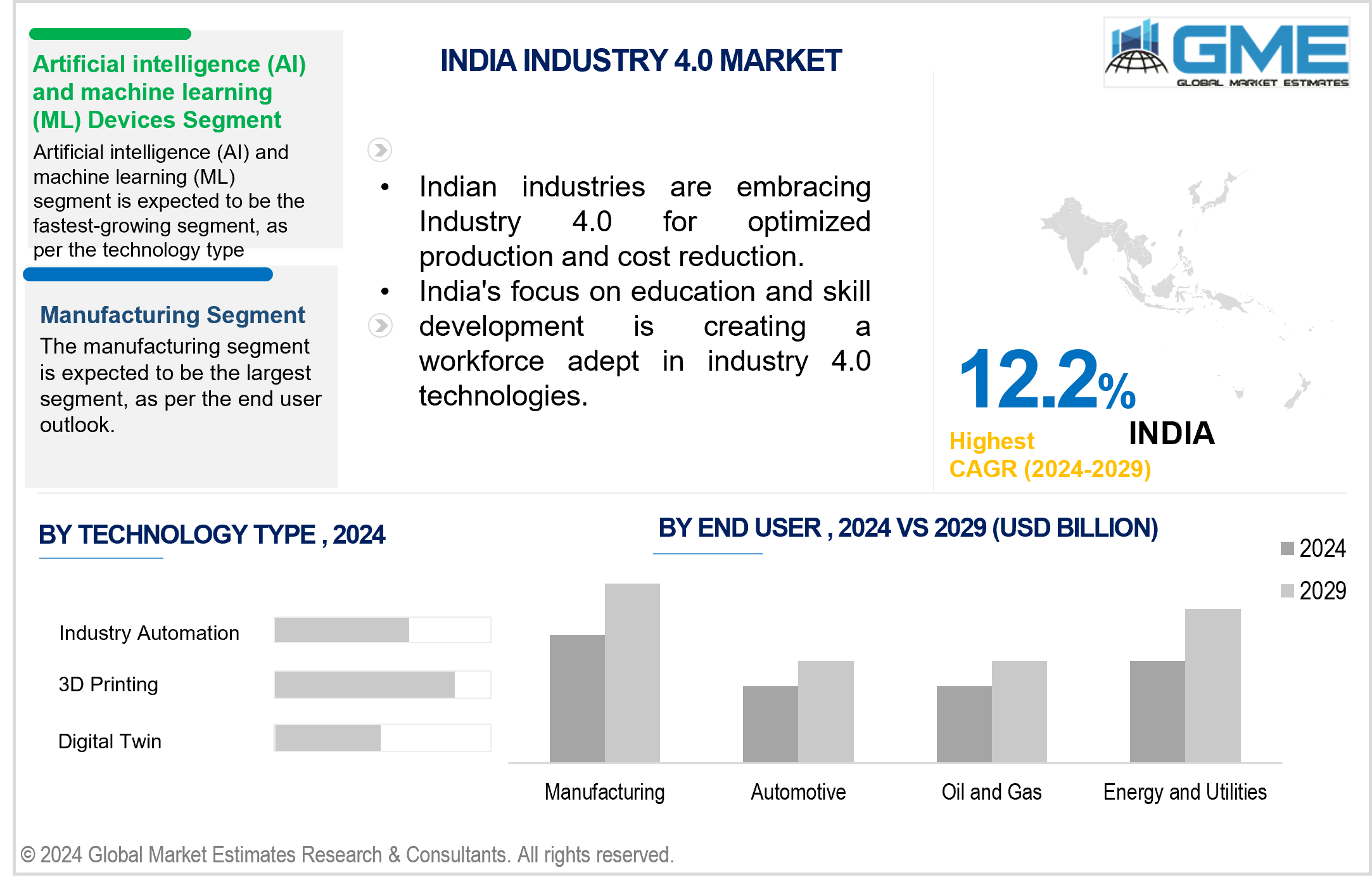

The India industry 4.0 market is projected to grow at a CAGR of 12.2% from 2024 to 2029.

The expansion of India's Industry 4.0 sector is mainly due to government initiatives such as "Make in India" and "Digital India," which promote a pro-technology environment. Supportive policies promote digitization and encourage enterprises to use Industry 4.0 technologies. These activities are critical in establishing India as a hub for advanced manufacturing and technical innovation, boosting economic growth and global competitiveness.

India's public and private sectors are significantly expanding their research and development (R&D) spending to bring innovation and technological progress. This increased commitment to research and development is critical in accelerating the development of cutting-edge technologies. By encouraging innovation, India positions itself at the forefront of technological progress, boosting economic growth and competitiveness on a national and global scale.

India's industries are experiencing a surge in the adoption of automation and smart manufacturing, driven by innovations and technologies. For instance, in June 2023, The Schaefer Systems International Pvt. Ltd., a solution provider of modular warehouse and logistics systems headquartered in India, introduced the SSI Piece Picking application, a fully automated piece-picking system equipped with innovative features. This solution incorporates specialized intelligent software and offers advanced functionalities.

The shift towards automation aims to optimize efficiency, decrease operational costs, and elevate overall productivity. Embracing automation reflects a strategic response to evolving market demands, positioning businesses to stay competitive and agile in a rapidly changing technological landscape. It ultimately contributes to the country's economic advancement.

The integration of connected devices, as well as the reliance on data sharing, raises cybersecurity risks. Ensuring the protection of sensitive data is critical for avoiding potential cyber threats and breaches.

The industrial Internet of Things (IIoT) segment is expected to hold the largest share of the market. This is attributed to its transformational effects on industrial operations. IIoT provides machine connectivity and data exchange, allowing for predictive maintenance, real-time monitoring, and increased operational efficiency.

The artificial intelligence (AI) and machine learning (ML) segment is expected to be the fastest-growing segment in the market from 2024-2029. The growth is attributed to the increasing integration of intelligent technology into industrial processes. AI and machine learning contribute to data analytics, predictive maintenance, and autonomous decision-making, improving productivity. These technologies' ability to adapt and learn from data patterns makes them essential components of Industry 4.0, contributing to the market's growth.

The automotive segment is anticipated to be the fastest-growing segment in the market from 2024-2029. The segment's growth is attributed to the automobile industry's increased emphasis on smart manufacturing, automation, and the incorporation of Industry 4.0 technology. The implementation of modern manufacturing methods, robots, and digitalization in the automotive sector is predicted to result in substantial breakthroughs, propelling the segment's growth.

The manufacturing segment is expected to hold the largest share of the market. This is due to its extensive use of modern technology to streamline production processes. Automation, IoT, and data analytics are examples of Industry 4.0 technologies that improve industrial efficiency, lower costs, and increase total productivity. As the manufacturing industry strives to modernize and remain competitive, the segment is predicted to hold the largest share.

Tata Consultancy Services Limited, Abee Research Labs Private Limited, Entrib Analytics Technology Private Limited, LivNSense Technologies Private Limited, Altizon Systems Private Limited, IBM India Private Limited, Microsoft Corporation India Private Limited, Omron Automation Private Limited, Rockwell Automation, and Universal Robots (India) Private Limited, among others, are some of the key players operating in the India industry 4.0 market.

Please note: This is not an exhaustive list of companies profiled in the report.

In May 2023, HFCL, a technology company, partnered with Microsoft to implement a Private 5G solution at its Optical Fibre manufacturing plant in Hyderabad, India, as part of its Industry 4.0 initiative. This partnership aims to enhance operational efficiency and manufacturing agility by leveraging new-age technologies such as IoT, Cloud, Edge Computing, AI, and Analytics.

In May 2019, Rockwell Automation introduced a new AI module, FactoryTalk Analytics LogixAI, for smart manufacturing and Industry 4.0. This module is designed to help industrial workers predict production issues and enhance processes using existing automation and control skills.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Technologys

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 INDIA MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 INDIA INDUSTRY 4.0 MARKET, BY TECHNOLOGY

4.1 Introduction

4.2 Industry 4.0 Market: Technology Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Artificial Intelligence (AI) and Machine Learning (ML)

4.4.1 Artificial Intelligence (AI) and Machine Learning (ML) Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 Industrial Internet of Things (IIoT)

4.5.1 Industrial Internet of Things (IIoT) Market Estimates and Forecast, 2021-2029 (USD Million)

4.6 Extended Reality (XR)

4.6.1 Extended Reality (XR) Market Estimates and Forecast, 2021-2029 (USD Million)

4.7 Industry Automation

4.7.1 Industry Automation Market Estimates and Forecast, 2021-2029 (USD Million)

4.8 3D Printing

4.8.1 3D Printing Market Estimates and Forecast, 2021-2029 (USD Million)

4.9 Digital Twin

4.9.1 Digital Twin Market Estimates and Forecast, 2021-2029 (USD Million)

4.10 Blockchain

4.10.1 Blockchain Market Estimates and Forecast, 2021-2029 (USD Million)

4.11 Others

4.11.1 Others Market Estimates and Forecast, 2021-2029 (USD Million)

5 INDIA INDUSTRY 4.0 MARKET, BY END USER

5.1 Introduction

5.2 Industry 4.0 Market: End User Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 Manufacturing

5.4.1 Manufacturing Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 Automotive

5.5.1 Automotive Market Estimates and Forecast, 2021-2029 (USD Million)

5.6 Oil and Gas

5.6.1 Oil and Gas Market Estimates and Forecast, 2021-2029 (USD Million)

5.7 Energy and Utilities

5.7.1 Energy and Utilities Market Estimates and Forecast, 2021-2029 (USD Million)

5.8 Food and Beverages

5.8.1 Food and Beverages Market Estimates and Forecast, 2021-2029 (USD Million)

5.9 Aerospace and Defense

5.9.1 Aerospace and Defense Market Estimates and Forecast, 2021-2029 (USD Million)

5.9 Others

5.9.1 Others Market Estimates and Forecast, 2021-2029 (USD Million)

6 COMPETITIVE LANDCAPE

6.1 Company Market Share Analysis

6.2 Four Quadrant Positioning Matrix

6.2.1 Market Leaders

6.2.2 Market Visionaries

6.2.3 Market Challengers

6.2.4 Niche Market Players

6.3 Vendor Landscape

6.3.1 India

6.4 Company Profiles

6.4.1 Tata Consultancy Services Limited

6.4.1.1 Business Description & Financial Analysis

6.4.1.2 SWOT Analysis

6.4.1.3 Products & Services Offered

6.4.1.4 Strategic Alliances between Business Partners

6.4.2 Abee Research Labs Private Limited

6.4.2.1 Business Description & Financial Analysis

6.4.2.2 SWOT Analysis

6.4.2.3 Products & Services Offered

6.4.2.4 Strategic Alliances between Business Partners

6.4.3 Entrib Analytics Technology Private Limited

6.4.3.1 Business Description & Financial Analysis

6.4.3.2 SWOT Analysis

6.4.3.3 Products & Services Offered

6.4.3.4 Strategic Alliances between Business Partners

6.4.4 LivNSense Technologies Private Limited

6.4.4.1 Business Description & Financial Analysis

6.4.4.2 SWOT Analysis

6.4.4.3 Products & Services Offered

6.4.4.4 Strategic Alliances between Business Partners

6.4.5 Altizon Systems Private Limited

6.4.5.1 Business Description & Financial Analysis

6.4.5.2 SWOT Analysis

6.4.5.3 Products & Services Offered

6.4.5.4 Strategic Alliances between Business Partners

6.4.6 IBM India Pvt Ltd.

6.4.6.1 Business Description & Financial Analysis

6.4.6.2 SWOT Analysis

6.4.6.3 Products & Services Offered

6.4.6.4 Strategic Alliances between Business Partners

6.4.7 Microsoft Corporation India Private Limited

6.4.7.1 Business Description & Financial Analysis

6.4.7.2 SWOT Analysis

6.4.7.3 Products & Services Offered

6.4.8.4 Strategic Alliances between Business Partners

6.4.8 Omron Automation Private Limited

6.4.8.1 Business Description & Financial Analysis

6.4.8.2 SWOT Analysis

6.4.8.3 Products & Services Offered

6.4.8.4 Strategic Alliances between Business Partners

6.4.9 Rockwell Automation

6.4.9.1 Business Description & Financial Analysis

6.4.9.2 SWOT Analysis

6.4.9.3 Products & Services Offered

6.4.9.4 Strategic Alliances between Business Partners

6.4.10 Universal Robots (India) Private Limited

6.4.10.1 Business Description & Financial Analysis

6.4.10.2 SWOT Analysis

6.4.10.3 Products & Services Offered

6.4.10.4 Strategic Alliances between Business Partners

6.4.11 Other Companies

6.4.11.1 Business Description & Financial Analysis

6.4.11.2 SWOT Analysis

6.4.11.3 Products & Services Offered

6.4.11.4 Strategic Alliances between Business Partners

7 RESEARCH METHODOLOGY

7.1 Market Introduction

7.1.1 Market Definition

7.1.2 Market Scope & Segmentation

7.2 Information Procurement

7.2.1 Secondary Research

7.2.1.1 Purchased Databases

7.2.1.2 GMEs Internal Data Repository

7.2.1.3 Secondary Resources & Third Party Perspectives

7.2.1.4 Company Information Sources

7.2.2 Primary Research

7.2.2.1 Various Types of Respondents for Primary Interviews

7.2.2.2 Number of Interviews Conducted throughout the Research Process

7.2.2.3 Primary Stakeholders

7.2.2.4 Discussion Guide for Primary Participants

7.2.3 Expert Panels

7.2.3.1 Expert Panels Across 30+ Industry

7.2.4 Paid Local Experts

7.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

7.3 Market Estimation

7.3.1 Top-Down Approach

7.3.1.1 Macro-Economic Indicators Considered

7.3.1.2 Micro-Economic Indicators Considered

7.3.2 Bottom Up Approach

7.3.2.1 Company Share Analysis Approach

7.3.2.2 Estimation of Potential Product Sales

7.4 Data Triangulation

7.4.1 Data Collection

7.4.2 Time Series, Cross Sectional & Panel Data Analysis

7.4.3 Cluster Analysis

7.5 Analysis and Output

7.5.1 Inhouse AI Based Real Time Analytics Tool

7.5.2 Output From Desk & Primary Research

7.6 Research Assumptions & Limitations

7.7.1 Research Assumptions

7.7.2 Research Limitations

LIST OF TABLES

1 India Industry 4.0 Market, By Technology, 2021-2029 (USD Million)

2 Artificial Intelligence (AI) and Machine Learning (ML) Market, 2021-2029 (USD Million)

3 Industrial Internet of Things (IIoT) Market, 2021-2029 (USD Million)

4 industrial automation Market, 2021-2029 (USD Million)

5 3d printing Market, 2021-2029 (USD Million)

6 digital twin Market, 2021-2029 (USD Million)

7 blockchain twin Market, 2021-2029 (USD Million)

8 Extended Reality (XR) Market, 2021-2029 (USD Million)

9 others Market, 2021-2029 (USD Million)

10 India Industry 4.0 Market, By End User, 2021-2029 (USD Million)

11 Manufacturing Market, 2021-2029 (USD Million)

12 Automotive Market, 2021-2029 (USD Million)

13 Oil and Gas Market, 2021-2029 (USD Million)

14 Energy and Utilities Market, 2021-2029 (USD Million)

15 Food and Beverages Market, 2021-2029 (USD Million)

16 Aerospace and Defense Market, 2021-2029 (USD Million)

17 others Market, 2021-2029 (USD Million)

18 India Industry 4.0 Market, By Technology, 2021-2029 (USD Million)

19 India Industry 4.0 Market, By End User, 2021-2029 (USD Million)

20 Tata Consultancy Services Limited: Products & Services Offering

21 Abee Research Labs Private Limited: Products & Services Offering

22 Entrib Analytics Technology Private Limited: Products & Services Offering

23 LivNSense Technologies Private Limited: Products & Services Offering

24 Altizon Systems Private Limited: Products & Services Offering

25 IBM India Pvt Ltd.: Products & Services Offering

26 Microsoft Corporation India Private Limited : Products & Services Offering

27 Omron Automation Private Limited: Products & Services Offering

28 Rockwell Automation, Inc: Products & Services Offering

29 Universal Robots (India) Private Limited: Products & Services Offering

30 Other Companies: Products & Services Offering

LIST OF FIGURES

1 India Industry 4.0 Market Overview

2 India Industry 4.0 Market Value From 2021-2029 (USD Million)

3 India Industry 4.0 Market Share, By Technology (2023)

4 India Industry 4.0 Market Share, By End User (2023)

5 India Industry 4.0 Market, By Region (Asia Pacific Market)

6 Technological Trends In India Industry 4.0 Market

7 Four Quadrant Competitor Positioning Matrix

8 Impact Of Macro & Micro Indicators On The Market

9 Impact Of Key Drivers On The India Industry 4.0 Market

10 Impact Of Challenges On The India Industry 4.0 Market

11 Porter’s Five Forces Analysis

12 India Industry 4.0 Market: By Technology Scope Key Takeaways

13 India Industry 4.0 Market, By Technology Segment: Revenue Growth Analysis

14 Artificial Intelligence (AI) and Machine Learning (ML) Market, 2021-2029 (USD Million)

15 Industrial Internet of Things (IIoT) Market, 2021-2029 (USD Million)

16 Extended Reality (XR) Market, 2021-2029 (USD Million)

17 Industry Automation Market, 2021-2029 (USD Million)

18 3D Printing Market, 2021-2029 (USD Million)

19 Digital Twin Market, 2021-2029 (USD Million)

20 Blockchain Market, 2021-2029 (USD Million)

21 Others Market, 2021-2029 (USD Million)

22 India Industry 4.0 Market: By End User Scope Key Takeaways

23 India Industry 4.0 Market, By End User Segment: Revenue Growth Analysis

24 Manufacturing Market, 2021-2029 (USD Million)

25 Automotive Market, 2021-2029 (USD Million)

26 Oil and Gas Market, 2021-2029 (USD Million)

27 Energy and Utilities Market, 2021-2029 (USD Million)

28 Food and Beverages Market, 2021-2029 (USD Million)

29 Aerospace and Defense Market, 2021-2029 (USD Million)

30 Others Market, 2021-2029 (USD Million)

31 India Industry 4.0 Market: Regional Analysis

32 India Industry 4.0 Market Overview

33 India Industry 4.0 Market, By Technology

34 India Industry 4.0 Market, By End User

35 Four Quadrant Positioning Matrix

36 Company Market Share Analysis

37 Tata Consultancy Services Limited: Company Snapshot

38 Tata Consultancy Services Limited: SWOT Analysis

39 Tata Consultancy Services Limited: Geographic Presence

40 Abee Research Labs Private Limited: Company Snapshot

41 Abee Research Labs Private Limited: SWOT Analysis

42 Abee Research Labs Private Limited: Geographic Presence

43 Entrib Analytics Technology Private Limited: Company Snapshot

44 Entrib Analytics Technology Private Limited: SWOT Analysis

45 Entrib Analytics Technology Private Limited: Geographic Presence

46 LivNSense Technologies Private Limited: Company Snapshot

47 LivNSense Technologies Private Limited: Swot Analysis

48 LivNSense Technologies Private Limited: Geographic Presence

49 Altizon Systems Private Limited: Company Snapshot

50 Altizon Systems Private Limited: SWOT Analysis

51 Altizon Systems Private Limited: Geographic Presence

52 IBM India Pvt Ltd.: Company Snapshot

53 IBM India Pvt Ltd.: SWOT Analysis

54 IBM India Pvt Ltd.: Geographic Presence

55 Microsoft Corporation India Private Limited : Company Snapshot

56 Microsoft Corporation India Private Limited : SWOT Analysis

57 Microsoft Corporation India Private Limited : Geographic Presence

58 Omron Automation Private Limited: Company Snapshot

59 Omron Automation Private Limited: SWOT Analysis

60 Omron Automation Private Limited: Geographic Presence

61 Rockwell Automation, Inc.: Company Snapshot

62 Rockwell Automation, Inc.: SWOT Analysis

63 Rockwell Automation, Inc.: Geographic Presence

64 Universal Robots (India) Private Limited: Company Snapshot

65 Universal Robots (India) Private Limited: SWOT Analysis

66 Universal Robots (India) Private Limited: Geographic Presence

67 Other Companies: Company Snapshot

68 Other Companies: SWOT Analysis

69 Other Companies: Geographic Presence

The India Industry 4.0 Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the India Industry 4.0 Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS