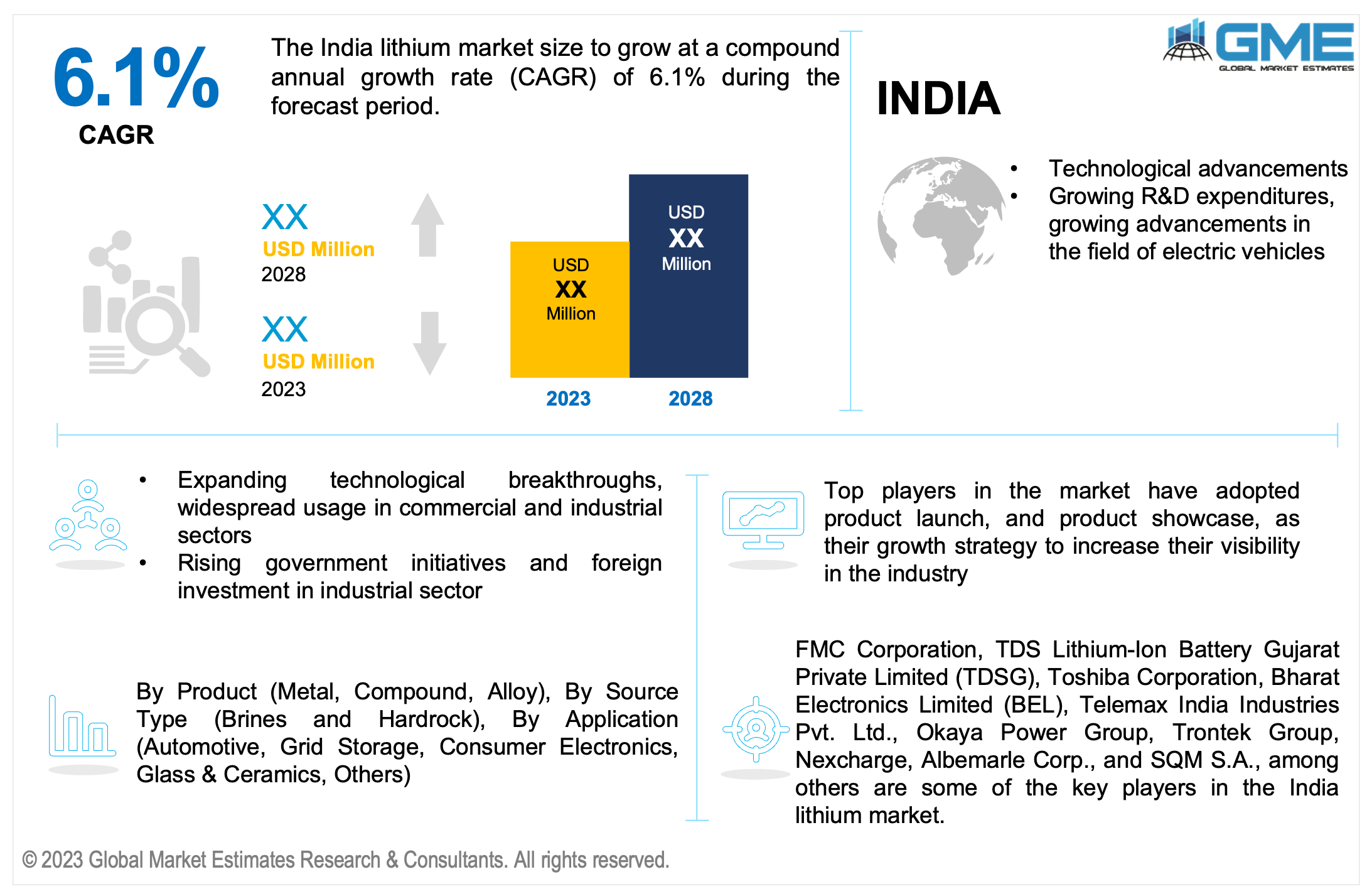

India Lithium Market Size, Trends & Analysis - Forecasts to 2028 By Product (Metal, Compound, Alloy), By Source Type (Brines, Hardrock), By Application (Automotive, Grid Storage, Consumer Electronics, Glass & Ceramics, Others), Competitive Landscape, Company Market Share Analysis, and Competitor Analysis

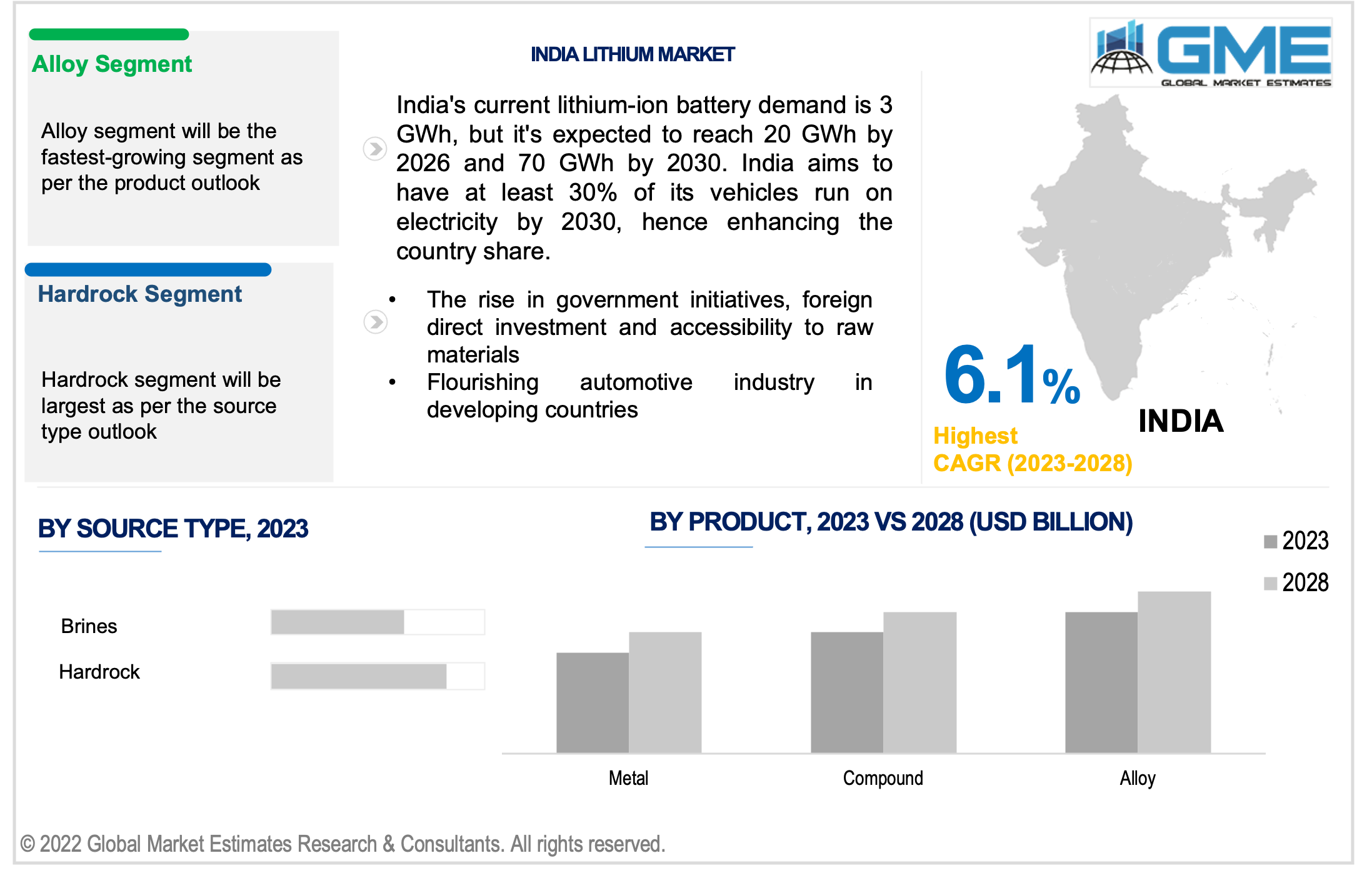

The Indian Lithium Market size is anticipated to grow at a CAGR of 6.1% from 2023 to 2028.

The lithium market in India is anticipated to grow as a result of declining lithium-ion battery prices and the emergence of brand-new, exciting markets, like energy storage systems (ESS) for both commercial and residential applications. A medium-sized lithium-ion battery system called the Li-Rack battery has been developed in India for use in commercial applications, multi-family buildings, and other demanding storage-intensive projects. Consumer preferences are quickly shifting towards small and portable devices, which has increased the demand for effective storage and power backup solutions. Additionally, the market is also growing as a result of the widespread use of lithium-ion batteries in automobiles.

India's growing lithium-ion battery recycling industry is expected to open up opportunities for the country's market. In addition, the goods and service tax on all varieties of lithium-ion batteries has been lowered by the Indian government from 28% to 18%. As a result, Lithium-ion batteries are now more widely used and less expensive in India. Furthermore, as a result of the government's promotion of renewable energy sources, there is now a greater need for effective storage options, such as lithium-ion batteries.

By 2030, India wants to be a significant EV adopting country. As the country moves towards the widespread adoption of electric vehicles, the government has announced a number of policies and incentives that are anticipated to drive the market during the forecast period. Due to the government's emphasis on e-mobility, domestic battery production has increased in India. The Indian government wants 30% of its fleet to be electric by 2030. Additionally, the Indian government announced income tax exemptions for potential EV buyers in July 2019 and reduced the goods and services tax (GST) on EVs from 12% to 5%. The Indian government has also established a National Mission on Transformative Mobility and Battery Storage in an effort to promote clean energy. The above policy initiatives by the government are anticipated to propel market growth of lithium in India.

Additionally, the government allocated INR 5,500 Crores for the second phase of the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) India Scheme in August 2018 to encourage the use of EVs and domestic lithium-ion battery production (which went into effect in April 2019). Numerous suppliers of power and energy solutions and producers of automotive parts, including Amara Raja Batteries, intend to locate their lithium-ion battery manufacturing operations in India to take advantage of the country's growing market for environmentally friendly vehicles. Due to the aforementioned factors, the country's lithium-ion battery market is anticipated to grow from 2023 to 2028 as a result of India's strategy to encourage the use of electric vehicles.

The alloy is expected to be the fastest-growing segment in the market from 2023-2028 owing to its material's attributes, which include its light weight, high tensile strength, and high yield strength. In recent years, Al-Li alloys have become more well-liked as potential light metals with safe uses in a range of aircraft structures and related aerospace applications. Additionally, aluminum-lithium alloy is a perfect material for astronautics due to its high strength and resistance to the outside environment. Due to this, the segment has grown faster than expected.

Based on source, India lithium market has been further bifurcated into brines and hardrock. The hardrock segment is anticipated to be the largest in the market from 2023-2028. The main factor driving the segment's growth is the advanced operational developments to achieve efficient production and sustainable methods. Additionally, the cost of producing hardrock is considerably lower than that of brine. For example, average cash cost for 11 hard-rock producers expected to be US$2,540/t LCE in 2019. The aforementioned elements are causing the segment's revenue to increase rapidly.

The consumer electronics segment is anticipated to be the fastest-growing segment in the market from 2023-2028. Lithium-ion batteries power various electronic gadgets like smartphones, laptops, smart watch, and remote controls. The size of the country's population and its level of disposable income have a significant impact on consumer electronics sales. India's rising living standards and rising disposable income have raised the demand for consumer electronics over the years. Additionally, the availability of the internet at incredibly reduced prices has dramatically increased smartphone penetration in India. India became the world's second-largest smartphone market after China in 2019, with 158 million shipments and 7% YoY growth, surpassing the United States for the first time on an annual level as of January 2020.

Due to the aforementioned factors, consumer electronics segment to dominate India lithium-ion battery market.

The paramount competitors covered in the India lithium market include FMC Corporation, TDS Lithium-Ion Battery Gujarat Private Limited (TDSG), Toshiba Corporation, Bharat Electronics Limited (BEL), Telemax India Industries Pvt. Ltd., Okaya Power Group, Trontek Group, Nexcharge, Albemarle Corp., and SQM S.A. among others.

Please note: This is not an exhaustive list of companies profiled in the report.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

2.4 Data Metrics on Feed Stocks

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

4 INDIA LITHIUM MARKET, BY PRODUCT

4.2 Lithium Market: Product Scope Key Takeaways

4.3 Revenue Growth Analysis, 2022 & 2028

4.4.1 Metal Market Estimates and Forecast, 2020-2028 (USD Million)

4.5.1 Compound Market Estimates and Forecast, 2020-2028 (USD Million)

4.7.1 Alloy Market Estimates and Forecast, 2020-2028 (USD Million)

5 INDIA LITHIUM MARKET, BY SOURCE TYPE

5.2 Lithium Market: Source Type Scope Key Takeaways

5.3 Revenue Growth Analysis, 2022 & 2028

5.4.1 Brines Market Estimates and Forecast, 2020-2028 (USD Million)

5.5.1 Hardrock Market Estimates and Forecast, 2020-2028 (USD Million)

6 INDIA LITHIUM MARKET, BY APPLICATION

6.2 Lithium Market: Application Scope Key Takeaways

6.3 Revenue Growth Analysis, 2022 & 2028

6.4.1 Automotive Market Estimates and Forecast, 2020-2028 (USD Million)

6.5.1 Grid Storage Market Estimates and Forecast, 2020-2028 (USD Million)

6.6.1 Consumer Electronics Market Estimates and Forecast, 2020-2028 (USD Million)

6.7.1 Glass & Ceramics Market Estimates and Forecast, 2020-2028 (USD Million)

6.8.1 Others Market Estimates and Forecast, 2020-2028 (USD Million)

7.1 Company Market Share Analysis

7.2 Four Quadrant Positioning Matrix

7.3.1.1 Business Description & Financial Analysis

7.3.1.3 Products & Services Offered

7.3.1.4 Strategic Alliances between Business Partners

7.3.2 TDS Lithium-Ion Battery Gujarat Private Limited (TDSG)

7.3.2.1 Business Description & Financial Analysis

7.3.2.3 Products & Services Offered

7.3.2.4 Strategic Alliances between Business Partners

7.3.3.1 Business Description & Financial Analysis

7.3.3.3 Products & Services Offered

7.3.3.4 Strategic Alliances between Business Partners

7.3.4 Bharat Electronics Limited (BEL)

7.3.4.1 Business Description & Financial Analysis

7.3.4.3 Products & Services Offered

7.3.4.4 Strategic Alliances between Business Partners

7.3.5 Telemax India Industries Pvt. Ltd.

7.3.5.1 Business Description & Financial Analysis

7.3.5.3 Products & Services Offered

7.3.5.4 Strategic Alliances between Business Partners

7.3.6.1 Business Description & Financial Analysis

7.3.6.3 Products & Services Offered

7.3.6.4 Strategic Alliances between Business Partners

7.3.7.1 Business Description & Financial Analysis

7.3.7.3 Products & Services Offered

7.3.8.4 Strategic Alliances between Business Partners

7.3.8.1 Business Description & Financial Analysis

7.3.8.3 Products & Services Offered

7.3.8.4 Strategic Alliances between Business Partners

7.3.9.1 Business Description & Financial Analysis

7.3.9.3 Products & Services Offered

7.3.9.4 Strategic Alliances between Business Partners

7.3.10.1 Business Description & Financial Analysis

7.3.10.3 Products & Services Offered

7.3.10.4 Strategic Alliances between Business Partners

7.3.11.1 Business Description & Financial Analysis

7.3.11.3 Products & Services Offered

7.3.11.4 Strategic Alliances between Business Partners

8.1.2 Market Scope & SegCompoundtation

8.2 Information ProcureCompoundt

8.2.1.2 GMEs Internal Data Repository

8.2.1.3 Secondary Resources & Third Party Perspectives

8.2.1.4 Company Information Sources

8.2.2.1 Various Source Type of Respondents for Primary Interviews

8.2.2.2 Number of Interviews Conducted throughout the Research Process

8.2.2.4 Discussion Guide for Primary Participants

8.2.3.1 Expert Panels Across 30+ Industry

8.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

8.3.1.1 Macro-Economic Indicators Considered

8.3.1.2 Micro-Economic Indicators Considered

8.3.2.1 Company Share Analysis Approach

8.3.2.2 Estimation of Potential Product Sales

8.4.2 Time Series, Cross Sectional & Panel Data Analysis

8.5.1 Inhouse AI Based Real Time Analytics Tool

8.5.2 Output From Desk & Primary Research

8.6 Research Assumptions & Limitations

LIST OF TABLES

1 India Lithium Market, By Product, 2020-2028 (USD Mllion)

2 Metal Market, 2020-2028 (USD Mllion)

3 Compound Market, 2020-2028 (USD Mllion)

4 Alloy Market, 2020-2028 (USD Mllion)

5 India Lithium Market, By Source Type, 2020-2028 (USD Mllion)

6 Brines Market, 2020-2028 (USD Mllion)

7 Hardrock Market, 2020-2028 (USD Mllion)

8 India Lithium Market, By Application, 2020-2028 (USD Mllion)

9 Automotive Market, 2020-2028 (USD Mllion)

10 Grid Storage Market, 2020-2028 (USD Mllion)

11 Consumer Electronics Market, 2020-2028 (USD Mllion)

12 Glass & Ceramics Market, 2020-2028 (USD Mllion)

13 Others Market, 2020-2028 (USD Mllion)

14 FMC Corporation: Products & Services Offering

15 TDS Lithium-Ion Battery Gujarat Private Limited (TDSG): Products & Services Offering

16 TOSHIBA CORPORATION: Products & Services Offering

17 Bharat Electronics Limited (BEL): Products & Services Offering

18 Telemax India Industries Pvt. Ltd.: Products & Services Offering

19 OKAYA POWER GROUP: Products & Services Offering

20 Trontek Group : Products & Services Offering

21 Nexcharge: Products & Services Offering

22 Albemarle Corp., Inc: Products & Services Offering

23 SQM S.A.: Products & Services Offering

24 Other Companies: Products & Services Offering

LIST OF FIGURES

1 India Lithium Market Overview

2 India Lithium Market Value From 2020-2028 (USD Mllion)

3 India Lithium Market Share, By Product (2022)

4 India Lithium Market Share, By Source Type (2022)

5 India Lithium Market Share, By Application (2022)

6 Technological Trends In India Lithium Market

7 Four Quadrant Competitor Positioning Matrix

8 Impact Of Macro & Micro Indicators On The Market

9 Impact Of Key Drivers On The India Lithium Market

10 Impact Of Challenges On The India Lithium Market

11 Porter’s Five Forces Analysis

12 India Lithium Market: By Product Scope Key Takeaways

13 India Lithium Market, By Product Segment: Revenue Growth Analysis

14 Metal Market, 2020-2028 (USD Mllion)

15 Compound Market, 2020-2028 (USD Mllion)

16 Alloy Market, 2020-2028 (USD Mllion)

17 India Lithium Market: By Source Type Scope Key Takeaways

18 India Lithium Market, By Source Type Segment: Revenue Growth Analysis

19 Brines Market, 2020-2028 (USD Mllion)

20 Hardrock Market, 2020-2028 (USD Mllion)

21 India Lithium Market: By Application Scope Key Takeaways

22 India Lithium Market, By Application Segment: Revenue Growth Analysis

23 Automotive Market, 2020-2028 (USD Mllion)

24 Grid Storage Market, 2020-2028 (USD Mllion)

25 Consumer Electronics Market, 2020-2028 (USD Mllion)

26 Glass & Ceramics Market, 2020-2028 (USD Mllion)

27 Others Market, 2020-2028 (USD Mllion)

28 Four Quadrant Positioning Matrix

29 Company Market Share Analysis

30 FMC Corporation: Company Snapshot

31 FMC Corporation: SWOT Analysis

32 FMC Corporation: Geographic Presence

33 TDS Lithium-Ion Battery Gujarat Private Limited (TDSG): Company Snapshot

34 TDS Lithium-Ion Battery Gujarat Private Limited (TDSG): SWOT Analysis

35 TDS Lithium-Ion Battery Gujarat Private Limited (TDSG): Geographic Presence

36 TOSHIBA CORPORATION: Company Snapshot

37 TOSHIBA CORPORATION: SWOT Analysis

38 TOSHIBA CORPORATION: Geographic Presence

39 Bharat Electronics Limited (BEL): Company Snapshot

40 Bharat Electronics Limited (BEL): Swot Analysis

41 Bharat Electronics Limited (BEL): Geographic Presence

42 Telemax India Industries Pvt. Ltd.: Company Snapshot

43 Telemax India Industries Pvt. Ltd.: SWOT Analysis

44 Telemax India Industries Pvt. Ltd.: Geographic Presence

45 Okaya Power Group: Company Snapshot

46 Okaya Power Group: SWOT Analysis

47 Okaya Power Group: Geographic Presence

48 Trontek Group : Company Snapshot

49 Trontek Group : SWOT Analysis

50 Trontek Group : Geographic Presence

51 Nexcharge: Company Snapshot

52 Nexcharge: SWOT Analysis

53 Nexcharge: Geographic Presence

54 Albemarle Corp., Inc.: Company Snapshot

55 Albemarle Corp., Inc.: SWOT Analysis

56 Albemarle Corp., Inc.: Geographic Presence

57 SQM S.A.: Company Snapshot

58 SQM S.A.: SWOT Analysis

59 SQM S.A.: Geographic Presence

60 Other Companies: Company Snapshot

61 Other Companies: SWOT Analysis

62 Other Companies: Geographic Presence

The India Lithium Market has been studied from the year 2019 till 2028. However, the CAGR provided in the report is from the year 2023 to 2028. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Lithium Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS