India Millet Market Size, Trends & Analysis - Forecasts to 2029 By Product Type (Finger Millet, Pearl Millet, Kodo Millet, Foxtail Millet, Proso Millet, Barnyard Millet, and Little Millet), By Application (Bread Goods, Beverages, Breakfast Foods, and Infant Food), By Distribution Channel (Supermarkets and Hypermarkets, Grocers, Online Retailers, and Others), Competitive Landscape, Company Market Share Analysis, and End User Analysis

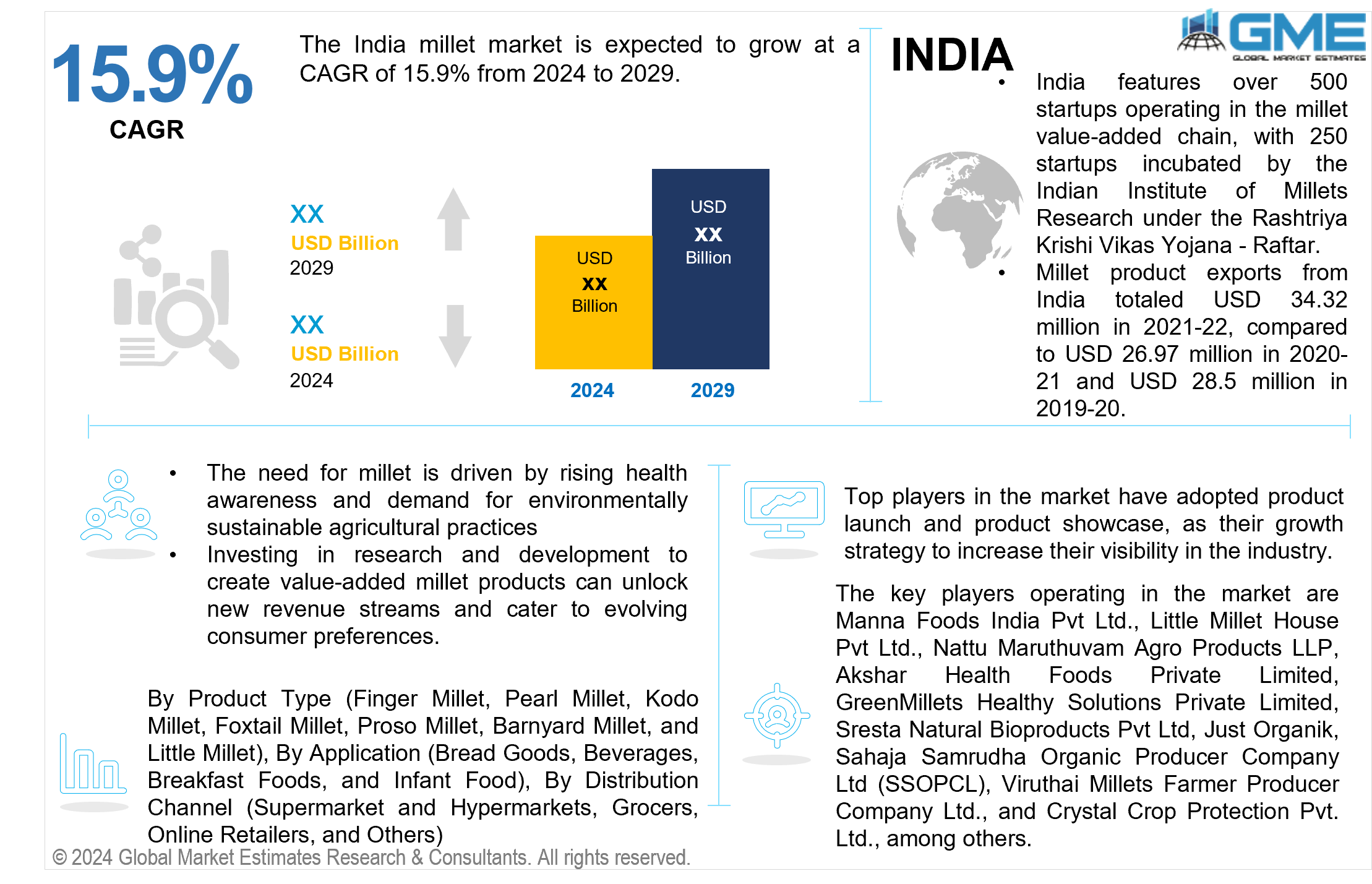

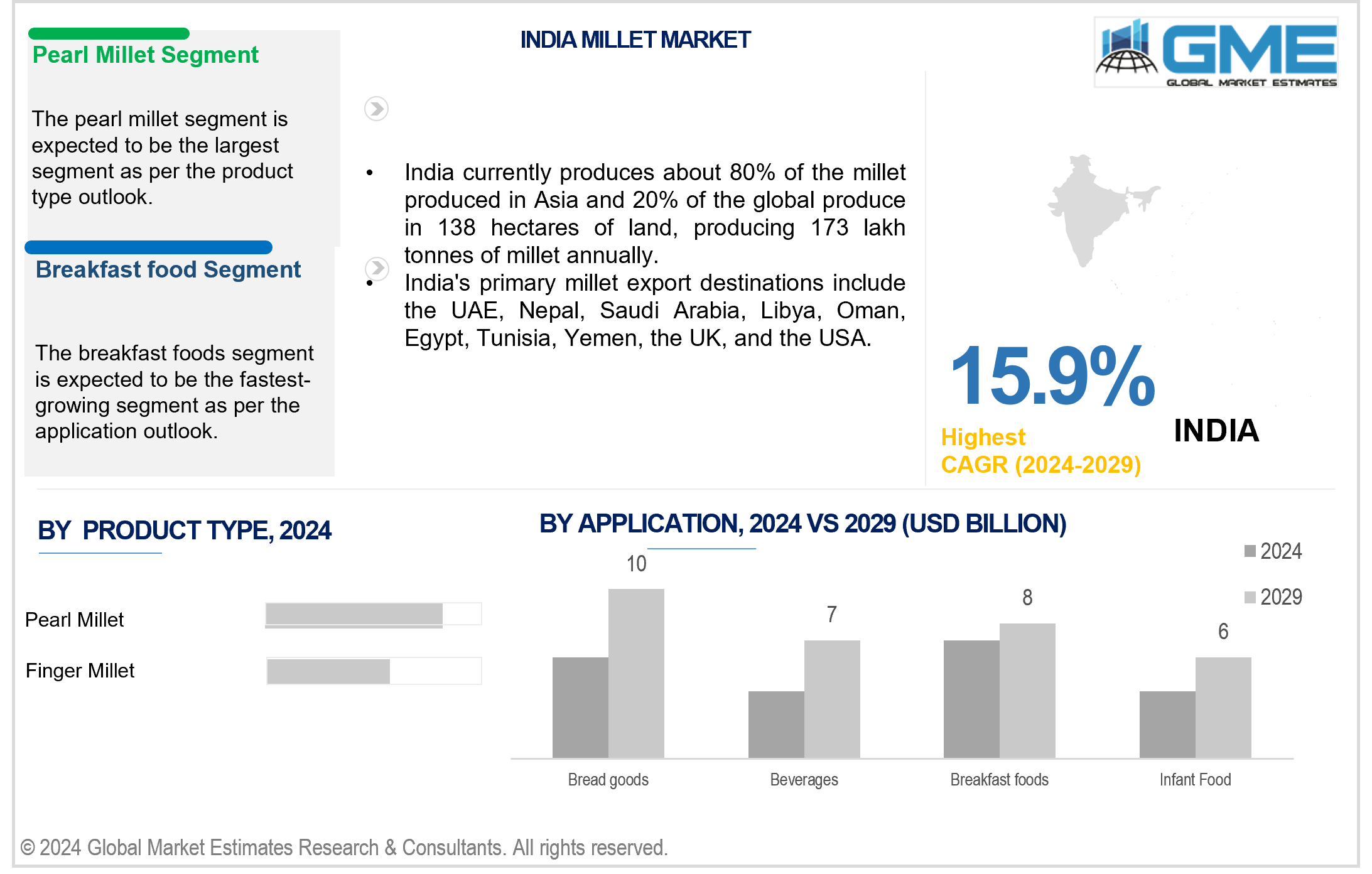

The India millet market is expected to grow at a CAGR of 15.9% from 2024 to 2029. Millets are small grains considered superfoods rich in essential nutrients such as iron, magnesium, phosphorus, and fiber. They are traditional grains consumed in India and were rendered as 'orphan crops' in the 1960s with the advent of the Green Revolution. India currently produces about 80% of the millet produced in Asia and 20% of the global produce in 138 hectares of land, producing 173 lakh tonnes of millets annually, as per Ministry of Agriculture and Farmer’s Welfare. India's primary millet export destinations include the UAE, Nepal, Saudi Arabia, Libya, Oman, Egypt, Tunisia, Yemen, the UK, and the USA. The types of millets exported from India consist of Pearl Millet (Bajra), Finger Millet (Ragi), Canary, Sorghum (Jowar), and Buckwheat. India features over 500 start-ups operating in the millet value-added chain, with 250 start-ups incubated by the Indian Institute of Millets Research under the Rashtriya Krishi Vikas Yojana - Raftar. Millet product exports from India totalled USD 34.32 million in 2021-22, compared to USD 26.97 million in 2020-21 and USD 28.5 million in 2019-20, as reported by Press Information Bureau.

Factors like rising health awareness and demand for environmentally sustainable agricultural practices are driving the market growth. Changes in lifestyle and eating habits lead to various health issues, such as obesity, diabetes, and heart disease. Millets, rich in minerals and proteins like calcium and iron, offer potential protection against these diseases. This increased awareness among city residents about the health benefits of millet consumption is expected to boost market growth in the future. Millets are known for their ability to thrive in different climates with minimal irrigation and in low-nutrient environments. They also show improved growth and productivity with minimal synthetic fertilizer use and are resilient to environmental pressures. Investing in research and development for value-added millet products can open up new revenue opportunities and meet changing consumer preferences.

One of the main challenges in the market is the limited availability of high-quality seeds. Lack of processing facilities at the village level and long distances between production and processing facilities have led to higher costs for processed millet products.

Based on product type, the market is segmented into finger millet, pearl millet, kodo millet, foxtail millet, proso millet, barnyard millet, and little millet. The pearl millet segment is expected to hold the largest share of the market during the forecast period. It has high drought tolerance and can thrive in arid and semi-arid regions where other crops struggle to grow, making it a reliable option for farmers in such areas. Pearl millet has a relatively short growing season, allowing for quicker harvests than other grains. Its versatility in culinary applications, from traditional dishes to modern food products, along with its nutritional value, contributes to its widespread popularity among consumers.

The finger millet segment is projected to grow fastest during the forecast period. Finger millet meets the growing demand for gluten-free items among people with gluten sensitivity, as it lacks gluten. It's packed with nutrients like calcium, vitamins, and fiber.

Based on application, the market is segmented into bread goods, beverages, breakfast foods, and infant food. The infant food segment is expected to hold the largest share of the market over the forecast period. Millets, being rich in essential vitamins, minerals, and dietary fiber, provide crucial nutrition for infants' healthy growth and development. Their gentle flavor makes them ideal for sensitive digestive systems, lowering the chances of digestive issues or allergies.

The breakfast foods segment is projected to grow fastest during the forecast period. Millets offer a nutritious alternative to traditional breakfast grains, supplying essential vitamins, minerals, and fiber to kickstart the day. They quickly incorporate into a range of morning dishes such as porridges, pancakes, muffins, and cereals, catering to various preferences and cooking methods. Furthermore, their lack of gluten makes them a superb option for individuals dealing with gluten sensitivity or celiac disease, thus increasing their appeal among health-conscious individuals.

Based on distribution channel, the market is segmented into supermarkets and hypermarkets, grocers, online retailers, and others. The grocers segment is projected to dominate the market during the forecast period. Sales directly through grocers typically occur in local communities or markets, allowing consumers to personally assess the quality and freshness of millets before buying, thereby boosting their trust in the product. Additionally, direct sales benefit local economies and small-scale farmers by avoiding intermediaries, guaranteeing fair prices, and encouraging sustainable farming methods.

The online segment is projected to grow fastest during the forecast period. Online sales provide convenience and easy access to a broader range of products. Various brands offer differently packaged millet products, empowering consumers to make informed choices once they understand the diverse types of millet available.

Manna Foods India Pvt Ltd., Little Millet House Pvt Ltd., Nattu Maruthuvam Agro Products LLP, Akshar Health Foods Private Limited, GreenMillets Healthy Solutions Private Limited, Sresta Natural Bioproducts Pvt Ltd, Just Organik, Sahaja Samrudha Organic Producer Company Ltd (SSOPCL), Viruthai Millets Farmer Producer Company Ltd., and Crystal Crop Protection Pvt. Ltd., among others, are some of the key players operating in the Indian market.

Please note: This is not an exhaustive list of companies profiled in the report.

In December 2021, NITI Aayog entered into a Statement of Intent (SoI) with the United Nations World Food Program (WFP). This collaboration aims to promote millets and assist India in becoming a global leader in knowledge sharing, leveraging the opportunity presented by 2023 as the International Year of Millets.

In December 2022, The Union Ministry of Agriculture and Farmers Welfare took a significant step to promote millets nationally and globally by arranging a 'Special Millets Lunch' for Members of Parliament (MPs) in the Parliament Courtyard. The event featured a carefully curated millet buffet showcasing various Indian millet varieties and cuisines.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 INDIA MILLET MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 INDIA MILLET MARKET, BY PRODUCT TYPE

4.1 Introduction

4.2 Millet Market: Product Type Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Finger Millet

4.4.1 Finger Millet Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 Pearl Millet

4.5.1 Pearl Millet Market Estimates and Forecast, 2021-2029 (USD Million)

4.6 Kodo Millet

4.6.1 Kodo Millet Market Estimates and Forecast, 2021-2029 (USD Million)

4.7 Foxtail Millet

4.7.1 Foxtail Millet Market Estimates and Forecast, 2021-2029 (USD Million)

4.8 Proso Millet

4.8.1 Proso Millet Market Estimates and Forecast, 2021-2029 (USD Million)

4.9 Barnyard Millet

4.9.1 Barnyard Millet Market Estimates and Forecast, 2021-2029 (USD Million)

4.10 Little Millet

4.10.1 Little Millet Market Estimates and Forecast, 2021-2029 (USD Million)

5 INDIA MILLET MARKET, BY DISTRIBUTION CHANNEL

5.1 Introduction

5.2 Millet Market: Distribution Channel Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 Supermarkets and Hypermarkets

5.4.1 Supermarkets and Hypermarkets Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 Grocers

5.5.1 Grocers Market Estimates and Forecast, 2021-2029 (USD Million)

5.6 Online Retailers

5.6.1 Online Retailers Market Estimates and Forecast, 2021-2029 (USD Million)

5.7 Others

5.7.1 Others Market Estimates and Forecast, 2021-2029 (USD Million)

6 INDIA MILLET MARKET, BY APPLICATION

6.1 Introduction

6.2 Millet Market: Application Scope Key Takeaways

6.3 Revenue Growth Analysis, 2023 & 2029

6.4 Bread Goods

6.4.1 Bread Goods Market Estimates and Forecast, 2021-2029 (USD Million)

6.5 Beverages

6.5.1 Beverages Market Estimates and Forecast, 2021-2029 (USD Million)

6.6 Breakfast Foods

6.6.1 Breakfast Foods Market Estimates and Forecast, 2021-2029 (USD Million)

6.7 Infant Food

6.7.1 Infant Food Market Estimates and Forecast, 2021-2029 (USD Million)

6.8 Others

6.8.1 Others Market Estimates and Forecast, 2021-2029 (USD Million)

7 INDIA MILLET MARKET

7.1 Introduction

7.2 India Millet Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.1 By Product Type

7.2.2 By Distribution Channel

7.2.3 By Application

8 COMPETITIVE LANDCAPE

8.1 Company Market Share Analysis

8.2 Four Quadrant Positioning Matrix

8.2.1 Market Leaders

8.2.2 Market Visionaries

8.2.3 Market Challengers

8.2.4 Niche Market Players

8.3 Vendor Landscape

8.3.1 India

8.4 Company Profiles

8.4.1 Manna Foods India Pvt Ltd.

8.4.1.1 Business Description & Financial Analysis

8.4.1.2 SWOT Analysis

8.4.1.3 Products & Services Offered

8.4.1.4 Strategic Alliances between Business Partners

8.4.2 Little Millet House Pvt Ltd.

8.4.2.1 Business Description & Financial Analysis

8.4.2.2 SWOT Analysis

8.4.2.3 Products & Services Offered

8.4.2.4 Strategic Alliances between Business Partners

8.4.3 Nattu Maruthuvam Agro Products LLP

8.4.3.1 Business Description & Financial Analysis

8.4.3.2 SWOT Analysis

8.4.3.3 Products & Services Offered

8.4.3.4 Strategic Alliances between Business Partners

8.4.4 Akshar Health Foods Private Limited

8.4.4.1 Business Description & Financial Analysis

8.4.4.2 SWOT Analysis

8.4.4.3 Products & Services Offered

8.4.4.4 Strategic Alliances between Business Partners

8.4.5 GreenMillets Healthy Solutions Private Limited

8.4.5.1 Business Description & Financial Analysis

8.4.5.2 SWOT Analysis

8.4.5.3 Products & Services Offered

8.4.5.4 Strategic Alliances between Business Partners

8.4.6 CRYSTAL CROP PROTECTION PVT. LTD.

8.4.6.1 Business Description & Financial Analysis

8.4.6.2 SWOT Analysis

8.4.6.3 Products & Services Offered

8.4.6.4 Strategic Alliances between Business Partners

8.4.7 Viruthai Millets Farmer Producer Company Ltd.

8.4.7.1 Business Description & Financial Analysis

8.4.7.2 SWOT Analysis

8.4.7.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.8 Sahaja Samrudha Organic Producer Company Ltd (SSOPCL)

8.4.8.1 Business Description & Financial Analysis

8.4.8.2 SWOT Analysis

8.4.8.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.9 SRESTA NATURAL BIOPRODUCTS PVT LTD

8.4.9.1 Business Description & Financial Analysis

8.4.9.2 SWOT Analysis

8.4.9.3 Products & Services Offered

8.4.9.4 Strategic Alliances between Business Partners

8.4.10 Just Organik

8.4.10.1 Business Description & Financial Analysis

8.4.10.2 SWOT Analysis

8.4.10.3 Products & Services Offered

8.4.10.4 Strategic Alliances between Business Partners

8.4.11 Other Companies

8.4.11.1 Business Description & Financial Analysis

8.4.11.2 SWOT Analysis

8.4.11.3 Products & Services Offered

8.4.11.4 Strategic Alliances between Business Partners

9 RESEARCH METHODOLOGY

9.1 Market Introduction

9.1.1 Market Definition

9.1.2 Market Scope & Segmentation

9.2 Information Procurement

9.2.1 Secondary Research

9.2.1.1 Purchased Databases

9.2.1.2 GMEs Internal Data Repository

9.2.1.3 Secondary Resources & Third Party Perspectives

9.2.1.4 Company Information Sources

9.2.2 Primary Research

9.2.2.1 Various Types of Respondents for Primary Interviews

9.2.2.2 Number of Interviews Conducted throughout the Research Process

9.2.2.3 Primary Stakeholders

9.2.2.4 Discussion Guide for Primary Participants

9.2.3 Expert Panels

9.2.3.1 Expert Panels Across 30+ Industry

9.2.4 Paid Local Experts

9.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

9.3 Market Estimation

9.3.1 Top-Down Approach

9.3.1.1 Macro-Economic Indicators Considered

9.3.1.2 Micro-Economic Indicators Considered

9.3.2 Bottom Up Approach

9.3.2.1 Company Share Analysis Approach

9.3.2.2 Estimation of Potential Product Sales

9.4 Data Triangulation

9.4.1 Data Collection

9.4.2 Time Series, Cross Sectional & Panel Data Analysis

9.4.3 Cluster Analysis

9.5 Analysis and Output

9.5.1 Inhouse AI Based Real Time Analytics Tool

9.5.2 Output From Desk & Primary Research

9.6 Research Assumptions & Limitations

9.7.1 Research Assumptions

9.7.2 Research Limitations

LIST OF TABLES

1 India Millet Market, By Product Type, 2021-2029 (USD Million)

2 Finger Millet Market, 2021-2029 (USD Million)

3 Pearl Millet Market, 2021-2029 (USD Million)

4 Kodo Millet Market, 2021-2029 (USD Million)

5 Foxtail Millet Market, 2021-2029 (USD Million)

6 Proso Millet Market, 2021-2029 (USD Million)

7 Barnyard Millet Market, 2021-2029 (USD Million)

8 Little Millet Market, 2021-2029 (USD Million)

9 India Millet Market, By Distribution Channel, 2021-2029 (USD Million)

10 Supermarkets and hypermarkets Market, 2021-2029 (USD Million)

11 Grocers Market, 2021-2029 (USD Million)

12 Online Retailers Market, 2021-2029 (USD Million)

13 Others Market, 2021-2029 (USD Million)

14 India Millet Market, By Application, 2021-2029 (USD Million)

15 Bread Goods Market, 2021-2029 (USD Million)

16 BEVERAGES Market, 2021-2029 (USD Million)

17 BREAKFAST FOODS Market, 2021-2029 (USD Million)

18 Infant Food Market, 2021-2029 (USD Million)

19 Regional Analysis, 2021-2029 (USD Million)

20 India Millet Market, By Product Type, 2021-2029 (USD Million)

21 India Millet Market, By Distribution Channel, 2021-2029 (USD Million)

22 India Millet Market, By Application, 2021-2029 (USD Million)

23 Manna Foods India Pvt Ltd.: Products & Services Offering

24 Little Millet House Pvt Ltd.: Products & Services Offering

25 Nattu Maruthuvam Agro Products LLP: Products & Services Offering

26 Akshar Health Foods Private Limited: Products & Services Offering

27 GreenMillets Healthy Solutions Private Limited: Products & Services Offering

28 CRYSTAL CROP PROTECTION PVT. LTD.: Products & Services Offering

29 Viruthai Millets Farmer Producer Company Ltd.: Products & Services Offering

30 Sahaja Samrudha Organic Producer Company Ltd (SSOPCL): Products & Services Offering

31 SRESTA NATURAL BIOPRODUCTS PVT LTD: Products & Services Offering

32 Just Organik: Products & Services Offering

33 Other Companies: Products & Services Offering

LIST OF FIGURES

1 India Millet Market Overview

2 India Millet Market Value From 2021-2029 (USD Million)

3 India Millet Market Share, By Product Type (2023)

4 India Millet Market Share, By Distribution Channel (2023)

5 India Millet Market Share, By Application (2023)

6 India Millet Market (Asia Pacific Market)

7 Technological Trends In India Millet Market

8 Four Quadrant Competitor Positioning Matrix

9 Impact Of Macro & Micro Indicators On The Market

10 Impact Of Key Drivers On The India Millet Market

11 Impact Of Challenges On The India Millet Market

12 Porter’s Five Forces Analysis

13 India Millet Market: By Product Type Scope Key Takeaways

14 India Millet Market, By Product Type Segment: Revenue Growth Analysis

15 Finger Millet Market, 2021-2029 (USD Million)

16 Pearl Millet Market, 2021-2029 (USD Million)

17 Kodo Millet Market, 2021-2029 (USD Million)

18 Foxtail Millet Market, 2021-2029 (USD Million)

19 Proso Millet Market, 2021-2029 (USD Million)

20 Barnyard Millet Market, 2021-2029 (USD Million)

21 Little Millet Market, 2021-2029 (USD Million)

22 India Millet Market: By Distribution Channel Scope Key Takeaways

23 India Millet Market, By Distribution Channel Segment: Revenue Growth Analysis

24 Supermarkets and Hypermarkets Market, 2021-2029 (USD Million)

25 Grocers Market, 2021-2029 (USD Million)

26 Online Retailers Market, 2021-2029 (USD Million)

27 Others Market, 2021-2029 (USD Million)

28 India Millet Market: By Application Scope Key Takeaways

29 India Millet Market, By Application Segment: Revenue Growth Analysis

30 Bread Goods Market, 2021-2029 (USD Million)

31 Beverages Market, 2021-2029 (USD Million)

32 Breakfast Foods Market, 2021-2029 (USD Million)

33 Infant Food Market, 2021-2029 (USD Million)

34 Regional Segment: Revenue Growth Analysis

35 India Millet Market: Regional Analysis

36 India Millet Market Overview

37 India Millet Market, By Product Type

38 India Millet Market, By Distribution Channel

39 India Millet Market, By Application

40 Four Quadrant Positioning Matrix

41 Company Market Share Analysis

42 Manna Foods India Pvt Ltd.: Company Snapshot

43 Manna Foods India Pvt Ltd.: SWOT Analysis

44 Manna Foods India Pvt Ltd.: Geographic Presence

45 Little Millet House Pvt Ltd.: Company Snapshot

46 Little Millet House Pvt Ltd.: SWOT Analysis

47 Little Millet House Pvt Ltd.: Geographic Presence

48 Nattu Maruthuvam Agro Products LLP: Company Snapshot

49 Nattu Maruthuvam Agro Products LLP: SWOT Analysis

50 Nattu Maruthuvam Agro Products LLP: Geographic Presence

51 Akshar Health Foods Private Limited: Company Snapshot

52 Akshar Health Foods Private Limited: Swot Analysis

53 Akshar Health Foods Private Limited: Geographic Presence

54 GreenMillets Healthy Solutions Private Limited: Company Snapshot

55 GreenMillets Healthy Solutions Private Limited: SWOT Analysis

56 GreenMillets Healthy Solutions Private Limited: Geographic Presence

57 CRYSTAL CROP PROTECTION PVT. LTD.: Company Snapshot

58 CRYSTAL CROP PROTECTION PVT. LTD.: SWOT Analysis

59 CRYSTAL CROP PROTECTION PVT. LTD.: Geographic Presence

60 Viruthai Millets Farmer Producer Company Ltd.: Company Snapshot

61 Viruthai Millets Farmer Producer Company Ltd.: SWOT Analysis

62 Viruthai Millets Farmer Producer Company Ltd.: Geographic Presence

63 Sahaja Samrudha Organic Producer Company Ltd (SSOPCL): Company Snapshot

64 Sahaja Samrudha Organic Producer Company Ltd (SSOPCL): SWOT Analysis

65 Sahaja Samrudha Organic Producer Company Ltd (SSOPCL): Geographic Presence

66 SRESTA NATURAL BIOPRODUCTS PVT LTD.: Company Snapshot

67 SRESTA NATURAL BIOPRODUCTS PVT LTD.: SWOT Analysis

68 SRESTA NATURAL BIOPRODUCTS PVT LTD.: Geographic Presence

69 Just Organik: Company Snapshot

70 Just Organik: SWOT Analysis

71 Just Organik: Geographic Presence

72 Other Companies: Company Snapshot

73 Other Companies: SWOT Analysis

74 Other Companies: Geographic Presence

The India Millet Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the India Millet Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS