India Smart Manufacturing Market Size, Trends & Analysis - Forecasts to 2029 By Technology (Machine Execution Systems, Programmable Logic Controller, Enterprise Resource Planning, SCADA, Discrete Control Systems, Human Machine Interface, Machine Vision, 3D Printing, Product Lifecycle Management, and Plant Asset Management) and By End-use (Automotive, Aerospace & Defense, Chemicals & Materials, Healthcare, Industrial Equipment, Electronics, Food & Agriculture, Oil & Gas, and Others), Competitive Landscape, Company Market Share Analysis, and End User Analysis

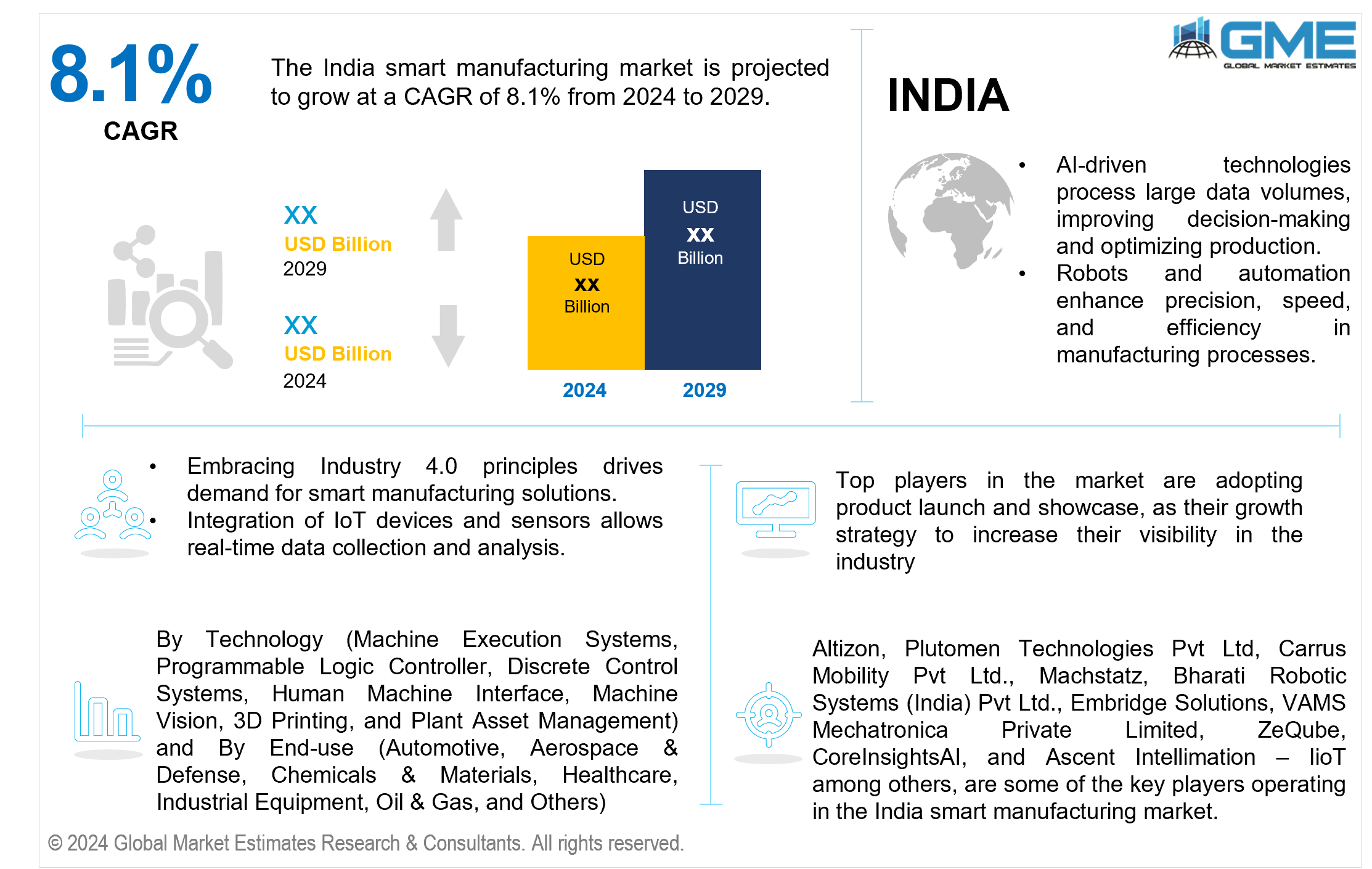

The India smart manufacturing market is projected to grow at a CAGR of 8.1% from 2024 to 2029.

The Indian government's programs, such as "Make in India" and "Digital India," are the main factors in promoting the growth of the manufacturing industry. These initiatives provide policies and incentives that actively encourage the adoption of smart manufacturing technology, thereby considerably advancing the sector.

In March 2023, Samsung's investment in smart manufacturing in Noida, India, is an example of a broader trend in industrial growth. The move is part of Samsung's strategy to enhance competitiveness in production capabilities. With a focus on the domestic market and serving as a regional export hub, the investment aligns with India's push for smart manufacturing. The government's initiatives like "Make in India" likely contribute to this trend, fostering an environment conducive to technological advancements and foreign investments in the manufacturing sector.

India's industrial sector is undergoing a considerable transition due to the implementation of Industry 4.0 principles. This includes incorporating digital technologies such as IoT, AI, and big data analytics. Companies in India are increasingly using smart manufacturing strategies to improve efficiency and competitiveness.

Smart manufacturing needs a trained staff familiar with emerging technologies such as IoT, AI, and automation. A lack of qualified staff in certain fields can be a substantial impediment, as businesses may struggle to find and keep talent with the appropriate skills, thereby hampering market growth.

The discrete control systems segment is expected to hold the largest share of the market. This is attributed to its widespread application in discrete manufacturing industries. Discrete control systems are becoming more popular in sectors such as automotive, electronics, and aerospace to increase production efficiency, quality, and automation. These technologies provide precise control over individual processes, which improves overall manufacturing capabilities and contributes to the segment's dominance in the market.

The 3D printing segment is expected to be the fastest-growing segment in the market from 2024-2029. The growth is attributed to its transformative impact on manufacturing processes. With advances in additive manufacturing technologies, 3D printing allows for rapid prototypes, customization, and cost-effective production. The capacity to create complex and intricate designs, combined with reduced material waste, makes 3D printing increasingly appealing across industries.

The aerospace & defense segment is anticipated to be the fastest-growing segment in the market from 2024 to 2029. The segment's growth is attributed to the increasing demand for advanced manufacturing technologies in the aerospace and defense industries. Smart manufacturing solutions are critical for increasing production efficiency, lowering costs, and maintaining the precision and quality necessary in aerospace and defense manufacturing.

The automotive segment is expected to hold the largest share of the market over the forecast period. The segment's expansion is due to the automobile industry's growing emphasis on smart manufacturing, automation, and the use of smart manufacturing technology. The adoption of new manufacturing methods, robots, and digitalization in the automotive sector is expected to contribute to market growth.

Altizon, Plutomen Technologies Pvt Ltd, Carrus Mobility Pvt Ltd., Machstatz, Bharati Robotic Systems (India) Pvt Ltd., Embridge Solutions, VAMS Mechatronica Private Limited, ZeQube, CoreInsightsAI, and Ascent Intellimation – IioT, among others, are some of the key players operating in the India smart manufacturing market.

Please note: This is not an exhaustive list of companies profiled in the report.

In April 2023, Advantech and Altizon jointly launched a smart factory solution, integrating Advantech's IoT hardware with Altizon's Datonis Digital Factory platform. The bundled solution includes specific Advantech edge devices, pre-validated and pre-installed, aiming to simplify the digital transformation of traditional factories.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Technologys

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 INDIA MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 INDIA SMART MANUFACTURING MARKET, BY TECHNOLOGY

4.1 Introduction

4.2 Smart Manufacturing Market: Technology Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Machine Execution Systems

4.4.1 Machine Execution Systems Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 Programmable Logic Controller

4.5.1 Programmable Logic Controller Market Estimates and Forecast, 2021-2029 (USD Million)

4.6 Enterprise Resource Planning

4.6.1 Enterprise Resource Planning Market Estimates and Forecast, 2021-2029 (USD Million)

4.7 SCADA

4.7.1 SCADA Market Estimates and Forecast, 2021-2029 (USD Million)

4.8 Discrete Control Systems

4.8.1 Discrete Control Systems Market Estimates and Forecast, 2021-2029 (USD Million)

4.9 Human Machine Interface

4.9.1 Human Machine Interface Market Estimates and Forecast, 2021-2029 (USD Million)

4.10 Machine Vision

4.10.1 Machine Vision Market Estimates and Forecast, 2021-2029 (USD Million)

4.11 3D Printing

4.11.1 3D Printing Market Estimates and Forecast, 2021-2029 (USD Million)

4.12 Product Lifecycle Management

4.12.1 Product Lifecycle Management Market Estimates and Forecast, 2021-2029 (USD Million)

4.13 Plant Asset Management

4.13.1 Plant Asset Management Market Estimates and Forecast, 2021-2029 (USD Million)

5 INDIA SMART MANUFACTURING MARKET, BY END-USE

5.1 Introduction

5.2 Smart Manufacturing Market: End-use Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 Automotive

5.4.1 Automotive Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 Aerospace & Defense

5.5.1 Aerospace & Defense Market Estimates and Forecast, 2021-2029 (USD Million)

5.6 Chemicals & Materials

5.6.1 Chemicals & Materials Market Estimates and Forecast, 2021-2029 (USD Million)

5.7 Healthcare

5.7.1 Healthcare Market Estimates and Forecast, 2021-2029 (USD Million)

5.8 Industrial Equipment

5.8.1 Industrial Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

5.9 Electronics

5.9.1 Electronics Market Estimates and Forecast, 2021-2029 (USD Million)

5.10 Food & Agriculture

5.10.1 Food & Agriculture Market Estimates and Forecast, 2021-2029 (USD Million)

5.11 Oil & Gas

5.11.1 Oil & Gas Market Estimates and Forecast, 2021-2029 (USD Million)

5.12 Others

5.12.1 Others Market Estimates and Forecast, 2021-2029 (USD Million)

6 COMPETITIVE LANDCAPE

6.1 Company Market Share Analysis

6.2 Four Quadrant Positioning Matrix

6.2.1 Market Leaders

6.2.2 Market Visionaries

6.2.3 Market Challengers

6.2.4 Niche Market Players

6.3 Vendor Landscape

6.3.1 India

6.4 Company Profiles

6.4.1 Altizon

6.4.1.1 Business Description & Financial Analysis

6.4.1.2 SWOT Analysis

6.4.1.3 Products & Services Offered

6.4.1.4 Strategic Alliances between Business Partners

6.4.2 Plutomen Technologies Pvt Ltd

6.4.2.1 Business Description & Financial Analysis

6.4.2.2 SWOT Analysis

6.4.2.3 Products & Services Offered

6.4.2.4 Strategic Alliances between Business Partners

6.4.3 Carrus Mobility Pvt Ltd.

6.4.3.1 Business Description & Financial Analysis

6.4.3.2 SWOT Analysis

6.4.3.3 Products & Services Offered

6.4.3.4 Strategic Alliances between Business Partners

6.4.4 MACHSTATZ

6.4.4.1 Business Description & Financial Analysis

6.4.4.2 SWOT Analysis

6.4.4.3 Products & Services Offered

6.4.4.4 Strategic Alliances between Business Partners

6.4.5 Bharati Robotic Systems (India) Pvt Ltd.

6.4.5.1 Business Description & Financial Analysis

6.4.5.2 SWOT Analysis

6.4.5.3 Products & Services Offered

6.4.5.4 Strategic Alliances between Business Partners

6.4.6 Embridge Solutions

6.4.6.1 Business Description & Financial Analysis

6.4.6.2 SWOT Analysis

6.4.6.3 Products & Services Offered

6.4.6.4 Strategic Alliances between Business Partners

6.4.7 VAMS Mechatronica Private Limited

6.4.7.1 Business Description & Financial Analysis

6.4.7.2 SWOT Analysis

6.4.7.3 Products & Services Offered

6.4.8.4 Strategic Alliances between Business Partners

6.4.8 ZeQube

6.4.8.1 Business Description & Financial Analysis

6.4.8.2 SWOT Analysis

6.4.8.3 Products & Services Offered

6.4.8.4 Strategic Alliances between Business Partners

6.4.9 CoreInsightsAI

6.4.9.1 Business Description & Financial Analysis

6.4.9.2 SWOT Analysis

6.4.9.3 Products & Services Offered

6.4.9.4 Strategic Alliances between Business Partners

6.4.10 Ascent Intellimation - IIoT

6.4.10.1 Business Description & Financial Analysis

6.4.10.2 SWOT Analysis

6.4.10.3 Products & Services Offered

6.4.10.4 Strategic Alliances between Business Partners

6.4.11 Other Companies

6.4.11.1 Business Description & Financial Analysis

6.4.11.2 SWOT Analysis

6.4.11.3 Products & Services Offered

6.4.11.4 Strategic Alliances between Business Partners

7 RESEARCH METHODOLOGY

7.1 Market Introduction

7.1.1 Market Definition

7.1.2 Market Scope & Segmentation

7.2 Information Procurement

7.2.1 Secondary Research

7.2.1.1 Purchased Databases

7.2.1.2 GMEs Internal Data Repository

7.2.1.3 Secondary Resources & Third Party Perspectives

7.2.1.4 Company Information Sources

7.2.2 Primary Research

7.2.2.1 Various Types of Respondents for Primary Interviews

7.2.2.2 Number of Interviews Conducted throughout the Research Process

7.2.2.3 Primary Stakeholders

7.2.2.4 Discussion Guide for Primary Participants

7.2.3 Expert Panels

7.2.3.1 Expert Panels Across 30+ Industry

7.2.4 Paid Local Experts

7.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

7.3 Market Estimation

7.3.1 Top-Down Approach

7.3.1.1 Macro-Economic Indicators Considered

7.3.1.2 Micro-Economic Indicators Considered

7.3.2 Bottom Up Approach

7.3.2.1 Company Share Analysis Approach

7.3.2.2 Estimation of Potential Product Sales

7.4 Data Triangulation

7.4.1 Data Collection

7.4.2 Time Series, Cross Sectional & Panel Data Analysis

7.4.3 Cluster Analysis

7.5 Analysis and Output

7.5.1 Inhouse AI Based Real Time Analytics Tool

7.5.2 Output From Desk & Primary Research

7.6 Research Assumptions & Limitations

7.7.1 Research Assumptions

7.7.2 Research Limitations

LIST OF TABLES

1 India Smart Manufacturing Market, By Technology, 2021-2029 (USD Million)

2 Machine Execution Systems Market, 2021-2029 (USD Million)

3 Programmable Logic Controller Market, 2021-2029 (USD Million)

4 Enterprise Resource Planning Market, 2021-2029 (USD Million)

5 SCADA Market, 2021-2029 (USD Million)

6 Discrete Control Systems Market, 2021-2029 (USD Million)

7 Human Machine Interface Market, 2021-2029 (USD Million)

8 Machine Vision Market, 2021-2029 (USD Million)

9 3D PRINTING Market, 2021-2029 (USD Million)

10 Product Lifecycle Management Market, 2021-2029 (USD Million)

11 Plant Asset Management Market, 2021-2029 (USD Million)

12 India Smart Manufacturing Market, By End-use, 2021-2029 (USD Million)

13 Automotive Market, 2021-2029 (USD Million)

14 CHEMICALS & MATERIALS Market, 2021-2029 (USD Million)

15 Aerospace & Defense Market, 2021-2029 (USD Million)

16 HEALTHCARE Market, 2021-2029 (USD Million)

17 INDUSTRIAL EQUIPMENT Market, 2021-2029 (USD Million)

18 ELECTRONICS Market, 2021-2029 (USD Million)

19 FOOD & AGRICULTURE Market, 2021-2029 (USD Million)

20 OIL & GAS Market, 2021-2029 (USD Million)

21 OTHERS Market, 2021-2029 (USD Million)

22 Altizon: Products & Services Offering

23 Plutomen Technologies Pvt Ltd: Products & Services Offering

24 Carrus Mobility Pvt Ltd.: Products & Services Offering

25 MACHSTATZ: Products & Services Offering

26 Bharati Robotic Systems (India) Pvt Ltd.: Products & Services Offering

27 Embridge Solutions: Products & Services Offering

28 VAMS Mechatronica Private Limited : Products & Services Offering

29 ZeQube: Products & Services Offering

30 CoreInsightsAI, Inc: Products & Services Offering

31 Ascent Intellimation - IIoT: Products & Services Offering

32 Other Companies: Products & Services Offering

LIST OF FIGURES

1 India Smart Manufacturing Market Overview

2 India Smart Manufacturing Market Value From 2021-2029 (USD Million)

3 India Smart Manufacturing Market Share, By Technology (2023)

4 India Smart Manufacturing Market Share, By End-use (2023)

5 India Smart Manufacturing Market, By Region (Asia Pacific Market)

6 Technological Trends In India Smart Manufacturing Market

7 Four Quadrant Competitor Positioning Matrix

8 Impact Of Macro & Micro Indicators On The Market

9 Impact Of Key Drivers On The India Smart Manufacturing Market

10 Impact Of Challenges On The India Smart Manufacturing Market

11 Porter’s Five Forces Analysis

12 India Smart Manufacturing Market: By Technology Scope Key Takeaways

13 India Smart Manufacturing Market, By Technology Segment: Revenue Growth Analysis

14 Machine Execution Systems Market, 2021-2029 (USD Million)

15 Programmable Logic Controller Market, 2021-2029 (USD Million)

16 Enterprise Resource Planning Market, 2021-2029 (USD Million)

17 SCADA Market, 2021-2029 (USD Million)

18 Discrete Control Systems Market, 2021-2029 (USD Million)

19 Machine Vision Market, 2021-2029 (USD Million)

20 3D Printing Market, 2021-2029 (USD Million)

21 Product Lifecycle Management Market, 2021-2029 (USD Million)

22 Plant Asset Management Market, 2021-2029 (USD Million)

23 India Smart Manufacturing Market: By End-use Scope Key Takeaways

24 India Smart Manufacturing Market, By End-use Segment: Revenue Growth Analysis

25 Automotive, 2021-2029 (USD Million)

26 Aerospace & Defense, 2021-2029 (USD Million)

27 Chemicals & Materials, 2021-2029 (USD Million)

28 Healthcare, 2021-2029 (USD Million)

29 Industrial Equipment, 2021-2029 (USD Million)

30 Electronics, 2021-2029 (USD Million)

31 Food & Agriculture, 2021-2029 (USD Million)

32 Oil & Gas, 2021-2029 (USD Million)

33 Others, 2021-2029 (USD Million)

34 Four Quadrant Positioning Matrix

35 Company Market Share Analysis

36 Altizon: Company Snapshot

37 Altizon: SWOT Analysis

38 Altizon: Geographic Presence

39 Plutomen Technologies Pvt Ltd: Company Snapshot

40 Plutomen Technologies Pvt Ltd: SWOT Analysis

41 Plutomen Technologies Pvt Ltd: Geographic Presence

42 Carrus Mobility Pvt Ltd.: Company Snapshot

43 Carrus Mobility Pvt Ltd.: SWOT Analysis

44 Carrus Mobility Pvt Ltd.: Geographic Presence

45 MACHSTATZ: Company Snapshot

46 MACHSTATZ: Swot Analysis

47 MACHSTATZ: Geographic Presence

48 Bharati Robotic Systems (India) Pvt Ltd.: Company Snapshot

49 Bharati Robotic Systems (India) Pvt Ltd.: SWOT Analysis

50 Bharati Robotic Systems (India) Pvt Ltd.: Geographic Presence

51 Embridge Solutions: Company Snapshot

52 Embridge Solutions: SWOT Analysis

53 Embridge Solutions: Geographic Presence

54 VAMS Mechatronica Private Limited : Company Snapshot

55 VAMS Mechatronica Private Limited : SWOT Analysis

56 VAMS Mechatronica Private Limited : Geographic Presence

57 ZeQube: Company Snapshot

58 ZeQube: SWOT Analysis

59 ZeQube: Geographic Presence

60 CoreInsightsAI, Inc.: Company Snapshot

61 CoreInsightsAI, Inc.: SWOT Analysis

62 CoreInsightsAI, Inc.: Geographic Presence

63 Ascent Intellimation - IIoT: Company Snapshot

64 Ascent Intellimation - IIoT: SWOT Analysis

65 Ascent Intellimation - IIoT: Geographic Presence

66 Other Companies: Company Snapshot

67 Other Companies: SWOT Analysis

68 Other Companies: Geographic Presence

The India Smart Manufacturing Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the India Smart Manufacturing Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS