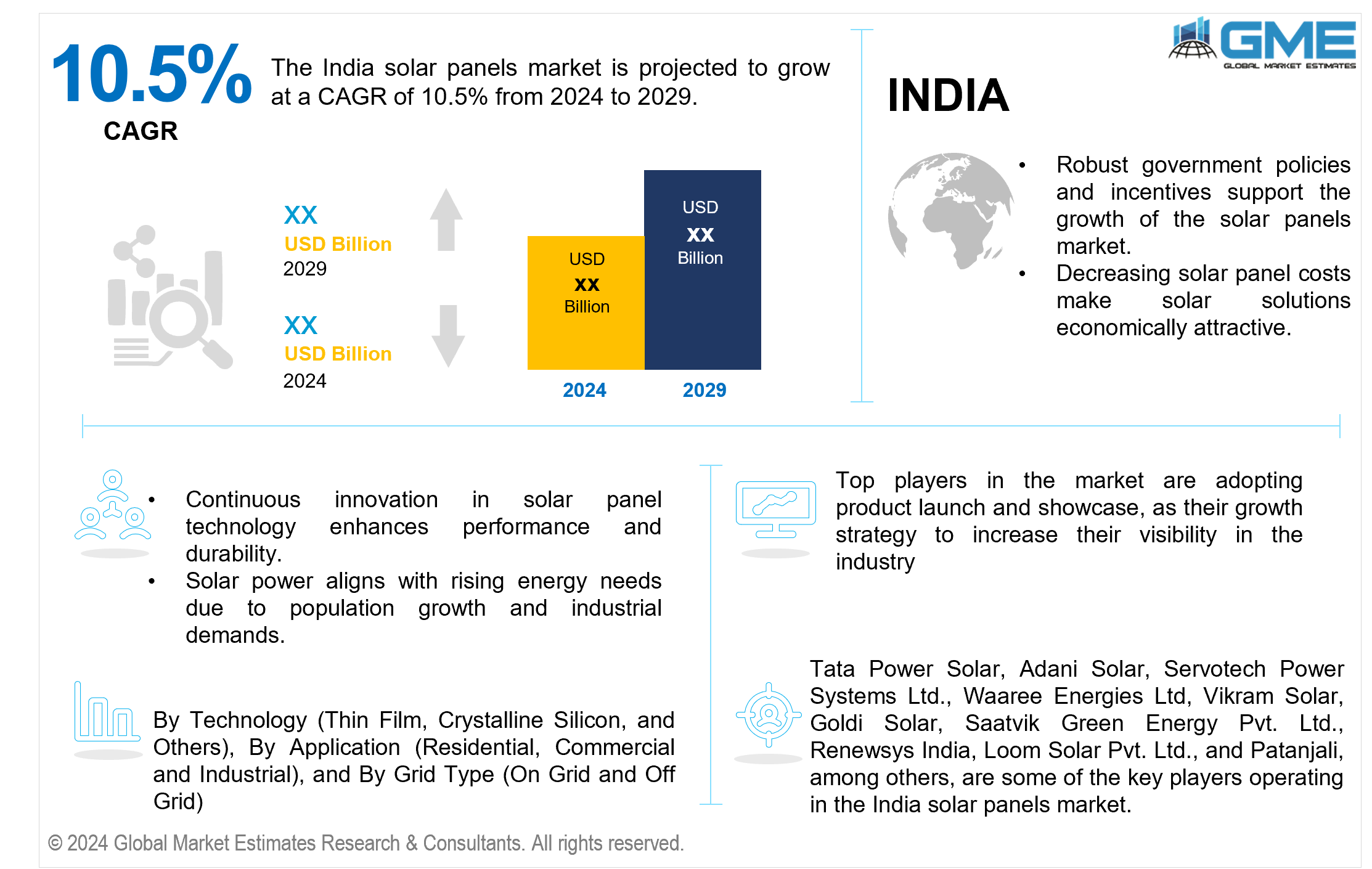

India Solar Panels Market Size, Trends & Analysis - Forecasts to 2029 By Technology (Thin Film, Crystalline Silicon, and Others), By Application (Residential, Commercial, and Industrial), and By Grid Type (On-grid and Off-grid), Competitive Landscape, Company Market Share Analysis, and End User Analysis

The India solar panels market is projected to grow at a CAGR of 10.5% from 2024 to 2029.

The Indian government actively promotes solar energy adoption through initiatives such as the Jawaharlal Nehru National Solar Mission (JNNSM) and Goods and Services Tax (GST) incentives for solar equipment. JNNSM establishes high renewable energy targets and outlines a strategic plan for solar expansion. The addition of GST benefits promotes the usage of solar technology by lowering financial barriers. These laws, taken together, create a favorable climate for investment, technological developments, and widespread use of solar energy, which aligns with India's commitment to sustainable and clean power sources. In India, the Grid Solar Power Division of the Ministry of New & Renewable Energy has significantly enhanced the local production of high-efficiency solar PV modules by implementing the Production Linked Incentive (PLI) Scheme dedicated to promoting the manufacturing of high-efficiency solar PV modules.

The reduced cost of solar panels has made solar energy more economically viable. The lower production and installation costs have made solar electricity an increasingly appealing choice for businesses and people. This promotes environmental sustainability and increases the economic viability of incorporating solar panels into numerous industries, enabling a broader and more accessible shift to renewable energy sources.

Advancements in solar panel technology, characterized by higher efficiency and durability, contribute greatly to the solar industry's overall expansion. These technological advancements play an important part in making solar energy more competitive when compared to traditional sources. Improved efficiency and durability not only make solar systems more appealing but also add to their reliability and cost-effectiveness. This constant innovation highlights the solar sector's dynamic nature, which drives its long-term expansion and incorporation into mainstream energy solutions.

However, the upfront cost associated with the installation of solar panels may be relatively elevated, dissuading certain prospective users, even though there are potential long-term savings on energy expenses.

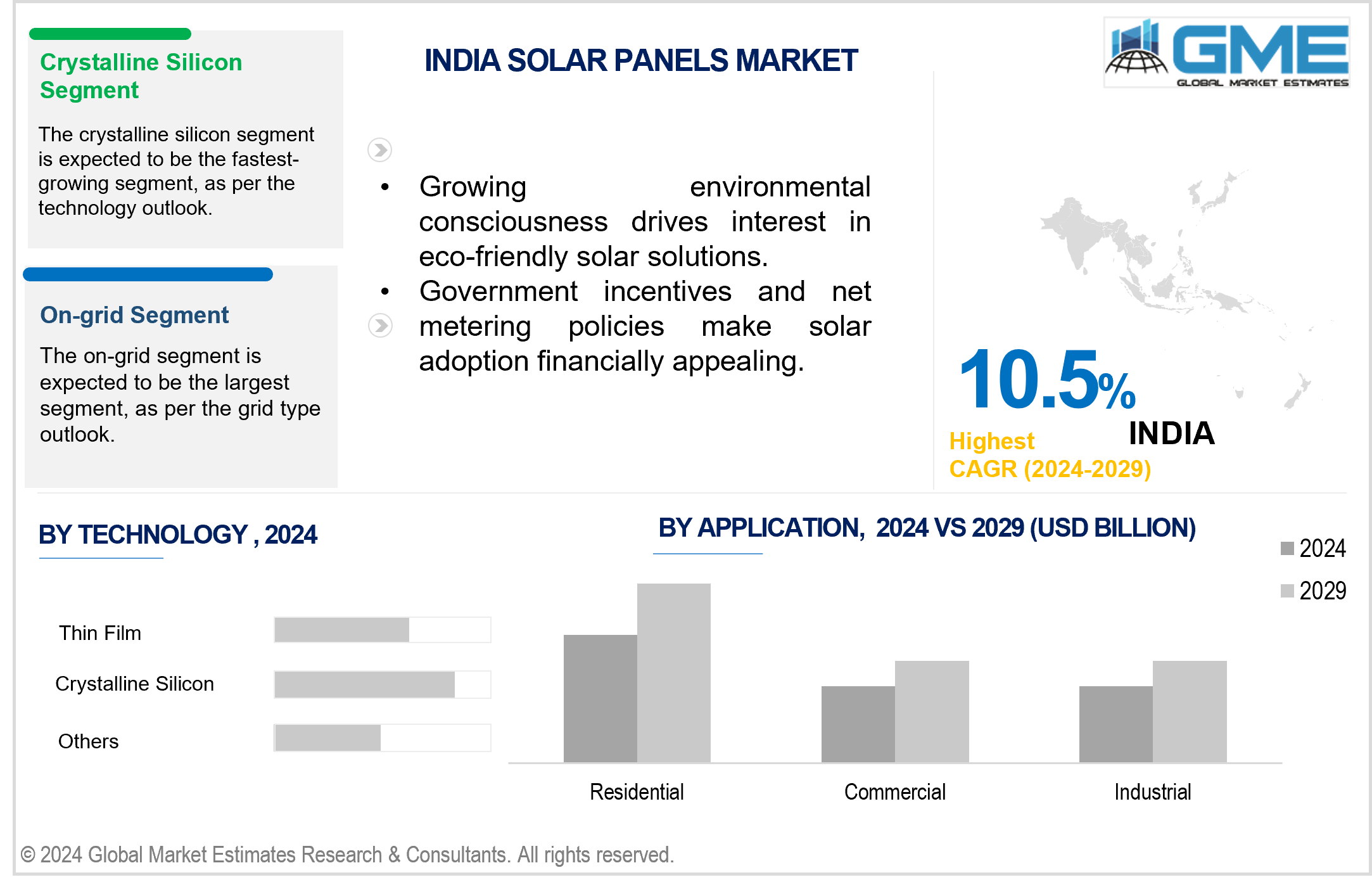

The thin film segment is expected to hold the largest share of the market. This is attributed to its advantages, such as lightweight flexibility, design, and cost-effectiveness in large-scale installations. Thin film technology allows for the fabrication of solar panels at reduced material prices and higher efficiency, making it an appealing choice for the Indian market.

The crystalline silicon segment is expected to be the fastest-growing segment in the market from 2024-2029. The growth is due to technological advancements, more need for energy conversion efficiency, and increased manufacturing scalability. With increasing research and development initiatives, the cost-effectiveness of crystalline silicon technology is steadily growing. Furthermore, its ability to meet both residential and commercial needs places it as the fastest-growing segment in the India solar panels market.

The off-grid segment is anticipated to be the fastest-growing segment in the market from 2024-2029. The segment's growth is due to advancements in energy storage technology, which is enhancing its viability in areas with restricted grid availability. The rising need for dependable power in remote areas and falling costs make off-grid solutions a dynamic and accessible option, contributing to their expected rapid market growth.

The on-grid segment is expected to hold the largest share of the market. This is due to increased demand for decentralized energy solutions. This growth is due to advancements in energy storage technology, which make off-grid solar solutions more feasible, particularly in places with restricted grid access.

The residential segment is anticipated to be the fastest-growing segment in the market from 2024 to 2029. The segment's growth is attributed to increased awareness, affordability, and government incentives. As solar technology becomes more affordable and accessible, more households are turning to solar panels to meet their energy requirements.

The industrial segment is expected to hold the largest share of the market. This is due to the rising use of solar panels to power industrial operations. Industries are recognizing the economic and environmental benefits of solar energy, such as cost savings and a lower carbon footprint. Government incentives and an increasing emphasis on sustainability encourage industrial firms to engage in solar solutions, contributing to the expected growth of the market.

Tata Power Solar, Adani Solar, Servotech Power Systems Ltd., Waaree Energies Ltd, Vikram Solar, Goldi Solar, Saatvik Green Energy Pvt. Ltd., Renewsys India, Loom Solar Pvt. Ltd., and Patanjali, among others, are some of the key players operating in the India solar panels market.

Please note: This is not an exhaustive list of companies profiled in the report.

On March 5, 2024, Tata Power Solar Systems Limited, a leading Indian solar company, renewed and expanded its partnership with Union Bank of India (UBI) to provide financing solutions for residential and commercial customers. The initiative aligns with the government's PM Surya Ghar Muft Bijli Yojana, promoting affordable solar rooftop adoption. The partnership extends loan limits up to USD 18,000 for residential and USD 1.92 million for commercial and industrial (C&I) customers, offering collateral-free financing options.

In October 2023, Loom Solar unveiled a range of solar solutions at the Renewable Energy India Expo (REI) 2023 in Greater Noida under the Mission-Zero Emission initiative. The solutions include "solar modules shark 575 -700 W TOPCon bifacial 16 bus bar, IoT-based energy storage solution Atlanta 5kWh-45 kWh, high-frequency solar inverter fusion 3kW-100kW, and customizable small solar panels for government and DIY projects".

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 INDIA MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 INDIA SOLAR PANELS MARKET, BY APPLICATION TYPE

4.1 Introduction

4.2 Solar Panels Market: Application Type Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Residential

4.4.1 Residential Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 Commercial

4.5.1 Commercial Market Estimates and Forecast, 2021-2029 (USD Million)

4.6 Industrial

4.6.1 Industrial Market Estimates and Forecast, 2021-2029 (USD Million)

5 INDIA SOLAR PANELS MARKET, BY TECHNOLOGY

5.1 Introduction

5.2 Solar Panels Market: Technology Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 Thin Film

5.4.1 Thin Film Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 Crystalline Silicon

5.5.1 Crystalline Silicon Market Estimates and Forecast, 2021-2029 (USD Million)

5.6 Others

5.6.1 Others Market Estimates and Forecast, 2021-2029 (USD Million)

6 INDIA SOLAR PANELS MARKET, BY GRID TYPE

6.1 Introduction

6.2 Solar Panels Market: Grid Type Scope Key Takeaways

6.3 Revenue Growth Analysis, 2023 & 2029

6.4 On-grid

6.4.1 On-grid Market Estimates and Forecast, 2021-2029 (USD Million)

6.5 Off-grid

6.5.1 Off-grid Market Estimates and Forecast, 2021-2029 (USD Million)

7 COMPETITIVE LANDCAPE

7.1 Company Market Share Analysis

7.2 Four Quadrant Positioning Matrix

7.2.1 Market Leaders

7.2.2 Market Visionaries

7.2.3 Market Challengers

7.2.4 Niche Market Players

7.3 Vendor Landscape

7.3.1 North America

7.3.2 Europe

7.3.3 Asia Pacific

7.3.4 Rest of the World

7.4 Company Profiles

7.4.1 Tata Power Solar

7.4.1.1 Business Description & Financial Analysis

7.4.1.2 SWOT Analysis

7.4.1.3 Products & Services Offered

7.4.1.4 Strategic Alliances between Business Partners

7.4.2 Adani Solar

7.4.2.1 Business Description & Financial Analysis

7.4.2.2 SWOT Analysis

7.4.2.3 Products & Services Offered

7.4.2.4 Strategic Alliances between Business Partners

7.4.3 Servotech Power Systems Ltd.

7.4.3.1 Business Description & Financial Analysis

7.4.3.2 SWOT Analysis

7.4.3.3 Products & Services Offered

7.4.3.4 Strategic Alliances between Business Partners

7.4.4 Waaree Energies Ltd

7.4.4.1 Business Description & Financial Analysis

7.4.4.2 SWOT Analysis

7.4.4.3 Products & Services Offered

7.4.4.4 Strategic Alliances between Business Partners

7.4.5 Vikram Solar

7.4.5.1 Business Description & Financial Analysis

7.4.5.2 SWOT Analysis

7.4.5.3 Products & Services Offered

7.4.5.4 Strategic Alliances between Business Partners

7.4.6 Goldi Solar

7.4.6.1 Business Description & Financial Analysis

7.4.6.2 SWOT Analysis

7.4.6.3 Products & Services Offered

7.4.6.4 Strategic Alliances between Business Partners

7.4.7 Saatvik Green Energy Pvt. Ltd.

7.4.7.1 Business Description & Financial Analysis

7.4.7.2 SWOT Analysis

7.4.7.3 Products & Services Offered

7.4.7.4 Strategic Alliances between Business Partners

7.4.8 Renewsys India

7.4.8.1 Business Description & Financial Analysis

7.4.8.2 SWOT Analysis

7.4.8.3 Products & Services Offered

7.4.8.4 Strategic Alliances between Business Partners

7.4.9 Loom Solar Pvt. Ltd

7.4.9.1 Business Description & Financial Analysis

7.4.9.2 SWOT Analysis

7.4.9.3 Products & Services Offered

7.4.9.4 Strategic Alliances between Business Partners

7.4.10 Patanjali

7.4.10.1 Business Description & Financial Analysis

7.4.10.2 SWOT Analysis

7.4.10.3 Products & Services Offered

7.4.10.4 Strategic Alliances between Business Partners

7.4.11 Other Companies

7.4.11.1 Business Description & Financial Analysis

7.4.11.2 SWOT Analysis

7.4.11.3 Products & Services Offered

7.4.11.4 Strategic Alliances between Business Partners

8 RESEARCH METHODOLOGY

8.1 Market Introduction

8.1.1 Market Definition

8.1.2 Market Scope & Segmentation

8.2 Information Procurement

8.2.1 Secondary Research

8.2.1.1 Purchased Databases

8.2.1.2 GMEs Internal Data Repository

8.2.1.3 Secondary Resources & Third Party Perspectives

8.2.1.4 Company Information Sources

8.2.2 Primary Research

8.2.2.1 Various Types of Respondents for Primary Interviews

8.2.2.2 Number of Interviews Conducted throughout the Research Process

8.2.2.3 Primary Stakeholders

8.2.2.4 Discussion Guide for Primary Participants

8.2.3 Expert Panels

8.2.3.1 Expert Panels Across 30+ Industry

8.2.4 Paid Local Experts

8.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

8.3 Market Estimation

8.3.1 Top-Down Approach

8.3.1.1 Macro-Economic Indicators Considered

8.3.1.2 Micro-Economic Indicators Considered

8.3.2 Bottom Up Approach

8.3.2.1 Company Share Analysis Approach

8.3.2.2 Estimation of Potential Product Sales

8.4 Data Triangulation

8.4.1 Data Collection

8.4.2 Time Series, Cross Sectional & Panel Data Analysis

8.4.3 Cluster Analysis

8.5 Analysis and Output

8.5.1 Inhouse AI Based Real Time Analytics Tool

8.5.2 Output From Desk & Primary Research

8.6 Research Assumptions & Limitations

8.7.1 Research Assumptions

8.7.2 Research Limitations

LIST OF TABLES

1 India Solar Panels Market, By Application Type, 2021-2029 (USD Million)

2 Residential Market, By Country, 2021-2029 (USD Million)

3 Commercial Market, By Country, 2021-2029 (USD Million)

4 Industrial Market, By Country, 2021-2029 (USD Million)

5 India Solar Panels Market, By Technology, 2021-2029 (USD Million)

6 Thin Film Market, By Country, 2021-2029 (USD Million)

7 CRYSTALLINE SILICON Market, By Country, 2021-2029 (USD Million)

8 Others Market, By Country, 2021-2029 (USD Million)

9 India Solar Panels Market, By Grid Type, 2021-2029 (USD Million)

10 On-grid Market, By Country, 2021-2029 (USD Million)

11 Off-grid Market, By Country, 2021-2029 (USD Million)

12 Tata Power Solar: Products & Services Offering

13 Adani Solar: Products & Services Offering

14 Servotech Power Systems Ltd.: Products & Services Offering

15 Waaree Energies Ltd: Products & Services Offering

16 Vikram Solar: Products & Services Offering

17 GOLDI SOLAR: Products & Services Offering

18 Saatvik Green Energy Pvt. Ltd. : Products & Services Offering

19 Renewsys India: Products & Services Offering

20 Loom Solar Pvt. Ltd, Inc: Products & Services Offering

21 Patanjali: Products & Services Offering

22 Other Companies: Products & Services Offering

LIST OF FIGURES

1 India Solar Panels Market Overview

2 India Solar Panels Market Value From 2021-2029 (USD Million)

3 India Solar Panels Market Share, By Application Type (2023)

4 India Solar Panels Market Share, By Technology (2023)

5 India Solar Panels Market Share, By Grid Type (2023)

6 Technological Trends In India Solar Panels Market

7 Four Quadrant Competitor Positioning Matrix

8 Impact Of Macro & Micro Indicators On The Market

9 Impact Of Key Drivers On The India Solar Panels Market

10 Impact Of Challenges On The India Solar Panels Market

11 Porter’s Five Forces Analysis

12 India Solar Panels Market: By Application Type Scope Key Takeaways

13 India Solar Panels Market, By Application Type Segment: Revenue Growth Analysis

14 Residential Market, By Country, 2021-2029 (USD Million)

15 Commercial Market, By Country, 2021-2029 (USD Million)

16 Industrial Market, By Country, 2021-2029 (USD Million)

17 India Solar Panels Market: By Technology Scope Key Takeaways

18 India Solar Panels Market, By Technology Segment: Revenue Growth Analysis

19 Thin Film Market, By Country, 2021-2029 (USD Million)

20 Crystalline Silicon Market, By Country, 2021-2029 (USD Million)

21 Others Market, By Country, 2021-2029 (USD Million)

22 India Solar Panels Market: By Grid Type Scope Key Takeaways

23 India Solar Panels Market, By Grid Type Segment: Revenue Growth Analysis

24 On-grid Market, By Country, 2021-2029 (USD Million)

25 Off-grid Market, By Country, 2021-2029 (USD Million)

26 Four Quadrant Positioning Matrix

27 Company Market Share Analysis

28 Tata Power Solar: Company Snapshot

29 Tata Power Solar: SWOT Analysis

30 Tata Power Solar: Geographic Presence

31 Adani Solar: Company Snapshot

32 Adani Solar: SWOT Analysis

33 Adani Solar: Geographic Presence

34 Servotech Power Systems Ltd.: Company Snapshot

35 Servotech Power Systems Ltd.: SWOT Analysis

36 Servotech Power Systems Ltd.: Geographic Presence

37 Waaree Energies Ltd: Company Snapshot

38 Waaree Energies Ltd: Swot Analysis

39 Waaree Energies Ltd: Geographic Presence

40 Vikram Solar: Company Snapshot

41 Vikram Solar: SWOT Analysis

42 Vikram Solar: Geographic Presence

43 Goldi Solar: Company Snapshot

44 Goldi Solar: SWOT Analysis

45 Goldi Solar: Geographic Presence

46 Saatvik Green Energy Pvt. Ltd. : Company Snapshot

47 Saatvik Green Energy Pvt. Ltd. : SWOT Analysis

48 Saatvik Green Energy Pvt. Ltd. : Geographic Presence

49 Renewsys India: Company Snapshot

50 Renewsys India: SWOT Analysis

51 Renewsys India: Geographic Presence

52 Loom Solar Pvt. Ltd, Inc.: Company Snapshot

53 Loom Solar Pvt. Ltd, Inc.: SWOT Analysis

54 Loom Solar Pvt. Ltd, Inc.: Geographic Presence

55 Patanjali: Company Snapshot

56 Patanjali: SWOT Analysis

57 Patanjali: Geographic Presence

58 Other Companies: Company Snapshot

59 Other Companies: SWOT Analysis

60 Other Companies: Geographic Presence

The India Solar Panels Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the India Solar Panels Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS