India Sustainable Farming Market Size, Trends & Analysis - Forecasts to 2029 By Application (Seed Treatment, Soil Treatment, Foliar Spray, and Others), By Crop Type (Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables, and Other Crop Types), By Farming System (Organic Farming, Conservation Agriculture, Integrated Pest Management (IPM), and Precision Agriculture), and By Product Type (Seeds and Traits, Biopesticides, Biostimulants, and Others) Competitive Landscape, Company Market Share Analysis, and End User Analysis

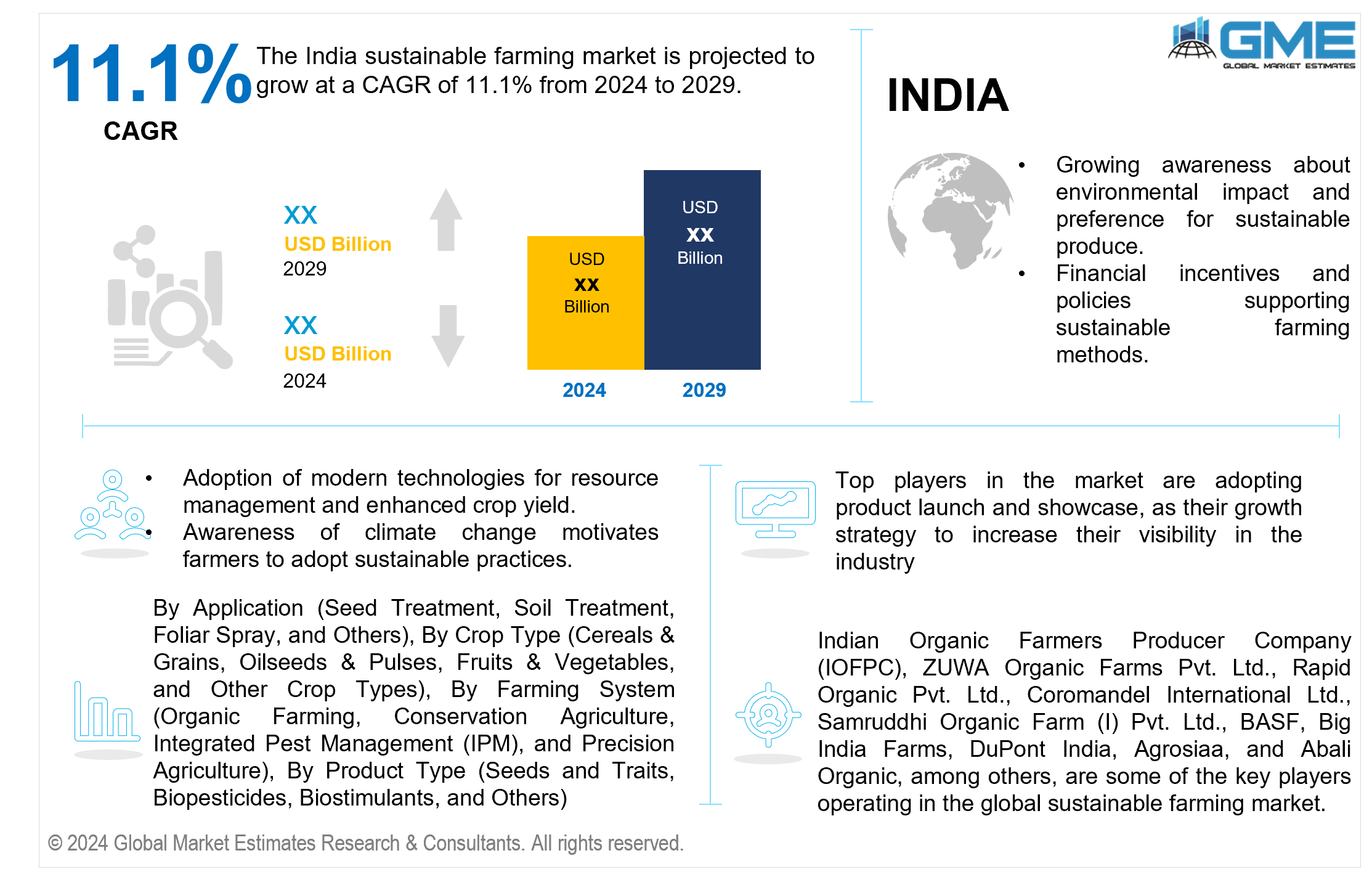

The India sustainable farming market is projected to grow at a CAGR of 11.1% from 2024 to 2029.

Consumers' growing knowledge of environmental issues, health concerns, and demand for chemical-free produce has increased demand for sustainably cultivated foods. The Indian government promotes sustainable farming with initiatives such as the National Mission for Sustainable Agriculture (NMSA) and the Paramparagat Krishi Vikas Yojana (PKVY). These programs provide financial incentives and support to farmers who adopt sustainable practices, promoting a national transition toward environmentally friendly and resource-efficient farming approaches.

The Indian government has actively endorsed organic farming through initiatives like the Paramparagat Krishi Vikas Yojana (PKVY) and the Mission Organic Value Chain Development in North East Region (MOVCDNER) since 2015. Farmers receive financial aid (Rs 31,000/ha/3 years in PKVY and Rs 32,500/ha/3 years in MOVCDNER) for organic inputs. Support extends to training, certification, and marketing of organic produce. PKVY also includes large area certification and a web portal (www.Jaivikkheti.in) for online marketing of organic products nationwide.

Water scarcity is a big concern in many parts of India. Sustainable farming methods prioritizing water management, such as drip irrigation and rainwater harvesting, are becoming popular. The water crisis in India has far-reaching consequences, negatively impacting various aspects of agriculture Reduced agricultural productivity is a direct outcome, as water scarcity limits the availability of this crucial resource for farming. This, in turn, affects food production and can lead to economic challenges for farmers and the broader economy.

The seeds and traits segment is expected to hold the largest share of the market over the forecast period. The expected growth of the segment is due to the growing use of genetically modified seeds and traits. These modified seeds and traits enhance crop resistance, productivity, and sustainability. Farmers are embracing these sophisticated seeds, which are backed by supporting government regulations and awareness efforts, making it the largest contributor to India's sustainable farming sector.

The biopesticides segment is expected to be the fastest-growing segment in the market from 2024-2029. The anticipated growth is attributed to the increasing awareness and demand for environmentally friendly pest management solutions. The government's emphasis on lowering chemical pesticide use, combined with the rising adoption of organic farming, is contributing to the biopesticides segment growth in the Indian sustainable farming market.

The precision agriculture segment is anticipated to be the fastest-growing segment in the market from 2024-2029. The anticipated growth is due to the increasing usage of modern agricultural technology. Precision agriculture uses tools like GPS, sensors, and data analytics to help farmers optimize resource use, increase crop yields, and reduce environmental impact. Precision agriculture is experiencing rapid market expansion due to the increasing demand for more effective and sustainable farming practices and continual technical advancements.

The organic farming segment is expected to hold the largest share of the market. The expected dominance of the segment is due to rising customer demand for chemical-free produce and environmental sustainability. Farmers are encouraged to embrace organic practices through government initiatives such as the Paramparagat Krishi Vikas Yojana (PKVY). Since fiscal year 2015-16, the Indian government has prioritized the promotion of organic farming in the country, primarily through the implementation of schemes like the Paramparagat Krishi Vikas Yojana (PKVY) and the Mission Organic Value Chain Development for the North Eastern Region (MOVCDNER).

The oilseeds & pulses segment is anticipated to be the fastest-growing segment in the market from 2024-2029. Consumers are becoming more aware of the nutritional benefits of oilseeds, contributing to the anticipated growth of the segment. Furthermore, these crops improve soil health and promote sustainable farming practices. Government programs and agricultural diversification assist in the cultivation of oilseeds and pulses.

The cereals & grains tracking segment is expected to hold the largest share of the market. This is due to their fundamental role in Indian agriculture and dietary habits. Cereals and grains, being staple foods, have consistent demand. According to the Agricultural and Processed Food Products Export Development Authority, India is positioned as the world's second-largest producer of rice, wheat, and other cereals. The substantial production volume meets domestic demands and allows surplus quantities available for export. Government laws, subsidies, and support for cereal and grain cultivation all contribute to their dominance in the India sustainable farming market.

The foliar spray segment is anticipated to be the fastest-growing segment in the market from 2024-2029. The growth is due to its efficiency in delivering nutrients directly to plant leaves. Foliar spraying improves nitrogen uptake and responds quickly to plant needs. Farmers are increasingly using foliar spray treatments to increase crop yields and optimize resource efficiency. This trend is fueled by developments in agricultural technology and a focus on sustainable farming techniques, which contribute to the segment's rapid expansion.

The soil treatment segment is expected to hold the largest share of the market. Soil treatment includes various activities, including organic amendments, cover cropping, and microbial applications, which all contribute to sustainable agriculture. Farmers prioritize soil treatment for long-term productivity by enhancing soil structure, nutrient content, and water retention. Government assistance, awareness of environmental benefits, and a holistic approach to farming contribute to the domination of the soil remediation sector in India.

.png)

Indian Organic Farmers Producer Company Limited (IOFPC),ZUWA Organic Farms Pvt. Ltd., Rapid Organic Pvt. Ltd., Coromandel International Ltd., Samruddhi Organic Farm (I) Pvt. Ltd., BASF, Big India Farms, DuPont India, Agrosiaa, and Abali Organic, among others, are some of the key players operating in the India sustainable farming market.

Please note: This is not an exhaustive list of companies profiled in the report.

In February 2023, Coromandel, a prominent Indian agri solutions provider, is poised for a technological breakthrough in agriculture. The company successfully developed a nano-technology-based fertilizer, Nano DAP, from its research and development center at IIT Bombay. In collaboration with leading agricultural universities, extensive field studies have demonstrated Nano DAP's efficacy in diverse agro-climatic zones.

In November 2023, DuPont Water Solutions (DWS) aims for substantial growth in India, exploring opportunities under its China plus one strategy. Focusing on sustainable water refinement, DWS offers a diverse portfolio addressing global water challenges responsibly. The company introduces innovations like Nanofiltration Membrane Elements and Ion Exchange Resin for applications like Lithium-Brine Purification and Green Hydrogen Production.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Product Types

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 INDIA MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 INDIA SUSTAINABLE FARMING MARKET, BY PRODUCT TYPE

4.1 Introduction

4.2 Sustainable Farming Market: Product Type Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Seeds and Traits

4.4.1 Seeds and Traits Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 Biopesticides

4.5.1 Biopesticides Market Estimates and Forecast, 2021-2029 (USD Million)

4.6 Biostimulants

4.6.1 Biostimulants Market Estimates and Forecast, 2021-2029 (USD Million)

4.7 Others

4.7.1 Others Market Estimates and Forecast, 2021-2029 (USD Million)

5 INDIA SUSTAINABLE FARMING MARKET, BY FARMING SYSTEM

5.1 Introduction

5.2 Sustainable Farming Market: Farming System Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 Organic Farming

5.4.1 Organic Farming Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 Conservation Agriculture

5.5.1 Conservation Agriculture Market Estimates and Forecast, 2021-2029 (USD Million)

5.6 Integrated Pest Management (IPM)

5.6.1 Integrated Pest Management (IPM) Market Estimates and Forecast, 2021-2029 (USD Million)

5.7 Precision Agriculture

5.7.1 Precision Agriculture Market Estimates and Forecast, 2021-2029 (USD Million)

6 INDIA SUSTAINABLE FARMING MARKET, BY APPLICATION

6.1 Introduction

6.2 Sustainable Farming Market: Application Scope Key Takeaways

6.3 Revenue Growth Analysis, 2023 & 2029

6.4 Seed Treatment

6.4.1 Seed Treatment Market Estimates and Forecast, 2021-2029 (USD Million)

6.5 Soil Treatment

6.5.1 Soil Treatment Market Estimates and Forecast, 2021-2029 (USD Million)

6.6 Foliar Spray

6.6.1 Foliar Spray Market Estimates and Forecast, 2021-2029 (USD Million)

6.7 Others

6.7.1 OthersMarket Estimates and Forecast, 2021-2029 (USD Million)

7 INDIA SUSTAINABLE FARMING MARKET, BY CROP TYPE

7.1 Introduction

7.2 Sustainable Farming Market: Crop Type Scope Key Takeaways

7.3 Revenue Growth Analysis, 2023 & 2029

7.4 Cereals & Grains

7.4.1 Cereals & Grains Market Estimates and Forecast, 2021-2029 (USD Million)

7.5 Oilseeds & Pulses

7.5.1 Oilseeds & Pulses Market Estimates and Forecast, 2021-2029 (USD Million)

7.6 Fruits & Vegetables

7.6.1 Fruits & Vegetables Market Estimates and Forecast, 2021-2029 (USD Million)

7.7 Other Crop Types

7.7.1 Other Crop Types Market Estimates and Forecast, 2021-2029 (USD Million)

8 INDIA SUSTAINABLE FARMING MARKET

8.1 Introduction

8.2 India Sustainable Farming Market Estimates and Forecast, 2021-2029 (USD Million)

8.2.1 By Product Type

8.2.2 By Farming System

8.2.3 By Application

8.2.4 By Crop Type

9 COMPETITIVE LANDCAPE

9.1 Company Market Share Analysis

9.2 Four Quadrant Positioning Matrix

9.2.1 Market Leaders

9.2.2 Market Visionaries

9.2.3 Market Challengers

9.2.4 Niche Market Players

9.3 Vendor Landscape

9.3.1 India

9.4 Company Profiles

9.4.1 Indian Organic Farmers Producer Company Limited (IOFPC)

9.4.1.1 Business Description & Financial Analysis

9.4.1.2 SWOT Analysis

9.4.1.3 Products & Services Offered

9.4.1.4 Strategic Alliances between Business Partners

9.4.2 ZUWA Organic Farms Pvt. Ltd.

9.4.2.1 Business Description & Financial Analysis

9.4.2.2 SWOT Analysis

9.4.2.3 Products & Services Offered

9.4.2.4 Strategic Alliances between Business Partners

9.4.3 Rapid Organic Pvt. Ltd.

9.4.3.1 Business Description & Financial Analysis

9.4.3.2 SWOT Analysis

9.4.3.3 Products & Services Offered

9.4.3.4 Strategic Alliances between Business Partners

9.4.4 Coromandel International Ltd.

9.4.4.1 Business Description & Financial Analysis

9.4.4.2 SWOT Analysis

9.4.4.3 Products & Services Offered

9.4.4.4 Strategic Alliances between Business Partners

9.4.5 Samruddhi Organic Farm (I) Pvt. Ltd.

9.4.5.1 Business Description & Financial Analysis

9.4.5.2 SWOT Analysis

9.4.5.3 Products & Services Offered

9.4.5.4 Strategic Alliances between Business Partners

9.4.6 BASF

9.4.6.1 Business Description & Financial Analysis

9.4.6.2 SWOT Analysis

9.4.6.3 Products & Services Offered

9.4.6.4 Strategic Alliances between Business Partners

9.4.7 Big India Farms

9.4.7.1 Business Description & Financial Analysis

9.4.7.2 SWOT Analysis

9.4.7.3 Products & Services Offered

9.4.8.4 Strategic Alliances between Business Partners

9.4.8 DuPont India

9.4.8.1 Business Description & Financial Analysis

9.4.8.2 SWOT Analysis

9.4.8.3 Products & Services Offered

9.4.8.4 Strategic Alliances between Business Partners

9.4.9 Agrosiaa

9.4.9.1 Business Description & Financial Analysis

9.4.9.2 SWOT Analysis

9.4.9.3 Products & Services Offered

9.4.9.4 Strategic Alliances between Business Partners

9.4.10 Abali Organic

9.4.10.1 Business Description & Financial Analysis

9.4.10.2 SWOT Analysis

9.4.10.3 Products & Services Offered

9.4.10.4 Strategic Alliances between Business Partners

9.4.11 Other Companies

9.4.11.1 Business Description & Financial Analysis

9.4.11.2 SWOT Analysis

9.4.11.3 Products & Services Offered

9.4.11.4 Strategic Alliances between Business Partners

10 RESEARCH METHODOLOGY

10.1 Market Introduction

10.1.1 Market Definition

10.1.2 Market Scope & Segmentation

10.2 Information Procurement

10.2.1 Secondary Research

10.2.1.1 Purchased Databases

10.2.1.2 GMEs Internal Data Repository

10.2.1.3 Secondary Resources & Third Party Perspectives

10.2.1.4 Company Information Sources

10.2.2 Primary Research

10.2.2.1 Various Types of Respondents for Primary Interviews

10.2.2.2 Number of Interviews Conducted throughout the Research Process

10.2.2.3 Primary Stakeholders

10.2.2.4 Discussion Guide for Primary Participants

10.2.3 Expert Panels

10.2.3.1 Expert Panels Across 30+ Industry

10.2.4 Paid Local Experts

10.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

10.3 Market Estimation

10.3.1 Top-Down Approach

10.3.1.1 Macro-Economic Indicators Considered

10.3.1.2 Micro-Economic Indicators Considered

10.3.2 Bottom Up Approach

10.3.2.1 Company Share Analysis Approach

10.3.2.2 Estimation of Potential Product Sales

10.4 Data Triangulation

10.4.1 Data Collection

10.4.2 Time Series, Cross Sectional & Panel Data Analysis

10.4.3 Cluster Analysis

10.5 Analysis and Output

10.5.1 Inhouse AI Based Real Time Analytics Tool

10.5.2 Output From Desk & Primary Research

10.6 Research Assumptions & Limitations

10.7.1 Research Assumptions

10.7.2 Research Limitations

LIST OF TABLES

1 India Sustainable Farming Market, By Product Type, 2021-2029 (USD Million)

2 Seeds and Traits Market, By Country, 2021-2029 (USD Million)

3 Biopesticides Market, By Country, 2021-2029 (USD Million)

4 Biostimulants Market, By Country, 2021-2029 (USD Million)

5 Others Market, By Country, 2021-2029 (USD Million)

6 India Sustainable Farming Market, By Farming System, 2021-2029 (USD Million)

7 Organic Farming Market, By Country, 2021-2029 (USD Million)

8 Conservation Agriculture Market, By Country, 2021-2029 (USD Million)

9 Integrated Pest Management (IPM) Market, By Country, 2021-2029 (USD Million)

10 Precision Agriculture Market, By Country, 2021-2029 (USD Million)

11 Personnel/ Staff Market, By Country, 2021-2029 (USD Million)

12 India Sustainable Farming Market, By Application, 2021-2029 (USD Million)

13 Seed Treatment Market, By Country, 2021-2029 (USD Million)

14 Soil Treatment Market, By Country, 2021-2029 (USD Million)

15 Foliar Spray Market, By Country, 2021-2029 (USD Million)

16 OthersMarket, By Country, 2021-2029 (USD Million)

17 Others Market, By Country, 2021-2029 (USD Million)

18 India Sustainable Farming Market, By Crop Type, 2021-2029 (USD Million)

19 Cereals & Grains Market, By Country, 2021-2029 (USD Million)

20 Oilseeds & Pulses Market, By Country, 2021-2029 (USD Million)

21 Country Analysis, 2021-2029 (USD Million)

22 India Sustainable Farming Market, By Product Type, 2021-2029 (USD Million)

23 India Sustainable Farming Market, By Farming System, 2021-2029 (USD Million)

24 India Sustainable Farming Market, By Application, 2021-2029 (USD Million)

25 india Sustainable Farming Market, By Crop Type, 2021-2029 (USD Million)

26 Indian Organic Farmers Producer Company Limited (IOFPC): Products & Services Offering

27 ZUWA Organic Farms Pvt. Ltd.: Products & Services Offering

28 Rapid Organic Pvt. Ltd.: Products & Services Offering

29 Coromandel International Ltd.: Products & Services Offering

30 Samruddhi Organic Farm (I) Pvt. Ltd.: Products & Services Offering

31 BASF: Products & Services Offering

32 Big India Farms : Products & Services Offering

33 DuPont India: Products & Services Offering

34 Agrosiaa, Inc: Products & Services Offering

35 Abali Organic: Products & Services Offering

36 Other Companies: Products & Services Offering

LIST OF FIGURES

1 India Sustainable Farming Market Overview

2 India Sustainable Farming Market Value From 2021-2029 (USD Million)

3 India Sustainable Farming Market Share, By Product Type (2023)

4 India Sustainable Farming Market Share, By Farming System (2023)

5 India Sustainable Farming Market Share, By Application (2023)

6 India Sustainable Farming Market Share, By Crop Type (2022)

7 India Sustainable Farming Market, By Country (Asia Pacific Market)

8 Technological Trends In India Sustainable Farming Market

9 Four Quadrant Competitor Positioning Matrix

10 Impact Of Macro & Micro Indicators On The Market

11 Impact Of Key Drivers On The India Sustainable Farming Market

12 Impact Of Challenges On The India Sustainable Farming Market

13 Porter’s Five Forces Analysis

14 India Sustainable Farming Market: By Product Type Scope Key Takeaways

15 India Sustainable Farming Market, By Product Type Segment: Revenue Growth Analysis

16 Seeds and Traits Market, By Country, 2021-2029 (USD Million)

17 Biopesticides Market, By Country, 2021-2029 (USD Million)

18 Biostimulants Market, By Country, 2021-2029 (USD Million)

19 Others Market, By Country, 2021-2029 (USD Million)

20 India Sustainable Farming Market: By Farming System Scope Key Takeaways

21 India Sustainable Farming Market, By Farming System Segment: Revenue Growth Analysis

22 Organic Farming Market, By Country, 2021-2029 (USD Million)

23 Conservation Agriculture Market, By Country, 2021-2029 (USD Million)

24 Integrated Pest Management (IPM) Market, By Country, 2021-2029 (USD Million)

25 Precision Agriculture Market, By Country, 2021-2029 (USD Million)

26 Personnel/ Staff Market, By Country, 2021-2029 (USD Million)

27 India Sustainable Farming Market: By Application Scope Key Takeaways

28 India Sustainable Farming Market, By Application Segment: Revenue Growth Analysis

29 Seed Treatment Market, By Country, 2021-2029 (USD Million)

30 Soil Treatment Market, By Country, 2021-2029 (USD Million)

31 Foliar Spray Market, By Country, 2021-2029 (USD Million)

32 OthersMarket, By Country, 2021-2029 (USD Million)

33 Others Market, By Country, 2021-2029 (USD Million)

34 India Sustainable Farming Market: By Crop Type Scope Key Takeaways

35 India Sustainable Farming Market, By Crop Type Segment: Revenue Growth Analysis

36 Cereals & Grains Market, By Country, 2021-2029 (USD Million)

37 Oilseeds & Pulses Market, By Country, 2021-2029 (USD Million)

38 Regional Segment: Revenue Growth Analysis

39 India Sustainable Farming Market: Regional Analysis

40 India Sustainable Farming Market Overview

41 India Sustainable Farming Market, By Product Type

42 India Sustainable Farming Market, By Farming System

43 India Sustainable Farming Market, By Application

44 India Sustainable Farming Market, By Crop Type

45 Four Quadrant Positioning Matrix

46 Company Market Share Analysis

47 Indian Organic Farmers Producer Company Limited (IOFPC): Company Snapshot

48 Indian Organic Farmers Producer Company Limited (IOFPC): SWOT Analysis

49 Indian Organic Farmers Producer Company Limited (IOFPC): Geographic Presence

50 ZUWA Organic Farms Pvt. Ltd.: Company Snapshot

51 ZUWA Organic Farms Pvt. Ltd.: SWOT Analysis

52 ZUWA Organic Farms Pvt. Ltd.: Geographic Presence

53 Rapid Organic Pvt. Ltd.: Company Snapshot

54 Rapid Organic Pvt. Ltd.: SWOT Analysis

55 Rapid Organic Pvt. Ltd.: Geographic Presence

56 Coromandel International Ltd.: Company Snapshot

57 Coromandel International Ltd.: Swot Analysis

58 Coromandel International Ltd.: Geographic Presence

59 Samruddhi Organic Farm (I) Pvt. Ltd.: Company Snapshot

60 Samruddhi Organic Farm (I) Pvt. Ltd.: SWOT Analysis

61 Samruddhi Organic Farm (I) Pvt. Ltd.: Geographic Presence

62 BASF: Company Snapshot

63 BASF: SWOT Analysis

64 BASF: Geographic Presence

65 Big India Farms : Company Snapshot

66 Big India Farms : SWOT Analysis

67 Big India Farms : Geographic Presence

68 DuPont India: Company Snapshot

69 DuPont India: SWOT Analysis

70 DuPont India: Geographic Presence

71 Agrosiaa, Inc.: Company Snapshot

72 Agrosiaa, Inc.: SWOT Analysis

73 Agrosiaa, Inc.: Geographic Presence

74 Abali Organic: Company Snapshot

75 Abali Organic: SWOT Analysis

76 Abali Organic: Geographic Presence

77 Other Companies: Company Snapshot

78 Other Companies: SWOT Analysis

79 Other Companies: Geographic Presence

The Global India Sustainable Farming Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the India Sustainable Farming Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS