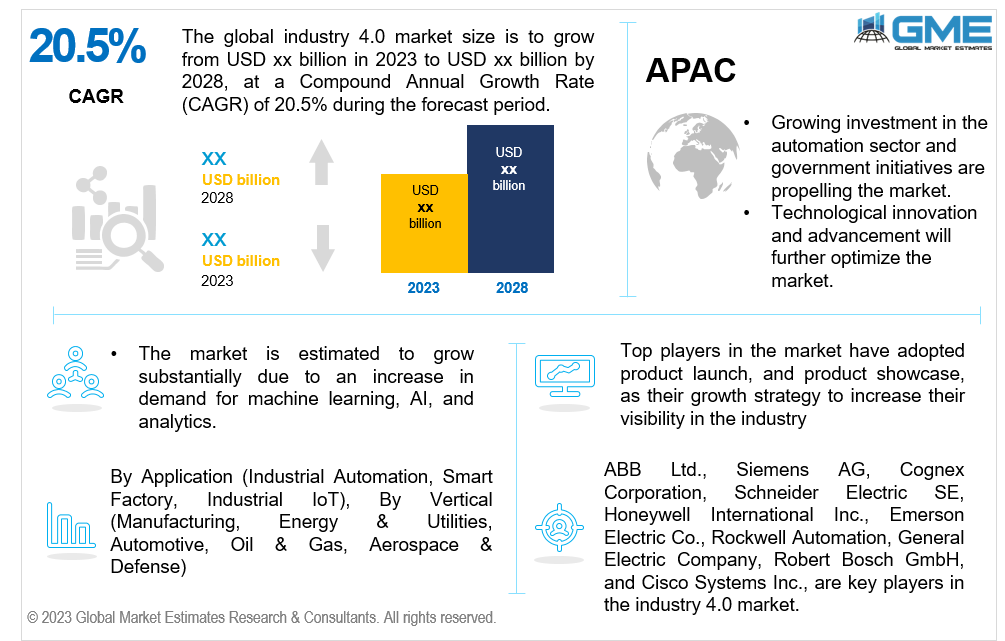

Global Industry 4.0 Market Size, Trends & Analysis - Forecasts to 2028 By Application (Industrial Automation, Smart Factory, Industrial IoT), By Vertical (Manufacturing, Energy & Utilities, Automotive, Oil & Gas, Aerospace & Defense), By Region (North America, Asia Pacific, Central & South America, Europe, and the Middle East & Africa), End-User Landscape Analysis, Company Market Share Analysis, and Competitor Analysis

The global industry 4.0 market is projected to grow at a CAGR of 20.5% from 2023 to 2028.

Industry 4.0 is changing how companies create, improve, and distribute their products. In recent years, many manufacturers are integrating the Internet of Things (IoT), cloud computing, artificial intelligence, analytics, and machine learning into product development and manufacturing processes. In smart factories, data is collected and analysed to aid in decision-making where advanced sensors, embedded software, and robotics are all present. Even more, value can be derived from previously archived data when operational data from corporate systems like ERP, supply chains, customer support, and others are integrated with data from production processes. As the pace of additive manufacturing is increasing, use of automated tools and equipment is also increasing in factories, warehouses, and manufacturing facilities. Companies are implementing digital technologies like 5G, IoT, artificial intelligence, and machine learning.

The global pandemic has accelerated the industry 4.0 environment by digitizing businesses. The epidemic presented fresh chances for digital leaders to develop and put into practice ground-breaking ideas, like remote working, to hasten digital transformation at all levels of the organization. The coronavirus pandemic has fastened Industry 4.0's rise and propelled businesses from a variety of sectors towards a higher level of Internet of Things (IoT) technology and workflow. Over the past few years, robotic automation has helped in replacing expensive machines due to their large diversity of performing tasks. Consumers across sectors utilize robotic machines, especially in the industrial sector. According to recent developments, industrial robots are being implemented in manufacturing facilities and this is helping the business significantly.

The manufacturing sector's production processes are increasingly incorporating robotics engineering and technology due to the field's rapid technological breakthroughs. Industrial robots are autonomous, multifunctional manipulators that can be programmed. Welding, heavy lifting, ironing, assembling, picking, positioning, palletizing, product inspection, and testing are a few other typical industrial robot applications. All these activities need a great deal of human endurance, quickness, and accuracy. According to the International Federation of Robotics (IFR), 486,800 units would have been carried globally in 2021. Industrial robots perform monotonous duties and, when necessary, take the place of human labour. They can also work in hazardous conditions where people cannot. Robotics technology will thus be a significant advancement in the market for industry 4.0. However, high industrial robot deployment costs and challenges with integration and interoperability restrain market expansion to some extent.

Business models, value and supply chains, processes, goods, skills, and stakeholder relationships are all evolving as a result of Industry 4.0. For Industry 4.0 to have a good impact on business and society, it has produced new opportunities and vulnerabilities that need to be controlled and governed. Governments all over the world have actively taken steps to encourage this new generation of manufacturing, including raising awareness, developing action plans, providing support, investing in infrastructure, sponsoring initiatives, and providing tax benefits. In addition to industrial plans, research initiatives have been started to investigate new enabling technologies developed by businesses, private organizations, or public-private partnerships, such as the Industrial Internet Consortium or the European Commission's Horizon 2020 program for "Factories of the Future".

The industrial IoT segment is expected to witness the largest share in the global industry 4.0 market during the forecast period of 2023-2028. The possible benefits of IoT have motivated several industry manufacturers to enhance their business development by adopting IoT. Manufacturers are connecting industrial equipment using sensor data and wireless connectivity with the products. By connecting industrial IoT with products, companies are aiming to enhance their performance and recognize their potential failures that help in the maintenance programs. Industrial IoT automation provides a wide range of technologies that help in reducing human intervention, provide flexibility, and boost the quality of manufacturing processes.

The smart factories segment is expected to grow the fastest during 2023-2028. In a smart digital factory, machines, people, and Big Data are all combined into a unified, digitally connected ecosystem. A smart factory not only gathers and analyses data, but also learns from experience. In order to predict trends and events, prescribe and implement automated manufacturing workflows, and derive insights from them, it evaluates data sets. The operating methods of a smart factory are constantly improved in order to self-correct and self-optimize. In this way, it might teach people to be stronger, more effective, and safer.

The manufacturing segment is expected to witness the largest share in the global industry 4.0 market during the forecast period of 2023-2028. The additive manufacturing process, also referred to as 3D printing, is one of the most creative instruments now in use. The use of 3D printing has grown significantly in recent years in order to meet the increasing demand for ventilator valves in hospitals around the globe.

Furthermore, the technology behind manufacturing 3D printing is about to change the present patterns in the manufacturing sector. To further explore the opportunities provided by 3D printing technology and to encourage its development, governments all over the world are establishing programs and providing funds to businesses that carry out research and develop the technology. National initiatives are being put into place in the United States, the United Kingdom, and Canada to encourage collegiate research on 3D printing, which is developing technology and generating start-ups. As new uses for the technology emerge, future industrialists and governments from all over the world will be drawn to 3D printing, which is predicted to generate lucrative growth potential for the industry 4.0 market.

The automotive segment is expected to grow the fastest during 2023-2028. Automotive plants are equipped with technology that tracks the production equipment and processes to detect possible problems on site. This helps in reducing production downtime. Automotive manufacturers are emphasizing on 4.0 operations to help them configure individual vehicles and reduce the delivery time. IoT-enabled cars also let you customize the dashboard and steering wheel, for example. The 4.0 industry is improving the idea of self-driving cars. The automotive segment is anticipated to expand the fastest throughout the forecast period due to increased expenditures in the industry and rapid technological advancement.

The North American segment is expected to witness the largest share in the global industry 4.0 market during the forecast period of 2023-2028. North America has many skilled technicians and there are advanced types of equipment as well as facilities in the region. Companies in the United States and Canada are actively increasing the concept of smart manufacturing across sectors like automotive, food & beverages, energy, and others. Most of the factories are operating with new types of machinery and smart technologies. This also helps other businesses to transform from conventional manufacturing methods.

Asia-Pacific is expected to grow the fastest during 2023-2028. For instance, countries like South Korea, Japan, and China are adopting exhaustive methods to adopt industrial automation. Companies in the APAC region are implementing disruptive technologies in their manufacturing system value chain. Government initiatives are also boosting the market during the forecast period. For example, the government of China has emphasized state-driven industrial policies to drive it global high-tech manufacturing. Japan has also launched the ‘Society 5.0 program’ that aims to address the economic, social, and industrial challenges in the country.

Europe is also expected to flourish during the forecast period. The major reasons attributed to Europe’s growth are technological advancements, strong acquisitions, and collaborations between countries for product development and this is contributing to the market growth. For instance, Honeywell International, Siemens, and General Electric are amongst the players adopting 4.0 technology in the European regions.

ABB Ltd., Siemens AG, Cognex Corporation, Schneider Electric SE, Honeywell International Inc., Emerson Electric Co., Rockwell Automation, General Electric Company, Robert Bosch GmbH, and Cisco Systems Inc. among others are some of the key players in the industry 4.0 market.

Please note: This is not an exhaustive list of companies profiled in the report.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

2.4 Data Metrics

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

4 GLOBAL INDUSTRY 4.0 MARKET, BY VERTICAL

4.2 Industry 4.0 Market: Vertical Scope Key Takeaways

4.3 Revenue Growth Analysis, 2022 & 2028

4.4.1 Manufacturing Market Estimates and Forecast, 2020-2028 (USD Million)

4.5.1 Energy & Utilities Market Estimates and Forecast, 2020-2028 (USD Million)

4.6.1 Automotive Market Estimates and Forecast, 2020-2028 (USD Million)

4.7.1 Oil & Gas Market Estimates and Forecast, 2020-2028 (USD Million)

4.8.1 Aerospace & Defense Market Estimates and Forecast, 2020-2028 (USD Million)

5 GLOBAL INDUSTRY 4.0 MARKET, BY APPLICATION

5.2 Industry 4.0 Market: Application Scope Key Takeaways

5.3 Revenue Growth Analysis, 2022 & 2028

5.4.1 Industrial Automation Market Estimates and Forecast, 2020-2028 (USD Million)

5.5.1 Smart Factory Market Estimates and Forecast, 2020-2028 (USD Million)

5.6.1 Industrial IoT Market Estimates and Forecast, 2020-2028 (USD Million)

6 GLOBAL INDUSTRY 4.0 MARKET, BY REGION

6.2 North America Industry 4.0 Market Estimates and Forecast, 2020-2028 (USD Million)

6.2.3.1 U.S. Industry 4.0 Market Estimates and Forecast, 2020-2028 (USD Million)

6.2.3.2 Canada Industry 4.0 Market Estimates and Forecast, 2020-2028 (USD Million)

6.2.3.3 Mexico Industry 4.0 Market Estimates and Forecast, 2020-2028 (USD Million)

6.3 Europe Industry 4.0 Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.1 Germany Industry 4.0 Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.2 U.K. Industry 4.0 Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.3 France Industry 4.0 Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.4 Italy Industry 4.0 Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.5 Spain Industry 4.0 Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.6 Netherlands Industry 4.0 Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.7 Rest of Europe Industry 4.0 Market Estimates and Forecast, 2020-2028 (USD Million)

6.4 Asia Pacific Industry 4.0 Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.1 China Industry 4.0 Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.2 Japan Industry 4.0 Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.3 India Industry 4.0 Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.4 South Korea Industry 4.0 Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.5 Singapore Industry 4.0 Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.6 Malaysia Industry 4.0 Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.7 Thailand Industry 4.0 Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.8 Indonesia Industry 4.0 Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.9 Vietnam Industry 4.0 Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.10 Taiwan Industry 4.0 Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.11 Rest of Asia Pacific Industry 4.0 Market Estimates and Forecast, 2020-2028 (USD Million)

6.5 Middle East & Africa Industry 4.0 Market Estimates and Forecast, 2020-2028 (USD Million)

6.5.3.1 Saudi Arabia Industry 4.0 Market Estimates and Forecast, 2020-2028 (USD Million)

6.5.3.2 U.A.E. Industry 4.0 Market Estimates and Forecast, 2020-2028 (USD Million)

6.5.3.3 Israel Industry 4.0 Market Estimates and Forecast, 2020-2028 (USD Million)

6.5.3.4 South Africa Industry 4.0 Market Estimates and Forecast, 2020-2028 (USD Million)

6.6 Central & South America Industry 4.0 Market Estimates and Forecast, 2020-2028 (USD Million)

6.6.3.1 Brazil Industry 4.0 Market Estimates and Forecast, 2020-2028 (USD Million)

6.6.3.2 Argentina Industry 4.0 Market Estimates and Forecast, 2020-2028 (USD Million)

6.6.3.3 Chile Industry 4.0 Market Estimates and Forecast, 2020-2028 (USD Million)

7.1 Company Market Share Analysis

7.2 Four Quadrant Positioning Matrix

7.4.1.1 Business Description & Financial Analysis

7.4.1.3 Products & Services Offered

7.4.1.4 Strategic Alliances between Business Partners

7.4.2.1 Business Description & Financial Analysis

7.4.2.3 Products & Services Offered

7.4.2.4 Strategic Alliances between Business Partners

7.4.3.1 Business Description & Financial Analysis

7.4.3.3 Products & Services Offered

7.4.3.4 Strategic Alliances between Business Partners

7.4.4.1 Business Description & Financial Analysis

7.4.4.3 Products & Services Offered

7.4.4.4 Strategic Alliances between Business Partners

7.4.5.1 Business Description & Financial Analysis

7.4.5.3 Products & Services Offered

7.4.5.4 Strategic Alliances between Business Partners

7.4.6.1 Business Description & Financial Analysis

7.4.6.3 Products & Services Offered

7.4.6.4 Strategic Alliances between Business Partners

7.4.7.1 Business Description & Financial Analysis

7.4.7.3 Products & Services Offered

7.4.7.4 Strategic Alliances between Business Partners

7.4.8 General Electric Company

7.4.8.1 Business Description & Financial Analysis

7.4.8.3 Products & Services Offered

7.4.8.4 Strategic Alliances between Business Partners

7.4.9.1 Business Description & Financial Analysis

7.4.9.3 Products & Services Offered

7.4.9.4 Strategic Alliances between Business Partners

7.4.10.1 Business Description & Financial Analysis

7.4.10.3 Products & Services Offered

7.4.10.4 Strategic Alliances between Business Partners

7.4.11.1 Business Description & Financial Analysis

7.4.11.3 Products & Services Offered

7.4.11.4 Strategic Alliances between Business Partners

8.1.2 Market Scope & Segmentation

8.2.1.2 GMEs Internal Data Repository

8.2.1.3 Secondary Resources & Third Party Perspectives

8.2.1.4 Company Information Sources

8.2.2.1 Various End Use of Respondents for Primary Interviews

8.2.2.2 Number of Interviews Conducted throughout the Research Process

8.2.2.4 Discussion Guide for Primary Participants

8.2.3.1 Expert Panels Across 30+ Industry

8.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

8.3.1.1 Macro-Economic Indicators Considered

8.3.1.2 Micro-Economic Indicators Considered

8.3.2.1 Company Share Analysis Approach

8.3.2.2 Estimation of Potential Product Sales

8.4.2 Time Series, Cross Sectional & Panel Data Analysis

8.5.1 Inhouse AI Based Real Time Analytics Tool

8.5.2 Output From Desk & Primary Research

8.6 Research Assumptions & Limitations

LIST OF TABLES

1 Global Industry 4.0 Market, By Vertical, 2020-2028 (USD Mllion)

2 Manufacturing Market, By Region, 2020-2028 (USD Mllion)

3 Energy & Utilities Market, By Region, 2020-2028 (USD Mllion)

4 Automotive Market, By Region, 2020-2028 (USD Mllion)

5 Oil & Gas Market, By Region, 2020-2028 (USD Mllion)

6 Aerospace & Defense Market, By Region, 2020-2028 (USD Mllion)

7 Global Industry 4.0 Market, By Application, 2020-2028 (USD Mllion)

8 Industrial Automation Market, By Region, 2020-2028 (USD Mllion)

9 Smart Factory Market, By Region, 2020-2028 (USD Mllion)

10 industrial iot Market, By Region, 2020-2028 (USD Mllion)

11 Regional Analysis, 2020-2028 (USD Mllion)

12 North America Industry 4.0 Market, By Vertical, 2020-2028 (USD Mllion)

13 North America Industry 4.0 Market, By Application, 2020-2028 (USD Mllion)

14 U.S. Industry 4.0 Market, By Vertical, 2020-2028 (USD Mllion)

15 U.S. Industry 4.0 Market, By Application, 2020-2028 (USD Mllion)

16 Canada Industry 4.0 Market, By Vertical, 2020-2028 (USD Mllion)

17 Canada Industry 4.0 Market, By Application, 2020-2028 (USD Mllion)

18 Mexico Industry 4.0 Market, By Vertical, 2020-2028 (USD Mllion)

19 Mexico Industry 4.0 Market, By Application, 2020-2028 (USD Mllion)

20 Europe Industry 4.0 Market, By Vertical, 2020-2028 (USD Mllion)

21 Europe Industry 4.0 Market, By Application, 2020-2028 (USD Mllion)

22 Germany Industry 4.0 Market, By Vertical, 2020-2028 (USD Mllion)

23 Germany Industry 4.0 Market, By Application, 2020-2028 (USD Mllion)

24 U.K. Industry 4.0 Market, By Vertical, 2020-2028 (USD Mllion)

25 U.K. Industry 4.0 Market, By Application, 2020-2028 (USD Mllion)

26 France Industry 4.0 Market, By Vertical, 2020-2028 (USD Mllion)

27 France Industry 4.0 Market, By Application, 2020-2028 (USD Mllion)

28 Italy Industry 4.0 Market, By Vertical, 2020-2028 (USD Mllion)

29 Italy Industry 4.0 Market, By Application, 2020-2028 (USD Mllion)

30 Spain Industry 4.0 Market, By Vertical, 2020-2028 (USD Mllion)

31 Spain Industry 4.0 Market, By Application, 2020-2028 (USD Mllion)

32 Netherlands Industry 4.0 Market, By Vertical, 2020-2028 (USD Mllion)

33 Netherlands Industry 4.0 Market, By Application, 2020-2028 (USD Mllion)

34 Rest Of Europe Industry 4.0 Market, By Vertical, 2020-2028 (USD Mllion)

35 Rest Of Europe Industry 4.0 Market, By Application, 2020-2028 (USD Mllion)

36 Asia Pacific Industry 4.0 Market, By Vertical, 2020-2028 (USD Mllion)

37 Asia Pacific Industry 4.0 Market, By Application, 2020-2028 (USD Mllion)

38 China Industry 4.0 Market, By Vertical, 2020-2028 (USD Mllion)

39 China Industry 4.0 Market, By Application, 2020-2028 (USD Mllion)

40 Japan Industry 4.0 Market, By Vertical, 2020-2028 (USD Mllion)

41 Japan Industry 4.0 Market, By Application, 2020-2028 (USD Mllion)

42 India Industry 4.0 Market, By Vertical, 2020-2028 (USD Mllion)

43 India Industry 4.0 Market, By Application, 2020-2028 (USD Mllion)

44 South Korea Industry 4.0 Market, By Vertical, 2020-2028 (USD Mllion)

45 South Korea Industry 4.0 Market, By Application, 2020-2028 (USD Mllion)

46 Singapore Industry 4.0 Market, By Vertical, 2020-2028 (USD Mllion)

47 Singapore Industry 4.0 Market, By Application, 2020-2028 (USD Mllion)

48 Thailand Industry 4.0 Market, By Vertical, 2020-2028 (USD Mllion)

49 Thailand Industry 4.0 Market, By Application, 2020-2028 (USD Mllion)

50 Malaysia Industry 4.0 Market, By Vertical, 2020-2028 (USD Mllion)

51 Malaysia Industry 4.0 Market, By Application, 2020-2028 (USD Mllion)

52 Indonesia Industry 4.0 Market, By Vertical, 2020-2028 (USD Mllion)

53 Indonesia Industry 4.0 Market, By Application, 2020-2028 (USD Mllion)

54 Vietnam Industry 4.0 Market, By Vertical, 2020-2028 (USD Mllion)

55 Vietnam Industry 4.0 Market, By Application, 2020-2028 (USD Mllion)

56 Taiwan Industry 4.0 Market, By Vertical, 2020-2028 (USD Mllion)

57 Taiwan Industry 4.0 Market, By Application, 2020-2028 (USD Mllion)

58 Rest of APAC Industry 4.0 Market, By Vertical, 2020-2028 (USD Mllion)

59 Rest of APAC Industry 4.0 Market, By Application, 2020-2028 (USD Mllion)

60 Middle East & Africa Industry 4.0 Market, By Vertical, 2020-2028 (USD Mllion)

61 Middle East & Africa Industry 4.0 Market, By Application, 2020-2028 (USD Mllion)

62 Saudi Arabia Industry 4.0 Market, By Vertical, 2020-2028 (USD Mllion)

63 Saudi Arabia Industry 4.0 Market, By Application, 2020-2028 (USD Mllion)

64 UAE Industry 4.0 Market, By Vertical, 2020-2028 (USD Mllion)

65 UAE Industry 4.0 Market, By Application, 2020-2028 (USD Mllion)

66 Israel Industry 4.0 Market, By Vertical, 2020-2028 (USD Mllion)

67 Israel Industry 4.0 Market, By Application, 2020-2028 (USD Mllion)

68 South Africa Industry 4.0 Market, By Vertical, 2020-2028 (USD Mllion)

69 South Africa Industry 4.0 Market, By Application, 2020-2028 (USD Mllion)

70 Rest Of Middle East & Africa Industry 4.0 Market, By Vertical, 2020-2028 (USD Mllion)

71 Rest Of Middle East & Africa Industry 4.0 Market, By Application, 2020-2028 (USD Mllion)

72 Central & South America Industry 4.0 Market, By Vertical, 2020-2028 (USD Mllion)

73 Central & South America Industry 4.0 Market, By Application, 2020-2028 (USD Mllion)

74 Brazil Industry 4.0 Market, By Vertical, 2020-2028 (USD Mllion)

75 Brazil Industry 4.0 Market, By Application, 2020-2028 (USD Mllion)

76 Chile Industry 4.0 Market, By Vertical, 2020-2028 (USD Mllion)

77 Chile Industry 4.0 Market, By Application, 2020-2028 (USD Mllion)

78 Argentina Industry 4.0 Market, By Vertical, 2020-2028 (USD Mllion)

79 Argentina Industry 4.0 Market, By Application, 2020-2028 (USD Mllion)

80 Rest Of Central & South America Industry 4.0 Market, By Vertical, 2020-2028 (USD Mllion)

81 Rest Of Central & South America Industry 4.0 Market, By Application, 2020-2028 (USD Mllion)

82 ABB Ltd.: Products & Services Offering

83 Siemens AG: Products & Services Offering

84 COGNEX CORPORATION: Products & Services Offering

85 SCHNEIDER ELECTRIC SE: Products & Services Offering

86 Honeywell International: Products & Services Offering

87 EMERSON ELECTRIC: Products & Services Offering

88 Rockwell Automation : Products & Services Offering

89 General Electric Company: Products & Services Offering

90 robert bosch gmbh: Products & Services Offering

91 Cisco Systems Inc. : Products & Services Offering

92 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Industry 4.0 Market Overview

2 Global Industry 4.0 Market Value From 2020-2028 (USD Mllion)

3 Global Industry 4.0 Market Share, By Vertical (2022)

4 Global Industry 4.0 Market Share, By Application (2022)

5 Global Industry 4.0 Market, By Region (Asia Pacific Market)

6 Technological Trends In Global Industry 4.0 Market

7 Four Quadrant Competitor Positioning Matrix

8 Impact Of Macro & Micro Indicators On The Market

9 Impact Of Key Drivers On The Global Industry 4.0 Market

10 Impact Of Challenges On The Global Industry 4.0 Market

11 Porter’s Five Forces Analysis

12 Global Industry 4.0 Market: By Vertical Scope Key Takeaways

13 Global Industry 4.0 Market, By Vertical Segment: Revenue Growth Analysis

14 Manufacturing Market, By Region, 2020-2028 (USD Mllion)

15 Energy & Utilities Market, By Region, 2020-2028 (USD Mllion)

16 Automotive Market, By Region, 2020-2028 (USD Mllion)

17 Oil & Gas Market, By Region, 2020-2028 (USD Mllion)

18 Aerospace & Defense Market, By Region, 2020-2028 (USD Mllion)

19 Global Industry 4.0 Market: By Application Scope Key TaSchneider Electric SEways

20 Global Industry 4.0 Market, By Application Segment: Revenue Growth Analysis

21 Industrial Automation Market, By Region, 2020-2028 (USD Mllion)

22 Smart Factory Market, By Region, 2020-2028 (USD Mllion)

23 Industrial IoT Market, By Region, 2020-2028 (USD Mllion)

24 Regional Segment: Revenue Growth Analysis

25 Global Industry 4.0 Market: Regional Analysis

26 North America Industry 4.0 Market Overview

27 North America Industry 4.0 Market, By Vertical

28 North America Industry 4.0 Market, By Application

29 North America Industry 4.0 Market, By Country

30 U.S. Industry 4.0 Market, By Vertical

31 U.S. Industry 4.0 Market, By Application

32 Canada Industry 4.0 Market, By Vertical

33 Canada Industry 4.0 Market, By Application

34 Mexico Industry 4.0 Market, By Vertical

35 Mexico Industry 4.0 Market, By Application

36 Four Quadrant Positioning Matrix

37 Company Market Share Analysis

38 ABB Ltd.: Company Snapshot

39 ABB Ltd.: SWOT Analysis

40 ABB Ltd.: Geographic Presence

41 Siemens AG: Company Snapshot

42 Siemens AG: SWOT Analysis

43 Siemens AG: Geographic Presence

44 Cognex Corporation: Company Snapshot

45 Cognex Corporation: SWOT Analysis

46 Cognex Corporation: Geographic Presence

47 Schneider Electric SE: Company Snapshot

48 Schneider Electric SE: Swot Analysis

49 Schneider Electric SE: Geographic Presence

50 Honeywell International: Company Snapshot

51 Honeywell International: SWOT Analysis

52 Honeywell International: Geographic Presence

53 Emerson Electric: Company Snapshot

54 Emerson Electric: SWOT Analysis

55 Emerson Electric: Geographic Presence

56 Rockwell Automation : Company Snapshot

57 Rockwell Automation : SWOT Analysis

58 Rockwell Automation : Geographic Presence

59 General Electric Company: Company Snapshot

60 General Electric Company: SWOT Analysis

61 General Electric Company: Geographic Presence

62 Robert Bosch GmbH: Company Snapshot

63 Robert Bosch GmbH: SWOT Analysis

64 Robert Bosch GmbH: Geographic Presence

65 Cisco Systems Inc. : Company Snapshot

66 Cisco Systems Inc. : SWOT Analysis

67 Cisco Systems Inc. : Geographic Presence

68 Other Companies: Company Snapshot

69 Other Companies: SWOT Analysis

70 Other Companies: Geographic Presence

The Global Industry 4.0 Market has been studied from the year 2019 till 2028. However, the CAGR provided in the report is from the year 2023 to 2028. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Industry 4.0 Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS