Global Inertial Measurement Unit Market Size, Trends & Analysis - Forecasts to 2026 By Module (Gyroscopes, Accelerometers, Magnetometers, Others), By Grade (Marine Grade, Navigation Grade, Tactical Grade, Space Grade, Commercial Grade) By Application (Aerospace and Defense, Automotive, Marine, Consumer Electronics, Others), Competitive Landscape Company Market Share Analysis, and Competitor Analysis

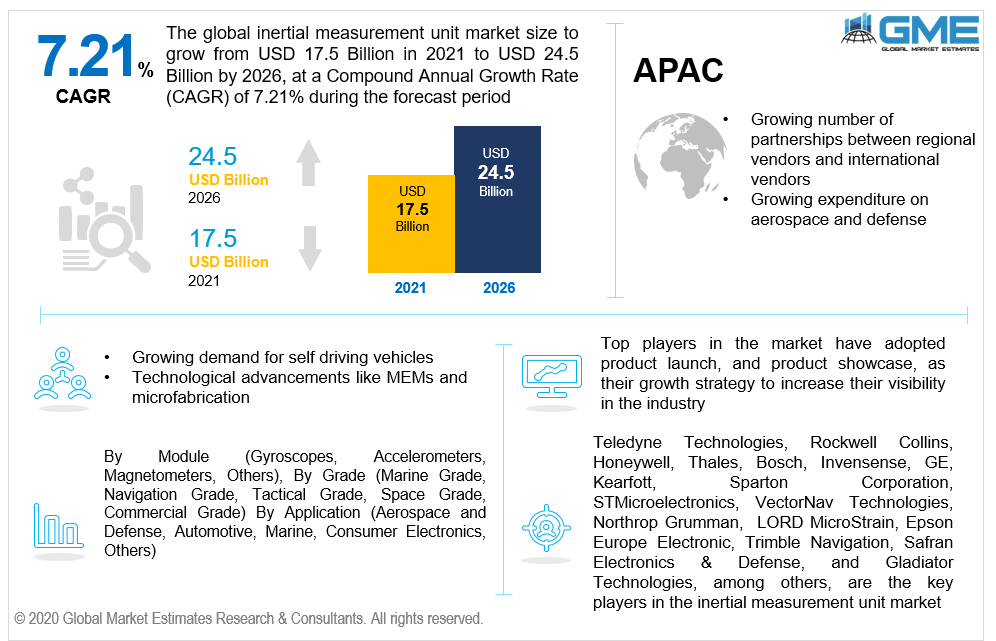

The global inertial measurement unit (IMU) market is expected to grow from USD 17.5 billion in 2021 to USD 24.5 billion in 2026 at a CAGR of 7.21%. The introduction of cutting-edge microelectromechanical systems combined with the increased demand for highly accurate navigation systems has been some of the major inertial measurement unit market drivers. Inertial measurement units have been used extensively in navigation systems of aircraft, vehicles, spacecraft, among other navigational systems.

With the advent of smartphones and other handheld devices, the demand for inertial measurement units has grown steadily. The growing demand for handheld consumer electronics like smartphones and fitness trackers has increased the inertial measurement unit global inertial measurement unit (IMU) market revenue. Handheld devices like smartphones, tablets, fitness trackers, among others utilize inertial measurement units to orient the devices.

The technological advancements in MEMs have made this application possible along with microfabrication to create smaller IMUs that can measure the linear and angular motion of devices. Such MEMs based inertial measurement units are smaller and have lower power consumptions with no reduction in performance have been crucial to the increased application of inertial measurement units. High precision inertial measurement units are used extensively in aerospace and defense industries. These industries rely heavily on accurate navigation to ensure precise and accurate measurement of vector-based variables to ensure the stability, device range, and performance of the equipment.

Advancements in the communications field have also allowed inertial measurement units to incorporate wireless communication. Incorporating wireless technology into inertial measurement units has allowed inertial measurement units to be used in biomechanical and virtual reality sectors. Recent inertial measurement unit market trends have shown that inertial measurement units are becoming increasingly popular in the automobile industry as they introduce new self-driving autonomous vehicles. Inertial measurement units work in tandem with LIDAR technology, motion detection systems, crash detection systems, and stability systems in automobiles.

The growing smartphone and associated products market across the globe represents a lucrative opportunity for inertial measurement vendors. The global inertial measurement unit (IMU) market is restrained by the complexity of such devices and the lower accuracy and lower performance of the cheaper MEMs-based inertial measurement units that are utilized in handheld devices. Elimination of drift error is another challenge faced by inertial measurement unit vendors.

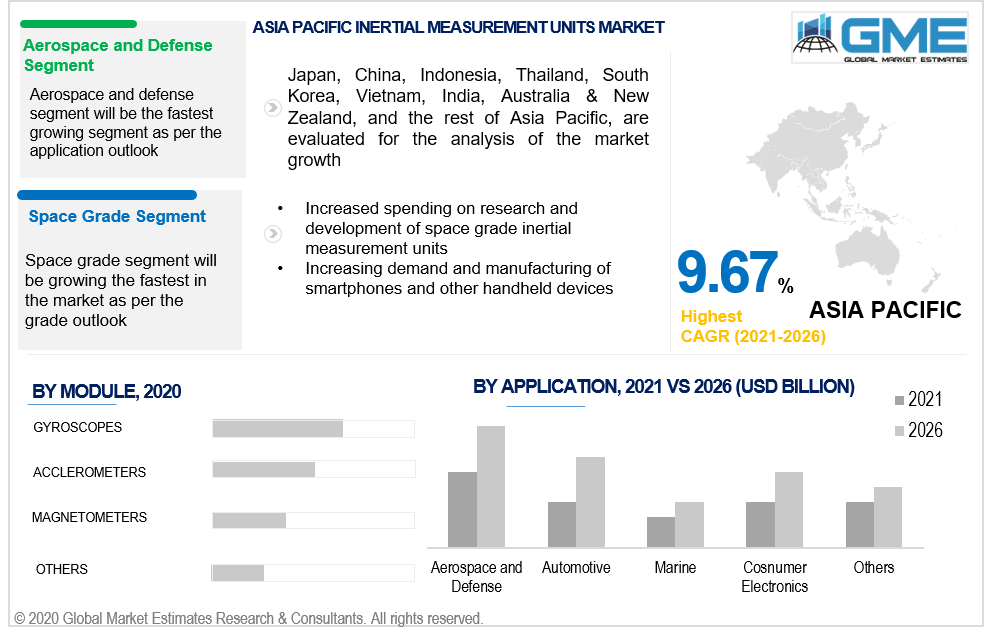

Based on the modules used in inertial measurement units (IMU), the market can be segmented into gyroscopes, accelerometers, magnetometers, and others. Gyroscopes had the largest grasp on the inertial measurement units market. The increased availability of MEMs based gyroscopes has increased their applications. Gyroscopes are becoming increasingly used in the automobile industry in various systems like stability and crash detection systems. Gyroscopes have also been extensively being used in image stabilization systems in cameras and smartphones. The gyroscope segment is also expected to register growth rates that are significantly higher than other segments owing to its increased application. Gyroscope inertial measurement units are expected to see an increase in applications like gaming remotes, augmented reality and virtual reality products during the forecast period [2021 to 2026].

Based on the accuracy and preciseness of the inertial measurement units can be segmented as tactical grade, marine grade, commercial grade, navigation grade, and space grade. The space grade segment is expected to witness the fastest growth rate among all the other segments during the forecast period for 2021 to 2026. The increased investments in spacecraft, satellites, and other space exploration equipment are expected to contribute to the growth of the space grade segment of the inertial measurement units market.

Inertial measurement units used in the space industry require high precision and much more complicated systems which result in greater revenue for the inertial measurement units vendor. IMUs are used in managing the various phases of flight like ascent, descent, landing, and entry. The increased application of inertial measurement units and the increased spending on space exploration by companies SpaceX, Boeing, and Virgin Galactic will only increase the demand for inertial measurement units.

Based on various applications of the inertial measurement units, the market can be segmented into aerospace and defense, automotive, marine, consumer electronics, and others. The aerospace and defense segment is expected to hold the dominant IMU market share of the global inertial measurement unit (IMU) market. The aerospace and defense sector is heavily reliant on inertial measurement units as they begin to introduce new unmanned vehicles and drones for military and civilian application.

The large expenditure on defense and aerospace by governments across the globe allows this sector to spend heavily on the research and development of novel inertial measurement units. Increasing space research and the growing use of MEMs are expected to increase the demand for inertial measurement units in this sector. FOG-based gyroscopes have become increasingly popular in defense applications like fighter planes, long and short-range missiles, military vehicles, among other defense applications are expected to increase the demand for inertial measurement units in the aerospace and defense segment.

Based on the geographical features of the global inertial measurement units (IMU) market, the market is segmented into North America, Europe, South America, Middle East & Africa, and Asian Pacific regions. The North American region clutched the largest IMU market share owing to the large defense budget of countries in the region. The United States defense sector is one of the most well-funded defense sectors in the world. In 2019 alone, the United States defense sector spent over 700 billion USD on defense projects. The increased usage of navigational and military grade inertial measurement units in the region has been one of the major contributors to the region’s hold on the market.

The APAC region is expected to witness the fastest growth rate during the forecast period. The countries in the APAC region are expected to receive increased budgets for space exploration and defense in the forecast period. The increased spending on these sectors along with the growing consumer electronics sector in the region is expected to be major inertial measurement units market drivers in the APAC region.

Teledyne Technologies, Rockwell Collins, Honeywell, Thales, Bosch, Invensense, GE, Kearfott, Sparton Corporation, STMicroelectronics, VectorNav Technologies, Northrop Grumman, LORD MicroStrain, Epson Europe Electronic, Trimble Navigation, Safran Electronics & Defense, and Gladiator Technologies, among others, are the key players in the global inertial measurement unit market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Inertial Measurement Unit Industry Overview, 2019-2026

2.1.1 Industry Overview

2.1.2 Module Overview

2.1.3 Grade Type Overview

2.1.4 Application Overview

2.1.6 Regional Overview

Chapter 3 Inertial Measurement Unit Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2019-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Growing demand for consumer electronics like smartphones, AR and VR headsets, and fitness trackers

3.3.2 Industry Challenges

3.3.2.1 Need to reduce build-up of drift error in inertial measurement units

3.4 Prospective Growth Scenario

3.4.1 Module Growth Scenario

3.4.2 Grade Type Growth Scenario

3.4.3 Application Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Application Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Inertial Measurement Unit Market, By Module

4.1 Module Outlook

4.2 Gyroscopes

4.2.1 Market Size, By Region, 2019-2026 (USD Million)

4.3 Accelerometers

4.3.1 Market Size, By Region, 2019-2026 (USD Million)

4.4 Magnetometers

4.3.1 Market Size, By Region, 2019-2026 (USD Million)

4.5 Others

4.3.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 5 Inertial Measurement Unit Market, By Grade Type

5.1 Grade Type Outlook

5.2 Marine Grade

5.2.1 Market Size, By Region, 2019-2026 (USD Million)

5.3 Navigation Grade

5.3.1 Market Size, By Region, 2019-2026 (USD Million)

5.4 Tactical Grade

5.4.1 Market Size, By Region, 2019-2026 (USD Million)

5.5 Space Grade

5.5.1 Market Size, By Region, 2019-2026 (USD Million)

5.6 Commercial Grade

5.5.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 6 Inertial Measurement Unit Market, By Application

6.1 Aerospace and Defense

6.1.1 Market Size, By Region, 2019-2026 (USD Million)

6.2 Automotive

6.2.1 Market Size, By Region, 2019-2026 (USD Million)

6.3 Marine

6.2.1 Market Size, By Region, 2019-2026 (USD Million)

6.4 Consumer Electronics

6.2.1 Market Size, By Region, 2019-2026 (USD Million)

6.5 Others

6.2.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 7 Inertial Measurement Unit Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2019-2026 (USD Million)

7.2.2 Market Size, By Module, 2019-2026 (USD Million)

7.2.3 Market Size, By Grade Type, 2019-2026 (USD Million)

7.2.4 Market Size, By Application, 2019-2026 (USD Million)

7.2.6 U.S.

7.2.6.1 Market Size, By Module, 2019-2026 (USD Million)

7.2.4.2 Market Size, By Grade Type, 2019-2026 (USD Million)

7.2.4.3 Market Size, By Application, 2019-2026 (USD Million)

7.2.7 Canada

7.2.7.1 Market Size, By Module, 2019-2026 (USD Million)

7.2.7.2 Market Size, By Grade Type, 2019-2026 (USD Million)

7.2.7.3 Market Size, By Application, 2019-2026 (USD Million)

7.3 Europe

7.3.1 Market Size, By Country 2019-2026 (USD Million)

7.3.2 Market Size, By Module, 2019-2026 (USD Million)

7.3.3 Market Size, By Grade Type, 2019-2026 (USD Million)

7.3.4 Market Size, By Application, 2019-2026 (USD Million)

7.3.6 Germany

7.3.6.1 Market Size, By Module, 2019-2026 (USD Million)

7.3.6.2 Market Size, By Grade Type, 2019-2026 (USD Million)

7.3.6.3 Market Size, By Application, 2019-2026 (USD Million)

7.3.7 UK

7.3.7.1 Market Size, By Module, 2019-2026 (USD Million)

7.3.7.2 Market Size, By Grade Type, 2019-2026 (USD Million)

7.3.7.3 Market Size, By Application, 2019-2026 (USD Million)

7.3.8 France

7.3.7.1 Market Size, By Module, 2019-2026 (USD Million)

7.3.7.2 Market Size, By Grade Type, 2019-2026 (USD Million)

7.3.7.3 Market Size, By Application, 2019-2026 (USD Million)

7.3.9 Italy

7.3.9.1 Market Size, By Module, 2019-2026 (USD Million)

7.3.9.2 Market Size, By Grade Type, 2019-2026 (USD Million)

7.3.9.3 Market Size, By Application, 2019-2026 (USD Million)

7.3.10 Spain

7.3.10.1 Market Size, By Module, 2019-2026 (USD Million)

7.3.10.2 Market Size, By Grade Type, 2019-2026 (USD Million)

7.3.10.3 Market Size, By Application, 2019-2026 (USD Million)

7.3.11 Russia

7.3.11.1 Market Size, By Module, 2019-2026 (USD Million)

7.3.11.2 Market Size, By Grade Type, 2019-2026 (USD Million)

7.3.11.3 Market Size, By Application, 2019-2026 (USD Million)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2019-2026 (USD Million)

7.4.2 Market Size, By Module, 2019-2026 (USD Million)

7.4.3 Market Size, By Grade Type, 2019-2026 (USD Million)

7.4.4 Market Size, By Application, 2019-2026 (USD Million)

7.4.6 China

7.4.6.1 Market Size, By Module, 2019-2026 (USD Million)

7.4.6.2 Market Size, By Grade Type, 2019-2026 (USD Million)

7.4.6.3 Market Size, By Application, 2019-2026 (USD Million)

7.4.7 India

7.4.7.1 Market Size, By Module, 2019-2026 (USD Million)

7.4.7.2 Market Size, By Grade Type, 2019-2026 (USD Million)

7.4.7.3 Market Size, By Application, 2019-2026 (USD Million)

7.4.8 Japan

7.4.7.1 Market Size, By Module, 2019-2026 (USD Million)

7.4.7.2 Market Size, By Grade Type, 2019-2026 (USD Million)

7.4.7.3 Market Size, By Application, 2019-2026 (USD Million)

7.4.9 Australia

7.4.9.1 Market Size, By Module, 2019-2026 (USD Million)

7.4.9.2 Market size, By Grade Type, 2019-2026 (USD Million)

7.4.9.3 Market Size, By Application, 2019-2026 (USD Million)

7.4.10 South Korea

7.4.10.1 Market Size, By Module, 2019-2026 (USD Million)

7.4.10.2 Market Size, By Grade Type, 2019-2026 (USD Million)

7.4.10.3 Market Size, By Application, 2019-2026 (USD Million)

7.5 Latin America

7.5.1 Market Size, By Country 2019-2026 (USD Million)

7.5.2 Market Size, By Module, 2019-2026 (USD Million)

7.5.3 Market Size, By Grade Type, 2019-2026 (USD Million)

7.5.4 Market Size, By Application, 2019-2026 (USD Million)

7.5.6 Brazil

7.5.6.1 Market Size, By Module, 2019-2026 (USD Million)

7.5.6.2 Market Size, By Grade Type, 2019-2026 (USD Million)

7.5.6.3 Market Size, By Application, 2019-2026 (USD Million)

7.5.7 Mexico

7.5.7.1 Market Size, By Module, 2019-2026 (USD Million)

7.5.7.2 Market Size, By Grade Type, 2019-2026 (USD Million)

7.5.7.3 Market Size, By Application, 2019-2026 (USD Million)

7.5.8 Argentina

7.5.7.1 Market Size, By Module, 2019-2026 (USD Million)

7.5.7.2 Market Size, By Grade Type, 2019-2026 (USD Million)

7.5.7.3 Market Size, By Application, 2019-2026 (USD Million)

7.6 MEA

7.6.1 Market Size, By Country 2019-2026 (USD Million)

7.6.2 Market Size, By Module, 2019-2026 (USD Million)

7.6.3 Market Size, By Grade Type, 2019-2026 (USD Million)

7.6.4 Market Size, By Application, 2019-2026 (USD Million)

7.6.6 Saudi Arabia

7.6.6.1 Market Size, By Module, 2019-2026 (USD Million)

7.6.6.2 Market Size, By Grade Type, 2019-2026 (USD Million)

7.6.6.3 Market Size, By Application, 2019-2026 (USD Million)

7.6.7 UAE

7.6.7.1 Market Size, By Module, 2019-2026 (USD Million)

7.6.7.2 Market Size, By Grade Type, 2019-2026 (USD Million)

7.6.7.3 Market Size, By Application, 2019-2026 (USD Million)

7.6.8 South Africa

7.6.7.1 Market Size, By Module, 2019-2026 (USD Million)

7.6.7.2 Market Size, By Grade Type, 2019-2026 (USD Million)

7.6.7.3 Market Size, By Application, 2019-2026 (USD Million)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 Teledyne Technologies

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Info Graphic Analysis

8.3 Rockwell Collins

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info Graphic Analysis

8.4 Honeywell

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info Graphic Analysis

8.5 Thales

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info Graphic Analysis

8.6 Bosch

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info Graphic Analysis

8.7 Invensense

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info Graphic Analysis

8.8 GE

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.9 Kearfott

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.10 Sparton Corporation

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info Graphic Analysis

8.11 VectorNAV

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info Graphic Analysis

The Global Inertial Measurement Unit Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Inertial Measurement Unit Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS