Global Infrastructure Orchestration Market Size, Trends & Analysis - Forecasts to 2029 By Organization Size (SMEs and Large Enterprise), By End-use Industry (IT and Telecommunications, BFSI, Healthcare, Manufacturing, and Others), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

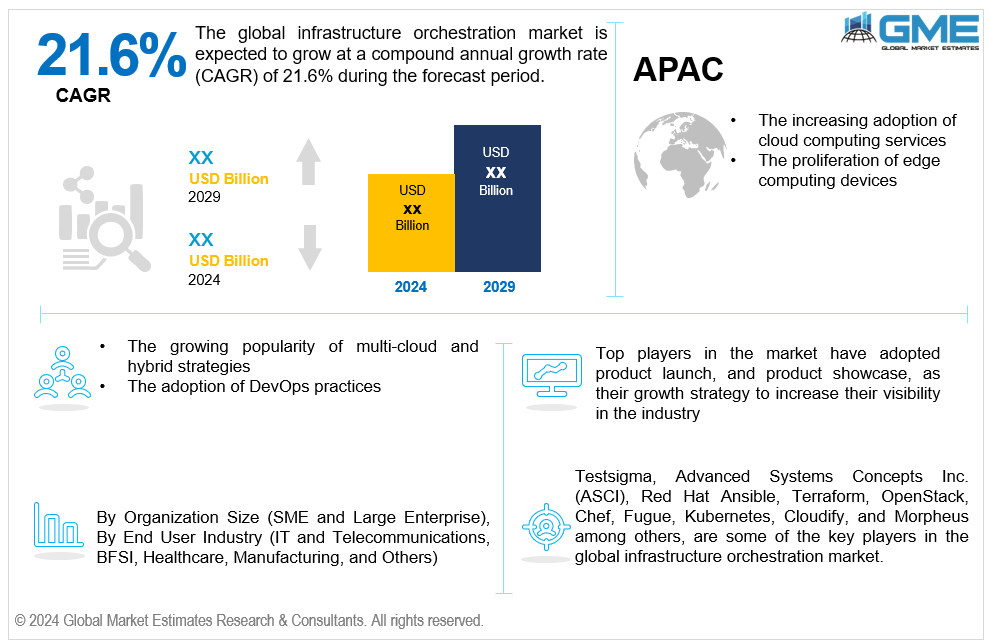

The global infrastructure orchestration market is estimated to exhibit a CAGR of 21.6% from 2024 to 2029.

The primary factors propelling the market growth are the increasing adoption of cloud computing services and the proliferation of edge computing devices. Due to cloud computing, companies can shift their infrastructure resources up or down in response to demand. Infrastructure orchestration solutions facilitate the efficient management of scalability by automating operations related to provisioning, configuration, and deployment inside cloud environments. Additionally, cloud computing and infrastructure orchestration go hand in hand in automating repetitive tasks such as provisioning, configuration management, and scaling. By automating these processes, companies can lower the amount of human labor required, boost operational effectiveness, and cut the time needed to introduce new services and apps. For instance, in 2020 alone, 61% of U.S. companies moved their workloads to the cloud, according to Zippia.

The growing popularity of multi-cloud and hybrid strategies and the adoption of DevOps practices are expected to support the market growth. Throughout the software development lifecycle, including infrastructure provisioning, configuration management, and deployment, DevOps places a strong emphasis on automation. Automation of these procedures is made possible by infrastructure orchestration solutions, which allow companies to create CI/CD pipelines that are more dependable and efficient. Moreover, DevOps encourages treating infrastructure configuration as code, which allows for versioning, testing, and automated deployment of infrastructure resources. For instance, 83% of IT decision-makers used DevOps methods to generate more business value, according to the Puppet 2021 State of DevOps Report.

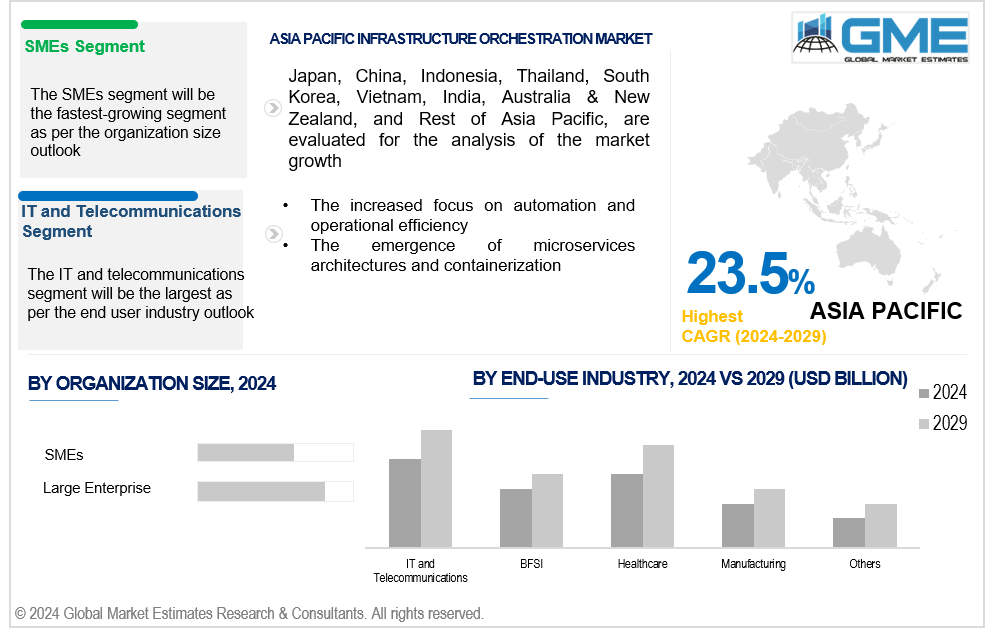

The increased focus on automation and operational efficiency and the emergence of microservices architecture and containerization fuels market growth. Containerization allows applications and their dependencies to be packaged into portable, lightweight containers. Organizations can dynamically manage and arrange these containers across server clusters using infrastructure orchestration systems like Kubernetes and Docker Swarm, which maximize resource usage and guarantee high availability. Furthermore, applications are divided into smaller, independently deployable services using microservices architectures. Infrastructure orchestration tools enable microservices to scale dynamically on demand, automatically allocating and adjusting resources to manage growing workloads effectively.

Infrastructure orchestration vendors can offer advanced automation, optimization, and management capabilities for distributed and intelligent infrastructure environments by integrating their solutions with cutting-edge technologies like edge computing, artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT). Moreover, infrastructure orchestration vendors can set themselves apart from the competition by providing robust security features like network segmentation, identity and access management (IAM), encryption, and compliance auditing to assist enterprises in safeguarding their infrastructure and data assets.

However, a lack of standardization and security and compliance concerns hinder market growth.

The large enterprise segment is expected to hold the largest share of the market over the forecast period. Large enterprises typically have extensive and complex IT infrastructures spanning multiple data centers, cloud environments, and geographic locations. Moreover, these companies need advanced infrastructure orchestration solutions to efficiently manage and orchestrate resources across many environments at scale. Additionally, large enterprises can engage in infrastructure orchestration platforms and projects since they have more financial resources and devoted IT staff. In order to optimize their IT operations and meet business growth targets, they are more ready and able to set aside funds for the deployment, customization, and upkeep of infrastructure orchestration solutions.

The SMEs segment is expected to be the fastest-growing segment in the market from 2024-2029. SMEs are increasingly adopting cloud services to leverage scalability, flexibility, and cost-effectiveness. SMEs need infrastructure orchestration solutions to effectively manage and optimize their cloud resources as they migrate their IT infrastructure to the cloud.

The IT and telecommunications segment is expected to hold the largest share of the market over the forecast period. The IT and telecommunications industries function inside intricate IT environments comprising a wide range of infrastructure elements, including servers, networking gear, data centers, storage systems, and cloud services. Effective management and orchestration of these heterogeneous systems requires infrastructure orchestration solutions. Moreover, the IT and telecommunications sector includes large enterprises, service providers, and carriers with vast IT infrastructures spanning numerous countries and regions. To grow the management of their massive networks, data centers, and cloud resources, these enterprises need reliable infrastructure orchestration solutions.

The healthcare segment is anticipated to be the fastest-growing segment in the market from 2024-2029. To digitize patient records, expedite clinical workflows, and enhance decision-making, healthcare organizations are progressively implementing healthcare information technology (IT) solutions, such as electronic health records (EHRs), telemedicine platforms, and healthcare analytics systems. Infrastructure orchestration solutions are crucial for controlling and coordinating the underlying IT infrastructure that supports these services and applications for healthcare IT.

North America is expected to be the largest region in the global market. North American companies are going through a digital transformation to update their IT infrastructure, increase agility, and boost competitiveness. By automating the provisioning, scalability, and administration of IT resources, infrastructure orchestration platforms are essential for assisting with digital transformation initiatives. For instance, as per the U.S. Bureau of Economic Analysis (BEA), the digital economy in the United States was valued at USD 3.70 trillion in 2021.

Asia Pacific is anticipated to witness rapid growth during the forecast period. Large volumes of data are produced in the Asia Pacific region by sources like social media, mobile devices, Internet of Things sensors, and e-commerce sites. Infrastructure orchestration solutions offer scalable and flexible infrastructure resources for data processing, analytics, and storage, assisting companies in effectively managing and analyzing this data. For instance, according to CNBC, China produced approximately 7.6 zettabytes of data in 2018.

Testsigma, Advanced Systems Concepts Inc. (ASCI), Red Hat Ansible, Terraform, OpenStack, Chef, Fugue, Kubernetes, Cloudify, and Morpheus among others, are some of the key players in the global infrastructure orchestration market.

Please note: This is not an exhaustive list of companies profiled in the report.

In February 2022, Testsigma raised USD 4.6 million in investment, including participation from BoldCap, led by Accel and Strive.

In January 2021, Advanced Systems Concepts Inc. (ASCI), creators of industry-leading workflow automation software ActiveBatch, announced the acquisition of JSCAPE, a managed file transfer (MFT) company.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL INFRASTRUCTURE ORCHESTRATION MARKET, BY ORGANIZATION SIZE

4.1 Introduction

4.2 Infrastructure Orchestration Market: Organization Size Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 SMEs

4.4.1 SMEs Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 Large Enterprise

4.5.1 Large Enterprise Market Estimates and Forecast, 2021-2029 (USD Million)

5 GLOBAL INFRASTRUCTURE ORCHESTRATION MARKET, BY END-USE INDUSTRY

5.1 Introduction

5.2 Infrastructure Orchestration Market: End-use Industry Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 IT and Telecommunications

5.4.1 IT and Telecommunications Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 BFSI

5.5.1 BFSI Market Estimates and Forecast, 2021-2029 (USD Million)

5.6 Healthcare

5.6.1 Healthcare Market Estimates and Forecast, 2021-2029 (USD Million)

5.7 Manufacturing

5.7.1 Manufacturing Market Estimates and Forecast, 2021-2029 (USD Million)

5.8 Others

5.8.1 Others Market Estimates and Forecast, 2021-2029 (USD Million)

6 GLOBAL INFRASTRUCTURE ORCHESTRATION MARKET, BY REGION

6.1 Introduction

6.2 North America Infrastructure Orchestration Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.1 By Organization Size

6.2.2 By End-use Industry

6.2.3 By Country

6.2.3.1 U.S. Infrastructure Orchestration Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.1.1 By Organization Size

6.2.3.1.2 By End-use Industry

6.2.3.2 Canada Infrastructure Orchestration Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.2.1 By Organization Size

6.2.3.2.2 By End-use Industry

6.2.3.3 Mexico Infrastructure Orchestration Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.3.1 By Organization Size

6.2.3.3.2 By End-use Industry

6.3 Europe Infrastructure Orchestration Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.1 By Organization Size

6.3.2 By End-use Industry

6.3.3 By Country

6.3.3.1 Germany Infrastructure Orchestration Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.1.1 By Organization Size

6.3.3.1.2 By End-use Industry

6.3.3.2 U.K. Infrastructure Orchestration Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.2.1 By Organization Size

6.3.3.2.2 By End-use Industry

6.3.3.3 France Infrastructure Orchestration Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.3.1 By Organization Size

6.3.3.3.2 By End-use Industry

6.3.3.4 Italy Infrastructure Orchestration Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.4.1 By Organization Size

6.3.3.4.2 By End-use Industry

6.3.3.5 Spain Infrastructure Orchestration Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.5.1 By Organization Size

6.3.3.5.2 By End-use Industry

6.3.3.6 Netherlands Infrastructure Orchestration Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.6.1 By Organization Size

6.3.3.6.2 By End-use Industry

6.3.3.7 Rest of Europe Infrastructure Orchestration Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.6.1 By Organization Size

6.3.3.6.2 By End-use Industry

6.4 Asia Pacific Infrastructure Orchestration Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.1 By Organization Size

6.4.2 By End-use Industry

6.4.3 By Country

6.4.3.1 China Infrastructure Orchestration Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.1.1 By Organization Size

6.4.3.1.2 By End-use Industry

6.4.3.2 Japan Infrastructure Orchestration Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.2.1 By Organization Size

6.4.3.2.2 By End-use Industry

6.4.3.3 India Infrastructure Orchestration Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.3.1 By Organization Size

6.4.3.3.2 By End-use Industry

6.4.3.4 South Korea Infrastructure Orchestration Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.4.1 By Organization Size

6.4.3.4.2 By End-use Industry

6.4.3.5 Singapore Infrastructure Orchestration Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.5.1 By Organization Size

6.4.3.5.2 By End-use Industry

6.4.3.6 Malaysia Infrastructure Orchestration Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.6.1 By Organization Size

6.4.3.6.2 By End-use Industry

6.4.3.7 Thailand Infrastructure Orchestration Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.6.1 By Organization Size

6.4.3.6.2 By End-use Industry

6.4.3.8 Indonesia Infrastructure Orchestration Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.7.1 By Organization Size

6.4.3.7.2 By End-use Industry

6.4.3.9 Vietnam Infrastructure Orchestration Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.8.1 By Organization Size

6.4.3.8.2 By End-use Industry

6.4.3.10 Taiwan Infrastructure Orchestration Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.10.1 By Organization Size

6.4.3.10.2 By End-use Industry

6.4.3.11 Rest of Asia Pacific Infrastructure Orchestration Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.11.1 By Organization Size

6.4.3.11.2 By End-use Industry

6.5 Middle East and Africa Infrastructure Orchestration Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.1 By Organization Size

6.5.2 By End-use Industry

6.5.3 By Country

6.5.3.1 Saudi Arabia Infrastructure Orchestration Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.1.1 By Organization Size

6.5.3.1.2 By End-use Industry

6.5.3.2 U.A.E. Infrastructure Orchestration Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.2.1 By Organization Size

6.5.3.2.2 By End-use Industry

6.5.3.3 Israel Infrastructure Orchestration Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.3.1 By Organization Size

6.5.3.3.2 By End-use Industry

6.5.3.4 South Africa Infrastructure Orchestration Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.4.1 By Organization Size

6.5.3.4.2 By End-use Industry

6.5.3.5 Rest of Middle East and Africa Infrastructure Orchestration Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.5.1 By Organization Size

6.5.3.5.2 By End-use Industry

6.6 Central and South America Infrastructure Orchestration Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.1 By Organization Size

6.6.2 By End-use Industry

6.6.3 By Country

6.6.3.1 Brazil Infrastructure Orchestration Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.1.1 By Organization Size

6.6.3.1.2 By End-use Industry

6.6.3.2 Argentina Infrastructure Orchestration Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.2.1 By Organization Size

6.6.3.2.2 By End-use Industry

6.6.3.3 Chile Infrastructure Orchestration Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.3.1 By Organization Size

6.6.3.3.2 By End-use Industry

6.6.3.3 Rest of Central and South America Infrastructure Orchestration Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.3.1 By Organization Size

6.6.3.3.2 By End-use Industry

7 COMPETITIVE LANDCAPE

7.1 Company Market Share Analysis

7.2 Four Quadrant Positioning Matrix

7.2.1 Market Leaders

7.2.2 Market Visionaries

7.2.3 Market Challengers

7.2.4 Niche Market Players

7.3 Vendor Landscape

7.3.1 North America

7.3.2 Europe

7.3.3 Asia Pacific

7.3.4 Rest of the World

7.4 Company Profiles

7.4.1 Testsigma

7.4.1.1 Business Description & Financial Analysis

7.4.1.2 SWOT Analysis

7.4.1.3 Products & Services Offered

7.4.1.4 Strategic Alliances between Business Partners

7.4.2 Advanced Systems Concepts Inc. (ASCI)

7.4.2.1 Business Description & Financial Analysis

7.4.2.2 SWOT Analysis

7.4.2.3 Products & Services Offered

7.4.2.4 Strategic Alliances between Business Partners

7.4.3 Red Hat Ansible

7.4.3.1 Business Description & Financial Analysis

7.4.3.2 SWOT Analysis

7.4.3.3 Products & Services Offered

7.4.3.4 Strategic Alliances between Business Partners

7.4.4 Terraform

7.4.4.1 Business Description & Financial Analysis

7.4.4.2 SWOT Analysis

7.4.4.3 Products & Services Offered

7.4.4.4 Strategic Alliances between Business Partners

7.4.5 OpenStack

7.4.5.1 Business Description & Financial Analysis

7.4.5.2 SWOT Analysis

7.4.5.3 Products & Services Offered

7.4.5.4 Strategic Alliances between Business Partners

7.4.6 Chef

7.4.6.1 Business Description & Financial Analysis

7.4.6.2 SWOT Analysis

7.4.6.3 Products & Services Offered

7.4.6.4 Strategic Alliances between Business Partners

7.4.7 Fugue

7.4.7.1 Business Description & Financial Analysis

7.4.7.2 SWOT Analysis

7.4.7.3 Products & Services Offered

7.4.7.4 Strategic Alliances between Business Partners

7.4.8 Kubernetes

7.4.8.1 Business Description & Financial Analysis

7.4.8.2 SWOT Analysis

7.4.8.3 Products & Services Offered

7.4.8.4 Strategic Alliances between Business Partners

7.4.9 Cloudify

7.4.9.1 Business Description & Financial Analysis

7.4.9.2 SWOT Analysis

7.4.9.3 Products & Services Offered

7.4.9.4 Strategic Alliances between Business Partners

7.4.10 Morpheus

7.4.10.1 Business Description & Financial Analysis

7.4.10.2 SWOT Analysis

7.4.10.3 Products & Services Offered

7.4.10.4 Strategic Alliances between Business Partners

7.4.11 Other Companies

7.4.11.1 Business Description & Financial Analysis

7.4.11.2 SWOT Analysis

7.4.11.3 Products & Services Offered

7.4.11.4 Strategic Alliances between Business Partners

8 RESEARCH METHODOLOGY

8.1 Market Introduction

8.1.1 Market Definition

8.1.2 Market Scope & Segmentation

8.2 Information Procurement

8.2.1 Secondary Research

8.2.1.1 Purchased Databases

8.2.1.2 GMEs Internal Data Repository

8.2.1.3 Secondary Resources & Third Party Perspectives

8.2.1.4 Company Information Sources

8.2.2 Primary Research

8.2.2.1 Various Types of Respondents for Primary Interviews

8.2.2.2 Number of Interviews Conducted throughout the Research Process

8.2.2.3 Primary Stakeholders

8.2.2.4 Discussion Guide for Primary Participants

8.2.3 Expert Panels

8.2.3.1 Expert Panels Across 30+ Industry

8.2.4 Paid Local Experts

8.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

8.3 Market Estimation

8.3.1 Top-Down Approach

8.3.1.1 Macro-Economic Indicators Considered

8.3.1.2 Micro-Economic Indicators Considered

8.3.2 Bottom Up Approach

8.3.2.1 Company Share Analysis Approach

8.3.2.2 Estimation of Potential Product Sales

8.4 Data Triangulation

8.4.1 Data Collection

8.4.2 Time Series, Cross Sectional & Panel Data Analysis

8.4.3 Cluster Analysis

8.5 Analysis and Output

8.5.1 Inhouse AI Based Real Time Analytics Tool

8.5.2 Output From Desk & Primary Research

8.6 Research Assumptions & Limitations

8.6.1 Research Assumptions

8.6.2 Research Limitations

LIST OF TABLES

1 Global Infrastructure Orchestration Market, By Organization Size, 2021-2029 (USD Mllion)

2 SMES Market, By Region, 2021-2029 (USD Mllion)

3 Large Enterprise Market, By Region, 2021-2029 (USD Mllion)

4 Global Infrastructure Orchestration Market, By End-use Industry, 2021-2029 (USD Mllion)

5 IT and Telecommunications Market, By Region, 2021-2029 (USD Mllion)

6 BFSI Market, By Region, 2021-2029 (USD Mllion)

7 Healthcare Market, By Region, 2021-2029 (USD Mllion)

8 Manufacturing Market, By Region, 2021-2029 (USD Mllion)

9 Others Market, By Region, 2021-2029 (USD Mllion)

10 Regional Analysis, 2021-2029 (USD Mllion)

11 North America Infrastructure Orchestration Market, By Organization Size, 2021-2029 (USD Mllion)

12 North America Infrastructure Orchestration Market, By End-use Industry, 2021-2029 (USD Mllion)

13 North America Infrastructure Orchestration Market, By COUNTRY, 2021-2029 (USD Mllion)

14 U.S. Infrastructure Orchestration Market, By Organization Size, 2021-2029 (USD Mllion)

15 U.S. Infrastructure Orchestration Market, By End-use Industry, 2021-2029 (USD Mllion)

16 Canada Infrastructure Orchestration Market, By Organization Size, 2021-2029 (USD Mllion)

17 Canada Infrastructure Orchestration Market, By End-use Industry, 2021-2029 (USD Mllion)

18 Mexico Infrastructure Orchestration Market, By Organization Size, 2021-2029 (USD Mllion)

19 Mexico Infrastructure Orchestration Market, By End-use Industry, 2021-2029 (USD Mllion)

20 Europe Infrastructure Orchestration Market, By Organization Size, 2021-2029 (USD Mllion)

21 Europe Infrastructure Orchestration Market, By End-use Industry, 2021-2029 (USD Mllion)

22 EUROPE Infrastructure Orchestration Market, By COUNTRY, 2021-2029 (USD Mllion)

23 Germany Infrastructure Orchestration Market, By Organization Size, 2021-2029 (USD Mllion)

24 Germany Infrastructure Orchestration Market, By End-use Industry, 2021-2029 (USD Mllion)

25 U.K. Infrastructure Orchestration Market, By Organization Size, 2021-2029 (USD Mllion)

26 U.K. Infrastructure Orchestration Market, By End-use Industry, 2021-2029 (USD Mllion)

27 France Infrastructure Orchestration Market, By Organization Size, 2021-2029 (USD Mllion)

28 France Infrastructure Orchestration Market, By End-use Industry, 2021-2029 (USD Mllion)

29 Italy Infrastructure Orchestration Market, By Organization Size, 2021-2029 (USD Mllion)

30 Italy Infrastructure Orchestration Market, By End-use Industry, 2021-2029 (USD Mllion)

31 Spain Infrastructure Orchestration Market, By Organization Size, 2021-2029 (USD Mllion)

32 Spain Infrastructure Orchestration Market, By End-use Industry, 2021-2029 (USD Mllion)

33 Netherlands Infrastructure Orchestration Market, By Organization Size, 2021-2029 (USD Mllion)

34 Netherlands Infrastructure Orchestration Market, By End-use Industry, 2021-2029 (USD Mllion)

35 Rest Of Europe Infrastructure Orchestration Market, By Organization Size, 2021-2029 (USD Mllion)

36 Rest Of Europe Infrastructure Orchestration Market, By End-use Industry, 2021-2029 (USD Mllion)

37 Asia Pacific Infrastructure Orchestration Market, By Organization Size, 2021-2029 (USD Mllion)

38 Asia Pacific Infrastructure Orchestration Market, By End-use Industry, 2021-2029 (USD Mllion)

39 ASIA PACIFIC Infrastructure Orchestration Market, By COUNTRY, 2021-2029 (USD Mllion)

40 China Infrastructure Orchestration Market, By Organization Size, 2021-2029 (USD Mllion)

41 China Infrastructure Orchestration Market, By End-use Industry, 2021-2029 (USD Mllion)

42 Japan Infrastructure Orchestration Market, By Organization Size, 2021-2029 (USD Mllion)

43 Japan Infrastructure Orchestration Market, By End-use Industry, 2021-2029 (USD Mllion)

44 India Infrastructure Orchestration Market, By Organization Size, 2021-2029 (USD Mllion)

45 India Infrastructure Orchestration Market, By End-use Industry, 2021-2029 (USD Mllion)

46 South Korea Infrastructure Orchestration Market, By Organization Size, 2021-2029 (USD Mllion)

47 South Korea Infrastructure Orchestration Market, By End-use Industry, 2021-2029 (USD Mllion)

48 Singapore Infrastructure Orchestration Market, By Organization Size, 2021-2029 (USD Mllion)

49 Singapore Infrastructure Orchestration Market, By End-use Industry, 2021-2029 (USD Mllion)

50 Thailand Infrastructure Orchestration Market, By Organization Size, 2021-2029 (USD Mllion)

51 Thailand Infrastructure Orchestration Market, By End-use Industry, 2021-2029 (USD Mllion)

52 Malaysia Infrastructure Orchestration Market, By Organization Size, 2021-2029 (USD Mllion)

53 Malaysia Infrastructure Orchestration Market, By End-use Industry, 2021-2029 (USD Mllion)

54 Indonesia Infrastructure Orchestration Market, By Organization Size, 2021-2029 (USD Mllion)

55 Indonesia Infrastructure Orchestration Market, By End-use Industry, 2021-2029 (USD Mllion)

56 Vietnam Infrastructure Orchestration Market, By Organization Size, 2021-2029 (USD Mllion)

57 Vietnam Infrastructure Orchestration Market, By End-use Industry, 2021-2029 (USD Mllion)

58 Taiwan Infrastructure Orchestration Market, By Organization Size, 2021-2029 (USD Mllion)

59 Taiwan Infrastructure Orchestration Market, By End-use Industry, 2021-2029 (USD Mllion)

60 Rest of APAC Infrastructure Orchestration Market, By Organization Size, 2021-2029 (USD Mllion)

61 Rest of APAC Infrastructure Orchestration Market, By End-use Industry, 2021-2029 (USD Mllion)

62 Middle East and Africa Infrastructure Orchestration Market, By Organization Size, 2021-2029 (USD Mllion)

63 Middle East and Africa Infrastructure Orchestration Market, By End-use Industry, 2021-2029 (USD Mllion)

64 MIDDLE EAST & ADRICA Infrastructure Orchestration Market, By COUNTRY, 2021-2029 (USD Mllion)

65 Saudi Arabia Infrastructure Orchestration Market, By Organization Size, 2021-2029 (USD Mllion)

66 Saudi Arabia Infrastructure Orchestration Market, By End-use Industry, 2021-2029 (USD Mllion)

67 UAE Infrastructure Orchestration Market, By Organization Size, 2021-2029 (USD Mllion)

68 UAE Infrastructure Orchestration Market, By End-use Industry, 2021-2029 (USD Mllion)

69 Israel Infrastructure Orchestration Market, By Organization Size, 2021-2029 (USD Mllion)

70 Israel Infrastructure Orchestration Market, By End-use Industry, 2021-2029 (USD Mllion)

71 South Africa Infrastructure Orchestration Market, By Organization Size, 2021-2029 (USD Mllion)

72 South Africa Infrastructure Orchestration Market, By End-use Industry, 2021-2029 (USD Mllion)

73 Rest Of Middle East and Africa Infrastructure Orchestration Market, By Organization Size, 2021-2029 (USD Mllion)

74 Rest Of Middle East and Africa Infrastructure Orchestration Market, By End-use Industry, 2021-2029 (USD Mllion)

75 Central and South America Infrastructure Orchestration Market, By Organization Size, 2021-2029 (USD Mllion)

76 Central and South America Infrastructure Orchestration Market, By End-use Industry, 2021-2029 (USD Mllion)

77 CENTRAL AND SOUTH AMERICA Infrastructure Orchestration Market, By COUNTRY, 2021-2029 (USD Mllion)

78 Brazil Infrastructure Orchestration Market, By Organization Size, 2021-2029 (USD Mllion)

79 Brazil Infrastructure Orchestration Market, By End-use Industry, 2021-2029 (USD Mllion)

80 Chile Infrastructure Orchestration Market, By Organization Size, 2021-2029 (USD Mllion)

81 Chile Infrastructure Orchestration Market, By End-use Industry, 2021-2029 (USD Mllion)

82 Argentina Infrastructure Orchestration Market, By Organization Size, 2021-2029 (USD Mllion)

83 Argentina Infrastructure Orchestration Market, By End-use Industry, 2021-2029 (USD Mllion)

84 Rest Of Central and South America Infrastructure Orchestration Market, By Organization Size, 2021-2029 (USD Mllion)

85 Rest Of Central and South America Infrastructure Orchestration Market, By End-use Industry, 2021-2029 (USD Mllion)

86 Testsigma: Products & Services Offering

87 Advanced Systems Concepts Inc. (ASCI): Products & Services Offering

88 Red Hat Ansible: Products & Services Offering

89 Terraform: Products & Services Offering

90 OpenStack: Products & Services Offering

91 Chef: Products & Services Offering

92 Fugue : Products & Services Offering

93 Kubernetes: Products & Services Offering

94 Cloudify, Inc: Products & Services Offering

95 Morpheus: Products & Services Offering

96 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Infrastructure Orchestration Market Overview

2 Global Infrastructure Orchestration Market Value From 2021-2029 (USD Mllion)

3 Global Infrastructure Orchestration Market Share, By Organization Size (2023)

4 Global Infrastructure Orchestration Market Share, By End-use Industry (2023)

5 Global Infrastructure Orchestration Market, By Region (Asia Pacific Market)

6 Technological Trends In Global Infrastructure Orchestration Market

7 Four Quadrant Competitor Positioning Matrix

8 Impact Of Macro & Micro Indicators On The Market

9 Impact Of Key Drivers On The Global Infrastructure Orchestration Market

10 Impact Of Challenges On The Global Infrastructure Orchestration Market

11 Porter’s Five Forces Analysis

12 Global Infrastructure Orchestration Market: By Organization Size Scope Key Takeaways

13 Global Infrastructure Orchestration Market, By Organization Size Segment: Revenue Growth Analysis

14 SMEs Market, By Region, 2021-2029 (USD Mllion)

15 Large Enterprise Market, By Region, 2021-2029 (USD Mllion)

16 Global Infrastructure Orchestration Market: By End-use Industry Scope Key Takeaways

17 Global Infrastructure Orchestration Market, By End-use Industry Segment: Revenue Growth Analysis

18 IT and Telecommunications Market, By Region, 2021-2029 (USD Mllion)

19 BFSI Market, By Region, 2021-2029 (USD Mllion)

20 Healthcare Market, By Region, 2021-2029 (USD Mllion)

21 Manufacturing Market, By Region, 2021-2029 (USD Mllion)

22 Others Market, By Region, 2021-2029 (USD Mllion)

23 Regional Segment: Revenue Growth Analysis

24 Global Infrastructure Orchestration Market: Regional Analysis

25 North America Infrastructure Orchestration Market Overview

26 North America Infrastructure Orchestration Market, By Organization Size

27 North America Infrastructure Orchestration Market, By End-use Industry

28 North America Infrastructure Orchestration Market, By Country

29 U.S. Infrastructure Orchestration Market, By Organization Size

30 U.S. Infrastructure Orchestration Market, By End-use Industry

31 Canada Infrastructure Orchestration Market, By Organization Size

32 Canada Infrastructure Orchestration Market, By End-use Industry

33 Mexico Infrastructure Orchestration Market, By Organization Size

34 Mexico Infrastructure Orchestration Market, By End-use Industry

35 Four Quadrant Positioning Matrix

36 Company Market Share Analysis

37 Testsigma: Company Snapshot

38 Testsigma: SWOT Analysis

39 Testsigma: Geographic Presence

40 Advanced Systems Concepts Inc. (ASCI): Company Snapshot

41 Advanced Systems Concepts Inc. (ASCI): SWOT Analysis

42 Advanced Systems Concepts Inc. (ASCI): Geographic Presence

43 Red Hat Ansible: Company Snapshot

44 Red Hat Ansible: SWOT Analysis

45 Red Hat Ansible: Geographic Presence

46 Terraform: Company Snapshot

47 Terraform: Swot Analysis

48 Terraform: Geographic Presence

49 OpenStack: Company Snapshot

50 OpenStack: SWOT Analysis

51 OpenStack: Geographic Presence

52 Chef: Company Snapshot

53 Chef: SWOT Analysis

54 Chef: Geographic Presence

55 Fugue : Company Snapshot

56 Fugue : SWOT Analysis

57 Fugue : Geographic Presence

58 Kubernetes: Company Snapshot

59 Kubernetes: SWOT Analysis

60 Kubernetes: Geographic Presence

61 Cloudify, Inc.: Company Snapshot

62 Cloudify, Inc.: SWOT Analysis

63 Cloudify, Inc.: Geographic Presence

64 Morpheus: Company Snapshot

65 Morpheus: SWOT Analysis

66 Morpheus: Geographic Presence

67 Other Companies: Company Snapshot

68 Other Companies: SWOT Analysis

69 Other Companies: Geographic Presence

The Global Infrastructure Orchestration Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Infrastructure Orchestration Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS