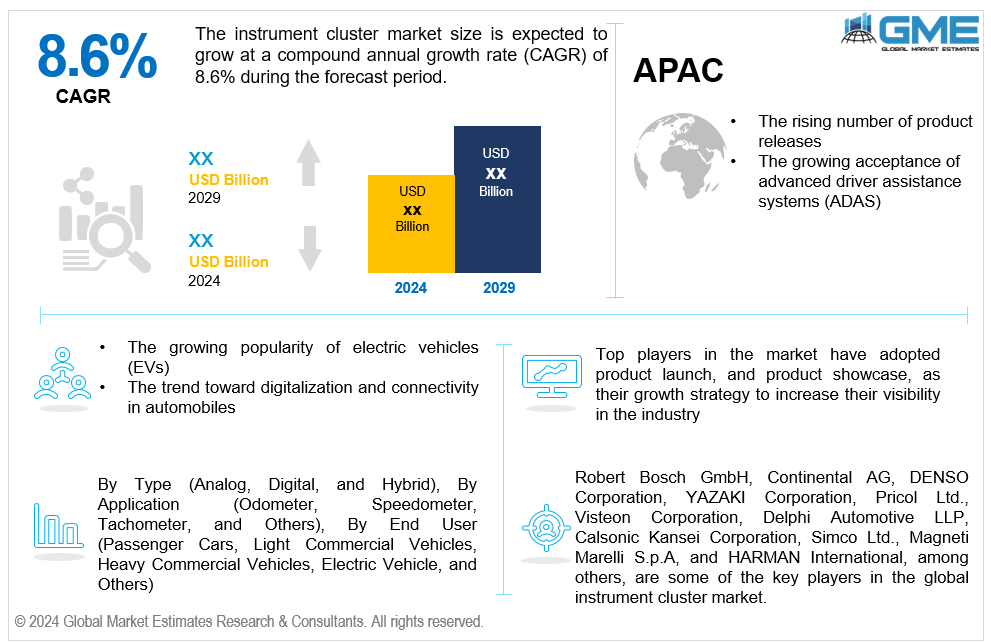

Global Instrument Cluster Market Size, Trends & Analysis - Forecasts to 2029 By Type (Analog, Digital, and Hybrid), By Application (Odometer, Speedometer, Tachometer, and Others), By End User (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles, Electric Vehicle, and Others), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

The global instrument cluster market is estimated to exhibit a CAGR of 8.6% from 2024 to 2029.

The market is growing primarily due to the rising number of product releases and the growing acceptance of advanced driver assistance systems (ADAS). The surge in product launches is closely tied to the rapid advancements in automotive display technology. manufacturers in the instrument cluster market are introducing products equipped with cutting-edge display technologies, including OLEDs, LCD cluster displays, HUD (Heads-Up Display) technology, and other high-resolution screens. This trend aligns with the consumer demand for visually appealing and technologically advanced interfaces inside vehicles. Moreover, the seamless integration of instrument clusters with vehicle dashboard innovations, such as infotainment systems, navigation, and connectivity options, is a key focus. This integration is crucial for creating a cohesive and user-friendly dashboard experience. For instance, Genesis introduced the 2022 G70 in April 2022, which included a 12.3-inch digital instrument cluster on the front side of the driver that produced a distinctive three-dimensional look.

The growing popularity of electric vehicles (EVs) coupled with the trend toward digitalization and connectivity in automobiles are expected to support the market growth throughout the forecast period. Instrument clusters now require advanced vehicle networking solutions due to the growing popularity of electric vehicles. The smooth integration of cloud services, smartphones, and other external devices is made possible by these solutions. In order to improve the overall user experience, electric vehicle instrument clusters can feature connectivity capabilities for over-the-air upgrades, remote monitoring, and smart home integration. Moreover, advanced digital instrument panel solutions provide electric vehicle drivers with real-time information about battery status, range, charging times, and energy consumption. For instance, in 2022, EV sales increased by 55% to a total of 10.5 million, according to the EV Volumes sales database.

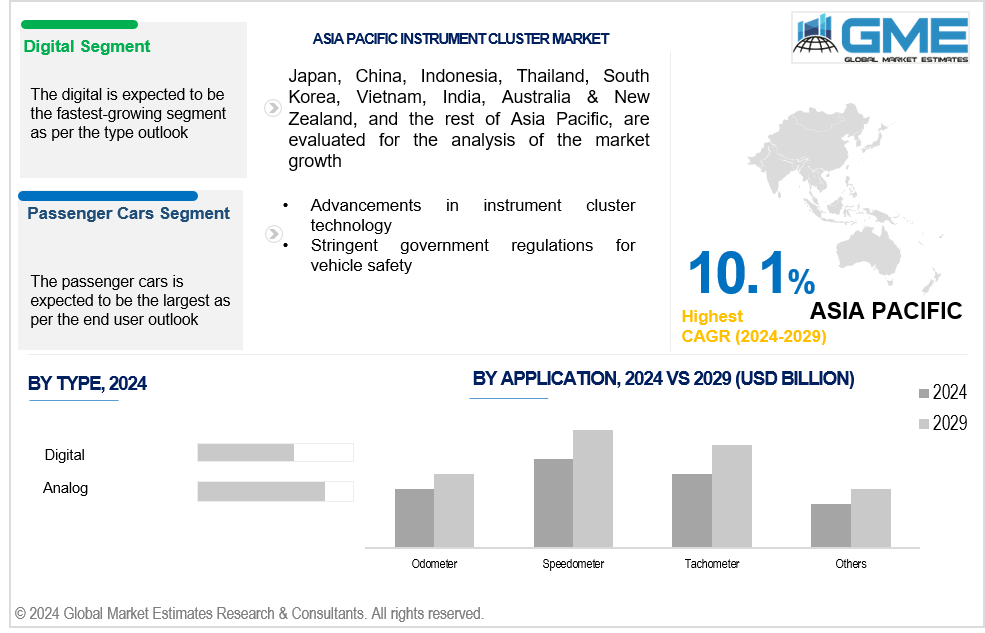

Advancements in instrument cluster technology and stringent government regulations for vehicle safety are propelling the market growth. Advancements in instrument cluster technology involve the seamless integration of driver information systems. The driver can receive real-time data from these systems, such as safety alarms, navigation directions, vital information regarding vehicle performance, and other pertinent factors. By providing crucial information through the instrument cluster in an understandable and accessible way, the driver information system improves the entire driving experience. Additionally, advanced instrument cluster features include multifunctional and customizable displays. Drivers have the option to customize the instrument cluster's information by selecting from a variety of themes and layouts.

The evolution of instrument clusters provides opportunities for the integration of sophisticated automotive user interfaces (UI). Manufacturers can benefit from the need for UIs in instrument clusters that are both adaptable and user-friendly in order to cater to the needs of contemporary car customers. The creation of cutting-edge in-vehicle display systems presents further opportunities in the instrument cluster market. Infotainment, navigation, and vehicle health data can all be shown on extra screens in these systems, which go beyond conventional instrument clusters. However, the high internal cost of components and cybersecurity concerns are hindering market growth.

The analog segment is expected to hold the largest share of the market. Analog instrument clusters are less expensive than their digital equivalents. This cost advantage is especially significant in price-sensitive regions where consumers' decisions are heavily influenced by affordability. Additionally, analog instrument clusters are known for their simplicity and reliability. Usually, they are made up of analog gauges, such as tachometers and speedometers, which are less expensive and easier to make than digital displays.

The digital segment is expected to be the fastest-growing segment in the market from 2024-2029. Advanced features and technology are becoming increasingly desirable to consumers in automobiles. Numerous features are available with digital instrument clusters, such as interactive touchscreens, displays that can be customized, and interaction with cutting-edge driver aid systems. The demand for these features is a key driver of the rapid growth in the digital segment.

The speedometer segment is expected to hold the largest share of the market. As the speedometer gives important information regarding the vehicle's speed, it is an essential part of an instrument cluster. This information is essential for safe and legal driving, making the speedometer a primary focus for drivers. As a result, it continues to be an essential and often utilized component in all kinds of cars. Moreover, regulatory standards often mandate the inclusion of a speedometer in vehicles. All around the world, governments and transportation authorities mandate that cars have speed-measuring devices installed to improve road safety and enforce adherence to speed restrictions. This legal mandate ensures a steady market for speedometers.

The tachometer segment is anticipated to be the fastest-growing segment in the market from 2024-2029. The tachometer remains useful since electric vehicles (EVs), especially high-performance electric ones, are becoming increasingly popular. In electric performance cars, tachometers can display motor speed or other pertinent metrics, similar to how they are used in traditional combustion engines to indicate engine revolutions per minute (RPM).

The passenger cars segment is expected to hold the largest share of the market. Sedans, hatchbacks, and SUVs are examples of passenger cars that usually have larger production and sales volumes than other vehicle sectors like commercial vehicles or specialty vehicles. The market dominance of this segment in the instrument cluster industry can be attributed to the sheer amount of passenger cars produced and sold. Additionally, passenger cars are the most common type of vehicle used for personal transportation, and consumer preferences heavily influence the demand for advanced instrument clusters.

The light commercial vehicles segment is anticipated to be the fastest-growing segment in the market from 2024-2029. Light commercial vehicles used for commercial purposes often benefit from the integration of fleet management systems. The need for advanced instrument clusters can grow as a result of their ability to provide fleet operators with pertinent data including maintenance warnings, fuel economy, and vehicle diagnostics.

North America is expected to be the largest region in the global market. Growing numbers of vehicle accidents frequently result in increased awareness of the need for better safety measures in automobiles. Instrument clusters are crucial for displaying information concerning safety technology such as collision warnings, adaptive cruise control, and lane departure alarms. The need for automobiles with cutting-edge safety features can fuel the instrument cluster market growth in North America. For instance, according to the Fatality Analysis Reporting System (FARS) data, an estimated 6,102,936 car accidents in the US were reported to the police in 2021.

Asia Pacific is anticipated to witness rapid growth during the forecast period. The Asia Pacific instrument cluster market grew as a result of increasing auto manufacturing, which included commercial vehicles, and passenger cars. Advanced instrument clusters were being included by manufacturers to improve the entire driving experience and provide passengers in the car additional information. For instance, China is the world's top vehicle manufacturer, producing more than 21.4 million cars and 4.6 million commercial vehicles in 2021 for a total production of just over 26 million vehicles, according to the World Organization of Motor Vehicle Manufacturers.

Robert Bosch GmbH, Continental AG, DENSO Corporation, YAZAKI Corporation, Pricol Ltd., Visteon Corporation, Delphi Automotive LLP, Calsonic Kansei Corporation, Simco Ltd., Magneti Marelli S.p.A, and HARMAN International, among others, are some of the key players in the global instrument cluster market.

Please note: This is not an exhaustive list of companies profiled in the report.

Robert Bosch GmbH (Bosch) announced the opening of its Engineering Centre in Sofia in November 2021. Technologies for car electrification, communication, instrument clusters, displays, and driver monitoring systems are being developed at the Bosch Engineering Centre Sofia.

In January 2021, Continental and Leia Inc. collaborated to create a revolutionary 3D display that utilized natural 3D Lightfield Technology. In a connected automobile, this technology saves weight and space, lowers expenses, and shows all digital services to all of the passengers.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL INSTRUMENT CLUSTER MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 End User Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL INSTRUMENT CLUSTER MARKET, BY TYPE

4.1 Introduction

4.2 Instrument Cluster Market: Type Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Analog

4.4.1 Analog Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 Digital

4.5.1 Digital Market Estimates and Forecast, 2021-2029 (USD Million)

4.6 Hybrid

4.6.1 Hybrid Market Estimates and Forecast, 2021-2029 (USD Million)

5 GLOBAL INSTRUMENT CLUSTER MARKET, BY APPLICATION

5.1 Introduction

5.2 Instrument Cluster Market: Application Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 Odometer

5.4.1 Odometer Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 Speedometer

5.5.1 Speedometer Market Estimates and Forecast, 2021-2029 (USD Million)

5.6 Tachometer

5.6.1 Tachometer Market Estimates and Forecast, 2021-2029 (USD Million)

5.7 Others

5.7.1 Others Market Estimates and Forecast, 2021-2029 (USD Million)

6 GLOBAL INSTRUMENT CLUSTER MARKET, BY END USER

6.1 Introduction

6.2 Instrument Cluster Market: End User Scope Key Takeaways

6.3 Revenue Growth Analysis, 2023 & 2029

6.4 Passenger Cars

6.4.1 Passenger Cars Market Estimates and Forecast, 2021-2029 (USD Million)

6.5 Light Commercial Vehicles

6.5.1 Light Commercial Vehicles Market Estimates and Forecast, 2021-2029 (USD Million)

6.6 Heavy Commercial Vehicles

6.6.1 Heavy Commercial Vehicles Market Estimates and Forecast, 2021-2029 (USD Million)

6.7 Electric Vehicle

6.7.1 Electric Vehicle Market Estimates and Forecast, 2021-2029 (USD Million)

6.8 Others

6.8.1 Others Market Estimates and Forecast, 2021-2029 (USD Million)

7 GLOBAL INSTRUMENT CLUSTER MARKET, BY REGION

7.1 Introduction

7.2 North America Instrument Cluster Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.1 By Type

7.2.2 By Application

7.2.3 By End User

7.2.4 By Country

7.2.4.1 U.S. Instrument Cluster Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.1.1 By Type

7.2.4.1.2 By Application

7.2.4.1.3 By End User

7.2.4.2 Canada Instrument Cluster Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.2.1 By Type

7.2.4.2.2 By Application

7.2.4.2.3 By End User

7.2.4.3 Mexico Instrument Cluster Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.3.1 By Type

7.2.4.3.2 By Application

7.2.4.3.3 By End User

7.3 Europe Instrument Cluster Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.1 By Type

7.3.2 By Application

7.3.3 By End User

7.3.4 By Country

7.3.4.1 Germany Instrument Cluster Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.1.1 By Type

7.3.4.1.2 By Application

7.3.4.1.3 By End User

7.3.4.2 U.K. Instrument Cluster Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.2.1 By Type

7.3.4.2.2 By Application

7.3.4.2.3 By End User

7.3.4.3 France Instrument Cluster Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.3.1 By Type

7.3.4.3.2 By Application

7.3.4.3.3 By End User

7.3.4.4 Italy Instrument Cluster Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.4.1 By Type

7.3.4.4.2 By Application

7.2.4.4.3 By End User

7.3.4.5 Spain Instrument Cluster Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.5.1 By Type

7.3.4.5.2 By Application

7.2.4.5.3 By End User

7.3.4.6 Netherlands Instrument Cluster Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.6.1 By Type

7.3.4.6.2 By Application

7.2.4.6.3 By End User

7.3.4.7 Rest of Europe Instrument Cluster Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.7.1 By Type

7.3.4.7.2 By Application

7.2.4.7.3 By End User

7.4 Asia Pacific Instrument Cluster Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.1 By Type

7.4.2 By Application

7.4.3 By End User

7.4.4 By Country

7.4.4.1 China Instrument Cluster Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.1.1 By Type

7.4.4.1.2 By Application

7.4.4.1.3 By End User

7.4.4.2 Japan Instrument Cluster Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.2.1 By Type

7.4.4.2.2 By Application

7.4.4.2.3 By End User

7.4.4.3 India Instrument Cluster Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.3.1 By Type

7.4.4.3.2 By Application

7.4.4.3.3 By End User

7.4.4.4 South Korea Instrument Cluster Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.4.1 By Type

7.4.4.4.2 By Application

7.4.4.4.3 By End User

7.4.4.5 Singapore Instrument Cluster Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.5.1 By Type

7.4.4.5.2 By Application

7.4.4.5.3 By End User

7.4.4.6 Malaysia Instrument Cluster Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.6.1 By Type

7.4.4.6.2 By Application

7.4.4.6.3 By End User

7.4.4.7 Thailand Instrument Cluster Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.7.1 By Type

7.4.4.7.2 By Application

7.4.4.7.3 By End User

7.4.4.8 Indonesia Instrument Cluster Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.8.1 By Type

7.4.4.8.2 By Application

7.4.4.8.3 By End User

7.4.4.9 Vietnam Instrument Cluster Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.9.1 By Type

7.4.4.9.2 By Application

7.4.4.9.3 By End User

7.4.4.10 Taiwan Instrument Cluster Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.10.1 By Type

7.4.4.10.2 By Application

7.4.4.10.3 By End User

7.4.4.11 Rest of Asia Pacific Instrument Cluster Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.11.1 By Type

7.4.4.11.2 By Application

7.4.4.11.3 By End User

7.5 Middle East and Africa Instrument Cluster Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.1 By Type

7.5.2 By Application

7.5.3 By End User

7.5.4 By Country

7.5.4.1 Saudi Arabia Instrument Cluster Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.1.1 By Type

7.5.4.1.2 By Application

7.5.4.1.3 By End User

7.5.4.2 U.A.E. Instrument Cluster Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.2.1 By Type

7.5.4.2.2 By Application

7.5.4.2.3 By End User

7.5.4.3 Israel Instrument Cluster Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.3.1 By Type

7.5.4.3.2 By Application

7.5.4.3.3 By End User

7.5.4.4 South Africa Instrument Cluster Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.4.1 By Type

7.5.4.4.2 By Application

7.5.4.4.3 By End User

7.5.4.5 Rest of Middle East and Africa Instrument Cluster Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.5.1 By Type

7.5.4.5.2 By Application

7.5.4.5.2 By End User

7.6 Central and South America Instrument Cluster Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.1 By Type

7.6.2 By Application

7.6.3 By End User

7.6.4 By Country

7.6.4.1 Brazil Instrument Cluster Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.1.1 By Type

7.6.4.1.2 By Application

7.6.4.1.3 By End User

7.6.4.2 Argentina Instrument Cluster Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.2.1 By Type

7.6.4.2.2 By Application

7.6.4.2.3 By End User

7.6.4.3 Chile Instrument Cluster Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.3.1 By Type

7.6.4.3.2 By Application

7.6.4.3.3 By End User

7.6.4.4 Rest of Central and South America Instrument Cluster Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.4.1 By Type

7.6.4.4.2 By Application

7.6.4.4.3 By End User

8 COMPETITIVE LANDCAPE

8.1 Company Market Share Analysis

8.2 Four Quadrant Positioning Matrix

8.2.1 Market Leaders

8.2.2 Market Visionaries

8.2.3 Market Challengers

8.2.4 Niche Market Players

8.3 Vendor Landscape

8.3.1 North America

8.3.2 Europe

8.3.3 Asia Pacific

8.3.4 Rest of the World

8.4 Company Profiles

8.4.1 Robert Bosch GmbH

8.4.1.1 Business Description & Financial Analysis

8.4.1.2 SWOT Analysis

8.4.1.3 Products & Services Offered

8.4.1.4 Strategic Alliances between Business Partners

8.4.2 Continental AG

8.4.2.1 Business Description & Financial Analysis

8.4.2.2 SWOT Analysis

8.4.2.3 Products & Services Offered

8.4.2.4 Strategic Alliances between Business Partners

8.4.3 DENSO Corporation

8.4.3.1 Business Description & Financial Analysis

8.4.3.2 SWOT Analysis

8.4.3.3 Products & Services Offered

8.4.3.4 Strategic Alliances between Business Partners

8.4.4 YAZAKI Corporation

8.4.4.1 Business Description & Financial Analysis

8.4.4.2 SWOT Analysis

8.4.4.3 Products & Services Offered

8.4.4.4 Strategic Alliances between Business Partners

8.4.5 Pricol Ltd.

8.4.5.1 Business Description & Financial Analysis

8.4.5.2 SWOT Analysis

8.4.5.3 Products & Services Offered

8.4.5.4 Strategic Alliances between Business Partners

8.4.6 VISTEON CORPORATION

8.4.6.1 Business Description & Financial Analysis

8.4.6.2 SWOT Analysis

8.4.6.3 Products & Services Offered

8.4.6.4 Strategic Alliances between Business Partners

8.4.7 Delphi Automotive LLP

8.4.7.1 Business Description & Financial Analysis

8.4.7.2 SWOT Analysis

8.4.7.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.8 Calsonic Kansei Corporation

8.4.8.1 Business Description & Financial Analysis

8.4.8.2 SWOT Analysis

8.4.8.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.9 Simco Ltd.

8.4.9.1 Business Description & Financial Analysis

8.4.9.2 SWOT Analysis

8.4.9.3 Products & Services Offered

8.4.9.4 Strategic Alliances between Business Partners

8.4.10 Magneti Marelli S.p.A

8.4.10.1 Business Description & Financial Analysis

8.4.10.2 SWOT Analysis

8.4.10.3 Products & Services Offered

8.4.10.4 Strategic Alliances between Business Partners

8.4.11 Other Companies

8.4.11.1 Business Description & Financial Analysis

8.4.11.2 SWOT Analysis

8.4.11.3 Products & Services Offered

8.4.11.4 Strategic Alliances between Business Partners

9 RESEARCH METHODOLOGY

9.1 Market Introduction

9.1.1 Market Definition

9.1.2 Market Scope & Segmentation

9.2 Information Procurement

9.2.1 Secondary Research

9.2.1.1 Purchased Databases

9.2.1.2 GMEs Internal Data Repository

9.2.1.3 Secondary Resources & Third Party Perspectives

9.2.1.4 Company Information Sources

9.2.2 Primary Research

9.2.2.1 Various Types of Respondents for Primary Interviews

9.2.2.2 Number of Interviews Conducted throughout the Research Process

9.2.2.3 Primary Stakeholders

9.2.2.4 Discussion Guide for Primary Participants

9.2.3 Expert Panels

9.2.3.1 Expert Panels Across 30+ Industry

9.2.4 Paid Local Experts

9.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

9.3 Market Estimation

9.3.1 Top-Down Approach

9.3.1.1 Macro-Economic Indicators Considered

9.3.1.2 Micro-Economic Indicators Considered

9.3.2 Bottom Up Approach

9.3.2.1 Company Share Analysis Approach

9.3.2.2 Estimation of Potential Type Sales

9.4 Data Triangulation

9.4.1 Data Collection

9.4.2 Time Series, Cross Sectional & Panel Data Analysis

9.4.3 Cluster Analysis

9.5 Analysis and Output

9.5.1 Inhouse AI Based Real Time Analytics Tool

9.5.2 Output From Desk & Primary Research

9.6 Research Assumptions & Limitations

9.7.1 Research Assumptions

9.7.2 Research Limitations

LIST OF TABLES

1 Global Instrument Cluster Market, By Type, 2021-2029(USD Mllion)

2 Analog Market, By Region, 2021-2029(USD Mllion)

3 Digital Market, By Region, 2021-2029(USD Mllion)

4 Hybrid Market, By Region, 2021-2029(USD Mllion)

5 Global Instrument Cluster Market, By Application, 2021-2029(USD Mllion)

6 Odometer Market, By Region, 2021-2029(USD Mllion)

7 Speedometer Market, By Region, 2021-2029(USD Mllion)

8 Tachometer Market, By Region, 2021-2029(USD Mllion)

9 Others Market, By Region, 2021-2029(USD Mllion)

10 Global Instrument Cluster Market, By End User, 2021-2029(USD Mllion)

11 Passenger Cars Market, By Region, 2021-2029(USD Mllion)

12 Light Commercial Vehicles Market, By Region, 2021-2029(USD Mllion)

13 Heavy Commercial Vehicles Market, By Region, 2021-2029(USD Mllion)

14 Electric Vehicle Market, By Region, 2021-2029(USD Mllion)

15 Others Market, By Region, 2021-2029(USD Mllion)

16 Regional Analysis, 2021-2029(USD Mllion)

17 North America Instrument Cluster Market, By Type, 2021-2029 (USD Million)

18 North America Instrument Cluster Market, By Application, 2021-2029 (USD Million)

19 North America Instrument Cluster Market, By End User, 2021-2029 (USD Million)

20 North America Instrument Cluster Market, By Country, 2021-2029 (USD Million)

21 U.S Instrument Cluster Market, By Type, 2021-2029 (USD Million)

22 U.S Instrument Cluster Market, By Application, 2021-2029 (USD Million)

23 U.S Instrument Cluster Market, By End User, 2021-2029 (USD Million)

24 Canada Instrument Cluster Market, By Type, 2021-2029 (USD Million)

25 Canada Instrument Cluster Market, By Application, 2021-2029 (USD Million)

26 Canada Instrument Cluster Market, By End User, 2021-2029 (USD Million)

27 Mexico Instrument Cluster Market, By Type, 2021-2029 (USD Million)

28 Mexico Instrument Cluster Market, By Application, 2021-2029 (USD Million)

29 Mexico Instrument Cluster Market, By End User, 2021-2029 (USD Million)

30 Europe Instrument Cluster Market, By Type, 2021-2029 (USD Million)

31 Europe Instrument Cluster Market, By Application, 2021-2029 (USD Million)

32 Europe Instrument Cluster Market, By End User, 2021-2029 (USD Million)

33 Europe Instrument Cluster Market, By Country 2021-2029 (USD Million)

34 Germany Instrument Cluster Market, By Type, 2021-2029 (USD Million)

35 Germany Instrument Cluster Market, By Application, 2021-2029 (USD Million)

36 Germany Instrument Cluster Market, By End User, 2021-2029 (USD Million)

37 U.K Instrument Cluster Market, By Type, 2021-2029 (USD Million)

38 U.K Instrument Cluster Market, By Application, 2021-2029 (USD Million)

39 U.K Instrument Cluster Market, By End User, 2021-2029 (USD Million)

40 France Instrument Cluster Market, By Type, 2021-2029 (USD Million)

41 France Instrument Cluster Market, By Application, 2021-2029 (USD Million)

42 France Instrument Cluster Market, By End User, 2021-2029 (USD Million)

43 Italy Instrument Cluster Market, By Type, 2021-2029 (USD Million)

44 Italy Instrument Cluster Market, By application, 2021-2029 (USD Million)

45 Italy Instrument Cluster Market, By End User, 2021-2029 (USD Million)

46 Spain Instrument Cluster Market, By Type, 2021-2029 (USD Million)

47 Spain Instrument Cluster Market, By Application, 2021-2029 (USD Million)

48 Spain Instrument Cluster Market, By End User, 2021-2029 (USD Million)

49 Netherlands Instrument Cluster Market, By Type, 2021-2029 (USD Million)

50 Netherlands Instrument Cluster Market, By Application, 2021-2029 (USD Million)

51 Netherlands Instrument Cluster Market, By End User, 2021-2029 (USD Million)

52 Rest Of Europe Instrument Cluster Market, By Type, 2021-2029 (USD Million)

53 Rest Of Europe Instrument Cluster Market, By Application, 2021-2029 (USD Million)

54 Rest of Europe Instrument Cluster Market, By End User, 2021-2029 (USD Million)

55 Asia Pacific Instrument Cluster Market, By Type, 2021-2029 (USD Million)

56 Asia Pacific Instrument Cluster Market, By Application, 2021-2029 (USD Million)

57 Asia Pacific Instrument Cluster Market, By End User, 2021-2029 (USD Million)

58 Asia Pacific Instrument Cluster Market, By Country, 2021-2029 (USD Million)

59 China Instrument Cluster Market, By Type, 2021-2029 (USD Million)

60 China Instrument Cluster Market, By Application, 2021-2029 (USD Million)

61 China Instrument Cluster Market, By End User, 2021-2029 (USD Million)

62 India Instrument Cluster Market, By Type, 2021-2029 (USD Million)

63 India Instrument Cluster Market, By Application, 2021-2029 (USD Million)

64 India Instrument Cluster Market, By End User, 2021-2029 (USD Million)

65 Japan Instrument Cluster Market, By Type, 2021-2029 (USD Million)

66 Japan Instrument Cluster Market, By Application, 2021-2029 (USD Million)

67 Japan Instrument Cluster Market, By End User, 2021-2029 (USD Million)

68 South Korea Instrument Cluster Market, By Type, 2021-2029 (USD Million)

69 South Korea Instrument Cluster Market, By Application, 2021-2029 (USD Million)

70 South Korea Instrument Cluster Market, By End User, 2021-2029 (USD Million)

71 malaysia Instrument Cluster Market, By Type, 2021-2029 (USD Million)

72 malaysia Instrument Cluster Market, By Application, 2021-2029 (USD Million)

73 malaysia Instrument Cluster Market, By End User, 2021-2029 (USD Million)

74 Thailand Instrument Cluster Market, By Type, 2021-2029 (USD Million)

75 Thailand Instrument Cluster Market, By Application, 2021-2029 (USD Million)

76 Thailand Instrument Cluster Market, By End User, 2021-2029 (USD Million)

77 Indonesia Instrument Cluster Market, By Type, 2021-2029 (USD Million)

78 Indonesia Instrument Cluster Market, By Application, 2021-2029 (USD Million)

79 Indonesia Instrument Cluster Market, By End User, 2021-2029 (USD Million)

80 Vietnam Instrument Cluster Market, By Type, 2021-2029 (USD Million)

81 Vietnam Instrument Cluster Market, By Application, 2021-2029 (USD Million)

82 Vietnam Instrument Cluster Market, By End User, 2021-2029 (USD Million)

83 Taiwan Instrument Cluster Market, By Type, 2021-2029 (USD Million)

84 Taiwan Instrument Cluster Market, By Application, 2021-2029 (USD Million)

85 Taiwan Instrument Cluster Market, By End User, 2021-2029 (USD Million)

86 Rest of Asia Pacific Instrument Cluster Market, By Type, 2021-2029 (USD Million)

87 Rest of Asia Pacific Instrument Cluster Market, By Application, 2021-2029 (USD Million)

88 Rest of Asia Pacific Instrument Cluster Market, By End User, 2021-2029 (USD Million)

89 Middle East and Africa Instrument Cluster Market, By Type, 2021-2029 (USD Million)

90 Middle East and Africa Instrument Cluster Market, By Application, 2021-2029 (USD Million)

91 Middle East and Africa Instrument Cluster Market, By End User, 2021-2029 (USD Million)

92 Middle East and Africa Instrument Cluster Market, By Country, 2021-2029 (USD Million)

93 Saudi Arabia Instrument Cluster Market, By Type, 2021-2029 (USD Million)

94 Saudi Arabia Instrument Cluster Market, By Application, 2021-2029 (USD Million)

95 Saudi Arabia Instrument Cluster Market, By End User, 2021-2029 (USD Million)

96 UAE Instrument Cluster Market, By Type, 2021-2029 (USD Million)

97 UAE Instrument Cluster Market, By Application, 2021-2029 (USD Million)

98 UAE Instrument Cluster Market, By End User, 2021-2029 (USD Million)

99 Israel Instrument Cluster Market, By Type, 2021-2029 (USD Million)

100 Israel Instrument Cluster Market, By Application, 2021-2029 (USD Million)

101 Israel Instrument Cluster Market, By End User, 2021-2029 (USD Million)

102 South Africa Instrument Cluster Market, By Type, 2021-2029 (USD Million)

103 South Africa Instrument Cluster Market, By Application, 2021-2029 (USD Million)

104 South Africa Instrument Cluster Market, By End User, 2021-2029 (USD Million)

105 Rest of Middle East and Africa Instrument Cluster Market, By Type, 2021-2029 (USD Million)

106 Rest of Middle East and Africa Instrument Cluster Market, By Application, 2021-2029 (USD Million)

107 UAE Rest of Middle East and Africa Instrument Cluster Market, By End User, 2021-2029 (USD Million)

108 Central and South America Instrument Cluster Market, By Type, 2021-2029 (USD Million)

109 Central and South America Instrument Cluster Market, By Application, 2021-2029 (USD Million)

110 Central and South America Instrument Cluster Market, By End User, 2021-2029 (USD Million)

111 Central and South America Instrument Cluster Market, By Country, 2021-2029 (USD Million)

112 Brazil Instrument Cluster Market, By Type, 2021-2029 (USD Million)

113 Brazil Instrument Cluster Market, By Application, 2021-2029 (USD Million)

114 Brazil Instrument Cluster Market, By End User, 2021-2029 (USD Million)

115 Argentina Instrument Cluster Market, By Type, 2021-2029 (USD Million)

116 Argentina Instrument Cluster Market, By Application, 2021-2029 (USD Million)

117 Argentina Instrument Cluster Market, By End User, 2021-2029 (USD Million)

118 Chile Instrument Cluster Market, By Type, 2021-2029 (USD Million)

119 Chile Instrument Cluster Market, By Application, 2021-2029 (USD Million)

120 Chile Instrument Cluster Market, By End User, 2021-2029 (USD Million)

121 Rest of Central and South America Instrument Cluster Market, By Type, 2021-2029 (USD Million)

122 Rest of Central and South America Instrument Cluster Market, By Application, 2021-2029 (USD Million)

123 Rest of Central and South America Instrument Cluster Market, By End User, 2021-2029 (USD Million)

124 Robert Bosch GmbH: Products & Services Offering

125 Continental AG: Products & Services Offering

126 DENSO Corporation: Products & Services Offering

127 YAZAKI Corporation: Products & Services Offering

128 Pricol Ltd.: Products & Services Offering

129 VISTEON CORPORATION: Products & Services Offering

130 Delphi Automotive LLP : Products & Services Offering

131 Calsonic Kansei Corporation: Products & Services Offering

132 Simco Ltd., Inc: Products & Services Offering

133 Magneti Marelli S.p.A: Products & Services Offering

134 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Instrument Cluster Market Overview

2 Global Instrument Cluster Market Value From 2021-2029(USD Mllion)

3 Global Instrument Cluster Market Share, By Type (2022)

4 Global Instrument Cluster Market Share, By Application (2022)

5 Global Instrument Cluster Market Share, By End User (2022)

6 Global Instrument Cluster Market, By Region (Asia Pacific Market)

7 Technological Trends In Global Instrument Cluster Market

8 Four Quadrant Competitor Positioning Matrix

9 Impact Of Macro & Micro Indicators On The Market

10 Impact Of Key Drivers On The Global Instrument Cluster Market

11 Impact Of Challenges On The Global Instrument Cluster Market

12 Porter’s Five Forces Analysis

13 Global Instrument Cluster Market: By Type Scope Key Takeaways

14 Global Instrument Cluster Market, By Type Segment: Revenue Growth Analysis

15 Analog Market, By Region, 2021-2029(USD Mllion)

16 Digital Market, By Region, 2021-2029(USD Mllion)

17 Hybrid Market, By Region, 2021-2029(USD Mllion)

18 Global Instrument Cluster Market: By Application Scope Key Takeaways

19 Global Instrument Cluster Market, By Application Segment: Revenue Growth Analysis

20 Odometer Market, By Region, 2021-2029(USD Mllion)

21 Speedometer Market, By Region, 2021-2029(USD Mllion)

22 Tachometer Market, By Region, 2021-2029(USD Mllion)

23 Others Market, By Region, 2021-2029(USD Mllion)

24 Global Instrument Cluster Market: By End User Scope Key Takeaways

25 Global Instrument Cluster Market, By End User Segment: Revenue Growth Analysis

26 Passenger Cars Market, By Region, 2021-2029(USD Mllion)

27 Light Commercial Vehicles Market, By Region, 2021-2029(USD Mllion)

28 Heavy Commercial Vehicles Market, By Region, 2021-2029(USD Mllion)

29 Electric Vehicle Market, By Region, 2021-2029(USD Mllion)

30 Others Market, By Region, 2021-2029(USD Mllion)

31 Regional Segment: Revenue Growth Analysis

32 Global Instrument Cluster Market: Regional Analysis

33 North America Instrument Cluster Market Overview

34 North America Instrument Cluster Market, By Type

35 North America Instrument Cluster Market, By Application

36 North America Instrument Cluster Market, By End User

37 North America Instrument Cluster Market, By Country

38 U.S. Instrument Cluster Market, By Type

39 U.S. Instrument Cluster Market, By Application

40 U.S. Instrument Cluster Market, By End User

41 Canada Instrument Cluster Market, By Type

42 Canada Instrument Cluster Market, By Application

43 Canada Instrument Cluster Market, By End User

44 Mexico Instrument Cluster Market, By Type

45 Mexico Instrument Cluster Market, By Application

46 Mexico Instrument Cluster Market, By End User

47 Four Quadrant Positioning Matrix

48 Company Market Share Analysis

49 Robert Bosch GmbH: Company Snapshot

50 Robert Bosch GmbH: SWOT Analysis

51 Robert Bosch GmbH: Geographic Presence

52 Continental AG: Company Snapshot

53 Continental AG: SWOT Analysis

54 Continental AG: Geographic Presence

55 DENSO Corporation: Company Snapshot

56 DENSO Corporation: SWOT Analysis

57 DENSO Corporation: Geographic Presence

58 YAZAKI Corporation: Company Snapshot

59 YAZAKI Corporation: Swot Analysis

60 YAZAKI Corporation: Geographic Presence

61 Pricol Ltd.: Company Snapshot

62 Pricol Ltd.: SWOT Analysis

63 Pricol Ltd.: Geographic Presence

64 VISTEON CORPORATION: Company Snapshot

65 VISTEON CORPORATION: SWOT Analysis

66 VISTEON CORPORATION: Geographic Presence

67 Delphi Automotive LLP : Company Snapshot

68 Delphi Automotive LLP : SWOT Analysis

69 Delphi Automotive LLP : Geographic Presence

70 Calsonic Kansei Corporation: Company Snapshot

71 Calsonic Kansei Corporation: SWOT Analysis

72 Calsonic Kansei Corporation: Geographic Presence

73 Simco Ltd., Inc.: Company Snapshot

74 Simco Ltd., Inc.: SWOT Analysis

75 Simco Ltd., Inc.: Geographic Presence

76 Magneti Marelli S.p.A: Company Snapshot

77 Magneti Marelli S.p.A: SWOT Analysis

78 Magneti Marelli S.p.A: Geographic Presence

79 Other Companies: Company Snapshot

80 Other Companies: SWOT Analysis

81 Other Companies: Geographic Presence

The Global Instrument Cluster Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Instrument Cluster Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS