Global Instrumentation Valves and Fitting Market Size, Trends & Analysis - Forecasts to 2026 By Product Type (Valves, Fittings, Actuators and others), By Material (Alloy, Cast Iron, Stainless Steel and Others), By Application (Chemicals, Energy and power, Healthcare, Oil & Gas, Pulp & Paper, and others), By Region (North America, Asia Pacific, Central & South America, Europe, and the Middle East & Africa), Competitive Landscape Company Market Share Analysis, and Competitor Analysis

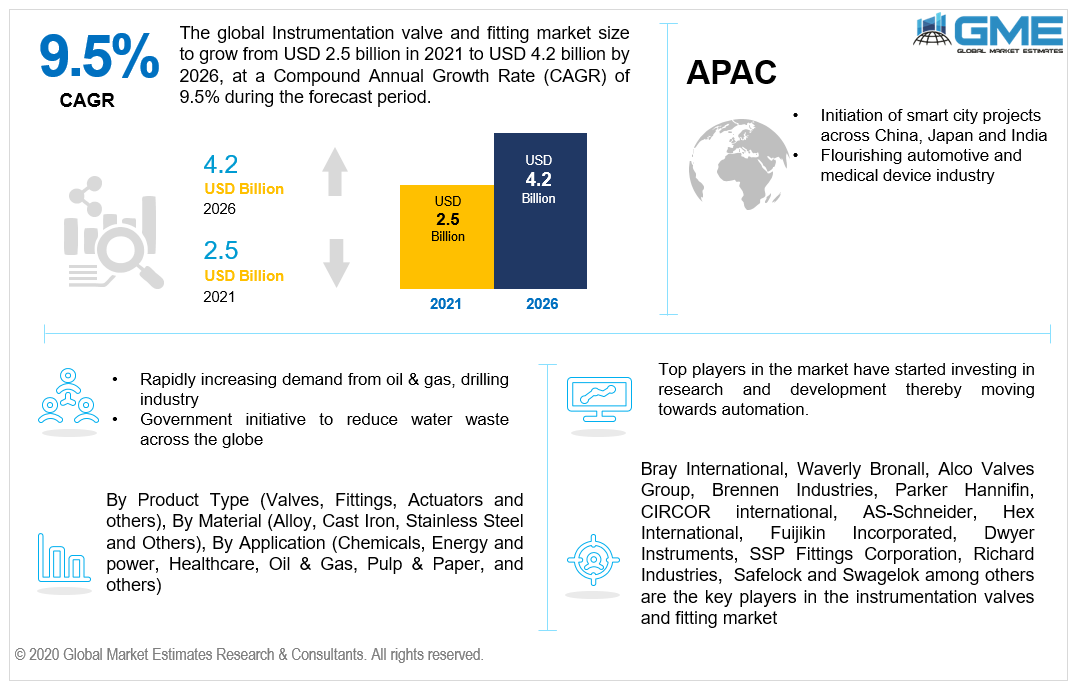

The global instrumentation valves and fitting market is projected to grow from USD 2.5 billion in 2021 to USD 4.2 billion by 2026 at a CAGR value of 9.5% between 2021 to 2026.

Plumbing components which help to regulate the flow of liquid or gas are classified under instrumentation valve and fitting products. In the chemicals industry, instrumentation valves and fittings are used in various applications such as backflow leakage prevention, acid/caustic/water flow control. Valvles are also used in regulating the pressure of media flowing from interconnected and linked pipelines. During a building construction, valves and other materials are used as they render qualities such as long lasting nature of the material, resistible to corrosion to pollution and water and high-end protecting againts harsh climatic conditions.

Instrumentation valves and fittings form an integral part of the manufacturing unit. Hence, increasing demand for valves and fittings from the oil & gas, chemical, paper & pulp industries is the major driver of the market growth. Furthermore, smart city initiatives taken up by various governments across the globe would also enhance the growth and demand of this market.

High demand from the ever-growing chemical industry, healthcare and pharmaceuticals industries especially post pandemic and technological advancement in construction industry would be some of the other major drivers for instrumentation valve and fitting market growth. Furthermore, new product launch strategies and other organic strategies are offering lucrative opportunities for the growth of the market at a global level.

Covid-19 has impacted all the industries across the globe and lockdown like situation which has restricted the movement of people has also led to decrease in demand for valve and fitting products. However, with the ease in the norms and the rising demand for healthcare products which require industrial valves would show immense growth during the forecast period of 2021 to 2026.

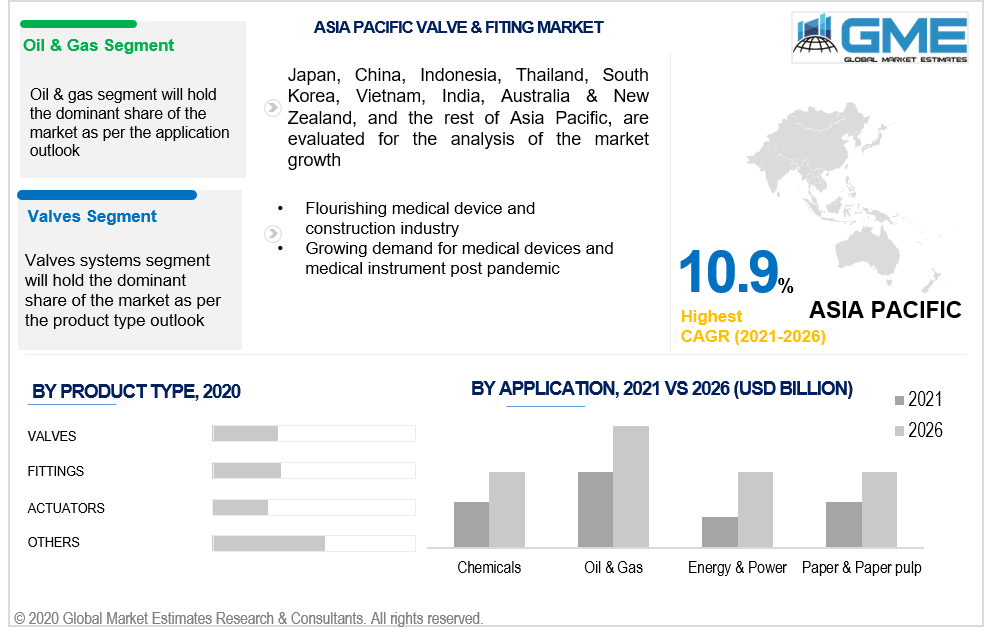

Based on the type of product, the market can be segmented into valves, fittings, actuators and others. Valves segment is expected to grow with the highest CAGR from 2021 to 2026.

Major players in the industry have started investing heavily in mini-valves (used in medical industry), solenoid valves (fittings of hospital beds) and pinch valves. Moreover, the global market is witnessing a series of organic and inorganic growth strategies pertaining to valves for the top manufacturing industries. Furthermore, increasing investment in research and development to automate the production of valves for both industrial and pharmaceutical purpose would be another driver for the segment.

Based on the materials, the market is segmented into Alloy, Cast Iron, Stainless Steel and others. Stainless Steel segment is expected to dominate the market from 2021 to 2026. This is mainly due to increasing demand for industrial valves from the construction and healthcare industries.

Stainless-steel valves can be easily customised and are resistive to corrosion thereby enhancing the demand in the market. Preference of stainless over carbon steel due to its resistance from corrosion is another plus factor for the growth of the segment. Furthermore, rising concern for hygiene in manufacturing industries would boost the demand for stainless steel valves.

Based on application in which valves are used, the market is segmented into chemicals, energy and power, healthcare, oil & gas, pulp & paper, and others. Oil & gas segment is a booming industry which contributes the most to the valves and fitting market. The oil & gas segment is analyzed to be the largest and fastest growing segment in the market.

Increasing demand for energy from the top industries, flourishing transportation industry and rising demand for drilling activities in GCC countries would be some of the other drivers for the growth of the segment.

Based on region, the market can be segmented into North America (U.S., Canada, and Mexico), Europe (Germany, UK, France, and Rest of Europe), Central & South America (Brazil and Rest of Central & South America), Middle East and Africa (UAE, Saudi Arabia and Rest of Middle East & Africa), and Asia Pacific (China, Japan, India and Rest of Asia Pacific).

The North American region is expected to hold the lion’s share of the revenues generated in the market. The dominant presence of top instrumentation valves and fitting players in the US, and the increasing product launch strategies in Canada and Mexico are some of the factors supporting the growth of the market. Increased investment in research and development activities and rising need for automation in manufacturing units are some of the other crucial factors driving the growth of the North American market.

Asia Pacific region is expected to growth the fastest in the market majorly due to rapidly increasing population, rising demand for instrumentation valves and fittings from healthcare, oil & gas industries and rising government initiatives and support for waste water treatment. Surge in demand for instrumentation valves and fittings for manufacturing units based out in developing countries would help in growth of the market. However, Covid 19 adversely affected this region as many of the industries had to close doors due to huge supply and demand gap.

Bray International, Waverly Bronall, Alco Valves Group, Brennen Industries, Parker Hannifin, CIRCOR international, AS-Schneider, Hex International, Fuijikin Incorporated, Dwyer Instruments, SSP Fittings Corporation, Richard Industries, Ham-Let Group, Safelock and Swagelok among others are the key players in the instrumentation valves and fitting market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Instrumentation Valves and Fitting Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Product Type Overview

2.1.3 Application Overview

2.1.4 Regional Overview

Chapter 3 Instrumentation Valves and Fitting Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Increasing demand for instrumentation valves and fittings from the construction and healthcare industry

3.3.2 Industry Challenges

3.3.2.1 Rising awareness regarding environmental concerns associated with raw materials

3.4 Prospective Growth Scenario

3.4.1 Product Type Growth Scenario

3.4.2 Application Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Instrumentation Valves and Fitting Market, By Product Type

4.1 Product Type Outlook

4.2 Valves

4.2.1 Market Size, By Region, 2020-2026 (USD Billion)

4.3 Fittings

4.3.1 Market Size, By Region, 2020-2026 (USD Billion)

4.4 Actuators

4.4.1 Market Size, By Region, 2020-2026 (USD Billion)

4.5 Others

4.5.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 5 Instrumentation Valves and Fitting Market, By Application

5.1 Application Outlook

5.2 Chemicals

5.2.1 Market Size, By Region, 2020-2026 (USD Billion)

5.3 Healthcare

5.3.1 Market Size, By Region, 2020-2026 (USD Billion)

5.4 Energy & Power

5.4.1 Market Size, By Region, 2020-2026 (USD Billion)

5.5 Oil & Gas

5.5.1 Market Size, By Region, 2020-2026 (USD Billion)

5.6 Others

5.6.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 6 Instrumentation Valves and Fitting Market, By Material

6.1 Application Outlook

6.2 Alloys

6.2.1 Market Size, By Region, 2020-2026 (USD Billion)

6.3 Stainless Steel

6.3.1 Market Size, By Region, 2020-2026 (USD Billion)

6.4 Cast iron

6.4.1 Market Size, By Region, 2020-2026 (USD Billion)

6.5 Others

6.5.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 7 Instrumentation Valves and Fitting Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2020-2026 (USD Billion)

7.2.2 Market Size, By Product Type, 2020-2026 (USD Billion)

7.2.3 Market Size, By Application, 2020-2026 (USD Billion)

7.2.4 U.S.

7.2.4.1 Market Size, By Product Type, 2020-2026 (USD Billion)

7.2.4.2 Market Size, By Application, 2020-2026 (USD Billion)

7.2.5 Canada

7.2.5.1 Market Size, By Product Type, 2020-2026 (USD Billion)

7.2.5.2 Market Size, By Application, 2020-2026 (USD Billion)

7.3 Europe

7.3.1 Market Size, By Country 2020-2026 (USD Billion)

7.3.2 Market Size, By Product Type, 2020-2026 (USD Billion)

7.3.3 Market Size, By Application, 2020-2026 (USD Billion)

7.3.4 Germany

7.3.4.1 Market Size, By Product Type, 2020-2026 (USD Billion)

7.3.4.2 Market Size, By Application, 2020-2026 (USD Billion)

7.3.5 UK

7.3.5.1 Market Size, By Product Type, 2020-2026 (USD Billion)

7.3.5.2 Market Size, By Application, 2020-2026 (USD Billion)

7.3.6 France

7.3.6.1 Market Size, By Product Type, 2020-2026 (USD Billion)

7.3.6.2 Market Size, By Application, 2020-2026 (USD Billion)

7.3.7 Italy

7.3.7.1 Market Size, By Product Type, 2020-2026 (USD Billion)

7.3.7.2 Market Size, By Application, 2020-2026 (USD Billion)

7.3.8 Spain

7.3.8.1 Market Size, By Product Type, 2020-2026 (USD Billion)

7.3.8.2 Market Size, By Application, 2020-2026 (USD Billion)

7.3.9 Russia

7.3.9.1 Market Size, By Product Type, 2020-2026 (USD Billion)

7.3.9.2 Market Size, By Application, 2020-2026 (USD Billion)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2020-2026 (USD Billion)

7.4.2 Market Size, By Product Type, 2020-2026 (USD Billion)

7.4.3 Market Size, By Application, 2020-2026 (USD Billion)

7.4.4 China

7.4.4.1 Market Size, By Product Type, 2020-2026 (USD Billion)

7.4.4.2 Market Size, By Application, 2020-2026 (USD Billion)

7.4.5 India

7.4.5.1 Market Size, By Product Type, 2020-2026 (USD Billion)

7.4.5.2 Market Size, By Application, 2020-2026 (USD Billion)

7.4.6 Japan

7.4.6.1 Market Size, By Product Type, 2020-2026 (USD Billion)

7.4.6.2 Market Size, By Application, 2020-2026 (USD Billion)

7.4.7 Australia

7.4.7.1 Market Size, By Product Type, 2020-2026 (USD Billion)

7.4.7.2 Market size, By Application, 2020-2026 (USD Billion)

7.4.8 South Korea

7.4.8.1 Market Size, By Product Type, 2020-2026 (USD Billion)

7.4.8.2 Market Size, By Application, 2020-2026 (USD Billion)

7.5 Latin America

7.5.1 Market Size, By Country 2020-2026 (USD Billion)

7.5.2 Market Size, By Product Type, 2020-2026 (USD Billion)

7.5.3 Market Size, By Application, 2020-2026 (USD Billion)

7.5.4 Brazil

7.5.4.1 Market Size, By Product Type, 2020-2026 (USD Billion)

7.5.4.2 Market Size, By Application, 2020-2026 (USD Billion)

7.5.5 Mexico

7.5.5.1 Market Size, By Product Type, 2020-2026 (USD Billion)

7.5.5.2 Market Size, By Application, 2020-2026 (USD Billion)

7.5.6 Argentina

7.5.6.1 Market Size, By Product Type, 2020-2026 (USD Billion)

7.5.6.2 Market Size, By Application, 2020-2026 (USD Billion)

7.6 MEA

7.6.1 Market Size, By Country 2020-2026 (USD Billion)

7.6.2 Market Size, By Product Type, 2020-2026 (USD Billion)

7.6.3 Market Size, By Application, 2020-2026 (USD Billion)

7.6.4 Saudi Arabia

7.6.4.1 Market Size, By Product Type, 2020-2026 (USD Billion)

7.6.4.2 Market Size, By Application, 2020-2026 (USD Billion)

7.6.5 UAE

7.6.5.1 Market Size, By Product Type, 2020-2026 (USD Billion)

7.6.5.2 Market Size, By Application, 2020-2026 (USD Billion)

7.6.6 South Africa

7.6.6.1 Market Size, By Product Type, 2020-2026 (USD Billion)

7.6.6.2 Market Size, By Application, 2020-2026 (USD Billion)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 Waverly Bronall

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Info Graphic Analysis

8.3 Bray International

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info Graphic Analysis

8.4 CIRCOR international

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info Graphic Analysis

8.5 AS-Schneider

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info Graphic Analysis

8.6 Hex International

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info Graphic Analysis

8.7 Fuijikin Incorporated

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info Graphic Analysis

8.8 SSP Fittings Corporation

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.9 Other Companies

8.9.1 Company Overview

8.9.2 Financial Analysis

8.9.3 Strategic Positioning

8.9.4 Info Graphic Analysis

The Global Instrumentation Valves and Fitting Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Instrumentation Valves and Fitting Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS