Global Intelligent Sprayer Market Size, Trends & Analysis - Forecasts to 2026 By Application (Row Crops, Arboriculture, Viticulture, and Horticulture), By Size of the Farms (Small-Sized Farms and Large-Sized Farms), By Mobility (Mounted, Self-Propelled, and Trailed), By Capacity (Ultra-low Volume, Low Volume, and High Volume), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Company Market Share Analysis, and Competitor Analysis

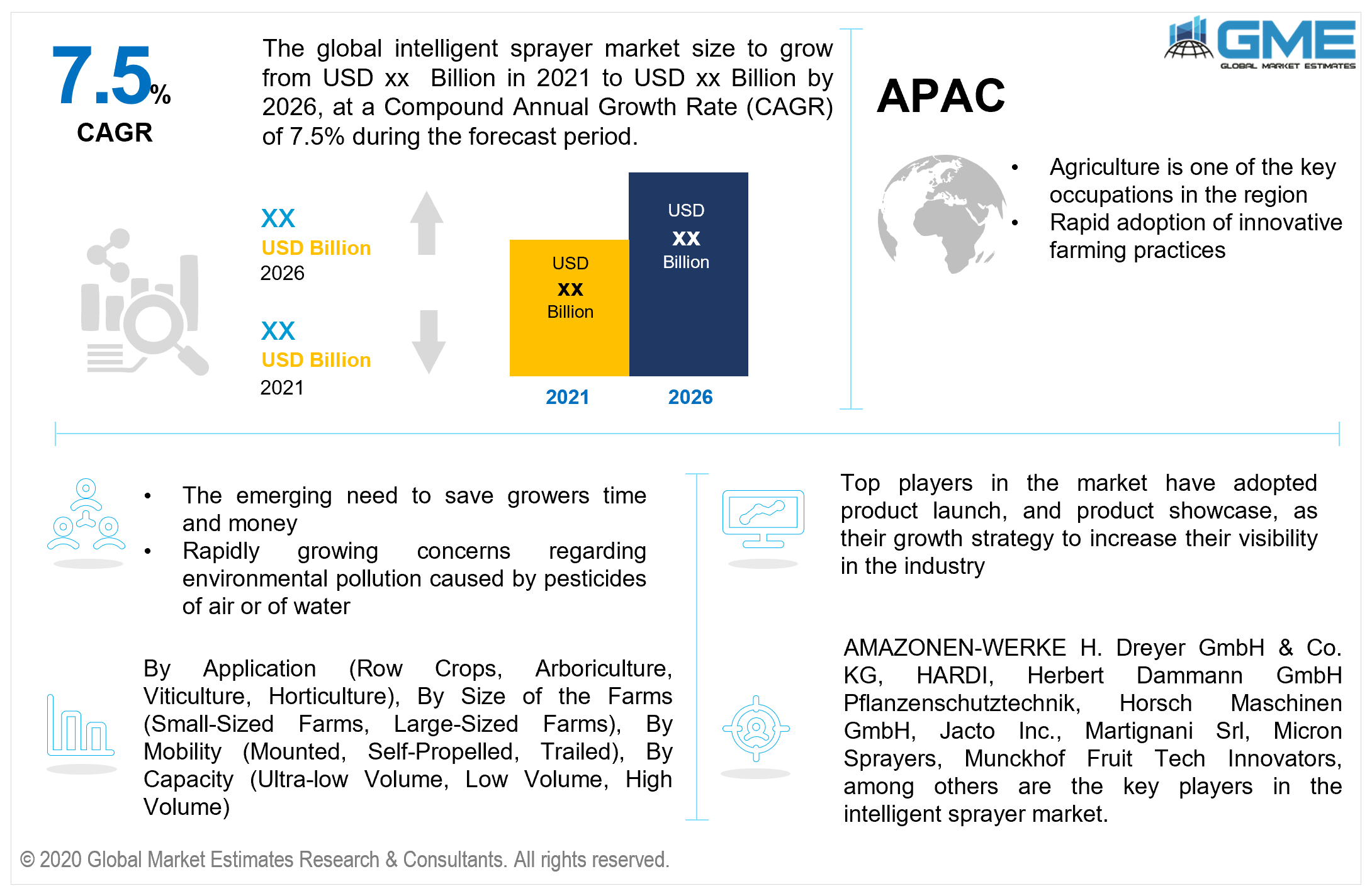

The global intelligent sprayer market is projected to grow at a CAGR value of 7.5% between 2021 to 2026. Spray treatments are an agriculturally important protection tool in the agricultural industry. They have aided in the production of a plethora of fruit crops and are a vital aspect of crop production. Pesticide treatments have ensured that high-quality goods from the fruit and nursery sectors fulfill stringent market standards.

Unfortunately, current spray systems are inefficient. The number of inefficiencies and inaccuracies in orchard and nursery applications is considerably higher than that in agricultural crops sprayers. Most young crops are over-sprayed when conventional spray equipment and mass flow predictions are used. Less than 30% of pesticides sprayed reach the juvenile canopy, with the remainder being lost. Pesticides are frequently used by nurseries at a cost of $500 to $1000 per acre annually. There is no uniform distribution system or strategy which can tackle all of these complicated differences. The majority of pesticides administered with current sprayers are lost due to off-target effects such as airborne dispersion, sedimental scatter, drainage, and absorption.

Studies by the United States Department of Agriculture (USDA) and The Ohio State University's College of Food, Agricultural, and Environmental Sciences (CFAES) indicated that intelligent sprayers can effectively remove such shortfalls and help to reduce air-borne moisture loss by up to 87%, spray deficit on the surface by up to 93%, and herbicide use by more than 50%.

The emerging need to save growers time and money along with rapidly growing concerns regarding environmental pollution caused by the presence of pesticides in air or water is driving the need for intelligent sprayers during the forecast period. Plantation producers who have employed the intelligent sprayer report yearly chemical reductions of roughly $230 per acre by lowering overall pesticide consumption. Given these huge pesticide expense advantages, a planter with a 100-acre field will see returns on the cost of intelligent sprayers in less than a year.

The market is also expanding due to significant alterations in farming and spraying innovations, as well as the use of agro-based sprayers in the spraying of weedkillers, fumigants, pesticides, and chemical fertilizer to crop production for higher yield and safety from crop-damaging microbes, which are driving the market growth during the forecast period.

There is a significant dearth of understanding among farmers concerning new industrial technologies. Farmers are often adopting obsolete and useless technology instead of current models leading to a shortage of awareness of current ones. The expansion of the power tool market is projected to be hampered as a result of this.

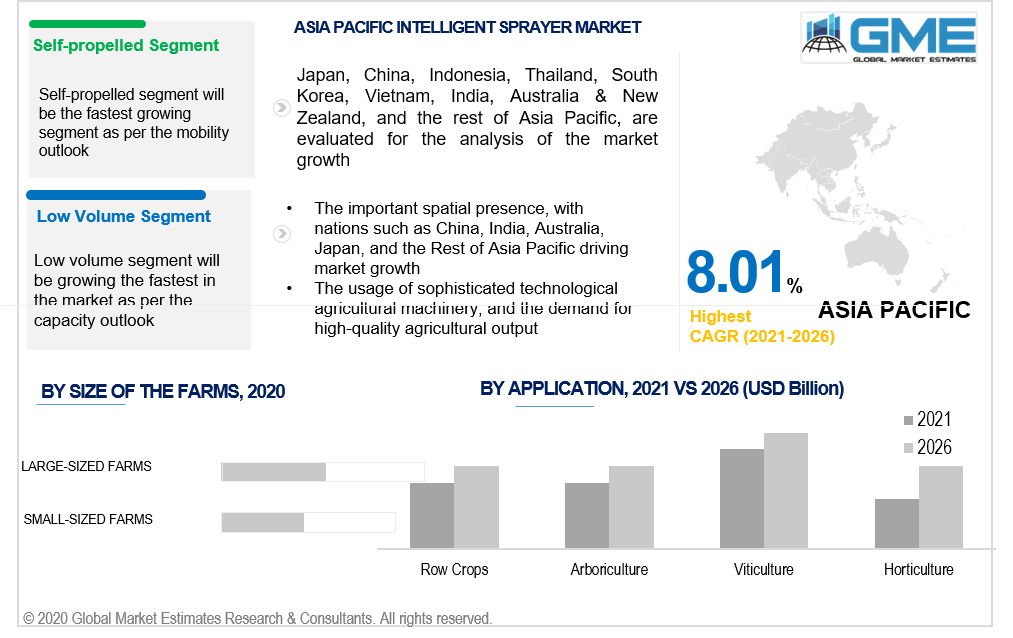

Based on the application, the market is segmented into row crops, arboriculture, viticulture, horticulture. The application of intelligent sprayers for viticulture is estimated to grow rapidly during the forecast period. The increase can be attributed to its increased use in orchard and vineyard cultivation, as this technology progresses spray penetration depth in the targeted area and diminishes off-target application. The use of intelligent sprayers is also rapidly increasing, as it minimizes harmful emissions during pesticide application in vineyards.

Based on the size of the farms, the market is segmented into small-sized farms and large-sized farms. The large-sized farms are expected to hold the largest share of the market. Large-scale farms tend to adopt technological innovations faster owing to their greater revenue and spending powers. Other factors for the high tendency of technologies in large-sized farms include better return on investment (ROI), versatility in the interconnection of software tools in hardware equipment, and a great investment in the cost of labor with the use of automated systems.

Based on the mobility, the market is segmented into mounted, self-propelled, and trailed. The self-propelled segment is expected to hold the lion’s share of the market. Self-propelled sprayers are adapted to address crop productivity demands on a wide scale. The tank capacity in such sprayers is substantially more than other types of sprayers, which enhances spray duration while decreasing transit time and barrel filling time.

Based on the capacity, the market is segmented into ultra-low volume, low volume, high volume. The market for low-volume sprays is estimated to have the largest share in the market during the forecast period. This increase can be due to the usage of low-volume sprayers to minimize the volume of spray solutions are needed. This sort of spraying is employed when there is a paucity of water and when treating big regions in a short span of time.

Around 1950, low-volume spraying was devised, primarily for the treatment of herbicides, wherein 10 or 20 gallons of water, turned into fine droplets, carried the pesticide.

Based on region, the market can be broken into various regions such as North America, Europe, Central and South America, Middle East and North Africa, and Asia Pacific regions.

The North American region is expected to be the dominant force in the market during the forecast period and hold the fastest growth rate among all regions. Europe also makes a substantial contribution to the total expansion of the intelligent sprayer market.

The Netherlands controls a sizable portion of Europe's intelligent sprayer business. The region is one of Europe's leading vegetable producers. The requirement for innovative sprayers in Europe is primarily driven by a rise in the desire for crop yield enhancement.

During the forecast period, the Asia Pacific region is also estimated to grow rapidly as agriculture is regarded as one of the key occupations in the Asia Pacific region, and it has an important spatial presence, with nations such as China, India, Australia, Japan, and the Rest of the Asia Pacific driving market growth. Furthermore, the region's intelligent sprayers market is predicted to be driven by rising farming practices, the usage of sophisticated technological agricultural machinery, and the demand for high-quality agricultural output. India is also expected to be the region's fastest-growing market. In India, the rate of adoption of agricultural machinery is rapidly increasing. It is a leading supplier of cereals like sorghum and pearl millet.

AMAZONEN-WERKE H. Dreyer GmbH & Co. KG, HARDI, Herbert Dammann GmbH Pflanzenschutztechnik, Horsch Maschinen GmbH, Jacto Inc., Martignani Srl, Micron Sprayers, Munckhof Fruit Tech Innovators, Bilberry, Exel Industries, Smart Guided Systems LLC., Greeneye Technology, Blue River Technology, Farmtario, Green Gorilla, among others are the key players in the intelligent sprayer market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Intelligent Sprayer Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Size of the Farms Overview

2.1.3 Mobility Overview

2.1.4 Application Overview

2.1.5 Capacity Overview

2.1.6 Regional Overview

Chapter 3 Intelligent Sprayer Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Advancements and significant alterations in farming and spraying innovations

3.3.2 Industry Challenges

3.3.2.1 There is a significant dearth of understanding among farmers concerning new industrial technologies.

3.4 Prospective Growth Scenario

3.4.1 Size of the Farms Growth Scenario

3.4.2 Mobility Growth Scenario

3.4.3 Application Growth Scenario

3.4.4 Capacity Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 End-User Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Intelligent Sprayer Market, By Size of the Farms

4.1 Size of the Farms Outlook

4.2 Small-Sized Farms

4.2.1 Market Size, By Region, 2020-2026 (USD Billion)

4.3 Large-Sized Farms

4.3.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 5 Intelligent Sprayer Market, By Application

5.1 Application Outlook

5.2 Row Crops

5.2.1 Market Size, By Region, 2020-2026 (USD Billion)

5.3 Arboriculture

5.3.1 Market Size, By Region, 2020-2026 (USD Billion)

5.4 Viticulture

5.4.1 Market Size, By Region, 2020-2026 (USD Billion)

5.5 Horticulture

5.5.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 6 Intelligent Sprayer Market, By Capacity

6.1 Ultra-low Volume

6.1.1 Market Size, By Region, 2020-2026 (USD Billion)

6.2 Low Volume

6.2.1 Market Size, By Region, 2020-2026 (USD Billion)

6.3 High Volume

6.3.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 7 Intelligent Sprayer Market, By Mobility

7.1 Mounted

7.1.1 Market Size, By Region, 2020-2026 (USD Billion)

7.2 Self-Propelled

7.2.1 Market Size, By Region, 2020-2026 (USD Billion)

7.3 Trailed

7.3.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 8 Intelligent Sprayer Market, By Region

8.1 Regional outlook

8.2 North America

8.2.1 Market Size, By Country 2020-2026 (USD Billion)

8.2.2 Market Size, By Size of the Farms, 2020-2026 (USD Billion)

8.2.3 Market Size, By Application, 2020-2026 (USD Billion)

8.2.4 Market Size, By Mobility, 2020-2026 (USD Billion)

8.2.5 Market Size, By Capacity, 2020-2026 (USD Billion)

8.2.6 U.S.

8.2.6.1 Market Size, By Size of the Farms, 2020-2026 (USD Billion)

8.2.4.2 Market Size, By Application, 2020-2026 (USD Billion)

8.2.4.3 Market Size, By Mobility, 2020-2026 (USD Billion)

8.2.4.4 Market Size, By Capacity, 2020-2026 (USD Billion)

8.2.7 Canada

8.2.7.1 Market Size, By Size of the Farms, 2020-2026 (USD Billion)

8.2.7.2 Market Size, By Application, 2020-2026 (USD Billion)

8.2.7.3 Market Size, By Mobility, 2020-2026 (USD Billion)

8.2.7.4 Market Size, By Capacity, 2020-2026 (USD Billion)

8.3 Europe

8.3.1 Market Size, By Size of the Farms, 2020-2026 (USD Billion)

8.3.2 Market Size, By Application, 2020-2026 (USD Billion)

8.3.3 Market Size, By Mobility, 2020-2026 (USD Billion)

8.3.4 Market Size, By Capacity, 2020-2026 (USD Billion)

8.3.5 Market Size, By Country 2020-2026 (USD Billion)

8.3.6 Germany

8.3.6.1 Market Size, By Size of the Farms, 2020-2026 (USD Billion)

8.3.6.2 Market Size, By Application, 2020-2026 (USD Billion)

8.3.6.3 Market Size, By Mobility, 2020-2026 (USD Billion)

8.3.6.4 Market Size, By Capacity, 2020-2026 (USD Billion)

8.3.7 UK

8.3.7.1 Market Size, By Size of the Farms, 2020-2026 (USD Billion)

8.3.7.2 Market Size, By Application, 2020-2026 (USD Billion)

8.3.7.3 Market Size, By Mobility, 2020-2026 (USD Billion)

8.3.7.4 Market Size, By Capacity, 2020-2026 (USD Billion)

8.3.8 France

8.3.8.1 Market Size, By Size of the Farms, 2020-2026 (USD Billion)

8.3.8.2 Market Size, By Application, 2020-2026 (USD Billion)

8.3.8.3 Market Size, By Mobility, 2020-2026 (USD Billion)

8.3.8.4 Market Size, By Capacity, 2020-2026 (USD Billion)

8.3.9 Italy

8.3.9.1 Market Size, By Size of the Farms, 2020-2026 (USD Billion)

8.3.9.2 Market Size, By Application, 2020-2026 (USD Billion)

8.3.9.3 Market Size, By Mobility, 2020-2026 (USD Billion)

8.3.9.4 Market Size, By Capacity, 2020-2026 (USD Billion)

8.3.10 Spain

8.3.10.1 Market Size, By Size of the Farms, 2020-2026 (USD Billion)

8.3.10.2 Market Size, By Application, 2020-2026 (USD Billion)

8.3.10.3 Market Size, By Mobility, 2020-2026 (USD Billion)

8.3.10.4 Market Size, By Capacity, 2020-2026 (USD Billion)

8.3.11 Russia

8.3.11.1 Market Size, By Size of the Farms, 2020-2026 (USD Billion)

8.3.11.2 Market Size, By Application, 2020-2026 (USD Billion)

8.3.11.3 Market Size, By Mobility, 2020-2026 (USD Billion)

8.3.11.4 Market Size, By Capacity, 2020-2026 (USD Billion)

8.4 Asia Pacific

8.4.1 Market Size, By Size of the Farms, 2020-2026 (USD Billion)

8.4.2 Market Size, By Application, 2020-2026 (USD Billion)

8.4.3 Market Size, By Mobility, 2020-2026 (USD Billion)

8.4.4 Market Size, By Capacity, 2020-2026 (USD Billion)

8.4.5 Market Size, By Country 2020-2026 (USD Billion)

8.4.6 China

8.4.6.1 Market Size, By Size of the Farms, 2020-2026 (USD Billion)

8.4.6.2 Market Size, By Application, 2020-2026 (USD Billion)

8.4.6.3 Market Size, By Mobility, 2020-2026 (USD Billion)

8.4.6.4 Market Size, By Capacity, 2020-2026 (USD Billion)

8.4.7 India

8.4.7.1 Market Size, By Size of the Farms, 2020-2026 (USD Billion)

8.4.7.2 Market Size, By Application, 2020-2026 (USD Billion)

8.4.7.3 Market Size, By Mobility, 2020-2026 (USD Billion)

8.4.7.4 Market Size, By Capacity, 2020-2026 (USD Billion)

8.4.8 Japan

8.4.8.1 Market Size, By Size of the Farms, 2020-2026 (USD Billion)

8.4.8.2 Market Size, By Application, 2020-2026 (USD Billion)

8.4.8.3 Market Size, By Mobility, 2020-2026 (USD Billion)

8.4.8.4 Market Size, By Capacity, 2020-2026 (USD Billion)

8.4.9 Australia

8.4.9.1 Market Size, By Size of the Farms, 2020-2026 (USD Billion)

8.4.9.2 Market size, By Application, 2020-2026 (USD Billion)

8.4.9.3 Market Size, By Mobility, 2020-2026 (USD Billion)

8.4.9.4 Market Size, By Capacity, 2020-2026 (USD Billion)

8.4.10 South Korea

8.4.10.1 Market Size, By Size of the Farms, 2020-2026 (USD Billion)

8.4.10.2 Market Size, By Application, 2020-2026 (USD Billion)

8.4.10.3 Market Size, By Mobility, 2020-2026 (USD Billion)

8.4.10.4 Market Size, By Capacity, 2020-2026 (USD Billion)

8.5 Latin America

8.5.1 Market Size, By Size of the Farms, 2020-2026 (USD Billion)

8.5.2 Market Size, By Application, 2020-2026 (USD Billion)

8.5.3 Market Size, By Mobility, 2020-2026 (USD Billion)

8.5.4 Market Size, By Capacity, 2020-2026 (USD Billion)

8.5.5 Market Size, By Country 2020-2026 (USD Billion)

8.5.6 Brazil

8.5.6.1 Market Size, By Size of the Farms, 2020-2026 (USD Billion)

8.5.6.2 Market Size, By Application, 2020-2026 (USD Billion)

8.5.6.3 Market Size, By Mobility, 2020-2026 (USD Billion)

8.5.6.4 Market Size, By Capacity, 2020-2026 (USD Billion)

8.5.7 Mexico

8.5.7.1 Market Size, By Size of the Farms, 2020-2026 (USD Billion)

8.5.7.2 Market Size, By Application, 2020-2026 (USD Billion)

8.5.7.3 Market Size, By Mobility, 2020-2026 (USD Billion)

8.5.7.4 Market Size, By Capacity, 2020-2026 (USD Billion)

8.5.8 Argentina

8.5.8.1 Market Size, By Size of the Farms, 2020-2026 (USD Billion)

8.5.8.2 Market Size, By Application, 2020-2026 (USD Billion)

8.5.8.3 Market Size, By Mobility, 2020-2026 (USD Billion)

8.5.8.4 Market Size, By Capacity, 2020-2026 (USD Billion)

8.6 MEA

8.6.1 Market Size, By Size of the Farms, 2020-2026 (USD Billion)

8.6.2 Market Size, By Application, 2020-2026 (USD Billion)

8.6.3 Market Size, By Mobility, 2020-2026 (USD Billion)

8.6.4 Market Size, By Capacity, 2020-2026 (USD Billion)

8.6.5 Market Size, By Country 2020-2026 (USD Billion)

8.6.6 Saudi Arabia

8.6.6.1 Market Size, By Size of the Farms, 2020-2026 (USD Billion)

8.6.6.2 Market Size, By Application, 2020-2026 (USD Billion)

8.6.6.3 Market Size, By Mobility, 2020-2026 (USD Billion)

8.6.6.4 Market Size, By Capacity, 2020-2026 (USD Billion)

8.6.7 UAE

8.6.7.1 Market Size, By Size of the Farms, 2020-2026 (USD Billion)

8.6.7.2 Market Size, By Application, 2020-2026 (USD Billion)

8.6.7.3 Market Size, By Mobility, 2020-2026 (USD Billion)

8.6.7.4 Market Size, By Capacity, 2020-2026 (USD Billion)

8.6.8 South Africa

8.6.8.1 Market Size, By Size of the Farms, 2020-2026 (USD Billion)

8.6.8.2 Market Size, By Application, 2020-2026 (USD Billion)

8.6.8.3 Market Size, By Mobility, 2020-2026 (USD Billion)

8.6.8.4 Market Size, By Capacity, 2020-2026 (USD Billion)

Chapter 9 Company Landscape

9.1 Competitive Analysis, 2020

9.2 AMAZONEN-WERKE H. Dreyer GmbH & Co

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Strategic Positioning

9.2.4 Info Graphic Analysis

9.3 HARDI

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Strategic Positioning

9.3.4 Info Graphic Analysis

9.4 Herbert Dammann GmbH Pflanzenschutztechnik

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Strategic Positioning

9.4.4 Info Graphic Analysis

9.5 Horsch Maschinen GmbH

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Strategic Positioning

9.5.4 Info Graphic Analysis

9.6 Jacto Inc

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Strategic Positioning

9.6.4 Info Graphic Analysis

9.7 Martignani Srl, Micron Sprayers

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Strategic Positioning

9.7.4 Info Graphic Analysis

9.8 Munckhof Fruit Tech Innovators

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Strategic Positioning

9.8.4 Info Graphic Analysis

9.9 Bilberry

9.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Strategic Positioning

9.9.4 Info Graphic Analysis

9.10 Exel Industries

9.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Strategic Positioning

9.10.4 Info Graphic Analysis

9.11 Smart Guided Systems LLC

9.11.1 Company Overview

9.11.2 Financial Analysis

9.11.3 Strategic Positioning

9.11.4 Info Graphic Analysis

9.12 Greeneye Technology

9.12.1 Company Overview

9.12.2 Financial Analysis

9.12.3 Strategic Positioning

9.12.4 Info Graphic Analysis

9.13 Blue River Technology

9.13.1 Company Overview

9.13.2 Financial Analysis

9.13.3 Strategic Positioning

9.13.4 Info Graphic Analysis

9.14 Farmtario

9.14.1 Company Overview

9.14.2 Financial Analysis

9.14.3 Strategic Positioning

9.14.4 Info Graphic Analysis

9.15 Green Gorilla

9.15.1 Company Overview

9.15.2 Financial Analysis

9.15.3 Strategic Positioning

9.15.4 Info Graphic Analysis

9.16 Other Companies

9.16.1 Company Overview

9.16.2 Financial Analysis

9.16.3 Strategic Positioning

9.16.4 Info Graphic Analysis

The Global Intelligent Sprayer Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Intelligent Sprayer Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS