Global Ion Chromatography Market Size, Trends & Analysis - Forecasts to 2026 By Technology (Ion-exchange Chromatography, Ion-exclusion Chromatography, Ion-pair Chromatography), By Application (Environmental Testing, Pharmaceutical Industry, Food Industry, Chemicals Industry, Other Applications), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Competitive Landscape Company Market Share Analysis, and Competitor Analysis

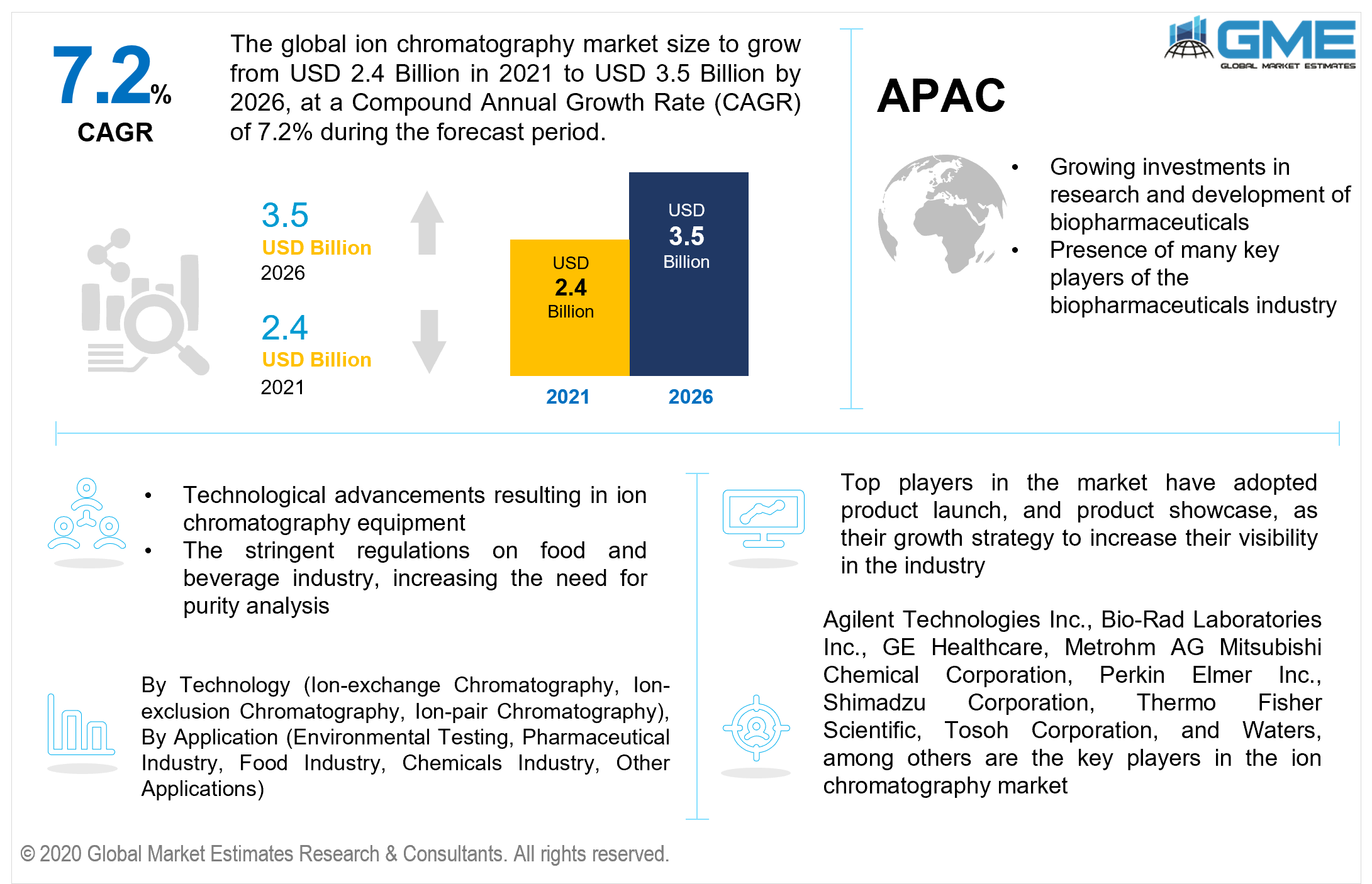

The global ion chromatography market is projected to grow from USD 2.4 billion in 2021 to USD 3.5 billion by 2026 at a CAGR value of 7.2% between 2021 to 2026. Ion chromatography is used to analyze the concentrates of samples through the separation of ions and polar molecule mechanism. The ion chromatography market has been growing steadily owing to the increased need for ion chromatography applications such as water purification, purification of monoclonal antibodies, and their growing application in the food and beverages industry. As this equipment allows to analyze the concentration and presence of constituents in the sample, they are used in the food and beverages industry to ensure product quality and safety. Ion chromatography is widely used in research institutions to study the concentrations of samples.

The rising investment in research and development activities for the development of novel materials, pharmaceuticals, and other compounds are expected to increase the demand for these products in the market. The growing demand for water purity and other purity analysis from various environmental and health agencies across the globe are expected to support the market growth.

The diagnostic tools are used extensively in the biopharmaceuticals industry as well to ensure the quality of pharmaceutical products. The ability of the equipment that allows for the analysis of liquid and gaseous samples has been vital in the widespread usage of ion chromatography. The COVID-19 pandemic has reduced expenditure on new equipment procurement, caused production shutdowns, and various products that were being developed had to be pushed back. The market for this equipment is expected to bounce back during the post-pandemic period. The growing investment in pharmaceutical research and development will further enhance the growth of the ion chromatography market during the forecast period. The market is restrained by the high initial cost of this equipment, a standard ion chromatography equipment starts from USD 4,000. Based on the application, their price increases in order to meet the application requirement and working environmental conditions required by the consumer.

The lack of availability of skilled professionals capable of running ion chromatography equipment will also hamper and restrain the growth of the market during the forecast period.

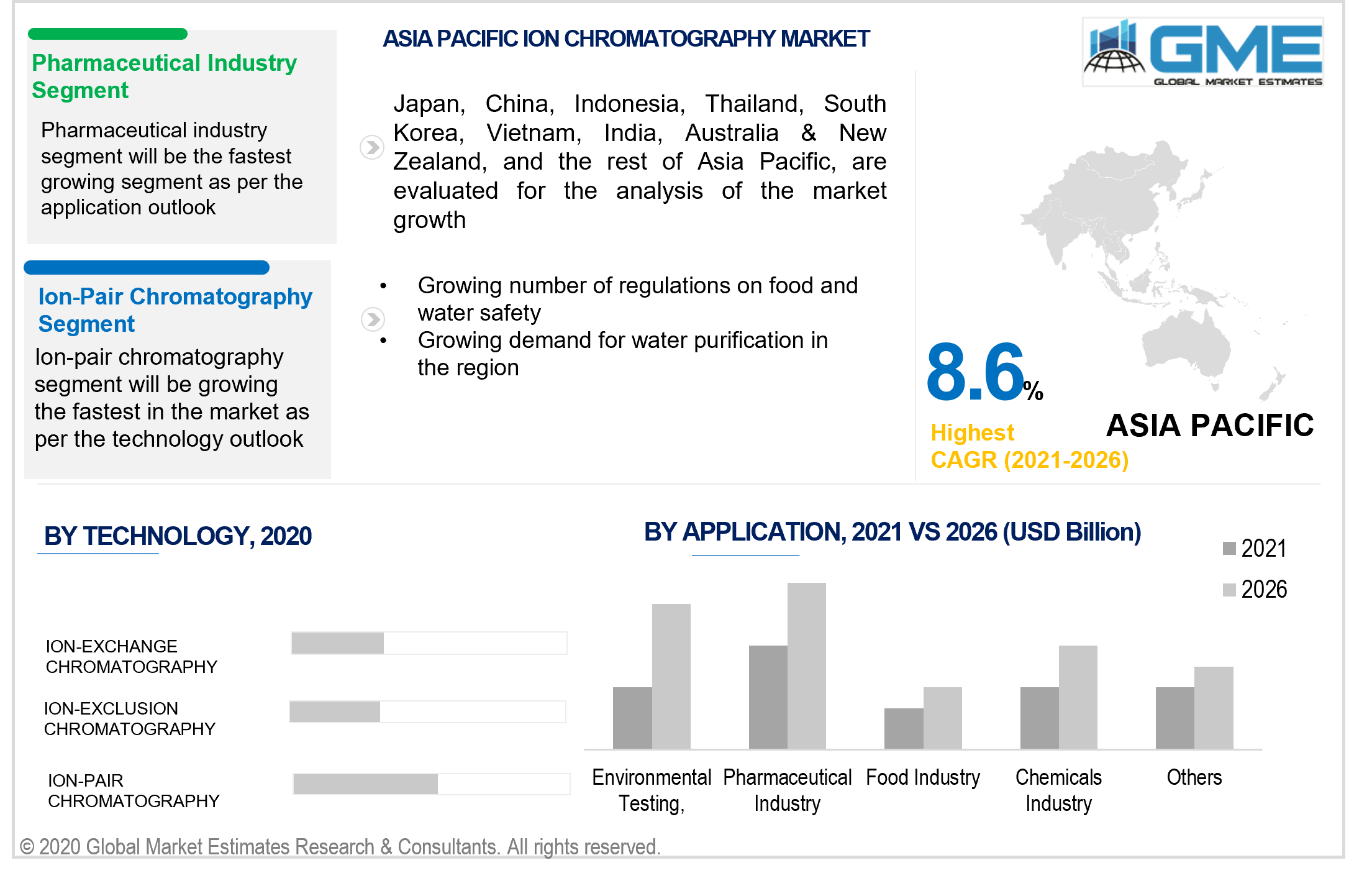

Based on the technology employed by this equipment, the market is segmented into ion-exchange chromatography, ion-exclusion chromatography, and ion-pair chromatography. The ion-pair chromatography segment is expected to hold the dominant share of the market in terms of revenue. The Ion-pair chromatography segment allows for faster analysis and more precise detection. The ability of this technique to simultaneously separate ionized and non-ionized molecules has contributed to their widespread usage in various end-use applications. While the cost of the technique is higher, the better results obtained from this technique are envisaged to result in the ion-pair chromatography segment showing the best growth rates among all segments during the forecast period.

Based on the various applications in which ion chromatography is used, the market is segmented into environmental testing, pharmaceutical industry, food industry, chemicals industry, and other applications. The pharmaceuticals industry is expected to hold the largest share of the market during the forecast period. Growing applications of monoclonal antibodies and their derivatives in the pharmaceuticals industry have been one of the major drivers of this segment during the forecast period. Ion chromatography is a reliable and quick method of ensuring monoclonal antibodies and separating them from their media through repeated chromatography, monoclonal antibodies can be purified. The stringent regulations on quality and the adverse impacts of impurities in the biopharmaceuticals industry have been the major driver of this segment. The pharmaceutical industry segment is also expected to grow much faster than any other segment during the forecast period as well.

Based on region, the market can be segmented into various regions such as North America, Europe, Central & South America, Middle East & South Africa, and Asia Pacific regions. The North American region is expected to be the dominant force in the market during the forecast period. The large investments in the research and development of novel biopharmaceuticals and the presence of key players in the pharmaceuticals industry in the region have been crucial to the dominance of the region’s market in the ion chromatography market. Stringent government regulations on food, beverages, and water also have a hand in the large demand for ion chromatography equipment in the region. Use of ion chromatography for testing purity and concentrations of impurities in samples are important factors of the growth of the North American ion chromatography market.

The APAC region is expected to show the fastest growth rates during the forecast period followed by Europe. The growing investments in research and development activities by public and private entities in the APAC region are expected to have a positive impact on the development of the ion chromatography market in the region. Growing demand for water purity testing as governments look to combat the growing water pollution levels in countries like China and India are expected to increase the demand for ion chromatography in the region.

The growing number of governmental and non-profit agencies that are involved in purity testing and ensuring the quality of the products sold in the region especially in the food and beverages industry is also expected to have hands in the growth of the ion chromatography market in the APAC region.

Agilent Technologies Inc., Bio-Rad Laboratories Inc., GE Healthcare, Metrohm AG, Mitsubishi Chemical Corporation, Perkin Elmer Inc., Shimadzu Corporation, Thermo Fisher Scientific, Tosoh Corporation, and Waters, among others are the key players in the ion chromatography market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Ion Chromatography Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Application Overview

2.1.3 Technology Overview

2.1.4 Regional Overview

Chapter 3 Ion Chromatography Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Technological advancement in ion chromatography

3.3.2 Industry Challenges

3.3.2.1 High cost of ion chromatography equipment in APAC region

3.4 Prospective Growth Scenario

3.4.1 Application Growth Scenario

3.4.2 Technology Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Ion Chromatography Market, By Application

4.1 Application Outlook

4.2 Environmental Testing

4.2.1 Market Size, By Region, 2020-2026 (USD Billion)

4.3 Autotransformer

4.3.1 Market Size, By Region, 2020-2026 (USD Billion)

4.4 Pharmaceutical Industry

4.4.1 Market Size, By Region, 2020-2026 (USD Billion)

4.5 Food Industry

4.5.1 Market Size, By Region, 2020-2026 (USD Billion)

4.6 Chemicals Industry

4.6.1 Market Size, By Region, 2020-2026 (USD Billion)

4.7 Other Applications

4.7.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 5 Ion Chromatography Market, By Technology

5.1 Technology Outlook

5.2 Ion-exchange Chromatography

5.2.1 Market Size, By Region, 2020-2026 (USD Billion)

5.3 Ion-exclusion Chromatography

5.3.1 Market Size, By Region, 2020-2026 (USD Billion)

5.4 Ion-pair Chromatography

5.4.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 6 Ion Chromatography Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2020-2026 (USD Billion)

6.2.2 Market Size, By Application, 2020-2026 (USD Billion)

6.2.3 Market Size, By Technology, 2020-2026 (USD Billion)

6.2.4 U.S.

6.2.4.1 Market Size, By Application, 2020-2026 (USD Billion)

6.2.4.2 Market Size, By Technology, 2020-2026 (USD Billion)

6.2.5 Canada

6.2.5.1 Market Size, By Application, 2020-2026 (USD Billion)

6.2.5.2 Market Size, By Technology, 2020-2026 (USD Billion)

6.3 Europe

6.3.1 Market Size, By Country 2020-2026 (USD Billion)

6.3.2 Market Size, By Application, 2020-2026 (USD Billion)

6.3.3 Market Size, By Technology, 2020-2026 (USD Billion)

6.3.4 Germany

6.3.4.1 Market Size, By Application, 2020-2026 (USD Billion)

6.3.4.2 Market Size, By Technology, 2020-2026 (USD Billion)

6.3.5 UK

6.3.5.1 Market Size, By Application, 2020-2026 (USD Billion)

6.3.5.2 Market Size, By Technology, 2020-2026 (USD Billion)

6.3.6 France

6.3.6.1 Market Size, By Application, 2020-2026 (USD Billion)

6.3.6.2 Market Size, By Technology, 2020-2026 (USD Billion)

6.3.7 Italy

6.3.7.1 Market Size, By Application, 2020-2026 (USD Billion)

6.3.7.2 Market Size, By Technology, 2020-2026 (USD Billion)

6.3.8 Spain

6.3.8.1 Market Size, By Application, 2020-2026 (USD Billion)

6.3.8.2 Market Size, By Technology, 2020-2026 (USD Billion)

6.3.9 Russia

6.3.9.1 Market Size, By Application, 2020-2026 (USD Billion)

6.3.9.2 Market Size, By Technology, 2020-2026 (USD Billion)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2020-2026 (USD Billion)

6.4.2 Market Size, By Application, 2020-2026 (USD Billion)

6.4.3 Market Size, By Technology, 2020-2026 (USD Billion)

6.4.4 China

6.4.4.1 Market Size, By Application, 2020-2026 (USD Billion)

6.4.4.2 Market Size, By Technology, 2020-2026 (USD Billion)

6.4.5 India

6.4.5.1 Market Size, By Application, 2020-2026 (USD Billion)

6.4.5.2 Market Size, By Technology, 2020-2026 (USD Billion)

6.4.6 Japan

6.4.6.1 Market Size, By Application, 2020-2026 (USD Billion)

6.4.6.2 Market Size, By Technology, 2020-2026 (USD Billion)

6.4.7 Australia

6.4.7.1 Market Size, By Application, 2020-2026 (USD Billion)

6.4.7.2 Market size, By Technology, 2020-2026 (USD Billion)

6.4.8 South Korea

6.4.8.1 Market Size, By Application, 2020-2026 (USD Billion)

6.4.8.2 Market Size, By Technology, 2020-2026 (USD Billion)

6.5 Latin America

6.5.1 Market Size, By Country 2020-2026 (USD Billion)

6.5.2 Market Size, By Application, 2020-2026 (USD Billion)

6.5.3 Market Size, By Technology, 2020-2026 (USD Billion)

6.5.4 Brazil

6.5.4.1 Market Size, By Application, 2020-2026 (USD Billion)

6.5.4.2 Market Size, By Technology, 2020-2026 (USD Billion)

6.5.5 Mexico

6.5.5.1 Market Size, By Application, 2020-2026 (USD Billion)

6.5.5.2 Market Size, By Technology, 2020-2026 (USD Billion)

6.5.6 Argentina

6.5.6.1 Market Size, By Application, 2020-2026 (USD Billion)

6.5.6.2 Market Size, By Technology, 2020-2026 (USD Billion)

6.6 MEA

6.6.1 Market Size, By Country 2020-2026 (USD Billion)

6.6.2 Market Size, By Application, 2020-2026 (USD Billion)

6.6.3 Market Size, By Technology, 2020-2026 (USD Billion)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Application, 2020-2026 (USD Billion)

6.6.4.2 Market Size, By Technology, 2020-2026 (USD Billion)

6.6.5 UAE

6.6.5.1 Market Size, By Application, 2020-2026 (USD Billion)

6.6.5.2 Market Size, By Technology, 2020-2026 (USD Billion)

6.6.6 South Africa

6.6.6.1 Market Size, By Application, 2020-2026 (USD Billion)

6.6.6.2 Market Size, By Technology, 2020-2026 (USD Billion)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 Agilent Technologies Inc.

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Info Graphic Analysis

7.3 Bio-Rad Laboratories Inc.

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Info Graphic Analysis

7.4 GE Healthcare

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Info Graphic Analysis

7.5 Metrohm AG

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Info Graphic Analysis

7.6 Mitsubishi Chemical Corporation

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 Info Graphic Analysis

7.7 Perkin Elmer Inc.

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info Graphic Analysis

7.8 Shimadzu Corporation

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Info Graphic Analysis

7.9 Thermo Fisher Scientific

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Info Graphic Analysis

7.10 Other Companies

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Info Graphic Analysis

The Global Ion Chromatography Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Ion Chromatography Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS