Global IoT in Aerospace and Defence Market Size, Trends & Analysis - Forecasts to 2026 By Component (Hardware, Software, Services), By Connectivity Technology (Cellular, Wi-Fi, Satellite Communication, Radio Frequency Identification), By Application (Real Time Fleet Management, Training & Simulation, Health Monitoring, Equipment Maintenance, Inventory Management), By End-User (Space Systems, Ground Vehicles, Others), By Region (North America, Asia Pacific, Central & South America, Europe, and the Middle East and Africa), Competitive Landscape Company Market Share Analysis, and Competitor Analysis

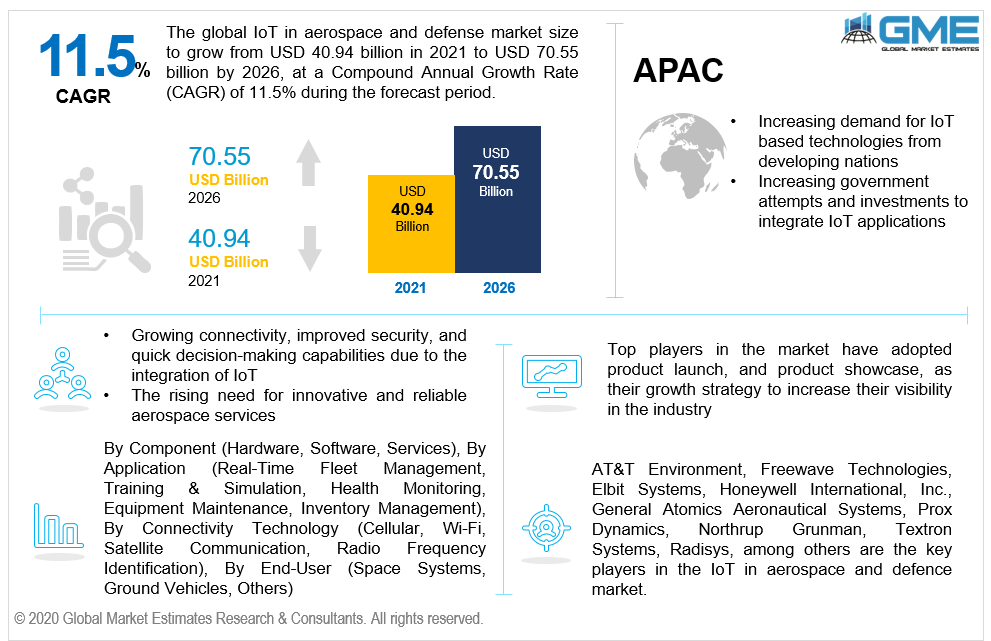

The global IoT in aerospace and defence market is projected to grow from USD 40.94 billion in 2021 to USD 70.55 billion by 2026 at a CAGR value of 11.5% from 2021 to 2026.

The Internet of Things (IoT) in today’s world offers a variety of technologies and services that help the aerospace and defence industry run more efficiently. Mobility planning, health management, inventory control, repair and maintenance, analytic tools, and other operations are some of the applications of IoT.

The growing need to implement Industry 4.0 technologies (i.e. the trend of automation and data exchange in manufacturing technologies) by transforming mobility, production and sales of products and services of the aerospace industry, and the rising need for data privacy and storage are some of the driving factors supporting the market’s growth throughout the forecast period.

The market is primarily driven by the advantages offered by IoT in terms of high connectivity, improved security, and quick decision-making capabilities. In addition, the market for IoT in the aircraft and defence sector is being driven by rising need for innovative and reliable aerospace services.

As more number of manufacturers integrate sensor technologies into their equipment, military and commercial airlines are generating gigabytes of data every day. Hence, with the rising need to store huge amount of data, the market for IoT in aerospace and defence will increase rapidly.

Some of the parameters that aircraft makers are benefiting from IoT integration are increased engine fuel economy and noise performance improvement and emission cancellation. Hence, these IoT solutions provide OEMs, engine makers, and airline operators with new revenue sources.

Satellite communication, ISR, and GPS, in particular, can boost situational awareness on the battlefield in the defence sector. Improved reporting also allows facilities to automatically contact medical teams based on a soldier's health status. They also benefit from predictive maintenance, which uses sensors to determine how long a piece of equipment will endure and when a replacement or repair is necessary or possible.

The COVID-19 outbreak had a significant impact on the IoT in aerospace and defence market. As many industries were forced to halt operations owing to the lockout, demand for IoT in Aerospace and Defence fell, limiting market growth and reduced the revenue of the IoT in aerospace and defence market in 2020. It also caused a supply chain disturbance, resulting in lower demand for the market.

Nonetheless, not only is technology a major cost to consider, but the expertise required to enable the technology to be implemented is a major challenge that will stymie market growth, and the shift to digitally connected systems has increased the demand for highly skilled labor, which may unintentionally reduce the demand for low-skill labor.

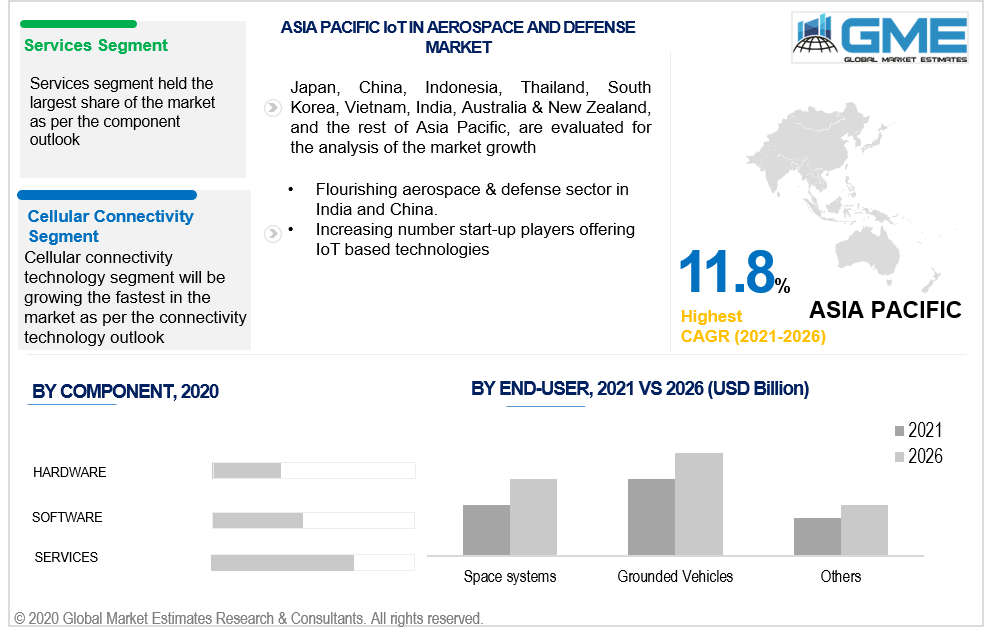

Based on the IoT aerospace and defence by component, the market is segmented into hardware, software and services. The services segment is expected to have a lion’s share in the market during the forecast period. These services comprise of consulting, development, data analytics, app management which aim at optimizing and automating the organization's workflows. This advantage is expected to support the segment’s growth from 2021 to 2026.

Based on the IoT aerospace and defence in connectivity technology, the market is segmented into cellular, Wi-Fi, satellite communication, radio frequency identification. The cellular connectivity technology of IoT in aerospace and defence market is expected to have the largest share during the forecast period as they offer additional dependable bandwidth correspondence for a variety of audio / data real - time applications.

Based on the application of IoT in aerospace and defence, the market is segmented into real time fleet management, training & simulation, health monitoring, equipment maintenance, inventory management. The real time fleet management is expected to hold the largest share of the market during the forecast period. Monitoring fleet is time-consuming and gets difficult with time. Also, the monitoring requires a high level of precision, accuracy, and attention. Fleet operators may equip themselves with innovative features and improve efficiency of operations by implementing the correct IoT solutions. In this way, IoT-enabled fleet management solutions may improve performance by improving asset visibility and vehicle usage, reducing wait times at destinations, and reducing costs through predictive maintenance.

Based on the various end-users adopting this IoT in aerospace and defence, the market is segmented into space systems, ground vehicles, and others. The ground vehicles segment is expected to hold the largest share of the market. Internet technology is mainly used by grounded vehicles to update algorithms based on user data, interact with infrastructure to obtain environmental information, and interface with other vehicles.

Since there are so many challenges to surmount, IoT in space is still more theoretical than practical. Failure of satellite IoT devices due to aging, loss of power, physical destruction, or external attack are all challenges. Organizations that need to replace outdated Internet of Things satellites will need funding as well as launchers to launch new satellites into orbit.

Based on region, the market is segmented into regions such as North America, Europe, Central and South America, Middle East and Africa, and the Asia Pacific. North America is analyzed to have the highest shares in the global market, owing to technologically equipped infrastructure, high adoption of Internet of Things (IoT), and growing demand for IoT in aerospace & defence tools.

Technological innovation drives the development of ICT infrastructure. Moreover, Asia-Pacific is expected to grow with the highest CAGR, owing to rising demand for IoT in aerospace & defence sector. Rising number of government initiatives in upgrading the defence and aerospace sector in several developing countries is expected to act as an opportunity for the growth of APAC IoT in the aerospace and defence market.

AT&T Environment, Freewave Technologies, Elbit Systems, Honeywell International, Inc., General Atomics Aeronautical Systems, Prox Dynamics, Northrup Grunman, Textron Systems, Radisys, among others are the key players in the IoT in aerospace and defence market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 IoT in Aerospace and Defense Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Component Overview

2.1.3 Application Overview

2.1.4 Connectivity Technology Overview

2.1.5 End-User Overview

2.1.6 Regional Overview

Chapter 3 IoT in Aerospace and Defense Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Growing need for connectivity, improved security, and quick decision-making capabilities in aerospace segment

3.3.2 Industry Challenges

3.3.2.1 Lack of expertise required to enable the IoT based technology

3.4 Prospective Growth Scenario

3.4.1 Component Growth Scenario

3.4.2 Connectivity Technology Growth Scenario

3.4.3 Application Growth Scenario

3.4.4 End-User Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 End-User Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 IoT in Aerospace and Defense Market, By Component

4.1 Component Outlook

4.2 Hardware

4.2.1 Market Size, By Region, 2020-2026 (USD Billion)

4.3 Software

4.3.1 Market Size, By Region, 2020-2026 (USD Billion)

4.4 Services

4.4.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 5 IoT in Aerospace and Defense Market, By Application

5.1 Application Outlook

5.2 Real-Time Fleet Management

5.2.1 Market Size, By Region, 2020-2026 (USD Billion)

5.3 Training & Simulation

5.3.1 Market Size, By Region, 2020-2026 (USD Billion)

5.4 Health Monitoring

5.4.1 Market Size, By Region, 2020-2026 (USD Billion)

5.5 Equipment Maintenance

5.5.1 Market Size, By Region, 2020-2026 (USD Billion)

5.6 Inventory Management

5.6.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 6 IoT in Aerospace and Defense Market, By Coonectivity Technology

6.1 Cellular

6.1.1 Market Size, By Region, 2020-2026 (USD Billion)

6.2 Wi-Fi

6.2.1 Market Size, By Region, 2020-2026 (USD Billion)

6.3 Satellite Communication

6.3.1 Market Size, By Region, 2020-2026 (USD Billion)

6.4 Radio Frequency Identification

6.4.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 7 IoT in Aerospace and Defense Market, By End-User

7.1 Space Systems

7.1.1 Market Size, By Region, 2020-2026 (USD Billion)

7.2 Ground Vehicles

7.2.1 Market Size, By Region, 2020-2026 (USD Billion)

7.3 Others

7.3.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 8 IoT in Aerospace and Defense Market, By Region

8.1 Regional outlook

8.2 North America

8.2.1 Market Size, By Country 2020-2026 (USD Billion)

8.2.2 Market Size, By Component, 2020-2026 (USD Billion)

8.2.3 Market Size, By Application, 2020-2026 (USD Billion)

8.2.4 Market Size, By Coonectivity Technology, 2020-2026 (USD Billion)

8.2.5 Market Size, By End-User, 2020-2026 (USD Billion)

8.2.6 U.S.

8.2.6.1 Market Size, By Component, 2020-2026 (USD Billion)

8.2.4.2 Market Size, By Application, 2020-2026 (USD Billion)

8.2.4.3 Market Size, By Coonectivity Technology, 2020-2026 (USD Billion)

Market Size, By End-User, 2020-2026 (USD Billion)

8.2.7 Canada

8.2.7.1 Market Size, By Component, 2020-2026 (USD Billion)

8.2.7.2 Market Size, By Application, 2020-2026 (USD Billion)

8.2.7.3 Market Size, By Coonectivity Technology, 2020-2026 (USD Billion)

8.2.7.4 Market Size, By End-User, 2020-2026 (USD Billion)

8.3 Europe

8.3.1 Market Size, By Country 2020-2026 (USD Billion)

8.3.2 Market Size, By Component, 2020-2026 (USD Billion)

8.3.3 Market Size, By Application, 2020-2026 (USD Billion)

8.3.4 Market Size, By Coonectivity Technology, 2020-2026 (USD Billion)

8.3.5 Market Size, By End-User, 2020-2026 (USD Billion)

8.3.6 Germany

8.3.6.1 Market Size, By Component, 2020-2026 (USD Billion)

8.3.6.2 Market Size, By Application, 2020-2026 (USD Billion)

8.3.6.3 Market Size, By Coonectivity Technology, 2020-2026 (USD Billion)

8.3.6.4 Market Size, By End-User, 2020-2026 (USD Billion)

8.3.7 UK

8.3.7.1 Market Size, By Component, 2020-2026 (USD Billion)

8.3.7.2 Market Size, By Application, 2020-2026 (USD Billion)

8.3.7.3 Market Size, By Coonectivity Technology, 2020-2026 (USD Billion)

8.3.7.4 Market Size, By End-User, 2020-2026 (USD Billion)

8.3.8 France

8.3.8.1 Market Size, By Component, 2020-2026 (USD Billion)

8.3.8.2 Market Size, By Application, 2020-2026 (USD Billion)

8.3.8.3 Market Size, By Coonectivity Technology, 2020-2026 (USD Billion)

8.3.8.4 Market Size, By End-User, 2020-2026 (USD Billion)

8.3.9 Italy

8.3.9.1 Market Size, By Component, 2020-2026 (USD Billion)

8.3.9.2 Market Size, By Application, 2020-2026 (USD Billion)

8.3.9.3 Market Size, By Coonectivity Technology, 2020-2026 (USD Billion)

8.3.9.4 Market Size, By End-User, 2020-2026 (USD Billion)

8.3.10 Spain

8.3.10.1 Market Size, By Component, 2020-2026 (USD Billion)

8.3.10.2 Market Size, By Application, 2020-2026 (USD Billion)

8.3.10.3 Market Size, By Coonectivity Technology, 2020-2026 (USD Billion)

8.3.10.4 Market Size, By End-User, 2020-2026 (USD Billion)

8.3.11 Russia

8.3.11.1 Market Size, By Component, 2020-2026 (USD Billion)

8.3.11.2 Market Size, By Application, 2020-2026 (USD Billion)

8.3.11.3 Market Size, By Coonectivity Technology, 2020-2026 (USD Billion)

8.3.11.4 Market Size, By End-User, 2020-2026 (USD Billion)

8.4 Asia Pacific

8.4.1 Market Size, By Country 2020-2026 (USD Billion)

8.4.2 Market Size, By Component, 2020-2026 (USD Billion)

8.4.3 Market Size, By Application, 2020-2026 (USD Billion)

8.4.4 Market Size, By Coonectivity Technology, 2020-2026 (USD Billion)

8.4.5 Market Size, By End-User, 2020-2026 (USD Billion)

8.4.6 China

8.4.6.1 Market Size, By Component, 2020-2026 (USD Billion)

8.4.6.2 Market Size, By Application, 2020-2026 (USD Billion)

8.4.6.3 Market Size, By Coonectivity Technology, 2020-2026 (USD Billion)

8.4.6.4 Market Size, By End-User, 2020-2026 (USD Billion)

8.4.7 India

8.4.7.1 Market Size, By Component, 2020-2026 (USD Billion)

8.4.7.2 Market Size, By Application, 2020-2026 (USD Billion)

8.4.7.3 Market Size, By Coonectivity Technology, 2020-2026 (USD Billion)

8.4.7.4 Market Size, By End-User, 2020-2026 (USD Billion)

8.4.8 Japan

8.4.8.1 Market Size, By Component, 2020-2026 (USD Billion)

8.4.8.2 Market Size, By Application, 2020-2026 (USD Billion)

8.4.8.3 Market Size, By Coonectivity Technology, 2020-2026 (USD Billion)

8.4.8.4 Market Size, By End-User, 2020-2026 (USD Billion)

8.4.9 Australia

8.4.9.1 Market Size, By Component, 2020-2026 (USD Billion)

8.4.9.2 Market size, By Application, 2020-2026 (USD Billion)

8.4.9.3 Market Size, By Coonectivity Technology, 2020-2026 (USD Billion)

8.4.9.4 Market Size, By End-User, 2020-2026 (USD Billion)

8.4.10 South Korea

8.4.10.1 Market Size, By Component, 2020-2026 (USD Billion)

8.4.10.2 Market Size, By Application, 2020-2026 (USD Billion)

8.4.10.3 Market Size, By Coonectivity Technology, 2020-2026 (USD Billion)

8.4.10.4 Market Size, By End-User, 2020-2026 (USD Billion)

8.5 Latin America

8.5.1 Market Size, By Country 2020-2026 (USD Billion)

8.5.2 Market Size, By Component, 2020-2026 (USD Billion)

8.5.3 Market Size, By Application, 2020-2026 (USD Billion)

8.5.4 Market Size, By Coonectivity Technology, 2020-2026 (USD Billion)

8.5.5 Market Size, By End-User, 2020-2026 (USD Billion)

8.5.6 Brazil

8.5.6.1 Market Size, By Component, 2020-2026 (USD Billion)

8.5.6.2 Market Size, By Application, 2020-2026 (USD Billion)

8.5.6.3 Market Size, By Coonectivity Technology, 2020-2026 (USD Billion)

8.5.6.4 Market Size, By End-User, 2020-2026 (USD Billion)

8.5.7 Mexico

8.5.7.1 Market Size, By Component, 2020-2026 (USD Billion)

8.5.7.2 Market Size, By Application, 2020-2026 (USD Billion)

8.5.7.3 Market Size, By Coonectivity Technology, 2020-2026 (USD Billion)

8.5.7.4 Market Size, By End-User, 2020-2026 (USD Billion)

8.5.8 Argentina

8.5.8.1 Market Size, By Component, 2020-2026 (USD Billion)

8.5.8.2 Market Size, By Application, 2020-2026 (USD Billion)

8.5.8.3 Market Size, By Coonectivity Technology, 2020-2026 (USD Billion)

8.5.8.4 Market Size, By End-User, 2020-2026 (USD Billion)

8.6 MEA

8.6.1 Market Size, By Country 2020-2026 (USD Billion)

8.6.2 Market Size, By Component, 2020-2026 (USD Billion)

8.6.3 Market Size, By Application, 2020-2026 (USD Billion)

8.6.4 Market Size, By Coonectivity Technology, 2020-2026 (USD Billion)

8.6.5 Market Size, By End-User, 2020-2026 (USD Billion)

8.6.6 Saudi Arabia

8.6.6.1 Market Size, By Component, 2020-2026 (USD Billion)

8.6.6.2 Market Size, By Application, 2020-2026 (USD Billion)

8.6.6.3 Market Size, By Coonectivity Technology, 2020-2026 (USD Billion)

8.6.6.4 Market Size, By End-User, 2020-2026 (USD Billion)

8.6.7 UAE

8.6.7.1 Market Size, By Component, 2020-2026 (USD Billion)

8.6.7.2 Market Size, By Application, 2020-2026 (USD Billion)

8.6.7.3 Market Size, By Coonectivity Technology, 2020-2026 (USD Billion)

8.6.7.4 Market Size, By End-User, 2020-2026 (USD Billion)

8.6.8 South Africa

8.6.8.1 Market Size, By Component, 2020-2026 (USD Billion)

8.6.8.2 Market Size, By Application, 2020-2026 (USD Billion)

8.6.8.3 Market Size, By Coonectivity Technology, 2020-2026 (USD Billion)

8.6.8.4 Market Size, By End-User, 2020-2026 (USD Billion)

Chapter 9 Company Landscape

9.1 Competitive Analysis, 2020

9.2 Radisys

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Strategic Positioning

9.2.4 Info Graphic Analysis

9.3 At & T

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Strategic Positioning

9.3.4 Info Graphic Analysis

9.4 Elbit Systems

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Strategic Positioning

9.4.4 Info Graphic Analysis

9.5 Freewave Technologies

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Strategic Positioning

9.5.4 Info Graphic Analysis

9.6 General Atomics Aeronautical Systems

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Strategic Positioning

9.6.4 Info Graphic Analysis

9.7 Honeywell International, Inc.

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Strategic Positioning

9.7.4 Info Graphic Analysis

9.8 Northrup Grunman

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Strategic Positioning

9.8.4 Info Graphic Analysis

9.9 Prox Dynamics

9.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Strategic Positioning

9.9.4 Info Graphic Analysis

9.10 Other Companies

9.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Strategic Positioning

9.10.4 Info Graphic Analysis

The Global IoT in Aerospace and Defence Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the IoT in Aerospace and Defence Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS