Global Isoprene Rubber Market Size, Trends & Analysis - Forecasts to 2026 By Type (Medical Grade, Industrial Grade), By Applications (Tires, Mechanical Rubber Products, Glove & Balloon, Cable Insulation, Conveyor Belts, Driving Belts, Medical, Footwear, Consumer Products, Others), By Region (North America, Europe, Asia Pacific, MEA, and CSA); Competitive Landscape, End-User Landscape, Company Market Share Analysis & Competitor Analysis

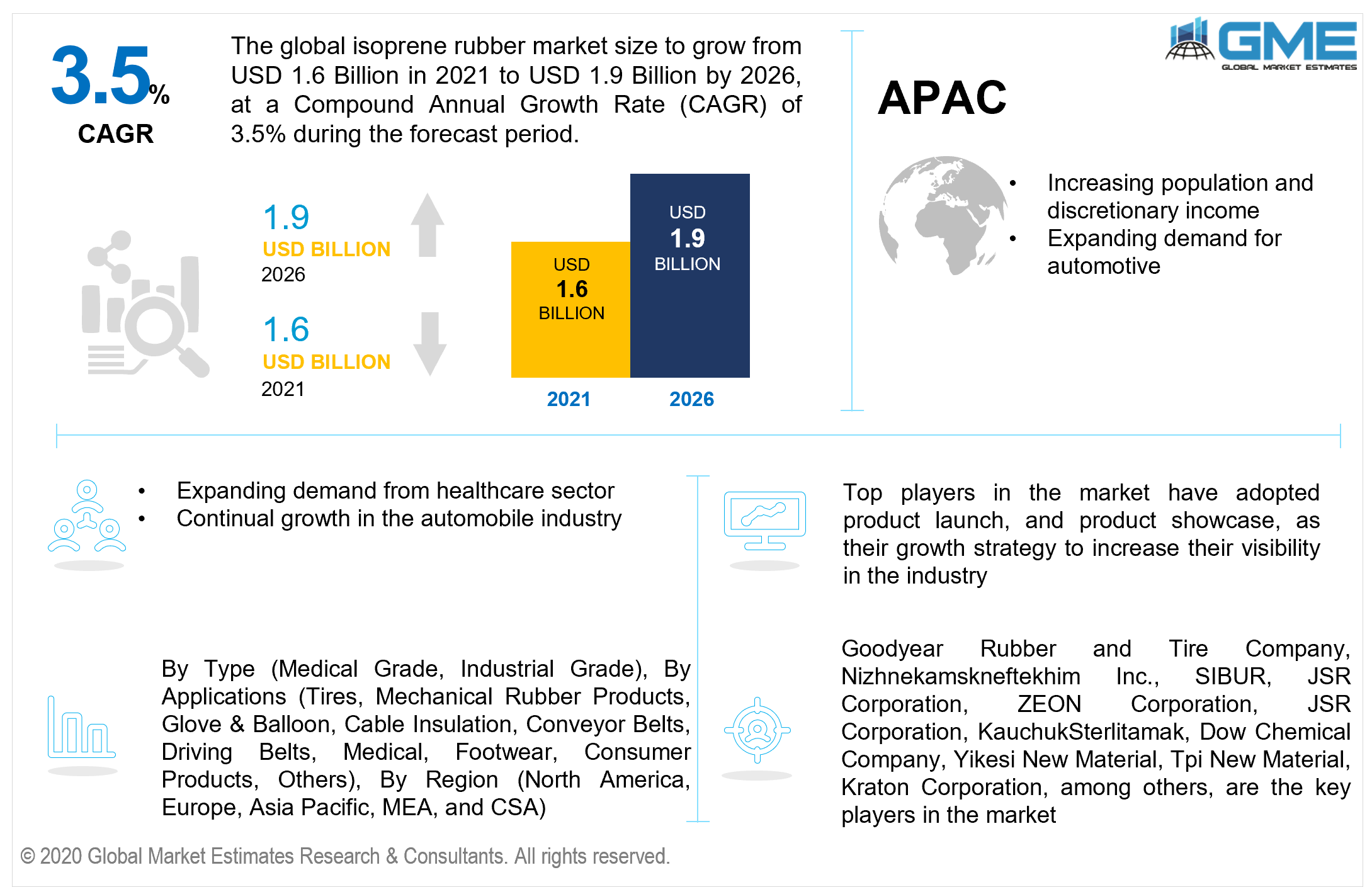

The global isoprene rubber market is estimated to be valued at USD 1.6 billion in 2021 and is projected to reach USD 1.9 billion by 2026 at a CAGR of 3.5%. Isoprene rubber is a necessary component in a wide spectrum of application domains to meet the consistent demand protrusions in the end-use industries. Rubber, both natural and synthetic, is extensively used in a variety of industrial applications for improved machinery and device longevity, in addition to serving as a protective liner for numerous corrosive environment and abrasive wear susceptible components. The item is a high-end industry constituent that has been powering a variety of commercial implementations. Such rubber is analogous to natural rubber and can be produced inevitably as well as synthetically.

Both synthetic and natural rubber versions are unequivocally utilized as a preliminary structural component that is debilitating and has exceptional heat, temperature, and abrasion susceptibility. Quality synthetic rubber, including isoprene rubber, has gained widespread popularity due to a variety of benefits such as increased resistance and lifespan. Furthermore, the large-scale and low-cost manufacturing process of synthetic rubber gives it a straightforward upper hand over natural rubber. The convenience of manufacturing and the low cost of such rubber will propel widespread adoption of the material over its natural equivalents. These considerations are expected to generate significant returns in the global isoprene market.

Natural rubber isoprene is more exorbitant because it is derived from organic rubber plantations through laborious production processes. Natural rubber has several drawbacks, including low-temperature susceptibility. Also, natural rubber has some downsides that cause it to degrade over time. They have unfavorable chemistry with hydrocarbons like oils and greases. Because of these aspects, dependency on synthetic rubber, including isoprene rubber, has become necessary. Synthetic rubber alterations including isoprene rubber will acquire eminence in the near future, propelling the global isoprene rubber market forward.

Isoprene rubber market advancement explicitly correlates with various end sector development because it is a key structural element of various components which has gained much attention with surging breakthroughs in the automotive parts to pharmaceuticals and industrial products, including Butyl rubber also known as isobutyl-isoprene rubber (IIR). Accompanied by enhanced lifestyle and expenditure ability, the demand for automotive, particularly for commuting, has increased, which is expected to have a positive impact on deployment and a corresponding upward expansion pattern in the global isobutyl rubber market.

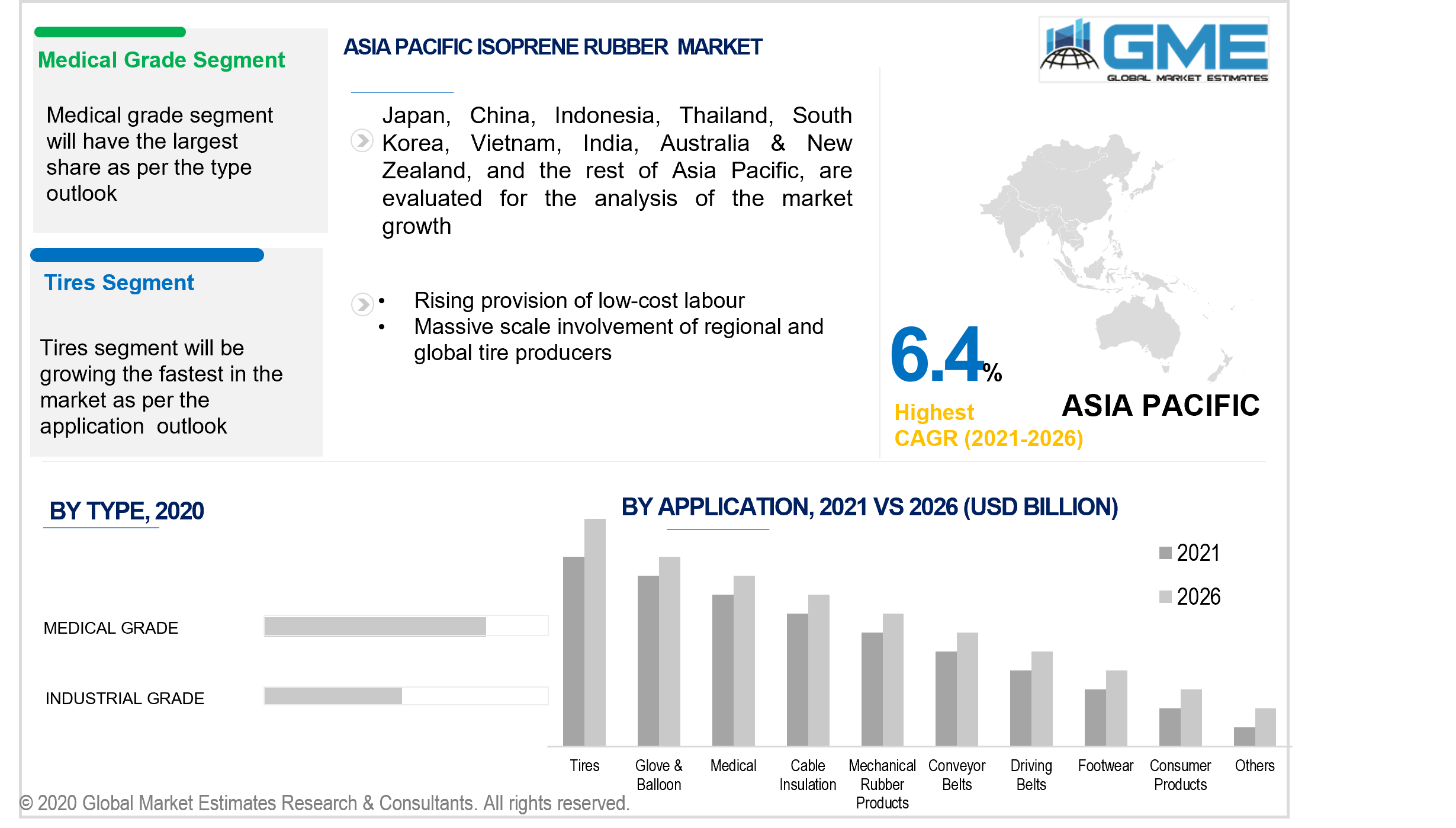

Depending on the type, the market is categorized as medical grade and industrial grade. Medical grade is foreseen to predominate. To address the high prevalence of latex allergy, alternative options including isoprene rubber, which has characteristics comparable to rubber, are positioned to efficiently substitute conventional rubber. Isoprene rubber is free of latex allergens which makes it to be exclusively used for medical-grade products. Aside from surgical gloves, such rubber is widely used in certain pharmaceutical products including catheters and balloons.

This equipment is best suited for usages in the healthcare sector for efficacious cardiovascular disease therapies including the entrance of catastrophic arteriovenous blockages. Several people have died as a result of premature balloon bursts caused by production flaws. Deployment of strong, isoprene rubber-based catheters and balloons has gained far-reaching prominence in subsequent years to primarily offbeat such incidences.

Moreover, synthetic polyisoprene compound has been tested and passed USP XXII biological Class IV Testing for medical compatibility. This renders this polymer an excellent alternative for product lines used in medical and surgical application fields.

Isoprene rubber manufacturers cater to a myriad range of application areas including tires, mechanical rubber products, glove & balloon, cable insulation, conveyor belts, driving belts, medical, footwear, consumer products, and others. The tire manufacturing and automotive sectors are major consumers of such rubber in the global market, and they are foreseen to drive prospective market growth. Despite a difficult 2020, the automotive sector has finally hit its stride in 2021, with revenues returning to pre-pandemic levels, providing a much-needed surge to the market.

The global automotive market's export value is expected to be around USD 37 million in 2020, up more than USD 11 million from the previous year. The expanding demand for fuel-efficient automobiles has propelled the EV segment of the automotive sector to new heights, with record sales in emerging markets such as China. This rising demand in the automobile and tire sectors could propel the market forward in the coming years. Moreover, the exclusive trends in the growing markets 2021 include the major industrial polymer- Butyl rubber (isobutylene-isoprene rubber or IIR industrial rubber) which is utilized in the manufacturing of various types of tires and tires accessories.

Due to rising demand from the medical and tire manufacturing sectors, Asia Pacific is foreseen to be the largest regional market. Furthermore, accelerated industrialization combined with rising healthcare and automobile demand in developing economies is presumed to drive the market over the forecast period.

With the massive scale involvement of regional and global tire producers in the areas, countries such as China and India are pioneers in advancing the tire manufacturing sector forward. ATMA Annual Convention, held in the Indian capital of Delhi, was solely focused on improving collaborative endeavors aimed at automobile manufacturers and the tire sector.

A prevalent platform for coordinated projects of vehicle manufacturers and tire producers is essential in the face of remarkable enhancements in the automotive sector to pander to evolving transportation needs. Such novel breakthroughs are likely to keep demand for synthetic rubber, including isoprene rubber, insatiable, resulting in regional market advancement.

Owing to compelling demand from the healthcare industry, North America is the second-largest market. The advancement of the market in this area is being driven by soaring industrialization and advanced nation's spiked adoption rate. The rubber manufacturing companies in this area are constantly advancing breakthroughs, and as a result, producers are broadening their product portfolios and concentrating on mergers and acquisitions to enhance their business footprint in this area. Furthermore, the demand for medical facilities is foreseen to expand rapidly in the region which will aid in overall market growth.

Goodyear Rubber and Tire Company, Nizhnekamskneftekhim Inc., SIBUR, JSR Corporation, ZEON Corporation, JSR Corporation, KauchukSterlitamak, Dow Chemical Company, Yikesi New Material, Tpi New Material, Kraton Corporation, among others, are the key players in the market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview And Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Global Isoprene Rubber Industry Overview, 2019-2026

2.1.1 Industry Overview

2.1.2 Type Overview

2.1.3 Applications Overview

2.1.4 Regional Overview

Chapter 3 Global Isoprene Rubber Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2019-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Stringent Environmental Regulations in Developed Regions Supporting the Use of Isoprene Rubber

3.3.1.2 Increasing Demand in Medical and Tire Manufacturing Sectors

3.3.2 Industry Challenges

3.3.2.1 Raw Material Costs Fluctuation

3.4 Prospective Growth Scenario

3.4.1 Type Growth Scenario

3.4.2 Applications Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Global Isoprene Rubber Market, By Type

4.1 Type Outlook

4.2 Medical Grade

4.2.1 Market Size, By Region, 2019-2026 (USD Billion)

4.3 Industrial Grade

4.3.1 Market Size, By Region, 2019-2026 (USD Billion)

Chapter 5 Global Isoprene Rubber Market, By Applications

5.1 Applications Outlook

5.2 Tires

5.2.1 Market Size, By Region, 2019-2026 (USD Billion)

5.3 Mechanical Rubber Products

5.3.1 Market Size, By Region, 2019-2026 (USD Billion)

5.4 Glove & Balloon

5.4.1 Market Size, By Region, 2019-2026 (USD Billion)

5.5 Cable Insulation

5.5.1 Market Size, By Region, 2019-2026 (USD Billion)

5.6 Conveyor Belts

5.6.1 Market Size, By Region, 2019-2026 (USD Billion)

5.7 Driving Belts

5.7.1 Market Size, By Region, 2019-2026 (USD Billion)

5.8 Medical

5.8.1 Market Size, By Region, 2019-2026 (USD Billion)

5.9 Footwear

5.9.1 Market Size, By Region, 2019-2026 (USD Billion)

5.10 Consumer Products

5.10.1 Market Size, By Region, 2019-2026 (USD Billion)

5.11 Others

5.11.1 Market Size, By Region, 2019-2026 (USD Billion)

Chapter 6 Global Isoprene Rubber Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2019-2026 (USD Billion)

6.2.2 Market Size, By Type, 2019-2026 (USD Billion)

6.2.3 Market Size, By Applications, 2019-2026 (USD Billion)

6.2.4 U.S.

6.2.4.1 Market Size, By Type, 2019-2026 (USD Billion)

6.2.4.2 Market Size, By Applications, 2019-2026 (USD Billion)

6.2.5 Canada

6.2.5.1 Market Size, By Type, 2019-2026 (USD Billion)

6.2.5.2 Market Size, By Applications, 2019-2026 (USD Billion)

6.3 Europe

6.3.1 Market Size, By Country 2019-2026 (USD Billion)

6.3.2 Market Size, By Type, 2019-2026 (USD Billion)

6.3.3 Market Size, By Applications, 2019-2026 (USD Billion)

6.3.4 Germany

6.2.4.1 Market Size, By Type, 2019-2026 (USD Billion)

6.2.4.2 Market Size, By Applications, 2019-2026 (USD Billion)

6.3.5 UK

6.3.5.1 Market Size, By Type, 2019-2026 (USD Billion)

6.3.5.2 Market Size, By Applications, 2019-2026 (USD Billion)

6.3.6 France

6.3.6.1 Market Size, By Type, 2019-2026 (USD Billion)

6.3.6.2 Market Size, By Applications, 2019-2026 (USD Billion)

6.3.7 Italy

6.3.7.1 Market Size, By Type, 2019-2026 (USD Billion)

6.3.7.2 Market Size, By Applications, 2019-2026 (USD Billion)

6.3.8 Spain

6.3.8.1 Market Size, By Type, 2019-2026 (USD Billion)

6.3.8.2 Market Size, By Applications, 2019-2026 (USD Billion)

6.3.9 Russia

6.3.9.1 Market Size, By Type, 2019-2026 (USD Billion)

6.3.9.2 Market Size, By Applications, 2019-2026 (USD Billion)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2019-2026 (USD Billion)

6.4.2 Market Size, By Type, 2019-2026 (USD Billion)

6.4.3 Market Size, By Applications, 2019-2026 (USD Billion)

6.4.4 China

6.4.4.1 Market Size, By Type, 2019-2026 (USD Billion)

6.4.4.2 Market Size, By Applications, 2019-2026 (USD Billion)

6.4.5 India

6.4.5.1 Market Size, By Type, 2019-2026 (USD Billion)

6.4.5.2 Market Size, By Applications, 2019-2026 (USD Billion)

6.4.6 Japan

6.4.6.1 Market Size, By Type, 2019-2026 (USD Billion)

6.4.6.2 Market Size, By Applications, 2019-2026 (USD Billion)

6.4.7 Australia

6.4.7.1 Market Size, By Type, 2019-2026 (USD Billion)

6.4.7.2 Market size, By Applications, 2019-2026 (USD Billion)

6.4.8 South Korea

6.4.8.1 Market Size, By Type, 2019-2026 (USD Billion)

6.4.8.2 Market Size, By Applications, 2019-2026 (USD Billion)

6.5 Latin America

6.5.1 Market Size, By Country 2019-2026 (USD Billion)

6.5.2 Market Size, By Type, 2019-2026 (USD Billion)

6.5.3 Market Size, By Applications, 2019-2026 (USD Billion)

6.5.4 Brazil

6.5.4.1 Market Size, By Type, 2019-2026 (USD Billion)

6.5.4.2 Market Size, By Applications, 2019-2026 (USD Billion)

6.5.5 Mexico

6.5.5.1 Market Size, By Type, 2019-2026 (USD Billion)

6.5.5.2 Market Size, By Applications, 2019-2026 (USD Billion)

6.5.6 Argentina

6.5.6.1 Market Size, By Type, 2019-2026 (USD Billion)

6.5.6.2 Market Size, By Applications, 2019-2026 (USD Billion)

6.6 MEA

6.6.1 Market Size, By Country 2019-2026 (USD Billion)

6.6.2 Market Size, By Type, 2019-2026 (USD Billion)

6.6.3 Market Size, By Applications, 2019-2026 (USD Billion)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Type, 2019-2026 (USD Billion)

6.6.4.2 Market Size, By Applications, 2019-2026 (USD Billion)

6.6.5 UAE

6.6.5.1 Market Size, By Type, 2019-2026 (USD Billion)

6.6.5.2 Market Size, By Applications, 2019-2026 (USD Billion)

6.6.6 South Africa

6.6.6.1 Market Size, By Type, 2019-2026 (USD Billion)

6.6.6.2 Market Size, By Applications, 2019-2026 (USD Billion)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 Goodyear Rubber and Tire Company

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Info Graphic Analysis

7.3 Nizhnekamskneftekhim Inc.

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Info Graphic Analysis

7.4 SIBUR

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Info Graphic Analysis

7.5 JSR Corporation

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Info Graphic Analysis

7.6 ZEON Corporation

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 Info Graphic Analysis

7.7 JSR Corporation

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info Graphic Analysis

7.8 KauchukSterlitamak

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Info Graphic Analysis

7.9 Dow Chemical Company

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Info Graphic Analysis

7.10 Yikesi New Material

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Info Graphic Analysis

7.11 Tpi New Material

7.11.1 Company Overview

7.11.2 Financial Analysis

7.11.3 Strategic Positioning

7.11.4 Info Graphic Analysis

7.12 Kraton Corporation

7.12.1 Company Overview

7.12.2 Financial Analysis

7.12.3 Strategic Positioning

7.12.4 Info Graphic Analysis

7.13 Other Companies

7.13.1 Company Overview

7.13.2 Financial Analysis

7.13.3 Strategic Positioning

7.13.4 Info Graphic Analysis

The Global Isoprene Rubber Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Isoprene Rubber Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS