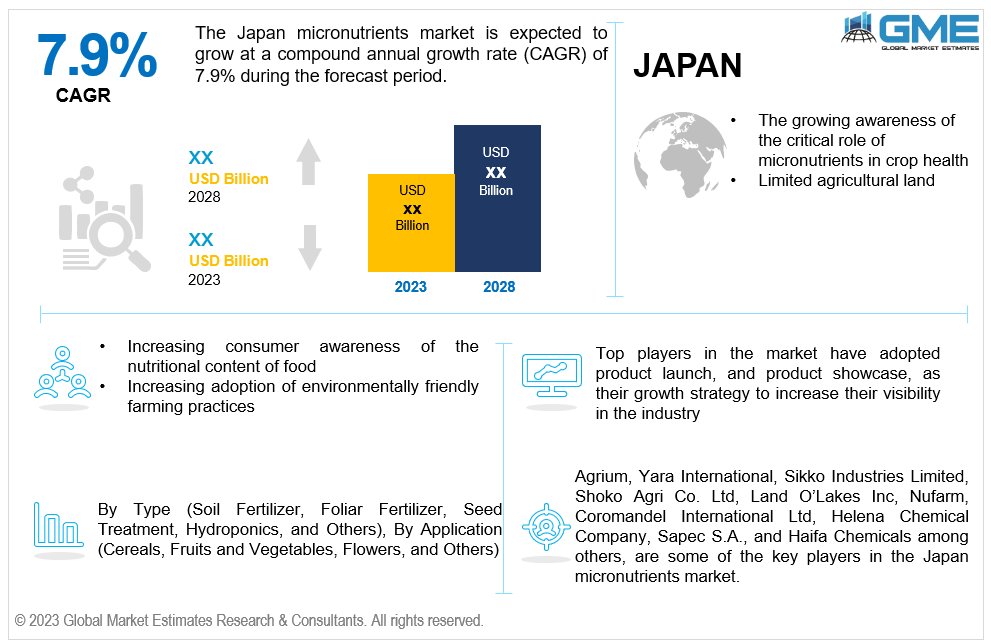

Japan Micronutrients Market Size, Trends & Analysis - Forecasts to 2028 By Type (Soil Fertilizer, Foliar Fertilizer, Seed Treatment, Hydroponics, and Others) and By Application (Cereals, Fruits and Vegetables, Flowers, and Others), Competitive Landscape, Company Market Share Analysis, and End User Analysis

Japan micronutrient market is estimated to exhibit a CAGR of 7.9% from 2023 to 2028.

The primary factors propelling the market growth are the growing awareness of the critical role of micronutrients in crop health and limited agricultural land. Due to limited agricultural area, intensive farming methods are frequently used, which, over time, can deplete the soil of vital nutrients. Micronutrients must be added to replenish the depleted soil and sustain plant development. With limited land available for cultivation, there can be a higher demand for high-yield crops. For best growth, these crops frequently need a specific combination of micronutrients. In order to improve soil fertility and guarantee adequate plant nutrition, there can be a rise in demand for micronutrient supplements. Farmers can use precision farming techniques to optimize output in limited areas. With these methods, fertilizers, including micronutrients, are applied precisely according to the demands of each field section. This focused strategy can boost consumer demand for goods containing micronutrients. For instance, Japan's agricultural land (percentage of total land area) was reported to be 12.78% in 2021 by the World Bank's collection of development indicators.

Increasing consumer awareness of the nutritional content of food and increasing adoption of environmentally friendly farming practices are expected to support micronutrient market growth in Japan. Government policies that support sustainable agriculture and environmental protection facilitate the implementation of practices that lessen the environmental effects of farming. These policies may include incentives for using micronutrients to address micronutrient deficiency in Japan. Additionally, farmers are being encouraged to adopt practices that increase the micronutrient content of crops through micronutrient fortification in Japanese foods in response to the demand from environmentally aware customers for nutrient-rich, sustainably produced meals. For instance, the Ministry of Agriculture, Forestry, and Fisheries (MAFF) unveiled a plan in 2019 to commercialize smart agricultural services and technologies. As part of the plan, MAFF works with companies, universities, and research centers to accomplish extreme labor-saving while preserving the standard of agricultural output.

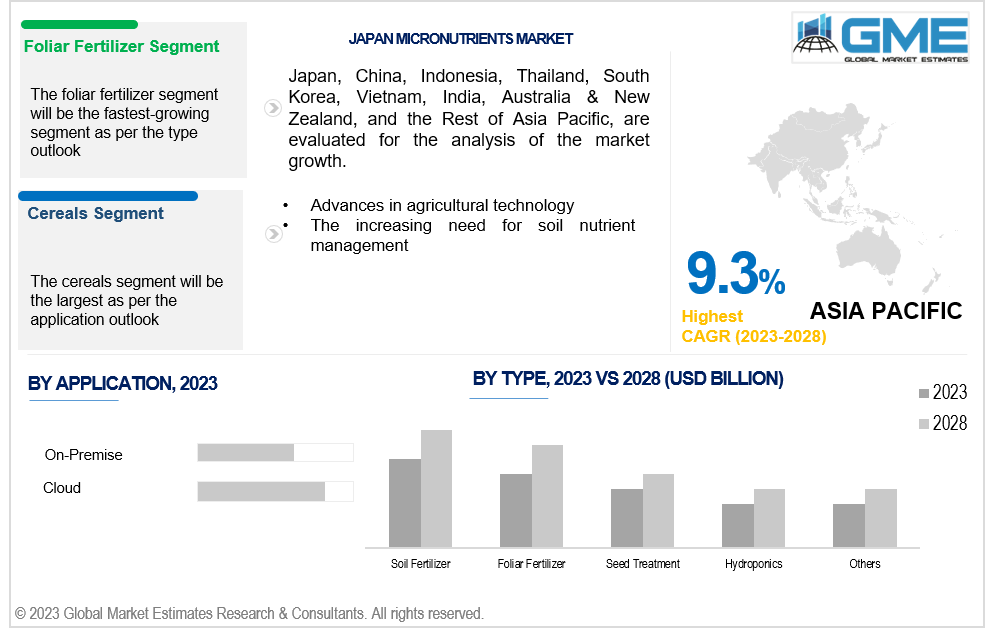

Advances in agricultural technology and the increasing need for soil nutrient management are propelling the market growth. In Japan, precision agricultural technologies are becoming increasingly popular, enabling farmers to regulate soil nutrients more precisely. Precision agriculture frequently uses tailored micronutrient treatments to correct specific deficits, making this development a significant feature of Japanese micronutrient industry trends. Additionally, Japan's farmers are adopting more balanced fertilization techniques as they realize that the entire health of their crops depends on a proper combination of macro and micronutrients. This shift is reflected in Japanese agriculture and micronutrient trends.

The increasing awareness of health and wellness trends in Japan drives consumer preferences towards nutrient-dense foods. Due to this change, micronutrient producers now have an opportunity to make products that meet consumer demand for crops that are higher in nutrients. Moreover, sustainable micronutrient practices in Japan, such as using environmentally friendly fertilizers, can be a selling point. There is an opportunity to promote micronutrient products to support sustainable agriculture and crop health.

However, the high cost of micronutrient fertilizers and lack of awareness and understanding among farmers may hinder market growth.

The soil fertilizer segment is expected to hold the largest share of the market. This can be attributed to several factors, including the reliance on traditional farming techniques, the efficiency of soil fertilizers in mitigating vitamin deficits, and continuous endeavors to improve micronutrient formulations for the best possible crop health. Micronutrients are necessary for crops to have a balanced diet. A systematic and regulated method of supplying micronutrients to plants through soil fertilizers encourages healthy development and raises the general standard of agricultural output. This trend aligns with Japan’s micronutrient consumption patterns and reinforces the vital role of micronutrients in supporting nutritional supplements in Japan.

The foliar fertilizer segment is expected to be the fastest-growing segment in the market from 2023-2028. Foliar fertilizers, when sprayed directly onto plant leaves, enable rapid and efficient absorption of nitrogen. This method of applying essential micronutrients directly to crops proves beneficial in addressing deficiencies and promoting accelerated growth. Additionally, foliar fertilizers provide precise management of nutrient distribution. By tailoring the micronutrient composition to the specific needs of their crops, Japanese farmers can effectively address nutrient shortages in a targeted manner, fostering optimal growth and development.

The cereals segment is expected to hold the largest share of the market. In Japan, giving cereal crops the right mix of micronutrients is frequently crucial to their optimum development, growth, and yield. Important micronutrients that are necessary for cereal crop health maintenance and deficiency correction include zinc, iron, manganese, and copper. Farmers in Japan are considering about using micronutrient fertilizers as a result of increased knowledge of the shortages in certain micronutrients in cereal crops. Adopting this proactive strategy for nutritional control helps Japan's cereal sector..

The fruits and vegetables segment is anticipated to be the fastest-growing segment in the market from 2023-2028. In Japan, there has been a notable increase in the consumption of fruits and vegetables, driven by changing dietary patterns and a heightened focus on health and nutrition. There is a rising demand for high-quality produce that offers enhanced nutritional benefits as consumers actively seek a diverse range of nutrient-rich options. Moreover, the preference for fruits and vegetables with improved flavor, vibrant color, and appealing overall appearance has led to the recognition of the role of micronutrients in achieving these qualities. Japanese growers are acknowledging the significance of visual appeal and taste in meeting consumer preferences, which has spurred the adoption of micronutrients.

In Japan, precision farming applies cutting-edge technology, such as sensors, drones, and GPS-guided tractors, to maximize crop farming's field-level management. This makes it possible to use micronutrients more precisely, focusing on deficient regions and guaranteeing effective utilization. For instance, since 2019, Japan has embraced a range of cutting-edge digital technology and is well-developed in sectors connected to smart farming, such as robots and drones (Agriculture, Forestry and Fisheries Research Council, 2022).

Agrium, Yara International, Sikko Industries Limited, Shoko Agri Co. Ltd, Land O’Lakes Inc, Nufarm, Coromandel International Ltd, Helena Chemical Company, Sapec S.A., and Haifa Chemicals among others, are some of the key players operating in the Japan micronutrients market.

Please note: This is not an exhaustive list of companies profiled in the report.

The Murugappa Group firm Coromandel International Limited introduced GroShakti Plus, a new fertilizer, in 2021. The new fertilizer aims to boost resistance with zinc and improve root growth with phosphorus.

The Haifa Group introduced NutriNet in 2019 as a cutting-edge digital tool to help agronomy specialists and producers create more individualized fertilization plans. In order to support farmers in making decisions, this application can include data on crops, soil type, water analysis, irrigation system setup, and other grower preferences.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 JAPAN MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 JAPAN MICRONUTRIENTS MARKET, BY TYPE

4.1 Introduction

4.2 Japan Micronutrients Market: Type Scope Key Takeaways

4.3 Revenue Growth Analysis, 2022 & 2028

4.4 Soil Fertilizer

4.4.1 Soil Fertilizer Market Estimates and Forecast, 2020-2028 (USD Million)

4.5 Foliar Fertilizer

4.5.1 Foliar Fertilizer Market Estimates and Forecast, 2020-2028 (USD Million)

4.6 Seed Treatment

4.6.1 Seed Treatment Market Estimates and Forecast, 2020-2028 (USD Million)

4.7 Hydroponics

4.7.1 Hydroponics Market Estimates and Forecast, 2020-2028 (USD Million)

4.8 Others

4.8.1 Others Market Estimates and Forecast, 2020-2028 (USD Million)

5 JAPAN MICRONUTRIENTS MARKET, BY APPLICATION

5.1 Introduction

5.2 Japan Micronutrients Market: Application Scope Key Takeaways

5.3 Revenue Growth Analysis, 2022 & 2028

5.4 Cereals

5.4.1 Cereals Market Estimates and Forecast, 2020-2028 (USD Million)

5.5 Fruits and Vegetables

5.5.1 Fruits and Vegetables Market Estimates and Forecast, 2020-2028 (USD Million)

5.6 Flowers

5.6.1 Flowers Market Estimates and Forecast, 2020-2028 (USD Million)

5.7 Others

5.7.1 Others Market Estimates and Forecast, 2020-2028 (USD Million)

6 JAPAN MICRONUTRIENTS MARKET

6.1 Japan Micronutrients Market Estimates and Forecast, 2020-2028 (USD Million)

6.1.1 By Type

6.1.2 By Application

7 COMPETITIVE LANDCAPE

7.1 Company Market Share Analysis

7.2 Four Quadrant Positioning Matrix

7.2.1 Market Leaders

7.2.2 Market Visionaries

7.2.3 Market Challengers

7.2.4 Niche Market Players

7.3 Vendor Landscape

7.3.1 Japan

7.4 Company Profiles

7.4.1 Agrium

7.4.1.1 Business Description & Financial Analysis

7.4.1.2 SWOT Analysis

7.4.1.3 Products & Services Offered

7.4.1.4 Strategic Alliances between Business Partners

7.4.2 Yara International

7.4.2.1 Business Description & Financial Analysis

7.4.2.2 SWOT Analysis

7.4.2.3 Products & Services Offered

7.4.2.4 Strategic Alliances between Business Partners

7.4.3 Sikko Industries Limited

7.4.3.1 Business Description & Financial Analysis

7.4.3.2 SWOT Analysis

7.4.3.3 Products & Services Offered

7.4.3.4 Strategic Alliances between Business Partners

7.4.4 Shoko Agri Co. Ltd

7.4.4.1 Business Description & Financial Analysis

7.4.4.2 SWOT Analysis

7.4.4.3 Products & Services Offered

7.4.4.4 Strategic Alliances between Business Partners

7.4.5 Land O’Lakes Inc

7.4.5.1 Business Description & Financial Analysis

7.4.5.2 SWOT Analysis

7.4.5.3 Products & Services Offered

7.4.5.4 Strategic Alliances between Business Partners

7.4.6 Nufarm

7.4.6.1 Business Description & Financial Analysis

7.4.6.2 SWOT Analysis

7.4.6.3 Products & Services Offered

7.4.6.4 Strategic Alliances between Business Partners

7.4.7 Coromandel International Ltd

7.4.7.1 Business Description & Financial Analysis

7.4.7.2 SWOT Analysis

7.4.7.3 Products & Services Offered

7.4.7.4 Strategic Alliances between Business Partners

7.4.8 Helena Chemical Company

7.4.8.1 Business Description & Financial Analysis

7.4.8.2 SWOT Analysis

7.4.8.3 Products & Services Offered

7.4.8.4 Strategic Alliances between Business Partners

7.4.9 Sapec S.A.

7.4.9.1 Business Description & Financial Analysis

7.4.9.2 SWOT Analysis

7.4.9.3 Products & Services Offered

7.4.9.4 Strategic Alliances between Business Partners

7.4.10 Haifa Chemicals

7.4.10.1 Business Description & Financial Analysis

7.4.10.2 SWOT Analysis

7.4.10.3 Products & Services Offered

7.4.10.4 Strategic Alliances between Business Partners

7.4.11 Other Companies

7.4.11.1 Business Description & Financial Analysis

7.4.11.2 SWOT Analysis

7.4.11.3 Products & Services Offered

7.4.11.4 Strategic Alliances between Business Partners

8 RESEARCH METHODOLOGY

8.1 Market Introduction

8.1.1 Market Definition

8.1.2 Market Scope & Segmentation

8.2 Information Procurement

8.2.1 Secondary Research

8.2.1.1 Purchased Databases

8.2.1.2 GMEs Internal Data Repository

8.2.1.3 Secondary Resources & Third Party Perspectives

8.2.1.4 Company Information Sources

8.2.2 Primary Research

8.2.2.1 Various Type of Respondents for Primary Interviews

8.2.2.2 Number of Interviews Conducted throughout the Research Process

8.2.2.3 Primary Stakeholders

8.2.2.4 Discussion Guide for Primary Participants

8.2.3 Expert Panels

8.2.3.1 Expert Panels Across 30+ Industry

8.2.4 Paid Local Experts

8.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

8.3 Market Estimation

8.3.1 Top-Down Approach

8.3.1.1 Macro-Economic Indicators Considered

8.3.1.2 Micro-Economic Indicators Considered

8.3.2 Bottom Up Approach

8.3.2.1 Company Share Analysis Approach

8.3.2.2 Estimation of Potential Product Sales

8.4 Data Triangulation

8.4.1 Data Collection

8.4.2 Time Series, Cross Sectional & Panel Data Analysis

8.4.3 Cluster Analysis

8.5 Analysis and Output

8.5.1 Inhouse AI Based Real Time Analytics Tool

8.5.2 Output From Desk & Primary Research

8.6 Research Assumptions & Limitations

8.6.1 Research Assumptions

8.6.2 Research Limitations

LIST OF TABLES

1 Japan Micronutrients Market, By Type, 2020-2028 (USD Mllion)

2 Soil Fertilizer Market, By Country, 2020-2028 (USD Mllion)

3 Foliar Fertilizer Market, By Country, 2020-2028 (USD Mllion)

4 Seed Treatment Market, By Country, 2020-2028 (USD Mllion)

5 Hydroponics Market, By Country, 2020-2028 (USD Mllion)

6 Others Market, By Country, 2020-2028 (USD Mllion)

7 Japan Micronutrients Market, By Application, 2020-2028 (USD Mllion)

8 Cereals Market, By Country, 2020-2028 (USD Mllion)

9 Fruits and Vegetables Market, By Country, 2020-2028 (USD Mllion)

10 Flowers Market, By Country, 2020-2028 (USD Mllion)

11 Others Market, By Country, 2020-2028 (USD Mllion)

12 Regional Analysis, 2020-2028 (USD Mllion)

13 Japan Micronutrients Market 2020-2028 (USD Mllion)

14 Japan Micronutrients Market, By Type, 2020-2028 (USD Mllion)

15 Japan Micronutrients Market, By Application, 2020-2028 (USD Mllion)

16 Agrium: Products & Services Offering

17 Yara International: Products & Services Offering

18 Sikko Industries Limited: Products & Services Offering

19 Shoko Agri Co. Ltd: Products & Services Offering

20 Land O’Lakes Inc: Products & Services Offering

21 NUFARM: Products & Services Offering

22 Coromandel International Ltd : Products & Services Offering

23 Helena Chemical Company: Products & Services Offering

24 Sapec S.A., Inc: Products & Services Offering

25 Haifa Chemicals: Products & Services Offering

26 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Japan Micronutrients Market Overview

2 Japan Micronutrients Market Value From 2020-2028 (USD Mllion)

3 Japan Micronutrients Market Share, By Type (2022)

4 Japan Micronutrients Market Share, By Application (2022)

5 Technological Trends In Japan Micronutrients Market

6 Four Quadrant Competitor Positioning Matrix

7 Impact Of Macro & Micro Indicators On The Market

8 Impact Of Key Drivers On The Japan Micronutrients Market

9 Impact Of Challenges On The Japan Micronutrients Market

10 Porter’s Five Forces Analysis

11 Japan Micronutrients Market: By Type Scope Key Takeaways

12 Japan Micronutrients Market, By Type Segment: Revenue Growth Analysis

13 Soil Fertilizer Market, By Country, 2020-2028 (USD Mllion)

14 Foliar Fertilizer Market, By Country, 2020-2028 (USD Mllion)

15 Seed Treatment Market, By Country, 2020-2028 (USD Mllion)

16 Hydroponics Market, By Country, 2020-2028 (USD Mllion)

17 Others Market, By Country, 2020-2028 (USD Mllion)

18 Japan Micronutrients Market: By Application Scope Key Takeaways

19 Japan Micronutrients Market, By Application Segment: Revenue Growth Analysis

20 Cereals Market, By Country, 2020-2028 (USD Mllion)

21 Fruits and Vegetables Market, By Country, 2020-2028 (USD Mllion)

22 Flowers Market, By Country, 2020-2028 (USD Mllion)

23 Others Market, By Country, 2020-2028 (USD Mllion)

24 Country Segment: Revenue Growth Analysis

25 Four Quadrant Positioning Matrix

26 Company Market Share Analysis

27 Agrium: Company Snapshot

28 Agrium: SWOT Analysis

29 Agrium: Geographic Presence

30 Yara International: Company Snapshot

31 Yara International: SWOT Analysis

32 Yara International: Geographic Presence

33 Sikko Industries Limited: Company Snapshot

34 Sikko Industries Limited: SWOT Analysis

35 Sikko Industries Limited: Geographic Presence

36 Shoko Agri Co. Ltd: Company Snapshot

37 Shoko Agri Co. Ltd: Swot Analysis

38 Shoko Agri Co. Ltd: Geographic Presence

39 Land O’Lakes Inc: Company Snapshot

40 Land O’Lakes Inc: SWOT Analysis

41 Land O’Lakes Inc: Geographic Presence

42 Nufarm: Company Snapshot

43 Nufarm: SWOT Analysis

44 Nufarm: Geographic Presence

45 Coromandel International Ltd : Company Snapshot

46 Coromandel International Ltd : SWOT Analysis

47 Coromandel International Ltd : Geographic Presence

48 Helena Chemical Company: Company Snapshot

49 Helena Chemical Company: SWOT Analysis

50 Helena Chemical Company: Geographic Presence

51 Sapec S.A., Inc.: Company Snapshot

52 Sapec S.A., Inc.: SWOT Analysis

53 Sapec S.A., Inc.: Geographic Presence

54 Haifa Chemicals: Company Snapshot

55 Haifa Chemicals: SWOT Analysis

56 Haifa Chemicals: Geographic Presence

57 Other Companies: Company Snapshot

58 Other Companies: SWOT Analysis

59 Other Companies: Geographic Presence

The Japan Micronutrients Market has been studied from the year 2019 till 2028. However, the CAGR provided in the report is from the year 2023 to 2028. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Japan Micronutrients Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS