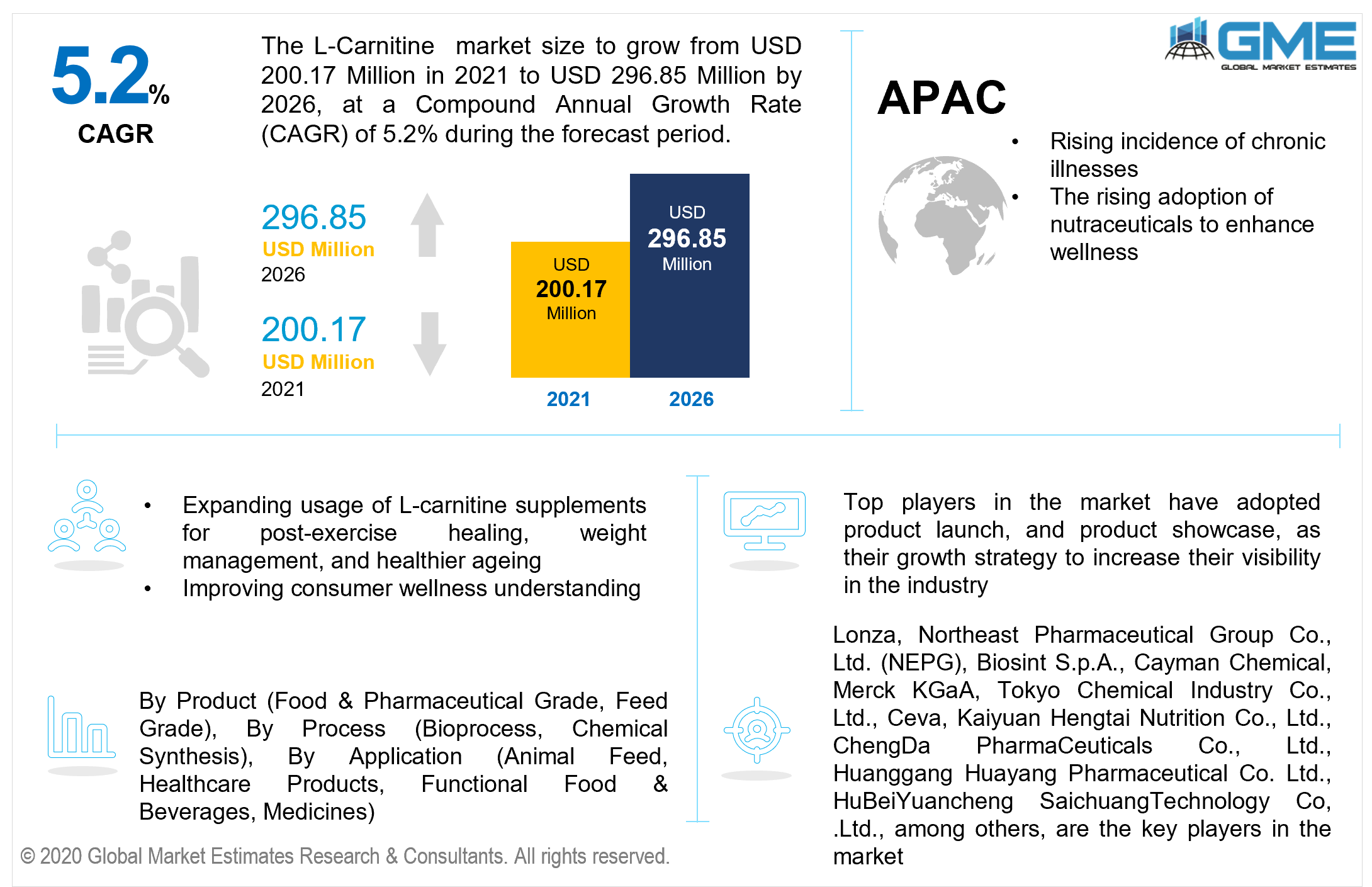

Global L-carnitine Market Size, Trends & Analysis - Forecasts to 2026 By Product (Food & Pharmaceutical Grade, Feed Grade), By Process (Bioprocess, Chemical Synthesis), By Application (Animal Feed, Healthcare Products, Functional Food & Beverages, Medicines), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and Competitor Analysis

The global L-carnitine market is projected to grow from USD 200.17 million in 2021 to USD 296.85 million by 2026 at a CAGR value of 5.2%. The market is expanding rapidly as a result of growing health-conscious target consumers, an increase in the volume of L-carnitine-containing product releases, and increased demand from the livestock feed sector. The market is projected to be propelled by improving knowledge of product advantages including improved muscle regeneration, reduced muscular pain, and muscle gain, resulting in increased product consumption for multiple application sectors, which is predicted to support market expansion. Over the forecast period, the market is anticipated to be driven by expanding usage of L-carnitine supplements for post-exercise healing, weight management, and healthier ageing.

People who have reduced levels of L-carnitine generated in their systems use L-carnitine as a supplementation. Low L-carnitine concentrations in certain persons are linked to a variety of reasons, comprising medical problems like skeletal syndromes, medication intake, and genetic abnormalities. Improving public consciousness of the importance of regular checkups and burgeoning public attention about medical conditions, as well as an expanding variety of therapies for numerous diseases and ailments, are likely to help the market throughout the forecast period.

According to research released by the National Library of Medicine, L-carnitine has also been proven to boost lactation and enhance metabolism in cattle (US Government). It is also utilised for muscle repair, fuel economy, and antioxidant qualities in dogs and horses, who allegedly advantage from L-carnitine supplementation, according to studies published by Oxford University Press. The advantages of L-carnitine supplements are likely to help market expansion throughout the forecast period.

Improving consumer wellness understanding and the rising incidence of chronic illnesses including cancer and diabetes as a result of hectic lives and poor dietary habits are significant aspects propelling growth in the global L-carnitine market. Other significant factors predicted to drive growth in the global L-carnitine market over the forecast period include expanding requirements for L-carnitine in the pharmaceutical sector for nutritional intervention and rising consumption from the f&b industry for the manufacture of nutritional supplementation.

Additional trends predicted to boost market expansion include increased usage of L-carnitine in the animal nutrition sector and skyrocketing demand for athletic nutrition food items. One other aspect that is predicted to help the advancement of this market is the introduction of numerous improved L-carnitine supplementation. Nevertheless, excessive intake of L-carnitine supplements may result in a variety of adverse effects, which would be a key impediment to the market's expansion throughout the forecast period.

L-carnitine saw a rise in demand during the COVID-19 epidemic due to increasing customer desire for healthcare and wellbeing products that lower the incidence of cardiovascular disease. Furthermore, scientists at the MRC Integrative Epidemiology Unit (IEU) at Bristol Medical School in the United Kingdom determined that L-carnitine and its analogues, including acetyl-carnitine, give significant protection against acute COVID-19. According to the study, increasing carnitine content in the blood decreases the incidence of acute COVID-19 by 40%. Such a favourable outcome for L-carnitine in acute COVID-19 patients is predicted to boost its consumption in a brief span of time.

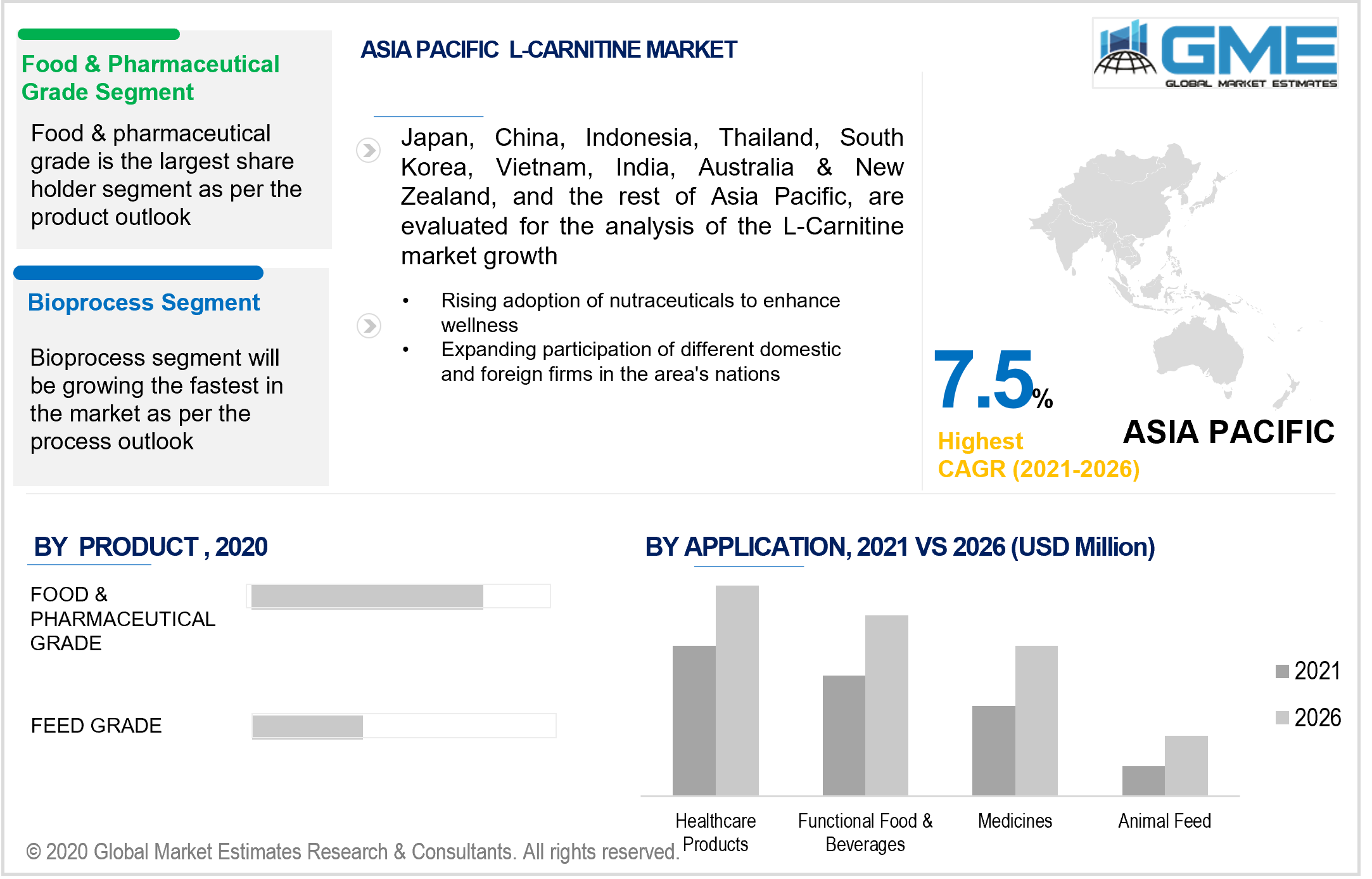

Based on the product the market is divided into food & pharmaceutical grade and feed grade. The food and pharmaceutical grade category is presumed to hold the largest market share. Pharmaceutical and food grade L-carnitine is predominantly used by individuals for a variety of purposes, namely healthy ageing, male fertility, newborn feeding, weight control, and post-exercise recovery. Even though the product is organically accessible in specific foods such as meat, avocados, and beans, a specified amount of L-carnitine is required to sustain an acceptable concentration in the body based on age, nutrition, and some other factors. The substance is ingested in a variety of ways, such as orally via dietary supplements, medications, multifunctional food and drinks, and infusions. It is crucial in aiding the healing mechanism following physical exertion.

Based on the type of process the market is divided into bioprocess, and chemical synthesis. The bioprocess category is likely to dominate the market and represent the majority of revenues. The increasing commercial consumption for L-carnitine has pushed producers to enhance their methods in order to increase manufacturing yield. Biological procedures that use microbes and enzymes are fundamentally asymmetrical and have significant output ratios.

Based on the application the market is categorized into animal feed, healthcare products, functional food and beverages, and medicines. Healthcare products are foreseen to dominate the market and account for the largest revenue share. L-carnitine is extensively utilised in a variety of healthcare items, notably weight reduction and stamina medications. L-Carnitine is utilised in the manufacture of healthcare goods such as vitamin supplements and powdered supplementation for weight loss, stamina, and cardiovascular fitness.

The use of L-Carnitine in dietary supplements aids in the treatment of low blood levels. The numerous chemical characteristics associated with L-Carnitine have resulted in an increase in its utilisation in the healthcare business, which has benefitted the L-Carnitine market on a global basis.

The North American region is expected to dominate the global market, attributable to the rising incidence of obesity and associated illnesses, as well as strong demand from the food and beverage, pharmaceuticals, and personal care sectors in this area. With the rise of a health-conscious customer base in the area over the last decade, the multifunctional food and beverage sector has witnessed tremendous advancement in North America. Individuals in North America are increasingly interested in L-carnitine supplements, which is likely to drive market expansion during the forecast period.

L-carnitine supplementation is also utilised in the medication of obesity for weight maintenance. Mexico and the United States have the world's most obese demographics, which has led to heightened usage of supplements for weight loss. This is likely to fuel the region's market throughout the forecast period.

The market in the Asia Pacific is expected to account for the highest CAGR, because of the participation of different domestic and foreign firms in the area's nations During the forecast period, the Asia Pacific area, particularly China and India, is expected to develop rapidly. Furthermore, greater production capability, reduced costs for raw material standards requirements for goods, expanding health concerns, and the increasing demographic of such developing nations are projected to fuel economic development.

The APAC nutraceutical sector is anticipated to develop owing to an expansion in the purchasing of supplements as a precautionary measure for health issues. Furthermore, owing to the negative side effects of medications, customers choose natural products over medications. The rising adoption of nutraceuticals to enhance wellness without posing any possible health risks is projected to drive market expansion during the forecast period.

Lonza, Northeast Pharmaceutical Group Co., Ltd. (NEPG), Biosint S.p.A., Cayman Chemical, Merck KGaA, Tokyo Chemical Industry Co., Ltd., Ceva, Kaiyuan Hengtai Nutrition Co., Ltd., ChengDa PharmaCeuticals Co., Ltd., Huanggang Huayang Pharmaceutical Co. Ltd., HuBeiYuancheng SaichuangTechnology Co, .Ltd., among others, are the key players in the market.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 L-carnitine Industry Overview, 2019-2026

2.1.1 Industry Overview

2.1.2 Proudct Overview

2.1.3 Process Overview

2.1.4 Application Overview

2.1.5 Regional Overview

Chapter 3 L-carnitine Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2019-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Growing health-conscious target consumers

3.3.1.2 Rising incidence of chronic illnesses

3.3.2 Industry Challenges

3.3.2.1 High consumption of L-carnitine supplements may have various side effects

3.4 Prospective Growth Scenario

3.4.1 Proudct Growth Scenario

3.4.2 Process Growth Scenario

3.4.3 Application Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 L-carnitine Market, By Proudct

4.1 Proudct Outlook

4.2 Food & Pharmaceutical Grade

4.2.1 Market Size, By Region, 2019-2026 (USD Million)

4.3 Feed Grade

4.3.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 5 L-carnitine Market, By Process

5.1 Process Outlook

5.2 Bioprocess

5.2.1 Market Size, By Region, 2019-2026 (USD Million)

5.3 Chemical Synthesis

5.3.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 6 L-carnitine Market, By Application

6.1 Application Outlook

6.2 Animal Feed

6.2.1 Market size, By Region, 2019-2026 (USD Million)

6.3 Healthcare Products

6.3.1 Market size, By Region, 2019-2026 (USD Million)

6.4 Functional Food & Beverages

6.4.1 Market size, By Region, 2019-2026 (USD Million)

6.5 Medicines

6.5.1 Market size, By Region, 2019-2026 (USD Million)

Chapter 7 L-carnitine Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2019-2026 (USD Million)

7.2.2 Market Size, By Proudct, 2019-2026 (USD Million)

7.2.3 Market Size, By Process, 2019-2026 (USD Million)

7.2.4 Market Size, By Application, 2019-2026 (USD Million)

7.2.5 U.S.

7.2.5.1 Market Size, By Proudct, 2019-2026 (USD Million)

7.2.5.2 Market Size, By Process, 2019-2026 (USD Million)

7.2.5.3 Market Size, By Application, 2019-2026 (USD Million)

7.2.6 Canada

7.2.6.1 Market Size, By Proudct, 2019-2026 (USD Million)

7.2.6.2 Market Size, By Process, 2019-2026 (USD Million)

7.2.6.3 Market Size, By Application, 2019-2026 (USD Million)

7.3 Europe

7.3.1 Market Size, By Country 2019-2026 (USD Million)

7.3.2 Market Size, By Proudct, 2019-2026 (USD Million)

7.3.3 Market Size, By Process, 2019-2026 (USD Million)

7.3.4 Market Size, By Application, 2019-2026 (USD Million)

7.3.5 Germany

7.2.5.1 Market Size, By Proudct, 2019-2026 (USD Million)

7.2.5.2 Market Size, By Process, 2019-2026 (USD Million)

7.2.5.3 Market Size, By Application, 2019-2026 (USD Million)

7.3.6 UK

7.3.6.1 Market Size, By Proudct, 2019-2026 (USD Million)

7.3.6.2 Market Size, By Process, 2019-2026 (USD Million)

7.3.6.3 Market Size, By Application, 2019-2026 (USD Million)

7.3.7 France

7.3.7.1 Market Size, By Proudct, 2019-2026 (USD Million)

7.3.7.2 Market Size, By Process, 2019-2026 (USD Million)

7.3.7.3 Market Size, By Application, 2019-2026 (USD Million)

7.3.8 Italy

7.3.8.1 Market Size, By Proudct, 2019-2026 (USD Million)

7.3.8.2 Market Size, By Process, 2019-2026 (USD Million)

7.3.8.3 Market Size, By Application, 2019-2026 (USD Million)

7.3.9 Spain

7.3.9.1 Market Size, By Proudct, 2019-2026 (USD Million)

7.3.9.2 Market Size, By Process, 2019-2026 (USD Million)

7.3.9.3 Market Size, By Application, 2019-2026 (USD Million)

7.3.10 Russia

7.3.10.1 Market Size, By Proudct, 2019-2026 (USD Million)

7.3.10.2 Market Size, By Process, 2019-2026 (USD Million)

7.3.10.3 Market Size, By Application, 2019-2026 (USD Million)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2019-2026 (USD Million)

7.4.2 Market Size, By Proudct, 2019-2026 (USD Million)

7.4.3 Market Size, By Process, 2019-2026 (USD Million)

7.4.4 Market Size, By Application, 2019-2026 (USD Million)

7.4.5 China

7.4.5.1 Market Size, By Proudct, 2019-2026 (USD Million)

7.4.5.2 Market Size, By Process, 2019-2026 (USD Million)

7.4.5.3 Market Size, By Application, 2019-2026 (USD Million)

7.4.6 India

7.4.6.1 Market Size, By Proudct, 2019-2026 (USD Million)

7.4.6.2 Market Size, By Process, 2019-2026 (USD Million)

7.4.6.3 Market Size, By Application, 2019-2026 (USD Million)

7.4.7 Japan

7.4.7.1 Market Size, By Proudct, 2019-2026 (USD Million)

7.4.7.2 Market Size, By Process, 2019-2026 (USD Million)

7.4.7.3 Market Size, By Application, 2019-2026 (USD Million)

7.4.8 Australia

7.4.8.1 Market Size, By Proudct, 2019-2026 (USD Million)

7.4.8.2 Market size, By Process, 2019-2026 (USD Million)

7.4.8.3 Market Size, By Application, 2019-2026 (USD Million)

7.4.9 South Korea

7.4.9.1 Market Size, By Proudct, 2019-2026 (USD Million)

7.4.9.2 Market Size, By Process, 2019-2026 (USD Million)

7.4.9.3 Market Size, By Application, 2019-2026 (USD Million)

7.5 Latin America

7.5.1 Market Size, By Country 2019-2026 (USD Million)

7.5.2 Market Size, By Proudct, 2019-2026 (USD Million)

7.5.3 Market Size, By Process, 2019-2026 (USD Million)

7.5.4 Market Size, By Application, 2019-2026 (USD Million)

7.5.5 Brazil

7.5.5.1 Market Size, By Proudct, 2019-2026 (USD Million)

7.5.5.2 Market Size, By Process, 2019-2026 (USD Million)

7.5.5.3 Market Size, By Application, 2019-2026 (USD Million)

7.5.6 Mexico

7.5.6.1 Market Size, By Proudct, 2019-2026 (USD Million)

7.5.6.2 Market Size, By Process, 2019-2026 (USD Million)

7.5.6.3 Market Size, By Application, 2019-2026 (USD Million)

7.5.7 Argentina

7.5.7.1 Market Size, By Proudct, 2019-2026 (USD Million)

7.5.7.2 Market Size, By Process, 2019-2026 (USD Million)

7.5.7.3 Market Size, By Application, 2019-2026 (USD Million)

7.6 MEA

7.6.1 Market Size, By Country 2019-2026 (USD Million)

7.6.2 Market Size, By Proudct, 2019-2026 (USD Million)

7.6.3 Market Size, By Process, 2019-2026 (USD Million)

7.6.4 Market Size, By Application, 2019-2026 (USD Million)

7.6.5 Saudi Arabia

7.6.5.1 Market Size, By Proudct, 2019-2026 (USD Million)

7.6.5.2 Market Size, By Process, 2019-2026 (USD Million)

7.6.5.3 Market Size, By Application, 2019-2026 (USD Million)

7.6.6 UAE

7.6.6.1 Market Size, By Proudct, 2019-2026 (USD Million)

7.6.6.2 Market Size, By Process, 2019-2026 (USD Million)

7.6.6.3 Market Size, By Application, 2019-2026 (USD Million)

7.6.7 South Africa

7.6.7.1 Market Size, By Proudct, 2019-2026 (USD Million)

7.6.7.2 Market Size, By Process, 2019-2026 (USD Million)

7.6.7.3 Market Size, By Application, 2019-2026 (USD Million)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 Lonza

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Info Graphic Analysis

8.3 Northeast Pharmaceutical Group Co., Ltd. (NEPG)

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info Graphic Analysis

8.4 Biosint S.p.A.

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info Graphic Analysis

8.5 Cayman Chemical

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info Graphic Analysis

8.6 Merck KGaA

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info Graphic Analysis

8.7 Tokyo Chemical Industry Co., Ltd.

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info Graphic Analysis

8.8 Ceva

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.9 Kaiyuan Hengtai Nutrition Co., Ltd.

8.9.1 Company Overview

8.9.2 Financial Analysis

8.9.3 Strategic Positioning

8.9.4 Info Graphic Analysis

8.10 ChengDa PharmaCeuticals Co., Ltd.

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info Graphic Analysis

8.11 Huanggang Huayang Pharmaceutical Co. Ltd.

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info Graphic Analysis

8.12 HuBeiYuancheng SaichuangTechnology Co, .Ltd.,

8.12.1 Company Overview

8.12.2 Financial Analysis

8.12.3 Strategic Positioning

8.12.4 Info Graphic Analysis

8.13 Other Companies

8.13.1 Company Overview

8.13.2 Financial Analysis

8.13.3 Strategic Positioning

8.13.4 Info Graphic Analysis

The Global L-carnitine Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the L-carnitine Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS