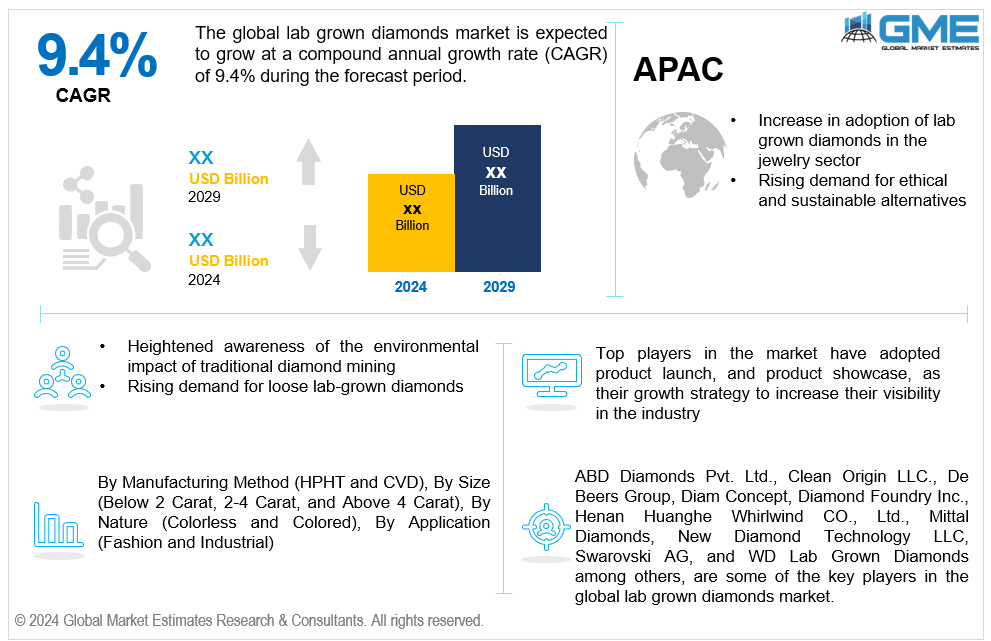

Global Lab Grown Diamonds Market Size, Trends & Analysis - Forecasts to 2029 By Manufacturing Method (HPHT and CVD), By Size (Below 2 Carat, 2-4 Carat, and Above 4 Carat), By Nature (Colorless and Colored), By Application (Fashion and Industrial), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

The global lab grown diamonds market is estimated to exhibit a CAGR of 9.4% from 2024 to 2029.

The primary factors propelling the market growth are the increase in the adoption of lab grown diamonds in the jewelry sector and rising demand for ethical and sustainable alternatives. The use of lab grown diamonds in jewelry has encouraged innovation in product design and customization. Since lab grown diamonds are more flexible in terms of size, shape, and color, jewelry designers are able to produce one-of-a-kind items that suit a wide range of consumer preferences. This customization capability enhances the appeal of lab grown diamonds and drives market growth. For instance, in February 2023, according to Edahn Golan, 17.3% of all diamond engagement ring purchases globally were set with lab grown diamonds.

Heightened awareness of the environmental impact of traditional diamond mining, along with the rising demand for loose lab grown diamonds, is expected to support the market growth. Compared to mined diamonds, loose lab grown diamonds provide increased supply chain efficiency. The supply chain uncertainties related to natural diamond mining are diminished by their ability to be manufactured in greater quantities and with more consistent qualities. This reliability in supply encourages jewelry retailers and manufacturers to stock loose lab grown diamonds to meet consumer demand, further driving market growth. For instance, Tenoris reports that the percentage of loose lab grown diamonds usage increased from 8.3% on average in 2020 to 17.3% in 2022.

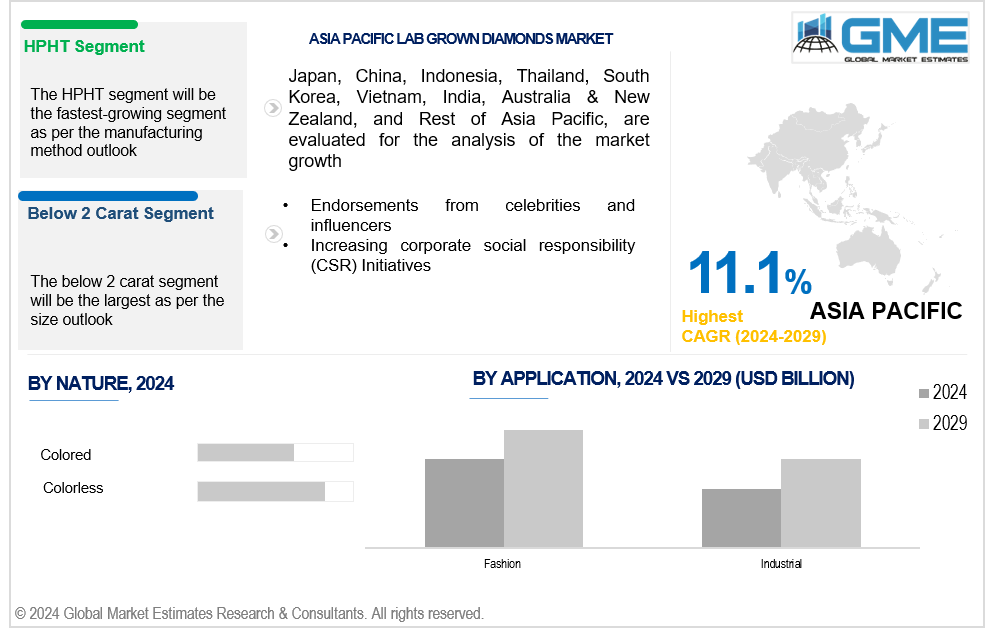

Endorsements from celebrities and influencers coupled with the increasing corporate social responsibility (CSR) Initiatives are propel market growth. In order to ensure ethical sourcing methods, CSR initiatives frequently place a strong emphasis on supply chain traceability and transparency. Lab-grown diamonds are an appealing alternative for companies dedicated to corporate social responsibility since they have an open supply chain with obvious traceability from manufacture to market. Companies can demonstrate their dedication to ethical sourcing and gain the trust of consumers who appreciate transparency by selecting lab grown diamonds. Additionally, compared to mined diamonds, lab grown diamonds have a much smaller environmental impact since they do not require large-scale mining operations, land disturbance, or heavy gear. In order to prevent resource depletion and encourage sustainable practices, companies that prioritize decreasing their environmental impact can select lab grown diamonds as part of their corporate social responsibility plan.

In addition to being useful for jewelry, lab grown diamonds have many industrial uses, including cutting tools, electronics, and medical devices.As technology advances and the quality of lab grown diamonds increases, there are opportunities to enhance their utilization in the industrial sector for cutting, grinding, drilling, and as a heat sink in electronics, creating demand outside of the traditional jewelry market. Moreover, customers are becoming increasingly concerned about transparency in the diamond supply chain. As the origin and production process of lab grown diamonds can be readily identified and validated, they provide a more transparent supply chain than mined diamonds. Companies that place a high value on transparency and provide certification for their lab grown diamonds can gain an advantage over rivals in the market.

However, uncertainty in the regulatory landscape and volatility in the price of lab grown diamonds hinder market growth.

The chemical vapor deposition (CVD) segment is expected to hold the largest share of the market over the forecast period. Since CVD methods are very scalable, large-scale production can benefit from using them. Due to its scalability, producers are able to effectively meet the increasing demand, which further contributes to CVD's market dominance.

The high pressure high temperature (HPHT) segment is expected to be the fastest-growing segment in the market from 2024-2029. Advances in HPHT technology have made the process more efficient and cost-effective. This includes improvements in the regulation of temperature and pressure and new developments in the diamond growth process. Due to these advancements, production costs have decreased, and the marketability of diamonds generated through HPHT has increased.

The below 2 carat segment is expected to hold the largest share of the market over the forecast period. For several reasons, including financial restraints, personal jewelry preferences, and subtle elegance, many buyers favor smaller diamonds. These needs are met by the below 2 carat segment, which is the most popular category in the market for lab grown diamonds.

The above 4 carat segment is anticipated to be the fastest-growing segment in the market from 2024-2029. Larger lab grown diamonds provide more room for personalization and modification, enabling customers to design one-of-a-kind jewelry products. To satisfy this demand, custom jewelers and designers are adding more lab grown diamonds over 4 carats to their collections.

The colorless segment is expected to hold the largest share of the market over the forecast period. Colorless diamonds are extremely valuable in the diamond industry because they are rare and of excellent quality. The Gemological Institute of America (GIA) and other grading laboratories have set rigid color grading criteria; colorless diamonds (rated D to F) are the most valued.

The colored segment is anticipated to be the fastest-growing segment in the market from 2024-2029. The color spectrum of lab grown diamonds is extensive and includes fancy colors like yellow, pink, blue, green, and orange, which are costly and rare in natural diamonds. Colored lab grown diamonds appeal to buyers looking for unusual and distinctive jewels because they manufacture these vivid hues through controlled techniques.

The fashion segment is expected to hold the largest share of the market over the forecast period. Environmentally conscious buyers in the fashion industry are drawn to lab grown diamonds, which are frequently thought of as being more ethical and sustainable than mined diamonds. As customers' concerns about sustainability increase, the fashion industry is projected to see a rise in demand for lab grown diamonds.

The industrial segment is anticipated to be the fastest-growing segment in the market from 2024 to 2029. Lab-grown diamonds are used in semiconductor substrates, heat sinks, and thermal management systems, among other electronic applications. Diamonds have great electrical insulation and thermal conductivity, which makes them perfect materials for dissipating heat and enhancing the functionality and dependability of electronic devices.

North America is expected to be the largest region in the global market. Much of North America's demand for diamonds is catered through imports. Retailers and producers in North America can maintain a consistent inventory flow due to the availability of imported lab grown diamonds, supporting market growth and fulfilling consumer demand for diamonds generated sustainably and morally. For instance, the United States imported USD 20.3 billion worth of diamonds in 2022, making it the second-largest importer of diamonds worldwide, according to the Observatory of Economic Complexity (OEC).

Asia Pacific is anticipated to witness rapid growth during the forecast period. Customers in the Asia Pacific region are exhibiting a preference for lab grown diamonds over mined diamonds due to increasing awareness of ethical sourcing and environmental issues. Lab-grown diamonds are seen to be more conflict-free and ecologically friendly than mined diamonds. For instance, as of May 2022, India produced 15% of the world's lab grown diamonds, according to a report from the Indian Commerce Ministry.

ABD Diamonds Pvt. Ltd., Clean Origin LLC.,De Beers Group, Diam Concept, Diamond Foundry Inc., Henan Huanghe Whirlwind CO., Ltd., Mittal Diamonds, New Diamond Technology LLC, Swarovski AG, and WD Lab Grown Diamonds among others, are some of the key players in the global lab grown diamonds market.

Please note: This is not an exhaustive list of companies profiled in the report.

In June 2022, De Beers Group, through its subsidiary, Element Six, established a partnership with Thorlabs, a company that designs and manufactures photonics equipment. As a result of this partnership, De Beers Group will provide a variety of CVD products, including optical diamond-enabled solutions.

In June 2021, WD Lab Grown Diamonds introduced Latitude, a new brand to broaden its offering. Latitude sells lab grown diamonds that are traceable.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Manufacturing Method Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL LAB GROWN DIAMONDS MARKET, BY MANUFACTURING METHOD

4.1 Introduction

4.2 Lab Grown Diamonds Market: Manufacturing Method Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 HPHT

4.4.1 HPHT Market Estimates and Forecast, 2021-2029 (USD Billion)

4.5 CVD

4.5.1 CVD Market Estimates and Forecast, 2021-2029 (USD Billion)

5 GLOBAL LAB GROWN DIAMONDS MARKET, BY SIZE

5.1 Introduction

5.2 Lab Grown Diamonds Market: Size Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 Below 2 Carat

5.4.1 Below 2 Carat Market Estimates and Forecast, 2021-2029 (USD Billion)

5.5 2-4 Carat

5.5.1 2-4 Carat Market Estimates and Forecast, 2021-2029 (USD Billion)

5.6 Above 4 Carat

5.6.1 Above 4 Carat Market Estimates and Forecast, 2021-2029 (USD Billion)

6 GLOBAL LAB GROWN DIAMONDS MARKET, BY NATURE

6.1 Introduction

6.2 Lab Grown Diamonds Market: Nature Scope Key Takeaways

6.3 Revenue Growth Analysis, 2023 & 2029

6.4 Colorless

6.4.1 Colorless Market Estimates and Forecast, 2021-2029 (USD Billion)

6.5 Colored

6.5.1 Colored Market Estimates and Forecast, 2021-2029 (USD Billion)

7 GLOBAL LAB GROWN DIAMONDS MARKET, BY APPLICATION

7.1 Introduction

7.2 Lab Grown Diamonds Market: Application Scope Key Takeaways

7.3 Revenue Growth Analysis, 2023 & 2029

7.4 Fashion

7.4.1 Fashion Market Estimates and Forecast, 2021-2029 (USD Billion)

7.5 Industrial

7.5.1 Industrial Market Estimates and Forecast, 2021-2029 (USD Billion)

8 GLOBAL LAB GROWN DIAMONDS MARKET, BY REGION

8.1 Introduction

8.2 North America Lab Grown Diamonds Market Estimates and Forecast, 2021-2029 (USD Billion)

8.2.1 By Manufacturing Method

8.2.2 By Size

8.2.3 By Nature

8.2.4 By Application

8.2.5 By Country

8.2.5.1 U.S. Lab Grown Diamonds Market Estimates and Forecast, 2021-2029 (USD Billion)

8.2.5.1.1 By Manufacturing Method

8.2.5.1.2 By Size

8.2.5.1.3 By Nature

8.2.5.1.4 By Application

8.2.5.2 Canada Lab Grown Diamonds Market Estimates and Forecast, 2021-2029 (USD Billion)

8.2.5.2.1 By Manufacturing Method

8.2.5.2.2 By Size

8.2.5.2.3 By Nature

8.2.5.2.4 By Application

8.2.5.3 Mexico Lab Grown Diamonds Market Estimates and Forecast, 2021-2029 (USD Billion)

8.2.5.3.1 By Manufacturing Method

8.2.5.3.2 By Size

8.2.5.3.3 By Nature

8.2.5.3.4 By Application

8.3 Europe Lab Grown Diamonds Market Estimates and Forecast, 2021-2029 (USD Billion)

8.3.1 By Manufacturing Method

8.3.2 By Size

8.3.3 By Nature

8.3.4 By Application

8.3.5 By Country

8.3.5.1 Germany Lab Grown Diamonds Market Estimates and Forecast, 2021-2029 (USD Billion)

8.3.5.1.1 By Manufacturing Method

8.3.5.1.2 By Size

8.3.5.1.3 By Nature

8.3.5.1.4 By Application

8.3.5.2 U.K. Presered Flowers Market Estimates and Forecast, 2021-2029 (USD Billion)

8.3.5.2.1 By Manufacturing Method

8.3.5.2.2 By Size

8.3.5.2.3 By Nature

8.3.5.2.4 By Application

8.3.5.3 France Lab Grown Diamonds Market Estimates and Forecast, 2021-2029 (USD Billion)

8.3.5.3.1 By Manufacturing Method

8.3.5.3.2 By Size

8.3.5.3.3 By Nature

8.3.5.3.4 By Application

8.3.5.4 Italy Lab Grown Diamonds Market Estimates and Forecast, 2021-2029 (USD Billion)

8.3.5.4.1 By Manufacturing Method

8.3.5.4.2 By Size

8.3.5.4.3 By Nature

8.3.5.4.4 By Application

8.3.5.5 Spain Lab Grown Diamonds Market Estimates and Forecast, 2021-2029 (USD Billion)

8.3.5.5.1 By Manufacturing Method

8.3.5.5.2 By Size

8.3.5.5.3 By Nature

8.3.5.5.4 By Application

8.3.5.6 Netherlands Lab Grown Diamonds Market Estimates and Forecast, 2021-2029 (USD Billion)

8.3.5.6.1 By Manufacturing Method

8.3.5.6.2 By Size

8.3.5.6.3 By Nature

8.3.5.6.4 By Application

8.3.5.7 Rest of Europe Lab Grown Diamonds Market Estimates and Forecast, 2021-2029 (USD Billion)

8.3.5.7.1 By Manufacturing Method

8.3.5.7.2 By Size

8.3.5.7.3 By Nature

8.3.5.7.4 By Application

8.4 Asia Pacific Lab Grown Diamonds Market Estimates and Forecast, 2021-2029 (USD Billion)

8.4.1 By Manufacturing Method

8.4.2 By Size

8.4.3 By Nature

8.4.4 By Application

8.4.5 By Country

8.4.5.1 China Lab Grown Diamonds Market Estimates and Forecast, 2021-2029 (USD Billion)

8.4.5.1.1 By Manufacturing Method

8.4.5.1.2 By Size

8.4.5.1.3 By Nature

8.4.5.1.4 By Application

8.4.5.2 Japan Lab Grown Diamonds Market Estimates and Forecast, 2021-2029 (USD Billion)

8.4.5.2.1 By Manufacturing Method

8.4.5.2.2 By Size

8.4.5.2.3 By Nature

8.4.5.2.4 By Application

8.4.5.3 India Lab Grown Diamonds Market Estimates and Forecast, 2021-2029 (USD Billion)

8.4.5.3.1 By Manufacturing Method

8.4.5.3.2 By Size

8.4.5.3.3 By Nature

8.4.5.3.4 By Application

8.4.5.4 South Korea Lab Grown Diamonds Market Estimates and Forecast, 2021-2029 (USD Billion)

8.4.5.4.1 By Manufacturing Method

8.4.5.4.2 By Size

8.4.5.4.3 By Nature

8.4.5.4.4 By Application

8.4.5.5 Singapore Lab Grown Diamonds Market Estimates and Forecast, 2021-2029 (USD Billion)

8.4.5.5.1 By Manufacturing Method

8.4.5.5.2 By Size

8.4.5.5.3 By Nature

8.4.5.5.4 By Application

8.4.5.6 Malaysia Lab Grown Diamonds Market Estimates and Forecast, 2021-2029 (USD Billion)

8.4.5.6.1 By Manufacturing Method

8.4.5.6.2 By Size

8.4.5.6.3 By Nature

8.4.5.6.4 By Application

8.4.5.7 Thailand Lab Grown Diamonds Market Estimates and Forecast, 2021-2029 (USD Billion)

8.4.5.7.1 By Manufacturing Method

8.4.5.7.2 By Size

8.4.5.7.3 By Nature

8.4.5.7.4 By Application

8.4.5.8 Indonesia Lab Grown Diamonds Market Estimates and Forecast, 2021-2029 (USD Billion)

8.4.5.8.1 By Manufacturing Method

8.4.5.8.2 By Size

8.4.5.8.3 By Nature

8.4.5.8.4 By Application

8.4.5.9 Vietnam Lab Grown Diamonds Market Estimates and Forecast, 2021-2029 (USD Billion)

8.4.5.9.1 By Manufacturing Method

8.4.5.9.2 By Size

8.4.5.9.3 By Nature

8.4.5.9.4 By Application

8.4.5.10 Taiwan Lab Grown Diamonds Market Estimates and Forecast, 2021-2029 (USD Billion)

8.4.5.10.1 By Manufacturing Method

8.4.5.10.2 By Size

8.4.5.10.3 By Nature

8.4.5.10.4 By Application

8.4.5.11 Rest of Asia Pacific Lab Grown Diamonds Market Estimates and Forecast, 2021-2029 (USD Billion)

8.4.5.11.1 By Manufacturing Method

8.4.5.11.2 By Size

8.4.5.11.3 By Nature

8.4.5.11.4 By Application

8.5 Middle East and Africa Lab Grown Diamonds Market Estimates and Forecast, 2021-2029 (USD Billion)

8.5.1 By Manufacturing Method

8.5.2 By Size

8.5.3 By Nature

8.5.4 By Application

8.5.5 By Country

8.5.5.1 Saudi Arabia Lab Grown Diamonds Market Estimates and Forecast, 2021-2029 (USD Billion)

8.5.5.1.1 By Manufacturing Method

8.5.5.1.2 By Size

8.5.5.1.3 By Nature

8.5.5.1.4 By Application

8.5.5.2 U.A.E. Lab Grown Diamonds Market Estimates and Forecast, 2021-2029 (USD Billion)

8.5.5.2.1 By Manufacturing Method

8.5.5.2.2 By Size

8.5.5.2.3 By Nature

8.5.5.2.4 By Application

8.5.5.3 Israel Lab Grown Diamonds Market Estimates and Forecast, 2021-2029 (USD Billion)

8.5.4.3.1 By Manufacturing Method

8.5.4.3.2 By Size

8.5.4.3.3 By Nature

8.5.5.3.4 By Application

8.5.5.4 South Africa Lab Grown Diamonds Market Estimates and Forecast, 2021-2029 (USD Billion)

8.5.5.4.1 By Manufacturing Method

8.5.5.4.2 By Size

8.5.5.4.3 By Nature

8.5.5.4.4 By Application

8.5.5.5 Rest of Middle East and Africa Lab Grown Diamonds Market Estimates and Forecast, 2021-2029 (USD Billion)

8.5.5.5.1 By Manufacturing Method

8.5.5.5.2 By Size

8.5.5.5.2 By Nature

8.5.5.5.4 By Application

8.6 Central & South America Lab Grown Diamonds Market Estimates and Forecast, 2021-2029 (USD Billion)

8.6.1 By Manufacturing Method

8.6.2 By Size

8.6.3 By Nature

8.6.4 By Application

8.6.5 By Country

8.6.5.1 Brazil Lab Grown Diamonds Market Estimates and Forecast, 2021-2029 (USD Billion)

8.6.5.1.1 By Manufacturing Method

8.6.5.1.2 By Size

8.6.5.1.3 By Nature

8.6.5.1.4 By Application

8.6.5.2 Argentina Lab Grown Diamonds Market Estimates and Forecast, 2021-2029 (USD Billion)

8.6.5.2.1 By Manufacturing Method

8.6.5.2.2 By Size

8.6.5.2.3 By Nature

8.6.5.2.4 By Application

8.6.5.3 Chile Lab Grown Diamonds Market Estimates and Forecast, 2021-2029 (USD Billion)

8.6.5.3.1 By Manufacturing Method

8.6.5.3.2 By Size

8.6.5.3.3 By Nature

8.6.5.5.4 By Application

8.6.5.4 Rest of Central & South America Lab Grown Diamonds Market Estimates and Forecast, 2021-2029 (USD Billion)

8.6.5.4.1 By Manufacturing Method

8.6.5.4.2 By Size

8.6.5.4.3 By Nature

8.6.5.4.4 By Application

9 COMPETITIVE LANDCAPE

9.1 Company Market Share Analysis

9.2 Four Quadrant Positioning Matrix

9.2.1 Market Leaders

9.2.2 Market Visionaries

9.2.3 Market Challengers

9.2.4 Niche Market Players

9.3 Vendor Landscape

9.3.1 North America

9.3.2 Europe

9.3.3 Asia Pacific

9.3.4 Rest of the World

9.4 Company Profiles

9.4.1 ABD Diamonds Pvt. Ltd.

9.4.1.1 Business Description & Financial Analysis

9.4.1.2 SWOT Analysis

9.4.1.3 Products & Services Offered

9.4.1.4 Strategic Alliances between Business Partners

9.4.2 Clean Origin LLC.

9.4.2.1 Business Description & Financial Analysis

9.4.2.2 SWOT Analysis

9.4.2.3 Products & Services Offered

9.4.2.4 Strategic Alliances between Business Partners

9.4.3 De Beers Group

9.4.3.1 Business Description & Financial Analysis

9.4.3.2 SWOT Analysis

9.4.3.3 Products & Services Offered

9.4.3.4 Strategic Alliances between Business Partners

9.4.4 Diam Concept

9.4.4.1 Business Description & Financial Analysis

9.4.4.2 SWOT Analysis

9.4.4.3 Products & Services Offered

9.4.4.4 Strategic Alliances between Business Partners

9.4.5 Diamond Foundry Inc.

9.4.5.1 Business Description & Financial Analysis

9.4.5.2 SWOT Analysis

9.4.5.3 Products & Services Offered

9.4.5.4 Strategic Alliances between Business Partners

9.4.6 HENAN HUANGHE WHIRLWIND CO., LTD.

9.4.6.1 Business Description & Financial Analysis

9.4.6.2 SWOT Analysis

9.4.6.3 Products & Services Offered

9.4.6.4 Strategic Alliances between Business Partners

9.4.7 Mittal Diamonds

9.4.7.1 Business Description & Financial Analysis

9.4.7.2 SWOT Analysis

9.4.7.3 Products & Services Offered

9.4.8.4 Strategic Alliances between Business Partners

9.4.8 New Diamond Technology LLC

9.4.8.1 Business Description & Financial Analysis

9.4.8.2 SWOT Analysis

9.4.8.3 Products & Services Offered

9.4.8.4 Strategic Alliances between Business Partners

9.4.9 Swarovski AG

9.4.9.1 Business Description & Financial Analysis

9.4.9.2 SWOT Analysis

9.4.9.3 Products & Services Offered

9.4.9.4 Strategic Alliances between Business Partners

9.4.10 WD Lab Grown Diamonds

9.4.10.1 Business Description & Financial Analysis

9.4.10.2 SWOT Analysis

9.4.10.3 Products & Services Offered

9.4.10.4 Strategic Alliances between Business Partners

9.4.11 Other Companies

9.4.11.1 Business Description & Financial Analysis

9.4.11.2 SWOT Analysis

9.4.11.3 Products & Services Offered

9.4.11.4 Strategic Alliances between Business Partners

10 RESEARCH METHODOLOGY

10.1 Market Introduction

10.1.1 Market Definition

10.1.2 Market Scope & Segmentation

10.2 Information Procurement

10.2.1 Secondary Research

10.2.1.1 Purchased Databases

10.2.1.2 GMEs Internal Data Repository

10.2.1.3 Secondary Resources & Third Party Perspectives

10.2.1.4 Company Information Sources

10.2.2 Primary Research

10.2.2.1 Various Types of Respondents for Primary Interviews

10.2.2.2 Number of Interviews Conducted throughout the Research Process

10.2.2.3 Primary Stakeholders

10.2.2.4 Discussion Guide for Primary Participants

10.2.3 Expert Panels

10.2.3.1 Expert Panels Across 30+ Industry

10.2.4 Paid Local Experts

10.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

10.3 Market Estimation

10.3.1 Top-Down Approach

10.3.1.1 Macro-Economic Indicators Considered

10.3.1.2 Micro-Economic Indicators Considered

10.3.2 Bottom Up Approach

10.3.2.1 Company Share Analysis Approach

10.3.2.2 Estimation of Potential Product Sales

10.4 Data Triangulation

10.4.1 Data Collection

10.4.2 Time Series, Cross Sectional & Panel Data Analysis

10.4.3 Cluster Analysis

10.5 Analysis and Output

10.5.1 Inhouse AI Based Real Time Analytics Tool

10.5.2 Output From Desk & Primary Research

10.6 Research Assumptions & Limitations

10.7.1 Research Assumptions

10.7.2 Research Limitations

LIST OF TABLES

1 Global Lab Grown Diamonds Market, By Manufacturing Method, 2021-2029 (USD Billion)

2 HPHT Market, By Region, 2021-2029 (USD Billion)

3 CVD Market, By Region, 2021-2029 (USD Billion)

4 Global Lab Grown Diamonds Market, By Size, 2021-2029 (USD Billion)

5 Below 2 Carat Market, By Region, 2021-2029 (USD Billion)

6 2-4 Carat Market, By Region, 2021-2029 (USD Billion)

7 Above 4 Carat Market, By Region, 2021-2029 (USD Billion)

8 Global Lab Grown Diamonds Market, By Nature, 2021-2029 (USD Billion)

9 Colorless Market, By Region, 2021-2029 (USD Billion)

10 Colored Market, By Region, 2021-2029 (USD Billion)

11 Global Lab Grown Diamonds Market, By APPLICATION, 2021-2029 (USD Billion)

12 Fashion Market, By Region, 2021-2029 (USD Billion)

13 Industrial Market, By Region, 2021-2029 (USD Billion)

14 Regional Analysis, 2021-2029 (USD Billion)

15 North America Lab Grown Diamonds Market, By Manufacturing Method, 2021-2029 (USD Billion)

16 North America Lab Grown Diamonds Market, By Size, 2021-2029 (USD Billion)

17 North America Lab Grown Diamonds Market, By Nature, 2021-2029 (USD Billion)

18 North America Lab Grown Diamonds Market, By Application, 2021-2029 (USD Billion)

19 North America Lab Grown Diamonds Market, By Country, 2021-2029 (USD Billion)

20 U.S Lab Grown Diamonds Market, By Manufacturing Method, 2021-2029 (USD Billion)

21 U.S Lab Grown Diamonds Market, By Size, 2021-2029 (USD Billion)

22 U.S Lab Grown Diamonds Market, By Nature, 2021-2029 (USD Billion)

23 U.S Lab Grown Diamonds Market, By Application, 2021-2029 (USD Billion)

24 Canada Lab Grown Diamonds Market, By Manufacturing Method, 2021-2029 (USD Billion)

25 Canada Lab Grown Diamonds Market, By Size, 2021-2029 (USD Billion)

26 Canada Lab Grown Diamonds Market, By Nature, 2021-2029 (USD Billion)

27 CANADA Lab Grown Diamonds Market, By Application, 2021-2029 (USD Billion)

28 Mexico Lab Grown Diamonds Market, By Manufacturing Method, 2021-2029 (USD Billion)

29 Mexico Lab Grown Diamonds Market, By Size, 2021-2029 (USD Billion)

30 Mexico Lab Grown Diamonds Market, By Nature, 2021-2029 (USD Billion)

31 mexico Lab Grown Diamonds Market, By Application, 2021-2029 (USD Billion)

32 Europe Lab Grown Diamonds Market, By Manufacturing Method, 2021-2029 (USD Billion)

33 Europe Lab Grown Diamonds Market, By Size, 2021-2029 (USD Billion)

34 Europe Lab Grown Diamonds Market, By Nature, 2021-2029 (USD Billion)

35 europe Lab Grown Diamonds Market, By Application, 2021-2029 (USD Billion)

36 europe Lab Grown Diamonds Market, By COUNTRY, 2021-2029 (USD Billion)

37 Germany Lab Grown Diamonds Market, By Manufacturing Method, 2021-2029 (USD Billion)

38 Germany Lab Grown Diamonds Market, By Size, 2021-2029 (USD Billion)

39 Germany Lab Grown Diamonds Market, By Nature, 2021-2029 (USD Billion)

40 germany Lab Grown Diamonds Market, By Application, 2021-2029 (USD Billion)

41 UK Lab Grown Diamonds Market, By Manufacturing Method, 2021-2029 (USD Billion)

42 UK Lab Grown Diamonds Market, By Size, 2021-2029 (USD Billion)

43 UK Lab Grown Diamonds Market, By Nature, 2021-2029 (USD Billion)

44 U.k Lab Grown Diamonds Market, By Application, 2021-2029 (USD Billion)

45 France Lab Grown Diamonds Market, By Manufacturing Method, 2021-2029 (USD Billion)

46 France Lab Grown Diamonds Market, By Size, 2021-2029 (USD Billion)

47 France Lab Grown Diamonds Market, By Nature, 2021-2029 (USD Billion)

48 france Lab Grown Diamonds Market, By Application, 2021-2029 (USD Billion)

49 Italy Lab Grown Diamonds Market, By Manufacturing Method, 2021-2029 (USD Billion)

50 Italy Lab Grown Diamonds Market, By T Size Type, 2021-2029 (USD Billion)

51 Italy Lab Grown Diamonds Market, By Nature, 2021-2029 (USD Billion)

52 italy Lab Grown Diamonds Market, By Application, 2021-2029 (USD Billion)

53 Spain Lab Grown Diamonds Market, By Manufacturing Method, 2021-2029 (USD Billion)

54 Spain Lab Grown Diamonds Market, By Size, 2021-2029 (USD Billion)

55 Spain Lab Grown Diamonds Market, By Nature, 2021-2029 (USD Billion)

56 spain Lab Grown Diamonds Market, By Application, 2021-2029 (USD Billion)

57 Netherlands Lab Grown Diamonds Market, By Manufacturing Method, 2021-2029 (USD Billion)

58 Netherlands Lab Grown Diamonds Market, By Size, 2021-2029 (USD Billion)

59 Netherlands Lab Grown Diamonds Market, By Nature, 2021-2029 (USD Billion)

60 Netherlands Lab Grown Diamonds Market, By APPLICATION, 2021-2029 (USD Billion)

61 Rest Of Europe Lab Grown Diamonds Market, By Manufacturing Method, 2021-2029 (USD Billion)

62 Rest Of Europe Lab Grown Diamonds Market, By Size, 2021-2029 (USD Billion)

63 Rest of Europe Lab Grown Diamonds Market, By Nature, 2021-2029 (USD Billion)

64 REST OF EUROPE Lab Grown Diamonds Market, By Application, 2021-2029 (USD Billion)

65 Asia Pacific Lab Grown Diamonds Market, By Manufacturing Method, 2021-2029 (USD Billion)

66 Asia Pacific Lab Grown Diamonds Market, By Size, 2021-2029 (USD Billion)

67 Asia Pacific Lab Grown Diamonds Market, By Nature, 2021-2029 (USD Billion)

68 asia Lab Grown Diamonds Market, By Application, 2021-2029 (USD Billion)

69 Asia Pacific Lab Grown Diamonds Market, By Country, 2021-2029 (USD Billion)

70 China Lab Grown Diamonds Market, By Manufacturing Method, 2021-2029 (USD Billion)

71 China Lab Grown Diamonds Market, By Size, 2021-2029 (USD Billion)

72 China Lab Grown Diamonds Market, By Nature, 2021-2029 (USD Billion)

73 china Lab Grown Diamonds Market, By Application, 2021-2029 (USD Billion)

74 India Lab Grown Diamonds Market, By Manufacturing Method, 2021-2029 (USD Billion)

75 India Lab Grown Diamonds Market, By Size, 2021-2029 (USD Billion)

76 India Lab Grown Diamonds Market, By Nature, 2021-2029 (USD Billion)

77 india Lab Grown Diamonds Market, By Application, 2021-2029 (USD Billion)

78 Japan Lab Grown Diamonds Market, By Manufacturing Method, 2021-2029 (USD Billion)

79 Japan Lab Grown Diamonds Market, By Size, 2021-2029 (USD Billion)

80 Japan Lab Grown Diamonds Market, By Nature, 2021-2029 (USD Billion)

81 japan Lab Grown Diamonds Market, By Application, 2021-2029 (USD Billion)

82 South Korea Lab Grown Diamonds Market, By Manufacturing Method, 2021-2029 (USD Billion)

83 South Korea Lab Grown Diamonds Market, By Size, 2021-2029 (USD Billion)

84 South Korea Lab Grown Diamonds Market, By Nature, 2021-2029 (USD Billion)

85 south korea Lab Grown Diamonds Market, By Application, 2021-2029 (USD Billion)

86 Singapore Lab Grown Diamonds Market, By Manufacturing Method, 2021-2029 (USD Billion)

87 Singapore Lab Grown Diamonds Market, By Size, 2021-2029 (USD Billion)

88 Singapore Lab Grown Diamonds Market, By Nature, 2021-2029 (USD Billion)

89 Singapore Lab Grown Diamonds Market, By Application, 2021-2029 (USD Billion)

90 Thailand Lab Grown Diamonds Market, By Manufacturing Method, 2021-2029 (USD Billion)

91 Thailand Lab Grown Diamonds Market, By Size, 2021-2029 (USD Billion)

92 Thailand Lab Grown Diamonds Market, By Nature, 2021-2029 (USD Billion)

93 Thailand Lab Grown Diamonds Market, By Application, 2021-2029 (USD Billion)

94 MALAYSIA Lab Grown Diamonds Market, By Manufacturing Method, 2021-2029 (USD Billion)

95 MALAYSIA Lab Grown Diamonds Market, By Size, 2021-2029 (USD Billion)

96 MALAYSIA Lab Grown Diamonds Market, By Nature, 2021-2029 (USD Billion)

97 MALAYSIA Lab Grown Diamonds Market, By Application, 2021-2029 (USD Billion)

98 Vietnam Lab Grown Diamonds Market, By Manufacturing Method, 2021-2029 (USD Billion)

99 Vietnam Lab Grown Diamonds Market, By Size, 2021-2029 (USD Billion)

100 Vietnam Lab Grown Diamonds Market, By Nature, 2021-2029 (USD Billion)

101 Taiwan Lab Grown Diamonds Market, By Manufacturing Method, 2021-2029 (USD Billion)

102 Taiwan Lab Grown Diamonds Market, By Size, 2021-2029 (USD Billion)

103 Taiwan Lab Grown Diamonds Market, By Nature, 2021-2029 (USD Billion)

104 Taiwan Lab Grown Diamonds Market, By Application, 2021-2029 (USD Billion)

105 REST OF APAC Lab Grown Diamonds Market, By Manufacturing Method, 2021-2029 (USD Billion)

106 REST OF APAC Lab Grown Diamonds Market, By Size, 2021-2029 (USD Billion)

107 REST OF APAC Lab Grown Diamonds Market, By Nature, 2021-2029 (USD Billion)

108 Rest of APAC Lab Grown Diamonds Market, By Application, 2021-2029 (USD Billion)

109 Middle East and Africa Lab Grown Diamonds Market, By Manufacturing Method, 2021-2029 (USD Billion)

110 Middle East and Africa Lab Grown Diamonds Market, By Size, 2021-2029 (USD Billion)

111 Middle East and Africa Lab Grown Diamonds Market, By Nature, 2021-2029 (USD Billion)

112 MIDDLE EAST AND AFRICA Lab Grown Diamonds Market, By Application, 2021-2029 (USD Billion)

113 Middle East and Africa Lab Grown Diamonds Market, By Country, 2021-2029 (USD Billion)

114 Saudi Arabia Lab Grown Diamonds Market, By Manufacturing Method, 2021-2029 (USD Billion)

115 Saudi Arabia Lab Grown Diamonds Market, By Size, 2021-2029 (USD Billion)

116 Saudi Arabia Lab Grown Diamonds Market, By Nature, 2021-2029 (USD Billion)

117 saudi arabia Lab Grown Diamonds Market, By Application, 2021-2029 (USD Billion)

118 UAE Lab Grown Diamonds Market, By Manufacturing Method, 2021-2029 (USD Billion)

119 UAE Lab Grown Diamonds Market, By Size, 2021-2029 (USD Billion)

120 UAE Lab Grown Diamonds Market, By Nature, 2021-2029 (USD Billion)

121 uae Lab Grown Diamonds Market, By Application, 2021-2029 (USD Billion)

122 Israel Lab Grown Diamonds Market, By Manufacturing Method, 2021-2029 (USD Billion)

123 Israel Lab Grown Diamonds Market, By Size, 2021-2029 (USD Billion)

124 Israel Lab Grown Diamonds Market, By Nature, 2021-2029 (USD Billion)

125 Israel Lab Grown Diamonds Market, By Application, 2021-2029 (USD Billion)

126 South Africa Lab Grown Diamonds Market, By Manufacturing Method, 2021-2029 (USD Billion)

127 South Africa Lab Grown Diamonds Market, By Size, 2021-2029 (USD Billion)

128 South Africa Lab Grown Diamonds Market, By Nature, 2021-2029 (USD Billion)

129 South Africa Lab Grown Diamonds Market, By Application, 2021-2029 (USD Billion)

130 REST OF MIDDLE EAST AND AFRICA Lab Grown Diamonds Market, By Manufacturing Method, 2021-2029 (USD Billion)

131 REST OF MIDDLE EAST AND AFRICA Lab Grown Diamonds Market, By Size, 2021-2029 (USD Billion)

132 REST OF MIDDLE EAST AND AFRICA Lab Grown Diamonds Market, By Nature, 2021-2029 (USD Billion)

133 REST OF MIDDLE EAST AND AFRICA Lab Grown Diamonds Market, By Application, 2021-2029 (USD Billion)

134 Central & South America Lab Grown Diamonds Market, By Manufacturing Method, 2021-2029 (USD Billion)

135 Central & South America Lab Grown Diamonds Market, By Size, 2021-2029 (USD Billion)

136 Central & South America Lab Grown Diamonds Market, By Nature, 2021-2029 (USD Billion)

137 CENTRAL & SOUTH AMERICA Lab Grown Diamonds Market, By Application, 2021-2029 (USD Billion)

138 Central & South America Lab Grown Diamonds Market, By Country, 2021-2029 (USD Billion)

139 Brazil Lab Grown Diamonds Market, By Manufacturing Method, 2021-2029 (USD Billion)

140 Brazil Lab Grown Diamonds Market, By Size, 2021-2029 (USD Billion)

141 Brazil Lab Grown Diamonds Market, By Nature, 2021-2029 (USD Billion)

142 brazil Lab Grown Diamonds Market, By Application, 2021-2029 (USD Billion)

143 Chile Lab Grown Diamonds Market, By Manufacturing Method, 2021-2029 (USD Billion)

144 Chile Lab Grown Diamonds Market, By Size, 2021-2029 (USD Billion)

145 Chile Lab Grown Diamonds Market, By Nature, 2021-2029 (USD Billion)

146 Chile Lab Grown Diamonds Market, By Application, 2021-2029 (USD Billion)

147 Argentina Lab Grown Diamonds Market, By Manufacturing Method, 2021-2029 (USD Billion)

148 Argentina Lab Grown Diamonds Market, By Size, 2021-2029 (USD Billion)

149 Argentina Lab Grown Diamonds Market, By Nature, 2021-2029 (USD Billion)

150 Argentina Lab Grown Diamonds Market, By Application, 2021-2029 (USD Billion)

151 REST OF CENTRAL AND SOUTH AMERICA Lab Grown Diamonds Market, By Manufacturing Method, 2021-2029 (USD Billion)

152 REST OF CENTRAL AND SOUTH AMERICA Lab Grown Diamonds Market, By Size, 2021-2029 (USD Billion)

153 REST OF CENTRAL AND SOUTH AMERICA Lab Grown Diamonds Market, By Nature, 2021-2029 (USD Billion)

154 REST OF CENTRAL AND SOUTH AMERICA Lab Grown Diamonds Market, By Application, 2021-2029 (USD Billion)

155 ABD Diamonds Pvt. Ltd.: Products & Services Offering

156 Clean Origin LLC.: Products & Services Offering

157 De Beers Group: Products & Services Offering

158 Diam Concept: Products & Services Offering

159 Diamond Foundry Inc.: Products & Services Offering

160 HENAN HUANGHE WHIRLWIND CO., LTD.: Products & Services Offering

161 Mittal Diamonds: Products & Services Offering

162 New Diamond Technology LLC: Products & Services Offering

163 Swarovski AG, Inc: Products & Services Offering

164 WD Lab Grown Diamonds: Products & Services Offering

165 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Lab Grown Diamonds Market Overview

2 Global Lab Grown Diamonds Market Value From 2021-2029 (USD Billion)

3 Global Lab Grown Diamonds Market Share, By Manufacturing Method (2023)

4 Global Lab Grown Diamonds Market Share, By Size (2023)

5 Global Lab Grown Diamonds Market Share, By Nature (2023)

6 Global Lab Grown Diamonds Market Share, By Application (2023)

7 Global Lab Grown Diamonds Market, By Region (Asia Pacific Market)

8 Technological Trends In Global Lab Grown Diamonds Market

9 Four Quadrant Competitor Positioning Matrix

10 Impact Of Macro & Micro Indicators On The Market

11 Impact Of Key Drivers On The Global Lab Grown Diamonds Market

12 Impact Of Challenges On The Global Lab Grown Diamonds Market

13 Porter’s Five Forces Analysis

14 Global Lab Grown Diamonds Market: By Manufacturing Method Scope Key Takeaways

15 Global Lab Grown Diamonds Market, By Manufacturing Method Segment: Revenue Growth Analysis

16 HPHT Market, By Region, 2021-2029 (USD Billion)

17 CVD Market, By Region, 2021-2029 (USD Billion)

18 Global Lab Grown Diamonds Market: By Size Scope Key Takeaways

19 Global Lab Grown Diamonds Market, By Size Segment: Revenue Growth Analysis

20 Below 2 Carat Market, By Region, 2021-2029 (USD Billion)

21 2-4 Carat Market, By Region, 2021-2029 (USD Billion)

22 Above 4 Carat Market, By Region, 2021-2029 (USD Billion)

23 Global Lab Grown Diamonds Market: By Nature Scope Key Takeaways

24 Global Lab Grown Diamonds Market, By Nature Segment: Revenue Growth Analysis

25 Colorless Market, By Region, 2021-2029 (USD Billion)

26 Colored Market, By Region, 2021-2029 (USD Billion)

27 Global Lab Grown Diamonds Market: By Application Scope Key Takeaways

28 Global Lab Grown Diamonds Market, By Application Segment: Revenue Growth Analysis

29 Fashion Market, By Region, 2021-2029 (USD Billion)

30 Industrial Market, By Region, 2021-2029 (USD Billion)

31 Regional Segment: Revenue Growth Analysis

32 Global Lab Grown Diamonds Market: Regional Analysis

33 North America Lab Grown Diamonds Market Overview

34 North America Lab Grown Diamonds Market, By Manufacturing Method

35 North America Lab Grown Diamonds Market, By Size

36 North America Lab Grown Diamonds Market, By Nature

37 North America Lab Grown Diamonds Market, By Application

38 North America Lab Grown Diamonds Market, By Country

39 U.S. Lab Grown Diamonds Market, By Manufacturing Method

40 U.S. Lab Grown Diamonds Market, By Size

41 U.S. Lab Grown Diamonds Market, By Nature

42 U.S. Lab Grown Diamonds Market, By Application

43 Canada Lab Grown Diamonds Market, By Manufacturing Method

44 Canada Lab Grown Diamonds Market, By Size

45 Canada Lab Grown Diamonds Market, By Nature

46 Canada Lab Grown Diamonds Market, By Application

47 Mexico Lab Grown Diamonds Market, By Manufacturing Method

48 Mexico Lab Grown Diamonds Market, By Size

49 Mexico Lab Grown Diamonds Market, By Nature

50 Mexico Lab Grown Diamonds Market, By Application

51 Four Quadrant Positioning Matrix

52 Company Market Share Analysis

53 ABD Diamonds Pvt. Ltd.: Company Snapshot

54 ABD Diamonds Pvt. Ltd.: SWOT Analysis

55 ABD Diamonds Pvt. Ltd.: Geographic Presence

56 Clean Origin LLC.: Company Snapshot

57 Clean Origin LLC.: SWOT Analysis

58 Clean Origin LLC.: Geographic Presence

59 De Beers Group: Company Snapshot

60 De Beers Group: SWOT Analysis

61 De Beers Group: Geographic Presence

62 Diam Concept: Company Snapshot

63 Diam Concept: Swot Analysis

64 Diam Concept: Geographic Presence

65 Diamond Foundry Inc.: Company Snapshot

66 Diamond Foundry Inc.: SWOT Analysis

67 Diamond Foundry Inc.: Geographic Presence

68 HENAN HUANGHE WHIRLWIND CO., LTD.: Company Snapshot

69 HENAN HUANGHE WHIRLWIND CO., LTD.: SWOT Analysis

70 HENAN HUANGHE WHIRLWIND CO., LTD.: Geographic Presence

71 Mittal Diamonds: Company Snapshot

72 Mittal Diamonds: SWOT Analysis

73 Mittal Diamonds: Geographic Presence

74 New Diamond Technology LLC: Company Snapshot

75 New Diamond Technology LLC: SWOT Analysis

76 New Diamond Technology LLC: Geographic Presence

77 Swarovski AG, Inc.: Company Snapshot

78 Swarovski AG, Inc.: SWOT Analysis

79 Swarovski AG, Inc.: Geographic Presence

80 WD Lab Grown Diamonds: Company Snapshot

81 WD Lab Grown Diamonds: SWOT Analysis

82 WD Lab Grown Diamonds: Geographic Presence

83 Other Companies: Company Snapshot

84 Other Companies: SWOT Analysis

85 Other Companies: Geographic Presence

The Global Lab Grown Diamonds Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Lab Grown Diamonds Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS