Global Leadless Pacemaker Market Size, Trends & Analysis - Forecasts to 2028 By Pacing Chamber (Single Chamber and Dual Chamber), By End-use (Hospitals and Outpatient Facilities), and By Region (North America, Asia Pacific, Central & South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

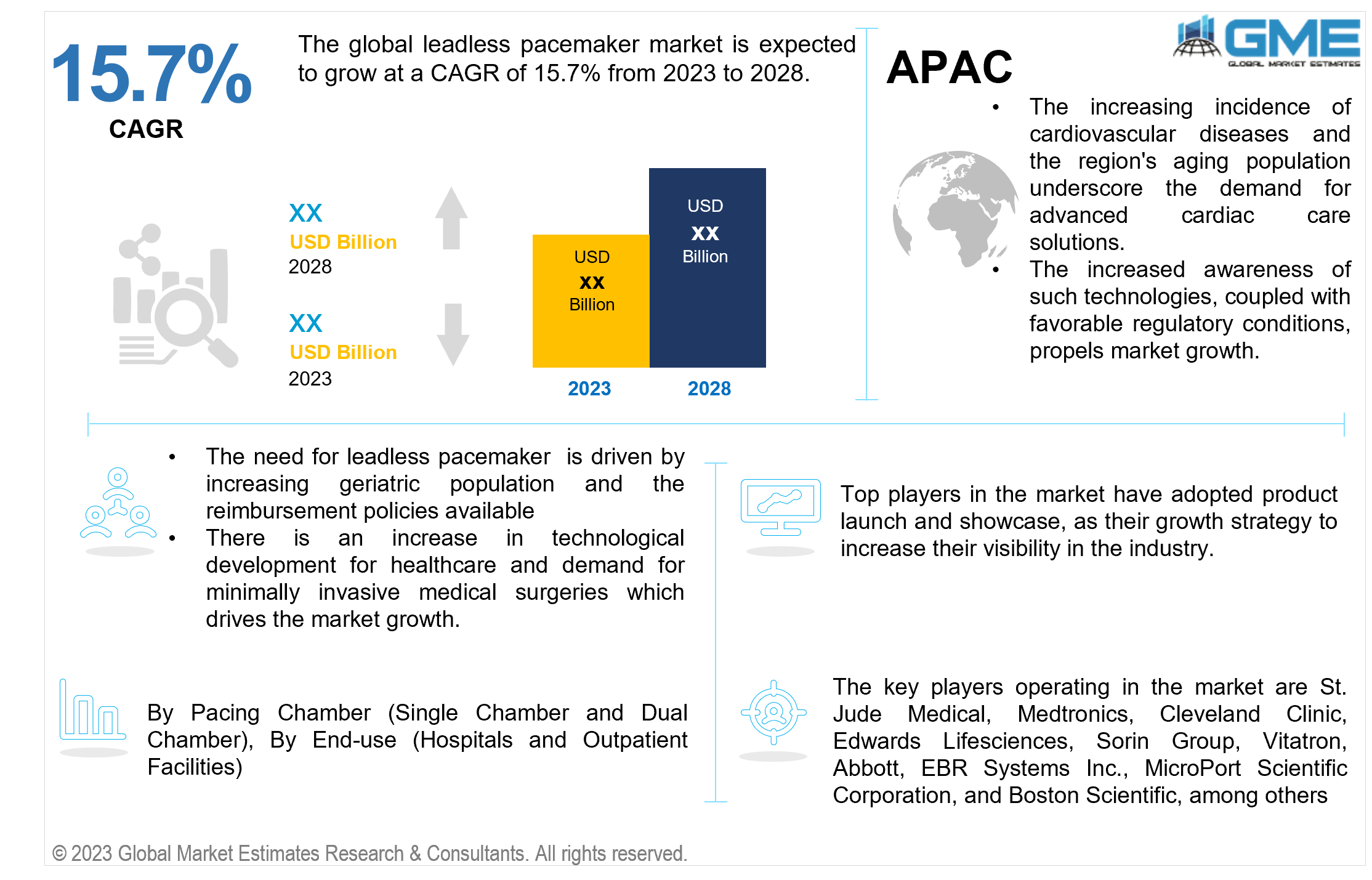

The global leadless pacemaker market is expected to grow at a CAGR of 15.7% from 2023 to 2028. Leadless pacemakers are self-contained devices that are implanted directly into the heart without the need for leads. They are designed to deliver electrical impulses to the heart's chambers, ensuring proper heart rate and rhythm. This innovation in pacemaker technology aims to improve patient outcomes and reduce the risks associated with traditional lead-based systems.

The driving factors of the global leadless pacemaker market mainly include increasing geriatric population and the reimbursement policies available. Reimbursement policies directly affect the financial burden on patients and healthcare providers. When reimbursement is available for advanced medical devices, it makes these technologies more financially accessible to patients and facilitates hospitals and healthcare facilities in incorporating them into their services. The aging population is more prone to cardiovascular diseases, including bradyarrhythmia (slow heart rate). As the global demographic shifts towards an older age structure, there is an increased incidence of cardiac conditions, creating a higher demand for pacemakers.

The restraining factors include lack of skills and expertise. The insertion of leadless pacemakers demands a specific skill set, and healthcare practitioners may need training to master the implantation procedure. This factor is linked to the adoption of this new technology can impede its smooth integration into everyday clinical practice.

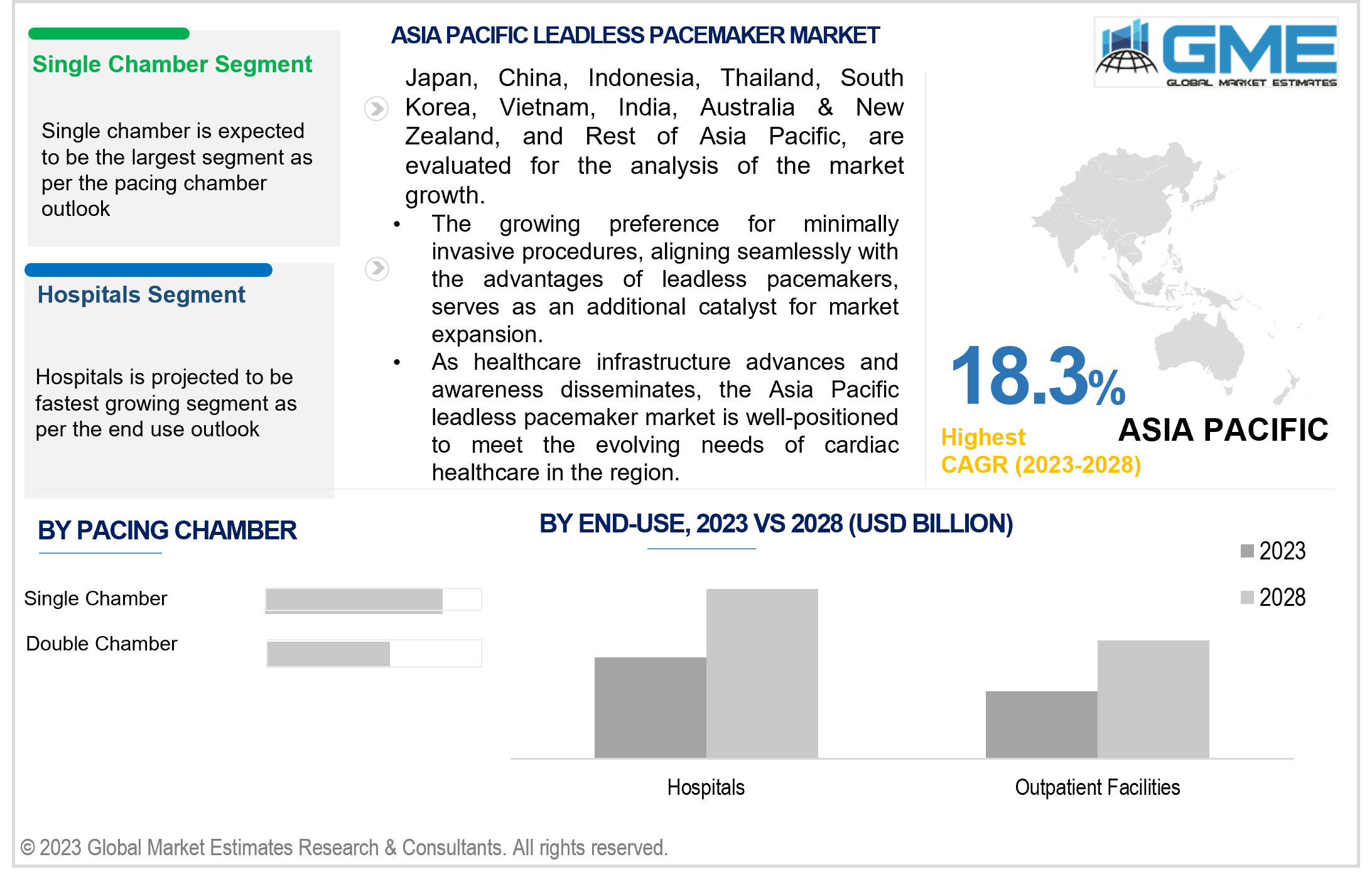

Based on pacing chamber, the market is segmented into single chamber and dual chamber. The single chamber segment is expected to dominate the market during the forecast period. Leadless pacemakers with a single chamber are suitable for a wider spectrum of patients experiencing bradycardia or heart block. Their reliability and simplicity make them a practical option for individuals who do not require the advanced features provided by dual-chamber devices. This device is designed to regulate the heart rate and rhythm by delivering electrical impulses through a single pacing electrode. The single-chamber configuration is often chosen for patients who do not require the additional features provided by dual-chamber pacemakers.

The dual chamber segment is projected to witness the fastest growth during the forecast period. Dual-chamber leadless pacemaker is a self-contained device implanted directly into the heart. This device is designed to regulate the heart's rate and rhythm by delivering electrical impulses through two pacing electrodes, one in the atrium and one in the ventricle. The dual-chamber configuration allows for more sophisticated pacing capabilities, including coordination of the timing between the atria and ventricles. This can be beneficial for patients with specific cardiac conditions that require more advanced pacing options.

Based on end use, the market is segmented into hospitals and outpatient facilities. The hospitals segment is expected to dominate the market during the forecast period. Hospitals are integrating leadless pacemakers into cardiac care by adopting their minimally invasive nature and advanced technology. Leadless pacemakers, when implanted directly into the heart, lower the likelihood of complications typically associated with conventional devices. Hospitals leverage their use for patients with bradycardia, utilizing the devices' reliability and simplicity. The compact design enables streamlined implantation procedures, contributing to quicker recovery times. As technology evolves, hospitals increasingly recognize the benefits of leadless pacemakers in providing effective and tailored cardiac pacing solutions, improving patient outcomes and enhancing the overall efficiency of cardiac care services.

The outpatient facilities segment is projected to witness the fastest growth during the forecast period. Outpatient facilities leverage the benefits of leadless pacemakers, such as their smaller size and simplified implantation procedure, to provide convenient and minimally invasive cardiac care. Patients can undergo the procedure with reduced recovery time, often allowing for same-day discharge. The use of leadless pacemakers in outpatient settings helps efficiently address bradycardia and heart block cases while enhancing patient comfort and streamlining the overall treatment process.

North America is analysed to be the largest region in the global leadless pacemaker market during the forecast period. The extensive healthcare infrastructure in the region, coupled with a high degree of awareness among healthcare providers, is fostering widespread adoption. Furthermore, the market is propelled by factors such as increasing aging population and a rising prevalence of cardiovascular diseases.

Asia Pacific is analysed to be the fastest-growing region in the global leadless pacemaker market during the forecast period. The increasing incidence of cardiovascular diseases and the region's aging population underscore the imperative for advanced cardiac care solutions. Furthermore, the increased awareness of such technologies, coupled with technological advancements and favorable regulatory conditions, propels market growth. The growing preference for minimally invasive procedures, aligning seamlessly with the advantages of leadless pacemakers, serves as an additional catalyst for market expansion. As healthcare infrastructure advances and awareness disseminates, the Asia Pacific leadless pacemaker market is well-positioned to meet the evolving needs of cardiac healthcare in the region

The key players operating in the global leadless pacemaker market are St. Jude Medical, Medtronics, Cleveland Clinic, Edwards Lifesciences, Sorin Group, Vitatron, Abbott, EBR Systems Inc., MicroPort Scientific Corporation, and Boston Scientific, among others.

Please note: This is not an exhaustive list of companies profiled in the report.

In August 2021, Medtronics announced new data from the Micra Coverage with Evidence Development (CED) Study, the largest evaluation of leadless pacemakers to date, which showed the Micra Transcatheter Pacing System (TPS) was associated with a 38% reduction in reinterventions and a 31% reduction in chronic complications at 2-years compared with traditional transvenous (TV-VVI) pacemakers.

In July 2023, Abbott announced that the U.S. Food and Drug Administration has granted the AVEIR™ dual chamber (DR) leadless pacemaker system, the world's first dual chamber leadless pacing system that treats people suffering from slow heart rhythms. The product approval significantly increases access to leadless pacing for millions of people across the U.S.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL LEADLESS PACEMAKER MARKET, BY PACING CHAMBER

4.1 Introduction

4.2 Leadless Pacemaker Market: Pacing Chamber Scope Key Takeaways

4.3 Revenue Growth Analysis, 2022 & 2028

4.4 Single Chamber

4.4.1 Single Chamber Market Estimates and Forecast, 2020-2028 (USD Million)

4.5 Double Chamber

4.5.1 Double Chamber Market Estimates and Forecast, 2020-2028 (USD Million)

5 GLOBAL LEADLESS PACEMAKER MARKET, BY END-USE

5.1 Introduction

5.2 Leadless Pacemaker Market: End-use Scope Key Takeaways

5.3 Revenue Growth Analysis, 2022 & 2028

5.4 Hospitals

5.4.1 Hospitals Market Estimates and Forecast, 2020-2028 (USD Million)

5.5 Outpatient Facilities

5.5.1 Outpatient Facilities Market Estimates and Forecast, 2020-2028 (USD Million)

6 GLOBAL LEADLESS PACEMAKER MARKET, BY REGION

6.1 Introduction

6.2 North America Leadless Pacemaker Market Estimates and Forecast, 2020-2028 (USD Million)

6.2.1 By Pacing Chamber

6.2.2 By End-use

6.2.3 By Country

6.2.3.1 U.S. Leadless Pacemaker Market Estimates and Forecast, 2020-2028 (USD Million)

6.2.3.1.1 By Pacing Chamber

6.2.3.1.2 By End-use

6.2.3.2 Canada Leadless Pacemaker Market Estimates and Forecast, 2020-2028 (USD Million)

6.2.3.2.1 By Pacing Chamber

6.2.3.2.2 By End-use

6.2.3.3 Mexico Leadless Pacemaker Market Estimates and Forecast, 2020-2028 (USD Million)

6.2.3.3.1 By Pacing Chamber

6.2.3.3.2 By End-use

6.3 Europe Leadless Pacemaker Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.1 By Pacing Chamber

6.3.2 By End-use

6.3.3 By Country

6.3.3.1 Germany Leadless Pacemaker Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.1.1 By Pacing Chamber

6.3.3.1.2 By End-use

6.3.3.2 U.K. Leadless Pacemaker Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.2.1 By Pacing Chamber

6.3.3.2.2 By End-use

6.3.3.3 France Leadless Pacemaker Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.3.1 By Pacing Chamber

6.3.3.3.2 By End-use

6.3.3.4 Italy Leadless Pacemaker Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.4.1 By Pacing Chamber

6.3.3.4.2 By End-use

6.3.3.5 Spain Leadless Pacemaker Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.5.1 By Pacing Chamber

6.3.3.5.2 By End-use

6.3.3.6 Netherlands Leadless Pacemaker Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.6.1 By Pacing Chamber

6.3.3.6.2 By End-use

6.3.3.7 Rest of Europe Leadless Pacemaker Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.6.1 By Pacing Chamber

6.3.3.6.2 By End-use

6.4 Asia Pacific Leadless Pacemaker Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.1 By Pacing Chamber

6.4.2 By End-use

6.4.3 By Country

6.4.3.1 China Leadless Pacemaker Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.1.1 By Pacing Chamber

6.4.3.1.2 By End-use

6.4.3.2 Japan Leadless Pacemaker Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.2.1 By Pacing Chamber

6.4.3.2.2 By End-use

6.4.3.3 India Leadless Pacemaker Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.3.1 By Pacing Chamber

6.4.3.3.2 By End-use

6.4.3.4 South Korea Leadless Pacemaker Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.4.1 By Pacing Chamber

6.4.3.4.2 By End-use

6.4.3.5 Singapore Leadless Pacemaker Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.5.1 By Pacing Chamber

6.4.3.5.2 By End-use

6.4.3.6 Malaysia Leadless Pacemaker Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.6.1 By Pacing Chamber

6.4.3.6.2 By End-use

6.4.3.7 Thailand Leadless Pacemaker Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.6.1 By Pacing Chamber

6.4.3.6.2 By End-use

6.4.3.8 Indonesia Leadless Pacemaker Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.7.1 By Pacing Chamber

6.4.3.7.2 By End-use

6.4.3.9 Vietnam Leadless Pacemaker Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.8.1 By Pacing Chamber

6.4.3.8.2 By End-use

6.4.3.10 Taiwan Leadless Pacemaker Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.10.1 By Pacing Chamber

6.4.3.10.2 By End-use

6.4.3.11 Rest of Asia Pacific Leadless Pacemaker Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.11.1 By Pacing Chamber

6.4.3.11.2 By End-use

6.5 Middle East and Africa Leadless Pacemaker Market Estimates and Forecast, 2020-2028 (USD Million)

6.5.1 By Pacing Chamber

6.5.2 By End-use

6.5.3 By Country

6.5.3.1 Saudi Arabia Leadless Pacemaker Market Estimates and Forecast, 2020-2028 (USD Million)

6.5.3.1.1 By Pacing Chamber

6.5.3.1.2 By End-use

6.5.3.2 U.A.E. Leadless Pacemaker Market Estimates and Forecast, 2020-2028 (USD Million)

6.5.3.2.1 By Pacing Chamber

6.5.3.2.2 By End-use

6.5.3.3 Israel Leadless Pacemaker Market Estimates and Forecast, 2020-2028 (USD Million)

6.5.3.3.1 By Pacing Chamber

6.5.3.3.2 By End-use

6.5.3.4 South Africa Leadless Pacemaker Market Estimates and Forecast, 2020-2028 (USD Million)

6.5.3.4.1 By Pacing Chamber

6.5.3.4.2 By End-use

6.5.3.5 Rest of Middle East and Africa Leadless Pacemaker Market Estimates and Forecast, 2020-2028 (USD Million)

6.5.3.5.1 By Pacing Chamber

6.5.3.5.2 By End-use

6.6 Central & South America Leadless Pacemaker Market Estimates and Forecast, 2020-2028 (USD Million)

6.6.1 By Pacing Chamber

6.6.2 By End-use

6.6.3 By Country

6.6.3.1 Brazil Leadless Pacemaker Market Estimates and Forecast, 2020-2028 (USD Million)

6.6.3.1.1 By Pacing Chamber

6.6.3.1.2 By End-use

6.6.3.2 Argentina Leadless Pacemaker Market Estimates and Forecast, 2020-2028 (USD Million)

6.6.3.2.1 By Pacing Chamber

6.6.3.2.2 By End-use

6.6.3.3 Chile Leadless Pacemaker Market Estimates and Forecast, 2020-2028 (USD Million)

6.6.3.3.1 By Pacing Chamber

6.6.3.3.2 By End-use

6.6.3.3 Rest of Central & South America Leadless Pacemaker Market Estimates and Forecast, 2020-2028 (USD Million)

6.6.3.3.1 By Pacing Chamber

6.6.3.3.2 By End-use

7 COMPETITIVE LANDCAPE

7.1 Company Market Share Analysis

7.2 Four Quadrant Positioning Matrix

7.2.1 Market Leaders

7.2.2 Market Visionaries

7.2.3 Market Challengers

7.2.4 Niche Market Players

7.3 Vendor Landscape

7.3.1 North America

7.3.2 Europe

7.3.3 Asia Pacific

7.3.4 Rest of the World

7.4 Company Profiles

7.4.1 St. Jude Medical Corporation

7.4.1.1 Business Description & Financial Analysis

7.4.1.2 SWOT Analysis

7.4.1.3 Products & Services Offered

7.4.1.4 Strategic Alliances between Business Partners

7.4.2 Medtronics

7.4.2.1 Business Description & Financial Analysis

7.4.2.2 SWOT Analysis

7.4.2.3 Products & Services Offered

7.4.2.4 Strategic Alliances between Business Partners

7.4.3 Cleveland Clinic

7.4.3.1 Business Description & Financial Analysis

7.4.3.2 SWOT Analysis

7.4.3.3 Products & Services Offered

7.4.3.4 Strategic Alliances between Business Partners

7.4.4 Edwards Lifesciences

7.4.4.1 Business Description & Financial Analysis

7.4.4.2 SWOT Analysis

7.4.4.3 Products & Services Offered

7.4.4.4 Strategic Alliances between Business Partners

7.4.5 Sorin GroupSorin Group

7.4.5.1 Business Description & Financial Analysis

7.4.5.2 SWOT Analysis

7.4.5.3 Products & Services Offered

7.4.5.4 Strategic Alliances between Business Partners

7.4.6 VITATRON

7.4.6.1 Business Description & Financial Analysis

7.4.6.2 SWOT Analysis

7.4.6.3 Products & Services Offered

7.4.6.4 Strategic Alliances between Business Partners

7.4.7 Abbott

7.4.7.1 Business Description & Financial Analysis

7.4.7.2 SWOT Analysis

7.4.7.3 Products & Services Offered

7.4.7.4 Strategic Alliances between Business Partners

7.4.8 EBR Systems Inc.

7.4.8.1 Business Description & Financial Analysis

7.4.8.2 SWOT Analysis

7.4.8.3 Products & Services Offered

7.4.8.4 Strategic Alliances between Business Partners

7.4.9 MicroPort Scientific Corporation

7.4.9.1 Business Description & Financial Analysis

7.4.9.2 SWOT Analysis

7.4.9.3 Products & Services Offered

7.4.9.4 Strategic Alliances between Business Partners

7.4.10 Boston Scientific

7.4.10.1 Business Description & Financial Analysis

7.4.10.2 SWOT Analysis

7.4.10.3 Products & Services Offered

7.4.10.4 Strategic Alliances between Business Partners

7.4.11 Other Companies

7.4.11.1 Business Description & Financial Analysis

7.4.11.2 SWOT Analysis

7.4.11.3 Products & Services Offered

7.4.11.4 Strategic Alliances between Business Partners

8 RESEARCH METHODOLOGY

8.1 Market Introduction

8.1.1 Market Definition

8.1.2 Market Scope & Segmentation

8.2 Information Procurement

8.2.1 Secondary Research

8.2.1.1 Purchased Databases

8.2.1.2 GMEs Internal Data Repository

8.2.1.3 Secondary Resources & Third Party Perspectives

8.2.1.4 Company Information Sources

8.2.2 Primary Research

8.2.2.1 Various Types of Respondents for Primary Interviews

8.2.2.2 Number of Interviews Conducted throughout the Research Process

8.2.2.3 Primary Stakeholders

8.2.2.4 Discussion Guide for Primary Participants

8.2.3 Expert Panels

8.2.3.1 Expert Panels Across 30+ Industry

8.2.4 Paid Local Experts

8.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

8.3 Market Estimation

8.3.1 Top-Down Approach

8.3.1.1 Macro-Economic Indicators Considered

8.3.1.2 Micro-Economic Indicators Considered

8.3.2 Bottom Up Approach

8.3.2.1 Company Share Analysis Approach

8.3.2.2 Estimation of Potential Product Sales

8.4 Data Triangulation

8.4.1 Data Collection

8.4.2 Time Series, Cross Sectional & Panel Data Analysis

8.4.3 Cluster Analysis

8.5 Analysis and Output

8.5.1 Inhouse AI Based Real Time Analytics Tool

8.5.2 Output From Desk & Primary Research

8.6 Research Assumptions & Limitations

8.6.1 Research Assumptions

8.6.2 Research Limitations

LIST OF TABLES

1 Global Leadless Pacemaker Market, By Pacing Chamber, 2020-2028 (USD Mllion)

2 Single Chamber Market, By Region, 2020-2028 (USD Mllion)

3 Double Chamber Market, By Region, 2020-2028 (USD Mllion)

4 Global Leadless Pacemaker Market, By End-use, 2020-2028 (USD Mllion)

5 Hospitals Market, By Region, 2020-2028 (USD Mllion)

6 Outpatient Facilities Market, By Region, 2020-2028 (USD Mllion)

7 Regional Analysis, 2020-2028 (USD Mllion)

8 North America Leadless Pacemaker Market, By Pacing Chamber, 2020-2028 (USD Mllion)

9 North America Leadless Pacemaker Market, By End-use, 2020-2028 (USD Mllion)

10 North America Leadless Pacemaker Market, By Country, 2020-2028 (USD Mllion)

11 U.S. Leadless Pacemaker Market, By Pacing Chamber, 2020-2028 (USD Mllion)

12 U.S. Leadless Pacemaker Market, By End-use, 2020-2028 (USD Mllion)

13 Canada Leadless Pacemaker Market, By Pacing Chamber, 2020-2028 (USD Mllion)

14 Canada Leadless Pacemaker Market, By End-use, 2020-2028 (USD Mllion)

15 Mexico Leadless Pacemaker Market, By Pacing Chamber, 2020-2028 (USD Mllion)

16 Mexico Leadless Pacemaker Market, By End-use, 2020-2028 (USD Mllion)

17 Europe Leadless Pacemaker Market, By Pacing Chamber, 2020-2028 (USD Mllion)

18 Europe Leadless Pacemaker Market, By End-use, 2020-2028 (USD Mllion)

19 Europe Leadless Pacemaker Market, By Country, 2020-2028 (USD Mllion)

20 Germany Leadless Pacemaker Market, By Pacing Chamber, 2020-2028 (USD Mllion)

21 Germany Leadless Pacemaker Market, By End-use, 2020-2028 (USD Mllion)

22 U.K. Leadless Pacemaker Market, By Pacing Chamber, 2020-2028 (USD Mllion)

23 U.K. Leadless Pacemaker Market, By End-use, 2020-2028 (USD Mllion)

24 France Leadless Pacemaker Market, By Pacing Chamber, 2020-2028 (USD Mllion)

25 France Leadless Pacemaker Market, By End-use, 2020-2028 (USD Mllion)

26 Italy Leadless Pacemaker Market, By Pacing Chamber, 2020-2028 (USD Mllion)

27 Italy Leadless Pacemaker Market, By End-use, 2020-2028 (USD Mllion)

28 Spain Leadless Pacemaker Market, By Pacing Chamber, 2020-2028 (USD Mllion)

29 Spain Leadless Pacemaker Market, By End-use, 2020-2028 (USD Mllion)

30 Netherlands Leadless Pacemaker Market, By Pacing Chamber, 2020-2028 (USD Mllion)

31 Netherlands Leadless Pacemaker Market, By End-use, 2020-2028 (USD Mllion)

32 Rest Of Europe Leadless Pacemaker Market, By Pacing Chamber, 2020-2028 (USD Mllion)

33 Rest Of Europe Leadless Pacemaker Market, By End-use, 2020-2028 (USD Mllion)

34 Asia Pacific Leadless Pacemaker Market, By Pacing Chamber, 2020-2028 (USD Mllion)

35 Asia Pacific Leadless Pacemaker Market, By End-use, 2020-2028 (USD Mllion)

36 Asia Pacific Leadless Pacemaker Market, By Country, 2020-2028 (USD Mllion)

37 China Leadless Pacemaker Market, By Pacing Chamber, 2020-2028 (USD Mllion)

38 China Leadless Pacemaker Market, By End-use, 2020-2028 (USD Mllion)

39 Japan Leadless Pacemaker Market, By Pacing Chamber, 2020-2028 (USD Mllion)

40 Japan Leadless Pacemaker Market, By End-use, 2020-2028 (USD Mllion)

41 India Leadless Pacemaker Market, By Pacing Chamber, 2020-2028 (USD Mllion)

42 India Leadless Pacemaker Market, By End-use, 2020-2028 (USD Mllion)

43 South Korea Leadless Pacemaker Market, By Pacing Chamber, 2020-2028 (USD Mllion)

44 South Korea Leadless Pacemaker Market, By End-use, 2020-2028 (USD Mllion)

45 Singapore Leadless Pacemaker Market, By Pacing Chamber, 2020-2028 (USD Mllion)

46 Singapore Leadless Pacemaker Market, By End-use, 2020-2028 (USD Mllion)

47 Thailand Leadless Pacemaker Market, By Pacing Chamber, 2020-2028 (USD Mllion)

48 Thailand Leadless Pacemaker Market, By End-use, 2020-2028 (USD Mllion)

49 Malaysia Leadless Pacemaker Market, By Pacing Chamber, 2020-2028 (USD Mllion)

50 Malaysia Leadless Pacemaker Market, By End-use, 2020-2028 (USD Mllion)

51 Indonesia Leadless Pacemaker Market, By Pacing Chamber, 2020-2028 (USD Mllion)

52 Indonesia Leadless Pacemaker Market, By End-use, 2020-2028 (USD Mllion)

53 Vietnam Leadless Pacemaker Market, By Pacing Chamber, 2020-2028 (USD Mllion)

54 Vietnam Leadless Pacemaker Market, By End-use, 2020-2028 (USD Mllion)

55 Taiwan Leadless Pacemaker Market, By Pacing Chamber, 2020-2028 (USD Mllion)

56 Taiwan Leadless Pacemaker Market, By End-use, 2020-2028 (USD Mllion)

57 Rest of APAC Leadless Pacemaker Market, By Pacing Chamber, 2020-2028 (USD Mllion)

58 Rest of APAC Leadless Pacemaker Market, By End-use, 2020-2028 (USD Mllion)

59 Middle East and Africa Leadless Pacemaker Market, By Pacing Chamber, 2020-2028 (USD Mllion)

60 Middle East and Africa Leadless Pacemaker Market, By End-use, 2020-2028 (USD Mllion)

61 Middle East and Africa Leadless Pacemaker Market, By country, 2020-2028 (USD Mllion)

62 Saudi Arabia Leadless Pacemaker Market, By Pacing Chamber, 2020-2028 (USD Mllion)

63 Saudi Arabia Leadless Pacemaker Market, By End-use, 2020-2028 (USD Mllion)

64 UAE Leadless Pacemaker Market, By Pacing Chamber, 2020-2028 (USD Mllion)

65 UAE Leadless Pacemaker Market, By End-use, 2020-2028 (USD Mllion)

66 Israel Leadless Pacemaker Market, By Pacing Chamber, 2020-2028 (USD Mllion)

67 Israel Leadless Pacemaker Market, By End-use, 2020-2028 (USD Mllion)

68 South Africa Leadless Pacemaker Market, By Pacing Chamber, 2020-2028 (USD Mllion)

69 South Africa Leadless Pacemaker Market, By End-use, 2020-2028 (USD Mllion)

70 Rest Of Middle East and Africa Leadless Pacemaker Market, By Pacing Chamber, 2020-2028 (USD Mllion)

71 Rest Of Middle East and Africa Leadless Pacemaker Market, By End-use, 2020-2028 (USD Mllion)

72 Central & South America Leadless Pacemaker Market, By Pacing Chamber, 2020-2028 (USD Mllion)

73 Central & South America Leadless Pacemaker Market, By End-use, 2020-2028 (USD Mllion)

74 Central & South America Leadless Pacemaker Market, By Country, 2020-2028 (USD Mllion)

75 Brazil Leadless Pacemaker Market, By Pacing Chamber, 2020-2028 (USD Mllion)

76 Brazil Leadless Pacemaker Market, By End-use, 2020-2028 (USD Mllion)

77 Chile Leadless Pacemaker Market, By Pacing Chamber, 2020-2028 (USD Mllion)

78 Chile Leadless Pacemaker Market, By End-use, 2020-2028 (USD Mllion)

79 Argentina Leadless Pacemaker Market, By Pacing Chamber, 2020-2028 (USD Mllion)

80 Argentina Leadless Pacemaker Market, By End-use, 2020-2028 (USD Mllion)

81 Rest Of Central & South America Leadless Pacemaker Market, By Pacing Chamber, 2020-2028 (USD Mllion)

82 Rest Of Central & South America Leadless Pacemaker Market, By End-use, 2020-2028 (USD Mllion)

83 St. Jude Medical Corporation: Products & Services Offering

84 Medtronics: Products & Services Offering

85 Cleveland Clinic: Products & Services Offering

86 Edwards Lifesciences: Products & Services Offering

87 Sorin Group: Products & Services Offering[A1]

88 VITATRON: Products & Services Offering

89 Abbott : Products & Services Offering

90 EBR Systems Inc.: Products & Services Offering

91 MicroPort Scientific Corporation: Products & Services Offering

92 Boston Scientific: Products & Services Offering

93 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Leadless Pacemaker Market Overview

2 Global Leadless Pacemaker Market Value From 2020-2028 (USD Mllion)

3 Global Leadless Pacemaker Market Share, By Pacing Chamber (2022)

4 Global Leadless Pacemaker Market Share, By End-use (2022)

5 Global Leadless Pacemaker Market, By Region (Asia Pacific Market)

6 Technological Trends In Global Leadless Pacemaker Market

7 Four Quadrant Competitor Positioning Matrix

8 Impact Of Macro & Micro Indicators On The Market

9 Impact Of Key Drivers On The Global Leadless Pacemaker Market

10 Impact Of Challenges On The Global Leadless Pacemaker Market

11 Porter’s Five Forces Analysis

12 Global Leadless Pacemaker Market: By Pacing Chamber Scope Key Takeaways

13 Global Leadless Pacemaker Market, By Pacing Chamber Segment: Revenue Growth Analysis

14 Single Chamber Market, By Region, 2020-2028 (USD Mllion)

15 Double Chamber Market, By Region, 2020-2028 (USD Mllion)

16 Global Leadless Pacemaker Market: By End-use Scope Key Takeaways

17 Global Leadless Pacemaker Market, By End-use Segment: Revenue Growth Analysis

18 Hospitals Market, By Region, 2020-2028 (USD Mllion)

19 Outpatient Facilities Market, By Region, 2020-2028 (USD Mllion)

20 Regional Segment: Revenue Growth Analysis

21 Global Leadless Pacemaker Market: Regional Analysis

22 North America Leadless Pacemaker Market Overview

23 North America Leadless Pacemaker Market, By Pacing Chamber

24 North America Leadless Pacemaker Market, By End-use

25 North America Leadless Pacemaker Market, By Country

26 U.S. Leadless Pacemaker Market, By Pacing Chamber

27 U.S. Leadless Pacemaker Market, By End-use

28 Canada Leadless Pacemaker Market, By Pacing Chamber

29 Canada Leadless Pacemaker Market, By End-use

30 Mexico Leadless Pacemaker Market, By Pacing Chamber

31 Mexico Leadless Pacemaker Market, By End-use

32 Four Quadrant Positioning Matrix

33 Company Market Share Analysis

34 St. Jude Medical Corporation: Company Snapshot

35 St. Jude Medical Corporation: SWOT Analysis

36 St. Jude Medical Corporation: Geographic Presence

37 Medtronics: Company Snapshot

38 Medtronics: SWOT Analysis

39 Medtronics: Geographic Presence

40 Cleveland Clinic: Company Snapshot

41 Cleveland Clinic: SWOT Analysis

42 Cleveland Clinic: Geographic Presence

43 Edwards Lifesciences: Company Snapshot

44 Edwards Lifesciences: Swot Analysis

45 Edwards Lifesciences: Geographic Presence

46 Sorin Group: Company Snapshot

47 Sorin Group: SWOT Analysis

48 Sorin Group: Geographic Presence

49 VITATRON: Company Snapshot

50 VITATRON: SWOT Analysis

51 VITATRON: Geographic Presence

52 Abbott : Company Snapshot

53 Abbott : SWOT Analysis

54 Abbott : Geographic Presence

55 EBR Systems Inc.: Company Snapshot

56 EBR Systems Inc.: SWOT Analysis

57 EBR Systems Inc.: Geographic Presence

58 MicroPort Scientific Corporation.: Company Snapshot

59 MicroPort Scientific Corporation.: SWOT Analysis

60 MicroPort Scientific Corporation.: Geographic Presence

61 Boston Scientific: Company Snapshot

62 Boston Scientific: SWOT Analysis

63 Boston Scientific: Geographic Presence

64 Other Companies: Company Snapshot

65 Other Companies: SWOT Analysis

66 Other Companies: Geographic Presence

The Global Leadless Pacemaker Market has been studied from the year 2019 till 2028. However, the CAGR provided in the report is from the year 2023 to 2028. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Leadless Pacemaker Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS