Global Leak Detection Market Size, Trends & Analysis - Forecasts to 2029 By Product (Handheld Gas Detectors, UAV-based Detectors, Vehicle-based Detectors, and Manned Aircraft Detectors), By Technology (Pressure-Flow Deviation Methods, Mass/Volume Balance, Thermal Imaging, Acoustic/Ultrasonic, Fiber Optic, and Others), By End User (Oil and Gas, Chemical Plants, Water Treatment Plants, Thermal Power Plants, Mining and Slurry, and Others), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

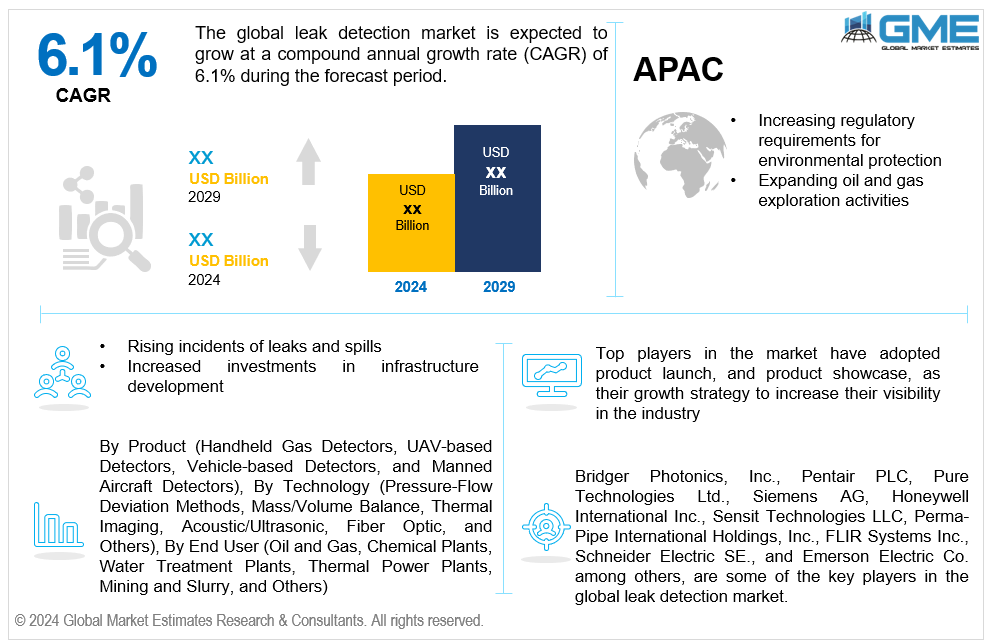

The global leak detection market is estimated to exhibit a CAGR of 6.1% from 2024 to 2029.

The primary factors propelling the market growth are the increasing regulatory requirements for environmental protection and expanding oil and gas exploration activities. Governments and regulatory bodies worldwide are implementing stringent standards to minimize environmental risks associated with leaks in industries such as oil and gas, water management, and manufacturing. These regulations mandate regular monitoring and reporting of leakages, pushing companies to adopt advanced leak detection technologies to comply with legal obligations. Due to the serious penalties, legal ramifications, and reputational harm that can arise from breaking these rules, companies are investing in reliable leak detection technologies. Further highlighting the necessity for efficient leak detection systems is the fact that companies are being held more and more responsible for their environmental impact as the global emphasis on sustainability grows.

Rising incidents of leaks and spills along with the increased investments in infrastructure development are expected to support the market growth. Frequent leaks in sectors such as oil and gas, water supply, and chemical manufacturing pose substantial risks, including environmental degradation, financial losses, and harm to public health. These incidents often lead to costly clean-up operations and legal liabilities, prompting companies to prioritize the implementation of effective leak detection systems. As awareness grows about the catastrophic consequences of leaks, organizations are compelled to adopt advanced technologies that enable real-time monitoring and rapid response to potential leaks. The demand for sophisticated solutions, such as acoustic sensors, fiber optics, and IoT-based monitoring systems, is surging to mitigate these risks.

Growing adoption of advanced technologies such as IoT and AI for real-time leak monitoring and detection coupled with the rising public and corporate awareness regarding sustainability and corporate social responsibility initiatives propel market growth. IoT-enabled sensors allow for continuous monitoring of infrastructure, providing instant alerts for any irregularities that could indicate a leak. By taking a proactive stance, companies can react quickly, limiting environmental harm and possible financial losses. These systems are further improved by AI algorithms, which examine enormous volumes of data to find trends and forecast possible leak events, resulting in better decision-making and preventative actions. By streamlining maintenance schedules and resource allocation, the combination of these technologies not only improves leak detection accuracy and dependability but also lowers operating expenses. As industries seek to enhance operational efficiency and ensure compliance with regulatory standards, the demand for IoT and AI-driven leak detection solutions continues to grow, positioning them as essential tools for modern leak management strategies.

The shift towards smart infrastructure presents a significant opportunity for leak detection solutions, as cities and facilities increasingly incorporate IoT technologies. Companies can create integrated systems that offer real-time surveillance, improving urban areas' operational effectiveness and safety. Furthermore, there is a lucrative opportunity to integrate AI and data analytics into leak detection systems. Companies can develop advanced algorithms that enhance predictive maintenance, allowing for proactive interventions and improved decision-making regarding leak prevention.

However, the significant upfront investment and complexity of integrating new leak detection systems with existing infrastructure impede market growth.

The handheld gas detectors segment is expected to hold the largest share of the market over the forecast period. Handheld gas detectors offer portability, enabling users to easily carry them for on-the-spot inspections in various environments. This convenience makes them ideal for both fieldwork and emergency response situations, allowing for quick detection of gas leaks wherever they occur.

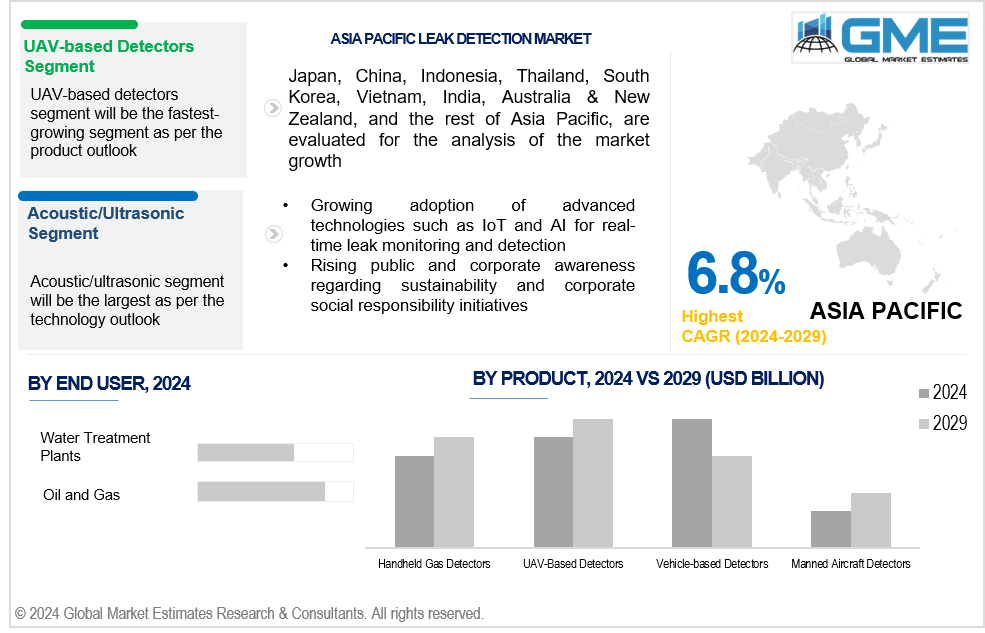

The UAV-based detectors segment is expected to be the fastest-growing segment in the market from 2024 to 2029. UAV-based detectors can easily access hard-to-reach areas, such as offshore oil rigs, pipelines in rugged terrain, or elevated structures. This ability significantly expands the scope of leak detection operations, enabling comprehensive monitoring in locations where traditional methods may be challenging.

The acoustic/ultrasonic segment is expected to hold the largest share of the market over the forecast period. Acoustic and ultrasonic leak detection technologies are highly sensitive and capable of detecting even minor leaks. Their ability to identify sound waves generated by escaping gases or liquids makes them effective for early detection, preventing significant issues before they escalate.

The thermal imaging segment is anticipated to be the fastest-growing segment in the market from 2024 to 2029. Thermal imaging enables non-contact leak detection, allowing operators to inspect equipment and pipelines from a safe distance. This function improves safety while preserving operational efficiency, which is especially helpful in dangerous environments.

The oil and gas segment is expected to hold the largest share of the market over the forecast period. The oil and gas industry relies on extensive networks of pipelines, refineries, and storage facilities that require constant monitoring for leaks. The need for reliable leak detection solutions to protect critical infrastructure makes this segment a significant driver of market demand.

The water treatment plants segment is anticipated to be the fastest-growing segment in the market from 2024 to 2029. Stricter regulations regarding water quality and leakage prevention are pushing water treatment plants to adopt advanced leak detection technologies. Compliance with these regulations is essential to avoid penalties and ensure public health, making this segment a key area of focus.

North America is expected to be the largest region in the global market. North America has a well-developed infrastructure across various industries, including oil and gas, water treatment, and manufacturing. This extensive network necessitates robust leak detection systems to ensure safety and compliance, driving significant market demand.

Asia Pacific is anticipated to witness rapid growth during the forecast period. The region is witnessing a surge in the adoption of advanced technologies such as IoT, AI, and smart sensors for leak detection. These innovations improve monitoring capabilities and are expected to drive market growth.

Bridger Photonics, Inc., Pentair PLC, Pure Technologies Ltd., Siemens AG, Honeywell International Inc., Sensit Technologies LLC, Perma-Pipe International Holdings, Inc., FLIR Systems Inc., Schneider Electric SE., and Emerson Electric Co. among others, are some of the key players in the global leak detection market.

Please note: This is not an exhaustive list of companies profiled in the report.

In January 2024, a well-known producer of gas detection equipment, CO2Meter, announced the release of an industrial gas detector designed to keep an eye on gases in industrial settings. The CM-900 series is made to detect low oxygen or high carbon dioxide levels to safeguard workers and personnel around dangerous gasses from things like unintentional leaks.

In September 2023, the ChemLogic Revive CL4R Four-Point Toxic Gas Detection System, designed to replace and improve fixed four-point monitors, was launched by DOD Technologies, a supplier of commercial and industrial gas detection systems, equipment, and services. This system collects ambient air samples up to 500 feet away using ChemLogic colorimetric technology to detect gas leaks.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL LEAK DETECTION MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL LEAK DETECTION MARKET, BY TECHNOLOGY

4.1 Introduction

4.2 Leak Detection Market: Type Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Pressure-Flow Deviation Methods

4.4.1 Pressure-Flow Deviation Methods Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 Mass/Volume Balance

4.5.1 Mass/Volume Balance Market Estimates and Forecast, 2021-2029 (USD Million)

4.6 Thermal Imaging

4.6.1 Thermal Imaging Market Estimates and Forecast, 2021-2029 (USD Million)

4.7 Acoustic/Ultrasonic

4.7.1 Acoustic/Ultrasonic Market Estimates and Forecast, 2021-2029 (USD Million)

4.8 Fiber Optic

4.8.1 Fiber Optic Market Estimates and Forecast, 2021-2029 (USD Million)

4.9 Others

4.9.1 Others Market Estimates and Forecast, 2021-2029 (USD Million)

5 GLOBAL LEAK DETECTION MARKET, BY END USER

5.1 Introduction

5.2 Leak Detection Market: End User Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 Oil and Gas

5.4.1 Oil and Gas Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 Chemical Plants

5.5.1 Chemical Plants Market Estimates and Forecast, 2021-2029 (USD Million)

5.6 Water Treatment Plants

5.6.1 Water Treatment Plants Market Estimates and Forecast, 2021-2029 (USD Million)

5.7 Thermal Power Plants

5.7.1 Thermal Power Plants Market Estimates and Forecast, 2021-2029 (USD Million)

5.8 Mining and Slurry

5.8.1 Mining and Slurry Market Estimates and Forecast, 2021-2029 (USD Million)

5.9 Others

5.9.1 Others Market Estimates and Forecast, 2021-2029 (USD Million)

6 GLOBAL LEAK DETECTION MARKET, BY PRODUCT

6.1 Introduction

6.2 Leak Detection Market: Product Scope Key Takeaways

6.3 Revenue Growth Analysis, 2023 & 2029

6.4 Handheld Gas Detectors

6.4.1 Handheld Gas Detectors Market Estimates and Forecast, 2021-2029 (USD Million)

6.5 UAV-based Detectors

6.5.1 UAV-based Detectors Market Estimates and Forecast, 2021-2029 (USD Million)

6.6 Vehicle-based Detectors

6.6.1 Vehicle-based Detectors Market Estimates and Forecast, 2021-2029 (USD Million)

6.7 Manned Aircraft Detectors

6.7.1 Manned Aircraft Detectors Market Estimates and Forecast, 2021-2029 (USD Million)

7 GLOBAL LEAK DETECTION MARKET, BY REGION

7.1 Introduction

7.2 North America Leak Detection Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.1 By Technology

7.2.2 By End User

7.2.3 By Product

7.2.4 By Country

7.2.4.1 U.S. Leak Detection Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.1.1 By Technology

7.2.4.1.2 By End User

7.2.4.1.3 By Product

7.2.4.2 Canada Leak Detection Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.2.1 By Technology

7.2.4.2.2 By End User

7.2.4.2.3 By Product

7.2.4.3 Mexico Leak Detection Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.3.1 By Technology

7.2.4.3.2 By End User

7.2.4.3.3 By Product

7.3 Europe Leak Detection Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.1 By Technology

7.3.2 By End User

7.3.3 By Product

7.3.4 By Country

7.3.4.1 Germany Leak Detection Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.1.1 By Technology

7.3.4.1.2 By End User

7.3.4.1.3 By Product

7.3.4.2 U.K. Leak Detection Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.2.1 By Technology

7.3.4.2.2 By End User

7.3.4.2.3 By Product

7.3.4.3 France Leak Detection Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.3.1 By Technology

7.3.4.3.2 By End User

7.3.4.3.3 By Product

7.3.4.4 Italy Leak Detection Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.4.1 By Technology

7.3.4.4.2 By End User

7.2.4.4.3 By Product

7.3.4.5 Spain Leak Detection Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.5.1 By Technology

7.3.4.5.2 By End User

7.2.4.5.3 By Product

7.3.4.6 Netherlands Leak Detection Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.6.1 By Technology

7.3.4.6.2 By End User

7.2.4.6.3 By Product

7.3.4.7 Rest of Europe Leak Detection Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.7.1 By Technology

7.3.4.7.2 By End User

7.2.4.7.3 By Product

7.4 Asia Pacific Leak Detection Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.1 By Technology

7.4.2 By End User

7.4.3 By Product

7.4.4 By Country

7.4.4.1 China Leak Detection Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.1.1 By Technology

7.4.4.1.2 By End User

7.4.4.1.3 By Product

7.4.4.2 Japan Leak Detection Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.2.1 By Technology

7.4.4.2.2 By End User

7.4.4.2.3 By Product

7.4.4.3 India Leak Detection Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.3.1 By Technology

7.4.4.3.2 By End User

7.4.4.3.3 By Product

7.4.4.4 South Korea Leak Detection Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.4.1 By Technology

7.4.4.4.2 By End User

7.4.4.4.3 By Product

7.4.4.5 Singapore Leak Detection Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.5.1 By Technology

7.4.4.5.2 By End User

7.4.4.5.3 By Product

7.4.4.6 Malaysia Leak Detection Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.6.1 By Technology

7.4.4.6.2 By End User

7.4.4.6.3 By Product

7.4.4.7 Thailand Leak Detection Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.7.1 By Technology

7.4.4.7.2 By End User

7.4.4.7.3 By Product

7.4.4.8 Indonesia Leak Detection Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.8.1 By Technology

7.4.4.8.2 By End User

7.4.4.8.3 By Product

7.4.4.9 Vietnam Leak Detection Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.9.1 By Technology

7.4.4.9.2 By End User

7.4.4.9.3 By Product

7.4.4.10 Taiwan Leak Detection Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.10.1 By Technology

7.4.4.10.2 By End User

7.4.4.10.3 By Product

7.4.4.11 Rest of Asia Pacific Leak Detection Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.11.1 By Technology

7.4.4.11.2 By End User

7.4.4.11.3 By Product

7.5 Middle East and Africa Leak Detection Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.1 By Technology

7.5.2 By End User

7.5.3 By Product

7.5.4 By Country

7.5.4.1 Saudi Arabia Leak Detection Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.1.1 By Technology

7.5.4.1.2 By End User

7.5.4.1.3 By Product

7.5.4.2 U.A.E. Leak Detection Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.2.1 By Technology

7.5.4.2.2 By End User

7.5.4.2.3 By Product

7.5.4.3 Israel Leak Detection Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.3.1 By Technology

7.5.4.3.2 By End User

7.5.4.3.3 By Product

7.5.4.4 South Africa Leak Detection Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.4.1 By Technology

7.5.4.4.2 By End User

7.5.4.4.3 By Product

7.5.4.5 Rest of Middle East and Africa Leak Detection Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.5.1 By Technology

7.5.4.5.2 By End User

7.5.4.5.2 By Product

7.6 Central and South America Leak Detection Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.1 By Technology

7.6.2 By End User

7.6.3 By Product

7.6.4 By Country

7.6.4.1 Brazil Leak Detection Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.1.1 By Technology

7.6.4.1.2 By End User

7.6.4.1.3 By Product

7.6.4.2 Argentina Leak Detection Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.2.1 By Technology

7.6.4.2.2 By End User

7.6.4.2.3 By Product

7.6.4.3 Chile Leak Detection Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.3.1 By Technology

7.6.4.3.2 By End User

7.6.4.3.3 By Product

7.6.4.4 Rest of Central and South America Leak Detection Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.4.1 By Technology

7.6.4.4.2 By End User

7.6.4.4.3 By Product

8 COMPETITIVE LANDCAPE

8.1 Company Market Share Analysis

8.2 Four Quadrant Positioning Matrix

8.2.1 Market Leaders

8.2.2 Market Visionaries

8.2.3 Market Challengers

8.2.4 Niche Market Players

8.3 Vendor Landscape

8.3.1 North America

8.3.2 Europe

8.3.3 Asia Pacific

8.3.4 Rest of the World

8.4 Company Profiles

8.4.1 Bridger Photonics, Inc.

8.4.1.1 Business Description & Financial Analysis

8.4.1.2 SWOT Analysis

8.4.1.3 Products & Services Offered

8.4.1.4 Strategic Alliances between Business Partners

8.4.2 Pentair PLC

8.4.2.1 Business Description & Financial Analysis

8.4.2.2 SWOT Analysis

8.4.2.3 Products & Services Offered

8.4.2.4 Strategic Alliances between Business Partners

8.4.3 Pure Technologies Ltd.

8.4.3.1 Business Description & Financial Analysis

8.4.3.2 SWOT Analysis

8.4.3.3 Products & Services Offered

8.4.3.4 Strategic Alliances between Business Partners

8.4.4 Honeywell International Inc.

8.4.4.1 Business Description & Financial Analysis

8.4.4.2 SWOT Analysis

8.4.4.3 Products & Services Offered

8.4.4.4 Strategic Alliances between Business Partners

8.4.5 Sensit Technologies LLC

8.4.5.1 Business Description & Financial Analysis

8.4.5.2 SWOT Analysis

8.4.5.3 Products & Services Offered

8.4.5.4 Strategic Alliances between Business Partners

8.4.6 PERMA-PIPE INTERNATIONAL HOLDINGS, INC.

8.4.6.1 Business Description & Financial Analysis

8.4.6.2 SWOT Analysis

8.4.6.3 Products & Services Offered

8.4.6.4 Strategic Alliances between Business Partners

8.4.7 FLIR Systems Inc.

8.4.7.1 Business Description & Financial Analysis

8.4.7.2 SWOT Analysis

8.4.7.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.8 Schneider Electric SE.

8.4.8.1 Business Description & Financial Analysis

8.4.8.2 SWOT Analysis

8.4.8.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.9 AMS Technologies AG

8.4.9.1 Business Description & Financial Analysis

8.4.9.2 SWOT Analysis

8.4.9.3 Products & Services Offered

8.4.9.4 Strategic Alliances between Business Partners

8.4.10 Siemens AG

8.4.10.1 Business Description & Financial Analysis

8.4.10.2 SWOT Analysis

8.4.10.3 Products & Services Offered

8.4.10.4 Strategic Alliances between Business Partners

8.4.11 Other Companies

8.4.11.1 Business Description & Financial Analysis

8.4.11.2 SWOT Analysis

8.4.11.3 Products & Services Offered

8.4.11.4 Strategic Alliances between Business Partners

9 RESEARCH METHODOLOGY

9.1 Market Introduction

9.1.1 Market Definition

9.1.2 Market Scope & Segmentation

9.2 Information Procurement

9.2.1 Secondary Research

9.2.1.1 Purchased Databases

9.2.1.2 GMEs Internal Data Repository

9.2.1.3 Secondary Resources & Third Party Perspectives

9.2.1.4 Company Information Sources

9.2.2 Primary Research

9.2.2.1 Various Types of Respondents for Primary Interviews

9.2.2.2 Number of Interviews Conducted throughout the Research Process

9.2.2.3 Primary Stakeholders

9.2.2.4 Discussion Guide for Primary Participants

9.2.3 Expert Panels

9.2.3.1 Expert Panels Across 30+ Industry

9.2.4 Paid Local Experts

9.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

9.3 Market Estimation

9.3.1 Top-Down Approach

9.3.1.1 Macro-Economic Indicators Considered

9.3.1.2 Micro-Economic Indicators Considered

9.3.2 Bottom Up Approach

9.3.2.1 Company Share Analysis Approach

9.3.2.2 Estimation of Potential Type Sales

9.4 Data Triangulation

9.4.1 Data Collection

9.4.2 Time Series, Cross Sectional & Panel Data Analysis

9.4.3 Cluster Analysis

9.5 Analysis and Output

9.5.1 Inhouse AI Based Real Time Analytics Tool

9.5.2 Output From Desk & Primary Research

9.6 Research Assumptions & Limitations

9.7.1 Research Assumptions

9.7.2 Research Limitations

LIST OF TABLES

1 Global Leak Detection Market, By Technology, 2021-2029 (USD Million)

2 Pressure-Flow Deviation Methods Market, By Region, 2021-2029 (USD Million)

3 Mass/Volume Balance Market, By Region, 2021-2029 (USD Million)

4 Thermal Imaging Market, By Region, 2021-2029 (USD Million)

5 Acoustic/Ultrasonic Market, By Region, 2021-2029 (USD Million)

6 Fiber Optic Market, By Region, 2021-2029 (USD Million)

7 Others Market, By Region, 2021-2029 (USD Million)

8 Global Leak Detection Market, By End User, 2021-2029 (USD Million)

9 Oil and Gas Market, By Region, 2021-2029 (USD Million)

10 Chemical Plants Market, By Region, 2021-2029 (USD Million)

11 Water Treatment Plants Market, By Region, 2021-2029 (USD Million)

12 Thermal Power Plants Market, By Region, 2021-2029 (USD Million)

13 Mining and Slurry Market, By Region, 2021-2029 (USD Million)

14 Others Market, By Region, 2021-2029 (USD Million)

15 Global Leak Detection Market, By Product, 2021-2029 (USD Million)

16 Handheld Gas Detectors Market, By Region, 2021-2029 (USD Million)

17 UAV-based Detectors Market, By Region, 2021-2029 (USD Million)

18 Vehicle-based Detectors Market, By Region, 2021-2029 (USD Million)

19 Manned Aircraft Detectors Market, By Region, 2021-2029 (USD Million)

20 Regional Analysis, 2021-2029 (USD Million)

21 North America Leak Detection Market, By Technology, 2021-2029 (USD Million)

22 North America Leak Detection Market, By End User, 2021-2029 (USD Million)

23 North America Leak Detection Market, By Product, 2021-2029 (USD Million)

24 North America Leak Detection Market, By Country, 2021-2029 (USD Million)

25 U.S Leak Detection Market, By Technology, 2021-2029 (USD Million)

26 U.S Leak Detection Market, By End User, 2021-2029 (USD Million)

27 U.S Leak Detection Market, By Product, 2021-2029 (USD Million)

28 Canada Leak Detection Market, By Technology, 2021-2029 (USD Million)

29 Canada Leak Detection Market, By End User, 2021-2029 (USD Million)

30 Canada Leak Detection Market, By Product, 2021-2029 (USD Million)

31 Mexico Leak Detection Market, By Technology, 2021-2029 (USD Million)

32 Mexico Leak Detection Market, By End User, 2021-2029 (USD Million)

33 Mexico Leak Detection Market, By Product, 2021-2029 (USD Million)

34 Europe Leak Detection Market, By Technology, 2021-2029 (USD Million)

35 Europe Leak Detection Market, By End User, 2021-2029 (USD Million)

36 Europe Leak Detection Market, By Product, 2021-2029 (USD Million)

37 Europe Leak Detection Market, By Country 2021-2029 (USD Million)

38 Germany Leak Detection Market, By Technology, 2021-2029 (USD Million)

39 Germany Leak Detection Market, By End User, 2021-2029 (USD Million)

40 Germany Leak Detection Market, By Product, 2021-2029 (USD Million)

41 U.K Leak Detection Market, By Technology, 2021-2029 (USD Million)

42 U.K Leak Detection Market, By End User, 2021-2029 (USD Million)

43 U.K Leak Detection Market, By Product, 2021-2029 (USD Million)

44 France Leak Detection Market, By Technology, 2021-2029 (USD Million)

45 France Leak Detection Market, By End User, 2021-2029 (USD Million)

46 France Leak Detection Market, By Product, 2021-2029 (USD Million)

47 Italy Leak Detection Market, By Technology, 2021-2029 (USD Million)

48 Italy Leak Detection Market, By End User, 2021-2029 (USD Million)

49 Italy Leak Detection Market, By Product, 2021-2029 (USD Million)

50 Spain Leak Detection Market, By Technology, 2021-2029 (USD Million)

51 Spain Leak Detection Market, By End User, 2021-2029 (USD Million)

52 Spain Leak Detection Market, By Product, 2021-2029 (USD Million)

53 Netherlands Leak Detection Market, By Technology, 2021-2029 (USD Million)

54 Netherlands Leak Detection Market, By End User, 2021-2029 (USD Million)

55 Netherlands Leak Detection Market, By Product, 2021-2029 (USD Million)

56 Rest Of Europe Leak Detection Market, By Technology, 2021-2029 (USD Million)

57 Rest Of Europe Leak Detection Market, By End User, 2021-2029 (USD Million)

58 Rest of Europe Leak Detection Market, By Product, 2021-2029 (USD Million)

59 Asia Pacific Leak Detection Market, By Technology, 2021-2029 (USD Million)

60 Asia Pacific Leak Detection Market, By End User, 2021-2029 (USD Million)

61 Asia Pacific Leak Detection Market, By Product, 2021-2029 (USD Million)

62 Asia Pacific Leak Detection Market, By Country, 2021-2029 (USD Million)

63 China Leak Detection Market, By Technology, 2021-2029 (USD Million)

64 China Leak Detection Market, By End User, 2021-2029 (USD Million)

65 China Leak Detection Market, By Product, 2021-2029 (USD Million)

66 India Leak Detection Market, By Technology, 2021-2029 (USD Million)

67 India Leak Detection Market, By End User, 2021-2029 (USD Million)

68 India Leak Detection Market, By Product, 2021-2029 (USD Million)

69 Japan Leak Detection Market, By Technology, 2021-2029 (USD Million)

70 Japan Leak Detection Market, By End User, 2021-2029 (USD Million)

71 Japan Leak Detection Market, By Product, 2021-2029 (USD Million)

72 South Korea Leak Detection Market, By Technology, 2021-2029 (USD Million)

73 South Korea Leak Detection Market, By End User, 2021-2029 (USD Million)

74 South Korea Leak Detection Market, By Product, 2021-2029 (USD Million)

75 malaysia Leak Detection Market, By Technology, 2021-2029 (USD Million)

76 malaysia Leak Detection Market, By End User, 2021-2029 (USD Million)

77 malaysia Leak Detection Market, By Product, 2021-2029 (USD Million)

78 Thailand Leak Detection Market, By Technology, 2021-2029 (USD Million)

79 Thailand Leak Detection Market, By End User, 2021-2029 (USD Million)

80 Thailand Leak Detection Market, By Product, 2021-2029 (USD Million)

81 Indonesia Leak Detection Market, By Technology, 2021-2029 (USD Million)

82 Indonesia Leak Detection Market, By End User, 2021-2029 (USD Million)

83 Indonesia Leak Detection Market, By Product, 2021-2029 (USD Million)

84 Vietnam Leak Detection Market, By Technology, 2021-2029 (USD Million)

85 Vietnam Leak Detection Market, By End User, 2021-2029 (USD Million)

86 Vietnam Leak Detection Market, By Product, 2021-2029 (USD Million)

87 Taiwan Leak Detection Market, By Technology, 2021-2029 (USD Million)

88 Taiwan Leak Detection Market, By End User, 2021-2029 (USD Million)

89 Taiwan Leak Detection Market, By Product, 2021-2029 (USD Million)

90 Rest of Asia Pacific Leak Detection Market, By Technology, 2021-2029 (USD Million)

91 Rest of Asia Pacific Leak Detection Market, By End User, 2021-2029 (USD Million)

92 Rest of Asia Pacific Leak Detection Market, By Product, 2021-2029 (USD Million)

93 Middle East and Africa Leak Detection Market, By Technology, 2021-2029 (USD Million)

94 Middle East and Africa Leak Detection Market, By End User, 2021-2029 (USD Million)

95 Middle East and Africa Leak Detection Market, By Product, 2021-2029 (USD Million)

96 Middle East and Africa Leak Detection Market, By Country, 2021-2029 (USD Million)

97 Saudi Arabia Leak Detection Market, By Technology, 2021-2029 (USD Million)

98 Saudi Arabia Leak Detection Market, By End User, 2021-2029 (USD Million)

99 Saudi Arabia Leak Detection Market, By Product, 2021-2029 (USD Million)

100 UAE Leak Detection Market, By Technology, 2021-2029 (USD Million)

101 UAE Leak Detection Market, By End User, 2021-2029 (USD Million)

102 UAE Leak Detection Market, By Product, 2021-2029 (USD Million)

103 Israel Leak Detection Market, By Technology, 2021-2029 (USD Million)

104 Israel Leak Detection Market, By End User, 2021-2029 (USD Million)

105 Israel Leak Detection Market, By Product, 2021-2029 (USD Million)

106 South Africa Leak Detection Market, By Technology, 2021-2029 (USD Million)

107 South Africa Leak Detection Market, By End User, 2021-2029 (USD Million)

108 South Africa Leak Detection Market, By Product, 2021-2029 (USD Million)

109 Rest of Middle East and Africa Leak Detection Market, By Technology, 2021-2029 (USD Million)

110 Rest of Middle East and Africa Leak Detection Market, By End User, 2021-2029 (USD Million)

111 Rest of Middle East and Africa Leak Detection Market, By Product, 2021-2029 (USD Million)

112 Central and South America Leak Detection Market, By Technology, 2021-2029 (USD Million)

113 Central and South America Leak Detection Market, By End User, 2021-2029 (USD Million)

114 Central and South America Leak Detection Market, By Product, 2021-2029 (USD Million)

115 Central and South America Leak Detection Market, By Country, 2021-2029 (USD Million)

116 Brazil Leak Detection Market, By Technology, 2021-2029 (USD Million)

117 Brazil Leak Detection Market, By End User, 2021-2029 (USD Million)

118 Brazil Leak Detection Market, By Product, 2021-2029 (USD Million)

119 Argentina Leak Detection Market, By Technology, 2021-2029 (USD Million)

120 Argentina Leak Detection Market, By End User, 2021-2029 (USD Million)

121 Argentina Leak Detection Market, By Product, 2021-2029 (USD Million)

122 Chile Leak Detection Market, By Technology, 2021-2029 (USD Million)

123 Chile Leak Detection Market, By End User, 2021-2029 (USD Million)

124 Chile Leak Detection Market, By Product, 2021-2029 (USD Million)

125 Rest of Central and South America Leak Detection Market, By Technology, 2021-2029 (USD Million)

126 Rest of Central and South America Leak Detection Market, By End User, 2021-2029 (USD Million)

127 Rest of Central and South America Leak Detection Market, By Product, 2021-2029 (USD Million)

128 Bridger Photonics, Inc.: Products & Services Offering

129 Pentair PLC: Products & Services Offering

130 Pure Technologies Ltd.: Products & Services Offering

131 Honeywell International Inc.: Products & Services Offering

132 Sensit Technologies LLC: Products & Services Offering

133 PERMA-PIPE INTERNATIONAL HOLDINGS, INC.: Products & Services Offering

134 FLIR Systems Inc.: Products & Services Offering

135 Schneider Electric SE.: Products & Services Offering

136 AMS Technologies AG, Inc: Products & Services Offering

137 Siemens AG: Products & Services Offering

138 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Leak Detection Market Overview

2 Global Leak Detection Market Value From 2021-2029 (USD Million)

3 Global Leak Detection Market Share, By Technology (2023)

4 Global Leak Detection Market Share, By End User (2023)

5 Global Leak Detection Market Share, By Product (2023)

6 Global Leak Detection Market, By Region (Asia Pacific Market)

7 Technological Trends In Global Leak Detection Market

8 Four Quadrant Competitor Positioning Matrix

9 Impact Of Macro & Micro Indicators On The Market

10 Impact Of Key Drivers On The Global Leak Detection Market

11 Impact Of Challenges On The Global Leak Detection Market

12 Porter’s Five Forces Analysis

13 Global Leak Detection Market: By Technology Scope Key Takeaways

14 Global Leak Detection Market, By Technology Segment: Revenue Growth Analysis

15 Pressure-Flow Deviation Methods Market, By Region, 2021-2029 (USD Million)

16 Mass/Volume Balance Market, By Region, 2021-2029 (USD Million)

17 Thermal Imaging Market, By Region, 2021-2029 (USD Million)

18 Acoustic/Ultrasonic Market, By Region, 2021-2029 (USD Million)

19 Fiber Optic Market, By Region, 2021-2029 (USD Million)

20 Others Market, By Region, 2021-2029 (USD Million)

21 Global Leak Detection Market: By End User Scope Key Takeaways

22 Global Leak Detection Market, By End User Segment: Revenue Growth Analysis

23 Oil and Gas Market, By Region, 2021-2029 (USD Million)

24 Chemical Plants Market, By Region, 2021-2029 (USD Million)

25 Water Treatment Plants Market, By Region, 2021-2029 (USD Million)

26 Thermal Power Plants Market, By Region, 2021-2029 (USD Million)

27 Mining and Slurry Market, By Region, 2021-2029 (USD Million)

28 Others Market, By Region, 2021-2029 (USD Million)

29 Global Leak Detection Market: By Product Scope Key Takeaways

30 Global Leak Detection Market, By Product Segment: Revenue Growth Analysis

31 Handheld Gas Detectors Market, By Region, 2021-2029 (USD Million)

32 UAV-based Detectors Market, By Region, 2021-2029 (USD Million)

33 Vehicle-based Detectors Market, By Region, 2021-2029 (USD Million)

34 Manned Aircraft Detectors Market, By Region, 2021-2029 (USD Million)

35 Regional Segment: Revenue Growth Analysis

36 Global Leak Detection Market: Regional Analysis

37 North America Leak Detection Market Overview

38 North America Leak Detection Market, By Technology

39 North America Leak Detection Market, By End User

40 North America Leak Detection Market, By Product

41 North America Leak Detection Market, By Country

42 U.S. Leak Detection Market, By Technology

43 U.S. Leak Detection Market, By End User

44 U.S. Leak Detection Market, By Product

45 Canada Leak Detection Market, By Technology

46 Canada Leak Detection Market, By End User

47 Canada Leak Detection Market, By Product

48 Mexico Leak Detection Market, By Technology

49 Mexico Leak Detection Market, By End User

50 Mexico Leak Detection Market, By Product

51 Four Quadrant Positioning Matrix

52 Company Market Share Analysis

53 Bridger Photonics, Inc.: Company Snapshot

54 Bridger Photonics, Inc.: SWOT Analysis

55 Bridger Photonics, Inc.: Geographic Presence

56 Pentair PLC: Company Snapshot

57 Pentair PLC: SWOT Analysis

58 Pentair PLC: Geographic Presence

59 Pure Technologies Ltd.: Company Snapshot

60 Pure Technologies Ltd.: SWOT Analysis

61 Pure Technologies Ltd.: Geographic Presence

62 Honeywell International Inc.: Company Snapshot

63 Honeywell International Inc.: Swot Analysis

64 Honeywell International Inc.: Geographic Presence

65 Sensit Technologies LLC: Company Snapshot

66 Sensit Technologies LLC: SWOT Analysis

67 Sensit Technologies LLC: Geographic Presence

68 PERMA-PIPE INTERNATIONAL HOLDINGS, INC.: Company Snapshot

69 PERMA-PIPE INTERNATIONAL HOLDINGS, INC.: SWOT Analysis

70 PERMA-PIPE INTERNATIONAL HOLDINGS, INC.: Geographic Presence

71 FLIR Systems Inc. : Company Snapshot

72 FLIR Systems Inc. : SWOT Analysis

73 FLIR Systems Inc. : Geographic Presence

74 Schneider Electric SE.: Company Snapshot

75 Schneider Electric SE.: SWOT Analysis

76 Schneider Electric SE.: Geographic Presence

77 AMS Technologies AG, Inc.: Company Snapshot

78 AMS Technologies AG, Inc.: SWOT Analysis

79 AMS Technologies AG, Inc.: Geographic Presence

80 Siemens AG: Company Snapshot

81 Siemens AG: SWOT Analysis

82 Siemens AG: Geographic Presence

83 Other Companies: Company Snapshot

84 Other Companies: SWOT Analysis

85 Other Companies: Geographic Presence

The Global Leak Detection Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Leak Detection Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS