Global LED Driver Market Size, Trends & Analysis - Forecasts to 2028 By Component (Driver IC, Discrete Component, and Others), By Luminaire Type (Decorative Lamps, Reflectors, Type A Lamp, and Others), By Supply Type (Constant Current and Constant Voltage), By Application (Automotive, Consumer Electronics, Lighting, and Outdoor Display), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and Competitor Analysis

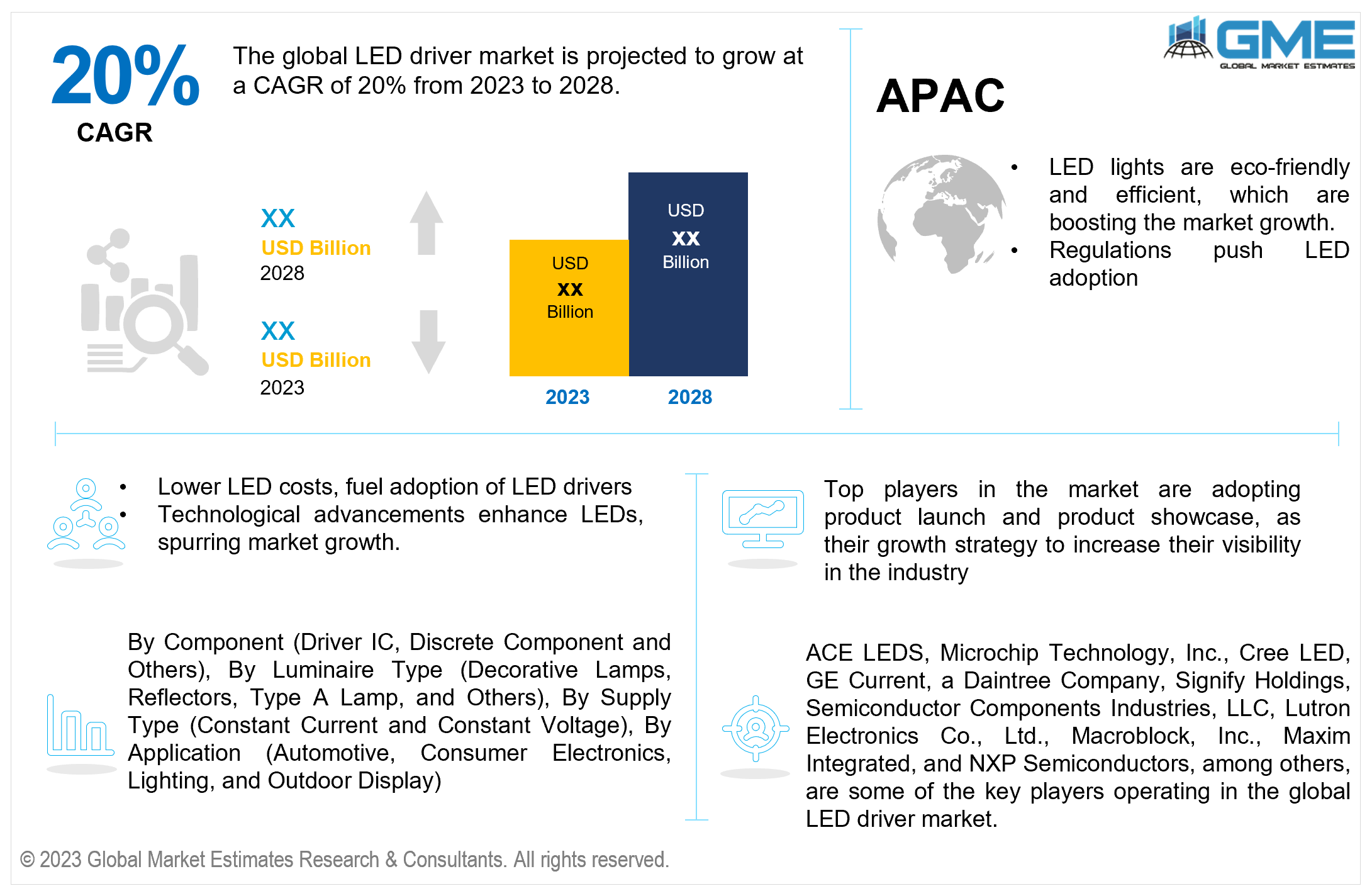

The global LED driver market is projected to grow at a CAGR of 20% from 2023 to 2028.

Rapid urbanization and increasing construction of new residential and commercial buildings fuel demand for modern and efficient lighting solutions, further propelling demand for LED drivers. According to the World Bank, over 50% of the global population lives in urban areas. However, by 2045, the global urban population is projected to grow by 1.5 times, reaching 6 billion people.

Industries and commercial spaces use LED lighting for enhanced visibility, reduced maintenance costs, and improved efficiency. Moreover, LED technology's price has decreased over the years, making it more accessible to consumers and industries. This affordability drives greater adoption and fuels demand for LED driver.

Continuous improvements in LED technology have increased its performance, efficacy, and adaptability. These developments encourage businesses and individuals to switch to LED lighting, boosting the demand for LED drivers. In May 2023, uPowerTek announced that their APD series 25-200W D4i LED driver received ENEC and CB certifications. APD series LED drivers meet the latest D4i standard . This series also has a feature that lets users adjust the light's power using a near field communication (NFC) programmer or a smartphone with NFC. The driver is water-resistant and can fit inside a light fixture. It works with a wide range of input voltages and has protection against sudden voltage spikes, making it reliable for outdoor use.

Several factors are constraining the growth of the market, such as absence of standardized production guidelines for these product lines, limited awareness about their benefits, and limited availability in emerging economies. Moreover, there is a misconception that the installation of LED drivers is costly, which might lead to negative industry trends.

Driver IC segment is expected to hold the largest share of the market during the forecast period. LEDs require a specific amount of electrical current to operate at their best. The brightness and longevity might be affected by too much or too little current. The driver IC ensures that the LED receives just the right amount of current for bright lighting and lasts a long time. Energy-efficient ED lighting is well-known for reducing electricity use and energy costs. This economic benefit drives the demand for driver ICs that optimize LED performance.

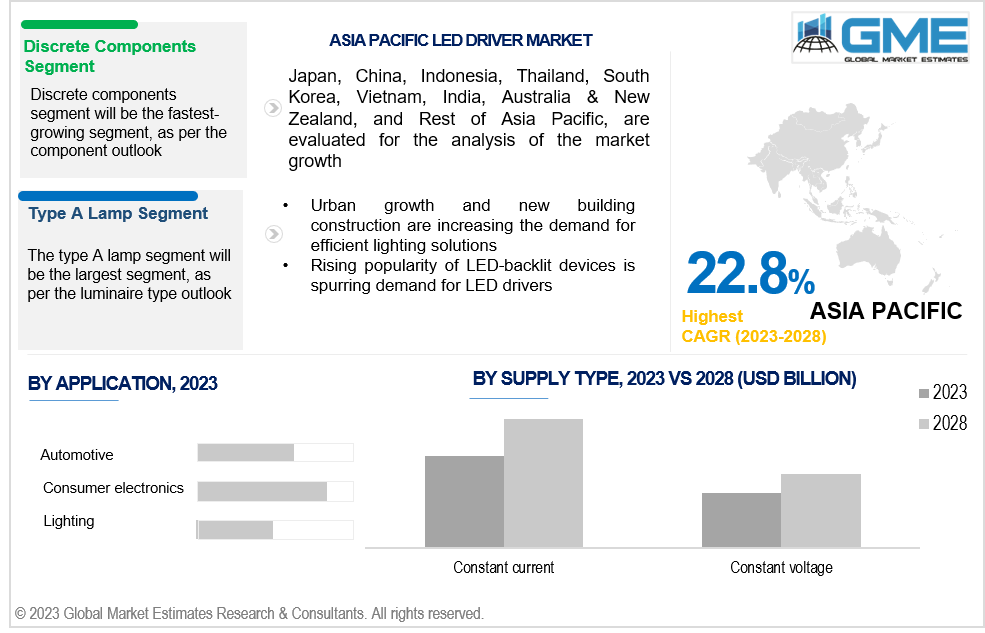

Discrete components segment is expected to be the fastest-growing segment in the market from 2023-2028. Discrete components are used in almost every electronic product, such as smartphones, Personal Computers (PCs), and others. Discrete components, including resistors, capacitors, and diodes, can be combined and configured in various ways to meet the specific needs of different LED lighting systems. Creating and dealing with separate circuits is less expensive and complicated when compared to integrated circuits (ICs).

Decorative lamp segment is anticipated to be the fastest-growing segment in the market from 2023-2028. Decorative lamps are applied in various settings, including homes, offices, hospitality venues, events, and public spaces. This versatility increases the demand for LED drivers catering to diverse decorative lighting needs. Different areas require different lighting intensities, colour temperatures, and dimming options, all of which can be achieved using specialized LED drivers personalized to the specific requirements of decorative lamps.

Type A Lamp segment is expected to hold the largest share of the market. LED drivers are like electronic helpers that ensure LED lights get the right amount of power. Type A lamps are made to replace conventional incandescent bulbs, so no changes to existing fixtures or sockets are necessary. his presents a convenient option for both individual customers and businesses aiming to enhance their energy efficiency through a straightforward adaptation process.

The constant voltage segment is anticipated to be the fastest-growing segment in the market from 2023-2028. The constant voltage driver can be used, when multiple LED lights need series connection, ensuring uniform illumination. Unlike a variable voltage, constant voltage drivers offer versatility, accommodating more LEDs up to the driver's current limit before diminishing brightness due to power distribution. However, they are less efficient than constant current drivers, needing more current stabilization and energy consumption.

The constant current segment is expected to hold the largest share of the market. Constant current drivers are used for various applications as they offer precise control, ensuring uniform brightness and clear displays. These drivers maintain energy efficiency by delivering a constant current, regardless of input voltage fluctuations. This stability prevents thermal runaway and excessive LED driving. Employing this approach in LED lighting applications ensures consistent brightness and prolonged lifespan.

The outdoor display segment is anticipated to be the fastest-growing segment in the market from 2023-2028. Outdoor displays, include signage, video walls, kiosks, and similar applications. The growth of outdoor displays segment is significant in nations such as the United States, China, Japan, and the United Kingdom, attributed to increased digital marketing and advertising endeavours. Despite the convention of using LCDs for outdoor displays, the adoption of LEDs is gaining traction due to decreasing costs.

The customer electronic segment is anticipated to hold the largest share of the market. This is attributed to increasing usage of smart phone, and television worldwide. According to GSMA, Ericsson, about 3.67 billion people had smartphones in 2016. Every year, this number grows between 300 million and 800 million. In 2022, it was estimated that around 6.57 billion people had smartphones.

LED drivers help optimize the power consumption of LED lighting systems, which in turn leads to lower energy bills for consumers. Due to their longer lifespan and reduced maintenance needs, LED lighting systems with efficient drivers can result in cost savings over time.

North America is expected to be the largest region in the market. The primary reason for boosting the market growth in this region is that governments are initiating rules to encourage the use of safe and energy-saving lights. For instance, in August 2020, the California government banned adding aftermarket vehicle HID light systems that produce blue light instead of the authorized white-to-yellow range. Moreover, people are becoming aware of the advantages of these lights, and reduced LED prices are driving the adoption of LED lights for homes, businesses, and industries. Furthermore, using smart lights to improve lighting and save energy in companies also drives regional market growth.

Asia Pacific is predicted to witness rapid growth during the forecast period. In this region, there is increasing adoption of LED lighting by residences, companies, and industries, which is expected to drive the regional market growth. In November 2021, China initiated a rule to stop using old-fashioned incandescent bulbs. Additionally, China's rapid urbanization and the construction of new buildings are contributing to the expansion of the LED driver market within the country. Electronics like phones, tablets, and TVs are widely manufactured in China, and the preference for these devices with LED lights is increasing, which further fuels the demand for LED drivers.

ACE LEDS, Microchip Technology, Inc., Cree LED, GE Current, a Daintree Company, Signify Holdings, Semiconductor Components Industries, LLC, Lutron Electronics Co., Ltd., Macroblock, Inc., Maxim Integrated, and NXP Semiconductors, among others, are some of the key players operating in the global LED driver market.

Please note: This is not an exhaustive list of companies profiled in the report.

In December 2021, Signify, announced that it had entered into an agreement with ams OSRAM to acquire Austin, Texas-based Fluence. This strategic acquisition enhances company’s international expansion in the agriculture lighting sector and further solidify their presence in the lucrative North American horticultural lighting market.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

4 GLOBAL LED DRIVER MARKET, BY LUMINAIRE TYPE

4.2 LED Driver Market: Luminaire Type Scope Key Takeaways

4.3 Revenue Growth Analysis, 2022 & 2028

4.4.1 Decorative Lamps Market Estimates and Forecast, 2020-2028 (USD Million)

4.5.1 Reflectors Market Estimates and Forecast, 2020-2028 (USD Million)

4.6.1 Type A Lamp Market Estimates and Forecast, 2020-2028 (USD Million)

4.7.1 Others Market Estimates and Forecast, 2020-2028 (USD Million)

5 GLOBAL LED DRIVER MARKET, BY COMPONENT

5.2 LED Driver Market: Component Scope Key Takeaways

5.3 Revenue Growth Analysis, 2022 & 2028

5.4.1 Driver IC Market Estimates and Forecast, 2020-2028 (USD Million)

5.5.1 Discrete Component Market Estimates and Forecast, 2020-2028 (USD Million)

5.6.1 Others Market Estimates and Forecast, 2020-2028 (USD Million)

6 GLOBAL LED DRIVER MARKET, BY APPLICATION

6.2 LED Driver Market: Application Scope Key Takeaways

6.3 Revenue Growth Analysis, 2022 & 2028

6.4.1 Automotive Market Estimates and Forecast, 2020-2028 (USD Million)

6.5.1 Consumer electronics Market Estimates and Forecast, 2020-2028 (USD Million)

6.6.1 Lighting Market Estimates and Forecast, 2020-2028 (USD Million)

6.7.1 Outdoor Display Market Estimates and Forecast, 2020-2028 (USD Million)

7 GLOBAL LED DRIVER MARKET, BY SUPPLY TYPE

7.2 LED Driver Market: Supply Type Scope Key Takeaways

7.3 Revenue Growth Analysis, 2022 & 2028

7.4.1 Constant current Market Estimates and Forecast, 2020-2028 (USD Million)

7.5.1 Constant Voltage Market Estimates and Forecast, 2020-2028 (USD Million)

8 GLOBAL LED DRIVER MARKET, BY REGION

8.2 North America LED Driver Market Estimates and Forecast, 2020-2028 (USD Million)

8.2.5.1 U.S. LED Driver Market Estimates and Forecast, 2020-2028 (USD Million)

8.2.5.2 Canada LED Driver Market Estimates and Forecast, 2020-2028 (USD Million)

8.2.5.3 Mexico LED Driver Market Estimates and Forecast, 2020-2028 (USD Million)

8.3 Europe LED Driver Market Estimates and Forecast, 2020-2028 (USD Million)

8.3.5.1 Germany LED Driver Market Estimates and Forecast, 2020-2028 (USD Million)

8.3.5.2 U.K. LED Driver Market Estimates and Forecast, 2020-2028 (USD Million)

8.3.5.3 France LED Driver Market Estimates and Forecast, 2020-2028 (USD Million)

8.3.5.4 Italy LED Driver Market Estimates and Forecast, 2020-2028 (USD Million)

8.3.5.5 Spain LED Driver Market Estimates and Forecast, 2020-2028 (USD Million)

8.3.5.6 Netherlands LED Driver Market Estimates and Forecast, 2020-2028 (USD Million)

8.3.5.7 Rest of Europe LED Driver Market Estimates and Forecast, 2020-2028 (USD Million)

8.4 Asia Pacific LED Driver Market Estimates and Forecast, 2020-2028 (USD Million)

8.4.5.1 China LED Driver Market Estimates and Forecast, 2020-2028 (USD Million)

8.4.5.2 Japan LED Driver Market Estimates and Forecast, 2020-2028 (USD Million)

8.4.5.3 India LED Driver Market Estimates and Forecast, 2020-2028 (USD Million)

8.4.5.4 South Korea LED Driver Market Estimates and Forecast, 2020-2028 (USD Million)

8.4.5.5 Singapore LED Driver Market Estimates and Forecast, 2020-2028 (USD Million)

8.4.5.6 Malaysia LED Driver Market Estimates and Forecast, 2020-2028 (USD Million)

8.4.5.7 Thailand LED Driver Market Estimates and Forecast, 2020-2028 (USD Million)

8.4.5.8 Indonesia LED Driver Market Estimates and Forecast, 2020-2028 (USD Million)

8.4.5.9 Vietnam LED Driver Market Estimates and Forecast, 2020-2028 (USD Million)

8.4.5.10 Taiwan LED Driver Market Estimates and Forecast, 2020-2028 (USD Million)

8.4.5.11 Rest of Asia Pacific LED Driver Market Estimates and Forecast, 2020-2028 (USD Million)

8.5 Middle East and Africa LED Driver Market Estimates and Forecast, 2020-2028 (USD Million)

8.5.5.1 Saudi Arabia LED Driver Market Estimates and Forecast, 2020-2028 (USD Million)

8.5.5.2 U.A.E. LED Driver Market Estimates and Forecast, 2020-2028 (USD Million)

8.5.5.3 Israel LED Driver Market Estimates and Forecast, 2020-2028 (USD Million)

8.5.5.4 South Africa LED Driver Market Estimates and Forecast, 2020-2028 (USD Million)

8.6 Central and South America LED Driver Market Estimates and Forecast, 2020-2028 (USD Million)

8.6.5.1 Brazil LED Driver Market Estimates and Forecast, 2020-2028 (USD Million)

8.6.5.2 Argentina LED Driver Market Estimates and Forecast, 2020-2028 (USD Million)

8.6.5.3 Chile LED Driver Market Estimates and Forecast, 2020-2028 (USD Million)

9.1 Company Market Share Analysis

9.2 Four Quadrant Positioning Matrix

9.4.1 Microchip Technology, Inc.

9.4.1.1 Business Description & Financial Analysis

9.4.1.3 Products & Services Offered

9.4.1.4 Strategic Alliances between Business Partners

9.4.2.1 Business Description & Financial Analysis

9.4.2.3 Products & Services Offered

9.4.2.4 Strategic Alliances between Business Partners

9.4.3 GE Current, a Daintree Company

9.4.3.1 Business Description & Financial Analysis

9.4.3.3 Products & Services Offered

9.4.3.4 Strategic Alliances between Business Partners

9.4.4.1 Business Description & Financial Analysis

9.4.4.3 Products & Services Offered

9.4.4.4 Strategic Alliances between Business Partners

9.4.5 Lutron Electronics Co., Ltd.

9.4.5.1 Business Description & Financial Analysis

9.4.5.3 Products & Services Offered

9.4.5.4 Strategic Alliances between Business Partners

9.4.6.1 Business Description & Financial Analysis

9.4.6.3 Products & Services Offered

9.4.6.4 Strategic Alliances between Business Partners

9.4.7.1 Business Description & Financial Analysis

9.4.7.3 Products & Services Offered

9.4.8.4 Strategic Alliances between Business Partners

9.4.8.1 Business Description & Financial Analysis

9.4.8.3 Products & Services Offered

9.4.8.4 Strategic Alliances between Business Partners

9.4.9.1 Business Description & Financial Analysis

9.4.9.3 Products & Services Offered

9.4.9.4 Strategic Alliances between Business Partners

9.4.10 Semiconductor Components Industries, LLC

9.4.10.1 Business Description & Financial Analysis

9.4.10.3 Products & Services Offered

9.4.10.4 Strategic Alliances between Business Partners

9.4.11.1 Business Description & Financial Analysis

9.4.11.3 Products & Services Offered

9.4.11.4 Strategic Alliances between Business Partners

10.1.2 Market Scope & Segmentation

10.2.1.2 GMEs Internal Data Repository

10.2.1.3 Secondary Resources & Third Party Perspectives

10.2.1.4 Company Information Sources

10.2.2.1 Various Types of Respondents for Primary Interviews

10.2.2.2 Number of Interviews Conducted throughout the Research Process

10.2.2.4 Discussion Guide for Primary Participants

10.2.3.1 Expert Panels Across 30+ Industry

10.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

10.3.1.1 Macro-Economic Indicators Considered

10.3.1.2 Micro-Economic Indicators Considered

10.3.2.1 Company Share Analysis Approach

10.3.2.2 Estimation of Potential Product Sales

10.4.2 Time Series, Cross Sectional & Panel Data Analysis

10.5.1 Inhouse AI Based Real Time Analytics Tool

10.5.2 Output From Desk & Primary Research

10.6 Research Assumptions & Limitations

LIST OF TABLES

1 Global LED Driver Market, By Luminaire Type, 2020-2028 (USD Mllion)

2 Decorative Lamps Market, By Region, 2020-2028 (USD Mllion)

3 Reflectors Market, By Region, 2020-2028 (USD Mllion)

4 Type A Lamp Market, By Region, 2020-2028 (USD Mllion)

5 Others Market, By Region, 2020-2028 (USD Mllion)

6 Global LED Driver Market, By Component, 2020-2028 (USD Mllion)

7 Driver IC Market, By Region, 2020-2028 (USD Mllion)

8 Discrete Component Market, By Region, 2020-2028 (USD Mllion)

9 Others Market, By Region, 2020-2028 (USD Mllion)

10 Global LED Driver Market, By Application, 2020-2028 (USD Mllion)

11 Automotive Market, By Region, 2020-2028 (USD Mllion)

12 Consumer electronics Market, By Region, 2020-2028 (USD Mllion)

13 Lighting Market, By Region, 2020-2028 (USD Mllion)

14 Outdoor Display Market, By Region, 2020-2028 (USD Mllion)

15 Global LED Driver Market, By Supply Type, 2020-2028 (USD Mllion)

16 Constant current Market, By Region, 2020-2028 (USD Mllion)

17 Constant Voltage Market, By Region, 2020-2028 (USD Mllion)

18 Regional Analysis, 2020-2028 (USD Mllion)

19 North America LED Driver Market, By Luminaire Type, 2020-2028 (USD Million)

20 North America LED Driver Market, By Component, 2020-2028 (USD Million)

21 North America LED Driver Market, By Application, 2020-2028 (USD Million)

22 North America LED Driver Market, By Supply Type, 2020-2028 (USD Million)

23 North America LED Driver Market, By Country, 2020-2028 (USD Million)

24 U.S LED Driver Market, By Luminaire Type, 2020-2028 (USD Million)

25 U.S LED Driver Market, By Component, 2020-2028 (USD Million)

26 U.S LED Driver Market, By Application, 2020-2028 (USD Million)

27 U.S LED Driver Market, By Supply Type, 2020-2028 (USD Million)

28 Canada LED Driver Market, By Luminaire Type, 2020-2028 (USD Million)

29 Canada LED Driver Market, By Component, 2020-2028 (USD Million)

30 Canada LED Driver Market, By Application, 2020-2028 (USD Million)

31 CANADA LED Driver Market, By Supply Type, 2020-2028 (USD Million)

32 Mexico LED Driver Market, By Luminaire Type, 2020-2028 (USD Million)

33 Mexico LED Driver Market, By Component, 2020-2028 (USD Million)

34 Mexico LED Driver Market, By Application, 2020-2028 (USD Million)

35 mexico LED Driver Market, By Supply Type, 2020-2028 (USD Million)

36 Europe LED Driver Market, By Luminaire Type, 2020-2028 (USD Million)

37 Europe LED Driver Market, By Component, 2020-2028 (USD Million)

38 Europe LED Driver Market, By Application, 2020-2028 (USD Million)

39 europe LED Driver Market, By Supply Type, 2020-2028 (USD Million)

40 Germany LED Driver Market, By Luminaire Type, 2020-2028 (USD Million)

41 Germany LED Driver Market, By Component, 2020-2028 (USD Million)

42 Germany LED Driver Market, By Application, 2020-2028 (USD Million)

43 germany LED Driver Market, By Supply Type, 2020-2028 (USD Million)

44 U.K. LED Driver Market, By Luminaire Type, 2020-2028 (USD Million)

45 U.K. LED Driver Market, By Component, 2020-2028 (USD Million)

46 U.K. LED Driver Market, By Application, 2020-2028 (USD Million)

47 U.k. LED Driver Market, By Supply Type, 2020-2028 (USD Million)

48 France LED Driver Market, By Luminaire Type, 2020-2028 (USD Million)

49 France LED Driver Market, By Component, 2020-2028 (USD Million)

50 France LED Driver Market, By Application, 2020-2028 (USD Million)

51 france LED Driver Market, By Supply Type, 2020-2028 (USD Million)

52 Italy LED Driver Market, By Luminaire Type, 2020-2028 (USD Million)

53 Italy LED Driver Market, By T Component Type, 2020-2028 (USD Million)

54 Italy LED Driver Market, By Application, 2020-2028 (USD Million)

55 italy LED Driver Market, By Supply Type, 2020-2028 (USD Million)

56 Spain LED Driver Market, By Luminaire Type, 2020-2028 (USD Million)

57 Spain LED Driver Market, By Component, 2020-2028 (USD Million)

58 Spain LED Driver Market, By Application, 2020-2028 (USD Million)

59 spain LED Driver Market, By Supply Type, 2020-2028 (USD Million)

60 Rest Of Europe LED Driver Market, By Luminaire Type, 2020-2028 (USD Million)

61 Rest Of Europe LED Driver Market, By Component, 2020-2028 (USD Million)

62 Rest of Europe LED Driver Market, By Application, 2020-2028 (USD Million)

63 REST OF EUROPE LED Driver Market, By Supply Type, 2020-2028 (USD Million)

64 Asia Pacific LED Driver Market, By Luminaire Type, 2020-2028 (USD Million)

65 Asia Pacific LED Driver Market, By Component, 2020-2028 (USD Million)

66 Asia Pacific LED Driver Market, By Application, 2020-2028 (USD Million)

67 asia LED Driver Market, By Supply Type, 2020-2028 (USD Million)

68 Asia Pacific LED Driver Market, By Country, 2020-2028 (USD Million)

69 China LED Driver Market, By Luminaire Type, 2020-2028 (USD Million)

70 China LED Driver Market, By Component, 2020-2028 (USD Million)

71 China LED Driver Market, By Application, 2020-2028 (USD Million)

72 china LED Driver Market, By Supply Type, 2020-2028 (USD Million)

73 India LED Driver Market, By Luminaire Type, 2020-2028 (USD Million)

74 India LED Driver Market, By Component, 2020-2028 (USD Million)

75 India LED Driver Market, By Application, 2020-2028 (USD Million)

76 india LED Driver Market, By Supply Type, 2020-2028 (USD Million)

77 Japan LED Driver Market, By Luminaire Type, 2020-2028 (USD Million)

78 Japan LED Driver Market, By Component, 2020-2028 (USD Million)

79 Japan LED Driver Market, By Application, 2020-2028 (USD Million)

80 japan LED Driver Market, By Supply Type, 2020-2028 (USD Million)

81 South Korea LED Driver Market, By Luminaire Type, 2020-2028 (USD Million)

82 South Korea LED Driver Market, By Component, 2020-2028 (USD Million)

83 South Korea LED Driver Market, By Application, 2020-2028 (USD Million)

84 south korea LED Driver Market, By Supply Type, 2020-2028 (USD Million)

85 Middle East and Africa LED Driver Market, By Luminaire Type, 2020-2028 (USD Million)

86 Middle East and Africa LED Driver Market, By Component, 2020-2028 (USD Million)

87 Middle East and Africa LED Driver Market, By Application, 2020-2028 (USD Million)

88 MIDDLE EAST and AFRICA LED Driver Market, By Supply Type, 2020-2028 (USD Million)

89 Middle East and Africa LED Driver Market, By Country, 2020-2028 (USD Million)

90 Saudi Arabia LED Driver Market, By Luminaire Type, 2020-2028 (USD Million)

91 Saudi Arabia LED Driver Market, By Component, 2020-2028 (USD Million)

92 Saudi Arabia LED Driver Market, By Application, 2020-2028 (USD Million)

93 saudi arabia LED Driver Market, By Supply Type, 2020-2028 (USD Million)

94 UAE LED Driver Market, By Luminaire Type, 2020-2028 (USD Million)

95 UAE LED Driver Market, By Component, 2020-2028 (USD Million)

96 UAE LED Driver Market, By Application, 2020-2028 (USD Million)

97 uae LED Driver Market, By Supply Type, 2020-2028 (USD Million)

98 Central and South America LED Driver Market, By Luminaire Type, 2020-2028 (USD Million)

99 Central and South America LED Driver Market, By Component, 2020-2028 (USD Million)

100 Central and South America LED Driver Market, By Application, 2020-2028 (USD Million)

101 CENTRAL and SOUTH AMERICA LED Driver Market, By Supply Type, 2020-2028 (USD Million)

102 Central and South America LED Driver Market, By Country, 2020-2028 (USD Million)

103 Brazil LED Driver Market, By Luminaire Type, 2020-2028 (USD Million)

104 Brazil LED Driver Market, By Component, 2020-2028 (USD Million)

105 Brazil LED Driver Market, By Application, 2020-2028 (USD Million)

106 brazil LED Driver Market, By Supply Type, 2020-2028 (USD Million)

107 Microchip Technology, Inc.: Products & Services Offering

108 Cree LED: Products & Services Offering

109 GE Current, a Daintree Company: Products & Services Offering

110 Signify Holdings: Products & Services Offering

111 Lutron Electronics Co., Ltd.: Products & Services Offering

112 ACE LEDS: Products & Services Offering

113 Macroblock, Inc. : Products & Services Offering

114 Maxim Integrated: Products & Services Offering

115 NXP Semiconductors, Inc: Products & Services Offering

116 Semiconductor Components Industries, LLC: Products & Services Offering

117 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global LED Driver Market Overview

2 Global LED Driver Market Value From 2020-2028 (USD Mllion)

3 Global LED Driver Market Share, By Luminaire Type (2022)

4 Global LED Driver Market Share, By Component (2022)

5 Global LED Driver Market Share, By Application (2022)

6 Global LED Driver Market Share, By Supply Type (2022)

7 Global LED Driver Market, By Region (Asia Pacific Market)

8 Technological Trends In Global LED Driver Market

9 Four Quadrant Competitor Positioning Matrix

10 Impact Of Macro & Micro Indicators On The Market

11 Impact Of Key Drivers On The Global LED Driver Market

12 Impact Of Challenges On The Global LED Driver Market

13 Porter’s Five Forces Analysis

14 Global LED Driver Market: By Luminaire Type Scope Key Takeaways

15 Global LED Driver Market, By Luminaire Type Segment: Revenue Growth Analysis

16 Decorative Lamps Market, By Region, 2020-2028 (USD Mllion)

17 Reflectors Market, By Region, 2020-2028 (USD Mllion)

18 Type A Lamp Market, By Region, 2020-2028 (USD Mllion)

19 Others Market, By Region, 2020-2028 (USD Mllion)

20 Global LED Driver Market: By Component Scope Key Takeaways

21 Global LED Driver Market, By Component Segment: Revenue Growth Analysis

22 Driver IC Market, By Region, 2020-2028 (USD Mllion)

23 Discrete Component Market, By Region, 2020-2028 (USD Mllion)

24 Others Market, By Region, 2020-2028 (USD Mllion)

25 Global LED Driver Market: By Application Scope Key Takeaways

26 Global LED Driver Market, By Application Segment: Revenue Growth Analysis

27 Automotive Market, By Region, 2020-2028 (USD Mllion)

28 Consumer electronics Market, By Region, 2020-2028 (USD Mllion)

29 Lighting Market, By Region, 2020-2028 (USD Mllion)

30 Outdoor Display Market, By Region, 2020-2028 (USD Mllion)

31 Global LED Driver Market: By Supply Type Scope Key Takeaways

32 Global LED Driver Market, By Supply Type Segment: Revenue Growth Analysis

33 Constant current Market, By Region, 2020-2028 (USD Mllion)

34 Constant Voltage Market, By Region, 2020-2028 (USD Mllion)

35 Regional Segment: Revenue Growth Analysis

36 Global LED Driver Market: Regional Analysis

37 North America LED Driver Market Overview

38 North America LED Driver Market, By Luminaire Type

39 North America LED Driver Market, By Component

40 North America LED Driver Market, By Application

41 North America LED Driver Market, By Supply Type

42 North America LED Driver Market, By Country

43 U.S. LED Driver Market, By Luminaire Type

44 U.S. LED Driver Market, By Component

45 U.S. LED Driver Market, By Application

46 U.S. LED Driver Market, By Supply Type

47 Canada LED Driver Market, By Luminaire Type

48 Canada LED Driver Market, By Component

49 Canada LED Driver Market, By Application

50 Canada LED Driver Market, By Supply Type

51 Mexico LED Driver Market, By Luminaire Type

52 Mexico LED Driver Market, By Component

53 Mexico LED Driver Market, By Application

54 Mexico LED Driver Market, By Supply Type

55 Four Quadrant Positioning Matrix

56 Company Market Share Analysis

57 Microchip Technology, Inc.: Company Snapshot

58 Microchip Technology, Inc.: SWOT Analysis

59 Microchip Technology, Inc.: Geographic Presence

60 Cree LED: Company Snapshot

61 Cree LED: SWOT Analysis

62 Cree LED: Geographic Presence

63 GE Current, a Daintree Company: Company Snapshot

64 GE Current, a Daintree Company: SWOT Analysis

65 GE Current, a Daintree Company: Geographic Presence

66 Signify Holdings: Company Snapshot

67 Signify Holdings: Swot Analysis

68 Signify Holdings: Geographic Presence

69 Lutron Electronics Co., Ltd.: Company Snapshot

70 Lutron Electronics Co., Ltd.: SWOT Analysis

71 Lutron Electronics Co., Ltd.: Geographic Presence

72 ACE LEDS: Company Snapshot

73 ACE LEDS: SWOT Analysis

74 ACE LEDS: Geographic Presence

75 Macroblock, Inc. : Company Snapshot

76 Macroblock, Inc. : SWOT Analysis

77 Macroblock, Inc. : Geographic Presence

78 Maxim Integrated: Company Snapshot

79 Maxim Integrated: SWOT Analysis

80 Maxim Integrated: Geographic Presence

81 NXP Semiconductors, Inc.: Company Snapshot

82 NXP Semiconductors, Inc.: SWOT Analysis

83 NXP Semiconductors, Inc.: Geographic Presence

84 Semiconductor Components Industries, LLC: Company Snapshot

85 Semiconductor Components Industries, LLC: SWOT Analysis

86 Semiconductor Components Industries, LLC: Geographic Presence

87 Other Companies: Company Snapshot

88 Other Companies: SWOT Analysis

89 Other Companies: Geographic Presence

The Global LED Driver Market has been studied from the year 2019 till 2028. However, the CAGR provided in the report is from the year 2023 to 2028. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the LED Driver Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS