Global Lentiviral Vector Manufacturing Market Size, Trends & Analysis - Forecasts to 2027 By Workflow (Upstream [Plasmid Manufacturing, Cell Expansion, Plasmid Transfection and Viral Vector Production] and Downstream [Purification, Fill and Finish], By Application (Cell & Gene Therapy, Vaccine Development, and Others), By End-User (Pharmaceutical and Biopharmaceutical Companies, and Research Institutes), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Company Market Share Analysis, and Competitor Analysis

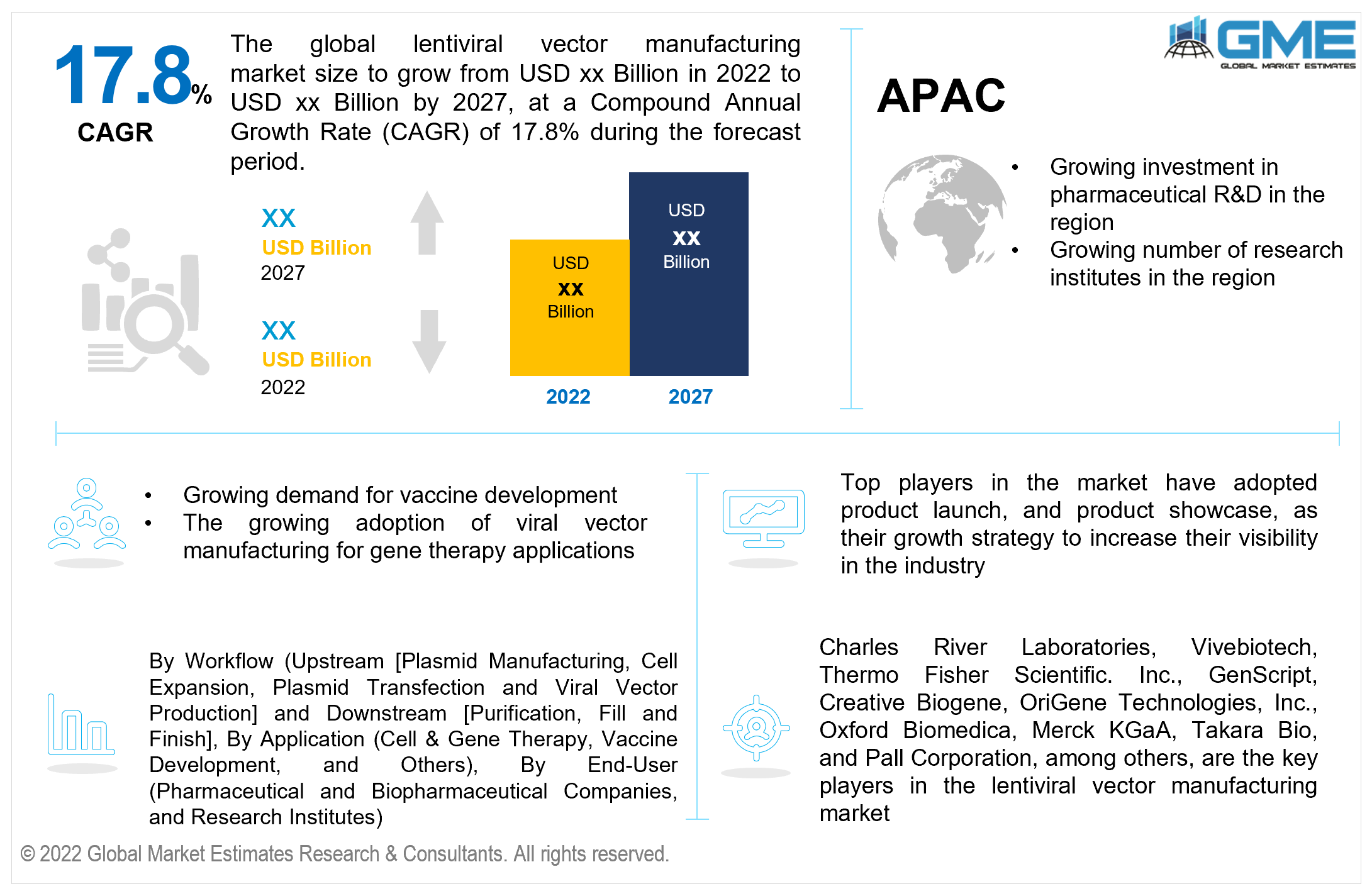

The Global Lentiviral Vector Manufacturing Market is projected to grow at a CAGR value of 17.8% from 2022 to 2027.

Researchers utilize lentiviral vectors to transport specific genes into the target cell. These tools are generally created from viruses. The growing adoption of various gene therapies for treating rare and genetic disorders has led to an increased focus on lentiviral vector manufacturing. The market for lentiviral vector manufacturing has tremendous potential for growth as governments and private entities increase investments in the research and development of vaccines for various disorders.

The increasing investment in the development of vaccines to combat viral epidemics has resulted in a surge in lentiviral vector manufacturing demand. Pharmaceutical companies are increasing their investment in lentiviral vector manufacturing in response to the increased demand for efficient vaccine manufacturing and packaging as part of the strategy to battle the spread of COVID.

The government's investment and measures to ramp up vaccine production and expansion of private sector investment in pharmaceutical manufacturing are likely to boost the lentiviral vector manufacturing market's growth.

The current growth of the lentiviral vector manufacturing market has been aided by the expanding expansion of vaccine production due to the COVID-19 pandemic. Governments have expanded efforts to ensure vaccinations are developed, stored, and transported in a safe manner.

With over 17 vaccines being currently utilized in the fight against COVID, biotech company TheraVectys has developed a new vaccine for COVID-19 based on the use of lentiviral vectors.

The lentiviral vector manufacturing market is predicted to increase significantly throughout the forecast period, with several vaccines still in the research phase and over 6 billion doses of vaccines administered as of the end of 2021. Growing investment in innovative vaccine research and development as pharmaceutical companies race to finish clinical studies and obtain government clearances in order to get their vaccine to market is projected to boost demand for lentiviral vector manufacturing.

The positive clinical trials from the application of lentiviral vectors for treating inherited diseases such as Thalassemia, Parkinson's disease, and chimeric antigen receptor-based immunotherapy of cancer are expected to increase the demand for lentiviral vector manufacturing during the forecast period.

The advantages of lentiviral vectors over traditionally used retroviral vectors, such as the ability to transduce non-dividing cells and less risky integration with target cells, are expected to increase the demand for lentiviral vector manufacturing. The ability of lentiviral vectors to transduce non-dividing cells has been crucial in their vaccine development application. The demand for lentiviral vector manufacturing is expected to grow as researchers develop new techniques that allow for scalable production through high vector titer.

The pandemic has boosted the demand for lentiviral vector production. Growing government initiatives, rising pharmaceutical manufacturing investment, and the vaccine demand contributed to the lentiviral vector manufacturing market's substantial expansion during COVID-19. Lentiviral vector production is rapidly being used in treating other disorders such as genetic and inherited diseases, and therefore the market is projected to develop even after the pandemic.

Government regulations on pharmaceutical development impede the market. Pharmaceutical companies are required to go through numerous rounds of medication safety testing, with the results and techniques being validated and approved by regulatory bodies. These procedures take time and considerably raise the development cost, resulting in higher costs. The high cost of such production technologies, the requirement for highly skilled specialists, and the vast number of obstacles to viral vector manufacturing capacity compared to traditional manufacturing methods inhibit the profitability of the lentiviral vector manufacturing market.

The lentiviral vector manufacturing market is driven mainly by the growing demand for lentiviral vectors in vaccine development, increasing adoption for treating genetic and acquired disorders, and the advantages of the lentiviral vectors over retroviral vectors.

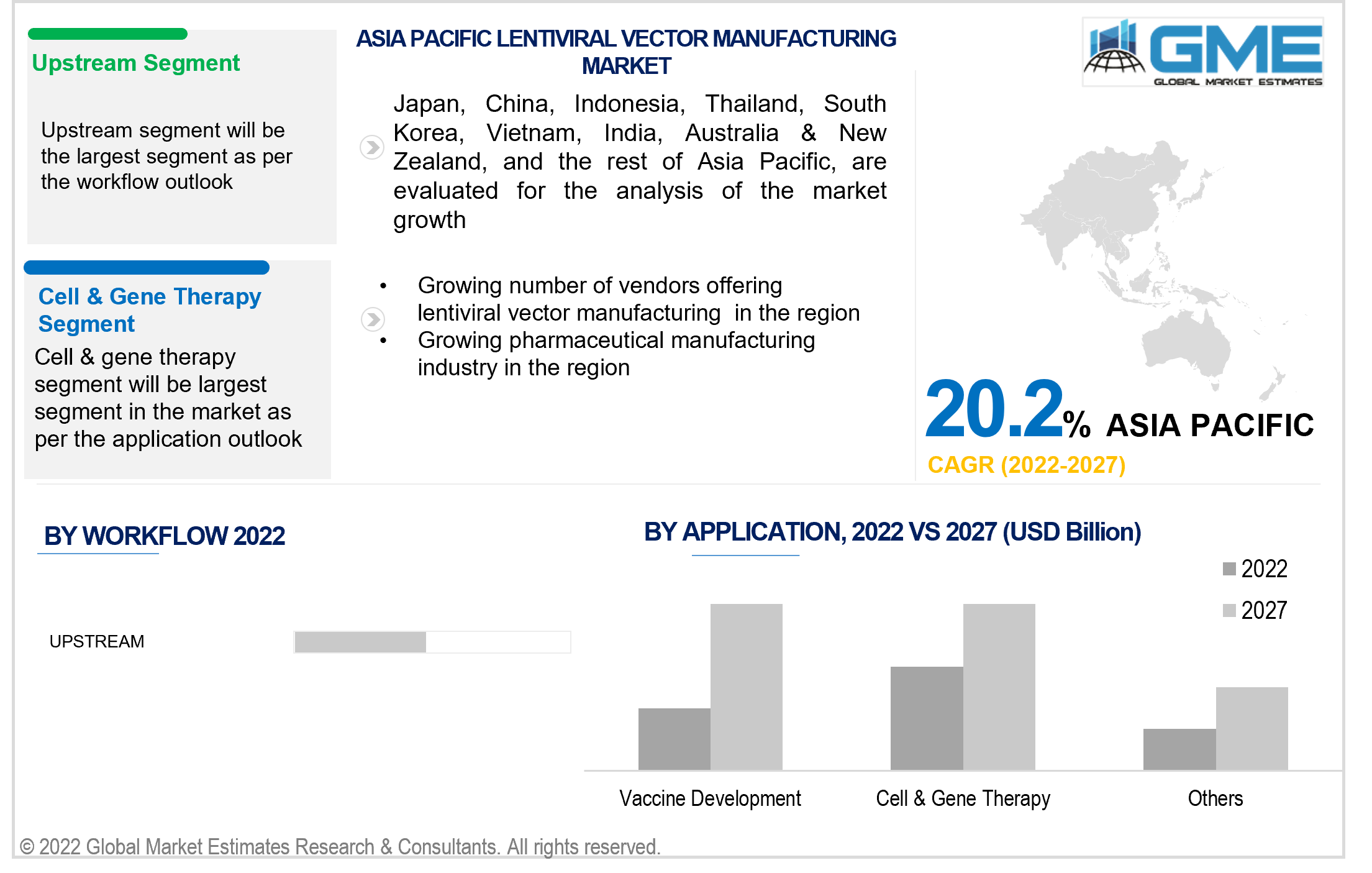

Based on the workflow, the lentiviral vector manufacturing market is segmented into upstream and downstream. The upstream segment is expected to hold the most significant piece of the market during the forecast period.

The upstream segment has been primarily driven by the growing demand for lentiviral vectors in vaccine development. Increasing investment in viral disease treatment and biologics has led to the domination of the upstream segment. The upstream segment includes plasmid manufacturing, cell expansion, plasmid transfection, and viral vector production.

Based on the various applications of lentiviral vectors, the market is segmented into cell & gene therapy, vaccine development, and others.

The cell & gene therapy segment held the lion's share of the market. Many favorable results in the application of lentiviral vectors for treating genetic and acquired disorders have led to the domination of this segment.

The growing investment in vaccine development owing to the COVID-19 pandemic has led to the vaccine development segment becoming the fastest-growing segment in the market.

Based on the various end-users, the market is segmented into pharmaceutical and biopharmaceutical companies and research institutes.

The pharmaceutical and biopharmaceutical companies segment held the lion's share of the market. The heavy investment by pharmaceutical companies into research and development and the large number of skilled research professionals employed by such companies have led to the domination of the pharmaceutical and biopharmaceutical companies segment.

Based on region, the market can be segmented into various regions such as North America, Europe, Central and South America, the Middle East and North Africa, and Asia Pacific regions.

The North American region is expected to be the dominant force in the market during the forecast period. The large number of pharmaceutical companies operating in this region and heavy investment in pharmaceutical R&D, vaccine development, stringent healthcare infrastructure, and heavy spending on healthcare by governments in the region have all contributed to the growth of the lentiviral vector manufacturing market in North America.

The APAC region is expected to be the fastest-growing segment during the projected period. The growing investment by governments into vaccine development, the growing availability of skilled professionals in the region, and the growth of the pharmaceutical manufacturing industry are the major contributors to the growth of the lentiviral vector manufacturing market in the region.

Charles River Laboratories, Vivebiotech, Thermo Fisher Scientific. Inc., GenScript, Creative Biogene, OriGene Technologies, Inc., Oxford Biomedica, Merck KGaA, Takara Bio, Pall Corporation, ITSBio Inc., ANDELYN BIOSCIENCES, Sino Biological Inc., Cellomics Technology, LLC, Virica Biotech, Cell Biolabs, Inc., SignaGen Laboratories, System Biosciences, Vigene Biosciences, LONZA, Mirus Bio LLC, FUJIFIM DIOSYNTH BIOTECHNOLOGIES, and SIRION-BIOTECH GMBH, among others, are the key players in the lentiviral vector manufacturing market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Lentiviral Vector Manufacturing Industry Overview, 2020-2027

2.1.1 Industry Overview

2.1.2 Workflow Overview

2.1.3 Application Overview

2.1.4 End-User Overview

2.1.6 Regional Overview

Chapter 3 Lentiviral Vector Manufacturing Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2027

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Rising demand for vaccine development

3.3.2 Industry Challenges

3.3.2.1 High cost of development and stringent regulations

3.4 Prospective Growth Scenario

3.4.1 Workflow Growth Scenario

3.4.2 Application Growth Scenario

3.4.3 End-User Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 End-User Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Lentiviral Vector Manufacturing Market, By Workflow

4.1 Workflow Outlook

4.2 Upstream

4.2.1 Market Size, By Region, 2020-2027 (USD Billion)

4.2.2 Plasmid Manufacturing

4.2.2.1 Market Size, By Region, 2020-2027 (USD Billion)

4.2.3 Cell Expansion

4.2.3.1 Market Size, By Region, 2020-2027 (USD Billion)

4.2.4 Plasmid Transfection and Viral Vector Production

4.2.4.1 Market Size, By Region, 2020-2027 (USD Billion)

4.3 Downstream

4.3.1 Market Size, By Region, 2020-2027 (USD Billion)

4.3.2 Purification

4.3.2.1 Market Size, By Region, 2020-2027 (USD Billion)

4.3.3 Fill and Finish

4.3.3.1 Market Size, By Region, 2020-2027 (USD Billion)

Chapter 5 Lentiviral Vector Manufacturing Market, By Application

5.1 Application Outlook

5.2 Cell & Gene Therapy

5.2.1 Market Size, By Region, 2020-2027 (USD Billion)

5.3 Vaccine Development

5.3.1 Market Size, By Region, 2020-2027 (USD Billion)

5.4 Others

5.4.1 Market Size, By Region, 2020-2027 (USD Billion)

Chapter 6 Lentiviral Vector Manufacturing Market, By End-User

6.1 Pharmaceutical and Biopharmaceutical Companies

6.1.1 Market Size, By Region, 2020-2027 (USD Billion)

6.2 Research Institutes

6.2.1 Market Size, By Region, 2020-2027 (USD Billion)

Chapter 7 Lentiviral Vector Manufacturing Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2020-2027 (USD Billion)

7.2.2 Market Size, By Workflow, 2020-2027 (USD Billion)

7.2.3 Market Size, By Application, 2020-2027 (USD Billion)

7.2.4 Market Size, By End-User, 2020-2027 (USD Billion)

7.2.6 U.S.

7.2.6.1 Market Size, By Workflow, 2020-2027 (USD Billion)

7.2.4.2 Market Size, By Application, 2020-2027 (USD Billion)

7.2.4.3 Market Size, By End-User, 2020-2027 (USD Billion)

7.2.7 Canada

7.2.7.1 Market Size, By Workflow, 2020-2027 (USD Billion)

7.2.7.2 Market Size, By Application, 2020-2027 (USD Billion)

7.2.7.3 Market Size, By End-User, 2020-2027 (USD Billion)

7.3 Europe

7.3.1 Market Size, By Country 2020-2027 (USD Billion)

7.3.2 Market Size, By Workflow, 2020-2027 (USD Billion)

7.3.3 Market Size, By Application, 2020-2027 (USD Billion)

7.3.4 Market Size, By End-User, 2020-2027 (USD Billion)

7.3.6 Germany

7.3.6.1 Market Size, By Workflow, 2020-2027 (USD Billion)

7.3.6.2 Market Size, By Application, 2020-2027 (USD Billion)

7.3.6.3 Market Size, By End-User, 2020-2027 (USD Billion)

7.3.7 UK

7.3.7.1 Market Size, By Workflow, 2020-2027 (USD Billion)

7.3.7.2 Market Size, By Application, 2020-2027 (USD Billion)

7.3.7.3 Market Size, By End-User, 2020-2027 (USD Billion)

7.3.8 France

7.3.7.1 Market Size, By Workflow, 2020-2027 (USD Billion)

7.3.7.2 Market Size, By Application, 2020-2027 (USD Billion)

7.3.7.3 Market Size, By End-User, 2020-2027 (USD Billion)

7.3.9 Italy

7.3.9.1 Market Size, By Workflow, 2020-2027 (USD Billion)

7.3.9.2 Market Size, By Application, 2020-2027 (USD Billion)

7.3.9.3 Market Size, By End-User, 2020-2027 (USD Billion)

7.3.10 Spain

7.3.10.1 Market Size, By Workflow, 2020-2027 (USD Billion)

7.3.10.2 Market Size, By Application, 2020-2027 (USD Billion)

7.3.10.3 Market Size, By End-User, 2020-2027 (USD Billion)

7.3.11 Russia

7.3.11.1 Market Size, By Workflow, 2020-2027 (USD Billion)

7.3.11.2 Market Size, By Application, 2020-2027 (USD Billion)

7.3.11.3 Market Size, By End-User, 2020-2027 (USD Billion)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2020-2027 (USD Billion)

7.4.2 Market Size, By Workflow, 2020-2027 (USD Billion)

7.4.3 Market Size, By Application, 2020-2027 (USD Billion)

7.4.4 Market Size, By End-User, 2020-2027 (USD Billion)

7.4.6 China

7.4.6.1 Market Size, By Workflow, 2020-2027 (USD Billion)

7.4.6.2 Market Size, By Application, 2020-2027 (USD Billion)

7.4.6.3 Market Size, By End-User, 2020-2027 (USD Billion)

7.4.7 India

7.4.7.1 Market Size, By Workflow, 2020-2027 (USD Billion)

7.4.7.2 Market Size, By Application, 2020-2027 (USD Billion)

7.4.7.3 Market Size, By End-User, 2020-2027 (USD Billion)

7.4.8 Japan

7.4.7.1 Market Size, By Workflow, 2020-2027 (USD Billion)

7.4.7.2 Market Size, By Application, 2020-2027 (USD Billion)

7.4.7.3 Market Size, By End-User, 2020-2027 (USD Billion)

7.4.9 Australia

7.4.9.1 Market Size, By Workflow, 2020-2027 (USD Billion)

7.4.9.2 Market size, By Application, 2020-2027 (USD Billion)

7.4.9.3 Market Size, By End-User, 2020-2027 (USD Billion)

7.4.10 South Korea

7.4.10.1 Market Size, By Workflow, 2020-2027 (USD Billion)

7.4.10.2 Market Size, By Application, 2020-2027 (USD Billion)

7.4.10.3 Market Size, By End-User, 2020-2027 (USD Billion)

7.5 Latin America

7.5.1 Market Size, By Country 2020-2027 (USD Billion)

7.5.2 Market Size, By Workflow, 2020-2027 (USD Billion)

7.5.3 Market Size, By Application, 2020-2027 (USD Billion)

7.5.4 Market Size, By End-User, 2020-2027 (USD Billion)

7.5.6 Brazil

7.5.6.1 Market Size, By Workflow, 2020-2027 (USD Billion)

7.5.6.2 Market Size, By Application, 2020-2027 (USD Billion)

7.5.6.3 Market Size, By End-User, 2020-2027 (USD Billion)

7.5.7 Mexico

7.5.7.1 Market Size, By Workflow, 2020-2027 (USD Billion)

7.5.7.2 Market Size, By Application, 2020-2027 (USD Billion)

7.5.7.3 Market Size, By End-User, 2020-2027 (USD Billion)

7.5.8 Argentina

7.5.7.1 Market Size, By Workflow, 2020-2027 (USD Billion)

7.5.7.2 Market Size, By Application, 2020-2027 (USD Billion)

7.5.7.3 Market Size, By End-User, 2020-2027 (USD Billion)

7.6 MEA

7.6.1 Market Size, By Country 2020-2027 (USD Billion)

7.6.2 Market Size, By Workflow, 2020-2027 (USD Billion)

7.6.3 Market Size, By Application, 2020-2027 (USD Billion)

7.6.4 Market Size, By End-User, 2020-2027 (USD Billion)

7.6.6 Saudi Arabia

7.6.6.1 Market Size, By Workflow, 2020-2027 (USD Billion)

7.6.6.2 Market Size, By Application, 2020-2027 (USD Billion)

7.6.6.3 Market Size, By End-User, 2020-2027 (USD Billion)

7.6.7 UAE

7.6.7.1 Market Size, By Workflow, 2020-2027 (USD Billion)

7.6.7.2 Market Size, By Application, 2020-2027 (USD Billion)

7.6.7.3 Market Size, By End-User, 2020-2027 (USD Billion)

7.6.8 South Africa

7.6.7.1 Market Size, By Workflow, 2020-2027 (USD Billion)

7.6.7.2 Market Size, By Application, 2020-2027 (USD Billion)

7.6.7.3 Market Size, By End-User, 2020-2027 (USD Billion)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 Charles River Laboratories

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Info Graphic Analysis

8.3 Vivebiotech

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info Graphic Analysis

8.4 Thermo Fisher Scientific. Inc.

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info Graphic Analysis

8.5 GenScript

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info Graphic Analysis

8.6 Creative Biogene

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info Graphic Analysis

8.7 OriGene Technologies, Inc.

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info Graphic Analysis

8.8 Oxford Biomedica

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.9 Merck KGaA

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.10 Takara Bio

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info Graphic Analysis

8.11 Other Companies

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info Graphic Analysis

The Global Lentiviral Vector Manufacturing Market has been studied from the year 2019 till 2027. However, the CAGR provided in the report is from the year 2022 to 2027. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Lentiviral Vector Manufacturing Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS