Global Life Science Tools Market Size, Trends & Analysis - Forecasts to 2029 By Technology (PCR and qPCR, Sanger Sequencing, Separation Technologies, Flow Cytometry, Nucleic Acid Microarray, Mass Spectrometry, Next Generation Sequencing, and Other Technologies), By Application (Proteomics Technology, Genomic Technology, Cell Biology Technology, and Other Applications), By End-use (Government & Academic, Biopharmaceutical Company, Healthcare, Industrial Applications, and Others), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

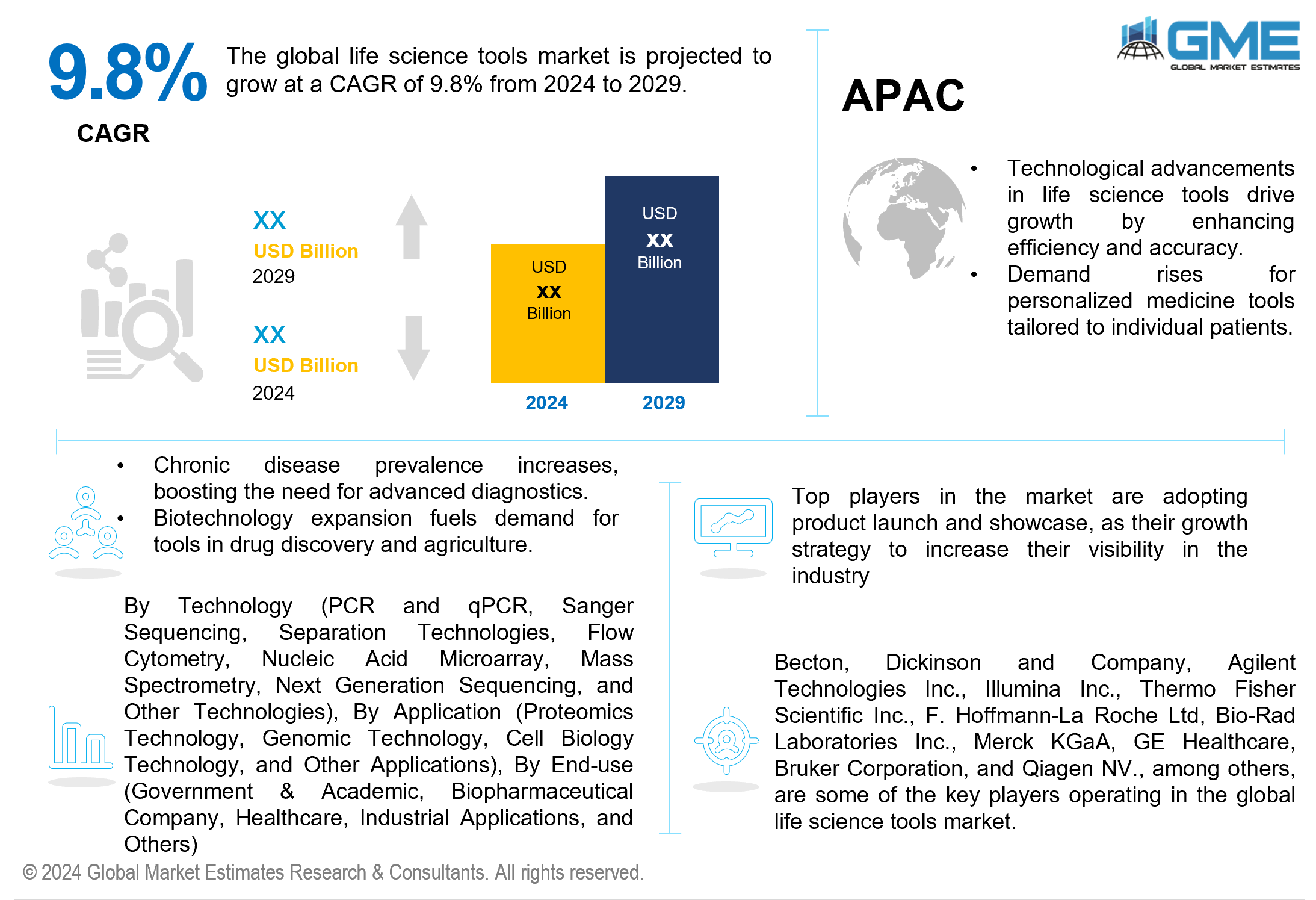

The global life science tools market is projected to grow at a CAGR of 9.8% from 2024 to 2029.

Genomics tools, such as next-generation sequencing (NGS), have transformed how researchers investigate genetic material, offering faster and more reliable results. This, together with cutting-edge proteomics tools that examine the structure and function of proteins, has opened up new possibilities for comprehending complicated biological processes and disorders. These developments are aided by increased investment in biotechnology tools and molecular biology tools, which are required for high-quality research and development in the life sciences.

Pharmaceutical and biotechnology businesses, academic institutions, and research organizations are increasing their R&D investments, which drives demand for sophisticated life science instrumentation and laboratory equipment market. This covers medication discovery, customized medicine, and fundamental research efforts. Major pharmaceutical companies such as Roche, Pfizer, Johnson & Johnson, and Novartis are significantly increasing their R&D budgets. For instance, Pfizer reported R&D expenditures of over USD 10.67 billion in 2023, and in 2021, the company invested 10.36 billion in R&D expenses. As the demand for precise life science diagnostics grows, so does the market for modern laboratory equipment and instruments, which contributes to the global life science tools industry growth.

Additionally, the increasing innovation in Life science tools further contributes to the market's growth. The development and use of sophisticated analytical instruments and cell analysis tools have improved the ability to conduct detailed and accurate scientific inquiries. The addition of bioinformatics tools to these instruments has simplified data analysis and interpretation, resulting in more efficient and insightful research findings.

Life science tools market trends emphasize innovation and the creation of new life science technologies. Life science tool manufacturers constantly launch new products to improve the efficiency and accuracy of clinical research tools, increasing the pace of scientific discovery. Life science reagents, which are required for various experimental techniques, are likewise evolving, improving life science research capacities.

According to the life science tools market analysis Industry growth, market trends, and the competitive environment are all actively studied to better understand life science tools pricing strategies. The continued development of next-generation sequencing tools and increased adoption of bioinformatics tools are likely to fuel market growth.

One major restraint to the global life science tools market is the high cost of sophisticated technologies and instruments. These costs may restrict access to smaller research institutions and emerging markets, thereby limiting the adoption of cutting-edge instruments and impeding overall industry growth.

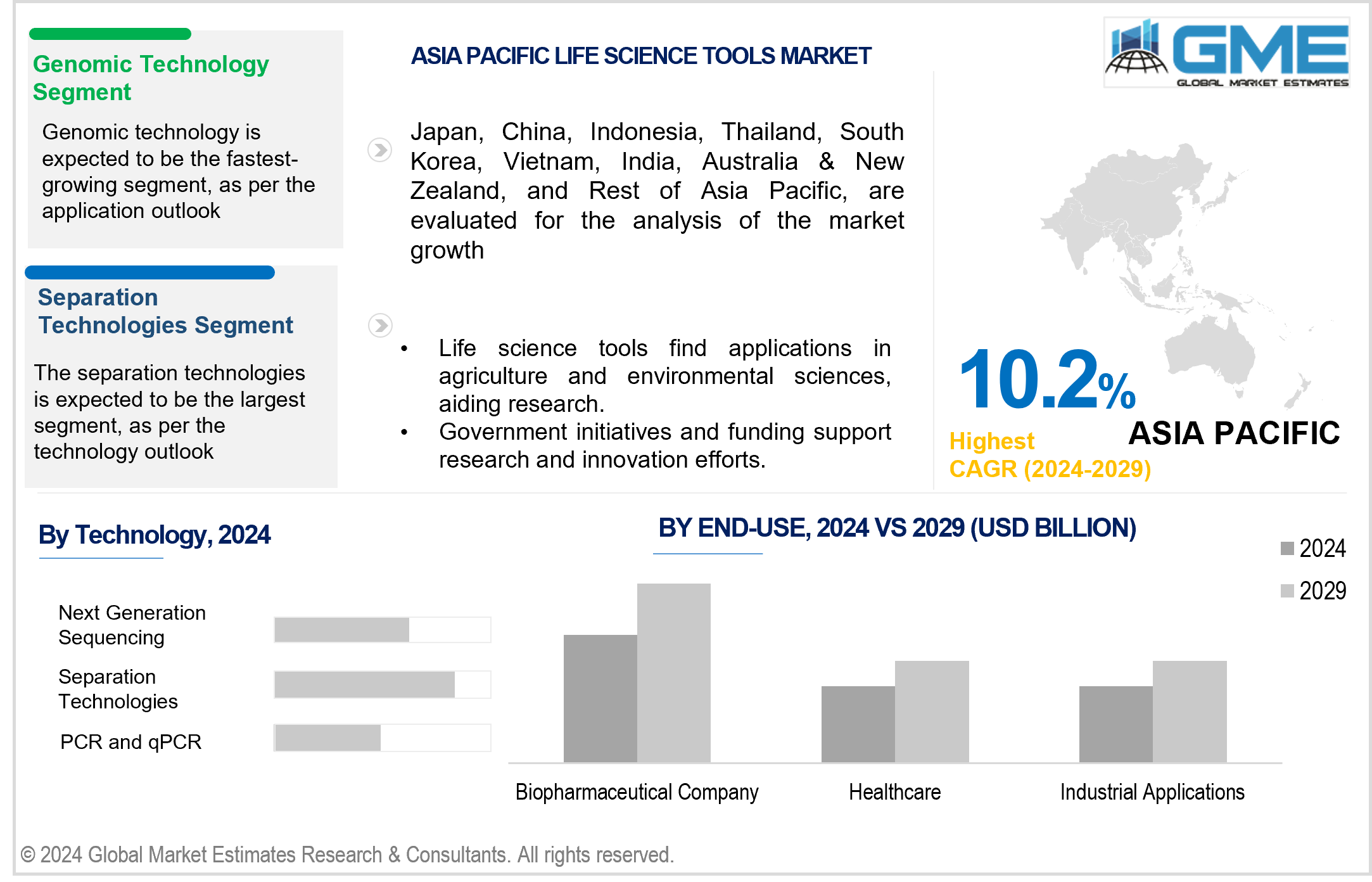

The separation technologies segment is expected to hold the largest share of the market. The segment growth is due to its critical role in a variety of life science applications such as genomics, proteomics, and molecular biology. These technologies, such as chromatography and electrophoresis, are critical for isolating and studying biomolecules with great accuracy.

The next generation sequencing segment is expected to be the fastest-growing segment in the market from 2024 to 2029. The growth is attributed to its transformative impact on genetic research and diagnostics. NGS enables rapid, high-throughput sequencing at a cheaper cost, allowing for advances in personalized medicine, illness detection, and drug discovery.

The genomic technology segment is anticipated to be the fastest-growing segment in the market from 2024 to 2029. The anticipated growth is due to its increasing role in personalized medicine, genetic research, and disease prevention. Advances in technology such as CRISPR and next-generation sequencing improve our ability to study and change genetic information. Increasing investments in genomics research and increased demand for precision medicine fuel growth, emphasizing its vital role in the life sciences market.

The cell biology technology segment is expected to hold the largest share of the market. The segment growth is due to its critical role in understanding cellular systems, disease processes, and drug development. Cell culture, imaging, and flow cytometry are standard techniques in both research and clinical settings. The growing emphasis on regenerative medicine, cancer research, and tailored medicines fuels demand, cementing its dominant market position.

The biopharmaceutical company segment is anticipated to be the fastest-growing segment in the market from 2024 to 2029. This growth is due to the increasing emphasis on developing targeted treatments and biologics. These firms are making significant investments in advanced life science methods for drug discovery and development, including genomics, proteomics, and cell biology technology. The increasing prevalence of chronic diseases and the increasing demand for innovative therapies also contribute to the market growth.

The healthcare segment is expected to hold the largest share of the market. This is due to the widespread use of life science technologies in diagnosis, patient monitoring, and treatment. The demand for better diagnostic technology, tailored therapy, and effective illness management drives increasing investment in life science tools. Furthermore, the aging population and rising frequency of chronic diseases demand improved healthcare solutions, contributing to the segment dominance.

North America is expected to be the largest region in the global market. The primary reasons boosting market growth in this region include developed healthcare infrastructure, significant expenditures in R&D, and the presence of key life science tool market players. High adoption of advanced technology, powerful academic and research institutions, and significant government financing for life sciences contribute to market growth. Furthermore, the region's customized medicine and Life science tools innovation concentration contributes to its market leadership.

Asia Pacific is predicted to witness rapid growth during the forecast period. The regional market growth is attributed to the increasing investment in healthcare infrastructure, increasing research & development activities, and a growing biopharmaceutical industry. The region's vast population, especially in growing economies like China and India, creates a significant market opportunity.

Becton, Dickinson and Company, Agilent Technologies Inc., Illumina Inc., Thermo Fisher Scientific Inc., F. Hoffmann-La Roche Ltd, Bio-Rad Laboratories Inc., Merck KGaA, GE Healthcare, Bruker Corporation, and Qiagen NV., among others, are some of the key players operating in the global life science tools market.

Please note: This is not an exhaustive list of companies profiled in the report.

In June 2024, BD (Becton, Dickinson and Company), a global medical technology firm, announced its acquisition of Edwards Lifesciences' Critical Care product group for USD 4.2 billion in cash. This strategic move aims to enhance BD's portfolio in smart connected care solutions and advanced monitoring technology. Critical Care, renowned for its hemodynamic monitoring technology and AI-driven clinical decision tools, will operate as a separate business unit within BD's Medical segment.

In January 2024, Agilent Technologies announced the release of their new automated parallel capillary electrophoresis system called the Agilent ProteoAnalyzer. The Agilent ProteoAnalyzer system aims to improve protein quality control workflows by automating the separation process, data processing, and sample preparation. This automation reduces the need for extensive training and lowers labor costs. The system can handle a variety of sample types and analyze different protein sizes and types in a single run, providing accurate results and minimizing the need for reanalysis.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL LIFE SCIENCE TOOLS MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL LIFE SCIENCE TOOLS MARKET, BY TECHNOLOGY

4.1 Introduction

4.2 Life Science Tools Market: Technology Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 PCR and qPCR

4.4.1 PCR and qPCR Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 Sanger Sequencing

4.5.1 Sanger Sequencing Market Estimates and Forecast, 2021-2029 (USD Million)

4.6 Separation Technologies

4.6.1 Separation Technologies Market Estimates and Forecast, 2021-2029 (USD Million)

4.7 Flow Cytometry

4.7.1 Flow Cytometry Market Estimates and Forecast, 2021-2029 (USD Million)

4.8 Nucleic Acid Microarray

4.8.1 Nucleic Acid Microarray Market Estimates and Forecast, 2021-2029 (USD Million)

4.9 Mass Spectrometry

4.9.1 Mass Spectrometry Market Estimates and Forecast, 2021-2029 (USD Million)

4.10 Other Technologies

4.10.1 Other Technologies Market Estimates and Forecast, 2021-2029 (USD Million)

5 GLOBAL LIFE SCIENCE TOOLS MARKET, BY END-USE

5.1 Introduction

5.2 Life Science Tools Market: End-use Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 Government & Academic

5.4.1 Government & Academic Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 Biopharmaceutical Company

5.5.1 Biopharmaceutical Company Market Estimates and Forecast, 2021-2029 (USD Million)

5.6 Healthcare

5.6.1 Healthcare Market Estimates and Forecast, 2021-2029 (USD Million)

5.7 Industrial Applications

5.7.1 Industrial Applications Market Estimates and Forecast, 2021-2029 (USD Million)

5.8 Others

5.8.1 Others Market Estimates and Forecast, 2021-2029 (USD Million)

6 GLOBAL LIFE SCIENCE TOOLS MARKET, BY APPLICATION

6.1 Introduction

6.2 Life Science Tools Market: Application Scope Key Takeaways

6.3 Revenue Growth Analysis, 2023 & 2029

6.4 Proteomics Technology

6.4.1 Proteomics Technology Market Estimates and Forecast, 2021-2029 (USD Million)

6.5 Genomic Technology

6.5.1 Genomic Technology Market Estimates and Forecast, 2021-2029 (USD Million)

6.6 Cell Biology Technology

6.6.1 Cell Biology Technology Market Estimates and Forecast, 2021-2029 (USD Million)

6.7 Other Applications

6.7.1 Other Applications Market Estimates and Forecast, 2021-2029 (USD Million)

7 GLOBAL LIFE SCIENCE TOOLS MARKET, BY REGION

7.1 Introduction

7.2 North America Life Science Tools Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.1 By Technology

7.2.2 By End-use

7.2.3 By Application

7.2.4 By Country

7.2.4.1 U.S. Life Science Tools Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.1.1 By Technology

7.2.4.1.2 By End-use

7.2.4.1.3 By Application

7.2.4.2 Canada Life Science Tools Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.2.1 By Technology

7.2.4.2.2 By End-use

7.2.4.2.3 By Application

7.2.4.3 Mexico Life Science Tools Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.3.1 By Technology

7.2.4.3.2 By End-use

7.2.4.3.3 By Application

7.3 Europe Life Science Tools Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.1 By Technology

7.3.2 By End-use

7.3.3 By Application

7.3.4 By Country

7.3.4.1 Germany Life Science Tools Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.1.1 By Technology

7.3.4.1.2 By End-use

7.3.4.1.3 By Application

7.3.4.2 U.K. Life Science Tools Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.2.1 By Technology

7.3.4.2.2 By End-use

7.3.4.2.3 By Application

7.3.4.3 France Life Science Tools Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.3.1 By Technology

7.3.4.3.2 By End-use

7.3.4.3.3 By Application

7.3.4.4 Italy Life Science Tools Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.4.1 By Technology

7.3.4.4.2 By End-use

7.2.4.4.3 By Application

7.3.4.5 Spain Life Science Tools Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.5.1 By Technology

7.3.4.5.2 By End-use

7.2.4.5.3 By Application

7.3.4.6 Netherlands Life Science Tools Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.6.1 By Technology

7.3.4.6.2 By End-use

7.2.4.6.3 By Application

7.3.4.7 Rest of Europe Life Science Tools Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.7.1 By Technology

7.3.4.7.2 By End-use

7.2.4.7.3 By Application

7.4 Asia Pacific Life Science Tools Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.1 By Technology

7.4.2 By End-use

7.4.3 By Application

7.4.4 By Country

7.4.4.1 China Life Science Tools Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.1.1 By Technology

7.4.4.1.2 By End-use

7.4.4.1.3 By Application

7.4.4.2 Japan Life Science Tools Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.2.1 By Technology

7.4.4.2.2 By End-use

7.4.4.2.3 By Application

7.4.4.3 India Life Science Tools Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.3.1 By Technology

7.4.4.3.2 By End-use

7.4.4.3.3 By Application

7.4.4.4 South Korea Life Science Tools Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.4.1 By Technology

7.4.4.4.2 By End-use

7.4.4.4.3 By Application

7.4.4.5 Singapore Life Science Tools Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.5.1 By Technology

7.4.4.5.2 By End-use

7.4.4.5.3 By Application

7.4.4.6 Malaysia Life Science Tools Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.6.1 By Technology

7.4.4.6.2 By End-use

7.4.4.6.3 By Application

7.4.4.7 Thailand Life Science Tools Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.7.1 By Technology

7.4.4.7.2 By End-use

7.4.4.7.3 By Application

7.4.4.8 Indonesia Life Science Tools Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.8.1 By Technology

7.4.4.8.2 By End-use

7.4.4.8.3 By Application

7.4.4.9 Vietnam Life Science Tools Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.9.1 By Technology

7.4.4.9.2 By End-use

7.4.4.9.3 By Application

7.4.4.10 Taiwan Life Science Tools Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.10.1 By Technology

7.4.4.10.2 By End-use

7.4.4.10.3 By Application

7.4.4.11 Rest of Asia Pacific Life Science Tools Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.11.1 By Technology

7.4.4.11.2 By End-use

7.4.4.11.3 By Application

7.5 Middle East and Africa Life Science Tools Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.1 By Technology

7.5.2 By End-use

7.5.3 By Application

7.5.4 By Country

7.5.4.1 Saudi Arabia Life Science Tools Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.1.1 By Technology

7.5.4.1.2 By End-use

7.5.4.1.3 By Application

7.5.4.2 U.A.E. Life Science Tools Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.2.1 By Technology

7.5.4.2.2 By End-use

7.5.4.2.3 By Application

7.5.4.3 Israel Life Science Tools Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.3.1 By Technology

7.5.4.3.2 By End-use

7.5.4.3.3 By Application

7.5.4.4 South Africa Life Science Tools Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.4.1 By Technology

7.5.4.4.2 By End-use

7.5.4.4.3 By Application

7.5.4.5 Rest of Middle East and Africa Life Science Tools Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.5.1 By Technology

7.5.4.5.2 By End-use

7.5.4.5.2 By Application

7.6 Central and South America Life Science Tools Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.1 By Technology

7.6.2 By End-use

7.6.3 By Application

7.6.4 By Country

7.6.4.1 Brazil Life Science Tools Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.1.1 By Technology

7.6.4.1.2 By End-use

7.6.4.1.3 By Application

7.6.4.2 Argentina Life Science Tools Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.2.1 By Technology

7.6.4.2.2 By End-use

7.6.4.2.3 By Application

7.6.4.3 Chile Life Science Tools Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.3.1 By Technology

7.6.4.3.2 By End-use

7.6.4.3.3 By Application

7.6.4.4 Rest of Central and South America Life Science Tools Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.4.1 By Technology

7.6.4.4.2 By End-use

7.6.4.4.3 By Application

8 COMPETITIVE LANDCAPE

8.1 Company Market Share Analysis

8.2 Four Quadrant Positioning Matrix

8.2.1 Market Leaders

8.2.2 Market Visionaries

8.2.3 Market Challengers

8.2.4 Niche Market Players

8.3 Vendor Landscape

8.3.1 North America

8.3.2 Europe

8.3.3 Asia Pacific

8.3.4 Rest of the World

8.4 Company Profiles

8.4.1 Becton, Dickinson and Company

8.4.1.1 Business Description & Financial Analysis

8.4.1.2 SWOT Analysis

8.4.1.3 Products & Services Offered

8.4.1.4 Strategic Alliances between Business Partners

8.4.2 Agilent Technologies Inc.

8.4.2.1 Business Description & Financial Analysis

8.4.2.2 SWOT Analysis

8.4.2.3 Products & Services Offered

8.4.2.4 Strategic Alliances between Business Partners

8.4.3 Illumina Inc.

8.4.3.1 Business Description & Financial Analysis

8.4.3.2 SWOT Analysis

8.4.3.3 Products & Services Offered

8.4.3.4 Strategic Alliances between Business Partners

8.4.4 Thermo Fisher Scientific Inc.

8.4.4.1 Business Description & Financial Analysis

8.4.4.2 SWOT Analysis

8.4.4.3 Products & Services Offered

8.4.4.4 Strategic Alliances between Business Partners

8.4.5 F. Hoffmann-La Roche Ltd

8.4.5.1 Business Description & Financial Analysis

8.4.5.2 SWOT Analysis

8.4.5.3 Products & Services Offered

8.4.5.4 Strategic Alliances between Business Partners

8.4.6 Bio-Rad Laboratories Inc.

8.4.6.1 Business Description & Financial Analysis

8.4.6.2 SWOT Analysis

8.4.6.3 Products & Services Offered

8.4.6.4 Strategic Alliances between Business Partners

8.4.7 Merck KGaA

8.4.7.1 Business Description & Financial Analysis

8.4.7.2 SWOT Analysis

8.4.7.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.8 GE Healthcare

8.4.8.1 Business Description & Financial Analysis

8.4.8.2 SWOT Analysis

8.4.8.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.9 Bruker Corporation

8.4.9.1 Business Description & Financial Analysis

8.4.9.2 SWOT Analysis

8.4.9.3 Products & Services Offered

8.4.9.4 Strategic Alliances between Business Partners

8.4.10 Qiagen NV

8.4.10.1 Business Description & Financial Analysis

8.4.10.2 SWOT Analysis

8.4.10.3 Products & Services Offered

8.4.10.4 Strategic Alliances between Business Partners

8.4.11 Other Companies

8.4.11.1 Business Description & Financial Analysis

8.4.11.2 SWOT Analysis

8.4.11.3 Products & Services Offered

8.4.11.4 Strategic Alliances between Business Partners

9 RESEARCH METHODOLOGY

9.1 Market Introduction

9.1.1 Market Definition

9.1.2 Market Scope & Segmentation

9.2 Information Procurement

9.2.1 Secondary Research

9.2.1.1 Purchased Databases

9.2.1.2 GMEs Internal Data Repository

9.2.1.3 Secondary Resources & Third Party Perspectives

9.2.1.4 Company Information Sources

9.2.2 Primary Research

9.2.2.1 Various Types of Respondents for Primary Interviews

9.2.2.2 Number of Interviews Conducted throughout the Research Process

9.2.2.3 Primary Stakeholders

9.2.2.4 Discussion Guide for Primary Participants

9.2.3 Expert Panels

9.2.3.1 Expert Panels Across 30+ Industry

9.2.4 Paid Local Experts

9.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

9.3 Market Estimation

9.3.1 Top-Down Approach

9.3.1.1 Macro-Economic Indicators Considered

9.3.1.2 Micro-Economic Indicators Considered

9.3.2 Bottom Up Approach

9.3.2.1 Company Share Analysis Approach

9.3.2.2 Estimation of Potential Product Sales

9.4 Data Triangulation

9.4.1 Data Collection

9.4.2 Time Series, Cross Sectional & Panel Data Analysis

9.4.3 Cluster Analysis

9.5 Analysis and Output

9.5.1 Inhouse AI Based Real Time Analytics Tool

9.5.2 Output From Desk & Primary Research

9.6 Research Assumptions & Limitations

9.7.1 Research Assumptions

9.7.2 Research Limitations

LIST OF TABLES

1 Global Life Science Tools Market, By Technology, 2021-2029 (USD Mllion)

2 PCR and qPCR Market, By Region, 2021-2029 (USD Mllion)

3 Sanger Sequencing Market, By Region, 2021-2029 (USD Mllion)

4 Separation Technologies Market, By Region, 2021-2029 (USD Mllion)

5 Flow Cytometry Market, By Region, 2021-2029 (USD Mllion)

6 Nucleic Acid Microarray Market, By Region, 2021-2029 (USD Mllion)

7 Mass Spectrometry Market, By Region, 2021-2029 (USD Mllion)

8 Other Technologies Market, By Region, 2021-2029 (USD Mllion)

9 Global Life Science Tools Market, By End-use, 2021-2029 (USD Mllion)

10 Government & Academic Market, By Region, 2021-2029 (USD Mllion)

11 Biopharmaceutical Company Market, By Region, 2021-2029 (USD Mllion)

12 Healthcare Market, By Region, 2021-2029 (USD Mllion)

13 Industrial Applications Market, By Region, 2021-2029 (USD Mllion)

14 Others Market, By Region, 2021-2029 (USD Mllion)

15 Global Life Science Tools Market, By Application, 2021-2029 (USD Mllion)

16 Proteomics Technology Market, By Region, 2021-2029 (USD Mllion)

17 Genomic Technology Market, By Region, 2021-2029 (USD Mllion)

18 Cell Biology Technology Market, By Region, 2021-2029 (USD Mllion)

19 Other Applications Market, By Region, 2021-2029 (USD Mllion)

20 Regional Analysis, 2021-2029 (USD Mllion)

21 North America Life Science Tools Market, By Technology, 2021-2029 (USD Million)

22 North America Life Science Tools Market, By End-use, 2021-2029 (USD Million)

23 North America Life Science Tools Market, By Application, 2021-2029 (USD Million)

24 North America Life Science Tools Market, By Country, 2021-2029 (USD Million)

25 U.S. Life Science Tools Market, By Technology, 2021-2029 (USD Million)

26 U.S. Life Science Tools Market, By End-use, 2021-2029 (USD Million)

27 U.S. Life Science Tools Market, By Application, 2021-2029 (USD Million)

28 Canada Life Science Tools Market, By Technology, 2021-2029 (USD Million)

29 Canada Life Science Tools Market, By End-use, 2021-2029 (USD Million)

30 Canada Life Science Tools Market, By Application, 2021-2029 (USD Million)

31 Mexico Life Science Tools Market, By Technology, 2021-2029 (USD Million)

32 Mexico Life Science Tools Market, By End-use, 2021-2029 (USD Million)

33 Mexico Life Science Tools Market, By Application, 2021-2029 (USD Million)

34 Europe Life Science Tools Market, By Technology, 2021-2029 (USD Million)

35 Europe Life Science Tools Market, By End-use, 2021-2029 (USD Million)

36 Europe Life Science Tools Market, By Application, 2021-2029 (USD Million)

37 Europe Life Science Tools Market, By COUNTRY, 2021-2029 (USD Million)

38 Germany Life Science Tools Market, By Technology, 2021-2029 (USD Million)

39 Germany Life Science Tools Market, By End-use, 2021-2029 (USD Million)

40 Germany Life Science Tools Market, By Application, 2021-2029 (USD Million)

41 U.K. Life Science Tools Market, By Technology, 2021-2029 (USD Million)

42 U.K. Life Science Tools Market, By End-use, 2021-2029 (USD Million)

43 U.K. Life Science Tools Market, By Application, 2021-2029 (USD Million)

44 France Life Science Tools Market, By Technology, 2021-2029 (USD Million)

45 France Life Science Tools Market, By End-use, 2021-2029 (USD Million)

46 France Life Science Tools Market, By Application, 2021-2029 (USD Million)

47 Italy Life Science Tools Market, By Technology, 2021-2029 (USD Million)

48 Italy Life Science Tools Market, By End-use , 2021-2029 (USD Million)

49 Italy Life Science Tools Market, By Application, 2021-2029 (USD Million)

50 Spain Life Science Tools Market, By Technology, 2021-2029 (USD Million)

51 Spain Life Science Tools Market, By End-use, 2021-2029 (USD Million)

52 Spain Life Science Tools Market, By Application, 2021-2029 (USD Million)

53 Rest Of Europe Life Science Tools Market, By Technology, 2021-2029 (USD Million)

54 Rest Of Europe Life Science Tools Market, By End-use, 2021-2029 (USD Million)

55 Rest of Europe Life Science Tools Market, By Application, 2021-2029 (USD Million)

56 Asia Pacific Life Science Tools Market, By Technology, 2021-2029 (USD Million)

57 Asia Pacific Life Science Tools Market, By End-use, 2021-2029 (USD Million)

58 Asia Pacific Life Science Tools Market, By Application, 2021-2029 (USD Million)

59 Asia Pacific Life Science Tools Market, By Country, 2021-2029 (USD Million)

60 China Life Science Tools Market, By Technology, 2021-2029 (USD Million)

61 China Life Science Tools Market, By End-use, 2021-2029 (USD Million)

62 China Life Science Tools Market, By Application, 2021-2029 (USD Million)

63 India Life Science Tools Market, By Technology, 2021-2029 (USD Million)

64 India Life Science Tools Market, By End-use, 2021-2029 (USD Million)

65 India Life Science Tools Market, By Application, 2021-2029 (USD Million)

66 Japan Life Science Tools Market, By Technology, 2021-2029 (USD Million)

67 Japan Life Science Tools Market, By End-use, 2021-2029 (USD Million)

68 Japan Life Science Tools Market, By Application, 2021-2029 (USD Million)

69 South Korea Life Science Tools Market, By Technology, 2021-2029 (USD Million)

70 South Korea Life Science Tools Market, By End-use, 2021-2029 (USD Million)

71 South Korea Life Science Tools Market, By Application, 2021-2029 (USD Million)

72 Singapore Life Science Tools Market, By Technology, 2021-2029 (USD Million)

73 Singapore Life Science Tools Market, By End-use, 2021-2029 (USD Million)

74 Singapore Life Science Tools Market, By Application, 2021-2029 (USD Million)

75 Malaysia Life Science Tools Market, By Technology, 2021-2029 (USD Million)

76 Malaysia Life Science Tools Market, By End-use, 2021-2029 (USD Million)

77 Malaysia Life Science Tools Market, By Application, 2021-2029 (USD Million)

78 Thailand Life Science Tools Market, By Technology, 2021-2029 (USD Million)

79 Thailand Life Science Tools Market, By End-use, 2021-2029 (USD Million)

80 Thailand Life Science Tools Market, By Application, 2021-2029 (USD Million)

81 Indonesia Life Science Tools Market, By Technology, 2021-2029 (USD Million)

82 Indonesia Life Science Tools Market, By End-use, 2021-2029 (USD Million)

83 Indonesia Life Science Tools Market, By Application, 2021-2029 (USD Million)

84 Vietnam Life Science Tools Market, By Technology, 2021-2029 (USD Million)

85 Vietnam Life Science Tools Market, By End-use, 2021-2029 (USD Million)

86 Vietnam Life Science Tools Market, By Application, 2021-2029 (USD Million)

87 Taiwan Life Science Tools Market, By Technology, 2021-2029 (USD Million)

88 Taiwan Life Science Tools Market, By End-use, 2021-2029 (USD Million)

89 Taiwan Life Science Tools Market, By Application, 2021-2029 (USD Million)

90 Rest of Asia Pacific Life Science Tools Market, By Technology, 2021-2029 (USD Million)

91 Rest of Asia Pacific Life Science Tools Market, By End-use, 2021-2029 (USD Million)

92 Rest of Asia Pacific Life Science Tools Market, By Application, 2021-2029 (USD Million)

93 Middle East and Africa Life Science Tools Market, By Technology, 2021-2029 (USD Million)

94 Middle East and Africa Life Science Tools Market, By End-use, 2021-2029 (USD Million)

95 Middle East and Africa Life Science Tools Market, By Application, 2021-2029 (USD Million)

96 Middle East and Africa Life Science Tools Market, By Country, 2021-2029 (USD Million)

97 Saudi Arabia Life Science Tools Market, By Technology, 2021-2029 (USD Million)

98 Saudi Arabia Life Science Tools Market, By End-use, 2021-2029 (USD Million)

99 Saudi Arabia Life Science Tools Market, By Application, 2021-2029 (USD Million)

100 UAE Life Science Tools Market, By Technology, 2021-2029 (USD Million)

101 UAE Life Science Tools Market, By End-use, 2021-2029 (USD Million)

102 UAE Life Science Tools Market, By Application, 2021-2029 (USD Million)

103 Israel Life Science Tools Market, By Technology, 2021-2029 (USD Million)

104 Israel Life Science Tools Market, By End-use, 2021-2029 (USD Million)

105 Israel Life Science Tools Market, By Application, 2021-2029 (USD Million)

106 South Africa Life Science Tools Market, By Technology, 2021-2029 (USD Million)

107 South Africa Life Science Tools Market, By End-use, 2021-2029 (USD Million)

108 South Africa Life Science Tools Market, By Application, 2021-2029 (USD Million)

109 Rest of Middle East and Africa Life Science Tools Market, By Technology, 2021-2029 (USD Million)

110 Rest of Middle East and Africa Life Science Tools Market, By End-use, 2021-2029 (USD Million)

111 Rest of Middle East and Africa Life Science Tools Market, By Application, 2021-2029 (USD Million)

112 Central and South America Life Science Tools Market, By Technology, 2021-2029 (USD Million)

113 Central and South America Life Science Tools Market, By End-use, 2021-2029 (USD Million)

114 Central and South America Life Science Tools Market, By Application, 2021-2029 (USD Million)

115 Central and South America Life Science Tools Market, By Country, 2021-2029 (USD Million)

116 Brazil Life Science Tools Market, By Technology, 2021-2029 (USD Million)

117 Brazil Life Science Tools Market, By End-use, 2021-2029 (USD Million)

118 Brazil Life Science Tools Market, By Application, 2021-2029 (USD Million)

119 Argentina Life Science Tools Market, By Technology, 2021-2029 (USD Million)

120 Argentina Life Science Tools Market, By End-use, 2021-2029 (USD Million)

121 Argentina Life Science Tools Market, By Application, 2021-2029 (USD Million)

122 Chile Life Science Tools Market, By Technology, 2021-2029 (USD Million)

123 Chile Life Science Tools Market, By End-use, 2021-2029 (USD Million)

124 Chile Life Science Tools Market, By Application, 2021-2029 (USD Million)

125 Rest of Central and South America Life Science Tools Market, By Technology, 2021-2029 (USD Million)

126 Rest of Central and South America Life Science Tools Market, By End-use, 2021-2029 (USD Million)

127 Rest of Central and South America Life Science Tools Market, By Application, 2021-2029 (USD Million)

128 Becton, Dickinson and Company: Products & Services Offering

129 Agilent Technologies Inc.: Products & Services Offering

130 Illumina Inc.: Products & Services Offering

131 Thermo Fisher Scientific Inc.: Products & Services Offering

132 F. Hoffmann-La Roche Ltd: Products & Services Offering

133 BIO-RAD LABORATORIES INC.: Products & Services Offering

134 Merck KGaA : Products & Services Offering

135 GE Healthcare: Products & Services Offering

136 Bruker Corporation, Inc: Products & Services Offering

137 Qiagen NV: Products & Services Offering

138 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Life Science Tools Market Overview

2 Global Life Science Tools Market Value From 2021-2029 (USD Mllion)

3 Global Life Science Tools Market Share, By Technology (2023)

4 Global Life Science Tools Market Share, By End-use (2023)

5 Global Life Science Tools Market Share, By Application (2023)

6 Global Life Science Tools Market, By Region (Asia Pacific Market)

7 Technological Trends In Global Life Science Tools Market

8 Four Quadrant Competitor Positioning Matrix

9 Impact Of Macro & Micro Indicators On The Market

10 Impact Of Key Drivers On The Global Life Science Tools Market

11 Impact Of Challenges On The Global Life Science Tools Market

12 Porter’s Five Forces Analysis

13 Global Life Science Tools Market: By Technology Scope Key Takeaways

14 Global Life Science Tools Market, By Technology Segment: Revenue Growth Analysis

15 PCR and qPCR Market, By Region, 2021-2029 (USD Mllion)

16 Sanger Sequencing Market, By Region, 2021-2029 (USD Mllion)

17 Separation Technologies Market, By Region, 2021-2029 (USD Mllion)

18 Flow Cytometry Market, By Region, 2021-2029 (USD Mllion)

19 Nucleic Acid Microarray Market, By Region, 2021-2029 (USD Mllion)

20 Mass Spectrometry Market, By Region, 2021-2029 (USD Mllion)

21 Other Technologies Market, By Region, 2021-2029 (USD Mllion)

22 Global Life Science Tools Market: By End-use Scope Key Takeaways

23 Global Life Science Tools Market, By End-use Segment: Revenue Growth Analysis

24 Government & Academic Market, By Region, 2021-2029 (USD Mllion)

25 Biopharmaceutical Company Market, By Region, 2021-2029 (USD Mllion)

26 Healthcare Market, By Region, 2021-2029 (USD Mllion)

27 Industrial Applications Market, By Region, 2021-2029 (USD Mllion)

28 Others Market, By Region, 2021-2029 (USD Mllion)

29 Global Life Science Tools Market: By Application Scope Key Takeaways

30 Global Life Science Tools Market, By Application Segment: Revenue Growth Analysis

31 Proteomics Technology Market, By Region, 2021-2029 (USD Mllion)

32 Genomic Technology Market, By Region, 2021-2029 (USD Mllion)

33 Cell Biology Technology Market, By Region, 2021-2029 (USD Mllion)

34 Other Applications Market, By Region, 2021-2029 (USD Mllion)

35 Regional Segment: Revenue Growth Analysis

36 Global Life Science Tools Market: Regional Analysis

37 North America Life Science Tools Market Overview

38 North America Life Science Tools Market, By Technology

39 North America Life Science Tools Market, By End-use

40 North America Life Science Tools Market, By Application

41 North America Life Science Tools Market, By Country

42 U.S. Life Science Tools Market, By Technology

43 U.S. Life Science Tools Market, By End-use

44 U.S. Life Science Tools Market, By Application

45 Canada Life Science Tools Market, By Technology

46 Canada Life Science Tools Market, By End-use

47 Canada Life Science Tools Market, By Application

48 Mexico Life Science Tools Market, By Technology

49 Mexico Life Science Tools Market, By End-use

50 Mexico Life Science Tools Market, By Application

51 Four Quadrant Positioning Matrix

52 Company Market Share Analysis

53 Becton, Dickinson and Company: Company Snapshot

54 Becton, Dickinson and Company: SWOT Analysis

55 Becton, Dickinson and Company: Geographic Presence

56 Agilent Technologies Inc.: Company Snapshot

57 Agilent Technologies Inc.: SWOT Analysis

58 Agilent Technologies Inc.: Geographic Presence

59 Illumina Inc.: Company Snapshot

60 Illumina Inc.: SWOT Analysis

61 Illumina Inc.: Geographic Presence

62 Thermo Fisher Scientific Inc.: Company Snapshot

63 Thermo Fisher Scientific Inc.: Swot Analysis

64 Thermo Fisher Scientific Inc.: Geographic Presence

65 F. Hoffmann-La Roche Ltd: Company Snapshot

66 F. Hoffmann-La Roche Ltd: SWOT Analysis

67 F. Hoffmann-La Roche Ltd: Geographic Presence

68 Bio-Rad Laboratories Inc.: Company Snapshot

69 Bio-Rad Laboratories Inc.: SWOT Analysis

70 Bio-Rad Laboratories Inc.: Geographic Presence

71 Merck KGaA : Company Snapshot

72 Merck KGaA : SWOT Analysis

73 Merck KGaA : Geographic Presence

74 GE Healthcare: Company Snapshot

75 GE Healthcare: SWOT Analysis

76 GE Healthcare: Geographic Presence

77 Bruker Corporation, Inc.: Company Snapshot

78 Bruker Corporation, Inc.: SWOT Analysis

79 Bruker Corporation, Inc.: Geographic Presence

80 Qiagen NV: Company Snapshot

81 Qiagen NV: SWOT Analysis

82 Qiagen NV: Geographic Presence

83 Other Companies: Company Snapshot

84 Other Companies: SWOT Analysis

85 Other Companies: Geographic Presence

The Global Life Science Tools Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Life Science Tools Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS