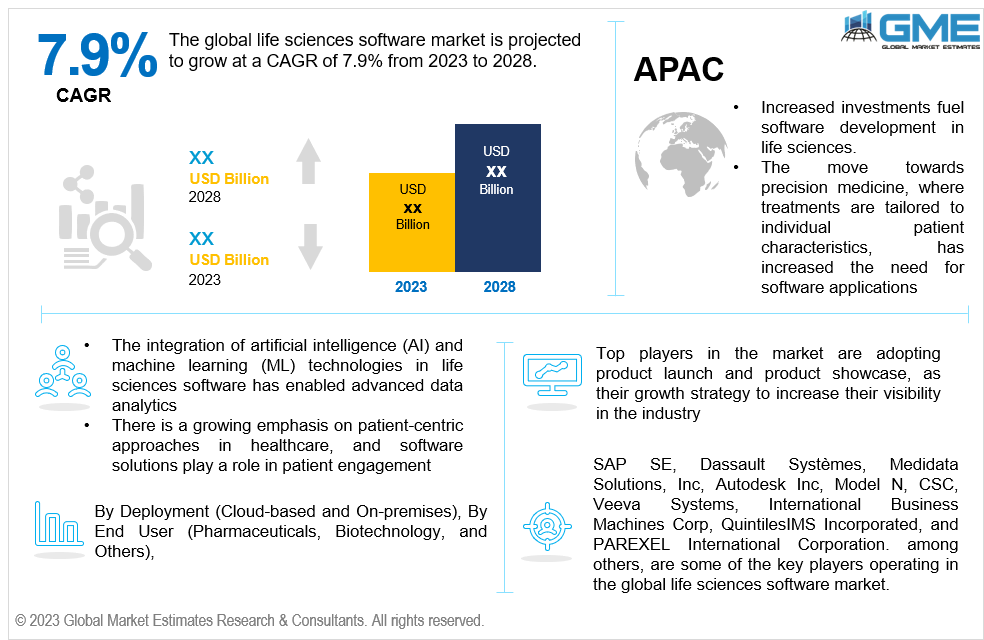

Global Life Sciences Software Market Size, Trends & Analysis - Forecasts to 2028 By Deployment (Cloud-based and On-premises), By End User (Pharmaceuticals, Biotechnology, and Others), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End user Analysis

The global life sciences software market is projected to grow at a CAGR of 7.9% from 2023 to 2028.

The life sciences generate large volumes of data, especially with the advent of genomics, proteomics, and other high-throughput technologies. Specialized software is essential for managing, analysing, and deriving insights from this massive data.

The incorporation of artificial intelligence (AI) and machine learning (ML) technologies in life science software enables advanced data analytics, predictive modelling, and pattern recognition, enhancing the efficiency of research and development processes. The growing emphasis on precision medicine, customizing medical treatment based on individual patient requirements, has increased the demand for software that can handle and interpret complex genomic and molecular data.

Furthermore, the global life sciences software market is experiencing growth through mergers and acquisitions, with companies acquiring specialized software providers to enhance their product portfolios and capabilities.

Growing investments in research and development (R&D) in the life sciences sector from private and public sources contribute to the demand for cutting-edge software tools to enhance research capabilities. For instance, in March 2020, the U.S. government has contributed over USD 20 billion to develop digital health technology as part of the Coronavirus Aid, Relief, and Economic Security (CARES) Act. Such significant financial additions to healthcare technology create new opportunities for health tech businesses and generate heightened interest from healthcare investors. Government support acts as a catalyst, attracting more investments into the life science software market, thereby accelerating progress and technological innovation within the healthcare sector.

The increasing incorporation of digital technologies in the healthcare sector is apparent through the uptake of electronic health records (EHRs), telemedicine, and remote monitoring devices. Electronic health records, for instance, improve care coordination and reduce errors. Telemedicine facilitates virtual medical care, reaching even remote and underserved areas. Additionally, remote monitoring devices, commonly utilized in post-acute care and home care settings, support early intervention and enhance overall outcomes.

The life science industry is heavily regulated, particularly when it comes to handling sensitive patient data and ensuring the safety and efficacy of medical treatments. Developing software that complies with these regulations, can be complex and time-consuming. Navigating this regulatory landscape can slow down the development and deployment of life science software.

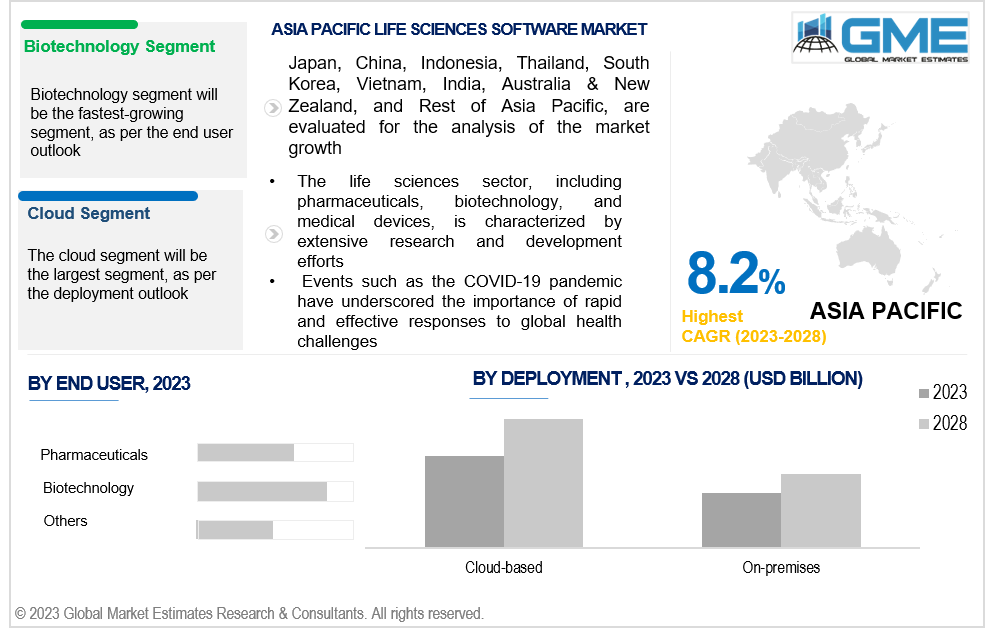

Cloud segment is expected to hold the largest share of the market. The increasing adoption of cloud-based software is attributed to the need for effective solutions in the life science industry, which enhances overall efficiency, productivity, and competitiveness. Cloud-based solutions eliminate the need for significant investment in hardware and infrastructure development. Instead, life science companies can opt for a subscription-based payment model, transforming capital expenses into operational expenses.

On-premises segment is expected to be the fastest-growing segment in the market from 2023-2028. The segment growth is attributed to the increasing awareness about data security. Healthcare companies handle sensitive data such as patient information and trade secrets, leading them to prefer storing it on their premises. This is why on-premise software is preferred in the pharmaceutical industry. With the software being locally stored, the companies focus on the setup and processes, ensuring a personalised and secure environment for managing critical information.

The biotechnology segment is anticipated to be the fastest-growing segment in the market from 2023-2028 is due to increased demand for advanced software tools in biotechnological applications, including genomics, drug discovery, and other areas of research and development within the biotechnology field. This trend is driven by technological advancements, rising investments in biotechnology research, and the increasing importance of software solutions in enhancing efficiency and innovation within biotech processes.

The pharmaceutical segment is expected to hold the largest share of the market. The segment growth is attributed to the rising need for pharmaceutical resource management, new drug discovery and development, and clinical trial designing and managing processes. For example, SAP's intelligent clinical supply management utilizes cloud software to support more clinical trials and more intricate trial designs.

North America is expected to be the largest region in the market over the forecast period. The primary reasons boosting the market growth in this region include increasing research and development and rising adoption of cloud-based solutions. Healthcare companies in this region are integrating software with their business operations. This includes examining clinical research data using the SAS database, which is particularly beneficial for early-stage drug development and revenue forecasting for health outcomes. For instance, Performix Inc., a supplier of manufacturing execution system (MES) software for the pharmaceutical and biotech industries, was acquired by Honeywell in September 2021. This acquisition focuses on creating an integrated software platform for the life sciences industry, aiming for faster compliance, improved reliability, and enhanced production throughput while maintaining high-quality standards.

Asia Pacific is predicted to witness rapid growth during the forecast period, attributed to the increasing investments in healthcare infrastructure and technology. The growing focus on improving healthcare services and outcomes drives the adoption of advanced software solutions in the life sciences sector. From 2008 to 2021, Asia Pacific region witnessed notable greenfield investments in specific sectors. The pharmaceutical sector emerged as the most attractive, drawing a substantial investment of USD 36 billion. Following closely, the medical devices sector secured USD 20 billion in greenfield investment. Additionally, the biotechnology sector received USD 17 billion, while the healthcare sector garnered USD 10.8 billion in greenfield investments during this period. These figures underscore the region's appeal for investors and highlight the substantial capital infusion into pharmaceuticals, medical devices, biotechnology, and healthcare industries.

SAP SE, Dassault Systèmes, Medidata Solutions, Inc, Autodesk Inc, Model N, CSC, Veeva Systems, International Business Machines Corp, QuintilesIMS Incorporated, and PAREXEL International Corporation., among others, are some of the key players operating in the global life sciences software market.

Please note: This is not an exhaustive list of companies profiled in the report.

In March 2022, Databricks introduced the Databricks Lakehouse for Healthcare and Life Sciences, providing a unified platform for data management, analytics, and advanced AI applications such as disease prediction, medical image classification, and biomarker discovery

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

4 GLOBAL LIFE SCIENCES SOFTWARE MARKET, BY END USER

4.2 Life Sciences Software Market: End User Scope Key Takeaways

4.3 Revenue Growth Analysis, 2022 & 2028

4.4.1 Pharmaceuticals Market Estimates and Forecast, 2020-2028 (USD Million)

4.5.1 Biotechnology Market Estimates and Forecast, 2020-2028 (USD Million)

4.6.1 Others Market Estimates and Forecast, 2020-2028 (USD Million)

5 GLOBAL LIFE SCIENCES SOFTWARE MARKET, BY DEPLOYMENT

5.2 Life Sciences Software Market: Deployment Scope Key Takeaways

5.3 Revenue Growth Analysis, 2022 & 2028

5.4.1 Cloud-based Market Estimates and Forecast, 2020-2028 (USD Million)

5.5.1 On-premises Market Estimates and Forecast, 2020-2028 (USD Million)

6 GLOBAL LIFE SCIENCES SOFTWARE MARKET, BY REGION

6.2 North America Life Sciences Software Market Estimates and Forecast, 2020-2028 (USD Million)

6.2.3.1 U.S. Life Sciences Software Market Estimates and Forecast, 2020-2028 (USD Million)

6.2.3.2 Canada Life Sciences Software Market Estimates and Forecast, 2020-2028 (USD Million)

6.2.3.3 Mexico Life Sciences Software Market Estimates and Forecast, 2020-2028 (USD Million)

6.3 Europe Life Sciences Software Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.1 Germany Life Sciences Software Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.2 U.K. Life Sciences Software Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.3 France Life Sciences Software Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.4 Italy Life Sciences Software Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.5 Spain Life Sciences Software Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.6 Netherlands Life Sciences Software Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.7 Rest of Europe Life Sciences Software Market Estimates and Forecast, 2020-2028 (USD Million)

6.4 Asia Pacific Life Sciences Software Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.1 China Life Sciences Software Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.2 Japan Life Sciences Software Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.3 India Life Sciences Software Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.4 South Korea Life Sciences Software Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.5 Singapore Life Sciences Software Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.6 Malaysia Life Sciences Software Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.7 Thailand Life Sciences Software Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.8 Indonesia Life Sciences Software Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.9 Vietnam Life Sciences Software Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.10 Taiwan Life Sciences Software Market Estimates and Forecast, 2020-2028 (USD Million)

6.5.3.1 Saudi Arabia Life Sciences Software Market Estimates and Forecast, 2020-2028 (USD Million)

6.5.3.2 U.A.E. Life Sciences Software Market Estimates and Forecast, 2020-2028 (USD Million)

6.5.3.3 Israel Life Sciences Software Market Estimates and Forecast, 2020-2028 (USD Million)

6.5.3.4 South Africa Life Sciences Software Market Estimates and Forecast, 2020-2028 (USD Million)

6.6.3.1 Brazil Life Sciences Software Market Estimates and Forecast, 2020-2028 (USD Million)

6.6.3.2 Argentina Life Sciences Software Market Estimates and Forecast, 2020-2028 (USD Million)

6.6.3.3 Chile Life Sciences Software Market Estimates and Forecast, 2020-2028 (USD Million)

7.1 Company Market Share Analysis

7.2 Four Quadrant Positioning Matrix

7.4.1.1 Business Description & Financial Analysis

7.4.1.3 Products & Services Offered

7.4.1.4 Strategic Alliances between Business Partners

7.4.2.1 Business Description & Financial Analysis

7.4.2.3 Products & Services Offered

7.4.2.4 Strategic Alliances between Business Partners

7.4.3.1 Business Description & Financial Analysis

7.4.3.3 Products & Services Offered

7.4.3.4 Strategic Alliances between Business Partners

7.4.4.1 Business Description & Financial Analysis

7.4.4.3 Products & Services Offered

7.4.4.4 Strategic Alliances between Business Partners

7.4.5.1 Business Description & Financial Analysis

7.4.5.3 Products & Services Offered

7.4.5.4 Strategic Alliances between Business Partners

7.4.6.1 Business Description & Financial Analysis

7.4.6.3 Products & Services Offered

7.4.6.4 Strategic Alliances between Business Partners

7.4.7.1 Business Description & Financial Analysis

7.4.7.3 Products & Services Offered

7.4.7.4 Strategic Alliances between Business Partners

7.4.8 International Business Machines Corp

7.4.8.1 Business Description & Financial Analysis

7.4.8.3 Products & Services Offered

7.4.8.4 Strategic Alliances between Business Partners

7.4.9 QuintilesIMS Incorporated

7.4.9.1 Business Description & Financial Analysis

7.4.9.3 Products & Services Offered

7.4.9.4 Strategic Alliances between Business Partners

7.4.10 PAREXEL International Corporation

7.4.10.1 Business Description & Financial Analysis

7.4.10.3 Products & Services Offered

7.4.10.4 Strategic Alliances between Business Partners

7.4.11.1 Business Description & Financial Analysis

7.4.11.3 Products & Services Offered

7.4.11.4 Strategic Alliances between Business Partners

8.1.2 Market Scope & Segmentation

8.2.1.2 GMEs Internal Data Repository

8.2.1.3 Secondary Resources & Third Party Perspectives

8.2.1.4 Company Information Sources

8.2.2.1 Various Types of Respondents for Primary Interviews

8.2.2.2 Number of Interviews Conducted throughout the Research Process

8.2.2.4 Discussion Guide for Primary Participants

8.2.3.1 Expert Panels Across 30+ Industry

8.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

8.3.1.1 Macro-Economic Indicators Considered

8.3.1.2 Micro-Economic Indicators Considered

8.3.2.1 Company Share Analysis Approach

8.3.2.2 Estimation of Potential Product Sales

8.4.2 Time Series, Cross Sectional & Panel Data Analysis

8.5.1 Inhouse AI Based Real Time Analytics Tool

8.5.2 Output From Desk & Primary Research

8.6 Research Assumptions & Limitations

LIST OF TABLES

1 Global Life Sciences Software Market, By End User, 2020-2028 (USD Mllion)

2 Pharmaceuticals Market, By Region, 2020-2028 (USD Mllion)

3 Biotechnology Market, By Region, 2020-2028 (USD Mllion)

4 Others Market, By Region, 2020-2028 (USD Mllion)

5 Global Life Sciences Software Market, By Deployment, 2020-2028 (USD Mllion)

6 Cloud-based Market, By Region, 2020-2028 (USD Mllion)

7 On-premises Market, By Region, 2020-2028 (USD Mllion)

8 Regional Analysis, 2020-2028 (USD Mllion)

9 North America Life Sciences Software Market, By End User, 2020-2028 (USD Mllion)

10 North America Life Sciences Software Market, By Deployment, 2020-2028 (USD Mllion)

11 U.S. Life Sciences Software Market, By End User, 2020-2028 (USD Mllion)

12 U.S. Life Sciences Software Market, By Deployment, 2020-2028 (USD Mllion)

13 Canada Life Sciences Software Market, By End User, 2020-2028 (USD Mllion)

14 Canada Life Sciences Software Market, By Deployment, 2020-2028 (USD Mllion)

15 Mexico Life Sciences Software Market, By End User, 2020-2028 (USD Mllion)

16 Mexico Life Sciences Software Market, By Deployment, 2020-2028 (USD Mllion)

17 Europe Life Sciences Software Market, By End User, 2020-2028 (USD Mllion)

18 Europe Life Sciences Software Market, By Deployment, 2020-2028 (USD Mllion)

19 Germany Life Sciences Software Market, By End User, 2020-2028 (USD Mllion)

20 Germany Life Sciences Software Market, By Deployment, 2020-2028 (USD Mllion)

21 U.K. Life Sciences Software Market, By End User, 2020-2028 (USD Mllion)

22 U.K. Life Sciences Software Market, By Deployment, 2020-2028 (USD Mllion)

23 France Life Sciences Software Market, By End User, 2020-2028 (USD Mllion)

24 France Life Sciences Software Market, By Deployment, 2020-2028 (USD Mllion)

25 Italy Life Sciences Software Market, By End User, 2020-2028 (USD Mllion)

26 Italy Life Sciences Software Market, By Deployment, 2020-2028 (USD Mllion)

27 Spain Life Sciences Software Market, By End User, 2020-2028 (USD Mllion)

28 Spain Life Sciences Software Market, By Deployment, 2020-2028 (USD Mllion)

29 Netherlands Life Sciences Software Market, By End User, 2020-2028 (USD Mllion)

30 Netherlands Life Sciences Software Market, By Deployment, 2020-2028 (USD Mllion)

31 Rest Of Europe Life Sciences Software Market, By End User, 2020-2028 (USD Mllion)

32 Rest Of Europe Life Sciences Software Market, By Deployment, 2020-2028 (USD Mllion)

33 Asia Pacific Life Sciences Software Market, By End User, 2020-2028 (USD Mllion)

34 Asia Pacific Life Sciences Software Market, By Deployment, 2020-2028 (USD Mllion)

35 China Life Sciences Software Market, By End User, 2020-2028 (USD Mllion)

36 China Life Sciences Software Market, By Deployment, 2020-2028 (USD Mllion)

37 Japan Life Sciences Software Market, By End User, 2020-2028 (USD Mllion)

38 Japan Life Sciences Software Market, By Deployment, 2020-2028 (USD Mllion)

39 India Life Sciences Software Market, By End User, 2020-2028 (USD Mllion)

40 India Life Sciences Software Market, By Deployment, 2020-2028 (USD Mllion)

41 South Korea Life Sciences Software Market, By End User, 2020-2028 (USD Mllion)

42 South Korea Life Sciences Software Market, By Deployment, 2020-2028 (USD Mllion)

43 Singapore Life Sciences Software Market, By End User, 2020-2028 (USD Mllion)

44 Singapore Life Sciences Software Market, By Deployment, 2020-2028 (USD Mllion)

45 Thailand Life Sciences Software Market, By End User, 2020-2028 (USD Mllion)

46 Thailand Life Sciences Software Market, By Deployment, 2020-2028 (USD Mllion)

47 Malaysia Life Sciences Software Market, By End User, 2020-2028 (USD Mllion)

48 Malaysia Life Sciences Software Market, By Deployment, 2020-2028 (USD Mllion)

49 Indonesia Life Sciences Software Market, By End User, 2020-2028 (USD Mllion)

50 Indonesia Life Sciences Software Market, By Deployment, 2020-2028 (USD Mllion)

51 Vietnam Life Sciences Software Market, By End User, 2020-2028 (USD Mllion)

52 Vietnam Life Sciences Software Market, By Deployment, 2020-2028 (USD Mllion)

53 Taiwan Life Sciences Software Market, By End User, 2020-2028 (USD Mllion)

54 Taiwan Life Sciences Software Market, By Deployment, 2020-2028 (USD Mllion)

55 Rest of APAC Life Sciences Software Market, By End User, 2020-2028 (USD Mllion)

56 Rest of APAC Life Sciences Software Market, By Deployment, 2020-2028 (USD Mllion)

57 Middle East and Africa Life Sciences Software Market, By End User, 2020-2028 (USD Mllion)

58 Middle East and Africa Life Sciences Software Market, By Deployment, 2020-2028 (USD Mllion)

59 Saudi Arabia Life Sciences Software Market, By End User, 2020-2028 (USD Mllion)

60 Saudi Arabia Life Sciences Software Market, By Deployment, 2020-2028 (USD Mllion)

61 UAE Life Sciences Software Market, By End User, 2020-2028 (USD Mllion)

62 UAE Life Sciences Software Market, By Deployment, 2020-2028 (USD Mllion)

63 Israel Life Sciences Software Market, By End User, 2020-2028 (USD Mllion)

64 Israel Life Sciences Software Market, By Deployment, 2020-2028 (USD Mllion)

65 South Africa Life Sciences Software Market, By End User, 2020-2028 (USD Mllion

66 South Africa Life Sciences Software Market, By Deployment, 2020-2028 (USD Mllion)

67 Rest Of Middle East and Africa Life Sciences Software Market, By End User, 2020-2028 (USD Mllion)

68 Rest Of Middle East and Africa Life Sciences Software Market, By Deployment, 2020-2028 (USD Mllion)

69 Central and South America Life Sciences Software Market, By End User, 2020-2028 (USD Mllion)

70 Central and South America Life Sciences Software Market, By Deployment, 2020-2028 (USD Mllion)

71 Brazil Life Sciences Software Market, By End User, 2020-2028 (USD Mllion)

72 Brazil Life Sciences Software Market, By Deployment, 2020-2028 (USD Mllion)

73 Chile Life Sciences Software Market, By End User, 2020-2028 (USD Mllion)

74 Chile Life Sciences Software Market, By Deployment, 2020-2028 (USD Mllion)

75 Argentina Life Sciences Software Market, By End User, 2020-2028 (USD Mllion)

76 Argentina Life Sciences Software Market, By Deployment, 2020-2028 (USD Mllion)

77 Rest Of Central and South America Life Sciences Software Market, By End User, 2020-2028 (USD Mllion)

78 Rest Of Central and South America Life Sciences Software Market, By Deployment, 2020-2028 (USD Mllion)

79 SAP SE: Products & Services Offering

80 Dassault Systèmes: Products & Services Offering

81 Medidata Solutions, Inc: Products & Services Offering

82 Autodesk Inc: Products & Services Offering

83 Model N: Products & Services Offering

84 CSC: Products & Services Offering

85 Veeva Systems : Products & Services Offering

86 International Business Machines Corp: Products & Services Offering

87 QuintilesIMS Incorporated, Inc: Products & Services Offering

88 PAREXEL International Corporation: Products & Services Offering

89 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Life Sciences Software Market Overview

2 Global Life Sciences Software Market Value From 2020-2028 (USD Mllion)

3 Global Life Sciences Software Market Share, By End User (2022)

4 Global Life Sciences Software Market Share, By Deployment (2022)

5 Global Life Sciences Software Market, By Region (Asia Pacific Market)

6 Technological Trends In Global Life Sciences Software Market

7 Four Quadrant Competitor Positioning Matrix

8 Impact Of Macro & Micro Indicators On The Market

9 Impact Of Key Drivers On The Global Life Sciences Software Market

10 Impact Of Challenges On The Global Life Sciences Software Market

11 Porter’s Five Forces Analysis

12 Global Life Sciences Software Market: By End User Scope Key Takeaways

13 Global Life Sciences Software Market, By End User Segment: Revenue Growth Analysis

14 Pharmaceuticals Market, By Region, 2020-2028 (USD Mllion)

15 Biotechnology Market, By Region, 2020-2028 (USD Mllion)

16 Others Market, By Region, 2020-2028 (USD Mllion)

17 Global Life Sciences Software Market: By Deployment Scope Key Takeaways

18 Global Life Sciences Software Market, By Deployment Segment: Revenue Growth Analysis

19 Cloud-based Market, By Region, 2020-2028 (USD Mllion)

20 On-premises Market, By Region, 2020-2028 (USD Mllion)

21 Regional Segment: Revenue Growth Analysis

22 Global Life Sciences Software Market: Regional Analysis

23 North America Life Sciences Software Market Overview

24 North America Life Sciences Software Market, By End User

25 North America Life Sciences Software Market, By Deployment

26 North America Life Sciences Software Market, By Country

27 U.S. Life Sciences Software Market, By End User

28 U.S. Life Sciences Software Market, By Deployment

29 Canada Life Sciences Software Market, By End User

30 Canada Life Sciences Software Market, By Deployment

31 Mexico Life Sciences Software Market, By End User

32 Mexico Life Sciences Software Market, By Deployment

33 Four Quadrant Positioning Matrix

34 Company Market Share Analysis

35 SAP SE: Company Snapshot

36 SAP SE: SWOT Analysis

37 SAP SE: Geographic Presence

38 Dassault Systèmes: Company Snapshot

39 Dassault Systèmes: SWOT Analysis

40 Dassault Systèmes: Geographic Presence

41 Medidata Solutions, Inc: Company Snapshot

42 Medidata Solutions, Inc: SWOT Analysis

43 Medidata Solutions, Inc: Geographic Presence

44 Autodesk Inc: Company Snapshot

45 Autodesk Inc: Swot Analysis

46 Autodesk Inc: Geographic Presence

47 Model N: Company Snapshot

48 Model N: SWOT Analysis

49 Model N: Geographic Presence

50 CSC: Company Snapshot

51 CSC: SWOT Analysis

52 CSC: Geographic Presence

53 Veeva Systems : Company Snapshot

54 Veeva Systems : SWOT Analysis

55 Veeva Systems : Geographic Presence

56 International Business Machines Corp: Company Snapshot

57 International Business Machines Corp: SWOT Analysis

58 International Business Machines Corp: Geographic Presence

59 QuintilesIMS Incorporated, Inc.: Company Snapshot

60 QuintilesIMS Incorporated, Inc.: SWOT Analysis

61 QuintilesIMS Incorporated, Inc.: Geographic Presence

62 PAREXEL International Corporation: Company Snapshot

63 PAREXEL International Corporation: SWOT Analysis

64 PAREXEL International Corporation: Geographic Presence

65 Other Companies: Company Snapshot

66 Other Companies: SWOT Analysis

67 Other Companies: Geographic Presence

The Global Life Sciences Software Market has been studied from the year 2019 till 2028. However, the CAGR provided in the report is from the year 2023 to 2028. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Life Sciences Software Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS