Global Limestone Market Size, Trends & Analysis - Forecasts to 2027 By End Use (Building & Construction, Iron & Steel, Agriculture, Chemical), By Region (North America, Asia Pacific, Central, and South America, Europe, and the Middle East and Africa), Competitive Landscape Company Market Share Analysis, and Competitor Analysis

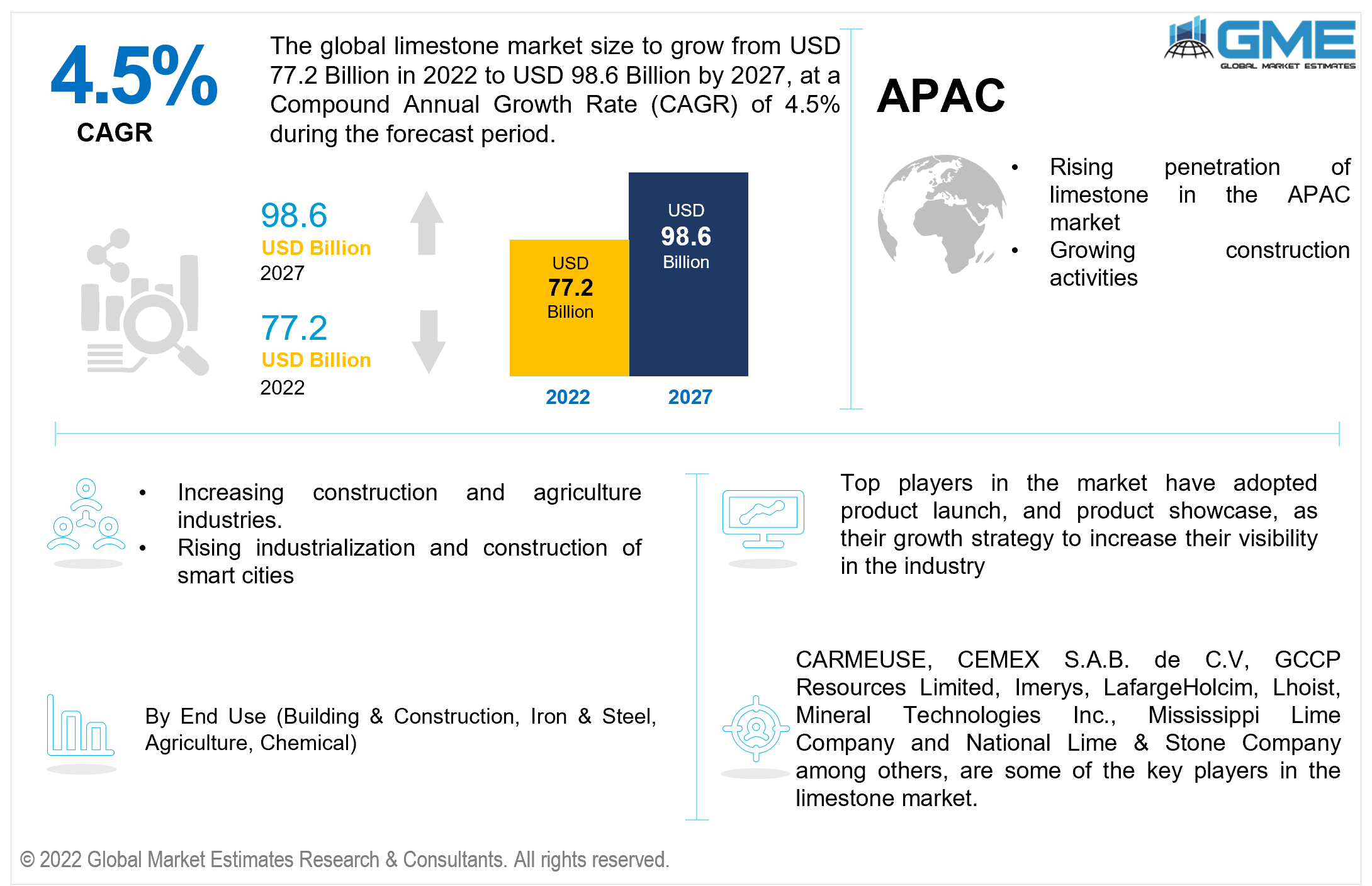

The Global Limestone Market is projected to grow from USD 77.2 Billion in 2022 to USD 98.6 Billion in 2027 at a CAGR value of 4.5% from 2022 to 2027.

The growing investment by governmental organizations in infrastructure redevelopment for retrofitting older areas, an increasing amount of construction activity in developing regions, growing usage of limestone in fossil-fuel power plants, increasing chemical stability in soil, drinking water filtration, and growing demand from fertilizer, paints, and varnish manufacturing industries are propelling the market growth.

Chalk, coquina, travertine, tufa, and fossiliferous, lithographic, and oolitic limestone are some of the most prevalent forms of limestone, which range in texture from very fine to coarse. Masonry stone, mortar, lime, and construction components may all be produced using limestone. It is also used in the manufacturing of steel and iron, water and wastewater treatment, building, agriculture, paper and pulp, and the chemical sector, among other things, due to its superior particle size and controlled and simple applications.

One of the primary aspects driving the market's favorable outlook is significant growth in the construction and agriculture industries around the world. In addition to serving as a raw material for the production of concrete and lime, limestone is frequently used in building structures and roads. Furthermore, limestone is used as an agricultural supplement to help improve soil quality by providing calcium for plant and soil nourishment. The usage of limestone for removing contaminants, purifying freshwater, and for removing acidic gases from flue gases is growing, which is propelling the market growth. In the paper and pulp business, limestone is also frequently utilized as a filter additive, coating dye, whitening agent, and surface finish additive.

Other factors including the execution of infrastructure development projects and the construction of smart cities, as well as rising industrialization, are expected to further propel the market.

The COVID-19 pandemic, had a detrimental influence on the market as it caused a worldwide lockdown, interrupting the manufacturing and production activity and supply networks. The construction and steel manufacturing activities also witnessed a halt due to covid 19 outbreak. Therefore, the demand for limestone declined during the period of Covid 19. With many countries easing up restrictions, employees are returning to work, and delayed projects are being completed in order to meet new deadlines. Growing investment in the healthcare infrastructure sector is also expected to further increase demand for construction materials in the post-pandemic period.

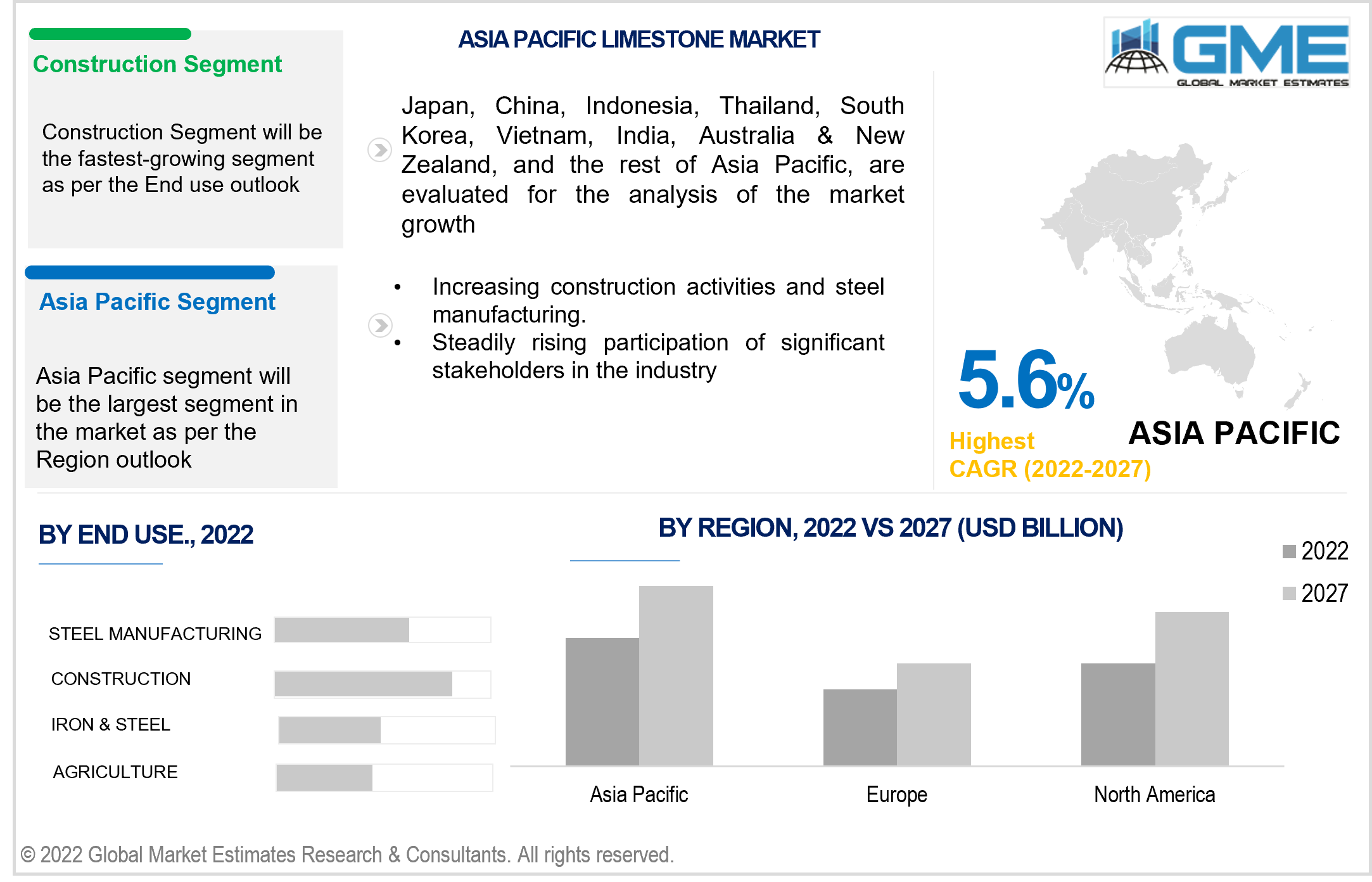

The construction segment is expected to be the fastest-growing segment in the market from 2022 to 2027. The segment is growing as a result of increased infrastructure construction around the world. The chemical compound is widely utilized as a construction material because it lends both beauty and solidity to a project's architecture, making it a favorite among architects and builders for many years. It's utilized in concrete, cement, road base, and train ballast, among other things. The material is available in a variety of finishes for use in the construction industry, including brown, red, pink, cream, gold, and black; however, pure limestone is practically white in color.

The Asia Pacific region will have a dominant share in the limestone market from 2022 to 2027. Rising constriction activities in South Korea, Japan, China, and India have led to the rapid growth of the APAC region. Significant economic development in the region is expected to aid in the growth of palp and paper, electrical and electronic, building and construction, and automotive industries. Due to its status as the world's largest steel manufacturer and the expansion of the construction sector in the region's rising nations, the region dominates the market.

China boasts the world's largest economy and one of the world's major manufacturing and industrial industries. Because of its abundant raw materials and large chemical industry, China dominates the limestone market in terms of consumption and production.

Globally, and in China as well, the iron and steel sector consumes the most limestone. Additionally, the need for iron and steel manufacturing in the nation is growing, which has spurred the recent rise of the limestone market.

CARMEUSE, CEMEX S.A.B. de C.V, GCCP Resources Limited, Imerys, LafargeHolcim, Lhoist, Mineral Technologies Inc., Mississippi Lime Company and National Lime & Stone Company among others, are some of the key players in the limestone market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Research Methodology

1.1 Research Assumptions

1.2 Research Methodology

1.2.1 Estimates and Forecast Timeline

1.3 Information Procurement

1.3.1 Purchased Database

1.3.2 GME’s Internal Database

1.3.3 Primary Research

1.3.4 Secondary Sources & Third-Party Perspectives

1.3.4.1 Company Information Sources: Annual Reports, Investor Presentation, Press Release, SEC Filling, Company Blogs & Website

1.3.4.2 Secondary Data Sources

1.4 Information or Data Analysis

1.4.1 Data Analysis Models

1.5 Market Formulation & Data Visualization

1.6 Data Validation & Publishing

1.7 Market Model

1.7.1 Model Details

1.7.1.1 Top-Down Approach

1.7.1.2 Bottom-Up Approach

1.8 Market Segmentation & Scope

1.9 Market Definition

Chapter 2 Executive Summary

2.1. Global Market Outlook

2.2 End Use Outlook

2.3 Regional Outlook

Chapter 3 Global Limestone Market Trend Analysis

3.1. Market Introduction

3.2 Penetration & Growth Prospect Mapping

3.3 Impact of COVID-19 on the Limestone Market

3.4 Metric Data on Cash Transactions

3.5 Market Driver Analysis

3.5.1 Market Driver Analysis

3.5.2 Market Restraint Analysis

3.5.3 Industry Challenges

3.5.4 Industry Opportunities

3.6 Porter’s Five Analysis

3.6.1 Supplier Power

3.6.2 Buyer Power

3.6.3 Substitution Threat

3.6.4 Threat from New Entrant

3.7 Market Entry Strategies

Chapter 4 Limestone Market: End Use Trend Analysis

4.1 End Use: Historic Data vs. Forecast Data Analysis, 2021 vs. 2027

4.2 Building & Construction

4.2.1 Market Estimates & Forecast Analysis of Building & Construction Segment, By Region, 2019-2027 (USD Billion)

4.3 Iron & Steel

4.3.1 Market Estimates & Forecast Analysis of Iron & Steel Segment, By Region, 2019-2027 (USD Billion)

4.4 Agriculture

4.4.1 Market Estimates & Forecast Analysis of Agriculture Segment, By Region, 2019-2027 (USD Billion)

4.5 Chemical

4.5.1 Market Estimates & Forecast Analysis of Chemical Segment, By Region, 2019-2027 (USD Billion)

Chapter 5 Limestone Market, By Region

5.1 Regional Outlook

5.2 North America

5.2.1 Market Estimates & Forecast Analysis, By Country 2019-2025 (USD Billion)

5.2.2 Market Estimates & Forecast Analysis, By End Use, 2019-2025 (USD Billion)

5.2.3 U.S.

5.2.3.1 Market Estimates & Forecast Analysis, By End Use, 2019-2025 (USD Billion)

5.2.4 Canada

5.2.4.1 Market Estimates & Forecast Analysis, By End Use, 2019-2025 (USD Billion)

5.2.5 Mexico

5.2.5.1 Market Estimates & Forecast Analysis, By End Use, 2019-2027 (USD Billion)

5.3 Europe

5.3.1 Market Estimates & Forecast Analysis, By Country 2019-2027 (USD Billion)

5.3.2 Market Estimates & Forecast Analysis, By End Use, 2019-2027 (USD Billion)

5.3.3 Germany

5.3.3.1 Market Estimates & Forecast Analysis, By End Use, 2019-2027 (USD Billion)

5.3.4 UK

5.3.4.1 Market Estimates & Forecast Analysis, By End Use, 2019-2027 (USD Billion)

5.3.5 France

5.3.5.1 Market Estimates & Forecast Analysis, By End Use, 2019-2027 (USD Billion)

5.3.6 Netherlands

5.3.6.1 Market Estimates & Forecast Analysis, By End Use, 2019-2027 (USD Billion)

5.3.7 Italy

5.3.7.1 Market Estimates & Forecast Analysis, By End Use, 2019-2027 (USD Billion)

5.3.8 Spain

5.3.8.1 Market Estimates & Forecast Analysis, By End Use, 2019-2027 (USD Billion)

5.3.9 Rest of Europe

5.3.9.1 Market Estimates & Forecast Analysis, By End Use, 2019-2027 (USD Billion)

5.4 Asia Pacific

5.4.1 Market Estimates & Forecast Analysis, By Country 2019-2027 (USD Billion)

5.4.2 Market Estimates & Forecast Analysis, By End Use, 2019-2027 (USD Billion)

5.4.3 China

5.4.3.1 Market Estimates & Forecast Analysis, By End Use, 2019-2027 (USD Billion)

5.4.4 India

5.4.4.1 Market Estimates & Forecast Analysis, By End Use, 2019-2027 (USD Billion)

5.4.5 Japan

5.4.5.1 Market Estimates & Forecast Analysis, By End Use, 2019-2027 (USD Billion)

5.4.6 Thailand

5.4.6.1 Market Estimates & Forecast Analysis, By End Use, 2019-2027 (USD Billion)

5.4.7 South Korea

5.4.7.1 Market Estimates & Forecast Analysis, By End Use, 2019-2027 (USD Billion)

5.4.8 Malaysia

5.4.8.1 Market Estimates & Forecast Analysis, By End Use, 2019-2027 (USD Billion)

5.4.9 Indonesia

5.4.9.1 Market Estimates & Forecast Analysis, By End Use, 2019-2027 (USD Billion)

5.4.10 Singapore

5.4.10.1 Market Estimates & Forecast Analysis, By End Use, 2019-2027 (USD Billion)

5.4.11 Vietnam

5.4.11.1 Market Estimates & Forecast Analysis, By End Use, 2019-2027 (USD Billion)

5.4.12 Rest of Asia Pacific

7.3.12.1 Market Estimates & Forecast Analysis, By End Use, 2019-2027 (USD Billion)

5.5 Central & South America

5.5.1 Market Estimates & Forecast Analysis, By Country 2019-2027 (USD Billion)

5.5.2 Market Estimates & Forecast Analysis, By End Use, 2019-2027 (USD Billion)

5.5.3 Brazil

5.5.3.1 Market Estimates & Forecast Analysis, By End Use, 2019-2027 (USD Billion)

5.5.4 Argentina

5.5.4.1 Market Estimates & Forecast Analysis, By End Use, 2019-2027 (USD Billion)

5.5.5 Chile

5.5.5.1 Market Estimates & Forecast Analysis, By End Use, 2019-2027 (USD Billion)

5.5.6 Rest of Central & South America

5.5.6.1 Market Estimates & Forecast Analysis, By End Use, 2019-2027 (USD Billion)

5.6 Middle East & Africa

5.6.1 Market Estimates & Forecast Analysis, By Country 2019-2027 (USD Billion)

5.6.2 Market Estimates & Forecast Analysis, By End Use, 2019-2027 (USD Billion)

5.6.3 Saudi Arabia

5.6.3.1 Market Estimates & Forecast Analysis, By End Use, 2019-2027 (USD Billion)

5.6.4 United Arab Emirates

5.6.4.1 Market Estimates & Forecast Analysis, By End Use, 2019-2027 (USD Billion)

5.6.5 South Africa

5.6.5.1 Market Estimates & Forecast Analysis, By End Use, 2019-2027 (USD Billion)

5.6.6 Israel

5.6.6.1 Market Estimates & Forecast Analysis, By End Use, 2019-2027 (USD Billion)

5.6.7 Rest of Middle East & Africa

5.6.7.1 Market Estimates & Forecast Analysis, By End Use, 2019-2027 (USD Billion)

Chapter 8 Competitive Analysis

8.1 Key Global Players, Recent Developments & their Impact on the Industry

8.2 Four Quadrant Competitor Positioning Matrix

8.2.1 Key Innovators

8.2.2 Market Leaders

8.2.3 Emerging Players

8.2.4 Market Challengers

8.3 Vendor Landscape Analysis

8.4 End-User Landscape Analysis

8.5 Company Market Share Analysis, 2021

Chapter 9 Company Profile Analysis

9.1 CARMEUSE

9.1.1 Company Overview

9.1.2 Financial Analysis

9.1.3 Strategic Initiatives

9.1.4 Product Benchmarking

9.2 CEMEX S.A.B. de C.V

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Strategic Initiatives

9.2.4 Product Benchmarking

9.3 GCCP Resources Limited

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Strategic Initiatives

9.3.4 Product Benchmarking

9.4 Imerys

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Strategic Initiatives

9.4.4 Product Benchmarking

9.5 LafargeHolcim

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Strategic Initiatives

9.5.4 Product Benchmarking

9.6 Lhoist

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Strategic Initiatives

9.6.4 Product Benchmarking

9.7 Mineral Technologies Inc.

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Strategic Initiatives

9.7.4 Product Benchmarking

9.8 Mississippi Lime Company

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Strategic Initiatives

9.8.4 Product Benchmarking

9.9 National Lime & Stone Company

9.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Strategic Initiatives

9.9.4 Product Benchmarking

9.10 Other Companies

9.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Strategic Initiatives

9.10.4 Product Benchmarking

List of Tables

1 Technological Advancements In Limestone Market

2 Global Limestone Market: Key Market Drivers

3 Global Limestone Market: Key Market Challenges

4 Global Limestone Market: Key Market Opportunities

5 Global Limestone Market: Key Market Restraints

6 Global Limestone Market Estimates & Forecast Analysis, 2019-2027 (USD Billion)

7 Global Limestone Market, By End Use, 2019-2027 (USD Billion)

8 Building & Construction: Global Limestone Market, By Region, 2019-2027 (USD Billion)

9 Iron & Steel: Global Limestone Market, By Region, 2019-2027 (USD Billion)

10 Agriculture: Global Limestone Market, By Region, 2019-2027 (USD Billion)

11 Chemical: Global Limestone Market, By Region, 2019-2027 (USD Billion)

12 Regional Analysis: Global Limestone Market, By Region, 2019-2027 (USD Billion)

13 North America: Limestone Market, By End Use, 2019-2027 (USD Billion)

14 North America: Limestone Market, By Country, 2019-2027 (USD Billion)

15 U.S: Limestone Market, By End Use, 2019-2027 (USD Billion)

16 Canada: Limestone Market, By End Use, 2019-2027 (USD Billion)

17 Mexico: Limestone Market, By End Use, 2019-2027 (USD Billion)

18 Europe: Limestone Market, By End Use, 2019-2027 (USD Billion)

19 Europe: Limestone Market, By Country, 2019-2027 (USD Billion)

20 Germany: Limestone Market, By End Use, 2019-2027 (USD Billion)

21 UK: Limestone Market, By End Use, 2019-2027 (USD Billion)

22 France: Limestone Market, By End Use, 2019-2027 (USD Billion)

23 Italy: Limestone Market, By End Use, 2019-2027 (USD Billion)

24 Spain: Limestone Market, By End Use, 2019-2027 (USD Billion)

25 Netherlands: Limestone Market, By End Use, 2019-2027 (USD Billion)

26 Rest Of Europe: Limestone Market, By End Use, 2019-2027 (USD Billion)

27 Asia Pacific: Limestone Market, By End Use, 2019-2027 (USD Billion)

28 Asia Pacific: Limestone Market, By Country, 2019-2027 (USD Billion)

29 China: Limestone Market, By End Use, 2019-2027 (USD Billion)

30 India: Limestone Market, By End Use, 2019-2027 (USD Billion)

31 Japan: Limestone Market, By End Use, 2019-2027 (USD Billion)

32 South Korea: Limestone Market, By End Use, 2019-2027 (USD Billion)

33 Thailand: Limestone Market, By End Use, 2019-2027 (USD Billion)

34 Indonesia: Limestone Market, By End Use, 2019-2027 (USD Billion)

35 Malaysia: Limestone Market, By End Use, 2019-2027 (USD Billion)

36 Singapore: Limestone Market, By End Use, 2019-2027 (USD Billion)

37 Vietnam: Limestone Market, By End Use, 2019-2027 (USD Billion)

38 Rest of Asia Pacific: Limestone Market, By End Use, 2019-2027 (USD Billion)

39 Middle East & Africa: Limestone Market, By End Use, 2019-2027 (USD Billion)

40 Middle East & Africa: Limestone Market, By Country, 2019-2027 (USD Billion)

41 Saudi Arabia: Limestone Market, By End Use, 2019-2027 (USD Billion)

42 UAE: Limestone Market, By End Use, 2019-2027 (USD Billion)

43 Israel: Limestone Market, By End Use, 2019-2027 (USD Billion)

44 South Africa: Limestone Market, By End Use, 2019-2027 (USD Billion)

45 Rest of Middle East & Africa: Limestone Market, By End Use, 2019-2027 (USD Billion)

46 Central & South America: Limestone Market, By End Use, 2019-2027 (USD Billion)

47 Central & South America: Limestone Market, By Country, 2019-2027 (USD Billion)

48 Brazil: Limestone Market, By End Use, 2019-2027 (USD Billion)

49 Argentina: Limestone Market, By End Use, 2019-2027 (USD Billion)

50 Chile: Limestone Market, By End Use, 2019-2027 (USD Billion)

51 Rest Of Central & South America: Limestone Market, By End Use, 2019-2027 (USD Billion)

52 CARMEUSE: Products Offered

53 CEMEX S.A.B. de C.V: Products Offered

54 GCCP Resources Limited: Products Offered

55 Imerys: Products Offered

56 LafargeHolcim: Products Offered

57 Lhoist: Products Offered

58 Mineral Technologies Inc.: Products Offered

59 Mississippi Lime Company: Products Offered

60 National Lime & Stone Company: Products Offered

61 Merck & Co.: Products Offered

62 Other Companies: Products Offered

List of Figures

1. Global Limestone Market Segmentation & Research Scope

2. Primary Research Partners and Local Informers

3. Primary Research Process

4. Primary Research Approaches

5. Primary Research Responses

6. Global Limestone Market: Penetration & Growth Prospect Mapping

7. Global Limestone Market: Value Chain Analysis

8. Global Limestone Market Drivers

9. Global Limestone Market Restraints

10. Global Limestone Market Opportunities

11. Global Limestone Market Challenges

12. Key Limestone Market Manufacturer Analysis

13. Global Limestone Market: Porter’s Five Forces Analysis

14. PESTLE Analysis & Impact Analysis

15. CARMEUSE: Company Snapshot

16. CARMEUSE: Swot Analysis

17. CEMEX S.A.B. de C.V: Company Snapshot

18. CEMEX S.A.B. de C.V: Swot Analysis

19. GCCP Resources Limited: Company Snapshot

20. GCCP Resources Limited: Swot Analysis

21. Imerys: Company Snapshot

22. Imerys: Swot Analysis

23. LafargeHolcim: Company Snapshot

24. LafargeHolcim: Swot Analysis

25. Lhoist: Company Snapshot

26. Lhoist: Swot Analysis

27. Mineral Technologies Inc.: Company Snapshot

28. Mineral Technologies Inc.: Swot Analysis

29. Mississippi Lime Company: Company Snapshot

30. Mississippi Lime Company: Swot Analysis

31. National Lime & Stone Company: Company Snapshot

32. National Lime & Stone Company: Swot Analysis

33. Other Companies: Company Snapshot

34. Other Companies: Swot Analysis

The Global Limestone Market has been studied from the year 2019 till 2027. However, the CAGR provided in the report is from the year 2022 to 2027. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Limestone Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS