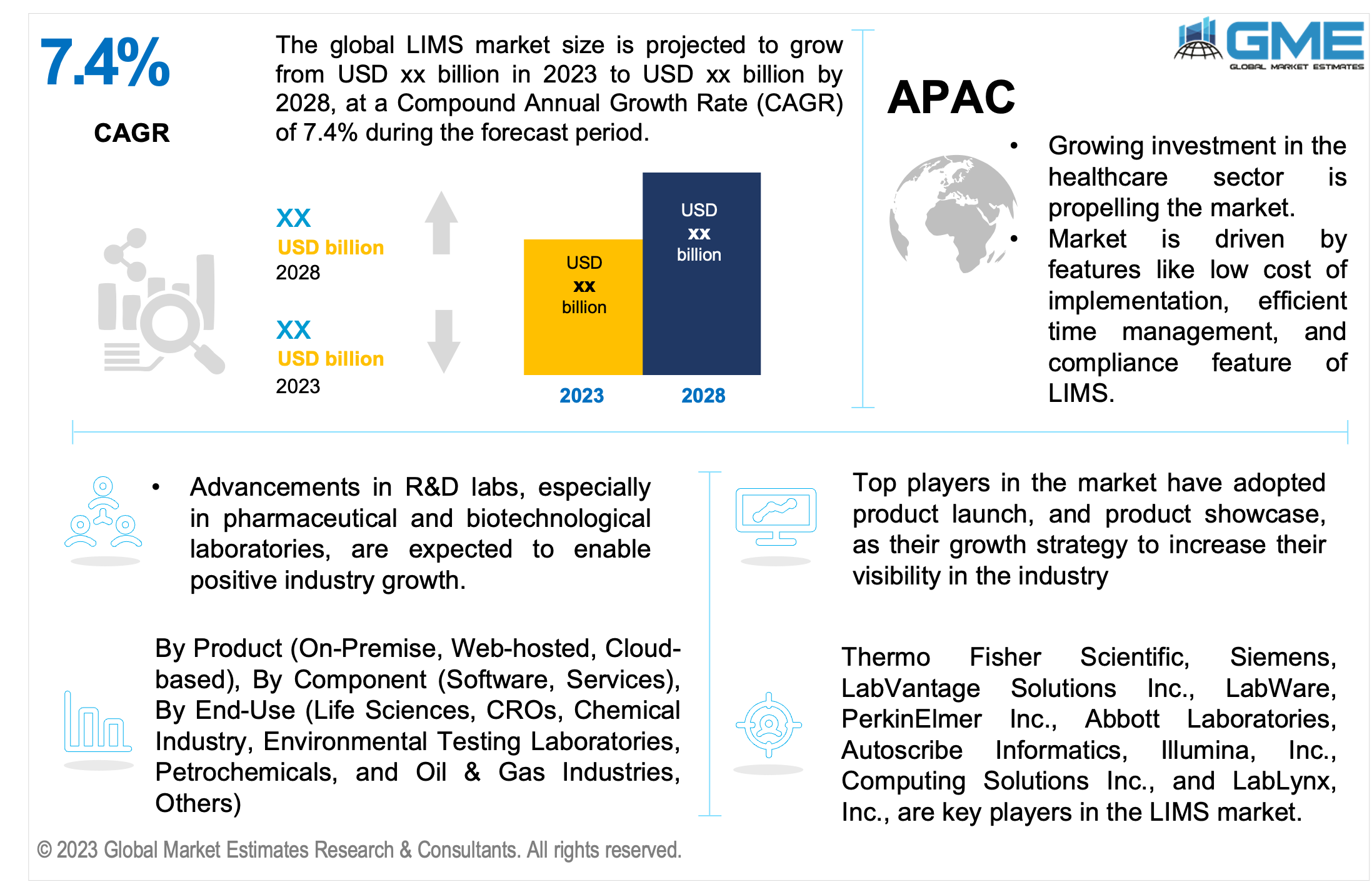

Global LIMS Market Size, Trends & Analysis - Forecasts to 2028 By Product (On-Premise, Web-hosted, Cloud-based), By Component (Software, Services), By End-Use (Life Sciences, CROs, Chemical Industry, Environmental Testing Laboratories, Petrochemicals, Oil & Gas Industries, Others), By Region (North America, Asia Pacific, Central & South America, Europe, the Middle East & Africa), End-User Landscape Analysis, Company Market Share Analysis, and Competitor Analysis

The global LIMS market is projected to grow at a CAGR of 7.4% from 2023 to 2028. Software Laboratory Information Management System (LIMS) provides efficient data management services to the Life Sciences, CROs, Chemical Industry, Environmental Testing Laboratories, Petrochemicals, and Oil & Gas Industries. Information management systems are widely used in the integration, maintenance, and validation of data. It is also used in handling samples and automating workflows. Consumers using LIMS can track data by running sequencing over time and in between studies to increase productivity. This allows them to deliver trustworthy results more rapidly and boosts the market dynamics. Data generated by modern genetics is unprecedented and labs must modernize their approach to handling, tracking, and centralizing genomics data considering rising data quantities and samples.

Laboratory information management systems (LIMS) facilitate the handling of huge volumes of lab data and compliance with rigid standards, while also enhancing productivity and turnaround times, enabling automation, and doing other things. Companies are providing configuration tools aimed to effectively establish optimized, highly adaptive processes as a result of developments in medicine. By minimizing manual activities, a LIMS' primary goal is to increase lab efficiency, quality control, and accuracy. This is majorly contributing to the growth of the market during the forecast period.

Over the past few years, the LIMS market has increased substantially due to technological advancements and its relevance in the field of pharmaceuticals, oil & gas, chemical, and healthcare industries. LIMS implementation in environmental testing laboratories is also rising due to increasing climate concerns. Due to this, there are many government initiatives in the market to improve research and development facilities in several laboratories. Furthermore, laboratory information management system also helps in reducing costs, errors in testing, and saves time efficiently due to its compliance solutions.

There is also a steep rise in collaborations among companies, partnerships, and acquisitions among different ventures due to new product development with advanced features and an increasing need to create a stronger information management system. This has made a huge impact on the market. In oil and gas industries, there is also a need for automation, and rising regulatory requirements to reduce human error.

The need for round-the-clock laboratory testing services increased during the COVID-19 epidemic. Additionally, clinical laboratories were running at maximum capacity, which put a great deal of strain on both the infrastructure and the lab staff. Such stressful settings are dreadful, especially in laboratories where there are so many hazardous substances that can regularly result in biohazards. As a result, LIMS systems are being used more frequently to streamline procedures in accordance with international standards.

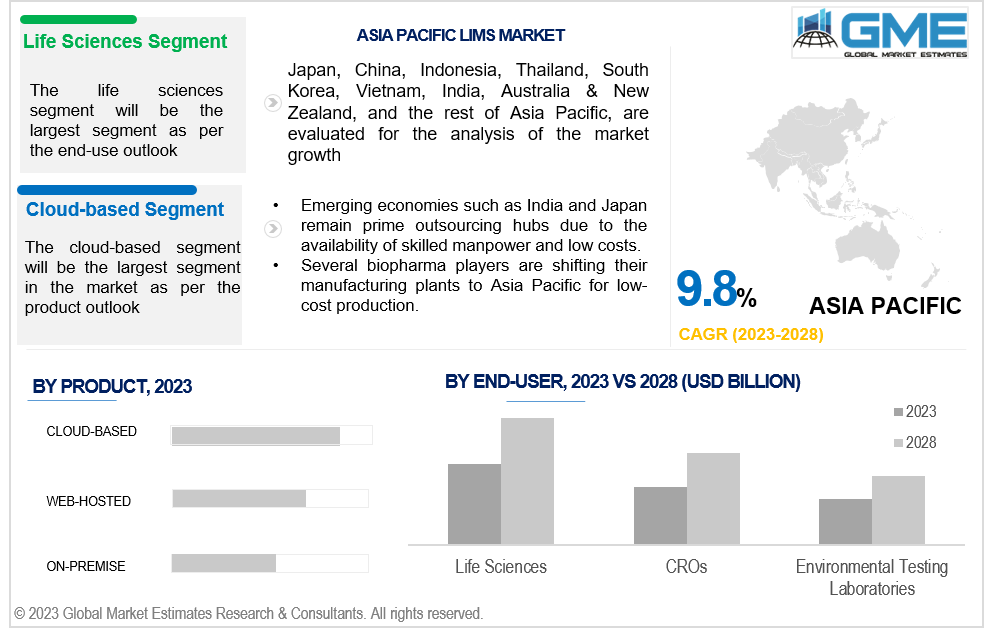

The cloud-based segment is expected to witness the largest share in the global LIMS market during the forecast period of 2023-2028. The number of access points to which the data can be accessed is practically endless. The adaptability provided by features like virtual access points continues to be a significant factor contributing to the supremacy of the cloud-based product market in an expanding culture of remote work. With advanced cloud-based systems, companies are looking to reduce the workload on IT staff and adopt inexpensive data management further influencing the segment.

The web-hosted segment is expected to grow the fastest during 2023-2028. Due to the high adoption of web-hosted LIMS software among consumers, this segment is expected to grow the fastest during the forecast period. LIMS solutions are available and suitable for various laboratories as per different needs and research for R&D purposes, manufacturing companies, public services, environmental companies, chemical contracts, and others.

The services segment is expected to witness the largest share in the global LIMS market during the forecast period of 2023-2028. Due to rapid integration, deployment, validation, and maintenance service, there is a rise in LIMS deployment. Furthermore, the segment is anticipated to rise due to the high demand for LIMS outsourcing solutions. Large pharmaceutical research labs frequently lack the tools and expertise needed for analytics adoption. So, these services are contracted out. Long-term, project-based, or short-term contracts may be used for this outsourcing. These services are offered as packages, and these packages may contain things like social media analytics, compliance with rules governing promotional spending, and benchmarking services.

The software segment is expected to grow the fastest during 2023-2028. The software sector is expected to continue to grow slowly over the course of the projection period as increasingly complex PaaS, CaaS, and community networks replace SaaS. Players in the market are continually implementing new tactics to foster market expansion. For instance, LabVantage Solutions unveiled an update to its LIMS Platform, a new certified SaaS solution, and an innovative analytics solution in May 2021.

The life sciences segment is expected to witness the largest share in the global LIMS market during the forecast period of 2023-2028. This is due to LIMS's widespread use in pharmaceutical laboratories. This market's expansion is anticipated to be supported by a lack of qualified workers, increased productivity and cost-effectiveness demands, and a rising need for biobanks and biorepositories.

The CROs segment is expected to grow the fastest during 2023-2028. This quick expansion can be due to the pharmaceutical and biotechnology industries' rising outsourcing demand. Over the projection period, it is anticipated that several connected advantages, including cost-effectiveness, the necessity to keep the emphasis on core capabilities, and reciprocal benefits to both contractor &client, will propel the growth of this market.

The North American segment is expected to witness the largest share in the global LIMS market during the forecast period of 2023-2028. The dominance is a result of favorable policies, such as EHR programs, that make laboratory automation adoption easier. The presence of cutting-edge infrastructure, rising interest in genetic research, and greater government financing are among additional reasons contributing to the region's high proportion.

Asia-Pacific is expected to grow the fastest during 2023-2028. Due to a rise in demand for CROs offering LIMS, the Asia Pacific LIMS market is predicted to grow profitably during the forecast period. Due to the availability of competent labor and competitive prices, emerging economies like Japan and India continue to be important outsourcing centers. Additionally, for low-cost production, some biopharmaceutical companies are moving their manufacturing facilities to Asia Pacific. As a result, Asia is seeing a huge increase in demand for LIMS.

The main emerging markets for LIMS include the Middle Eastern nations, China, Singapore, India, Brazil, and Japan. There is a huge market opportunity for suppliers that can match the criteria set in industrialized nations like the U.S. because these markets have lax government rules and international standards.

Thermo Fisher Scientific, Siemens, LabVantage Solutions Inc., LabWare, PerkinElmer Inc., Abbott Laboratories, Autoscribe Informatics, Illumina, Inc., Computing Solutions Inc., Agilent Technologies, and LabLynx, Inc. among others are some of the key players in the LIMS market.

Please note: This is not an exhaustive list of companies profiled in the report.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

2.4 Data Metrics

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

4 GLOBAL LIMS MARKET, BY PRODUCT

4.2 LIMS Market: Technology Scope Key Takeaways

4.3 Revenue Growth Analysis, 2022 & 2028

4.4.1 On-Premise Market Estimates and Forecast, 2020-2028 (USD Million)

4.5.1 Web-hosted Market Estimates and Forecast, 2020-2028 (USD Million)

4.6.1 Cloud-based Market Estimates and Forecast, 2020-2028 (USD Million)

5 GLOBAL LIMS MARKET, BY COMPONENT

5.2 LIMS Market: Type Scope Key Takeaways

5.3 Revenue Growth Analysis, 2022 & 2028

5.4.1 Software Market Estimates and Forecast, 2020-2028 (USD Million)

5.5.1 Services Market Estimates and Forecast, 2020-2028 (USD Million)

6 GLOBAL LIMS MARKET, BY END-USE

6.2 LIMS Market: Application Scope Key Takeaways

6.3 Revenue Growth Analysis, 2022 & 2028

6.4.1 Life Sciences Market Estimates and Forecast, 2020-2028 (USD Million)

6.5.1 CROs Market Estimates and Forecast, 2020-2028 (USD Million)

6.6.1 Chemical Industry Market Estimates and Forecast, 2020-2028 (USD Million)

6.7 Environemntal Testing Laboratories

6.7.1 Environemntal Testing Laboratories Market Estimates and Forecast, 2020-2028 (USD Million)

6.8.1 Petrochemicals Market Estimates and Forecast, 2020-2028 (USD Million)

6.9.1 Oil & Gas Industries Market Estimates and Forecast, 2020-2028 (USD Million)

6 GLOBAL LIMS MARKET, BY REGION

6.2 North America LIMS Market Estimates and Forecast, 2020-2028 (USD Million)

6.2.4.1 U.S. LIMS Market Estimates and Forecast, 2020-2028 (USD Million)

6.2.4.2 Canada LIMS Market Estimates and Forecast, 2020-2028 (USD Million)

6.2.4.3 Mexico LIMS Market Estimates and Forecast, 2020-2028 (USD Million)

6.3 Europe LIMS Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.4.1 Germany LIMS Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.4.2 U.K. LIMS Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.4.3 France LIMS Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.4.4 Italy LIMS Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.4.5 Spain LIMS Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.4.6 Netherlands LIMS Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.4.7 Rest of Europe LIMS Market Estimates and Forecast, 2020-2028 (USD Million)

6.4 Asia Pacific LIMS Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.4.1 China LIMS Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.4.2 Japan LIMS Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.4.3 India LIMS Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.4.4 South Korea LIMS Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.4.5 Singapore LIMS Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.4.6 Malaysia LIMS Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.4.7 Thailand LIMS Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.4.8 Indonesia LIMS Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.4.9 Vietnam LIMS Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.4.10 Taiwan LIMS Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.4.11 Rest of Asia Pacific LIMS Market Estimates and Forecast, 2020-2028 (USD Million)

6.5 Middle East & Africa LIMS Market Estimates and Forecast, 2020-2028 (USD Million)

6.5.4.1 Saudi Arabia LIMS Market Estimates and Forecast, 2020-2028 (USD Million)

6.5.4.2 U.A.E. LIMS Market Estimates and Forecast, 2020-2028 (USD Million)

6.5.4.3 Israel LIMS Market Estimates and Forecast, 2020-2028 (USD Million)

6.5.4.4 South Africa LIMS Market Estimates and Forecast, 2020-2028 (USD Million)

6.5.4.5 Rest of Middle East & Africa LIMS Market Estimates and Forecast, 2020-2028 (USD Million)

6.6 Central & South America LIMS Market Estimates and Forecast, 2020-2028 (USD Million)

6.6.4.1 Brazil LIMS Market Estimates and Forecast, 2020-2028 (USD Million)

6.6.4.2 Argentina LIMS Market Estimates and Forecast, 2020-2028 (USD Million)

6.6.4.3 Chile LIMS Market Estimates and Forecast, 2020-2028 (USD Million)

6.6.4.4 Rest of Central & South America LIMS Market Estimates and Forecast, 2020-2028 (USD Million)

7.1 Company Market Share Analysis

7.2 Four Quadrant Positioning Matrix

7.4.1 Thermo Fisher Scientific

7.4.1.1 Business Description & Financial Analysis

7.4.1.3 Products & Services Offered

7.4.1.4 Strategic Alliances between Business Partners

7.4.2.1 Business Description & Financial Analysis

7.4.2.3 Products & Services Offered

7.4.2.4 Strategic Alliances between Business Partners

7.4.3 LabVantage Solutions Inc.

7.4.3.1 Business Description & Financial Analysis

7.4.3.3 Products & Services Offered

7.4.3.4 Strategic Alliances between Business Partners

7.4.4.1 Business Description & Financial Analysis

7.4.4.3 Products & Services Offered

7.4.4.4 Strategic Alliances between Business Partners

7.4.5.1 Business Description & Financial Analysis

7.4.5.3 Products & Services Offered

7.4.5.4 Strategic Alliances between Business Partners

7.4.6.1 Business Description & Financial Analysis

7.4.6.3 Products & Services Offered

7.4.6.4 Strategic Alliances between Business Partners

7.4.7.1 Business Description & Financial Analysis

7.4.7.3 Products & Services Offered

7.4.7.4 Strategic Alliances between Business Partners

7.4.8.1 Business Description & Financial Analysis

7.4.8.3 Products & Services Offered

7.4.8.4 Strategic Alliances between Business Partners

7.4.9 COMPUTING SOLUTIONS INC.

7.4.9.1 Business Description & Financial Analysis

7.4.9.3 Products & Services Offered

7.4.9.4 Strategic Alliances between Business Partners

7.4.10.1 Business Description & Financial Analysis

7.4.10.3 Products & Services Offered

7.4.10.4 Strategic Alliances between Business Partners

7.4.11.1 Business Description & Financial Analysis

7.4.11.3 Products & Services Offered

7.4.11.4 Strategic Alliances between Business Partners

8.1.2 Market Scope & Segmentation

8.2.1.2 GMEs Internal Data Repository

8.2.1.3 Secondary Resources & Third Party Perspectives

8.2.1.4 Company Information Sources

8.2.2.1 Various End Use of Respondents for Primary Interviews

8.2.2.2 Number of Interviews Conducted throughout the Research Process

8.2.2.4 Discussion Guide for Primary Participants

8.2.3.1 Expert Panels Across 30+ Industry

8.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

8.3.1.1 Macro-Economic Indicators Considered

8.3.1.2 Micro-Economic Indicators Considered

8.3.2.1 Company Share Analysis Approach

8.3.2.2 Estimation of Potential Product Sales

8.4.2 Time Series, Cross Sectional & Panel Data Analysis

8.5.1 Inhouse AI Based Real Time Analytics Tool

8.5.2 Output From Desk & Primary Research

8.6 Research Assumptions & Limitations

LIST OF TABLES

1 Global LIMS Market, By Product, 2020-2028 (USD Mllion)

2 On-Premise Market, By Region, 2020-2028 (USD Mllion)

3 Web-hosted Market, By Region, 2020-2028 (USD Mllion)

4 Cloud-based Market, By Region, 2020-2028 (USD Mllion)

5 Regional & Short Lines Market, By Region, 2020-2028 (USD Mllion)

6 Global LIMS Market, By Component, 2020-2028 (USD Mllion)

7 Software Market, By Region, 2020-2028 (USD Mllion)

8 Services Market, By Region, 2020-2028 (USD Mllion)

9 Global LIMS Market, By End-Use, 2020-2028 (USD Mllion)

10 Life Sciences Market, By Region, 2020-2028 (USD Mllion)

11 CROs Market, By Region, 2020-2028 (USD Mllion)

12 Chemical Industry Market, By Region, 2020-2028 (USD Mllion)

13 Environemntal Testing Laboratories Market, By Region, 2020-2028 (USD Mllion)

14 Petrochemicals Market, By Region, 2020-2028 (USD Mllion)

15 Oil & Gas Industries Market, By Region, 2020-2028 (USD Mllion)

16 Regional Analysis, 2020-2028 (USD Mllion)

17 North America LIMS Market, By Product, 2020-2028 (USD Million)

18 North America LIMS Market, By Component, 2020-2028 (USD Million)

19 North America LIMS Market, By End-Use, 2020-2028 (USD Million)

20 North America LIMS Market, By Country, 2020-2028 (USD Million)

21 U.S LIMS Market, By Product, 2020-2028 (USD Million)

22 U.S LIMS Market, By Component, 2020-2028 (USD Million)

23 U.S LIMS Market, By End-Use, 2020-2028 (USD Million)

24 Canada LIMS Market, By Product, 2020-2028 (USD Million)

25 Canada LIMS Market, By Component, 2020-2028 (USD Million)

26 Canada LIMS Market, By End-Use, 2020-2028 (USD Million)

27 Mexico LIMS Market, By Product, 2020-2028 (USD Million)

28 Mexico LIMS Market, By Component, 2020-2028 (USD Million)

29 Mexico LIMS Market, By End-Use, 2020-2028 (USD Million)

30 Europe LIMS Market, By Product, 2020-2028 (USD Million)

31 Europe LIMS Market, By Component, 2020-2028 (USD Million)

32 Europe LIMS Market, By End-Use, 2020-2028 (USD Million)

33 Germany LIMS Market, By Product, 2020-2028 (USD Million)

34 Germany LIMS Market, By Component, 2020-2028 (USD Million)

35 Germany LIMS Market, By End-Use, 2020-2028 (USD Million)

36 UK LIMS Market, By Product, 2020-2028 (USD Million)

37 UK LIMS Market, By Component, 2020-2028 (USD Million)

38 UK LIMS Market, By End-Use, 2020-2028 (USD Million)

39 France LIMS Market, By Product, 2020-2028 (USD Million)

40 France LIMS Market, By Component, 2020-2028 (USD Million)

41 France LIMS Market, By End-Use, 2020-2028 (USD Million)

42 Italy LIMS Market, By Product, 2020-2028 (USD Million)

43 Italy LIMS Market, By T End Use Type, 2020-2028 (USD Million)

44 Italy LIMS Market, By End-Use, 2020-2028 (USD Million)

45 Spain LIMS Market, By Product, 2020-2028 (USD Million)

46 Spain LIMS Market, By Component, 2020-2028 (USD Million)

47 Spain LIMS Market, By End-Use, 2020-2028 (USD Million)

48 Rest Of Europe LIMS Market, By Product, 2020-2028 (USD Million)

49 Rest Of Europe LIMS Market, By Component, 2020-2028 (USD Million)

50 Rest of Europe LIMS Market, By End-Use, 2020-2028 (USD Million)

51 Asia Pacific LIMS Market, By Product, 2020-2028 (USD Million)

52 Asia Pacific LIMS Market, By Component, 2020-2028 (USD Million)

53 Asia Pacific LIMS Market, By End-Use, 2020-2028 (USD Million)

54 Asia Pacific LIMS Market, By Country, 2020-2028 (USD Million)

55 China LIMS Market, By Product, 2020-2028 (USD Million)

56 China LIMS Market, By Component, 2020-2028 (USD Million)

57 China LIMS Market, By End-Use, 2020-2028 (USD Million)

58 India LIMS Market, By Product, 2020-2028 (USD Million)

59 India LIMS Market, By Component, 2020-2028 (USD Million)

60 India LIMS Market, By End-Use, 2020-2028 (USD Million)

61 Japan LIMS Market, By Product, 2020-2028 (USD Million)

62 Japan LIMS Market, By Component, 2020-2028 (USD Million)

63 Japan LIMS Market, By End-Use, 2020-2028 (USD Million)

64 South Korea LIMS Market, By Product, 2020-2028 (USD Million)

65 South Korea LIMS Market, By Component, 2020-2028 (USD Million)

66 South Korea LIMS Market, By End-Use, 2020-2028 (USD Million)

67 Middle East & Africa LIMS Market, By Product, 2020-2028 (USD Million)

68 Middle East & Africa LIMS Market, By Component, 2020-2028 (USD Million)

69 Middle East & Africa LIMS Market, By End-Use, 2020-2028 (USD Million)

70 Middle East & Africa LIMS Market, By Country, 2020-2028 (USD Million)

71 Saudi Arabia LIMS Market, By Product, 2020-2028 (USD Million)

72 Saudi Arabia LIMS Market, By Component, 2020-2028 (USD Million)

73 Saudi Arabia LIMS Market, By End-Use, 2020-2028 (USD Million)

74 UAE LIMS Market, By Product, 2020-2028 (USD Million)

75 UAE LIMS Market, By Component, 2020-2028 (USD Million)

76 UAE LIMS Market, By End-Use, 2020-2028 (USD Million)

77 Central & South America LIMS Market, By Product, 2020-2028 (USD Million)

78 Central & South America LIMS Market, By Component, 2020-2028 (USD Million)

79 Central & South America LIMS Market, By End-Use, 2020-2028 (USD Million)

80 Central & South America LIMS Market, By Country, 2020-2028 (USD Million)

81 Brazil LIMS Market, By Product, 2020-2028 (USD Million)

82 Brazil LIMS Market, By Component, 2020-2028 (USD Million)

83 Brazil LIMS Market, By End-Use, 2020-2028 (USD Million)

84 Thermo Fisher Scientific: Products & Services Offering

85 Siemens: Products & Services Offering

86 LabVantage Solutions Inc.: Products & Services Offering

87 LabWare: Products & Services Offering

88 PerkinElmer Inc.: Products & Services Offering

89 ABBOTT LABORATORIES: Products & Services Offering

90 Autoscribe Informatics : Products & Services Offering

91 Illumina Inc.: Products & Services Offering

92 COMPUTING SOLUTIONS INC., Inc: Products & Services Offering

93 LabLynx: Products & Services Offering

94 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global LIMS Market Overview

2 Global LIMS Market Value From 2020-2028 (USD Mllion)

3 Global LIMS Market Share, By Product (2022)

4 Global LIMS Market Share, By Component (2022)

5 Global LIMS Market Share, By End-Use (2022)

6 Global LIMS Market, By Region (Asia Pacific Market)

7 Technological Trends In Global LIMS Market

8 Four Quadrant Competitor Positioning Matrix

9 Impact Of Macro & Micro Indicators On The Market

10 Impact Of Key Drivers On The Global LIMS Market

11 Impact Of Challenges On The Global LIMS Market

12 Porter’s Five Forces Analysis

13 Global LIMS Market: By Product Scope Key Takeaways

14 Global LIMS Market, By Product Segment: Revenue Growth Analysis

15 On-Premise Market, By Region, 2020-2028 (USD Mllion)

16 Web-hosted Market, By Region, 2020-2028 (USD Mllion)

17 Cloud-based Market, By Region, 2020-2028 (USD Mllion)

18 Regional & Short Lines Market, By Region, 2020-2028 (USD Mllion)

19 Global LIMS Market: By Component Scope Key Takeaways

20 Global LIMS Market, By Component Segment: Revenue Growth Analysis

21 Software Market, By Region, 2020-2028 (USD Mllion)

22 Services Market, By Region, 2020-2028 (USD Mllion)

23 Global LIMS Market: By End-Use Scope Key Takeaways

24 Global LIMS Market, By End-Use Segment: Revenue Growth Analysis

25 Life Sciences Market, By Region, 2020-2028 (USD Mllion)

26 CROs Market, By Region, 2020-2028 (USD Mllion)

27 Chemical Industry Market, By Region, 2020-2028 (USD Mllion)

28 Environemntal Testing Laboratories Market, By Region, 2020-2028 (USD Mllion)

29 Petrochemicals Market, By Region, 2020-2028 (USD Mllion)

30 Oil & Gas Industries Market, By Region, 2020-2028 (USD Mllion)

31 Regional Segment: Revenue Growth Analysis

32 Global LIMS Market: Regional Analysis

33 North America LIMS Market Overview

34 North America LIMS Market, By Product

35 North America LIMS Market, By Component

36 North America LIMS Market, By End-Use

37 North America LIMS Market, By Country

38 U.S. LIMS Market, By Product

39 U.S. LIMS Market, By Component

40 U.S. LIMS Market, By End-Use

41 Canada LIMS Market, By Product

42 Canada LIMS Market, By Component

43 Canada LIMS Market, By End-Use

44 Mexico LIMS Market, By Product

45 Mexico LIMS Market, By Component

46 Mexico LIMS Market, By End-Use

47 Four Quadrant Positioning Matrix

48 Company Market Share Analysis

49 Thermo Fisher Scientific: Company Snapshot

50 Thermo Fisher Scientific: SWOT Analysis

51 Thermo Fisher Scientific: Geographic Presence

52 Siemens: Company Snapshot

53 Siemens: SWOT Analysis

54 Siemens: Geographic Presence

55 LabVantage Solutions Inc.: Company Snapshot

56 LabVantage Solutions Inc.: SWOT Analysis

57 LabVantage Solutions Inc.: Geographic Presence

58 LabWare: Company Snapshot

59 LabWare: Swot Analysis

60 LabWare: Geographic Presence

61 PerkinElmer Inc.: Company Snapshot

62 PerkinElmer Inc.: SWOT Analysis

63 PerkinElmer Inc.: Geographic Presence

64 Abbott Laboratories: Company Snapshot

65 Abbott Laboratories: SWOT Analysis

66 Abbott Laboratories: Geographic Presence

67 Autoscribe Informatics : Company Snapshot

68 Autoscribe Informatics : SWOT Analysis

69 Autoscribe Informatics : Geographic Presence

70 Illumina Inc.: Company Snapshot

71 Illumina Inc.: SWOT Analysis

72 Illumina Inc.: Geographic Presence

73 COMPUTING SOLUTIONS INC., Inc.: Company Snapshot

74 COMPUTING SOLUTIONS INC., Inc.: SWOT Analysis

75 COMPUTING SOLUTIONS INC., Inc.: Geographic Presence

76 LabLynx: Company Snapshot

77 LabLynx: SWOT Analysis

78 LabLynx: Geographic Presence

79 Other Companies: Company Snapshot

80 Other Companies: SWOT Analysis

81 Other Companies: Geographic Presence

The Global LIMS Market has been studied from the year 2019 till 2028. However, the CAGR provided in the report is from the year 2023 to 2028. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the LIMS Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS