Global Livestock Electric Bucket Milking Machine Market Size, Trends & Analysis - Forecasts to 2026 By Livestock Type (Cow, Goat, Buffalo, Camels and Others), By Number of Milking Clusters (Single Milking Cluster, Double Milking Cluster, Triple Milking Cluster, Quad Milking Cluster and Others), By Portability (Trolley/ Portable Machine, and Standalone Machine), By Farm Size (Small Family Farms and Large-Herd Operations Farms), End-Use Landscape, Company Market Share Analysis, and Competitor Analysis

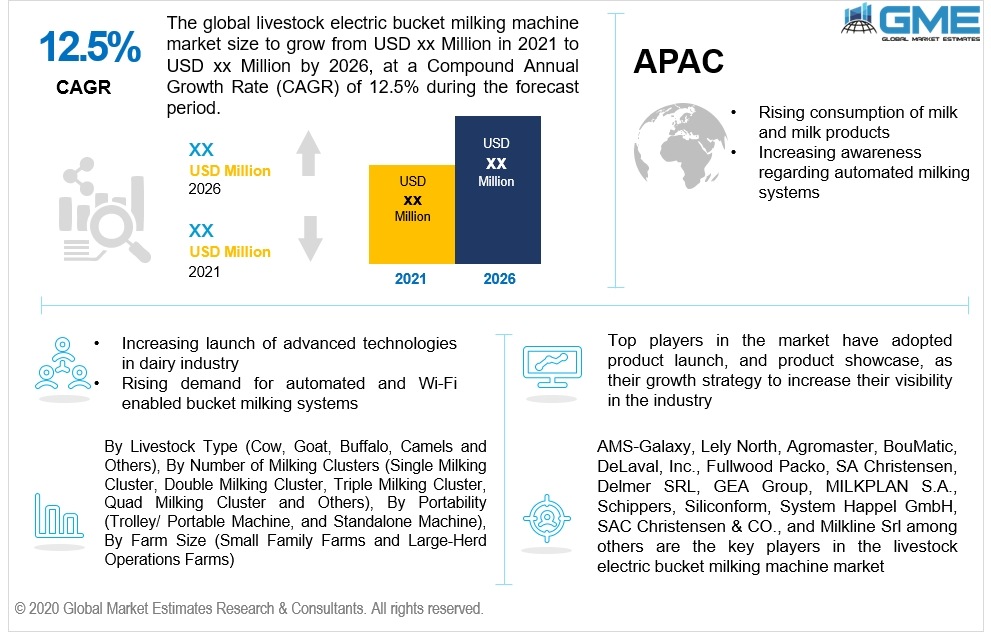

The global livestock electric bucket milking machine market is projected to grow at a CAGR value of 12.5% during the forecast period [2021 to 2026]. Electric bucket milking machine/ system is an efficient milking unit for small sized and large sized dairy farms, for milking cows, buffaloes, and other livestock animals in order to get better productivity with less manpower.

The growing demand for hassle-free, and hygienic milking procedures, is the major driver for the growth of this market. The added advantages of using the electric machine in a farm set up are the increasing possibility to manage herd size, reduce the dependency on labour, increased business profitability and productivity, facility of extracting milk which is untouched, and high in quality, and efficient convince during milking process. Hence, these features have caused an increase in the demand for automatic machines, thereby leading to the growth of the market.

Rising research and developmental activities to launch robotic and automatic milking systems in developed countries, increasing private and public investment programs to launch electric bucket milking machines, and rising awareness regarding advanced milking technologies across developing regions are some of the other drivers of the market.

Due to the COVID-19 pandemic, the dynamics of the dairy farm industry have changed drastically. The major reason being, the rapidly rising consumption of milk and milk products, increasing need for hands-free, hygienic, milking process to avoid cross-contamination and viral infection. Hence, the market post-COVID-19 will foresee a higher growth rate and achieve maximum shares in the industry. COVID-19 has been a positive influence on the market.

The manual method of inspection and process of milking was time-consuming and was highly dependent on skilled labourers. However, due to the augmented robotic and electric milking machines, the market has witnessed a whopping demand for the product. Therefore, the need to process high-quality milk using electric machines will boost the market growth from 2021 to 2026. However, high maintenance, and purchase cost of the automatic machines, and lack of access to the latest products especially in rural areas of developing regions may pose as challenging factors in the market.

Based on livestock type, the market is segregated into cow, goat, buffalo, camels and others. The cow segment will be the largest shareholder in the market. The rapidly rising consumption of cow milk and milk/ dairy products and stringent regulatory norms for milk product safety will support the growth of the segment in the market.

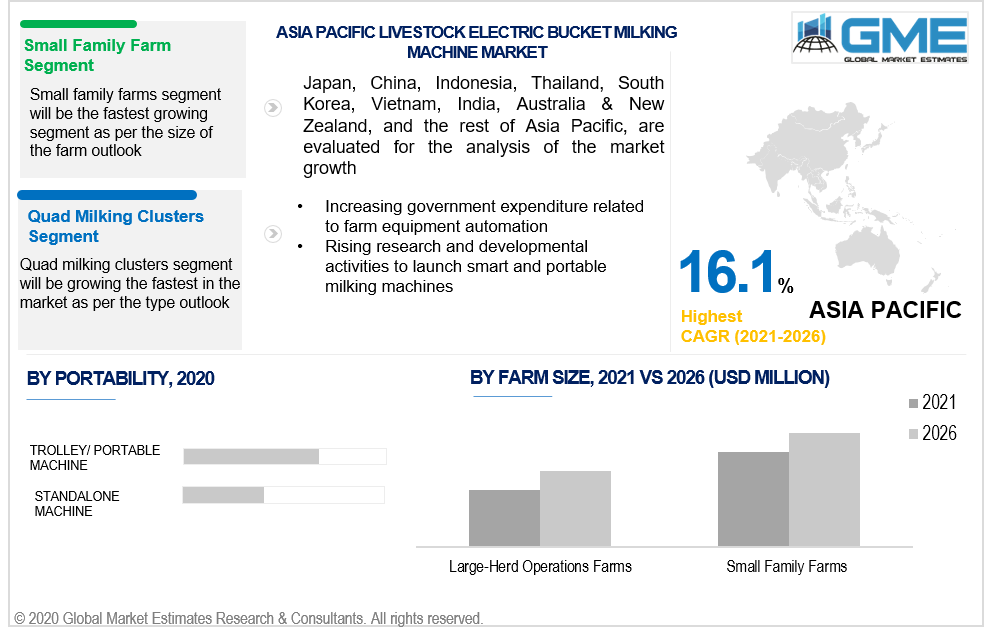

Based on the farm size, the livestock electric bucket milking machine market is segmented into small family farms and large-herd operations farms. The small family farms segment will be the fastest growing one from 2021 to 2026. This is mainly because of rapidly rising awareness regarding smart and portable milking machines amongst small farm owners and farmers, and the declining cost of the products due to high demand from developed regions.

Based on the number of milking clusters, the market is segmented into single milking cluster, double milking cluster, triple milking cluster, quad milking cluster, and others. Quad milking cluster will be the largest shareholder of the market owing to rising awareness regarding automatic milking machines for a higher quantity of milk. Moreover increasing the spending power of farmers to automate the process and go hassle-free milking to avoid cross-contamination for milk in bulk quantity will also support the growth of the segment.

Based on the portability of the milking machine, the market is classified into trolley/ portable machine, and standalone machine. The trolley/ portable machine will be the fastest growing segment and will envisage the largest share of the market owing to properties such as high portability, ease in herd management, and efficient milking process.

As per the geographical analysis, the livestock electric bucket milking machine market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central & South America (Brazil, Argentina, and Rest of Central and South America).

North America (the United States, Canada, and Mexico) will have a dominant share in the market from 2021 to 2026. The dominant share of North America is mainly attributed to increasing awareness about automatic robots for small and large size farm management, rapidly rising consumption of milk and milk products, increasing launch of latest and advanced milking robots, and increasing government funding programs to fulfill the large size cattle herd management demand.

However, the Asia Pacific will be the fastest growing segment followed by Europe and the Middle Eastern region. This is mainly due to the rapidly flourishing food industry, dairy industry, and increasing consumption due to the rapidly rising population in Asian countries (such as China, India, and Japan). Moreover, increasing awareness regarding automation in farm equipment amongst urban farmers will support the market growth in the Asia Pacific.

AMS-Galaxy, Lely North, Agromaster, BouMatic, DeLaval, Inc., Fullwood Packo, SA Christensen, Delmer SRL, GEA Group, MILKPLAN S.A., Schippers, Siliconform, System Happel GmbH, SAC Christensen & CO., Agrimerin Agricultural Machinery, Alper Makine, Arden Milking Technologies, ENKA Tarim, IMPULSA AG, Intermilk, Interpuls SPA, J. Delgado S.A., JSC Mototecha, LAKTO Dairy Technologies, and Milkline Srl among others are the key players in the livestock electric bucket milking machine market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Livestock Electric Bucket Milking Machine Industry Overview, 2021-2026

2.1.1 Industry Overview

2.1.2 Livestock Type Overview

2.1.3 Portability Overview

2.1.4 Number of Milking Clusters Overview

2.1.5 Farm Size Overview

2.1.6 Regional Overview

Chapter 3 Livestock Electric Bucket Milking Machine Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2019-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Advancements in the farm milking machines

3.3.2 Industry Challenges

3.3.2.1 Lack of adequate infrastructure and automated systems in rural areas

3.4 Prospective Growth Scenario

3.4.1 Livestock Type Growth Scenario

3.4.2 Portability Growth Scenario

3.4.3 Number of Milking Clusters Growth Scenario

3.4.4 Farm Size Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Farm Size Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Livestock Electric Bucket Milking Machine Market, By Livestock Type

4.1 Livestock Type Outlook

4.2 Cow

4.2.1 Market Size, By Region, 2019-2026 (USD Million)

4.3 Goat

4.3.1 Market Size, By Region, 2019-2026 (USD Million)

4.4 Buffalo

4.4.1 Market Size, By Region, 2019-2026 (USD Million)

4.5 Camels

4.5.1 Market Size, By Region, 2019-2026 (USD Million)

4.6 Others

4.6.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 5 Livestock Electric Bucket Milking Machine Market, By Number of Milking Clusters

5.1 Number of Milking Clusters Outlook

5.2 Single Milking Cluster

5.2.1 Market Size, By Region, 2019-2026 (USD Million)

5.3 Double Milking Cluster

5.3.1 Market Size, By Region, 2019-2026 (USD Million)

5.4 Triple Milking Cluster

5.4.1 Market Size, By Region, 2019-2026 (USD Million)

5.5 Quad Milking Cluster

5.5.1 Market Size, By Region, 2019-2026 (USD Million)

5.6 Others

5.6.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 6 Livestock Electric Bucket Milking Machine Market, By Portability

6.1 Trolley/ Portable Machine

6.1.1 Market Size, By Region, 2019-2026 (USD Million)

6.2 Standalone Machine

6.2.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 7 Livestock Electric Bucket Milking Machine Market, By Farm Size

7.1 Small Family Farms

7.1.1 Market Size, By Region, 2019-2026 (USD Million)

7.2 Large-Herd Operations Farms

7.2.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 8 Livestock Electric Bucket Milking Machine Market, By Region

8.1 Regional outlook

8.2 North America

8.2.1 Market Size, By Country 2019-2026 (USD Million)

8.2.2 Market Size, By Livestock Type, 2019-2026 (USD Million)

8.2.3 Market Size, By Portability, 2019-2026 (USD Million)

8.2.4 Market Size, By Number of Milking Clusters, 2019-2026 (USD Million)

8.2.5 Market Size, By Farm Size, 2019-2026 (USD Million)

8.2.6 U.S.

8.2.6.1 Market Size, By Livestock Type, 2019-2026 (USD Million)

8.2.4.2 Market Size, By Portability, 2019-2026 (USD Million)

8.2.4.3 Market Size, By Number of Milking Clusters, 2019-2026 (USD Million)

Market Size, By Farm Size, 2019-2026 (USD Million)

8.2.7 Canada

8.2.7.1 Market Size, By Livestock Type, 2019-2026 (USD Million)

8.2.7.2 Market Size, By Portability, 2019-2026 (USD Million)

8.2.7.3 Market Size, By Number of Milking Clusters, 2019-2026 (USD Million)

8.2.7.4 Market Size, By Farm Size, 2019-2026 (USD Million)

8.3 Europe

8.3.1 Market Size, By Country 2019-2026 (USD Million)

8.3.2 Market Size, By Livestock Type, 2019-2026 (USD Million)

8.3.3 Market Size, By Portability, 2019-2026 (USD Million)

8.3.4 Market Size, By Number of Milking Clusters, 2019-2026 (USD Million)

8.3.5 Market Size, By Farm Size, 2019-2026 (USD Million)

8.3.6 Germany

8.3.6.1 Market Size, By Livestock Type, 2019-2026 (USD Million)

8.3.6.2 Market Size, By Portability, 2019-2026 (USD Million)

8.3.6.3 Market Size, By Number of Milking Clusters, 2019-2026 (USD Million)

8.3.6.4 Market Size, By Farm Size, 2019-2026 (USD Million)

8.3.7 UK

8.3.7.1 Market Size, By Livestock Type, 2019-2026 (USD Million)

8.3.7.2 Market Size, By Portability, 2019-2026 (USD Million)

8.3.7.3 Market Size, By Number of Milking Clusters, 2019-2026 (USD Million)

8.3.7.4 Market Size, By Farm Size, 2019-2026 (USD Million)

8.3.8 France

8.3.8.1 Market Size, By Livestock Type, 2019-2026 (USD Million)

8.3.8.2 Market Size, By Portability, 2019-2026 (USD Million)

8.3.8.3 Market Size, By Number of Milking Clusters, 2019-2026 (USD Million)

8.3.8.4 Market Size, By Farm Size, 2019-2026 (USD Million)

8.3.9 Italy

8.3.9.1 Market Size, By Livestock Type, 2019-2026 (USD Million)

8.3.9.2 Market Size, By Portability, 2019-2026 (USD Million)

8.3.9.3 Market Size, By Number of Milking Clusters, 2019-2026 (USD Million)

8.3.9.4 Market Size, By Farm Size, 2019-2026 (USD Million)

8.3.10 Spain

8.3.10.1 Market Size, By Livestock Type, 2019-2026 (USD Million)

8.3.10.2 Market Size, By Portability, 2019-2026 (USD Million)

8.3.10.3 Market Size, By Number of Milking Clusters, 2019-2026 (USD Million)

8.3.10.4 Market Size, By Farm Size, 2019-2026 (USD Million)

8.3.11 Russia

8.3.11.1 Market Size, By Livestock Type, 2019-2026 (USD Million)

8.3.11.2 Market Size, By Portability, 2019-2026 (USD Million)

8.3.11.3 Market Size, By Number of Milking Clusters, 2019-2026 (USD Million)

8.3.11.4 Market Size, By Farm Size, 2019-2026 (USD Million)

8.4 Asia Pacific

8.4.1 Market Size, By Country 2019-2026 (USD Million)

8.4.2 Market Size, By Livestock Type, 2019-2026 (USD Million)

8.4.3 Market Size, By Portability, 2019-2026 (USD Million)

8.4.4 Market Size, By Number of Milking Clusters, 2019-2026 (USD Million)

8.4.5 Market Size, By Farm Size, 2019-2026 (USD Million)

8.4.6 China

8.4.6.1 Market Size, By Livestock Type, 2019-2026 (USD Million)

8.4.6.2 Market Size, By Portability, 2019-2026 (USD Million)

8.4.6.3 Market Size, By Number of Milking Clusters, 2019-2026 (USD Million)

8.4.6.4 Market Size, By Farm Size, 2019-2026 (USD Million)

8.4.7 India

8.4.7.1 Market Size, By Livestock Type, 2019-2026 (USD Million)

8.4.7.2 Market Size, By Portability, 2019-2026 (USD Million)

8.4.7.3 Market Size, By Number of Milking Clusters, 2019-2026 (USD Million)

8.4.7.4 Market Size, By Farm Size, 2019-2026 (USD Million)

8.4.8 Japan

8.4.8.1 Market Size, By Livestock Type, 2019-2026 (USD Million)

8.4.8.2 Market Size, By Portability, 2019-2026 (USD Million)

8.4.8.3 Market Size, By Number of Milking Clusters, 2019-2026 (USD Million)

8.4.8.4 Market Size, By Farm Size, 2019-2026 (USD Million)

8.4.9 Australia

8.4.9.1 Market Size, By Livestock Type, 2019-2026 (USD Million)

8.4.9.2 Market size, By Portability, 2019-2026 (USD Million)

8.4.9.3 Market Size, By Number of Milking Clusters, 2019-2026 (USD Million)

8.4.9.4 Market Size, By Farm Size, 2019-2026 (USD Million)

8.4.10 South Korea

8.4.10.1 Market Size, By Livestock Type, 2019-2026 (USD Million)

8.4.10.2 Market Size, By Portability, 2019-2026 (USD Million)

8.4.10.3 Market Size, By Number of Milking Clusters, 2019-2026 (USD Million)

8.4.10.4 Market Size, By Farm Size, 2019-2026 (USD Million)

8.5 Latin America

8.5.1 Market Size, By Country 2019-2026 (USD Million)

8.5.2 Market Size, By Livestock Type, 2019-2026 (USD Million)

8.5.3 Market Size, By Portability, 2019-2026 (USD Million)

8.5.4 Market Size, By Number of Milking Clusters, 2019-2026 (USD Million)

8.5.5 Market Size, By Farm Size, 2019-2026 (USD Million)

8.5.6 Brazil

8.5.6.1 Market Size, By Livestock Type, 2019-2026 (USD Million)

8.5.6.2 Market Size, By Portability, 2019-2026 (USD Million)

8.5.6.3 Market Size, By Number of Milking Clusters, 2019-2026 (USD Million)

8.5.6.4 Market Size, By Farm Size, 2019-2026 (USD Million)

8.5.7 Mexico

8.5.7.1 Market Size, By Livestock Type, 2019-2026 (USD Million)

8.5.7.2 Market Size, By Portability, 2019-2026 (USD Million)

8.5.7.3 Market Size, By Number of Milking Clusters, 2019-2026 (USD Million)

8.5.7.4 Market Size, By Farm Size, 2019-2026 (USD Million)

8.5.8 Argentina

8.5.8.1 Market Size, By Livestock Type, 2019-2026 (USD Million)

8.5.8.2 Market Size, By Portability, 2019-2026 (USD Million)

8.5.8.3 Market Size, By Number of Milking Clusters, 2019-2026 (USD Million)

8.5.8.4 Market Size, By Farm Size, 2019-2026 (USD Million)

8.6 MEA

8.6.1 Market Size, By Country 2019-2026 (USD Million)

8.6.2 Market Size, By Livestock Type, 2019-2026 (USD Million)

8.6.3 Market Size, By Portability, 2019-2026 (USD Million)

8.6.4 Market Size, By Number of Milking Clusters, 2019-2026 (USD Million)

8.6.5 Market Size, By Farm Size, 2019-2026 (USD Million)

8.6.6 Saudi Arabia

8.6.6.1 Market Size, By Livestock Type, 2019-2026 (USD Million)

8.6.6.2 Market Size, By Portability, 2019-2026 (USD Million)

8.6.6.3 Market Size, By Number of Milking Clusters, 2019-2026 (USD Million)

8.6.6.4 Market Size, By Farm Size, 2019-2026 (USD Million)

8.6.7 UAE

8.6.7.1 Market Size, By Livestock Type, 2019-2026 (USD Million)

8.6.7.2 Market Size, By Portability, 2019-2026 (USD Million)

8.6.7.3 Market Size, By Number of Milking Clusters, 2019-2026 (USD Million)

8.6.7.4 Market Size, By Farm Size, 2019-2026 (USD Million)

8.6.8 South Africa

8.6.8.1 Market Size, By Livestock Type, 2019-2026 (USD Million)

8.6.8.2 Market Size, By Portability, 2019-2026 (USD Million)

8.6.8.3 Market Size, By Number of Milking Clusters, 2019-2026 (USD Million)

8.6.8.4 Market Size, By Farm Size, 2019-2026 (USD Million)

Chapter 9 Company Landscape

9.1 Competitive Analysis, 2020

9.2 AMS-Galaxy

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Strategic Positioning

9.2.4 Info Graphic Analysis

9.3 Lely North

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Strategic Positioning

9.3.4 Info Graphic Analysis

9.4 Agromaster

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Strategic Positioning

9.4.4 Info Graphic Analysis

9.5 BouMatic

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Strategic Positioning

9.5.4 Info Graphic Analysis

9.6 DeLaval, Inc.

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Strategic Positioning

9.6.4 Info Graphic Analysis

9.7 Fullwood Packo

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Strategic Positioning

9.7.4 Info Graphic Analysis

9.8 SA Christensen

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Strategic Positioning

9.8.4 Info Graphic Analysis

9.9 Delmer SRL

9.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Strategic Positioning

9.9.4 Info Graphic Analysis

9.10 GEA Group

9.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Strategic Positioning

9.10.4 Info Graphic Analysis

9.11 Other Companies

9.11.1 Company Overview

9.11.2 Financial Analysis

9.11.3 Strategic Positioning

9.11.4 Info Graphic Analysis

The Global Livestock Electric Bucket Milking Machine Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Livestock Electric Bucket Milking Machine Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS