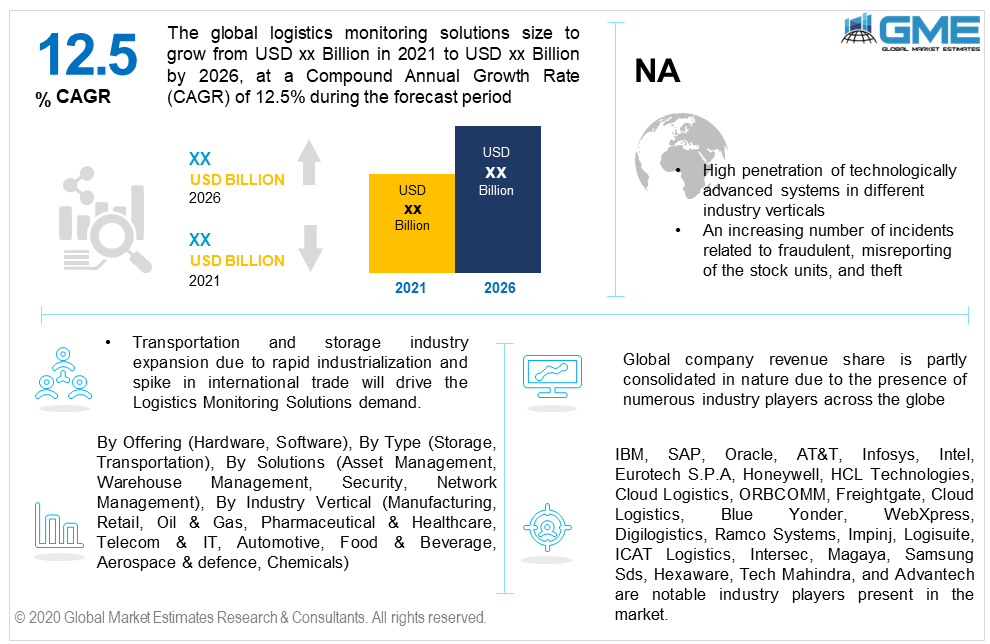

Global Logistics Monitoring Solutions Market Size, Trends & Analysis - Forecasts to 2026 By Offering (Hardware, Software), By Type (Storage, Transportation), By Solutions (Asset Management, Warehouse Management, Security, Network Management), By Industry Vertical (Manufacturing, Retail, Oil & Gas, Pharmaceutical & Healthcare, Telecom & IT, Automotive, Food & Beverage, Aerospace & defence, Chemicals), By Region (North America, Asia Pacific, Europe, Latin America, Middle East & Africa); End-User Landscape, Company Market Share Analysis, and Competitor Analysis

The global logistics monitoring solutions market size will witness around 12.5% CAGR from 2021 to 2026, with the Asia Pacific dominating the regional revenue share. Transportation and storage industry expansion due to rapid industrialization and spike in international trade will drive the logistics monitoring solutions demand.

The industry faced a notable setback in the initial phase of the covid-19 pandemic. Abrupt halt on manufacturing, transportation, and international trade activities severely affected the industry. However, as of now, the industry is getting back to its normal pace due to relaxation in international trade activities.

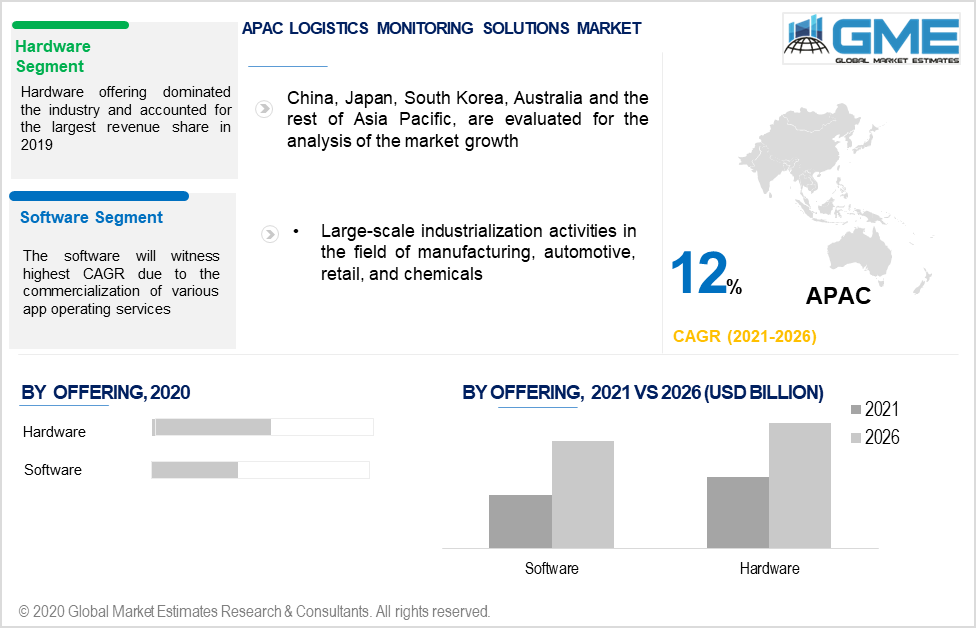

By offering, the industry is divided into hardware and software. Hardware led the offering segment and obtained the highest demand in 2020. Various services offerings related to management and controlling tools are prime factors to witness high adoption in this segment. The software offering is likely to foresee the fastest growth owing to the increasing requirement of in-built automation programs in the industry.

The type segment is divided into storage & transportation. Each type holds abundant prospects and probability to improvise the overall operations. The automation process in the transportation sector is gaining high deployment of products and services in recent years. Increased urgency to streamline the business and achieve cost optimization were the major factors to fuel demand in this segment.

In the storage type, most of the demand is observed from cold chain services. The increasing need to record and maintain the goods efficiently to avoid any wastage and product loss is among the key reason to promote the adoption in this segment.

The solutions are categorized into warehouse management, asset management, security, and network management. Asset management with the help of various automated tools are observing high demand in recent years.

Network management usually deals with the communication and controlling of the activities remotely. The segment will observe the highest CAGR due to the increasing importance to maintain the internal & external networking system. The rising number of cases related to theft, burglary, and misconduct inside or outside the premises has encouraged the deployment of an effective security system.

Manufacturing, Oil & Gas, Retail, Pharmaceutical & Healthcare, Automotive, Telecom & IT, Food & Beverage, Chemicals, and Aerospace & defense are the major industries where these services are highly used. Effective management of goods, financials, safety, and networking are key attributing factors to drive demand. These automated programs are highly beneficial for large-scale industries due to the exchange of goods and data on a large scale. Globalization and expansion in importation & exportation activities have prompted the adoption of these management services.

The manufacturing industry accounted for the largest share in the industry and is expected to hold more than 30% of the share by the end of 2026. High production output and large-scale transportation & storage are the prime reasons to induce demand in this segment.

Another key industry vertical that holds high potential is pharmaceutical & healthcare. The industry witnessed a high spike owing to the effects of the Covid-19 pandemic. Increased production of medical supplies along with high demand to optimize the transport management of these goods has prompted the penetration in this industry.

Asia Pacific Market dominated the regional demand and accounted for more than 38% of the revenue share in 2020. Large-scale industrialization activities in the field of manufacturing, automotive, retail, and chemicals were the key attributing factors to drive regional demand. Cost efficiency, lenient regulations, and cheap labor availability are the prime reasons to set up manufacturing facilities in APAC, which in turn creating demand for updated tracking solutions. China, Malaysia, India, Japan, and South Korea are the leading countries owing to their large factory set-up for diversified industry verticals.

North America will observe significant growth from 2021 to 2026. High penetration of technologically advanced systems in different industry verticals along with the increasing need to manage and track the transportation and storage of the goods will support the regional industry growth. An increasing number of incidents related to fraud, misreporting of the stock units, and theft have instigated the adoption of automated process solutions in the industry.

The European industry is stimulated by automated process development tools and programs. Industry practices up-gradation and acceptance towards robotic practices to maintain the asset management, warehouse management, and networking has proliferated the adoption in the region.

The Middle East & Africa holds a promising future in the coming years. Rapid growth in importation & exportation activities along with the increasing number of foreign investors has encouraged the region to adopt advanced and automated services in the industry. Saudi Arabia, UAE, and South Africa will be the major contributor to MEA region.

Global company revenue share is partly consolidated in nature due to the presence of numerous industry players across the globe. End-use companies’ are heavily investing in network management other warehouses security-related services that open new avenues in the industry. Product customization as per the customer preference, budget, and suitability was a highly noted strategy in the industry.

IBM, SAP, Oracle, AT&T, Infosys, Intel, Eurotech S.P.A, Honeywell, HCL Technologies, Cloud Logistics, ORBCOMM, Freightgate, Cloud Logistics, Blue Yonder, WebXpress, Digilogistics, Ramco Systems, Impinj, Logisuite, ICAT Logistics, Intersec, Magaya, Samsung Sds, Hexaware, Tech Mahindra, and Advantech are notable industry players present in the market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market scope & definitions

1.2 Estimates & forecast calculation

1.3 Historical data overview and validation

1.4 Data sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Logistics Monitoring Solutions industry overview, 2019-2026

2.1.1 Industry overview

2.1.2 Offering overview

2.1.3 Type overview

2.1.4 Solutions overview

2.1.5 Industry Verticals overview

2.1.6 Regional overview

Chapter 3 Logistics Monitoring Solutions Market Trends

3.1 Market segmentation

3.2 Industry background, 2019-2026

3.3 Market key trends

3.3.1 Positive trends

3.3.2 Industry challenges

3.4 Prospective growth scenario

3.5 COVID-19 influence over industry growth

3.6 Porter’s analysis

3.7 PESTEL analysis

3.8 Value chain & supply chain analysis

3.9 Regulatory framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology overview

3.11 Market share analysis, 2020

3.11.1 Company positioning overview, 2020

Chapter 4 Logistics Monitoring Solutions Market, By Offering

4.1 Offering Outlook

4.2 Hardware

4.2.1 Market size, by region, 2019-2026 (USD Million)

4.3 Software

4.3.1 Market size, by region, 2019-2026 (USD Million)

Chapter 5 Logistics Monitoring Solutions Market, By Type

5.1 Type Outlook

5.2 Storage

5.2.1 Market size, by region, 2019-2026 (USD Million)

5.5 Transportation

5.5.1 Market size, by region, 2019-2026 (USD Million)

Chapter 6 Logistics Monitoring Solutions Market, By Solutions

6.1 Solutions Outlook

6.2 Asset Management

6.2.1 Market size, by region, 2019-2026 (USD Million)

6.3 Warehouse Management

6.3.1 Market size, by region, 2019-2026 (USD Million)

6.4 Security

6.4.1 Market size, by region, 2019-2026 (USD Million)

6.5 Network Management

6.5.1 Market size, by region, 2019-2026 (USD Million)

6.6 Others

6.6.1 Market size, by region, 2019-2026 (USD Million)

Chapter 7 Logistics Monitoring Solutions Market, By Industry Vertical

7.1 Industry Vertical Outlook

7.2 Manufacturing

7.2.1 Market size, by region, 2019-2026 (USD Million)

7.3 Retail

7.3.1 Market size, by region, 2019-2026 (USD Million)

7.4 Oil & Gas

7.4.1 Market size, by region, 2019-2026 (USD Million)

7.5 Pharmaceutical & Healthcare

7.5.1 Market size, by region, 2019-2026 (USD Million)

7.6 Telecom & IT

7.6.1 Market size, by region, 2019-2026 (USD Million)

7.7 Automotive

7.7.1 Market size, by region, 2019-2026 (USD Million)

7.8 Food & Beverage

7.8.1 Market size, by region, 2019-2026 (USD Million)

7.9 Aerospace & defence

7.9.1 Market size, by region, 2019-2026 (USD Million)

7.10 Chemicals

7.10.1 Market size, by region, 2019-2026 (USD Million)

7.11 Others

7.11.1 Market size, by region, 2019-2026 (USD Million)

Chapter 8 Logistics Monitoring Solutions Market, By Region

8.1 Regional outlook

8.2 North America

8.2.1 Market size, by country 2019-2026 (USD Million)

8.2.2 Market size, by offering, 2019-2026 (USD Million)

8.2.3 Market size, by type, 2019-2026 (USD Million)

8.2.4 Market size, by solution, 2019-2026 (USD Million)

8.2.5 Market size, by industry vertical, 2019-2026 (USD Million)

8.2.6 U.S.

8.2.6.1 Market size, by offering, 2019-2026 (USD Million)

8.2.6.2 Market size, by type, 2019-2026 (USD Million)

8.2.6.3 Market size, by solution, 2019-2026 (USD Million)

8.2.6.4 Market size, by industry vertical, 2019-2026 (USD Million)

8.2.7 Canada

8.2.7.1 Market size, by offering, 2019-2026 (USD Million)

8.2.7.2 Market size, by type, 2019-2026 (USD Million)

8.2.7.3 Market size, by solution, 2019-2026 (USD Million)

8.2.7.4 Market size, by industry vertical, 2019-2026 (USD Million)

8.3 Europe

8.3.1 Market size, by country 2019-2026 (USD Million)

8.3.2 Market size, by offering, 2019-2026 (USD Million)

8.3.3 Market size, by type, 2019-2026 (USD Million)

8.3.4 Market size, by solution, 2019-2026 (USD Million)

8.3.5 Market size, by industry vertical, 2019-2026 (USD Million)

8.3.6 Germany

8.2.6.1 Market size, by offering, 2019-2026 (USD Million)

8.2.6.2 Market size, by type, 2019-2026 (USD Million)

8.2.6.3 Market size, by solution, 2019-2026 (USD Million)

8.2.6.4 Market size, by industry vertical, 2019-2026 (USD Million)

8.3.7 UK

8.3.7.1 Market size, by offering, 2019-2026 (USD Million)

8.3.7.2 Market size, by type, 2019-2026 (USD Million)

8.3.7.3 Market size, by solution, 2019-2026 (USD Million)

8.3.7.4 Market size, by industry vertical, 2019-2026 (USD Million)

8.3.8 France

8.3.8.1 Market size, by offering, 2019-2026 (USD Million)

8.3.8.2 Market size, by type, 2019-2026 (USD Million)

8.3.8.3 Market size, by solution, 2019-2026 (USD Million)

8.3.8.4 Market size, by industry vertical, 2019-2026 (USD Million)

8.3.9 Italy

8.3.9.1 Market size, by offering, 2019-2026 (USD Million)

8.3.9.2 Market size, by type, 2019-2026 (USD Million)

8.3.9.3 Market size, by solution, 2019-2026 (USD Million)

8.3.9.4 Market size, by industry vertical, 2019-2026 (USD Million)

8.3.10 Spain

8.3.10.1 Market size, by offering, 2019-2026 (USD Million)

8.3.10.2 Market size, by type, 2019-2026 (USD Million)

8.3.10.3 Market size, by solution, 2019-2026 (USD Million)

8.3.10.4 Market size, by industry vertical, 2019-2026 (USD Million)

8.4 Asia Pacific

8.4.1 Market size, by country 2019-2026 (USD Million)

8.4.2 Market size, by offering, 2019-2026 (USD Million)

8.4.3 Market size, by type, 2019-2026 (USD Million)

8.4.4 Market size, by solution, 2019-2026 (USD Million)

8.4.5 Market size, by industry vertical, 2019-2026 (USD Million)

8.4.6 China

8.4.6.1 Market size, by offering, 2019-2026 (USD Million)

8.4.6.2 Market size, by type, 2019-2026 (USD Million)

8.4.6.3 Market size, by solution, 2019-2026 (USD Million)

8.4.6.4 Market size, by industry vertical, 2019-2026 (USD Million)

8.4.7 India

8.4.7.1 Market size, by offering, 2019-2026 (USD Million)

8.4.7.2 Market size, by type, 2019-2026 (USD Million)

8.4.7.3 Market size, by solution, 2019-2026 (USD Million)

8.4.7.4 Market size, by industry vertical, 2019-2026 (USD Million)

8.4.8 Japan

8.4.8.1 Market size, by offering, 2019-2026 (USD Million)

8.4.8.2 Market size, by type, 2019-2026 (USD Million)

8.4.8.3 Market size, by solution, 2019-2026 (USD Million)

8.4.8.4 Market size, by industry vertical, 2019-2026 (USD Million)

8.4.9 Australia

8.4.9.1 Market size, by offering, 2019-2026 (USD Million)

8.4.9.2 Market size, by type, 2019-2026 (USD Million)

8.4.9.3 Market size, by solution, 2019-2026 (USD Million)

8.4.9.4 Market size, by industry vertical, 2019-2026 (USD Million)

8.4.10 South Korea

8.4.10.1 Market size, by offering, 2019-2026 (USD Million)

8.4.10.2 Market size, by type, 2019-2026 (USD Million)

8.4.10.3 Market size, by solution, 2019-2026 (USD Million)

8.4.10.4 Market size, by industry vertical, 2019-2026 (USD Million)

8.5 Latin America

8.5.1 Market size, by country 2019-2026 (USD Million)

8.5.2 Market size, by offering, 2019-2026 (USD Million)

8.5.3 Market size, by type, 2019-2026 (USD Million)

8.5.4 Market size, by solution, 2019-2026 (USD Million)

8.5.5 Market size, by industry vertical, 2019-2026 (USD Million)

8.5.6 Brazil

8.5.6.1 Market size, by offering, 2019-2026 (USD Million)

8.5.6.2 Market size, by type, 2019-2026 (USD Million)

8.5.6.3 Market size, by solution, 2019-2026 (USD Million)

8.5.6.4 Market size, by industry vertical, 2019-2026 (USD Million)

8.5.7 Mexico

8.5.7.1 Market size, by offering, 2019-2026 (USD Million)

8.5.7.2 Market size, by type, 2019-2026 (USD Million)

8.5.7.3 Market size, by solution, 2019-2026 (USD Million)

8.5.7.4 Market size, by industry vertical, 2019-2026 (USD Million)

8.6 MEA

8.6.1 Market size, by country 2019-2026 (USD Million)

8.6.2 Market size, by offering, 2019-2026 (USD Million)

8.6.3 Market size, by type, 2019-2026 (USD Million)

8.6.4 Market size, by solution, 2019-2026 (USD Million)

8.6.5 Market size, by industry vertical, 2019-2026 (USD Million)

8.6.6 Saudi Arabia

8.6.6.1 Market size, by offering, 2019-2026 (USD Million)

8.6.6.2 Market size, by type, 2019-2026 (USD Million)

8.6.6.3 Market size, by solution, 2019-2026 (USD Million)

8.6.6.4 Market size, by industry vertical, 2019-2026 (USD Million)

8.6.7 UAE

8.6.7.1 Market size, by offering, 2019-2026 (USD Million)

8.6.7.2 Market size, by type, 2019-2026 (USD Million)

8.6.7.3 Market size, by solution, 2019-2026 (USD Million)

8.6.7.4 Market size, by industry vertical, 2019-2026 (USD Million)

Chapter 9 Company Landscape

9.1 Competitive analysis, 2020

9.2 IBM

9.2.1 Company overview

9.2.2 Financial analysis

9.2.3 Strategic positioning

9.2.4 Info graphic analysis

9.3 Oracle

9.3.1 Company overview

9.3.2 Financial analysis

9.3.3 Strategic positioning

9.3.4 Info graphic analysis

9.4 SAP

9.4.1 Company overview

9.4.2 Financial analysis

9.4.3 Strategic positioning

9.4.4 Info graphic analysis

9.5 AT&T

9.5.1 Company overview

9.5.2 Financial analysis

9.5.3 Strategic positioning

9.5.4 Info graphic analysis

9.6 Intel

9.6.1 Company overview

9.6.2 Financial analysis

9.6.3 Strategic positioning

9.6.4 Info graphic analysis

9.7 Infosys

9.7.1 Company overview

9.7.2 Financial analysis

9.7.3 Strategic positioning

9.7.4 Info graphic analysis

9.8 Honeywell

9.8.1 Company overview

9.8.2 Financial analysis

9.8.3 Strategic positioning

9.8.4 Info graphic analysis

9.9 Eurotech S.P.A

9.9.1 Company overview

9.9.2 Financial analysis

9.9.3 Strategic positioning

9.9.4 Info graphic analysis

9.10 HCL Technologies

9.10.1 Company overview

9.10.2 Financial analysis

9.10.3 Strategic positioning

9.10.4 Info graphic analysis

9.11 ORBCOMM

9.11.1 Company overview

9.11.2 Financial analysis

9.11.3 Strategic positioning

9.11.4 Info graphic analysis

9.12 Cloud Logistics (US)

9.12.1 Company overview

9.12.2 Financial analysis

9.12.3 Strategic positioning

9.12.4 Info graphic analysis

9.13 Freightgate

9.13.1 Company overview

9.13.2 Financial analysis

9.13.3 Strategic positioning

9.13.4 Info graphic analysis

9.14 Blue Yonder

9.14.1 Company overview

9.14.2 Financial analysis

9.14.3 Strategic positioning

9.14.4 Info graphic analysis

9.15 Digilogistics

9.15.1 Company overview

9.15.2 Financial analysis

9.15.3 Strategic positioning

9.15.4 Info graphic analysis

9.16 WebXpress

9.16.1 Company overview

9.16.2 Financial analysis

9.16.3 Strategic positioning

9.16.4 Info graphic analysis

9.17 Ramco Systems

9.17.1 Company overview

9.17.2 Financial analysis

9.17.3 Strategic positioning

9.17.4 Info graphic analysis

The Global Logistics Monitoring Solutions Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Logistics Monitoring Solutions Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS