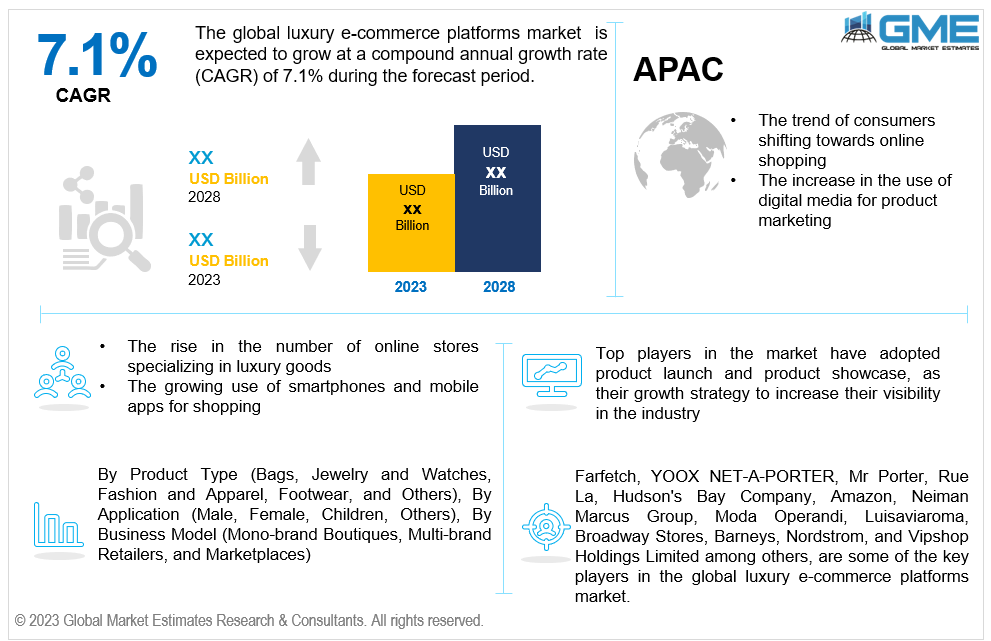

Global Luxury E-commerce Platforms Market Size, Trends & Analysis - Forecasts to 2028 By Product Type (Bags, Jewelry and Watches, Fashion and Apparel, Footwear, and Others), By Application (Male, Female, Children, and Others), By Business Model (Mono-brand Boutiques, Multi-brand Retailers, and Marketplaces), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

The global luxury e-commerce platforms market is estimated to exhibit a CAGR of 7.1% from 2023 to 2028.

The primary factors propelling the market growth are the trend of consumers shifting towards online shopping and the increase in the use of digital media for product marketing. Luxury companies can reach a considerably more extensive and more varied audience online than they can through conventional brick-and-mortar storefronts. Online shoppers can purchase luxury goods from various geographical places, including emerging markets including China, India, and others. This improves market potential and diversifies the client base. Additionally, luxury e-commerce platforms use advanced algorithms and AI-driven suggestions to assist customers in finding items that match their tastes and preferences. This tailored strategy improves the shopping experience and entices customers to look around and buy more goods. For instance, according to the Cloudwards, there were approximately 2.14 billion unique online buyers worldwide in 2021.

The rising online stores specializing in luxury goods and the growing use of smartphones and mobile apps for shopping are expected to support the market growth during the forecast period. Online luxury stores can concentrate their marketing efforts on luxury niches or consumer groups. This methodical approach helps draw customers especially interested in the kinds of goods and experiences the platform offers. Luxury-focused e-commerce platforms companies are making investments to provide an interactive shopping experience for customers. Audio-visual content that showcases expensive products, extensive product descriptions, and appealing website design may all be part of the future of interactive shopping. For instance, in 2021, the Russia-based company Alrosa finished consolidating its jewelry manufacturing in 2021 and opened its first online jewelry store. The company aims to promote Russian diamonds with provenance guarantees, enhance user experience, and stop market fraud.

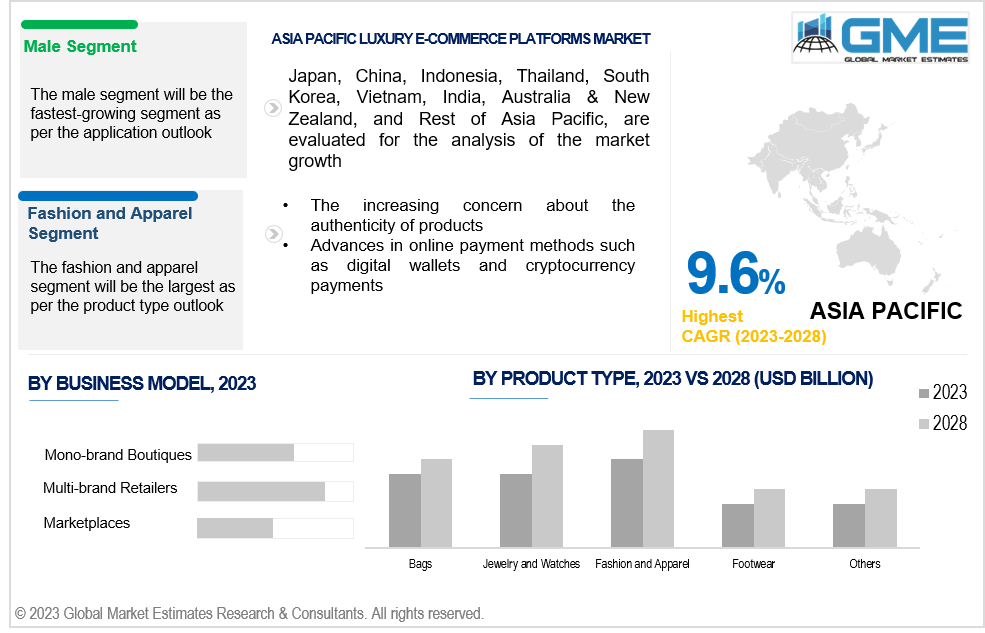

The increasing concern about the authenticity of products and advances in online payment methods such as digital wallets and cryptocurrency payments are propelling the market growth. Luxury e-commerce platforms invest in technologies and procedures for authenticating and verifying products. To guarantee the legitimacy of products, they work with specialists, utilize blockchain technology, or put unique identifiers in place. Customers can feel confident in the validity of their purchases due to this. Luxury e-commerce platforms also use robust anti-counterfeiting systems to secure their products and customers. Holograms, tamper-evident packaging, and specialty labels with complex designs can be used as security measures.

Increasing awareness about sustainable products offers promising growth opportunities for the luxury goods industry, which emphasizes eco-friendly raw materials and responsible utility consumption. Additionally, VR and AR technology can offer clients realistic shopping experiences, where they can virtually try on clothes and accessories or even see how expensive furniture or art can look in their homes.

The fashion and apparel segment is expected to hold the largest share of the market. One of the most demanded luxury commodities is fashion and apparel. The need for fashionable clothing and accessories is one of the most persistent features of human civilization. Fashion is a well-liked medium for individuals to express their unique qualities, making it a particularly attractive market for luxury e-commerce platforms. The segment growth is also fuelled by the expansion of the luxury clothes supply chain and distribution. For instance, the Saudi Arabian General Authority for Competition granted permission for a joint venture between G Distribution B.V. and Al Rubaiyat Co. for Industry & Trade Holding to advertise and distribute Gucci products throughout the Kingdom in December 2021.

The jewelry and watches segment is expected to be the fastest-growing segment in the market from 2023-2028. Luxury accessories like jewelry and watches frequently allow for customization through engraving, gemstone selection, or unique design choices. E-commerce platforms can facilitate these customization options, improving the purchasing experience and persuading customers to search for distinctive and personalized goods. For instance, the Mecanique series, a series of luxury watches with a distinct mecanique design style, was introduced in Hong Kong market in April 2023 by Bernhard H. Mayer, a Swiss personal fashion brand owned by QNET LTD.

The female segment is expected to hold the largest share of the market. Women have been significant contributors to the enormous global movement towards online buying. Particularly for luxury products, which can be more readily available in local retailers, many women prefer the ease and variety provided by e-commerce platforms. Women also tend to adopt a greater range of styles and follow fashion trends more closely. Many luxury e-commerce platforms employ AI and data analytics to provide customized product suggestions. This can improve the shopping experience and encourage female shoppers to purchase more.

The male segment is anticipated to be the fastest-growing segment in the market from 2023-2028. Men are becoming increasingly interested in grooming and fashion and are conscious of their own sense of style, grooming habits, and physical presentation. Due to their increased interest in fashion, men segment represent an attractive market for luxury e-commerce platforms.

The multi-brand retailers segment is expected to hold the largest share of the market. Due to their extensive store area and ability to cater different preferences, multi-brand retailers are the primary distribution channels for luxury goods. Several options are available at multi-brand stores for different categories of luxury products. Customers who purchase luxury items from multi-brand retailers have various inventive packaging choices. Additionally, multi-brand stores often carefully filter their product selections, providing a selected assortment of high-end products that align with the most recent fashion trends and consumer preferences. Customers' buying experience can be streamlined by this curation, which would also highlight the best products..

The mono-brand boutiques segment is anticipated to be the fastest-growing segment in the market from 2023-2028. Mono-brand boutiques only display goods from one high-end brand. This exclusivity has the potential to develop a strong brand identity and a distinctive online shopping experience that appeals to loyal consumers. Mono-brand boutiques also guarantee brand continuity regarding product presentation, message, and the entire brand experience. This reliability can bolster the brand's reputation and ideals.

North America is expected to be the largest region in the market. North American luxury e-commerce platforms market growth is driven by a growing number of high-net-worth individuals who display a great enthusiasm for owning a variety of luxury goods. For instance, Coldwell Banker Global Luxury and Coldwell Banker Real Estate LLC survey revealed that in 2021, the proportion of Americans with a net worth of at least USD 5 million increased by almost 25%.

Asia Pacific is anticipated to witness rapid growth during the forecast period. Internet adoption and smartphone use have increased significantly in the Asia Pacific region. Consumers now find e-commerce to be more manageable and accessible because of this digital adoption, which is fuelling the growth of the luxury e-commerce platforms market. China and Japan are among the top buyers of luxury goods in the Asia Pacific region and have the greatest average per capita earnings. According to Alibaba, China's sales of luxury goods rose from 11% in 2019 to 20% in 2020, compared to the industry's total worldwide sales.

Farfetch, YOOX NET-A-PORTER, Mr Porter, Rue La, Hudson's Bay Company, Amazon, Neiman Marcus Group, Moda Operandi, Luisaviaroma, Broadway Stores, Barneys, Nordstrom, and Vipshop Holdings Limited among others, are some of the key players operating in the global luxury e-commerce platforms market.

Please note: This is not an exhaustive list of companies profiled in the report.

In October 2022, FARFETCH Limited, a leading global platform for luxury fashion industry offered cryptocurrency payment options for customers in 37 countries including Germany, Brazil, China, and others.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL LUXURY E-COMMERCE PLATFORMS MARKET OUTLOOK

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

4 GLOBAL LUXURY E-COMMERCE PLATFORMS MARKET, BY PRODUCT TYPE

4.2 Luxury E-commerce Platforms Market: Product Type Scope Key Takeaways

4.3 Revenue Growth Analysis, 2022 & 2028

4.4.1 Bags Market Estimates and Forecast, 2020-2028 (USD Million)

4.5.1 Jewelry and Watches Market Estimates and Forecast, 2020-2028 (USD Million)

4.6.1 Fashion and Apparel Market Estimates and Forecast, 2020-2028 (USD Million)

4.7.1 Footwear Market Estimates and Forecast, 2020-2028 (USD Million)

4.8.1 Others Market Estimates and Forecast, 2020-2028 (USD Million)

5 GLOBAL LUXURY E-COMMERCE PLATFORMS MARKET, BY APPLICATION

5.2 Luxury E-commerce Platforms Market: Application Scope Key Takeaways

5.3 Revenue Growth Analysis, 2022 & 2028

5.4.1 Male Market Estimates and Forecast, 2020-2028 (USD Million)

5.5.1 Female Market Estimates and Forecast, 2020-2028 (USD Million)

5.6.1 Children Market Estimates and Forecast, 2020-2028 (USD Million)

5.7.1 Others Market Estimates and Forecast, 2020-2028 (USD Million)

6 GLOBAL LUXURY E-COMMERCE PLATFORMS MARKET, BY BUSINESS MODEL

6.2 Luxury E-commerce Platforms Market: Business Model Scope Key Takeaways

6.3 Revenue Growth Analysis, 2022 & 2028

6.4.1 Mono-brand Boutiques Market Estimates and Forecast, 2020-2028 (USD Million)

6.5.1 Multi-brand Retailers Market Estimates and Forecast, 2020-2028 (USD Million)

6.6.1 Marketplaces Market Estimates and Forecast, 2020-2028 (USD Million)

7 GLOBAL LUXURY E-COMMERCE PLATFORMS MARKET, BY REGION

7.2 North America Luxury E-commerce Platforms Market Estimates and Forecast, 2020-2028 (USD Million)

7.2.4.1 U.S. Luxury E-commerce Platforms Market Estimates and Forecast, 2020-2028 (USD Million)

7.2.4.2 Canada Luxury E-commerce Platforms Market Estimates and Forecast, 2020-2028 (USD Million)

7.2.4.3 Mexico Luxury E-commerce Platforms Market Estimates and Forecast, 2020-2028 (USD Million)

7.3 Europe Luxury E-commerce Platforms Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.4.1 Germany Luxury E-commerce Platforms Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.4.2 U.K. Luxury E-commerce Platforms Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.4.3 France Luxury E-commerce Platforms Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.4.4 Italy Luxury E-commerce Platforms Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.4.5 Spain Luxury E-commerce Platforms Market Estimates and Forecast, 2020-2028 (USD Million)

7.4 Asia Pacific Luxury E-commerce Platforms Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.1 China Luxury E-commerce Platforms Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.2 Japan Luxury E-commerce Platforms Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.3 India Luxury E-commerce Platforms Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.5 Singapore Luxury E-commerce Platforms Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.6 Malaysia Luxury E-commerce Platforms Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.7 Thailand Luxury E-commerce Platforms Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.8 Indonesia Luxury E-commerce Platforms Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.9 Vietnam Luxury E-commerce Platforms Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.10 Taiwan Luxury E-commerce Platforms Market Estimates and Forecast, 2020-2028 (USD Million)

7.5.4.2 U.A.E. Luxury E-commerce Platforms Market Estimates and Forecast, 2020-2028 (USD Million)

7.5.4.3 Israel Luxury E-commerce Platforms Market Estimates and Forecast, 2020-2028 (USD Million)

7.6.4.1 Brazil Luxury E-commerce Platforms Market Estimates and Forecast, 2020-2028 (USD Million)

7.6.4.2 Argentina Eaporative Air Cooler Market Estimates and Forecast, 2020-2028 (USD Million)

7.6.4.3 Chile Luxury E-commerce Platforms Market Estimates and Forecast, 2020-2028 (USD Million)

8.1 Company Market Share Analysis

8.2 Four Quadrant Positioning Matrix

8.4.1.1 Business Description & Financial Analysis

8.4.1.3 Products & Services Offered

8.4.1.4 Strategic Alliances between Business Partners

8.4.2.1 Business Description & Financial Analysis

8.4.2.3 Products & Services Offered

8.4.2.4 Strategic Alliances between Business Partners

8.4.3.1 Business Description & Financial Analysis

8.4.3.3 Products & Services Offered

8.4.3.4 Strategic Alliances between Business Partners

8.4.4.1 Business Description & Financial Analysis

8.4.4.3 Products & Services Offered

8.4.4.4 Strategic Alliances between Business Partners

8.4.5.1 Business Description & Financial Analysis

8.4.5.3 Products & Services Offered

8.4.5.4 Strategic Alliances between Business Partners

8.4.6.1 Business Description & Financial Analysis

8.4.6.3 Products & Services Offered

8.4.6.4 Strategic Alliances between Business Partners

8.4.7.1 Business Description & Financial Analysis

8.4.7.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.8.1 Business Description & Financial Analysis

8.4.8.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.9.1 Business Description & Financial Analysis

8.4.9.3 Products & Services Offered

8.4.9.4 Strategic Alliances between Business Partners

8.4.10.1 Business Description & Financial Analysis

8.4.10.3 Products & Services Offered

8.4.10.4 Strategic Alliances between Business Partners

8.4.11.1 Business Description & Financial Analysis

8.4.11.3 Products & Services Offered

8.4.11.4 Strategic Alliances between Business Partners

9.1.2 Market Scope & Segmentation

9.2.1.2 GMEs Internal Data Repository

9.2.1.3 Secondary Resources & Third Party Perspectives

9.2.1.4 Company Information Sources

9.2.2.1 Various Types of Respondents for Primary Interviews

9.2.2.2 Number of Interviews Conducted throughout the Research Process

9.2.2.4 Discussion Guide for Primary Participants

9.2.3.1 Expert Panels Across 30+ Industry

9.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

9.3.1.1 Macro-Economic Indicators Considered

9.3.1.2 Micro-Economic Indicators Considered

9.3.2.1 Company Share Analysis Approach

9.3.2.2 Estimation of Potential Product Sales

9.4.2 Time Series, Cross Sectional & Panel Data Analysis

9.5.1 Inhouse AI Based Real Time Analytics Tool

9.5.2 Output From Desk & Primary Research

9.6 Research Assumptions & Limitations

LIST OF TABLES

1 Global Luxury E-commerce Platforms Market, By Product Type, 2020-2028 (USD Mllion)

2 Bags Market, By Region, 2020-2028 (USD Mllion)

3 Jewelry and Watches Market, By Region, 2020-2028 (USD Mllion)

4 Fashion and Apparel Market, By Region, 2020-2028 (USD Mllion)

5 Footwear Market, By Region, 2020-2028 (USD Mllion)

6 Others Market, By Region, 2020-2028 (USD Mllion)

7 Global Luxury E-commerce Platforms Market, By Application, 2020-2028 (USD Mllion)

8 Male Market, By Region, 2020-2028 (USD Mllion)

9 Female Market, By Region, 2020-2028 (USD Mllion)

10 Children Market, By Region, 2020-2028 (USD Mllion)

11 Others Market, By Region, 2020-2028 (USD Mllion)

12 Global Luxury E-commerce Platforms Market, By Business Model, 2020-2028 (USD Mllion)

13 Mono-brand Boutiques Market, By Region, 2020-2028 (USD Mllion)

14 Multi-brand Retailers Market, By Region, 2020-2028 (USD Mllion)

15 Marketplaces Market, By Region, 2020-2028 (USD Mllion)

16 Regional Analysis, 2020-2028 (USD Mllion)

17 North America Luxury E-commerce Platforms Market, By Product Type, 2020-2028 (USD Million)

18 North America Luxury E-commerce Platforms Market, By Application, 2020-2028 (USD Million)

19 North America Luxury E-commerce Platforms Market, By Business Model, 2020-2028 (USD Million)

20 North America Luxury E-commerce Platforms Market, By Country, 2020-2028 (USD Million)

21 U.S Luxury E-commerce Platforms Market, By Product Type, 2020-2028 (USD Million)

22 U.S Luxury E-commerce Platforms Market, By Application, 2020-2028 (USD Million)

23 U.S Luxury E-commerce Platforms Market, By Business Model, 2020-2028 (USD Million)

24 Canada Luxury E-commerce Platforms Market, By Product Type, 2020-2028 (USD Million)

25 Canada Luxury E-commerce Platforms Market, By Application, 2020-2028 (USD Million)

26 Canada Luxury E-commerce Platforms Market, By Business Model, 2020-2028 (USD Million)

27 Mexico Luxury E-commerce Platforms Market, By Product Type, 2020-2028 (USD Million)

28 Mexico Luxury E-commerce Platforms Market, By Application, 2020-2028 (USD Million)

29 Mexico Luxury E-commerce Platforms Market, By Business Model, 2020-2028 (USD Million)

30 Europe Luxury E-commerce Platforms Market, By Product Type, 2020-2028 (USD Million)

31 Europe Luxury E-commerce Platforms Market, By Application, 2020-2028 (USD Million)

32 Europe Luxury E-commerce Platforms Market, By Business Model, 2020-2028 (USD Million)

33 Germany Luxury E-commerce Platforms Market, By Product Type, 2020-2028 (USD Million)

34 Germany Luxury E-commerce Platforms Market, By Application, 2020-2028 (USD Million)

35 Germany Luxury E-commerce Platforms Market, By Business Model, 2020-2028 (USD Million)

36 UK Luxury E-commerce Platforms Market, By Product Type, 2020-2028 (USD Million)

37 UK Luxury E-commerce Platforms Market, By Application, 2020-2028 (USD Million)

38 UK Luxury E-commerce Platforms Market, By Business Model, 2020-2028 (USD Million)

39 France Luxury E-commerce Platforms Market, By Product Type, 2020-2028 (USD Million)

40 France Luxury E-commerce Platforms Market, By Application, 2020-2028 (USD Million)

41 France Luxury E-commerce Platforms Market, By Business Model, 2020-2028 (USD Million)

42 Italy Luxury E-commerce Platforms Market, By Product Type, 2020-2028 (USD Million)

43 Italy Luxury E-commerce Platforms Market, By T Application Type, 2020-2028 (USD Million)

44 Italy Luxury E-commerce Platforms Market, By Business Model, 2020-2028 (USD Million)

45 Spain Luxury E-commerce Platforms Market, By Product Type, 2020-2028 (USD Million)

46 Spain Luxury E-commerce Platforms Market, By Application, 2020-2028 (USD Million)

47 Spain Luxury E-commerce Platforms Market, By Business Model, 2020-2028 (USD Million)

48 Rest Of Europe Luxury E-commerce Platforms Market, By Product Type, 2020-2028 (USD Million)

49 Rest Of Europe Luxury E-commerce Platforms Market, By Application, 2020-2028 (USD Million)

50 Rest of Europe Luxury E-commerce Platforms Market, By Business Model, 2020-2028 (USD Million)

51 Asia Pacific Luxury E-commerce Platforms Market, By Product Type, 2020-2028 (USD Million)

52 Asia Pacific Luxury E-commerce Platforms Market, By Application, 2020-2028 (USD Million)

53 Asia Pacific Luxury E-commerce Platforms Market, By Business Model, 2020-2028 (USD Million)

54 Asia Pacific Luxury E-commerce Platforms Market, By Country, 2020-2028 (USD Million)

55 China Luxury E-commerce Platforms Market, By Product Type, 2020-2028 (USD Million)

56 China Luxury E-commerce Platforms Market, By Application, 2020-2028 (USD Million)

57 China Luxury E-commerce Platforms Market, By Business Model, 2020-2028 (USD Million)

58 India Luxury E-commerce Platforms Market, By Product Type, 2020-2028 (USD Million)

59 India Luxury E-commerce Platforms Market, By Application, 2020-2028 (USD Million)

60 India Luxury E-commerce Platforms Market, By Business Model, 2020-2028 (USD Million)

61 Japan Luxury E-commerce Platforms Market, By Product Type, 2020-2028 (USD Million)

62 Japan Luxury E-commerce Platforms Market, By Application, 2020-2028 (USD Million)

63 Japan Luxury E-commerce Platforms Market, By Business Model, 2020-2028 (USD Million)

64 South Korea Luxury E-commerce Platforms Market, By Product Type, 2020-2028 (USD Million)

65 South Korea Luxury E-commerce Platforms Market, By Application, 2020-2028 (USD Million)

66 South Korea Luxury E-commerce Platforms Market, By Business Model, 2020-2028 (USD Million)

67 Middle East and Africa Luxury E-commerce Platforms Market, By Product Type, 2020-2028 (USD Million)

68 Middle East and Africa Luxury E-commerce Platforms Market, By Application, 2020-2028 (USD Million)

69 Middle East and Africa Luxury E-commerce Platforms Market, By Business Model, 2020-2028 (USD Million)

70 Middle East and Africa Luxury E-commerce Platforms Market, By Country, 2020-2028 (USD Million)

71 Saudi Arabia Luxury E-commerce Platforms Market, By Product Type, 2020-2028 (USD Million)

72 Saudi Arabia Luxury E-commerce Platforms Market, By Application, 2020-2028 (USD Million)

73 Saudi Arabia Luxury E-commerce Platforms Market, By Business Model, 2020-2028 (USD Million)

74 UAE Luxury E-commerce Platforms Market, By Product Type, 2020-2028 (USD Million)

75 UAE Luxury E-commerce Platforms Market, By Application, 2020-2028 (USD Million)

76 UAE Luxury E-commerce Platforms Market, By Business Model, 2020-2028 (USD Million)

77 Central and South America Luxury E-commerce Platforms Market, By Product Type, 2020-2028 (USD Million)

78 Central and South America Luxury E-commerce Platforms Market, By Application, 2020-2028 (USD Million)

79 Central and South America Luxury E-commerce Platforms Market, By Business Model, 2020-2028 (USD Million)

80 Central and South America Luxury E-commerce Platforms Market, By Country, 2020-2028 (USD Million)

81 Brazil Luxury E-commerce Platforms Market, By Product Type, 2020-2028 (USD Million)

82 Brazil Luxury E-commerce Platforms Market, By Application, 2020-2028 (USD Million)

83 Brazil Luxury E-commerce Platforms Market, By Business Model, 2020-2028 (USD Million)

84 Farfetch: Products & Services Offering

85 YOOX NET-A-PORTER: Products & Services Offering

86 Mr Porter: Products & Services Offering

87 Rue La La: Products & Services Offering

88 Hudson’s Bay Company: Products & Services Offering

89 AMAZON: Products & Services Offering

90 Neiman Marcus Group : Products & Services Offering

91 Moda Operandi: Products & Services Offering

92 Luisaviaroma, Inc: Products & Services Offering

93 Broadway Stores: Products & Services Offering

94 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Luxury E-commerce Platforms Market Overview

2 Global Luxury E-commerce Platforms Market Value From 2020-2028 (USD Mllion)

3 Global Luxury E-commerce Platforms Market Share, By Product Type (2022)

4 Global Luxury E-commerce Platforms Market Share, By Application (2022)

5 Global Luxury E-commerce Platforms Market Share, By Business Model (2022)

6 Global Luxury E-commerce Platforms Market, By Region (Asia Pacific Market)

7 Technological Trends In Global Luxury E-commerce Platforms Market

8 Four Quadrant Competitor Positioning Matrix

9 Impact Of Macro & Micro Indicators On The Market

10 Impact Of Key Drivers On The Global Luxury E-commerce Platforms Market

11 Impact Of Challenges On The Global Luxury E-commerce Platforms Market

12 Porter’s Five Forces Analysis

13 Global Luxury E-commerce Platforms Market: By Product Type Scope Key Takeaways

14 Global Luxury E-commerce Platforms Market, By Product Type Segment: Revenue Growth Analysis

15 Bags Market, By Region, 2020-2028 (USD Mllion)

16 Jewelry and Watches Market, By Region, 2020-2028 (USD Mllion)

17 Fashion and Apparel Market, By Region, 2020-2028 (USD Mllion)

18 Footwear Market, By Region, 2020-2028 (USD Mllion)

19 Others Market, By Region, 2020-2028 (USD Mllion)

20 Global Luxury E-commerce Platforms Market: By Application Scope Key Takeaways

21 Global Luxury E-commerce Platforms Market, By Application Segment: Revenue Growth Analysis

22 Male Market, By Region, 2020-2028 (USD Mllion)

23 Female Market, By Region, 2020-2028 (USD Mllion)

24 Children Market, By Region, 2020-2028 (USD Mllion)

25 Others Market, By Region, 2020-2028 (USD Mllion)

26 Global Luxury E-commerce Platforms Market: By Business Model Scope Key Takeaways

27 Global Luxury E-commerce Platforms Market, By Business Model Segment: Revenue Growth Analysis

28 Mono-brand Boutiques Market, By Region, 2020-2028 (USD Mllion)

29 Multi-brand Retailers Market, By Region, 2020-2028 (USD Mllion)

30 Marketplaces Market, By Region, 2020-2028 (USD Mllion)

31 Regional Segment: Revenue Growth Analysis

32 Global Luxury E-commerce Platforms Market: Regional Analysis

33 North America Luxury E-commerce Platforms Market Overview

34 North America Luxury E-commerce Platforms Market, By Product Type

35 North America Luxury E-commerce Platforms Market, By Application

36 North America Luxury E-commerce Platforms Market, By Business Model

37 North America Luxury E-commerce Platforms Market, By Country

38 U.S. Luxury E-commerce Platforms Market, By Product Type

39 U.S. Luxury E-commerce Platforms Market, By Application

40 U.S. Luxury E-commerce Platforms Market, By Business Model

41 Canada Luxury E-commerce Platforms Market, By Product Type

42 Canada Luxury E-commerce Platforms Market, By Application

43 Canada Luxury E-commerce Platforms Market, By Business Model

44 Mexico Luxury E-commerce Platforms Market, By Product Type

45 Mexico Luxury E-commerce Platforms Market, By Application

46 Mexico Luxury E-commerce Platforms Market, By Business Model

47 Four Quadrant Positioning Matrix

48 Company Market Share Analysis

49 Farfetch: Company Snapshot

50 Farfetch: SWOT Analysis

51 Farfetch: Geographic Presence

52 YOOX NET-A-PORTER: Company Snapshot

53 YOOX NET-A-PORTER: SWOT Analysis

54 YOOX NET-A-PORTER: Geographic Presence

55 Mr Porter: Company Snapshot

56 Mr Porter: SWOT Analysis

57 Mr Porter: Geographic Presence

58 Rue La La: Company Snapshot

59 Rue La La: Swot Analysis

60 Rue La La: Geographic Presence

61 Hudson’s Bay Company: Company Snapshot

62 Hudson’s Bay Company: SWOT Analysis

63 Hudson’s Bay Company: Geographic Presence

64 AMAZON: Company Snapshot

65 AMAZON: SWOT Analysis

66 AMAZON: Geographic Presence

67 Neiman Marcus Group : Company Snapshot

68 Neiman Marcus Group : SWOT Analysis

69 Neiman Marcus Group : Geographic Presence

70 Moda Operandi: Company Snapshot

71 Moda Operandi: SWOT Analysis

72 Moda Operandi: Geographic Presence

73 Luisaviaroma, Inc.: Company Snapshot

74 Luisaviaroma, Inc.: SWOT Analysis

75 Luisaviaroma, Inc.: Geographic Presence

76 Broadway Stores: Company Snapshot

77 Broadway Stores: SWOT Analysis

78 Broadway Stores: Geographic Presence

79 Other Companies: Company Snapshot

80 Other Companies: SWOT Analysis

81 Other Companies: Geographic Presence

The Global Luxury E-commerce Platforms Market has been studied from the year 2019 till 2028. However, the CAGR provided in the report is from the year 2023 to 2028. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Luxury E-commerce Platforms Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS