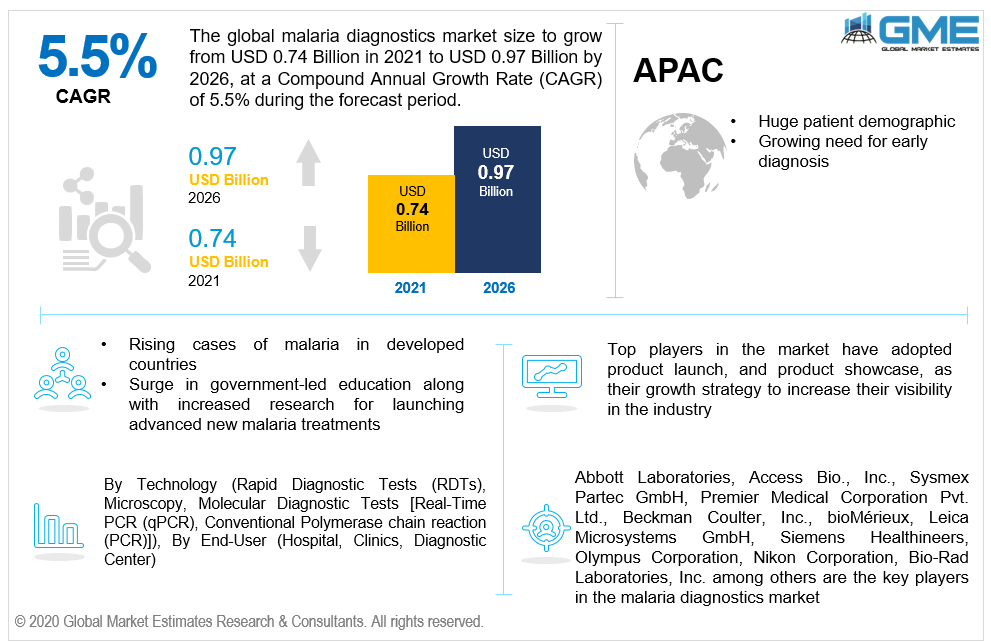

Global Malaria Diagnostics Market Size, Trends & Analysis - Forecasts to 2026 By Technology (Rapid Diagnostic Tests (RDTs), Microscopy, Molecular Diagnostic Tests [Real-Time PCR (qPCR), Conventional Polymerase chain reaction (PCR)]), By End-User (Hospital, Clinics, Diagnostic Center), By Region (North America, Asia Pacific, Europe, Latin America, Middle East & Africa); End-User Landscape, Company Market Share Analysis, and Competitor Analysis

The global malaria diagnostics market is projected to grow from USD 0.74 billion in 2021 to USD 0.97 billion by 2026 at a CAGR value of 5.5% from 2021 to 2026.

Factors that are responsible for the growth of this market include the growing demand for diagnostic tools in malaria-endemic regions, increasing technological advancements and efficient diagnostics, and scale-up of rapid diagnostic tests, and universal access to diagnosis.

The advent of Point-of-Care (POC) diagnostic equipment for improved accuracy is also helping to drive the industry forward. Other considerations, such as rising public health care expenditure capacities and the execution of favorable government initiatives to support patient safety, are expected to propel the market forward.

Other significant factors driving the market is the large investments controlled by government entities and investment funds to reduce illness prevalence. Growing need for high-quality, launch of cost-effective diagnostics technologies are anticipated to lead to innovations that can increase diagnostic availability, particularly in rural areas.

As per the World Health Organization (WHO), the subtropical sickness transmitted by anopheles mosquito’s plasmodium species killed about 4,35,000 people globally in 2017. Also, according to the report, over 219 million malaria cases were reported in many countries, with over 92 percent of the cases reported from Africa, 6% from South Asia, and 2% from the East Mediterranean regions. As a result, increased disease incidence is expected to promote market growth in the future.

Due to shutdowns and other restrictions imposed to minimize disease spread, the COVID-19 pandemic has led to millions of illnesses, and many fatalities, and considerable societal damage. Malaria is a leading cause of mortality and disease that mostly affects individuals in low-resource settings, and little emphasis has indeed been paid to how the epidemic has altered the therapy, treatment, and management of the disease. However, in developing countries, a lack of healthcare understanding is a major factor limiting the development of the malaria diagnostics market.

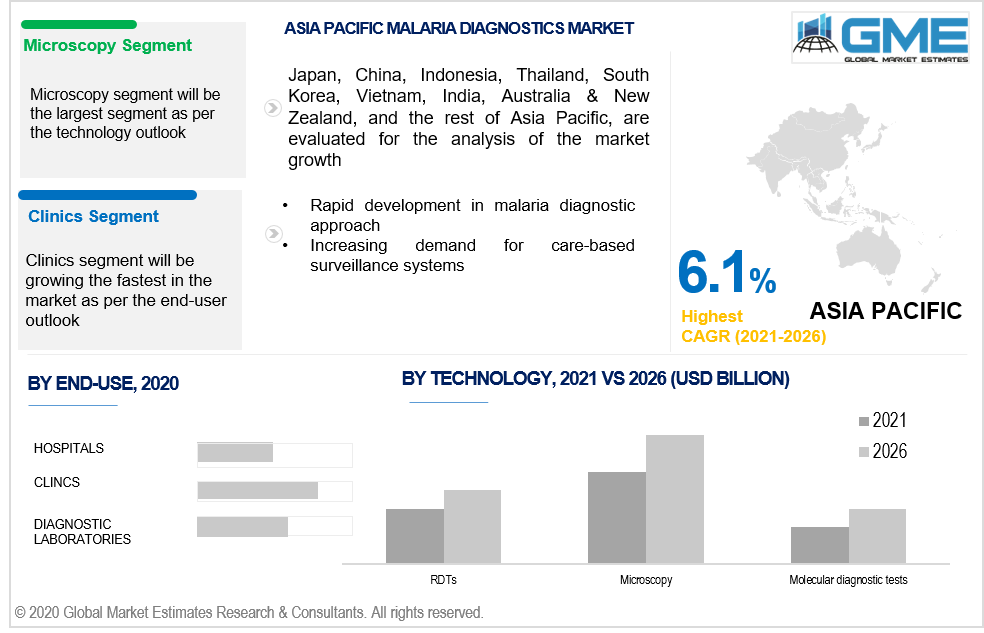

Based on the technology, the market is segmented into rapid diagnostic tests (RDTs), microscopy, and molecular diagnostic tests which are further sub-segmented into real-time polymerase chain reaction(qPCR) and conventional polymerase chain reaction (PCR). The microscopy segment is expected to grow the fastest in the malaria diagnostics market from 2021 to 2026. Microscopy will become a significant component during the forecast period as it is a tried-and-true method of diagnosing diseases. More than 204 million microscopic malarial exams have already been performed globally, as per the World Health Organization (WHO).

P. ovale malaria, P. falciparum malaria, and P. vivax malaria parasites can all be identified using this microscopy approach. The fastest growth is expected in the malaria diagnostics market in the forecast period, owing to the exact detection provided by such tests in the molecular analysis area.

During the forecast period, rapid diagnostic test (RDT) is also estimated to grow rapidly because of the advantages of using RDTs in the diagnosis of malaria RDTs, are affordable, easy to use and interpret, have very high sensitivity and specificity, resistant to high temperatures, and produce data quickly. As a consequence, contribute to the rise of the market for malaria diagnostic tests.

Molecular diagnostic tests include conventional Polymerase Chain Reaction (PCR) and quantitative or Real Time-PCR (qPCR). Low parasite levels or mixed infections have been diagnosed using qPCR utilizing DNA taken from blood samples. These tests are precise, robust, and perceptive enough to identify low parasitic counts. However, due to the high cost and a dearth of specialized laboratories and qualified workers, these tests have a smaller market share.

Based on the end-user, the market is segmented into hospitals, clinics, and diagnostic centers. The clinic's segment is expected to hold a larger share as compared to other segments owing to an increasing number of clinics around the world. Furthermore, rising demand for early diagnosis of falciparum malaria for better healthcare treatment, launch of advanced diagnostics facilities are predicted to grow at the largest rate during the forecast period.

As per the geographical analysis, the malaria diagnostics market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central & South America (Brazil, Argentina, and Rest of Central and South America).

Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), will be the fastest growing segment in the malaria diagnostics market from 2021 to 2026. This is due to the increasing awareness regarding the use of malaria diagnostic devices.

Moreover, the North America (the United States, Canada, and Mexico) region is expected to be the largest shareholding segment in the malaria diagnostics market during the forecast period. The demand for malaria diagnostics in this region is predicted to rise due to presence of top diagnostic companies in countries such as the United States, Canada and Mexico, presence of large patient population, rising need for early diagnosis, and increased awareness concerning diagnostic methods.

Abbott Laboratories, Access Bio., Inc., Sysmex Partec GmbH, Premier Medical Corporation Pvt. Ltd., Beckman Coulter, Inc., bioMérieux, Leica Microsystems GmbH, Siemens Healthineers, Olympus Corporation, Nikon Corporation, Bio-Rad Laboratories, Inc. among others are the key players in the malaria diagnostics market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Malaria Diagnostics Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 End-User Overview

2.1.3 Technology Overview

2.1.4 Regional Overview

Chapter 3 Malaria Diagnostics Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 The rapidly increasing malaria cases in emerging economies

3.3.2 Industry Challenges

3.3.2.1 A lack of healthcare understanding is a major factor limiting the development

3.4 Prospective Growth Scenario

3.4.1 End-User Growth Scenario

3.4.2 Technology Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 End-User Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Malaria Diagnostics Market, By End-User

4.1 End-User Outlook

4.2 Hospital

4.2.1 Market Size, By Region, 2020-2026 (USD Million)

4.3 Clinics

4.3.1 Market Size, By Region, 2020-2026 (USD Million)

4.4 Diagnostic Center

4.4.1 Market Size, By Region, 2020-2026 (USD Million)

Chapter 5 Malaria Diagnostics Market, By Technology

5.1 Technology Outlook

5.2 Rapid Diagnostic Tests (RDTs)

5.2.1 Market Size, By Region, 2020-2026 (USD Million)

5.3 Microscopy

5.3.1 Market Size, By Region, 2020-2026 (USD Million)

5.4 Molecular Diagnostic Tests

5.4.1 Market Size, By Region, 2020-2026 (USD Million)

Chapter 6 Malaria Diagnostics Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2020-2026 (USD Million)

6.2.2 Market Size, By End-User, 2020-2026 (USD Million)

6.2.3 Market Size, By Technology, 2020-2026 (USD Million)

6.2.4 U.S.

6.2.4.1 Market Size, By End-User, 2020-2026 (USD Million)

6.2.4.2 Market Size, By Technology, 2020-2026 (USD Million)

6.2.5 Canada

6.2.5.1 Market Size, By End-User, 2020-2026 (USD Million)

6.2.5.2 Market Size, By Technology, 2020-2026 (USD Million)

6.3 Europe

6.3.1 Market Size, By Country 2020-2026 (USD Million)

6.3.2 Market Size, By End-User, 2020-2026 (USD Million)

6.3.3 Market Size, By Technology, 2020-2026 (USD Million)

6.3.4 Germany

6.3.4.1 Market Size, By End-User, 2020-2026 (USD Million)

6.3.4.2 Market Size, By Technology, 2020-2026 (USD Million)

6.3.5 UK

6.3.5.1 Market Size, By End-User, 2020-2026 (USD Million)

6.3.5.2 Market Size, By Technology, 2020-2026 (USD Million)

6.3.6 France

6.3.6.1 Market Size, By End-User, 2020-2026 (USD Million)

6.3.6.2 Market Size, By Technology, 2020-2026 (USD Million)

6.3.7 Italy

6.3.7.1 Market Size, By End-User, 2020-2026 (USD Million)

6.3.7.2 Market Size, By Technology, 2020-2026 (USD Million)

6.3.8 Spain

6.3.8.1 Market Size, By End-User, 2020-2026 (USD Million)

6.3.8.2 Market Size, By Technology, 2020-2026 (USD Million)

6.3.9 Russia

6.3.9.1 Market Size, By End-User, 2020-2026 (USD Million)

6.3.9.2 Market Size, By Technology, 2020-2026 (USD Million)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2020-2026 (USD Million)

6.4.2 Market Size, By End-User, 2020-2026 (USD Million)

6.4.3 Market Size, By Technology, 2020-2026 (USD Million)

6.4.4 China

6.4.4.1 Market Size, By End-User, 2020-2026 (USD Million)

6.4.4.2 Market Size, By Technology, 2020-2026 (USD Million)

6.4.5 India

6.4.5.1 Market Size, By End-User, 2020-2026 (USD Million)

6.4.5.2 Market Size, By Technology, 2020-2026 (USD Million)

6.4.6 Japan

6.4.6.1 Market Size, By End-User, 2020-2026 (USD Million)

6.4.6.2 Market Size, By Technology, 2020-2026 (USD Million)

6.4.7 Australia

6.4.7.1 Market Size, By End-User, 2020-2026 (USD Million)

6.4.7.2 Market size, By Technology, 2020-2026 (USD Million)

6.4.8 South Korea

6.4.8.1 Market Size, By End-User, 2020-2026 (USD Million)

6.4.8.2 Market Size, By Technology, 2020-2026 (USD Million)

6.5 Latin America

6.5.1 Market Size, By Country 2020-2026 (USD Million)

6.5.2 Market Size, By End-User, 2020-2026 (USD Million)

6.5.3 Market Size, By Technology, 2020-2026 (USD Million)

6.5.4 Brazil

6.5.4.1 Market Size, By End-User, 2020-2026 (USD Million)

6.5.4.2 Market Size, By Technology, 2020-2026 (USD Million)

6.5.5 Mexico

6.5.5.1 Market Size, By End-User, 2020-2026 (USD Million)

6.5.5.2 Market Size, By Technology, 2020-2026 (USD Million)

6.5.6 Argentina

6.5.6.1 Market Size, By End-User, 2020-2026 (USD Million)

6.5.6.2 Market Size, By Technology, 2020-2026 (USD Million)

6.6 MEA

6.6.1 Market Size, By Country 2020-2026 (USD Million)

6.6.2 Market Size, By End-User, 2020-2026 (USD Million)

6.6.3 Market Size, By Technology, 2020-2026 (USD Million)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By End-User, 2020-2026 (USD Million)

6.6.4.2 Market Size, By Technology, 2020-2026 (USD Million)

6.6.5 UAE

6.6.5.1 Market Size, By End-User, 2020-2026 (USD Million)

6.6.5.2 Market Size, By Technology, 2020-2026 (USD Million)

6.6.6 South Africa

6.6.6.1 Market Size, By End-User, 2020-2026 (USD Million)

6.6.6.2 Market Size, By Technology, 2020-2026 (USD Million)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 Abbott Laboratories

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Info Graphic Analysis

7.3 Access Bio., Inc

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Info Graphic Analysis

7.4 Sysmex Partec GmbH

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Info Graphic Analysis

7.5 Premier Medical Corporation Pvt. Ltd

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Info Graphic Analysis

7.6 Beckman Coulter, Inc

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 Info Graphic Analysis

7.7 Leica Microsystems GmbH

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info Graphic Analysis

7.8 Siemens Healthineers

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Info Graphic Analysis

7.9 Olympus Corporation

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Info Graphic Analysis

7.10 Other Companies

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Info Graphic Analysis

The Global Malaria Diagnostics Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Malaria Diagnostics Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS