Global Managed AI Infrastructure Market Size, Trends & Analysis - Forecasts to 2029 By Industry Vertical (Enterprises, Governments, and Cloud Service Providers), By Technology (Machine Learning and Deep Learning), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

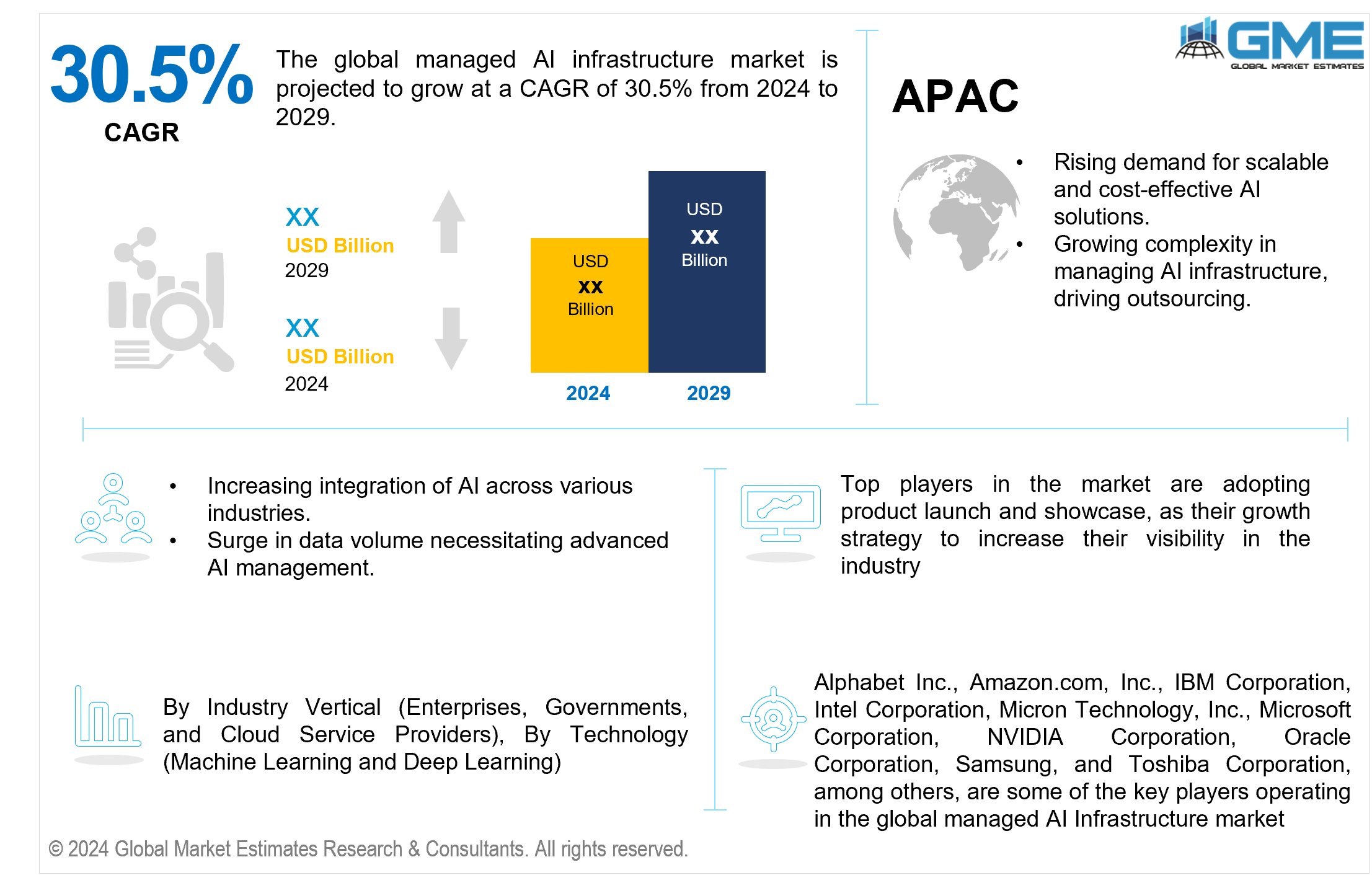

The global managed AI infrastructure market is projected to grow at a CAGR of 30.5% from 2024 to 2029.

Several factors are influencing the growth of the global managed AI infrastructure market. Businesses are increasingly using artificial intelligence (AI) to enhance their operations, which has increased the requirement for managed AI infrastructure services. This demand is driven by the complexity of AI applications, which raises the need for specialized infrastructure to cater to the processing demands of machine learning and deep learning algorithms. Managed AI infrastructure providers are crucial for lowering the complexity associated with the deployment, optimization, and scaling of AI workloads. The need for businesses to remain competitive in a world where artificial intelligence is changing everything is one of the primary drivers. As more companies become aware of how artificial intelligence (AI) may improve productivity, creativity, and decision-making, managed services that ensure the seamless integration of AI infrastructure become crucial. The market is also being driven by the increasing amount of data being produced across sectors, which is driving the need for scalable and dependable AI infrastructure solutions. In addition, industry players are using strategic acquisitions to increase the scope of their operations and customer base. For instance, in January 2022, Oracle Corporation announced that it had acquired Federos, a company that offers services related to machine learning and artificial intelligence.

The advancement of cloud computing has also been a major factor in the creation of regulated AI infrastructure. Cloud-based AI services offer businesses the flexibility, scalability, and accessibility to utilize AI capabilities without the burden of maintaining a substantial amount of in-house technology. Managed AI infrastructure services, whether on-premises or in the cloud, provide a comprehensive approach to implementing AI, taking care of data management, security, and compliance issues in addition to hardware.

Furthermore, as people become more aware of the environmental effects of AI infrastructure, sustainability is receiving more attention. By gradually incorporating eco-friendly solutions, managed AI infrastructure firms are addressing concerns about energy consumption and carbon impact. This commitment to environmentally friendly practices is in line with the broader trend toward the responsible use of artificial intelligence.

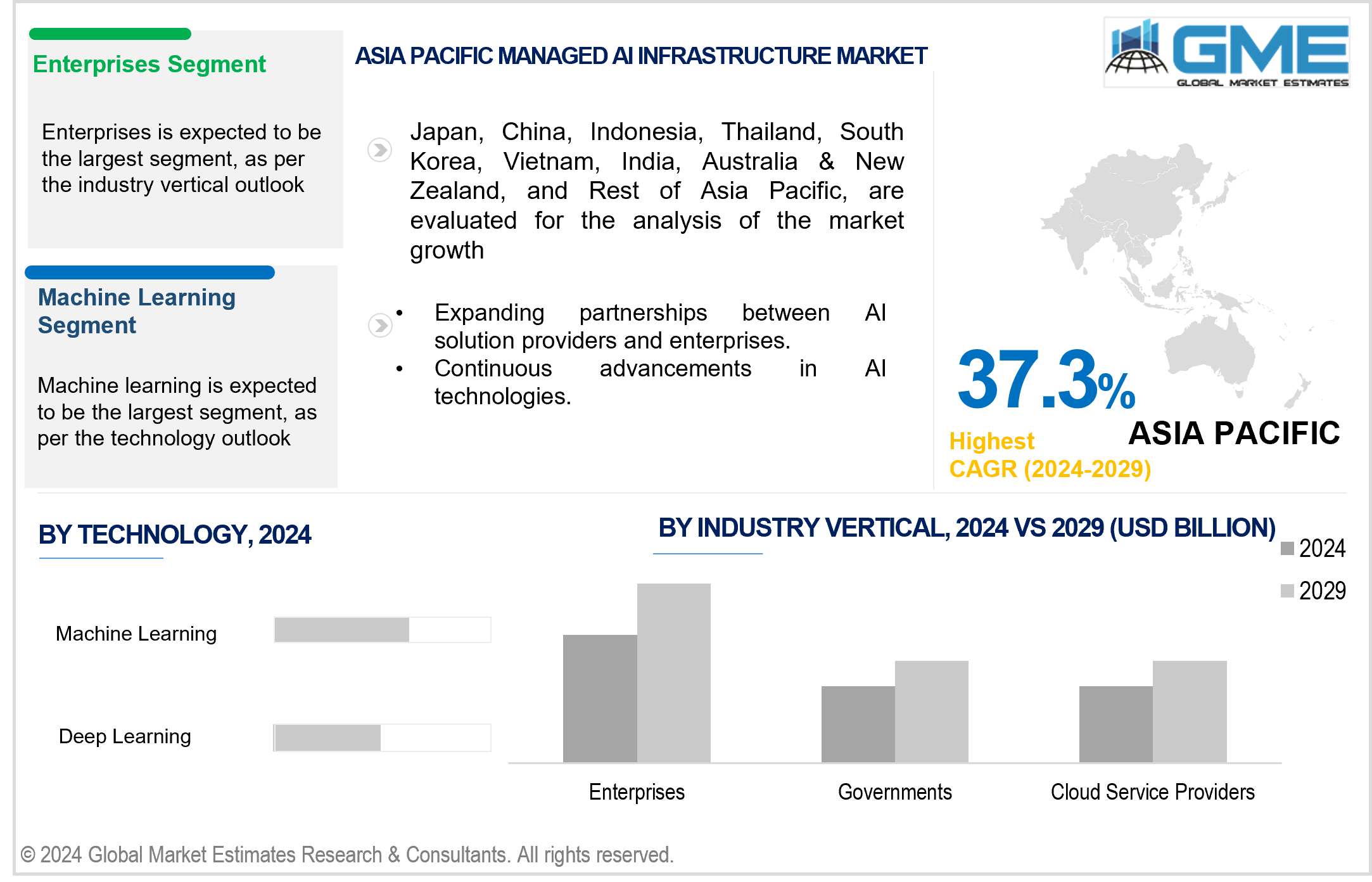

Within the global generative AI automation market, machine learning technology is analyzed to be the largest segment over the forecast period. Algorithms for machine learning, which can autonomously improve performance and adjust to changing conditions, are essential. These algorithms make it easier to generate automation codes and solutions accurately and effectively. Machine learning is becoming increasingly important as companies incorporate generative AI into their operations. This is because machine learning enables complex and flexible automation processes in various industries. This dominance reflects how crucial machine learning has been in determining how generative AI automation has developed.

The deep learning technology segment is analyzed to be the fastest-growing segment in the managed AI infrastructure market. The deep learning solutions market is growing rapidly due to the increased demand for sophisticated analytics and complex data processing capabilities. Organizations looking to leverage artificial intelligence are prioritizing deep learning algorithms due to their capacity to self-learn complex patterns and representations. This increase highlights deep learning has crucial role in directing the managed AI infrastructure market's growth trajectory and demonstrates its prominence in influencing the market for AI-driven products and services.

The enterprises segment is expected to account for the largest market share within the global managed AI infrastructure market during the forecast period. This dominance is attributed to businesses realizing the strategic benefits of using AI technologies. Businesses in various sectors are significantly investing in managed AI infrastructure to improve operational effectiveness, obtain insightful knowledge, and maintain their competitiveness in the quickly changing business environment. The growing demand from businesses highlights the critical role managed AI infrastructure plays in enabling corporations to fully utilize AI to achieve game-changing business results.

The cloud service providers segment is anticipated to the fastest-growing segment in the global managed AI infrastructure market. Cloud service providers are increasingly using AI technology to satisfy their customers' changing needs, which is driving this rise. These suppliers deliberately incorporate managed AI infrastructure solutions to provide enterprises with scalable, effective, and high-performance AI capabilities. The increase in demand is indicative of the critical role cloud service providers have played in promoting innovation, expanding access to cutting-edge AI tools, and accelerating the potential of AI to disrupt a wide range of industries.

North America is expected to be the largest region in the global market for managed AI infrastructure. Numerous variables, such as the strong presence of major industry players, significant investments in AI technology, and an established IT infrastructure, are responsible for the region's dominance. North America's leadership in the managed AI infrastructure market is also a result of the proactive adoption of AI solutions across a range of industries, a supportive legislative framework, and a well-established ecosystem for technological breakthroughs. The region is still experiencing steady growth, fueled by a focus on utilizing AI to improve company processes and spur innovation.

Asia Pacific is anticipated to be the fastest-growing region in the global market for managed AI infrastructure. The growing demand for sophisticated AI solutions, rising investments in digital transformation, and growing awareness of the revolutionary potential of AI technologies are driving the region's accelerated growth. The rising emphasis on efficiency and innovation by organizations in Asia Pacific is anticipated to significantly increase the use of managed AI infrastructure. A growing population that is tech-savvy, encouraging government efforts, and a thriving startup ecosystem all play a part in the region's status as a central hub for the creation of managed AI infrastructure.

Alphabet Inc., Amazon.com, Inc., IBM Corporation, Intel Corporation, Micron Technology, Inc., Microsoft Corporation, NVIDIA Corporation, Oracle Corporation, Samsung, and Toshiba Corporation, among others, are some of the key players operating in the global managed AI infrastructure market.

Please note: This is not an exhaustive list of companies profiled in the report.

In March 2024, Amazon Web Services (AWS) announced that AI safety and research company Anthropic’s Claude 3 family of state-of-the-art models, known for industry-leading accuracy, performance, speed, and cost-effectiveness, was available on Amazon Bedrock. This enhancement aimed to empower customers of all sizes to swiftly test, build, and deploy generative artificial intelligence (AI) applications across their organizations.

In February 2024, Wipro Limited announced the launch of the Wipro Enterprise Artificial Intelligence (AI)-Ready Platform. This service was introduced to enable clients to establish their enterprise-level, fully integrated, and customized AI environments.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Industry Vertical Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL MANAGED AI INFRASTRUCTURE MARKET, BY INDUSTRY VERTICAL

4.1 Introduction

4.2 Managed AI Infrastructure Market: Industry Vertical Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Enterprises

4.4.1 Enterprises Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 Governments

4.5.1 Governments Market Estimates and Forecast, 2021-2029 (USD Million)

4.6 Cloud Service Providers

4.6.1 Cloud Service Providers Market Estimates and Forecast, 2021-2029 (USD Million)

5 GLOBAL MANAGED AI INFRASTRUCTURE MARKET, BY TECHNOLOGY

5.1 Introduction

5.2 Managed AI Infrastructure Market: Technology Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 Machine Learning

5.4.1 Machine Learning Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 Deep Learning

5.5.1 Deep Learning Market Estimates and Forecast, 2021-2029 (USD Million)

6 GLOBAL MANAGED AI INFRASTRUCTURE MARKET, BY REGION

6.1 Introduction

6.2 North America Managed AI Infrastructure Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.1 By Industry Vertical

6.2.2 By Technology

6.2.3 By Country

6.2.3.1 U.S. Managed AI Infrastructure Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.1.1 By Industry Vertical

6.2.3.1.2 By Technology

6.2.3.2 Canada Managed AI Infrastructure Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.2.1 By Industry Vertical

6.2.3.2.2 By Technology

6.2.3.3 Mexico Managed AI Infrastructure Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.3.1 By Industry Vertical

6.2.3.3.2 By Technology

6.3 Europe Managed AI Infrastructure Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.1 By Industry Vertical

6.3.2 By Technology

6.3.3 By Country

6.3.3.1 Germany Managed AI Infrastructure Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.1.1 By Industry Vertical

6.3.3.1.2 By Technology

6.3.3.2 U.K. Managed AI Infrastructure Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.2.1 By Industry Vertical

6.3.3.2.2 By Technology

6.3.3.3 France Managed AI Infrastructure Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.3.1 By Industry Vertical

6.3.3.3.2 By Technology

6.3.3.4 Italy Managed AI Infrastructure Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.4.1 By Industry Vertical

6.3.3.4.2 By Technology

6.3.3.5 Spain Managed AI Infrastructure Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.5.1 By Industry Vertical

6.3.3.5.2 By Technology

6.3.3.6 Netherlands Managed AI Infrastructure Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.6.1 By Industry Vertical

6.3.3.6.2 By Technology

6.3.3.7 Rest of Europe Managed AI Infrastructure Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.6.1 By Industry Vertical

6.3.3.6.2 By Technology

6.4 Asia Pacific Managed AI Infrastructure Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.1 By Industry Vertical

6.4.2 By Technology

6.4.3 By Country

6.4.3.1 China Managed AI Infrastructure Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.1.1 By Industry Vertical

6.4.3.1.2 By Technology

6.4.3.2 Japan Managed AI Infrastructure Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.2.1 By Industry Vertical

6.4.3.2.2 By Technology

6.4.3.3 India Managed AI Infrastructure Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.3.1 By Industry Vertical

6.4.3.3.2 By Technology

6.4.3.4 South Korea Managed AI Infrastructure Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.4.1 By Industry Vertical

6.4.3.4.2 By Technology

6.4.3.5 Singapore Managed AI Infrastructure Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.5.1 By Industry Vertical

6.4.3.5.2 By Technology

6.4.3.6 Malaysia Managed AI Infrastructure Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.6.1 By Industry Vertical

6.4.3.6.2 By Technology

6.4.3.7 Thailand Managed AI Infrastructure Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.6.1 By Industry Vertical

6.4.3.6.2 By Technology

6.4.3.8 Indonesia Managed AI Infrastructure Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.7.1 By Industry Vertical

6.4.3.7.2 By Technology

6.4.3.9 Vietnam Managed AI Infrastructure Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.8.1 By Industry Vertical

6.4.3.8.2 By Technology

6.4.3.10 Taiwan Managed AI Infrastructure Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.10.1 By Industry Vertical

6.4.3.10.2 By Technology

6.4.3.11 Rest of Asia Pacific Managed AI Infrastructure Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.11.1 By Industry Vertical

6.4.3.11.2 By Technology

6.5 Middle East and Africa Managed AI Infrastructure Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.1 By Industry Vertical

6.5.2 By Technology

6.5.3 By Country

6.5.3.1 Saudi Arabia Managed AI Infrastructure Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.1.1 By Industry Vertical

6.5.3.1.2 By Technology

6.5.3.2 U.A.E. Managed AI Infrastructure Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.2.1 By Industry Vertical

6.5.3.2.2 By Technology

6.5.3.3 Israel Managed AI Infrastructure Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.3.1 By Industry Vertical

6.5.3.3.2 By Technology

6.5.3.4 South Africa Managed AI Infrastructure Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.4.1 By Industry Vertical

6.5.3.4.2 By Technology

6.5.3.5 Rest of Middle East and Africa Managed AI Infrastructure Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.5.1 By Industry Vertical

6.5.3.5.2 By Technology

6.6 Central and South America Managed AI Infrastructure Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.1 By Industry Vertical

6.6.2 By Technology

6.6.3 By Country

6.6.3.1 Brazil Managed AI Infrastructure Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.1.1 By Industry Vertical

6.6.3.1.2 By Technology

6.6.3.2 Argentina Managed AI Infrastructure Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.2.1 By Industry Vertical

6.6.3.2.2 By Technology

6.6.3.3 Chile Managed AI Infrastructure Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.3.1 By Industry Vertical

6.6.3.3.2 By Technology

6.6.3.3 Rest of Central and South America Managed AI Infrastructure Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.3.1 By Industry Vertical

6.6.3.3.2 By Technology

7 COMPETITIVE LANDCAPE

7.1 Company Market Share Analysis

7.2 Four Quadrant Positioning Matrix

7.2.1 Market Leaders

7.2.2 Market Visionaries

7.2.3 Market Challengers

7.2.4 Niche Market Players

7.3 Vendor Landscape

7.3.1 North America

7.3.2 Europe

7.3.3 Asia Pacific

7.3.4 Rest of the World

7.4 Company Profiles

7.4.1 IBM

7.4.1.1 Business Description & Financial Analysis

7.4.1.2 SWOT Analysis

7.4.1.3 Products & Services Offered

7.4.1.4 Strategic Alliances between Business Partners

7.4.2 Microsoft

7.4.2.1 Business Description & Financial Analysis

7.4.2.2 SWOT Analysis

7.4.2.3 Products & Services Offered

7.4.2.4 Strategic Alliances between Business Partners

7.4.3 Alphabet Inc.

7.4.3.1 Business Description & Financial Analysis

7.4.3.2 SWOT Analysis

7.4.3.3 Products & Services Offered

7.4.3.4 Strategic Alliances between Business Partners

7.4.4 Amazon.com, Inc.

7.4.4.1 Business Description & Financial Analysis

7.4.4.2 SWOT Analysis

7.4.4.3 Products & Services Offered

7.4.4.4 Strategic Alliances between Business Partners

7.4.5 Intel Corporation

7.4.5.1 Business Description & Financial Analysis

7.4.5.2 SWOT Analysis

7.4.5.3 Products & Services Offered

7.4.5.4 Strategic Alliances between Business Partners

7.4.6 Micron Technology

7.4.6.1 Business Description & Financial Analysis

7.4.6.2 SWOT Analysis

7.4.6.3 Products & Services Offered

7.4.6.4 Strategic Alliances between Business Partners

7.4.7 NVIDIA Corporation

7.4.7.1 Business Description & Financial Analysis

7.4.7.2 SWOT Analysis

7.4.7.3 Products & Services Offered

7.4.7.4 Strategic Alliances between Business Partners

7.4.8 Oracle Corporation

7.4.8.1 Business Description & Financial Analysis

7.4.8.2 SWOT Analysis

7.4.8.3 Products & Services Offered

7.4.8.4 Strategic Alliances between Business Partners

7.4.9 Samsung

7.4.9.1 Business Description & Financial Analysis

7.4.9.2 SWOT Analysis

7.4.9.3 Products & Services Offered

7.4.9.4 Strategic Alliances between Business Partners

7.4.10 Toshiba Corporation

7.4.10.1 Business Description & Financial Analysis

7.4.10.2 SWOT Analysis

7.4.10.3 Products & Services Offered

7.4.10.4 Strategic Alliances between Business Partners

7.4.11 Other Companies

7.4.11.1 Business Description & Financial Analysis

7.4.11.2 SWOT Analysis

7.4.11.3 Products & Services Offered

7.4.11.4 Strategic Alliances between Business Partners

8 RESEARCH METHODOLOGY

8.1 Market Introduction

8.1.1 Market Definition

8.1.2 Market Scope & Segmentation

8.2 Information Procurement

8.2.1 Secondary Research

8.2.1.1 Purchased Databases

8.2.1.2 GMEs Internal Data Repository

8.2.1.3 Secondary Resources & Third Party Perspectives

8.2.1.4 Company Information Sources

8.2.2 Primary Research

8.2.2.1 Various Types of Respondents for Primary Interviews

8.2.2.2 Number of Interviews Conducted throughout the Research Process

8.2.2.3 Primary Stakeholders

8.2.2.4 Discussion Guide for Primary Participants

8.2.3 Expert Panels

8.2.3.1 Expert Panels Across 30+ Industry

8.2.4 Paid Local Experts

8.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

8.3 Market Estimation

8.3.1 Top-Down Approach

8.3.1.1 Macro-Economic Indicators Considered

8.3.1.2 Micro-Economic Indicators Considered

8.3.2 Bottom Up Approach

8.3.2.1 Company Share Analysis Approach

8.3.2.2 Estimation of Potential Product Sales

8.4 Data Triangulation

8.4.1 Data Collection

8.4.2 Time Series, Cross Sectional & Panel Data Analysis

8.4.3 Cluster Analysis

8.5 Analysis and Output

8.5.1 Inhouse AI Based Real Time Analytics Tool

8.5.2 Output From Desk & Primary Research

8.6 Research Assumptions & Limitations

8.6.1 Research Assumptions

8.6.2 Research Limitations

LIST OF TABLES

1 Global Managed AI Infrastructure Market, By Industry Vertical, 2021-2029 (USD Mllion)

2 Enterprises Market, By Region, 2021-2029 (USD Mllion)

3 Governments Market, By Region, 2021-2029 (USD Mllion)

4 Finance Market, By Region, 2021-2029 (USD Mllion)

5 Cloud Service Providers Market, By Region, 2021-2029 (USD Mllion)

6 Global Managed AI Infrastructure Market, By Technology, 2021-2029 (USD Mllion)

7 Machine Learning Market, By Region, 2021-2029 (USD Mllion)

8 Deep Learning Market, By Region, 2021-2029 (USD Mllion)

9 Regional Analysis, 2021-2029 (USD Mllion)

10 North America Managed AI Infrastructure Market, By Industry Vertical, 2021-2029 (USD Mllion)

11 North America Managed AI Infrastructure Market, By Technology, 2021-2029 (USD Mllion)

12 North America Managed AI Infrastructure Market, By COUNTRY, 2021-2029 (USD Mllion)

13 U.S. Managed AI Infrastructure Market, By Industry Vertical, 2021-2029 (USD Mllion)

14 U.S. Managed AI Infrastructure Market, By Technology, 2021-2029 (USD Mllion)

15 Canada Managed AI Infrastructure Market, By Industry Vertical, 2021-2029 (USD Mllion)

16 Canada Managed AI Infrastructure Market, By Technology, 2021-2029 (USD Mllion)

17 Mexico Managed AI Infrastructure Market, By Industry Vertical, 2021-2029 (USD Mllion)

18 Mexico Managed AI Infrastructure Market, By Technology, 2021-2029 (USD Mllion)

19 Europe Managed AI Infrastructure Market, By Industry Vertical, 2021-2029 (USD Mllion)

20 Europe Managed AI Infrastructure Market, By Technology, 2021-2029 (USD Mllion)

21 Europe Managed AI Infrastructure Market, By Country, 2021-2029 (USD Mllion)

22 Germany Managed AI Infrastructure Market, By Industry Vertical, 2021-2029 (USD Mllion)

23 Germany Managed AI Infrastructure Market, By Technology, 2021-2029 (USD Mllion)

24 U.K. Managed AI Infrastructure Market, By Industry Vertical, 2021-2029 (USD Mllion)

25 U.K. Managed AI Infrastructure Market, By Technology, 2021-2029 (USD Mllion)

26 France Managed AI Infrastructure Market, By Industry Vertical, 2021-2029 (USD Mllion)

27 France Managed AI Infrastructure Market, By Technology, 2021-2029 (USD Mllion)

28 Italy Managed AI Infrastructure Market, By Industry Vertical, 2021-2029 (USD Mllion)

29 Italy Managed AI Infrastructure Market, By Technology, 2021-2029 (USD Mllion)

30 Spain Managed AI Infrastructure Market, By Industry Vertical, 2021-2029 (USD Mllion)

31 Spain Managed AI Infrastructure Market, By Technology, 2021-2029 (USD Mllion)

32 Netherlands Managed AI Infrastructure Market, By Industry Vertical, 2021-2029 (USD Mllion)

33 Netherlands Managed AI Infrastructure Market, By Technology, 2021-2029 (USD Mllion)

34 Rest Of Europe Managed AI Infrastructure Market, By Industry Vertical, 2021-2029 (USD Mllion)

35 Rest Of Europe Managed AI Infrastructure Market, By Technology, 2021-2029 (USD Mllion)

36 Asia Pacific Managed AI Infrastructure Market, By Industry Vertical, 2021-2029 (USD Mllion)

37 Asia Pacific Managed AI Infrastructure Market, By Technology, 2021-2029 (USD Mllion)

38 Asia Pacific Managed AI Infrastructure Market, By Country, 2021-2029 (USD Mllion)

39 China Managed AI Infrastructure Market, By Industry Vertical, 2021-2029 (USD Mllion)

40 China Managed AI Infrastructure Market, By Technology, 2021-2029 (USD Mllion)

41 Japan Managed AI Infrastructure Market, By Industry Vertical, 2021-2029 (USD Mllion)

42 Japan Managed AI Infrastructure Market, By Technology, 2021-2029 (USD Mllion)

43 India Managed AI Infrastructure Market, By Industry Vertical, 2021-2029 (USD Mllion)

44 India Managed AI Infrastructure Market, By Technology, 2021-2029 (USD Mllion)

45 South Korea Managed AI Infrastructure Market, By Industry Vertical, 2021-2029 (USD Mllion)

46 South Korea Managed AI Infrastructure Market, By Technology, 2021-2029 (USD Mllion)

47 Singapore Managed AI Infrastructure Market, By Industry Vertical, 2021-2029 (USD Mllion)

48 Singapore Managed AI Infrastructure Market, By Technology, 2021-2029 (USD Mllion)

49 Thailand Managed AI Infrastructure Market, By Industry Vertical, 2021-2029 (USD Mllion)

50 Thailand Managed AI Infrastructure Market, By Technology, 2021-2029 (USD Mllion)

51 Malaysia Managed AI Infrastructure Market, By Industry Vertical, 2021-2029 (USD Mllion)

52 Malaysia Managed AI Infrastructure Market, By Technology, 2021-2029 (USD Mllion)

53 Indonesia Managed AI Infrastructure Market, By Industry Vertical, 2021-2029 (USD Mllion)

54 Indonesia Managed AI Infrastructure Market, By Technology, 2021-2029 (USD Mllion)

55 Vietnam Managed AI Infrastructure Market, By Industry Vertical, 2021-2029 (USD Mllion)

56 Vietnam Managed AI Infrastructure Market, By Technology, 2021-2029 (USD Mllion)

57 Taiwan Managed AI Infrastructure Market, By Industry Vertical, 2021-2029 (USD Mllion)

58 Taiwan Managed AI Infrastructure Market, By Technology, 2021-2029 (USD Mllion)

59 Rest of APAC Managed AI Infrastructure Market, By Industry Vertical, 2021-2029 (USD Mllion)

60 Rest of APAC Managed AI Infrastructure Market, By Technology, 2021-2029 (USD Mllion)

61 Middle East and Africa Managed AI Infrastructure Market, By Industry Vertical, 2021-2029 (USD Mllion)

62 Middle East and Africa Managed AI Infrastructure Market, By Technology, 2021-2029 (USD Mllion)

63 Middle East and Africa Managed AI Infrastructure Market, By Country, 2021-2029 (USD Mllion)

64 Saudi Arabia Managed AI Infrastructure Market, By Industry Vertical, 2021-2029 (USD Mllion)

65 Saudi Arabia Managed AI Infrastructure Market, By Technology, 2021-2029 (USD Mllion)

66 UAE Managed AI Infrastructure Market, By Industry Vertical, 2021-2029 (USD Mllion)

67 UAE Managed AI Infrastructure Market, By Technology, 2021-2029 (USD Mllion)

68 Israel Managed AI Infrastructure Market, By Industry Vertical, 2021-2029 (USD Mllion)

69 Israel Managed AI Infrastructure Market, By Technology, 2021-2029 (USD Mllion)

70 South Africa Managed AI Infrastructure Market, By Industry Vertical, 2021-2029 (USD Mllion)

71 South Africa Managed AI Infrastructure Market, By Technology, 2021-2029 (USD Mllion)

72 Rest Of Middle East and Africa Managed AI Infrastructure Market, By Industry Vertical, 2021-2029 (USD Mllion)

73 Rest Of Middle East and Africa Managed AI Infrastructure Market, By Technology, 2021-2029 (USD Mllion)

74 Central and South America Managed AI Infrastructure Market, By Industry Vertical, 2021-2029 (USD Mllion)

75 Central and South America Managed AI Infrastructure Market, By Technology, 2021-2029 (USD Mllion)

76 Central and South America Managed AI Infrastructure Market, By Country, 2021-2029 (USD Mllion)

77 Brazil Managed AI Infrastructure Market, By Industry Vertical, 2021-2029 (USD Mllion)

78 Brazil Managed AI Infrastructure Market, By Technology, 2021-2029 (USD Mllion)

79 Chile Managed AI Infrastructure Market, By Industry Vertical, 2021-2029 (USD Mllion)

80 Chile Managed AI Infrastructure Market, By Technology, 2021-2029 (USD Mllion)

81 Argentina Managed AI Infrastructure Market, By Industry Vertical, 2021-2029 (USD Mllion)

82 Argentina Managed AI Infrastructure Market, By Technology, 2021-2029 (USD Mllion)

83 Rest Of Central and South America Managed AI Infrastructure Market, By Industry Vertical, 2021-2029 (USD Mllion)

84 Rest Of Central and South America Managed AI Infrastructure Market, By Technology, 2021-2029 (USD Mllion)

85 IBM: Products & Services Offering

86 Microsoft: Products & Services Offering

87 Alphabet Inc.: Products & Services Offering

88 Amazon.com, Inc.: Products & Services Offering

89 Intel Corporation: Products & Services Offering

90 WASTE4CHANGE: Products & Services Offering

91 NVIDIA Corporation : Products & Services Offering

92 Oracle Corporation: Products & Services Offering

93 Samsung: Products & Services Offering

94 Toshiba Corporation: Products & Services Offering

95 other companies: Products & Services Offering

LIST OF FIGURES

1 Global Managed AI Infrastructure Market Overview

2 Global Managed AI Infrastructure Market Value From 2021-2029 (USD Mllion)

3 Global Managed AI Infrastructure Market Share, By Industry Vertical (2023)

4 Global Managed AI Infrastructure Market Share, By Technology (2023)

5 Global Managed AI Infrastructure Market, By Region (Asia Pacific Market)

6 Technological Trends In Global Managed AI Infrastructure Market

7 Four Quadrant Competitor Positioning Matrix

8 Impact Of Macro & Micro Indicators On The Market

9 Impact Of Key Drivers On The Global Managed AI Infrastructure Market

10 Impact Of Challenges On The Global Managed AI Infrastructure Market

11 Porter’s Five Forces Analysis

12 Global Managed AI Infrastructure Market: By Industry Vertical Scope Key Takeaways

13 Global Managed AI Infrastructure Market, By Industry Vertical Segment: Revenue Growth Analysis

14 Enterprises Market, By Region, 2021-2029 (USD Mllion)

15 Governments Market, By Region, 2021-2029 (USD Mllion)

16 Cloud Service Providers Market, By Region, 2021-2029 (USD Mllion)

17 Finance Market, By Region, 2021-2029 (USD Mllion)

18 Global Managed AI Infrastructure Market: By Technology Scope Key Takeaways

19 Global Managed AI Infrastructure Market, By Technology Segment: Revenue Growth Analysis

20 Machine Learning Market, By Region, 2021-2029 (USD Mllion)

21 Deep Learning Market, By Region, 2021-2029 (USD Mllion)

22 Regional Segment: Revenue Growth Analysis

23 Global Managed AI Infrastructure Market: Regional Analysis

24 North America Managed AI Infrastructure Market Overview

25 North America Managed AI Infrastructure Market, By Industry Vertical

26 North America Managed AI Infrastructure Market, By Technology

27 North America Managed AI Infrastructure Market, By Country

28 U.S. Managed AI Infrastructure Market, By Industry Vertical

29 U.S. Managed AI Infrastructure Market, By Technology

30 Canada Managed AI Infrastructure Market, By Industry Vertical

31 Canada Managed AI Infrastructure Market, By Technology

32 Mexico Managed AI Infrastructure Market, By Industry Vertical

33 Mexico Managed AI Infrastructure Market, By Technology

34 Four Quadrant Positioning Matrix

35 Company Market Share Analysis

36 IBM: Company Snapshot

37 IBM: SWOT Analysis

38 IBM: Geographic Presence

39 Microsoft: Company Snapshot

40 Microsoft: SWOT Analysis

41 Microsoft: Geographic Presence

42 Alphabet Inc.: Company Snapshot

43 Alphabet Inc.: SWOT Analysis

44 Alphabet Inc.: Geographic Presence

45 Amazon.com, Inc.: Company Snapshot

46 Amazon.com, Inc.: Swot Analysis

47 Amazon.com, Inc.: Geographic Presence

48 Intel Corporation: Company Snapshot

49 Intel Corporation: SWOT Analysis

50 Intel Corporation: Geographic Presence

51 Micron Technology: Company Snapshot

52 Micron Technology: SWOT Analysis

53 Micron Technology: Geographic Presence

54 NVIDIA Corporation : Company Snapshot

55 NVIDIA Corporation : SWOT Analysis

56 NVIDIA Corporation : Geographic Presence

57 Oracle Corporation: Company Snapshot

58 Oracle Corporation: SWOT Analysis

59 Oracle Corporation: Geographic Presence

60 Samsung: Company Snapshot

61 Samsung: SWOT Analysis

62 Samsung: Geographic Presence

63 Toshiba Corporation: Company Snapshot

64 Toshiba Corporation: SWOT Analysis

65 Toshiba Corporation: Geographic Presence

66 Other Companies: Company Snapshot

67 Other Companies: SWOT Analysis

68 Other Companies: Geographic Presence

The Global Managed AI Infrastructure Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Managed AI Infrastructure Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS