Global Medical Footwear Market Size, Trends, and Analysis - Forecasts to 2026 End-use (Men, Women), By Distribution Channel (Offline, Online), Competitive Landscape, Company Market Share Analysis, and Competitor Analysis; By Region (North America, Europe, Asia Pacific, MEA, and CSA); End-User Landscape, Company Market Share Analysis & Competitor Analysis

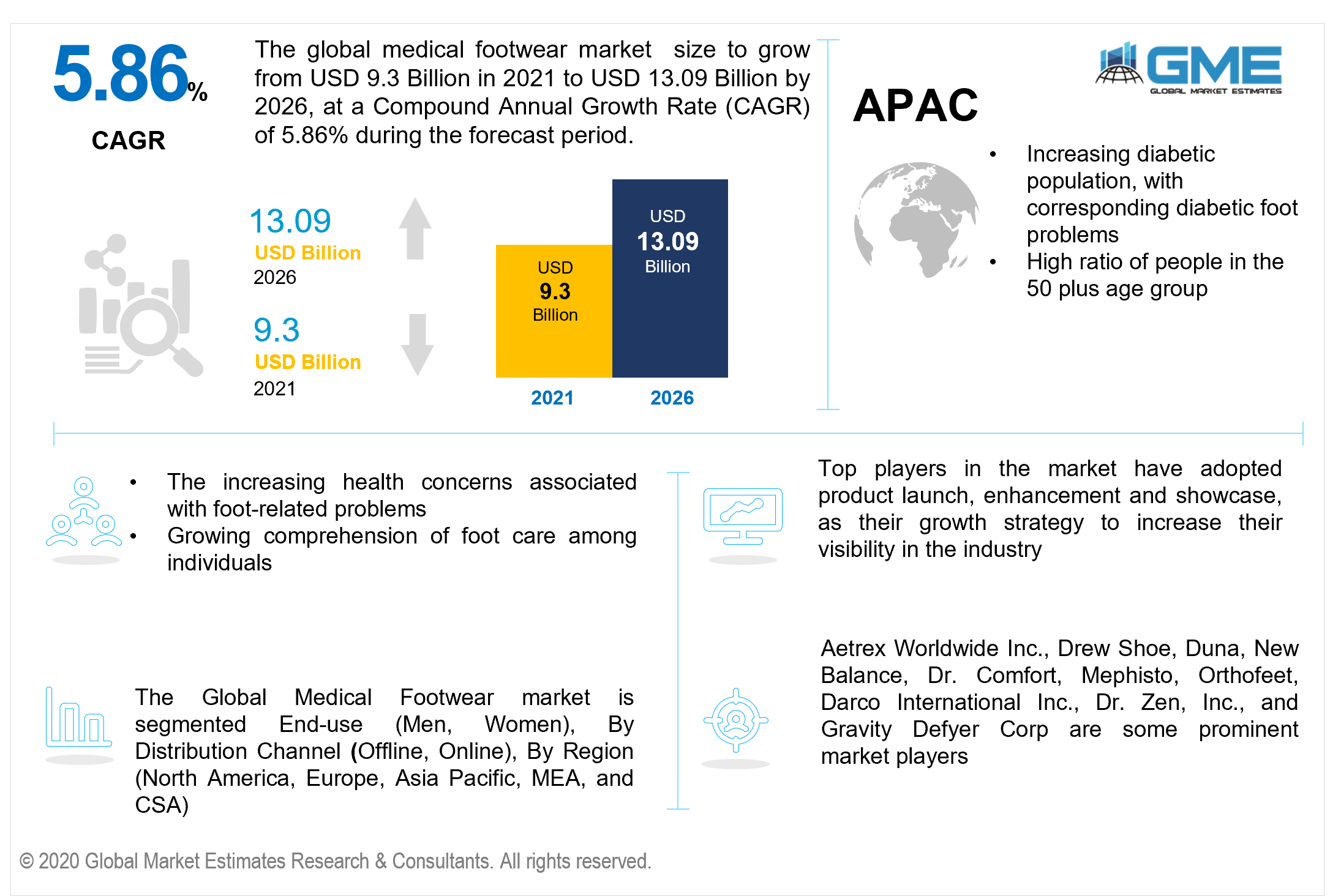

The medical footwear market is estimated to be valued at USD 9.3 billion in 2021 and is projected to reach USD 13.09 billion by 2026 at a CAGR of 5.86%. Consumers utilization of medical footwear has increased as a result of surging health concerns associated with foot-related problems. The numerous benefits of such footwear over conventional footwear are assumed to drive up demand for this footwear in the long run.

Furthermore, rising regular exercise practices have boosted the market for medical shoes as a result of wellness issues. As a consequence, the market is foreseen to grow at a faster rate in the coming years. Researchers have devised distinctive shoes to address a variety of health problems associated with the improvement of scientific research and technological advancements. Moreover, expanded comprehension of foot care among individuals associated with limiting joint mobility, enhancing leg flexibility, and curbing discomfort has boosted the adoption of such footwear, which benefits the medical footwear brand.

The American Podiatric Medical Association (APMA) conducted surveys all across the USA to understand the foot-related issues faced by people. The most common behavior that was observed among the people under the study was a lack of adequate attention given to foot care. It was observed that 77% of adults reported facing some foot-related issues. These foot-related problems range from heel pain or plantar fasciitis to pain in the ball of the feet, bunions, bone spurs, tendinitis, stress fractures, hammertoes, pinched nerve, and arthritis. People under this survey also increasingly reported other issues that can be the reason for foot pain, like weight issues, improperly fitting heels or shoes, excessive heel wear, sprains, some accidents with impact or trauma on feet.

Studies have also shown 83% of people report basic foot pain due to exertion, and 51% of people reported restraints in carrying out regular activities due to severe foot-related issues. Improper care or lack of immediate actions taken for foot-related issues can cause discomfort in regular walking, heel pain if standing for an extended period, exercising, and can also cause disturbance and create discomfort while sleeping. These reported foot-related issues can be extensively solved by using this type of footwear specifically designed for such medical issues. Usually, orthopedic doctors suggest this footwear when a patient is found to have flat foot problems, arthritis, diabetes, or plantar fasciitis. This footwear provides support for the feet, decreases the discomfort caused over time due to these foot-related issues, and makes mobility easy.

It is observed that patients with diagnosed diabetes have a problem called sensory diabetic neuropathy, which causes severe nerve damage and results in severe pain in the feet while walking or excessive standing. This issue is mainly observed among people in the 40 to 60 years of age group, where the first and foremost solution suggested by professionals to reduce the discomfort is to use such footwear regularly. Besides the problem of diabetes, approximately 63% of elderly people report having the issue of arthritis and pain in the ankle joints. This joint pain problem and distress in walking can be reduced by making the patients aware of such kinds of footwear availability.

Medical footwear or orthopedic shoes enable the patients to experience easy movement and improve blood circulation in all the nerves present in the foot area. Surveys have shown that a person every day approximately takes 10,000 steps, and considering this fact, people using inappropriate footwear and ill-fitting shoes in their daily lives can cause severe discomfort issues and problems. Investments in high-quality footwear with an appropriate and correct fit for regular use are the best option or solution for these issues.

Besides these mentioned issues, selective groups of people with their professions in running, advanced hiking, and adventurous sports, sports enthusiasts, athletics, and military services have to face rigorous training that can cause strain and trauma to feet, heels, and ankles. Thus, footwear manufacturers have brought in athletic and walking shoes to facilitate these specific requirements, reducing distress and providing easy and comfortable movements. Many people decades ago reported being embarrassed using such footwear due to their unpleasant style and look. However, today's manufacturers, incorporating new fashion trends and styles into such footwear, have encouraged people to adapt themselves to using them regularly.

The manufacturers have introduced innovations like orthopedic boots, sandals, clogs, therapeutic slippers, and many more. With their awareness programs, the medical departments and other healthcare organizations have increased their knowledge regarding such footwear benefits. Studies have reported that 90% of diabetic patients with foot-related issues indeed have complete education and awareness regarding medical footwear usage.

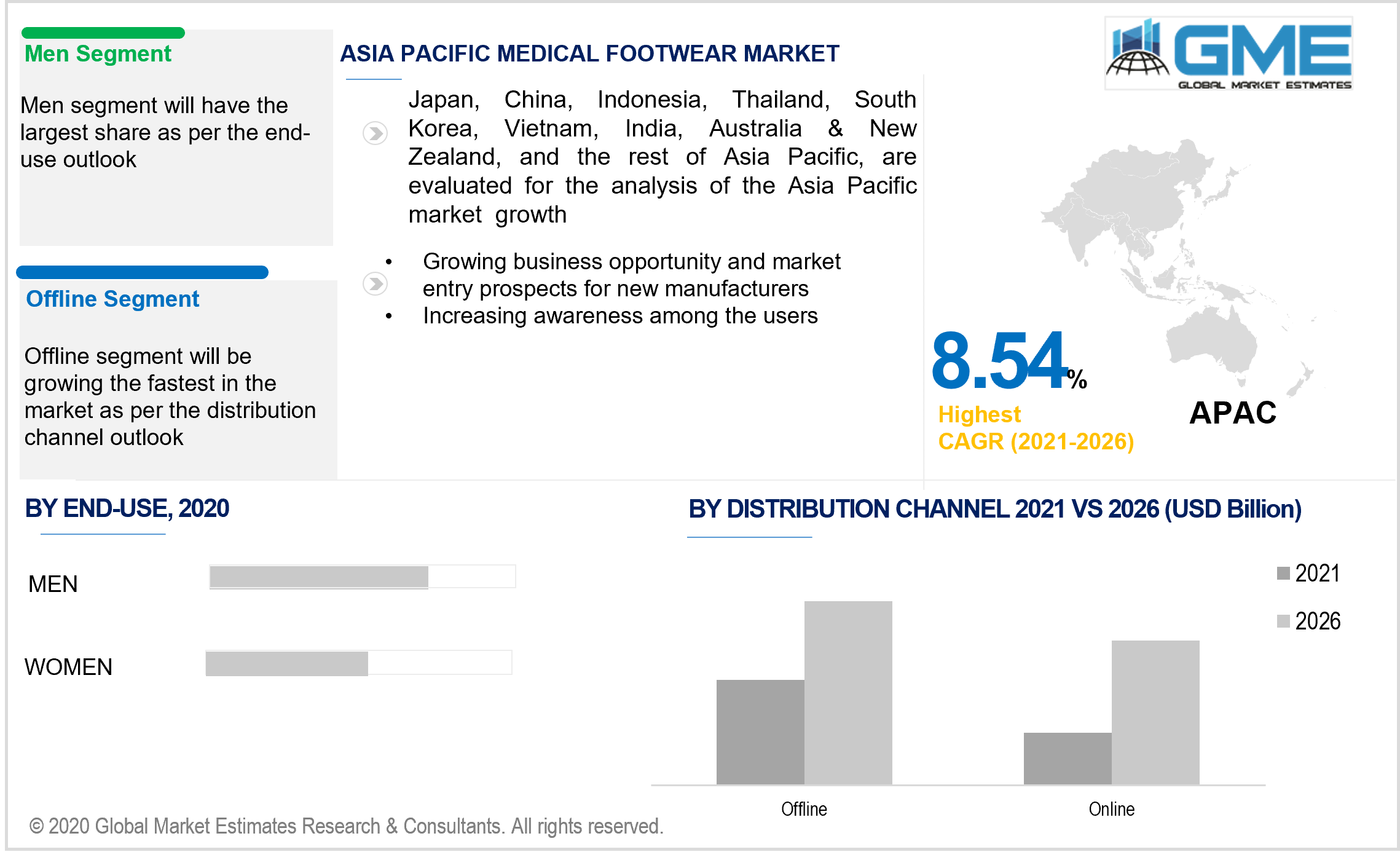

Surveys and reported databases have shown that the prevalence of foot-related issues is significantly high in the male population compared to females. Men of all age groups face various problems ranging from plantar fasciitis, ingrown toenails, athlete's foot, gout, bunions, Achilles tendonitis. These above-mentioned issues are explicit and are reported majorly in men. Amongst these, plantar fasciitis, which is due to excessive sports or outdoor activities; ingrown toenail, which causes extensive pain and pressure; and athlete’s foot, which happens in between toes and causes burning and red patches, is most commonly reported among the male population.

Foot deformities like clubfeet are severe issues and are significantly found in males. Apart from these issues, the World Health Organisation reportedly mentions that across the globe a total of 422 million diabetic cases are registered, out of which 57.2% of the cases registered are males. The increasing male population with diabetic issues is correspondingly facing increased foot-related issues, pain, and discomfort, who increasingly demand medical footwear to experience easy and comfortable mobility.

The end users majorly prefer offline distribution channels for such footwear. Manufacturers have experienced greater sales results on offline platforms as compared to online platforms. The offline platforms or distribution channels give the end-users the facility to verify the quality, durability, comfort brought by such footwear. With online platforms, besides the risk and lack of assurance about the durability of the footwear, the end-users also face the issue of the correct fit. With these online modes, there are higher chances that the end-user gets confused with what size fits their feet correctly, giving them appropriate spacing and comfort. These reasons make people rely more upon and incline towards offline platforms.

North America is foreseen to predominate. North American countries have reported the highest number of patients with a various range of foot-related issues and increasing demand for such footwear. As mentioned earlier, 77% of adults in the USA face foot-related issues. The USA reports having 53% of adults with different foot surgeries, 44% of adults with ankle injuries, 36% of the patients with diabetic foot issues, 30% with bunions, and many more. Countries with increasing contributions from healthcare agencies are experiencing increased awareness regarding such footwear. This region is also one giant hub for such footwear manufacturers.

The Asia-Pacific region is expected to witness fast growth in the demand for such footwear during the forecast period. Government reports have shown that countries like India are experiencing a surge in diabetic patients every passing year. India has reported 72.96 million diabetic patients as of 2019. With such increasing cases, diabetic foot issues are also drastically increasing, rising the demand for such footwear. The growing population and high ratio of people in the 50 plus age group in the APAC countries experience increasing foot-related issues like arthritis, sprains, difficulty in walking, or movement, which are increasingly being treated by orthopedics by suggesting such footwear for regular use.

The APAC region is a lucrative region, giving entry and ample opportunity to budding manufacturers to introduce innovative and creative medical footwear styles that attract end-user’s attention. Along with the manufacturers, the healthcare agencies and organizations in the APAC region also spread awareness and knowledge among patients about the benefits of using such footwear regularly.

Aetrex Worldwide Inc., Drew Shoe, Duna, New Balance, Dr. Comfort, Mephisto, Orthofeet, Darco International Inc., Dr. Zen, Inc., and Gravity Defyer Corp are some of the prominent market players.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview And Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Global Medical Footwear Industry Overview, 2019-2026

2.1.1 Industry Overview

2.1.2 End-use Overview

2.1.3 Distribution Channel Overview

2.1.4 Regional Overview

Chapter 3 Global Medical Footwear Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2019-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Rising Comprehension of Foot Care Among Individuals

3.3.1.2 Increasing Introduction of Innovative Footwear By Numerous Manufacturers

3.3.2 Industry Challenges

3.3.2.1 High Cost of Medical Footwear

3.4 Prospective Growth Scenario

3.4.1 End-use Growth Scenario

3.4.2 Distribution Channel Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Global Medical Footwear Market, By End-use

4.1 End-use Outlook

4.2 Men

4.2.1 Market Size, By Region, 2019-2026 (USD Million)

4.3 Women

4.3.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 5 Global Medical Footwear Market, By Distribution Channel

5.1 Distribution Channel Outlook

5.2 Offline

5.2.1 Market Size, By Region, 2019-2026 (USD Million)

5.3 Online

5.3.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 6 Global Medical Footwear Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2019-2026 (USD Million)

6.2.2 Market Size, By End-use, 2019-2026 (USD Million)

6.2.3 Market Size, By Distribution Channel, 2019-2026 (USD Million)

6.2.4 U.S.

6.2.4.1 Market Size, By End-use, 2019-2026 (USD Million)

6.2.4.2 Market Size, By Distribution Channel, 2019-2026 (USD Million)

6.2.5 Canada

6.2.5.1 Market Size, By End-use, 2019-2026 (USD Million)

6.2.5.2 Market Size, By Distribution Channel, 2019-2026 (USD Million)

6.3 Europe

6.3.1 Market Size, By Country 2019-2026 (USD Million)

6.3.2 Market Size, By End-use, 2019-2026 (USD Million)

6.3.3 Market Size, By Distribution Channel, 2019-2026 (USD Million)

6.3.4 Germany

6.2.4.1 Market Size, By End-use, 2019-2026 (USD Million)

6.2.4.2 Market Size, By Distribution Channel, 2019-2026 (USD Million)

6.3.5 UK

6.3.5.1 Market Size, By End-use, 2019-2026 (USD Million)

6.3.5.2 Market Size, By Distribution Channel, 2019-2026 (USD Million)

6.3.6 France

6.3.6.1 Market Size, By End-use, 2019-2026 (USD Million)

6.3.6.2 Market Size, By Distribution Channel, 2019-2026 (USD Million)

6.3.7 Italy

6.3.7.1 Market Size, By End-use, 2019-2026 (USD Million)

6.3.7.2 Market Size, By Distribution Channel, 2019-2026 (USD Million)

6.3.8 Spain

6.3.8.1 Market Size, By End-use, 2019-2026 (USD Million)

6.3.8.2 Market Size, By Distribution Channel, 2019-2026 (USD Million)

6.3.9 Russia

6.3.9.1 Market Size, By End-use, 2019-2026 (USD Million)

6.3.9.2 Market Size, By Distribution Channel, 2019-2026 (USD Million)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2019-2026 (USD Million)

6.4.2 Market Size, By End-use, 2019-2026 (USD Million)

6.4.3 Market Size, By Distribution Channel, 2019-2026 (USD Million)

6.4.4 China

6.4.4.1 Market Size, By End-use, 2019-2026 (USD Million)

6.4.4.2 Market Size, By Distribution Channel, 2019-2026 (USD Million)

6.4.5 India

6.4.5.1 Market Size, By End-use, 2019-2026 (USD Million)

6.4.5.2 Market Size, By Distribution Channel, 2019-2026 (USD Million)

6.4.6 Japan

6.4.6.1 Market Size, By End-use, 2019-2026 (USD Million)

6.4.6.2 Market Size, By Distribution Channel, 2019-2026 (USD Million)

6.4.7 Australia

6.4.7.1 Market Size, By End-use, 2019-2026 (USD Million)

6.4.7.2 Market size, By Distribution Channel, 2019-2026 (USD Million)

6.4.8 South Korea

6.4.8.1 Market Size, By End-use, 2019-2026 (USD Million)

6.4.8.2 Market Size, By Distribution Channel, 2019-2026 (USD Million)

6.5 Latin America

6.5.1 Market Size, By Country 2019-2026 (USD Million)

6.5.2 Market Size, By End-use, 2019-2026 (USD Million)

6.5.3 Market Size, By Distribution Channel, 2019-2026 (USD Million)

6.5.4 Brazil

6.5.4.1 Market Size, By End-use, 2019-2026 (USD Million)

6.5.4.2 Market Size, By Distribution Channel, 2019-2026 (USD Million)

6.5.5 Mexico

6.5.5.1 Market Size, By End-use, 2019-2026 (USD Million)

6.5.5.2 Market Size, By Distribution Channel, 2019-2026 (USD Million)

6.5.6 Argentina

6.5.6.1 Market Size, By End-use, 2019-2026 (USD Million)

6.5.6.2 Market Size, By Distribution Channel, 2019-2026 (USD Million)

6.6 MEA

6.6.1 Market Size, By Country 2019-2026 (USD Million)

6.6.2 Market Size, By End-use, 2019-2026 (USD Million)

6.6.3 Market Size, By Distribution Channel, 2019-2026 (USD Million)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By End-use, 2019-2026 (USD Million)

6.6.4.2 Market Size, By Distribution Channel, 2019-2026 (USD Million)

6.6.5 UAE

6.6.5.1 Market Size, By End-use, 2019-2026 (USD Million)

6.6.5.2 Market Size, By Distribution Channel, 2019-2026 (USD Million)

6.6.6 South Africa

6.6.6.1 Market Size, By End-use, 2019-2026 (USD Million)

6.6.6.2 Market Size, By Distribution Channel, 2019-2026 (USD Million)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 Aetrex Worldwide Inc.

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Info Graphic Analysis

7.3 Drew Shoe

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Info Graphic Analysis

7.4 Duna

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Info Graphic Analysis

7.5 New Balance

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Info Graphic Analysis

7.6 Dr. Comfort

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 Info Graphic Analysis

7.7 Mephisto

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info Graphic Analysis

7.8 Orthofeet

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Info Graphic Analysis

7.9 Darco International Inc.

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Info Graphic Analysis

7.10 Dr. Zen, Inc.

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Info Graphic Analysis

7.11 Gravity Defyer Corp

7.11.1 Company Overview

7.11.2 Financial Analysis

7.11.3 Strategic Positioning

7.11.4 Info Graphic Analysis

7.12 Other Companies

7.12.1 Company Overview

7.12.2 Financial Analysis

7.12.3 Strategic Positioning

7.12.4 Info Graphic Analysis

The Global Medical Footwear Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Medical Footwear Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS