Global Medical-grade Polymers for Surgical Instruments Market Size, Trends & Analysis - Forecasts to 2029 By Type (Scalpels, Forceps, Retractors, and Others), By Polymer Type (Polyetheretherketone (PEEK), Polypropylene (PP), Polyethylene (PE), Polycarbonate (PC), Polysulfone (PSU), Polyvinyl Chloride (PVC), and Others), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

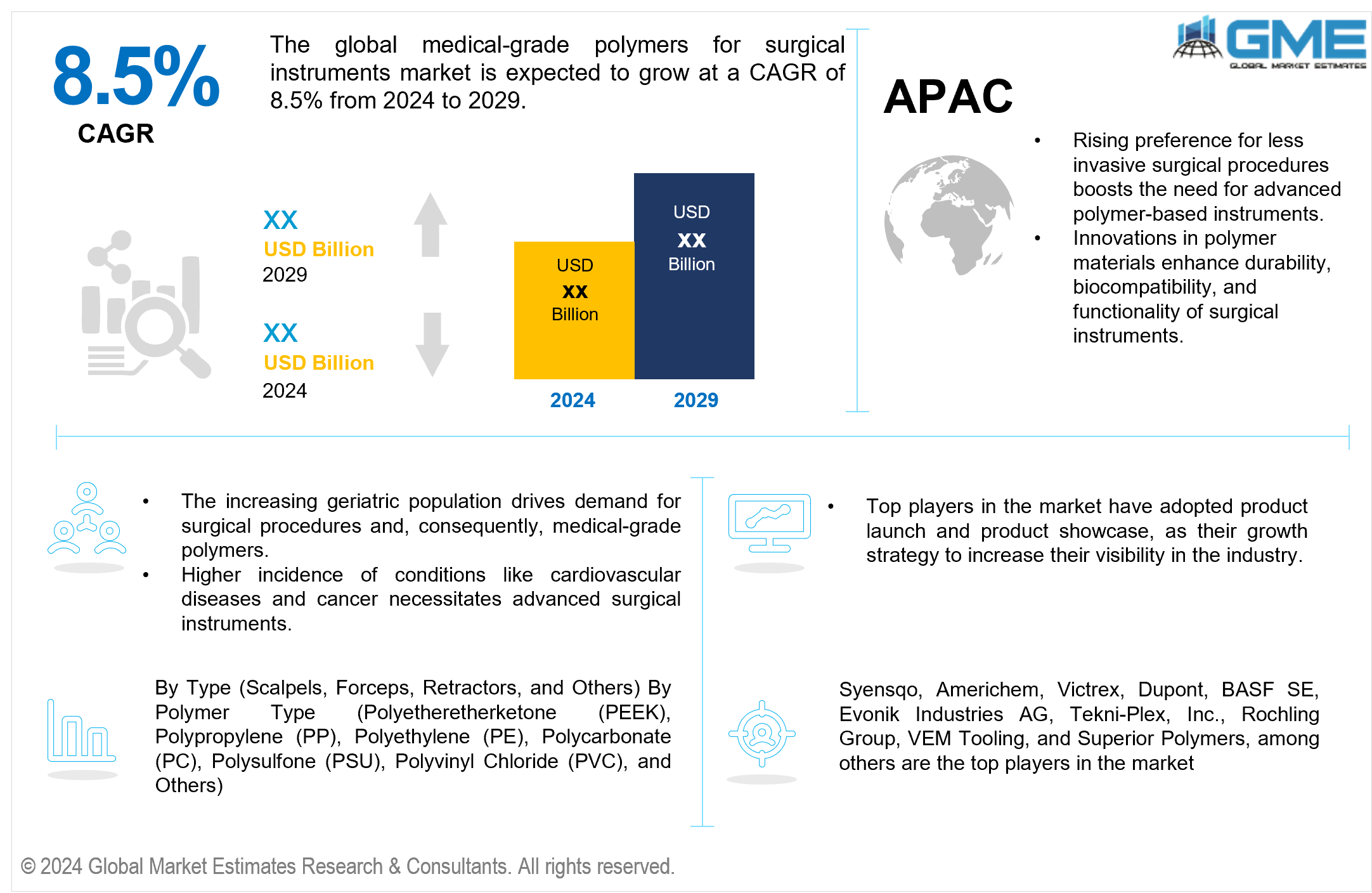

The global medical-grade polymers for surgical instruments market is expected to exhibit a CAGR of 8.5% from 2024 to 2029.

The global medical-grade polymers for surgical tools market is expanding rapidly, driven by rising demand for less invasive operations and improved medical equipment. Medical-grade polymers, such as polyetheretherketone (PEEK), polypropylene (PP), and polyvinyl chloride (PVC), are preferred due to their high strength, biocompatibility, and adaptability. These materials are critical in fabricating surgical equipment, implants, and disposables, which are essential to modern medical practices.

Several key factors are driving the market's growth and expansion. One key factor is the rising prevalence of chronic diseases, which has led to an increase in surgical treatments. For example, the World Health Organization (WHO) predicts that chronic diseases will account for roughly three-quarters of all deaths globally by 2025, necessitating improved surgical procedures. Furthermore, the aging population, notably in North America and Europe, is driving up demand for surgical operations, boosting the market even more. Technological improvements in polymer production have also played an important impact. Innovations like 3D printing using medical-grade polymers allow for the creation of highly tailored and precise surgical equipment, which improves their effectiveness and patient outcomes. For example, PEEK-based spinal implants are widely used due to their excellent mechanical properties and compatibility with imaging techniques. These factors collectively contribute to the robust growth of the global medical-grade polymers market for surgical instruments.

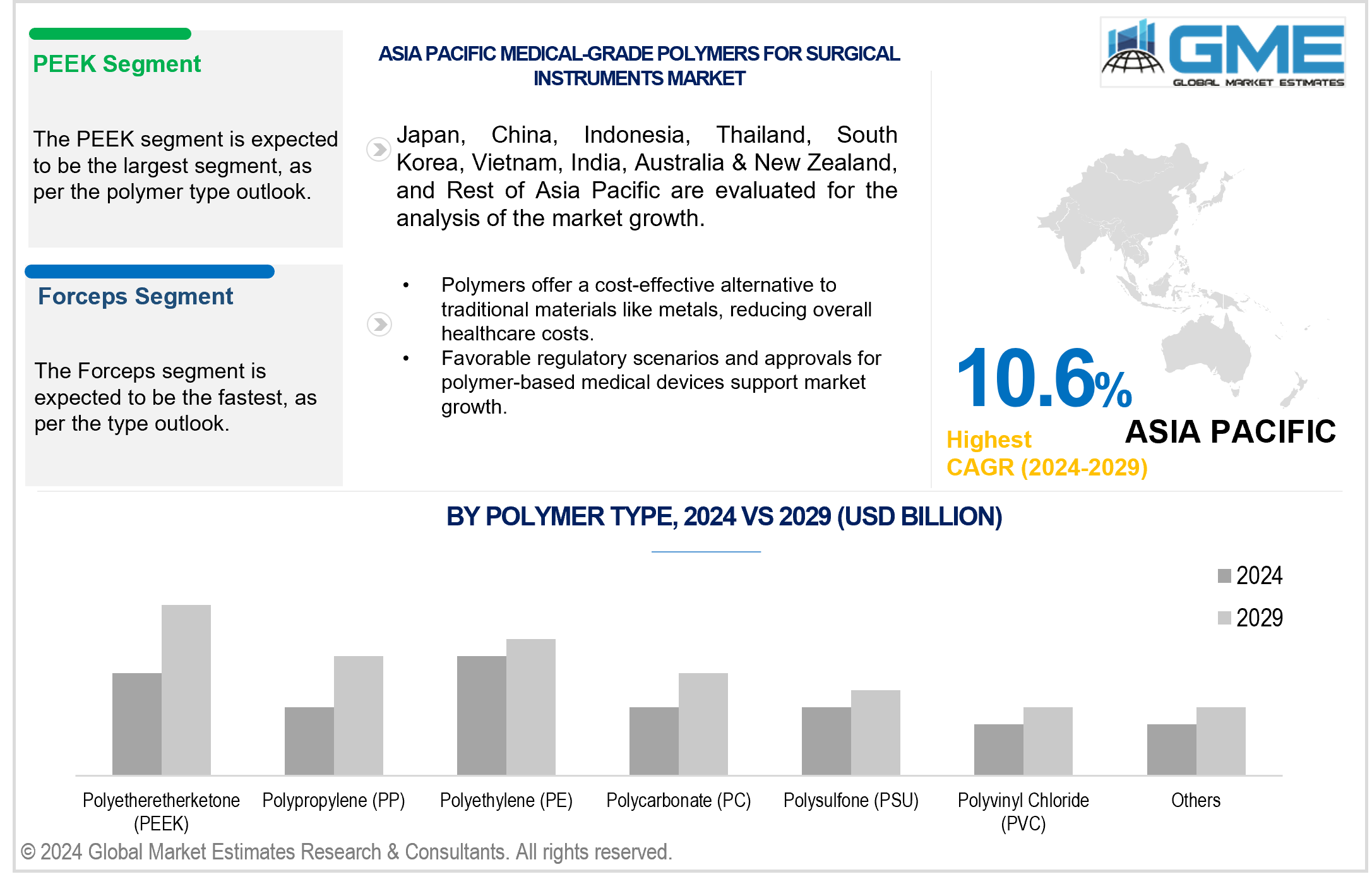

The polyetheretherketone (PEEK) segment is analyzed to hold the largest share of the global market. PEEK is highly valued for its exceptional mechanical properties, including high strength, durability, and resistance to wear and chemicals. These characteristics make PEEK ideal for critical surgical instruments and implants, such as spinal devices and orthopedic components. Additionally, PEEK's compatibility with imaging techniques, such as MRI and CT scans, makes it a preferred choice in the medical field. The material's extensive use in various high-demand applications within the medical industry underpins its dominance in the market.

The polypropylene (PP) segment, on the other hand, is analyzed to be the fastest-growing polymer type in the medical-grade polymers market for surgical instruments. PP's growth is driven by its versatility, cost-effectiveness, and wide range of applications, from disposable surgical tools to medical packaging and sutures. The increasing emphasis on single-use medical devices, especially in response to the growing need for infection control and prevention, has significantly boosted the demand for PP. Its lightweight nature, chemical resistance, and ease of sterilization further enhance its appeal in the medical sector. As healthcare systems across the globe continue to prioritize patient safety and cost efficiency, the demand for polypropylene is expected to surge, solidifying its status as the fastest-growing segment in the market.

In the global medical-grade polymers for surgical instruments market, retractors are anticipated to stand out as the largest segment by type. Retractors play a crucial role in surgical procedures by holding back underlying organs or tissues, providing surgeons with optimal visibility and access to the surgical site. The demand for retractors is driven by their essential function across various surgical specialties, including orthopedic, cardiovascular, and neurosurgery. Moreover, advancements in retractors' design and materials, particularly the adoption of medical-grade polymers like Polyetheretherketone (PEEK) and Polycarbonate (PC), contribute to their widespread usage and dominance in the market.

Forceps emerge as the fastest-growing segment in the medical-grade polymers for surgical instruments market. Forceps are versatile surgical instruments used for grasping, holding, and manipulating tissues during surgical procedures. The growing prevalence of minimally invasive surgeries and the increasing adoption of advanced surgical techniques drive the demand for forceps made from medical-grade polymers. These polymers offer benefits such as lightweight construction, enhanced maneuverability, and compatibility with sterilization processes, making them well-suited for delicate surgical procedures. As healthcare providers prioritize patient outcomes and surgical efficiency, the demand for forceps crafted from medical-grade polymers is expected to witness significant growth, propelling this segment forward as the fastest-growing in the market.

In the global market for medical-grade polymers used in surgical instruments, North America is expected to emerge as the largest region in terms of market share. The region's dominance can be attributed to several factors, including the presence of advanced healthcare infrastructure, high healthcare expenditures, and the rapid adoption of innovative surgical technologies. Additionally, the region boasts a well-established regulatory framework and a strong emphasis on patient safety, encouraging the widespread adoption of medical-grade polymers for surgical instruments.

Meanwhile, the Asia Pacific (APAC) region stands out as the fastest-growing market for medical-grade polymers in surgical instruments. APAC market's rapid growth is fueled by factors such as the increasing prevalence of chronic diseases, rising healthcare expenditure, and expanding access to healthcare services in emerging economies. Moreover, growing investments in healthcare infrastructure and rising awareness about the benefits of advanced surgical techniques drive the demand for medical-grade polymers in surgical instruments across the APAC region. With a burgeoning population and a growing focus on improving healthcare outcomes, APAC presents lucrative opportunities for market players in the medical-grade polymers for surgical instruments segment.

Syensqo, Americhem, Victrex, Dupont, BASF SE, Evonik Industries AG, Tekni-Plex, Inc., Rochling Group, VEM Tooling, and Superior Polymers, among others are the top players in the market.

In October 2023, Superior Polymers announced the launch of Magnolia Trinity PEEK, which combined three clinically proven biomaterials. Magnolia Trinity PEEK merged carbon fiber, hydroxyapatite, and polyether ether ketone—essential materials for demanding medical applications. With its debut, Magnolia Trinity PEEK offered unmatched versatility, biocompatibility, and durability for various medical devices, including orthopedic and cardiovascular implants, surgical instruments, catheter components, and more.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL MEDICAL-GRADE POLYMERS FOR SURGICAL INSTRUMENTS MARKET, BY POLYMER TYPE

4.1 Introduction

4.2 Medical-grade Polymers for Surgical Instruments Market: Polymer Type Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Polyetheretherketone (PEEK)

4.4.1 Polyetheretherketone (PEEK) Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 Polypropylene (PP)

4.5.1 Polypropylene (PP) Market Estimates and Forecast, 2021-2029 (USD Million)

4.6 Polyethylene (PE)

4.6.1 Polyethylene (PE) Market Estimates and Forecast, 2021-2029 (USD Million)

4.7 Polycarbonate (PC)

4.7.1 Polycarbonate (PC) Market Estimates and Forecast, 2021-2029 (USD Million)

4.8 Polysulfone (PSU)

4.8.1 Polysulfone (PSU) Market Estimates and Forecast, 2021-2029 (USD Million)

4.9 Polyvinyl Chloride (PVC)

4.9.1 Polyvinyl Chloride (PVC)Market Estimates and Forecast, 2021-2029 (USD Million)

4.10 Others

4.10.1 Others Market Estimates and Forecast, 2021-2029 (USD Million)

5 GLOBAL MEDICAL-GRADE POLYMERS FOR SURGICAL INSTRUMENTS MARKET, BY TYPE

5.1 Introduction

5.2 Medical-grade Polymers for Surgical Instruments Market: Type Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 Scalpels

5.4.1 Scalpels Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 Forceps

5.5.1 Forceps Market Estimates and Forecast, 2021-2029 (USD Million)

5.6 Retractors

5.6.1 Retractors Market Estimates and Forecast, 2021-2029 (USD Million)

5.7 Others

5.7.1 Others Market Estimates and Forecast, 2021-2029 (USD Million)

6 GLOBAL MEDICAL-GRADE POLYMERS FOR SURGICAL INSTRUMENTS MARKET, BY REGION

6.1 Introduction

6.2 North America Medical-grade Polymers for Surgical Instruments Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.1 By Polymer Type

6.2.2 By Type

6.2.3 By Country

6.2.3.1 U.S. Medical-grade Polymers for Surgical Instruments Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.1.1 By Polymer Type

6.2.3.1.2 By Type

6.2.3.2 Canada Medical-grade Polymers for Surgical Instruments Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.2.1 By Polymer Type

6.2.3.2.2 By Type

6.2.3.3 Mexico Medical-grade Polymers for Surgical Instruments Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.3.1 By Polymer Type

6.2.3.3.2 By Type

6.3 Europe Medical-grade Polymers for Surgical Instruments Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.1 By Polymer Type

6.3.2 By Type

6.3.3 By Country

6.3.3.1 Germany Medical-grade Polymers for Surgical Instruments Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.1.1 By Polymer Type

6.3.3.1.2 By Type

6.3.3.2 U.K. Medical-grade Polymers for Surgical Instruments Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.2.1 By Polymer Type

6.3.3.2.2 By Type

6.3.3.3 France Medical-grade Polymers for Surgical Instruments Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.3.1 By Polymer Type

6.3.3.3.2 By Type

6.3.3.4 Italy Medical-grade Polymers for Surgical Instruments Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.4.1 By Polymer Type

6.3.3.4.2 By Type

6.3.3.5 Spain Medical-grade Polymers for Surgical Instruments Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.5.1 By Polymer Type

6.3.3.5.2 By Type

6.3.3.6 Netherlands Medical-grade Polymers for Surgical Instruments Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.6.1 By Polymer Type

6.3.3.6.2 By Type

6.3.3.7 Rest of Europe Medical-grade Polymers for Surgical Instruments Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.6.1 By Polymer Type

6.3.3.6.2 By Type

6.4 Asia Pacific Medical-grade Polymers for Surgical Instruments Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.1 By Polymer Type

6.4.2 By Type

6.4.3 By Country

6.4.3.1 China Medical-grade Polymers for Surgical Instruments Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.1.1 By Polymer Type

6.4.3.1.2 By Type

6.4.3.2 Japan Medical-grade Polymers for Surgical Instruments Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.2.1 By Polymer Type

6.4.3.2.2 By Type

6.4.3.3 India Medical-grade Polymers for Surgical Instruments Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.3.1 By Polymer Type

6.4.3.3.2 By Type

6.4.3.4 South Korea Medical-grade Polymers for Surgical Instruments Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.4.1 By Polymer Type

6.4.3.4.2 By Type

6.4.3.5 Singapore Medical-grade Polymers for Surgical Instruments Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.5.1 By Polymer Type

6.4.3.5.2 By Type

6.4.3.6 Malaysia Medical-grade Polymers for Surgical Instruments Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.6.1 By Polymer Type

6.4.3.6.2 By Type

6.4.3.7 Thailand Medical-grade Polymers for Surgical Instruments Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.6.1 By Polymer Type

6.4.3.6.2 By Type

6.4.3.8 Indonesia Medical-grade Polymers for Surgical Instruments Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.7.1 By Polymer Type

6.4.3.7.2 By Type

6.4.3.9 Vietnam Medical-grade Polymers for Surgical Instruments Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.8.1 By Polymer Type

6.4.3.8.2 By Type

6.4.3.10 Taiwan Medical-grade Polymers for Surgical Instruments Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.10.1 By Polymer Type

6.4.3.10.2 By Type

6.4.3.11 Rest of Asia Pacific Medical-grade Polymers for Surgical Instruments Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.11.1 By Polymer Type

6.4.3.11.2 By Type

6.5 Middle East and Africa Medical-grade Polymers for Surgical Instruments Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.1 By Polymer Type

6.5.2 By Type

6.5.3 By Country

6.5.3.1 Saudi Arabia Medical-grade Polymers for Surgical Instruments Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.1.1 By Polymer Type

6.5.3.1.2 By Type

6.5.3.2 U.A.E. Medical-grade Polymers for Surgical Instruments Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.2.1 By Polymer Type

6.5.3.2.2 By Type

6.5.3.3 Israel Medical-grade Polymers for Surgical Instruments Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.3.1 By Polymer Type

6.5.3.3.2 By Type

6.5.3.4 South Africa Medical-grade Polymers for Surgical Instruments Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.4.1 By Polymer Type

6.5.3.4.2 By Type

6.5.3.5 Rest of Middle East and Africa Medical-grade Polymers for Surgical Instruments Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.5.1 By Polymer Type

6.5.3.5.2 By Type

6.6 Central and South America Medical-grade Polymers for Surgical Instruments Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.1 By Polymer Type

6.6.2 By Type

6.6.3 By Country

6.6.3.1 Brazil Medical-grade Polymers for Surgical Instruments Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.1.1 By Polymer Type

6.6.3.1.2 By Type

6.6.3.2 Argentina Medical-grade Polymers for Surgical Instruments Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.2.1 By Polymer Type

6.6.3.2.2 By Type

6.6.3.3 Chile Medical-grade Polymers for Surgical Instruments Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.3.1 By Polymer Type

6.6.3.3.2 By Type

6.6.3.3 Rest of Central and South America Medical-grade Polymers for Surgical Instruments Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.3.1 By Polymer Type

6.6.3.3.2 By Type

7 COMPETITIVE LANDCAPE

7.1 Company Market Share Analysis

7.2 Four Quadrant Positioning Matrix

7.2.1 Market Leaders

7.2.2 Market Visionaries

7.2.3 Market Challengers

7.2.4 Niche Market Players

7.3 Vendor Landscape

7.3.1 North America

7.3.2 Europe

7.3.3 Asia Pacific

7.3.4 Rest of the World

7.4 Company Profiles

7.4.1 Syensqo

7.4.1.1 Business Description & Financial Analysis

7.4.1.2 SWOT Analysis

7.4.1.3 Products & Services Offered

7.4.1.4 Strategic Alliances between Business Partners

7.4.2 Americhem

7.4.2.1 Business Description & Financial Analysis

7.4.2.2 SWOT Analysis

7.4.2.3 Products & Services Offered

7.4.2.4 Strategic Alliances between Business Partners

7.4.3 Victrex

7.4.3.1 Business Description & Financial Analysis

7.4.3.2 SWOT Analysis

7.4.3.3 Products & Services Offered

7.4.3.4 Strategic Alliances between Business Partners

7.4.4 Dupont

7.4.4.1 Business Description & Financial Analysis

7.4.4.2 SWOT Analysis

7.4.4.3 Products & Services Offered

7.4.4.4 Strategic Alliances between Business Partners

7.4.5 BASF SE

7.4.5.1 Business Description & Financial Analysis

7.4.5.2 SWOT Analysis

7.4.5.3 Products & Services Offered

7.4.5.4 Strategic Alliances between Business Partners

7.4.6 Evonik Industries AG

7.4.6.1 Business Description & Financial Analysis

7.4.6.2 SWOT Analysis

7.4.6.3 Products & Services Offered

7.4.6.4 Strategic Alliances between Business Partners

7.4.7 Tekni-Plex, Inc.

7.4.7.1 Business Description & Financial Analysis

7.4.7.2 SWOT Analysis

7.4.7.3 Products & Services Offered

7.4.7.4 Strategic Alliances between Business Partners

7.4.8 Rochling Group

7.4.8.1 Business Description & Financial Analysis

7.4.8.2 SWOT Analysis

7.4.8.3 Products & Services Offered

7.4.8.4 Strategic Alliances between Business Partners

7.4.9 VEM Tooling

7.4.9.1 Business Description & Financial Analysis

7.4.9.2 SWOT Analysis

7.4.9.3 Products & Services Offered

7.4.9.4 Strategic Alliances between Business Partners

7.4.10 Superior Polymers

7.4.10.1 Business Description & Financial Analysis

7.4.10.2 SWOT Analysis

7.4.10.3 Products & Services Offered

7.4.10.4 Strategic Alliances between Business Partners

7.4.11 Other Companies

7.4.11.1 Business Description & Financial Analysis

7.4.11.2 SWOT Analysis

7.4.11.3 Products & Services Offered

7.4.11.4 Strategic Alliances between Business Partners

8 RESEARCH METHODOLOGY

8.1 Market Introduction

8.1.1 Market Definition

8.1.2 Market Scope & Segmentation

8.2 Information Procurement

8.2.1 Secondary Research

8.2.1.1 Purchased Databases

8.2.1.2 GMEs Internal Data Repository

8.2.1.3 Secondary Resources & Third Party Perspectives

8.2.1.4 Company Information Sources

8.2.2 Primary Research

8.2.2.1 Various Types of Respondents for Primary Interviews

8.2.2.2 Number of Interviews Conducted throughout the Research Process

8.2.2.3 Primary Stakeholders

8.2.2.4 Discussion Guide for Primary Participants

8.2.3 Expert Panels

8.2.3.1 Expert Panels Across 30+ Industry

8.2.4 Paid Local Experts

8.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

8.3 Market Estimation

8.3.1 Top-Down Approach

8.3.1.1 Macro-Economic Indicators Considered

8.3.1.2 Micro-Economic Indicators Considered

8.3.2 Bottom Up Approach

8.3.2.1 Company Share Analysis Approach

8.3.2.2 Estimation of Potential Product Sales

8.4 Data Triangulation

8.4.1 Data Collection

8.4.2 Time Series, Cross Sectional & Panel Data Analysis

8.4.3 Cluster Analysis

8.5 Analysis and Output

8.5.1 Inhouse AI Based Real Time Analytics Tool

8.5.2 Output From Desk & Primary Research

8.6 Research Assumptions & Limitations

8.6.1 Research Assumptions

8.6.2 Research Limitations

LIST OF TABLES

1 Global Medical-grade Polymers for Surgical Instruments Market, By Polymer Type, 2021-2029 (USD Mllion)

2 Polyetheretherketone (PEEK) Market, By Region, 2021-2029 (USD Mllion)

3 Polypropylene (PP) Market, By Region, 2021-2029 (USD Mllion)

4 Polycarbonate (PC) Market, By Region, 2021-2029 (USD Mllion)

5 Polysulfone (PSU) Market, By Region, 2021-2029 (USD Mllion)

6 Polyethylene (PE) Market, By Region, 2021-2029 (USD Mllion)

7 Polyvinyl Chloride (PVC)Market, By Region, 2021-2029 (USD Mllion)

8 Others Market, By Region, 2021-2029 (USD Mllion)

9 Global Medical-grade Polymers for Surgical Instruments Market, By Type, 2021-2029 (USD Mllion)

10 Scalpels Market, By Region, 2021-2029 (USD Mllion)

11 Forceps Market, By Region, 2021-2029 (USD Mllion)

12 Retractors Market, By Region, 2021-2029 (USD Mllion)

13 Others Market, By Region, 2021-2029 (USD Mllion)

14 Regional Analysis, 2021-2029 (USD Mllion)

15 North America Medical-grade Polymers for Surgical Instruments Market, By Polymer Type, 2021-2029 (USD Mllion)

16 North America Medical-grade Polymers for Surgical Instruments Market, By Type, 2021-2029 (USD Mllion)

17 North America Medical-grade Polymers for Surgical Instruments Market, By COUNTRY, 2021-2029 (USD Mllion)

18 U.S. Medical-grade Polymers for Surgical Instruments Market, By Polymer Type, 2021-2029 (USD Mllion)

19 U.S. Medical-grade Polymers for Surgical Instruments Market, By Type, 2021-2029 (USD Mllion)

20 Canada Medical-grade Polymers for Surgical Instruments Market, By Polymer Type, 2021-2029 (USD Mllion)

21 Canada Medical-grade Polymers for Surgical Instruments Market, By Type, 2021-2029 (USD Mllion)

22 Mexico Medical-grade Polymers for Surgical Instruments Market, By Polymer Type, 2021-2029 (USD Mllion)

23 Mexico Medical-grade Polymers for Surgical Instruments Market, By Type, 2021-2029 (USD Mllion)

24 Europe Medical-grade Polymers for Surgical Instruments Market, By Polymer Type, 2021-2029 (USD Mllion)

25 Europe Medical-grade Polymers for Surgical Instruments Market, By Type, 2021-2029 (USD Mllion)

26 Europe Medical-grade Polymers for Surgical Instruments Market, By Country, 2021-2029 (USD Mllion)

27 Germany Medical-grade Polymers for Surgical Instruments Market, By Polymer Type, 2021-2029 (USD Mllion)

28 Germany Medical-grade Polymers for Surgical Instruments Market, By Type, 2021-2029 (USD Mllion)

29 U.K. Medical-grade Polymers for Surgical Instruments Market, By Polymer Type, 2021-2029 (USD Mllion)

30 U.K. Medical-grade Polymers for Surgical Instruments Market, By Type, 2021-2029 (USD Mllion)

31 France Medical-grade Polymers for Surgical Instruments Market, By Polymer Type, 2021-2029 (USD Mllion)

32 France Medical-grade Polymers for Surgical Instruments Market, By Type, 2021-2029 (USD Mllion)

33 Italy Medical-grade Polymers for Surgical Instruments Market, By Polymer Type, 2021-2029 (USD Mllion)

34 Italy Medical-grade Polymers for Surgical Instruments Market, By Type, 2021-2029 (USD Mllion)

35 Spain Medical-grade Polymers for Surgical Instruments Market, By Polymer Type, 2021-2029 (USD Mllion)

36 Spain Medical-grade Polymers for Surgical Instruments Market, By Type, 2021-2029 (USD Mllion)

37 Netherlands Medical-grade Polymers for Surgical Instruments Market, By Polymer Type, 2021-2029 (USD Mllion)

38 Netherlands Medical-grade Polymers for Surgical Instruments Market, By Type, 2021-2029 (USD Mllion)

39 Rest Of Europe Medical-grade Polymers for Surgical Instruments Market, By Polymer Type, 2021-2029 (USD Mllion)

40 Rest Of Europe Medical-grade Polymers for Surgical Instruments Market, By Type, 2021-2029 (USD Mllion)

41 Asia Pacific Medical-grade Polymers for Surgical Instruments Market, By Polymer Type, 2021-2029 (USD Mllion)

42 Asia Pacific Medical-grade Polymers for Surgical Instruments Market, By Type, 2021-2029 (USD Mllion)

43 Asia Pacific Medical-grade Polymers for Surgical Instruments Market, By Country, 2021-2029 (USD Mllion)

44 China Medical-grade Polymers for Surgical Instruments Market, By Polymer Type, 2021-2029 (USD Mllion)

45 China Medical-grade Polymers for Surgical Instruments Market, By Type, 2021-2029 (USD Mllion)

46 Japan Medical-grade Polymers for Surgical Instruments Market, By Polymer Type, 2021-2029 (USD Mllion)

47 Japan Medical-grade Polymers for Surgical Instruments Market, By Type, 2021-2029 (USD Mllion)

48 India Medical-grade Polymers for Surgical Instruments Market, By Polymer Type, 2021-2029 (USD Mllion)

49 India Medical-grade Polymers for Surgical Instruments Market, By Type, 2021-2029 (USD Mllion)

50 South Korea Medical-grade Polymers for Surgical Instruments Market, By Polymer Type, 2021-2029 (USD Mllion)

51 South Korea Medical-grade Polymers for Surgical Instruments Market, By Type, 2021-2029 (USD Mllion)

52 Singapore Medical-grade Polymers for Surgical Instruments Market, By Polymer Type, 2021-2029 (USD Mllion)

53 Singapore Medical-grade Polymers for Surgical Instruments Market, By Type, 2021-2029 (USD Mllion)

54 Thailand Medical-grade Polymers for Surgical Instruments Market, By Polymer Type, 2021-2029 (USD Mllion)

55 Thailand Medical-grade Polymers for Surgical Instruments Market, By Type, 2021-2029 (USD Mllion)

56 Malaysia Medical-grade Polymers for Surgical Instruments Market, By Polymer Type, 2021-2029 (USD Mllion)

57 Malaysia Medical-grade Polymers for Surgical Instruments Market, By Type, 2021-2029 (USD Mllion)

58 Indonesia Medical-grade Polymers for Surgical Instruments Market, By Polymer Type, 2021-2029 (USD Mllion)

59 Indonesia Medical-grade Polymers for Surgical Instruments Market, By Type, 2021-2029 (USD Mllion)

60 Vietnam Medical-grade Polymers for Surgical Instruments Market, By Polymer Type, 2021-2029 (USD Mllion)

61 Vietnam Medical-grade Polymers for Surgical Instruments Market, By Type, 2021-2029 (USD Mllion)

62 Taiwan Medical-grade Polymers for Surgical Instruments Market, By Polymer Type, 2021-2029 (USD Mllion)

63 Taiwan Medical-grade Polymers for Surgical Instruments Market, By Type, 2021-2029 (USD Mllion)

64 Rest of APAC Medical-grade Polymers for Surgical Instruments Market, By Polymer Type, 2021-2029 (USD Mllion)

65 Rest of APAC Medical-grade Polymers for Surgical Instruments Market, By Type, 2021-2029 (USD Mllion)

66 Middle East and Africa Medical-grade Polymers for Surgical Instruments Market, By Polymer Type, 2021-2029 (USD Mllion)

67 Middle East and Africa Medical-grade Polymers for Surgical Instruments Market, By Type, 2021-2029 (USD Mllion)

68 Middle East and Africa Medical-grade Polymers for Surgical Instruments Market, By Country, 2021-2029 (USD Mllion)

69 Saudi Arabia Medical-grade Polymers for Surgical Instruments Market, By Polymer Type, 2021-2029 (USD Mllion)

70 Saudi Arabia Medical-grade Polymers for Surgical Instruments Market, By Type, 2021-2029 (USD Mllion)

71 UAE Medical-grade Polymers for Surgical Instruments Market, By Polymer Type, 2021-2029 (USD Mllion)

72 UAE Medical-grade Polymers for Surgical Instruments Market, By Type, 2021-2029 (USD Mllion)

73 Israel Medical-grade Polymers for Surgical Instruments Market, By Polymer Type, 2021-2029 (USD Mllion)

74 Israel Medical-grade Polymers for Surgical Instruments Market, By Type, 2021-2029 (USD Mllion)

75 South Africa Medical-grade Polymers for Surgical Instruments Market, By Polymer Type, 2021-2029 (USD Mllion)

76 South Africa Medical-grade Polymers for Surgical Instruments Market, By Type, 2021-2029 (USD Mllion)

77 Rest Of Middle East and Africa Medical-grade Polymers for Surgical Instruments Market, By Polymer Type, 2021-2029 (USD Mllion)

78 Rest Of Middle East and Africa Medical-grade Polymers for Surgical Instruments Market, By Type, 2021-2029 (USD Mllion)

79 Central and South America Medical-grade Polymers for Surgical Instruments Market, By Polymer Type, 2021-2029 (USD Mllion)

80 Central and South America Medical-grade Polymers for Surgical Instruments Market, By Type, 2021-2029 (USD Mllion)

81 Central and South America Medical-grade Polymers for Surgical Instruments Market, By Country, 2021-2029 (USD Mllion)

82 Brazil Medical-grade Polymers for Surgical Instruments Market, By Polymer Type, 2021-2029 (USD Mllion)

83 Brazil Medical-grade Polymers for Surgical Instruments Market, By Type, 2021-2029 (USD Mllion)

84 Chile Medical-grade Polymers for Surgical Instruments Market, By Polymer Type, 2021-2029 (USD Mllion)

85 Chile Medical-grade Polymers for Surgical Instruments Market, By Type, 2021-2029 (USD Mllion)

86 Argentina Medical-grade Polymers for Surgical Instruments Market, By Polymer Type, 2021-2029 (USD Mllion)

87 Argentina Medical-grade Polymers for Surgical Instruments Market, By Type, 2021-2029 (USD Mllion)

88 Rest Of Central and South America Medical-grade Polymers for Surgical Instruments Market, By Polymer Type, 2021-2029 (USD Mllion)

89 Rest Of Central and South America Medical-grade Polymers for Surgical Instruments Market, By Type, 2021-2029 (USD Mllion)

90 Syensqo: Products & Services Offering

91 Americhem: Products & Services Offering

92 Victrex: Products & Services Offering

93 Dupont: Products & Services Offering

94 BASF SE: Products & Services Offering

95 Evonik Industries AG: Products & Services Offering

96 Tekni-Plex, Inc. : Products & Services Offering

97 Rochling Group: Products & Services Offering

98 VEM Tooling, Inc: Products & Services Offering

99 Superior Polymers: Products & Services Offering

100 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Medical-grade Polymers for Surgical Instruments Market Overview

2 Global Medical-grade Polymers for Surgical Instruments Market Value From 2021-2029 (USD Mllion)

3 Global Medical-grade Polymers for Surgical Instruments Market Share, By Polymer Type (2023)

4 Global Medical-grade Polymers for Surgical Instruments Market Share, By Type (2023)

5 Global Medical-grade Polymers for Surgical Instruments Market, By Region (Asia Pacific Market)

6 Technological Trends In Global Medical-grade Polymers for Surgical Instruments Market

7 Four Quadrant Competitor Positioning Matrix

8 Impact Of Macro & Micro Indicators On The Market

9 Impact Of Key Drivers On The Global Medical-grade Polymers for Surgical Instruments Market

10 Impact Of Challenges On The Global Medical-grade Polymers for Surgical Instruments Market

11 Porter’s Five Forces Analysis

12 Global Medical-grade Polymers for Surgical Instruments Market: By Polymer Type Scope Key Takeaways

13 Global Medical-grade Polymers for Surgical Instruments Market, By Polymer Type Segment: Revenue Growth Analysis

14 Polyetheretherketone (PEEK) Market, By Region, 2021-2029 (USD Mllion)

15 Polypropylene (PP) Market, By Region, 2021-2029 (USD Mllion)

16 Polycarbonate (PC)Market, By Region, 2021-2029 (USD Mllion)

17 Polysulfone (PSU) Market, By Region, 2021-2029 (USD Mllion)

18 Polyethylene (PE) Market, By Region, 2021-2029 (USD Mllion)

19 Polyvinyl Chloride (PVC)Market, By Region, 2021-2029 (USD Mllion)

20 Others Market, By Region, 2021-2029 (USD Mllion)

21 Global Medical-grade Polymers for Surgical Instruments Market: By Type Scope Key Takeaways

22 Global Medical-grade Polymers for Surgical Instruments Market, By Type Segment: Revenue Growth Analysis

23 Scalpels Market, By Region, 2021-2029 (USD Mllion)

24 Forceps Market, By Region, 2021-2029 (USD Mllion)

25 Retractors Market, By Region, 2021-2029 (USD Mllion)

26 Others Market, By Region, 2021-2029 (USD Mllion)

27 Regional Segment: Revenue Growth Analysis

28 Global Medical-grade Polymers for Surgical Instruments Market: Regional Analysis

29 North America Medical-grade Polymers for Surgical Instruments Market Overview

30 North America Medical-grade Polymers for Surgical Instruments Market, By Polymer Type

31 North America Medical-grade Polymers for Surgical Instruments Market, By Type

32 North America Medical-grade Polymers for Surgical Instruments Market, By Country

33 U.S. Medical-grade Polymers for Surgical Instruments Market, By Polymer Type

34 U.S. Medical-grade Polymers for Surgical Instruments Market, By Type

35 Canada Medical-grade Polymers for Surgical Instruments Market, By Polymer Type

36 Canada Medical-grade Polymers for Surgical Instruments Market, By Type

37 Mexico Medical-grade Polymers for Surgical Instruments Market, By Polymer Type

38 Mexico Medical-grade Polymers for Surgical Instruments Market, By Type

39 Four Quadrant Positioning Matrix

40 Company Market Share Analysis

41 Syensqo: Company Snapshot

42 Syensqo: SWOT Analysis

43 Syensqo: Geographic Presence

44 Americhem: Company Snapshot

45 Americhem: SWOT Analysis

46 Americhem: Geographic Presence

47 Victrex: Company Snapshot

48 Victrex: SWOT Analysis

49 Victrex: Geographic Presence

50 Dupont: Company Snapshot

51 Dupont: Swot Analysis

52 Dupont: Geographic Presence

53 BASF SE: Company Snapshot

54 BASF SE: SWOT Analysis

55 BASF SE: Geographic Presence

56 Evonik Industries AG: Company Snapshot

57 Evonik Industries AG: SWOT Analysis

58 Evonik Industries AG: Geographic Presence

59 Tekni-Plex, Inc. : Company Snapshot

60 Tekni-Plex, Inc. : SWOT Analysis

61 Tekni-Plex, Inc. : Geographic Presence

62 Rochling Group: Company Snapshot

63 Rochling Group: SWOT Analysis

64 Rochling Group: Geographic Presence

65 VEM Tooling, Inc.: Company Snapshot

66 VEM Tooling, Inc.: SWOT Analysis

67 VEM Tooling, Inc.: Geographic Presence

68 Superior Polymers: Company Snapshot

69 Superior Polymers: SWOT Analysis

70 Superior Polymers: Geographic Presence

71 Other Companies: Company Snapshot

72 Other Companies: SWOT Analysis

73 Other Companies: Geographic Presence

The Global Medical-grade Polymers for Surgical Instruments Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Medical-grade Polymers for Surgical Instruments Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS