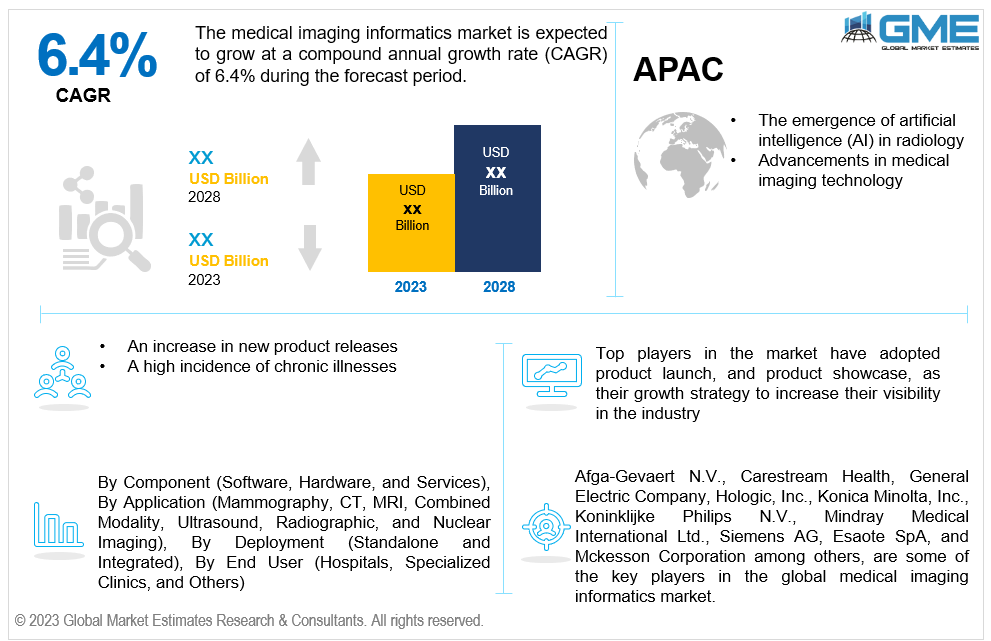

Global Medical Imaging Informatics Market Size, Trends & Analysis - Forecasts to 2028 By Component (Software, Hardware, and Services), By Application (Mammography, CT, MRI, Combined Modality, Ultrasound, Radiographic, and Nuclear Imaging), By Deployment (Standalone and Integrated), By End User (Hospitals, Specialized Clinics, and Others), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

The global medical imaging informatics market is estimated to exhibit a CAGR of 6.4% from 2023 to 2028.

The primary factors propelling the market growth are the emergence of artificial intelligence (AI) in radiology and advancements in medical imaging technology. The range of diagnostic information obtained from medical images has increased due to new imaging technologies, including 3D and 4D imaging, spectral imaging, and enhanced contrast agents. These developments raise the data created for each patient, which calls for increasingly advanced informatics systems to handle and decipher these intricate images. Moreover, digital images are more suitable for incorporation into informatics systems as they are simpler to store, transmit, and modify. The use of informatics systems has increased due to the ability to deal with digital images. For instance, Google Cloud introduced the Medical Imaging Suite in October 2022 as a new platform to improve the interoperability and accessibility of radiology and other imaging data.

An increase in new product releases and a high incidence of chronic illnesses are predicted to boost market growth throughout the forecast period. A wide range of informatics solutions catering to various specialties, modalities, and healthcare settings are introduced through new product launches. Due to the range of options, healthcare professionals can choose the approach that most closely matches their unique demands. Many product launches offer adaptable solutions to cater to the specific requirements of medical institutions and radiology departments. Customization can increase workflow effectiveness and fit an institution's unique needs into informatics systems. For instance, Esaote SpA introduced the new MyLab X75 ultrasound system in May 2021. It provides access to specialized clinical solutions, including micro-vascularization evaluation, quantification of liver stiffness, and Zero-Click left ventricle functional analysis.

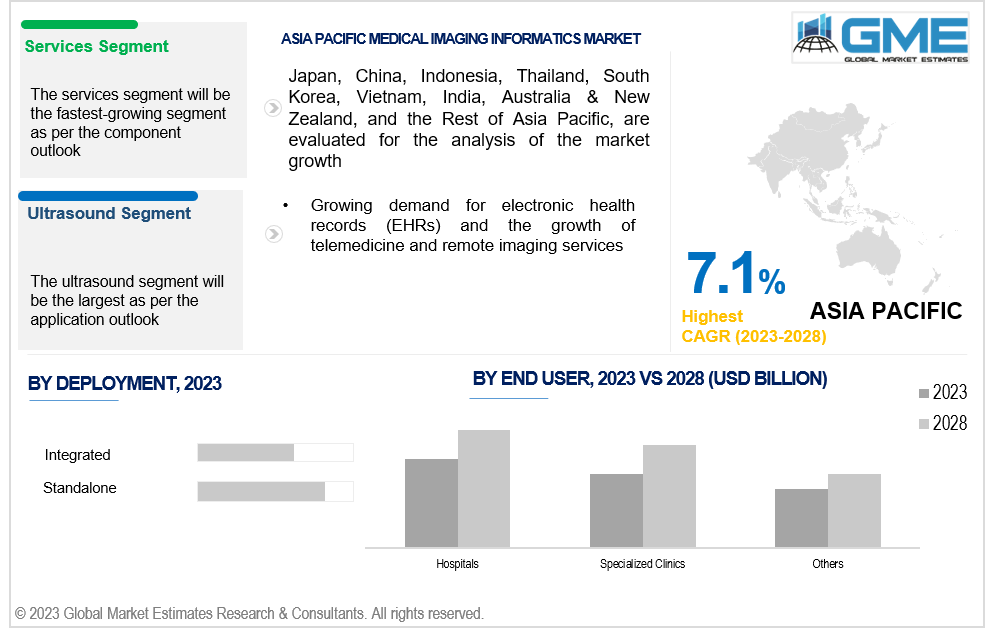

Growing demand for electronic health records (EHRs) and the growth of telemedicine and remote imaging services propel the market growth. EHRs are designed to store a patient's complete medical history, including information from imaging tests like X-rays, MRIs, and CT scans. Medical Imaging Informatics solutions are now more crucial than ever, given the need for EHRs and the smooth integration of medical imaging data. Healthcare professionals can now make informed choices based on a patient's entire medical history due to integrated medical imaging informatics. This leads to improved patient care and making timely diagnoses and treatment plans.

Integrating artificial intelligence (AI) and machine learning in medical imaging informatics presents significant opportunities. AI in medical imaging solutions can improve image analysis, automate repetitive operations, and give more precise and effective diagnostics. Moreover, adopting cloud-based medical imaging informatics solutions offers opportunities for scalability and flexibility. Healthcare practitioners now have easier access to and sharing imaging data due to cloud-based technologies, which are especially useful in remote healthcare systems.

However, the market expansion is being constrained by increasing changes in reimbursement policies in the medical imaging industry and a lack of experience in using medical imaging informatics systems.

The software segment is expected to hold the largest share of the market during the forecast period. Radiology informatics and imaging informatics software play a pivotal role in the efficient management of vast volumes of medical images generated daily. These imaging analysis software solutions enable the archiving, retrieval, and organization of different imaging data, including those from X-rays, MRIs, CT scans, and other imaging procedures. Healthcare imaging informatics software facilitates clinical processes by giving medical staff quick access to patient pictures and data. It improves clinical departments' efficiency in fields like radiology, allowing for more rapid diagnosis and treatment.

The services segment is expected to be the fastest-growing segment in the market from 2023-2028. Medical imaging informatics services provide a wide variety of integration and implementation services. Healthcare institutions frequently need professional support to integrate these technologies effectively into their current infrastructure when they deploy advanced informatics solutions. Additionally, diagnostic imaging informatics services providers offer assistance in troubleshooting issues, applying updates, and ensuring system reliability.

The ultrasound segment is expected to hold the largest share of the market. Many medical professions, including obstetrics, gynaecology, cardiology, and abdominal imaging, employ ultrasound as a flexible imaging modality. Due to the widespread use of ultrasound, a large amount of imaging data is produced, making effective administration and interpretation essential. PACS (Picture Archiving and Communication System) is ideally suited for this purpose.

The MRI segment is anticipated to be the fastest-growing segment in the market from 2023-2028. Larger data volumes result from the complex and highly detailed images MRI imaging produces. These complex MRI images are stored, transmitted, and managed using the standardized DICOM (Digital Imaging and Communications in Medicine) format, which is crucial for effective data processing.

The standalone segment is expected to hold the largest share of the market. Due to their ability to be adopted gradually without necessitating a total redesign of current infrastructure, standalone solutions tend to be simpler to adopt. The ease of use of standalone systems encourages medical facilities to use them for effective medical imaging data management. Standalone systems provide remote consultations and safe access and sharing of medical pictures and data by healthcare professionals, making them an integral part of current medical imaging informatics trends.

The integrated segment is anticipated to be the fastest-growing segment in the market from 2023-2028. Integrated solutions provide a streamlined approach to medical imaging informatics integration, which is vital for efficient data sharing and management across healthcare facilities. When integrated, radiology information systems (RIS) ensure a seamless flow of information between radiology departments and other healthcare units.

The hospitals segment is expected to hold the largest share of the market over the forecast period. Hospitals often serve more patients than clinics, outpatient centers, and other healthcare settings. The large volume of medical imaging data produced by the high patient throughput necessitates using effective informatics solutions. In addition to emergency care, hospitals also provide surgeries and diagnostic procedures. Several clinical disciplines, such as radiology, cardiology, oncology, and others, substantially rely on medical imaging, which increases the demand for reliable informatics solutions.

The specialized clinics segment is anticipated to be the fastest-growing segment in the market from 2023-2028. Modern clinical trials and cutting-edge research are frequently conducted at specialized clinics. These clinics require informatics systems that can assist in data collecting, analysis, and safe data exchange to support their research objectives.

North America is expected to be the largest region in the global market. The probability of developing cancer has increased in North America. Environmental influences, lifestyle modifications, and aging population contribute to this increase. As more individuals are diagnosed with cancer, there is a rising need for medical imaging services. For instance, according to the National Center for Health Statistics, the United States is expected to witness around 1,958,310 new cancer cases and 609,820 cancer deaths in 2023.

Asia Pacific is anticipated to witness rapid growth during the forecast period. The market for medical imaging informatics has grown as a result of the rising frequency of chronic diseases in Asia Pacific, such as cancer, diabetes, and cardiovascular diseases. For instance, one in four deaths in India is attributed to cardiovascular diseases (CVDs), with ischemic heart disease and stroke accounting for more than 80% of this burden, according to a research article published in the Journal for Cardiovascular Quality and Outcomes in 2019.

Afga-Gevaert N.V., Carestream Health, General Electric Company, Hologic, Inc., Konica Minolta, Inc., Koninklijke Philips N.V., Mindray Medical International Ltd., Siemens AG, Esaote SpA, and Mckesson Corporation among others, are some of the key players in the global medical imaging informatics market.

Please note: This is not an exhaustive list of companies profiled in the report.

Royal Philips introduced its most recent analytics and interoperability technologies at the HIMSS22 Global Health Conference & Exhibition in March 2022. A completely integrated cloud-enabled health IT platform, Philips HealthSuite Interoperability, can accommodate various workflow requirements throughout the imaging organization.

Agfa-Gevaert Group stated in March 2022 that Spire Healthcare has decided to equip several of its 40 hospitals around the U.K. with Agfa direct radiography (DR) equipment and solutions.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL MEDICAL IMAGING INFORMATICS MARKET, BY COMPONENT

4.1 Introduction

4.2 Medical Imaging Informatics Market: Component Scope Key Takeaways

4.3 Revenue Growth Analysis, 2022 & 2028

4.4 Software

4.4.1 Software Market Estimates and Forecast, 2020-2028 (USD Billion)

4.5 Hardware

4.5.1 Hardware Market Estimates and Forecast, 2020-2028 (USD Billion)

4.6 Services

4.6.1 Services Market Estimates and Forecast, 2020-2028 (USD Billion)

5 GLOBAL MEDICAL IMAGING INFORMATICS MARKET, BY APPLICATION

5.1 Introduction

5.2 Medical Imaging Informatics Market: Application Scope Key Takeaways

5.3 Revenue Growth Analysis, 2022 & 2028

5.4 Mammography

5.4.1 Mammography Market Estimates and Forecast, 2020-2028 (USD Billion)

5.5 CT

5.5.1 CT Market Estimates and Forecast, 2020-2028 (USD Billion)

5.6 MRI

5.6.1 MRI Market Estimates and Forecast, 2020-2028 (USD Billion)

5.7 Combined Modality

5.7.1 Combined Modality Market Estimates and Forecast, 2020-2028 (USD Billion)

5.8 Ultrasound

5.8.1 Ultrasound Market Estimates and Forecast, 2020-2028 (USD Billion)

5.9 Radiographic

5.9.1 Radiographic Market Estimates and Forecast, 2020-2028 (USD Billion)

5.10 Nuclear Imaging

5.10.1 Nuclear Imaging Market Estimates and Forecast, 2020-2028 (USD Billion)

6 GLOBAL MEDICAL IMAGING INFORMATICS MARKET, BY DEPLOYMENT

6.1 Introduction

6.2 Medical Imaging Informatics Market: Deployment Scope Key Takeaways

6.3 Revenue Growth Analysis, 2022 & 2028

6.4 Standalone

6.4.1 Standalone Market Estimates and Forecast, 2020-2028 (USD Billion)

6.5 Integrated

6.5.1 Integrated Market Estimates and Forecast, 2020-2028 (USD Billion)

7 GLOBAL MEDICAL IMAGING INFORMATICS MARKET, BY END USER

7.1 Introduction

7.2 Medical Imaging Informatics Market: End User Scope Key Takeaways

7.3 Revenue Growth Analysis, 2022 & 2028

7.4 Hospitals

7.4.1 Hospitals Market Estimates and Forecast, 2020-2028 (USD Billion)

7.5 Specialized Clinics

7.5.1 Specialized Clinics Market Estimates and Forecast, 2020-2028 (USD Billion)

7.6 Others

7.6.1 Others Market Estimates and Forecast, 2020-2028 (USD Billion)

8 GLOBAL MEDICAL IMAGING INFORMATICS MARKET, BY REGION

8.1 Introduction

8.2 North America Medical Imaging Informatics Market Estimates and Forecast, 2020-2028 (USD Billion)

8.2.1 By Component

8.2.2 By Application

8.2.3 By Deployment

8.2.4 By End User

8.2.5 By Country

8.2.5.1 U.S. Medical Imaging Informatics Market Estimates and Forecast, 2020-2028 (USD Billion)

8.2.5.1.1 By Component

8.2.5.1.2 By Application

8.2.5.1.3 By Deployment

8.2.5.1.4 By End User

8.2.5.2 Canada Medical Imaging Informatics Market Estimates and Forecast, 2020-2028 (USD Billion)

8.2.5.2.1 By Component

8.2.5.2.2 By Application

8.2.5.2.3 By Deployment

8.2.5.2.4 By End User

8.2.5.3 Mexico Medical Imaging Informatics Market Estimates and Forecast, 2020-2028 (USD Billion)

8.2.5.3.1 By Component

8.2.5.3.2 By Application

8.2.5.3.3 By Deployment

8.2.5.3.4 By End User

8.3 Europe Medical Imaging Informatics Market Estimates and Forecast, 2020-2028 (USD Billion)

8.3.1 By Component

8.3.2 By Application

8.3.3 By Deployment

8.3.4 By End User

8.3.5 By Country

8.3.5.1 Germany Medical Imaging Informatics Market Estimates and Forecast, 2020-2028 (USD Billion)

8.3.5.1.1 By Component

8.3.5.1.2 By Application

8.3.5.1.3 By Deployment

8.3.5.1.4 By End User

8.3.5.2 U.K. Presered Flowers Market Estimates and Forecast, 2020-2028 (USD Billion)

8.3.5.2.1 By Component

8.3.5.2.2 By Application

8.3.5.2.3 By Deployment

8.3.5.2.4 By End User

8.3.5.3 France Medical Imaging Informatics Market Estimates and Forecast, 2020-2028 (USD Billion)

8.3.5.3.1 By Component

8.3.5.3.2 By Application

8.3.5.3.3 By Deployment

8.3.5.3.4 By End User

8.3.5.4 Italy Medical Imaging Informatics Market Estimates and Forecast, 2020-2028 (USD Billion)

8.3.5.4.1 By Component

8.3.5.4.2 By Application

8.3.5.4.3 By Deployment

8.3.5.4.4 By End User

8.3.5.5 Spain Medical Imaging Informatics Market Estimates and Forecast, 2020-2028 (USD Billion)

8.3.5.5.1 By Component

8.3.5.5.2 By Application

8.3.5.5.3 By Deployment

8.3.5.5.4 By End User

8.3.5.6 Netherlands Medical Imaging Informatics Market Estimates and Forecast, 2020-2028 (USD Billion)

8.3.5.6.1 By Component

8.3.5.6.2 By Application

8.3.5.6.3 By Deployment

8.3.5.6.4 By End User

8.3.5.7 Rest of Europe Medical Imaging Informatics Market Estimates and Forecast, 2020-2028 (USD Billion)

8.3.5.7.1 By Component

8.3.5.7.2 By Application

8.3.5.7.3 By Deployment

8.3.5.7.4 By End User

8.4 Asia Pacific Medical Imaging Informatics Market Estimates and Forecast, 2020-2028 (USD Billion)

8.4.1 By Component

8.4.2 By Application

8.4.3 By Deployment

8.4.4 By End User

8.4.5 By Country

8.4.5.1 China Medical Imaging Informatics Market Estimates and Forecast, 2020-2028 (USD Billion)

8.4.5.1.1 By Component

8.4.5.1.2 By Application

8.4.5.1.3 By Deployment

8.4.5.1.4 By End User

8.4.5.2 Japan Medical Imaging Informatics Market Estimates and Forecast, 2020-2028 (USD Billion)

8.4.5.2.1 By Component

8.4.5.2.2 By Application

8.4.5.2.3 By Deployment

8.4.5.2.4 By End User

8.4.5.3 India Medical Imaging Informatics Market Estimates and Forecast, 2020-2028 (USD Billion)

8.4.5.3.1 By Component

8.4.5.3.2 By Application

8.4.5.3.3 By Deployment

8.4.5.3.4 By End User

8.4.5.4 South Korea Medical Imaging Informatics Market Estimates and Forecast, 2020-2028 (USD Billion)

8.4.5.4.1 By Component

8.4.5.4.2 By Application

8.4.5.4.3 By Deployment

8.4.5.4.4 By End User

8.4.5.5 Singapore Medical Imaging Informatics Market Estimates and Forecast, 2020-2028 (USD Billion)

8.4.5.5.1 By Component

8.4.5.5.2 By Application

8.4.5.5.3 By Deployment

8.4.5.5.4 By End User

8.4.5.6 Malaysia Medical Imaging Informatics Market Estimates and Forecast, 2020-2028 (USD Billion)

8.4.5.6.1 By Component

8.4.5.6.2 By Application

8.4.5.6.3 By Deployment

8.4.5.6.4 By End User

8.4.5.7 Thailand Medical Imaging Informatics Market Estimates and Forecast, 2020-2028 (USD Billion)

8.4.5.7.1 By Component

8.4.5.7.2 By Application

8.4.5.7.3 By Deployment

8.4.5.7.4 By End User

8.4.5.8 Indonesia Medical Imaging Informatics Market Estimates and Forecast, 2020-2028 (USD Billion)

8.4.5.8.1 By Component

8.4.5.8.2 By Application

8.4.5.8.3 By Deployment

8.4.5.8.4 By End User

8.4.5.9 Vietnam Medical Imaging Informatics Market Estimates and Forecast, 2020-2028 (USD Billion)

8.4.5.9.1 By Component

8.4.5.9.2 By Application

8.4.5.9.3 By Deployment

8.4.5.9.4 By End User

8.4.5.10 Taiwan Medical Imaging Informatics Market Estimates and Forecast, 2020-2028 (USD Billion)

8.4.5.10.1 By Component

8.4.5.10.2 By Application

8.4.5.10.3 By Deployment

8.4.5.10.4 By End User

8.4.5.11 Rest of Asia Pacific Medical Imaging Informatics Market Estimates and Forecast, 2020-2028 (USD Billion)

8.4.5.11.1 By Component

8.4.5.11.2 By Application

8.4.5.11.3 By Deployment

8.4.5.11.4 By End User

8.5 Middle East and Africa Medical Imaging Informatics Market Estimates and Forecast, 2020-2028 (USD Billion)

8.5.1 By Component

8.5.2 By Application

8.5.3 By Deployment

8.5.4 By End User

8.5.5 By Country

8.5.5.1 Saudi Arabia Medical Imaging Informatics Market Estimates and Forecast, 2020-2028 (USD Billion)

8.5.5.1.1 By Component

8.5.5.1.2 By Application

8.5.5.1.3 By Deployment

8.5.5.1.4 By End User

8.5.5.2 U.A.E. Medical Imaging Informatics Market Estimates and Forecast, 2020-2028 (USD Billion)

8.5.5.2.1 By Component

8.5.5.2.2 By Application

8.5.5.2.3 By Deployment

8.5.5.2.4 By End User

8.5.5.3 Israel Medical Imaging Informatics Market Estimates and Forecast, 2020-2028 (USD Billion)

8.5.4.3.1 By Component

8.5.4.3.2 By Application

8.5.4.3.3 By Deployment

8.5.5.3.4 By End User

8.5.5.4 South Africa Medical Imaging Informatics Market Estimates and Forecast, 2020-2028 (USD Billion)

8.5.5.4.1 By Component

8.5.5.4.2 By Application

8.5.5.4.3 By Deployment

8.5.5.4.4 By End User

8.5.5.5 Rest of Middle East and Africa Medical Imaging Informatics Market Estimates and Forecast, 2020-2028 (USD Billion)

8.5.5.5.1 By Component

8.5.5.5.2 By Application

8.5.5.5.2 By Deployment

8.5.5.5.4 By End User

8.6 Central & South America Medical Imaging Informatics Market Estimates and Forecast, 2020-2028 (USD Billion)

8.6.1 By Component

8.6.2 By Application

8.6.3 By Deployment

8.6.4 By End User

8.6.5 By Country

8.6.5.1 Brazil Medical Imaging Informatics Market Estimates and Forecast, 2020-2028 (USD Billion)

8.6.5.1.1 By Component

8.6.5.1.2 By Application

8.6.5.1.3 By Deployment

8.6.5.1.4 By End User

8.6.5.2 Argentina Medical Imaging Informatics Market Estimates and Forecast, 2020-2028 (USD Billion)

8.6.5.2.1 By Component

8.6.5.2.2 By Application

8.6.5.2.3 By Deployment

8.6.5.2.4 By End User

8.6.5.3 Chile Medical Imaging Informatics Market Estimates and Forecast, 2020-2028 (USD Billion)

8.6.5.3.1 By Component

8.6.5.3.2 By Application

8.6.5.3.3 By Deployment

8.6.5.5.4 By End User

8.6.5.4 Rest of Central & South America Medical Imaging Informatics Market Estimates and Forecast, 2020-2028 (USD Billion)

8.6.5.4.1 By Component

8.6.5.4.2 By Application

8.6.5.4.3 By Deployment

8.6.5.4.4 By End User

9 COMPETITIVE LANDCAPE

9.1 Company Market Share Analysis

9.2 Four Quadrant Positioning Matrix

9.2.1 Market Leaders

9.2.2 Market Visionaries

9.2.3 Market Challengers

9.2.4 Niche Market Players

9.3 Vendor Landscape

9.3.1 North America

9.3.2 Europe

9.3.3 Asia Pacific

9.3.4 Rest of the World

9.4 Company Profiles

9.4.1 Afga-Gevaert N.V.

9.4.1.1 Business Description & Financial Analysis

9.4.1.2 SWOT Analysis

9.4.1.3 Products & Services Offered

9.4.1.4 Strategic Alliances between Business Partners

9.4.2 Carestream Health

9.4.2.1 Business Description & Financial Analysis

9.4.2.2 SWOT Analysis

9.4.2.3 Products & Services Offered

9.4.2.4 Strategic Alliances between Business Partners

9.4.3 General Electric Company

9.4.3.1 Business Description & Financial Analysis

9.4.3.2 SWOT Analysis

9.4.3.3 Products & Services Offered

9.4.3.4 Strategic Alliances between Business Partners

9.4.4 Hologic, Inc.

9.4.4.1 Business Description & Financial Analysis

9.4.4.2 SWOT Analysis

9.4.4.3 Products & Services Offered

9.4.4.4 Strategic Alliances between Business Partners

9.4.5 Konica Minolta, Inc.

9.4.5.1 Business Description & Financial Analysis

9.4.5.2 SWOT Analysis

9.4.5.3 Products & Services Offered

9.4.5.4 Strategic Alliances between Business Partners

9.4.6 KONINKLIJKE PHILIPS N.V.

9.4.6.1 Business Description & Financial Analysis

9.4.6.2 SWOT Analysis

9.4.6.3 Products & Services Offered

9.4.6.4 Strategic Alliances between Business Partners

9.4.7 Mindray Medical International Ltd.

9.4.7.1 Business Description & Financial Analysis

9.4.7.2 SWOT Analysis

9.4.7.3 Products & Services Offered

9.4.8.4 Strategic Alliances between Business Partners

9.4.8 Siemens AG

9.4.8.1 Business Description & Financial Analysis

9.4.8.2 SWOT Analysis

9.4.8.3 Products & Services Offered

9.4.8.4 Strategic Alliances between Business Partners

9.4.9 Esaote SpA

9.4.9.1 Business Description & Financial Analysis

9.4.9.2 SWOT Analysis

9.4.9.3 Products & Services Offered

9.4.9.4 Strategic Alliances between Business Partners

9.4.10 Mckesson Corporation

9.4.10.1 Business Description & Financial Analysis

9.4.10.2 SWOT Analysis

9.4.10.3 Products & Services Offered

9.4.10.4 Strategic Alliances between Business Partners

9.4.11 Other Companies

9.4.11.1 Business Description & Financial Analysis

9.4.11.2 SWOT Analysis

9.4.11.3 Products & Services Offered

9.4.11.4 Strategic Alliances between Business Partners

10 RESEARCH METHODOLOGY

10.1 Market Introduction

10.1.1 Market Definition

10.1.2 Market Scope & Segmentation

10.2 Information Procurement

10.2.1 Secondary Research

10.2.1.1 Purchased Databases

10.2.1.2 GMEs Internal Data Repository

10.2.1.3 Secondary Resources & Third Party Perspectives

10.2.1.4 Company Information Sources

10.2.2 Primary Research

10.2.2.1 Various Types of Respondents for Primary Interviews

10.2.2.2 Number of Interviews Conducted throughout the Research Process

10.2.2.3 Primary Stakeholders

10.2.2.4 Discussion Guide for Primary Participants

10.2.3 Expert Panels

10.2.3.1 Expert Panels Across 30+ Industry

10.2.4 Paid Local Experts

10.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

10.3 Market Estimation

10.3.1 Top-Down Approach

10.3.1.1 Macro-Economic Indicators Considered

10.3.1.2 Micro-Economic Indicators Considered

10.3.2 Bottom Up Approach

10.3.2.1 Company Share Analysis Approach

10.3.2.2 Estimation of Potential Product Sales

10.4 Data Triangulation

10.4.1 Data Collection

10.4.2 Time Series, Cross Sectional & Panel Data Analysis

10.4.3 Cluster Analysis

10.5 Analysis and Output

10.5.1 Inhouse AI Based Real Time Analytics Tool

10.5.2 Output From Desk & Primary Research

10.6 Research Assumptions & Limitations

10.7.1 Research Assumptions

10.7.2 Research Limitations

LIST OF TABLES

1 Global Medical Imaging Informatics Market, By Component, 2020-2028 (USD Billion)

2 Software Market, By Region, 2020-2028 (USD Billion)

3 Hardware Market, By Region, 2020-2028 (USD Billion)

4 Services Market, By Region, 2020-2028 (USD Billion)

5 Global Medical Imaging Informatics Market, By Application, 2020-2028 (USD Billion)

6 Mammography Market, By Region, 2020-2028 (USD Billion)

7 CT Market, By Region, 2020-2028 (USD Billion)

8 MRI Market, By Region, 2020-2028 (USD Billion)

9 Combined Modality Market, By Region, 2020-2028 (USD Billion)

10 Ultrasound Market, By Region, 2020-2028 (USD Billion)

11 Radiographic Market, By Region, 2020-2028 (USD Billion)

12 Nuclear Imaging Market, By Region, 2020-2028 (USD Billion)

13 Global Medical Imaging Informatics Market, By Deployment, 2020-2028 (USD Billion)

14 Standalone Market, By Region, 2020-2028 (USD Billion)

15 Integrated Market, By Region, 2020-2028 (USD Billion)

16 Global Medical Imaging Informatics Market, By END USER, 2020-2028 (USD Billion)

17 Hospitals Market, By Region, 2020-2028 (USD Billion)

18 Specialized Clinics Market, By Region, 2020-2028 (USD Billion)

19 Others Market, By Region, 2020-2028 (USD Billion)

20 Regional Analysis, 2020-2028 (USD Billion)

21 North America Medical Imaging Informatics Market, By Component, 2020-2028 (USD Billion)

22 North America Medical Imaging Informatics Market, By Application, 2020-2028 (USD Billion)

23 North America Medical Imaging Informatics Market, By Deployment, 2020-2028 (USD Billion)

24 North America Medical Imaging Informatics Market, By End User, 2020-2028 (USD Billion)

25 North America Medical Imaging Informatics Market, By Country, 2020-2028 (USD Billion)

26 U.S Medical Imaging Informatics Market, By Component, 2020-2028 (USD Billion)

27 U.S Medical Imaging Informatics Market, By Application, 2020-2028 (USD Billion)

28 U.S Medical Imaging Informatics Market, By Deployment, 2020-2028 (USD Billion)

29 U.S Medical Imaging Informatics Market, By End User, 2020-2028 (USD Billion)

30 Canada Medical Imaging Informatics Market, By Component, 2020-2028 (USD Billion)

31 Canada Medical Imaging Informatics Market, By Application, 2020-2028 (USD Billion)

32 Canada Medical Imaging Informatics Market, By Deployment, 2020-2028 (USD Billion)

33 CANADA Medical Imaging Informatics Market, By End User, 2020-2028 (USD Billion)

34 Mexico Medical Imaging Informatics Market, By Component, 2020-2028 (USD Billion)

35 Mexico Medical Imaging Informatics Market, By Application, 2020-2028 (USD Billion)

36 Mexico Medical Imaging Informatics Market, By Deployment, 2020-2028 (USD Billion)

37 mexico Medical Imaging Informatics Market, By End User, 2020-2028 (USD Billion)

38 Europe Medical Imaging Informatics Market, By Component, 2020-2028 (USD Billion)

39 Europe Medical Imaging Informatics Market, By Application, 2020-2028 (USD Billion)

40 Europe Medical Imaging Informatics Market, By Deployment, 2020-2028 (USD Billion)

41 europe Medical Imaging Informatics Market, By End User, 2020-2028 (USD Billion)

42 europe Medical Imaging Informatics Market, By COUNTRY, 2020-2028 (USD Billion)

43 Germany Medical Imaging Informatics Market, By Component, 2020-2028 (USD Billion)

44 Germany Medical Imaging Informatics Market, By Application, 2020-2028 (USD Billion)

45 Germany Medical Imaging Informatics Market, By Deployment, 2020-2028 (USD Billion)

46 germany Medical Imaging Informatics Market, By End User, 2020-2028 (USD Billion)

47 UK Medical Imaging Informatics Market, By Component, 2020-2028 (USD Billion)

48 UK Medical Imaging Informatics Market, By Application, 2020-2028 (USD Billion)

49 UK Medical Imaging Informatics Market, By Deployment, 2020-2028 (USD Billion)

50 U.kMedical Imaging Informatics Market, By End User, 2020-2028 (USD Billion)

51 France Medical Imaging Informatics Market, By Component, 2020-2028 (USD Billion)

52 France Medical Imaging Informatics Market, By Application, 2020-2028 (USD Billion)

53 France Medical Imaging Informatics Market, By Deployment, 2020-2028 (USD Billion)

54 france Medical Imaging Informatics Market, By End User, 2020-2028 (USD Billion)

55 Italy Medical Imaging Informatics Market, By Component, 2020-2028 (USD Billion)

56 Italy Medical Imaging Informatics Market, By T Application Type, 2020-2028 (USD Billion)

57 Italy Medical Imaging Informatics Market, By Deployment, 2020-2028 (USD Billion)

58 italy Medical Imaging Informatics Market, By End User, 2020-2028 (USD Billion)

59 Spain Medical Imaging Informatics Market, By Component, 2020-2028 (USD Billion)

60 Spain Medical Imaging Informatics Market, By Application, 2020-2028 (USD Billion)

61 Spain Medical Imaging Informatics Market, By Deployment, 2020-2028 (USD Billion)

62 spain Medical Imaging Informatics Market, By End User, 2020-2028 (USD Billion)

63 Netherlands Medical Imaging Informatics Market, By Component, 2020-2028 (USD Billion)

64 Netherlands Medical Imaging Informatics Market, By Application, 2020-2028 (USD Billion)

65 Netherlands Medical Imaging Informatics Market, By Deployment, 2020-2028 (USD Billion)

66 Rest Of Europe Medical Imaging Informatics Market, By Component, 2020-2028 (USD Billion)

67 Rest Of Europe Medical Imaging Informatics Market, By Application, 2020-2028 (USD Billion)

68 Rest of Europe Medical Imaging Informatics Market, By Deployment, 2020-2028 (USD Billion)

69 REST OF EUROPE Medical Imaging Informatics Market, By End User, 2020-2028 (USD Billion)

70 Asia Pacific Medical Imaging Informatics Market, By Component, 2020-2028 (USD Billion)

71 Asia Pacific Medical Imaging Informatics Market, By Application, 2020-2028 (USD Billion)

72 Asia Pacific Medical Imaging Informatics Market, By Deployment, 2020-2028 (USD Billion)

73 asia Medical Imaging Informatics Market, By End User, 2020-2028 (USD Billion)

74 Asia Pacific Medical Imaging Informatics Market, By Country, 2020-2028 (USD Billion)

75 China Medical Imaging Informatics Market, By Component, 2020-2028 (USD Billion)

76 China Medical Imaging Informatics Market, By Application, 2020-2028 (USD Billion)

77 China Medical Imaging Informatics Market, By Deployment, 2020-2028 (USD Billion)

78 china Medical Imaging Informatics Market, By End User, 2020-2028 (USD Billion)

79 India Medical Imaging Informatics Market, By Component, 2020-2028 (USD Billion)

80 India Medical Imaging Informatics Market, By Application, 2020-2028 (USD Billion)

81 India Medical Imaging Informatics Market, By Deployment, 2020-2028 (USD Billion)

82 india Medical Imaging Informatics Market, By End User, 2020-2028 (USD Billion)

83 Japan Medical Imaging Informatics Market, By Component, 2020-2028 (USD Billion)

84 Japan Medical Imaging Informatics Market, By Application, 2020-2028 (USD Billion)

85 Japan Medical Imaging Informatics Market, By Deployment, 2020-2028 (USD Billion)

86 japan Medical Imaging Informatics Market, By End User, 2020-2028 (USD Billion)

87 South Korea Medical Imaging Informatics Market, By Component, 2020-2028 (USD Billion)

88 South Korea Medical Imaging Informatics Market, By Application, 2020-2028 (USD Billion)

89 South Korea Medical Imaging Informatics Market, By Deployment, 2020-2028 (USD Billion)

90 south korea Medical Imaging Informatics Market, By End User, 2020-2028 (USD Billion)

91 Singapore Medical Imaging Informatics Market, By Component, 2020-2028 (USD Billion)

92 Singapore Medical Imaging Informatics Market, By Application, 2020-2028 (USD Billion)

93 Singapore Medical Imaging Informatics Market, By Deployment, 2020-2028 (USD Billion)

94 Singapore Medical Imaging Informatics Market, By End User, 2020-2028 (USD Billion)

95 Thailand Medical Imaging Informatics Market, By Component, 2020-2028 (USD Billion)

96 Thailand Medical Imaging Informatics Market, By Application, 2020-2028 (USD Billion)

97 Thailand Medical Imaging Informatics Market, By Deployment, 2020-2028 (USD Billion)

98 Thailand Medical Imaging Informatics Market, By End User, 2020-2028 (USD Billion)

99 MALAYSIA Medical Imaging Informatics Market, By Component, 2020-2028 (USD Billion)

100 MALAYSIA Medical Imaging Informatics Market, By Application, 2020-2028 (USD Billion)

101 MALAYSIA Medical Imaging Informatics Market, By Deployment, 2020-2028 (USD Billion)

102 MALAYSIA Medical Imaging Informatics Market, By End User, 2020-2028 (USD Billion)

103 Vietnam Medical Imaging Informatics Market, By Component, 2020-2028 (USD Billion)

104 Vietnam Medical Imaging Informatics Market, By Application, 2020-2028 (USD Billion)

105 Vietnam Medical Imaging Informatics Market, By Deployment, 2020-2028 (USD Billion)

106 Taiwan Medical Imaging Informatics Market, By Component, 2020-2028 (USD Billion)

107 Taiwan Medical Imaging Informatics Market, By Application, 2020-2028 (USD Billion)

108 Taiwan Medical Imaging Informatics Market, By Deployment, 2020-2028 (USD Billion)

109 Taiwan Medical Imaging Informatics Market, By End User, 2020-2028 (USD Billion)

110 REST OF APAC Medical Imaging Informatics Market, By Component, 2020-2028 (USD Billion)

111 REST OF APAC Medical Imaging Informatics Market, By Application, 2020-2028 (USD Billion)

112 REST OF APAC Medical Imaging Informatics Market, By Deployment, 2020-2028 (USD Billion)

113 Rest of APAC Medical Imaging Informatics Market, By End User, 2020-2028 (USD Billion)

114 Middle East and Africa Medical Imaging Informatics Market, By Component, 2020-2028 (USD Billion)

115 Middle East and Africa Medical Imaging Informatics Market, By Application, 2020-2028 (USD Billion)

116 Middle East and Africa Medical Imaging Informatics Market, By Deployment, 2020-2028 (USD Billion)

117 MIDDLE EAST AND AFRICA Medical Imaging Informatics Market, By End User, 2020-2028 (USD Billion)

118 Middle East and Africa Medical Imaging Informatics Market, By Country, 2020-2028 (USD Billion)

119 Saudi Arabia Medical Imaging Informatics Market, By Component, 2020-2028 (USD Billion)

120 Saudi Arabia Medical Imaging Informatics Market, By Application, 2020-2028 (USD Billion)

121 Saudi Arabia Medical Imaging Informatics Market, By Deployment, 2020-2028 (USD Billion)

122 saudi arabia Medical Imaging Informatics Market, By End User, 2020-2028 (USD Billion)

123 UAE Medical Imaging Informatics Market, By Component, 2020-2028 (USD Billion)

124 UAE Medical Imaging Informatics Market, By Application, 2020-2028 (USD Billion)

125 UAE Medical Imaging Informatics Market, By Deployment, 2020-2028 (USD Billion)

126 uae Medical Imaging Informatics Market, By End User, 2020-2028 (USD Billion)

127 Israel Medical Imaging Informatics Market, By Component, 2020-2028 (USD Billion)

128 Israel Medical Imaging Informatics Market, By Application, 2020-2028 (USD Billion)

129 Israel Medical Imaging Informatics Market, By Deployment, 2020-2028 (USD Billion)

130 Israel Medical Imaging Informatics Market, By End User, 2020-2028 (USD Billion)

131 South Africa Medical Imaging Informatics Market, By Component, 2020-2028 (USD Billion)

132 South Africa Medical Imaging Informatics Market, By Application, 2020-2028 (USD Billion)

133 South Africa Medical Imaging Informatics Market, By Deployment, 2020-2028 (USD Billion)

134 South Africa Medical Imaging Informatics Market, By End User, 2020-2028 (USD Billion)

135 REST OF MIDDLE EAST AND AFRICA Medical Imaging Informatics Market, By Component, 2020-2028 (USD Billion)

136 REST OF MIDDLE EAST AND AFRICA Medical Imaging Informatics Market, By Application, 2020-2028 (USD Billion)

137 REST OF MIDDLE EAST AND AFRICA Medical Imaging Informatics Market, By Deployment, 2020-2028 (USD Billion)

138 REST OF MIDDLE EAST AND AFRICA Medical Imaging Informatics Market, By End User, 2020-2028 (USD Billion)

139 Central & South America Medical Imaging Informatics Market, By Component, 2020-2028 (USD Billion)

140 Central & South America Medical Imaging Informatics Market, By Application, 2020-2028 (USD Billion)

141 Central & South America Medical Imaging Informatics Market, By Deployment, 2020-2028 (USD Billion)

142 CENTRAL & SOUTH AMERICA Medical Imaging Informatics Market, By End User, 2020-2028 (USD Billion)

143 Central & South America Medical Imaging Informatics Market, By Country, 2020-2028 (USD Billion)

144 Brazil Medical Imaging Informatics Market, By Component, 2020-2028 (USD Billion)

145 Brazil Medical Imaging Informatics Market, By Application, 2020-2028 (USD Billion)

146 Brazil Medical Imaging Informatics Market, By Deployment, 2020-2028 (USD Billion)

147 brazil Medical Imaging Informatics Market, By End User, 2020-2028 (USD Billion)

148 Chile Medical Imaging Informatics Market, By Component, 2020-2028 (USD Billion)

149 Chile Medical Imaging Informatics Market, By Application, 2020-2028 (USD Billion)

150 Chile Medical Imaging Informatics Market, By Deployment, 2020-2028 (USD Billion)

151 Chile Medical Imaging Informatics Market, By End User, 2020-2028 (USD Billion)

152 Argentina Medical Imaging Informatics Market, By Component, 2020-2028 (USD Billion)

153 Argentina Medical Imaging Informatics Market, By Application, 2020-2028 (USD Billion)

154 Argentina Medical Imaging Informatics Market, By Deployment, 2020-2028 (USD Billion)

155 Argentina Medical Imaging Informatics Market, By End User, 2020-2028 (USD Billion)

156 REST OF CENTRAL AND SOUTH AMERICA Medical Imaging Informatics Market, By Component, 2020-2028 (USD Billion)

157 REST OF CENTRAL AND SOUTH AMERICA Medical Imaging Informatics Market, By Application, 2020-2028 (USD Billion)

158 REST OF CENTRAL AND SOUTH AMERICA Medical Imaging Informatics Market, By Deployment, 2020-2028 (USD Billion)

159 REST OF CENTRAL AND SOUTH AMERICA Medical Imaging Informatics Market, By End User, 2020-2028 (USD Billion)

160 Afga-Gevaert N.V.: Products & Services Offering

161 Carestream Health: Products & Services Offering

162 General Electric Company: Products & Services Offering

163 Hologic, Inc.: Products & Services Offering

164 Konica Minolta, Inc.: Products & Services Offering

165 KONINKLIJKE PHILIPS N.V.: Products & Services Offering

166 Mindray Medical International Ltd. : Products & Services Offering

167 Siemens AG: Products & Services Offering

168 Esaote SpA, Inc: Products & Services Offering

169 Mckesson Corporation: Products & Services Offering

170 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Medical Imaging Informatics Market Overview

2 Global Medical Imaging Informatics Market Value From 2020-2028 (USD Billion)

3 Global Medical Imaging Informatics Market Share, By Component (2022)

4 Global Medical Imaging Informatics Market Share, By Application (2022)

5 Global Medical Imaging Informatics Market Share, By Deployment (2022)

6 Global Medical Imaging Informatics Market Share, By End User (2022)

7 Global Medical Imaging Informatics Market, By Region (Asia Pacific Market)

8 Technological Trends In Global Medical Imaging Informatics Market

9 Four Quadrant Competitor Positioning Matrix

10 Impact Of Macro & Micro Indicators On The Market

11 Impact Of Key Drivers On The Global Medical Imaging Informatics Market

12 Impact Of Challenges On The Global Medical Imaging Informatics Market

13 Porter’s Five Forces Analysis

14 Global Medical Imaging Informatics Market: By Component Scope Key Takeaways

15 Global Medical Imaging Informatics Market, By Component Segment: Revenue Growth Analysis

16 Software Market, By Region, 2020-2028 (USD Billion)

17 Hardware Market, By Region, 2020-2028 (USD Billion)

18 Services Market, By Region, 2020-2028 (USD Billion)

19 Global Medical Imaging Informatics Market: By Application Scope Key Takeaways

20 Global Medical Imaging Informatics Market, By Application Segment: Revenue Growth Analysis

21 Mammography Market, By Region, 2020-2028 (USD Billion)

22 CT Market, By Region, 2020-2028 (USD Billion)

23 MRI Market, By Region, 2020-2028 (USD Billion)

24 Combined Modality Market, By Region, 2020-2028 (USD Billion)

25 Ultrasound Market, By Region, 2020-2028 (USD Billion)

26 Radiographic Market, By Region, 2020-2028 (USD Billion)

27 Nuclear Imaging Market, By Region, 2020-2028 (USD Billion)

28 Global Medical Imaging Informatics Market: By Deployment Scope Key Takeaways

29 Global Medical Imaging Informatics Market, By Deployment Segment: Revenue Growth Analysis

30 Standalone Market, By Region, 2020-2028 (USD Billion)

31 Integrated Market, By Region, 2020-2028 (USD Billion)

32 Global Medical Imaging Informatics Market: By End User Scope Key Takeaways

33 Global Medical Imaging Informatics Market, By End User Segment: Revenue Growth Analysis

34 Hospitals Market, By Region, 2020-2028 (USD Billion)

35 Specialized Clinics Market, By Region, 2020-2028 (USD Billion)

36 Others Market, By Region, 2020-2028 (USD Billion)

37 Regional Segment: Revenue Growth Analysis

38 Global Medical Imaging Informatics Market: Regional Analysis

39 North America Medical Imaging Informatics Market Overview

40 North America Medical Imaging Informatics Market, By Component

41 North America Medical Imaging Informatics Market, By Application

42 North America Medical Imaging Informatics Market, By Deployment

43 North America Medical Imaging Informatics Market, By End User

44 North America Medical Imaging Informatics Market, By Country

45 U.S. Medical Imaging Informatics Market, By Component

46 U.S. Medical Imaging Informatics Market, By Application

47 U.S. Medical Imaging Informatics Market, By Deployment

48 U.S. Medical Imaging Informatics Market, By End User

49 Canada Medical Imaging Informatics Market, By Component

50 Canada Medical Imaging Informatics Market, By Application

51 Canada Medical Imaging Informatics Market, By Deployment

52 Canada Medical Imaging Informatics Market, By End User

53 Mexico Medical Imaging Informatics Market, By Component

54 Mexico Medical Imaging Informatics Market, By Application

55 Mexico Medical Imaging Informatics Market, By Deployment

56 Mexico Medical Imaging Informatics Market, By End User

57 Four Quadrant Positioning Matrix

58 Company Market Share Analysis

59 Afga-Gevaert N.V.: Company Snapshot

60 Afga-Gevaert N.V.: SWOT Analysis

61 Afga-Gevaert N.V.: Geographic Presence

62 Carestream Health: Company Snapshot

63 Carestream Health: SWOT Analysis

64 Carestream Health: Geographic Presence

65 General Electric Company: Company Snapshot

66 General Electric Company: SWOT Analysis

67 General Electric Company: Geographic Presence

68 Hologic, Inc.: Company Snapshot

69 Hologic, Inc.: Swot Analysis

70 Hologic, Inc.: Geographic Presence

71 Konica Minolta, Inc.: Company Snapshot

72 Konica Minolta, Inc.: SWOT Analysis

73 Konica Minolta, Inc.: Geographic Presence

74 KONINKLIJKE PHILIPS N.V.: Company Snapshot

75 KONINKLIJKE PHILIPS N.V.: SWOT Analysis

76 KONINKLIJKE PHILIPS N.V.: Geographic Presence

77 Mindray Medical International Ltd. : Company Snapshot

78 Mindray Medical International Ltd. : SWOT Analysis

79 Mindray Medical International Ltd. : Geographic Presence

80 Siemens AG: Company Snapshot

81 Siemens AG: SWOT Analysis

82 Siemens AG: Geographic Presence

83 Esaote SpA, Inc.: Company Snapshot

84 Esaote SpA, Inc.: SWOT Analysis

85 Esaote SpA, Inc.: Geographic Presence

86 Mckesson Corporation: Company Snapshot

87 Mckesson Corporation: SWOT Analysis

88 Mckesson Corporation: Geographic Presence

89 Other Companies: Company Snapshot

90 Other Companies: SWOT Analysis

91 Other Companies: Geographic Presence

The Global Medical Imaging Informatics Market has been studied from the year 2019 till 2028. However, the CAGR provided in the report is from the year 2023 to 2028. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Medical Imaging Informatics Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS