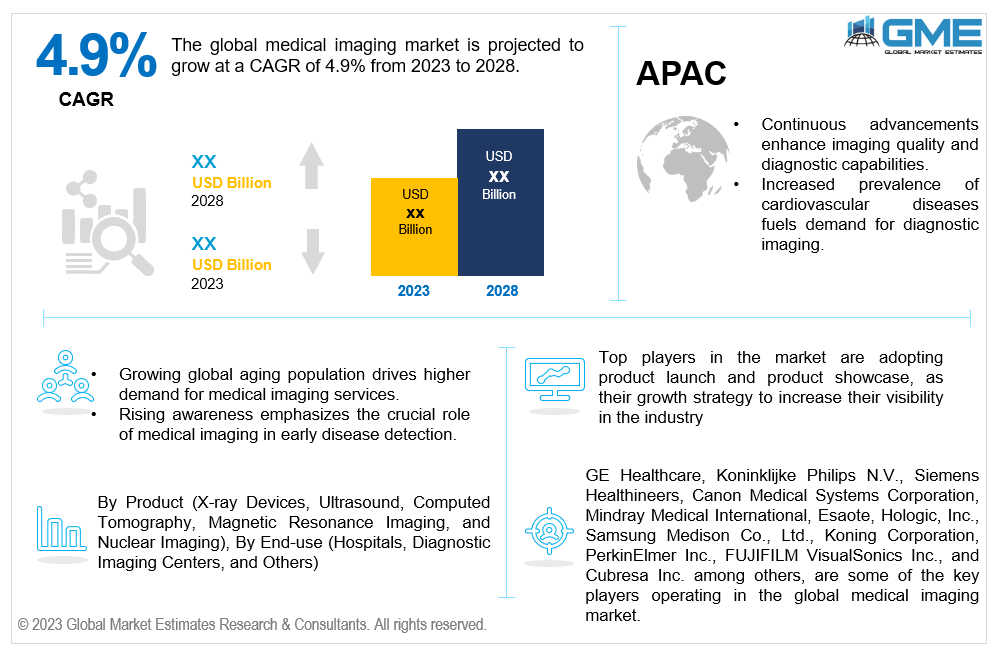

Global Medical Imaging Market Size, Trends & Analysis - Forecasts to 2028 By Product (X-ray Devices, Ultrasound, Computed Tomography, Magnetic Resonance Imaging, and Nuclear Imaging), By End-use (Hospitals, Diagnostic Imaging Centers, and Others), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

The global medical imaging market is projected to grow at a CAGR of 4.9% from 2023 to 2028.

Medical imaging applications include diagnosing and monitoring diseases, visualizing anatomical structures, guiding surgical procedures, and assessing treatment responses. Medical imaging modalities like X-ray, CT, MRI, ultrasound, and nuclear medicine play vital roles in detecting and managing conditions and enhancing patient care through non-invasive visualization of internal body structures and functions.

The growth of the medical imaging market is driven by ongoing developments in medical imaging technologies, including nuclear medicine, ultrasound, computed tomography (CT), and magnetic resonance imaging (MRI). Improvements in image resolution, speed, and diagnostic accuracy drive the adoption of newer imaging modalities. Medical imaging procedures are now more accurate and productive due to integrating artificial intelligence (AI) and machine learning. AI algorithms assist in image interpretation, enabling faster and more precise diagnoses, thus driving market growth. The increased adoption of telemedicine and remote imaging services has further increased the accessibility of medical imaging. Remote diagnostic capabilities and the ability to share images for expert consultation contribute to market expansion.

Growing awareness among patients about the importance of early diagnosis and preventive healthcare measures has increased the demand for medical imaging services. Patients are becoming more proactive in seeking imaging procedures for better health management. The global aging population is a significant driver for the medical imaging market. As people age, there is a higher possibility of developing health issues that require diagnostic imaging for accurate diagnosis and treatment planning.

Some imaging modalities, such as X-ray and CT scans, involve ionizing radiation, raising concerns about potential long-term health risks and limiting their frequency of use. This factor may hamper the market growth over the forecast period.

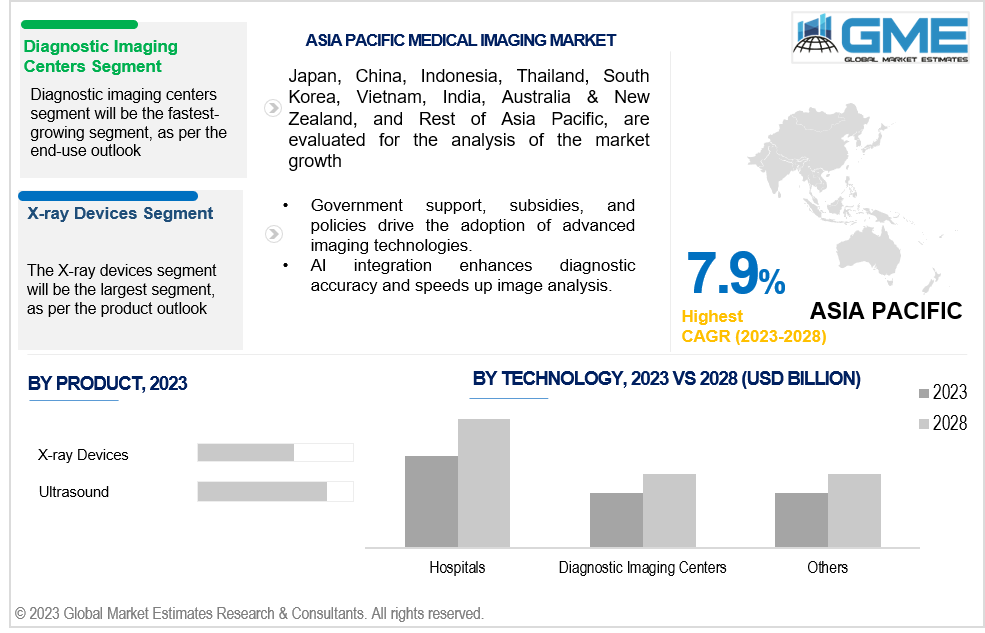

The X-ray devices segment is expected to hold the largest share of the market over the forecast period. This dominance is due to significant demand for diagnostic services globally, especially for prevalent diseases like cancer, TB, and cardiac conditions. Ongoing technological advancements, such as integrating cloud-based AI in medical and 3D medical imaging, contribute to the segment's sustained growth.

The ultrasound segment is expected to be the fastest-growing segment in the market from 2023-2028. The segment growth is due to its versatile applications and global accessibility. The introduction of ergonomic models, especially portable ultrasounds, addresses unmet healthcare needs, fostering a surge in demand. Technological advancements, such as advanced transducers and artificial intelligence integration, enhance diagnostic capabilities. With widespread use from gynaecology to abdominal imaging, ultrasound's affordability and adaptability contribute to its fastest growth. As it offers real-time imaging, aids in diverse medical cases, and aligns with the increasing demand for advanced healthcare equipment, the ultrasound segment is expected to exhibit highest CAGR over the forecast period.

The hospital segment is expected to hold the largest market share, attributed to the rising demand for advanced imaging sensory systems, increased awareness for early diagnosis, the proliferation of hospital surgical centers, and the increasing demand for medical imaging systems, particularly in addressing cancer and heart diseases. Furthermore, the digitization of radiology imaging services, a surge in imaging procedures, and the adoption of advanced systems in hospitals for superior patient care are also contributing to the growth of the hospital segment.

The diagnostic imaging centers segment is anticipated to be the fastest-growing segment in the market from 2023-2028. The anticipated growth is due to the increasing number of such centers in developed and emerging countries. Notably, the U.S. has over 6,000 independent diagnostic testing facilities (IDTFs) within the outpatient sector, underscoring the segment's prominence. Diagnostic imaging centers provide essential facilities for imaging procedures, catering mainly to general clinics and smaller healthcare setups that may lack comprehensive imaging resources. This segment's anticipated rapid revenue growth stems from its ability to offer specialized imaging services to a broader healthcare audience.

North America is expected to be the largest region in the market over the forecast period. The primary reasons boosting this region's medical imaging market growth include the presence of numerous medical imaging industry players, increasing product launches, rising adoption of advanced medical imaging equipment, favourable reimbursement scenarios, and substantial healthcare spending. The prevalence of chronic diseases, a growing aging population, and a trend toward preventive diagnostic practices further contribute to North America's market growth.

Asia Pacific is predicted to witness rapid growth during the forecast period. The growth is due to the rising incidence of chronic diseases and a heightened demand for advanced imaging devices. Establishing more local manufacturing units is anticipated to contribute to the availability of reasonably priced diagnostic imaging technologies units, addressing the price sensitivity and relatively lower market penetration in this region.

GE Healthcare, Koninklijke Philips N.V., Siemens Healthineers, Canon Medical Systems Corporation, Mindray Medical International, Esaote, Hologic, Inc., Samsung Medison Co., Ltd., Koning Corporation, PerkinElmer Inc., FUJIFILM VisualSonics Inc., and Cubresa Inc. among others, are some of the key players operating in the global medical imaging market.

Please note: This is not an exhaustive list of companies profiled in the report.

In September 2023, Mayo Clinic and GE HealthCare entered into a collaboration, aiming to leverage each organization's strengths to accelerate the development and implementation of advanced medical imaging and theranostic technologies.

In May 2023, Royal Philips, a global leader in health technology, showcased its smart connected imaging systems and integrated radiology workflow solutions at the European Congress of Radiology (ECR) 2023 in Vienna, Austria. The company showcased its AI-powered technology to enhance diagnostic confidence, improve clinical outcomes, and drive operational efficiency in various medical fields, including radiology, oncology, cardiology, and pathology.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL MEDICAL IMAGING MARKET, BY PRODUCT

4.1 Introduction

4.2 Medical Imaging Market: Product Scope Key Takeaways

4.3 Revenue Growth Analysis, 2022 & 2028

4.4 X-ray Devices

4.4.1 X-ray Devices Market Estimates and Forecast, 2020-2028 (USD Million)

4.5 Ultrasound

4.5.1 Ultrasound Market Estimates and Forecast, 2020-2028 (USD Million)

4.6 Computed Tomography

4.6.1 Computed Tomography Market Estimates and Forecast, 2020-2028 (USD Million)

4.7 Magnetic Resonance Imaging

4.7.1 Magnetic Resonance Imaging Market Estimates and Forecast, 2020-2028 (USD Million)

4.8 Nuclear Imaging

4.8.1 Nuclear Imaging Market Estimates and Forecast, 2020-2028 (USD Million)

5 GLOBAL MEDICAL IMAGING MARKET, BY END-USE

5.1 Introduction

5.2 Medical Imaging Market: End-use Scope Key Takeaways

5.3 Revenue Growth Analysis, 2022 & 2028

5.4 Hospitals

5.4.1 Hospitals Market Estimates and Forecast, 2020-2028 (USD Million)

5.5 Diagnostic Imaging Centers

5.5.1 Diagnostic Imaging Centers Market Estimates and Forecast, 2020-2028 (USD Million)

5.6 Others

5.6.1 Others Market Estimates and Forecast, 2020-2028 (USD Million)

6 GLOBAL MEDICAL IMAGING MARKET, BY REGION

6.1 Introduction

6.2 North America Medical Imaging Market Estimates and Forecast, 2020-2028 (USD Million)

6.2.1 By Product

6.2.2 By End-use

6.2.3 By Country

6.2.3.1 U.S. Medical Imaging Market Estimates and Forecast, 2020-2028 (USD Million)

6.2.3.1.1 By Product

6.2.3.1.2 By End-use

6.2.3.2 Canada Medical Imaging Market Estimates and Forecast, 2020-2028 (USD Million)

6.2.3.2.1 By Product

6.2.3.2.2 By End-use

6.2.3.3 Mexico Medical Imaging Market Estimates and Forecast, 2020-2028 (USD Million)

6.2.3.3.1 By Product

6.2.3.3.2 By End-use

6.3 Europe Medical Imaging Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.1 By Product

6.3.2 By End-use

6.3.3 By Country

6.3.3.1 Germany Medical Imaging Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.1.1 By Product

6.3.3.1.2 By End-use

6.3.3.2 U.K. Medical Imaging Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.2.1 By Product

6.3.3.2.2 By End-use

6.3.3.3 France Medical Imaging Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.3.1 By Product

6.3.3.3.2 By End-use

6.3.3.4 Italy Medical Imaging Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.4.1 By Product

6.3.3.4.2 By End-use

6.3.3.5 Spain Medical Imaging Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.5.1 By Product

6.3.3.5.2 By End-use

6.3.3.6 Netherlands Medical Imaging Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.6.1 By Product

6.3.3.6.2 By End-use

6.3.3.7 Rest of Europe Medical Imaging Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.6.1 By Product

6.3.3.6.2 By End-use

6.4 Asia Pacific Medical Imaging Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.1 By Product

6.4.2 By End-use

6.4.3 By Country

6.4.3.1 China Medical Imaging Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.1.1 By Product

6.4.3.1.2 By End-use

6.4.3.2 Japan Medical Imaging Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.2.1 By Product

6.4.3.2.2 By End-use

6.4.3.3 India Medical Imaging Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.3.1 By Product

6.4.3.3.2 By End-use

6.4.3.4 South Korea Medical Imaging Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.4.1 By Product

6.4.3.4.2 By End-use

6.4.3.5 Singapore Medical Imaging Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.5.1 By Product

6.4.3.5.2 By End-use

6.4.3.6 Malaysia Medical Imaging Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.6.1 By Product

6.4.3.6.2 By End-use

6.4.3.7 Thailand Medical Imaging Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.6.1 By Product

6.4.3.6.2 By End-use

6.4.3.8 Indonesia Medical Imaging Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.7.1 By Product

6.4.3.7.2 By End-use

6.4.3.9 Vietnam Medical Imaging Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.8.1 By Product

6.4.3.8.2 By End-use

6.4.3.10 Taiwan Medical Imaging Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.10.1 By Product

6.4.3.10.2 By End-use

6.4.3.11 Rest of Asia Pacific Medical Imaging Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.11.1 By Product

6.4.3.11.2 By End-use

6.5 Middle East and Africa Medical Imaging Market Estimates and Forecast, 2020-2028 (USD Million)

6.5.1 By Product

6.5.2 By End-use

6.5.3 By Country

6.5.3.1 Saudi Arabia Medical Imaging Market Estimates and Forecast, 2020-2028 (USD Million)

6.5.3.1.1 By Product

6.5.3.1.2 By End-use

6.5.3.2 U.A.E. Medical Imaging Market Estimates and Forecast, 2020-2028 (USD Million)

6.5.3.2.1 By Product

6.5.3.2.2 By End-use

6.5.3.3 Israel Medical Imaging Market Estimates and Forecast, 2020-2028 (USD Million)

6.5.3.3.1 By Product

6.5.3.3.2 By End-use

6.5.3.4 South Africa Medical Imaging Market Estimates and Forecast, 2020-2028 (USD Million)

6.5.3.4.1 By Product

6.5.3.4.2 By End-use

6.5.3.5 Rest of Middle East and Africa Medical Imaging Market Estimates and Forecast, 2020-2028 (USD Million)

6.5.3.5.1 By Product

6.5.3.5.2 By End-use

6.6 Central and South America Medical Imaging Market Estimates and Forecast, 2020-2028 (USD Million)

6.6.1 By Product

6.6.2 By End-use

6.6.3 By Country

6.6.3.1 Brazil Medical Imaging Market Estimates and Forecast, 2020-2028 (USD Million)

6.6.3.1.1 By Product

6.6.3.1.2 By End-use

6.6.3.2 Argentina Medical Imaging Market Estimates and Forecast, 2020-2028 (USD Million)

6.6.3.2.1 By Product

6.6.3.2.2 By End-use

6.6.3.3 Chile Medical Imaging Market Estimates and Forecast, 2020-2028 (USD Million)

6.6.3.3.1 By Product

6.6.3.3.2 By End-use

6.6.3.3 Rest of Central and South America Medical Imaging Market Estimates and Forecast, 2020-2028 (USD Million)

6.6.3.3.1 By Product

6.6.3.3.2 By End-use

7 COMPETITIVE LANDCAPE

7.1 Company Market Share Analysis

7.2 Four Quadrant Positioning Matrix

7.2.1 Market Leaders

7.2.2 Market Visionaries

7.2.3 Market Challengers

7.2.4 Niche Market Players

7.3 Vendor Landscape

7.3.1 North America

7.3.2 Europe

7.3.3 Asia Pacific

7.3.4 Rest of the World

7.4 Company Profiles

7.4.1 GE Healthcare

7.4.1.1 Business Description & Financial Analysis

7.4.1.2 SWOT Analysis

7.4.1.3 Products & Services Offered

7.4.1.4 Strategic Alliances between Business Partners

7.4.2 Koninklijke Philips N.V.

7.4.2.1 Business Description & Financial Analysis

7.4.2.2 SWOT Analysis

7.4.2.3 Products & Services Offered

7.4.2.4 Strategic Alliances between Business Partners

7.4.3 Siemens Healthineers

7.4.3.1 Business Description & Financial Analysis

7.4.3.2 SWOT Analysis

7.4.3.3 Products & Services Offered

7.4.3.4 Strategic Alliances between Business Partners

7.4.4 Canon Medical Systems Corporation

7.4.4.1 Business Description & Financial Analysis

7.4.4.2 SWOT Analysis

7.4.4.3 Products & Services Offered

7.4.4.4 Strategic Alliances between Business Partners

7.4.5 Mindray Medical International

7.4.5.1 Business Description & Financial Analysis

7.4.5.2 SWOT Analysis

7.4.5.3 Products & Services Offered

7.4.5.4 Strategic Alliances between Business Partners

7.4.6 Esaote

7.4.6.1 Business Description & Financial Analysis

7.4.6.2 SWOT Analysis

7.4.6.3 Products & Services Offered

7.4.6.4 Strategic Alliances between Business Partners

7.4.7 Hologic, Inc.

7.4.7.1 Business Description & Financial Analysis

7.4.7.2 SWOT Analysis

7.4.7.3 Products & Services Offered

7.4.7.4 Strategic Alliances between Business Partners

7.4.8 Samsung Medison Co., Ltd.

7.4.8.1 Business Description & Financial Analysis

7.4.8.2 SWOT Analysis

7.4.8.3 Products & Services Offered

7.4.8.4 Strategic Alliances between Business Partners

7.4.9 Koning Corporation

7.4.9.1 Business Description & Financial Analysis

7.4.9.2 SWOT Analysis

7.4.9.3 Products & Services Offered

7.4.9.4 Strategic Alliances between Business Partners

7.4.10 PerkinElmer Inc.

7.4.10.1 Business Description & Financial Analysis

7.4.10.2 SWOT Analysis

7.4.10.3 Products & Services Offered

7.4.10.4 Strategic Alliances between Business Partners

7.4.11 Other Companies

7.4.11.1 Business Description & Financial Analysis

7.4.11.2 SWOT Analysis

7.4.11.3 Products & Services Offered

7.4.11.4 Strategic Alliances between Business Partners

8 RESEARCH METHODOLOGY

8.1 Market Introduction

8.1.1 Market Definition

8.1.2 Market Scope & Segmentation

8.2 Information Procurement

8.2.1 Secondary Research

8.2.1.1 Purchased Databases

8.2.1.2 GMEs Internal Data Repository

8.2.1.3 Secondary Resources & Third Party Perspectives

8.2.1.4 Company Information Sources

8.2.2 Primary Research

8.2.2.1 Various Types of Respondents for Primary Interviews

8.2.2.2 Number of Interviews Conducted throughout the Research Process

8.2.2.3 Primary Stakeholders

8.2.2.4 Discussion Guide for Primary Participants

8.2.3 Expert Panels

8.2.3.1 Expert Panels Across 30+ Industry

8.2.4 Paid Local Experts

8.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

8.3 Market Estimation

8.3.1 Top-Down Approach

8.3.1.1 Macro-Economic Indicators Considered

8.3.1.2 Micro-Economic Indicators Considered

8.3.2 Bottom Up Approach

8.3.2.1 Company Share Analysis Approach

8.3.2.2 Estimation of Potential Product Sales

8.4 Data Triangulation

8.4.1 Data Collection

8.4.2 Time Series, Cross Sectional & Panel Data Analysis

8.4.3 Cluster Analysis

8.5 Analysis and Output

8.5.1 Inhouse AI Based Real Time Analytics Tool

8.5.2 Output From Desk & Primary Research

8.6 Research Assumptions & Limitations

8.6.1 Research Assumptions

8.6.2 Research Limitations

LIST OF TABLES

1 Global Medical Imaging Market, By Product, 2020-2028 (USD Mllion)

2 X-ray Devices Market, By Region, 2020-2028 (USD Mllion)

3 Ultrasound Market, By Region, 2020-2028 (USD Mllion)

4 Computed Tomography Market, By Region, 2020-2028 (USD Mllion)

5 Magnetic Resonance Imaging Market, By Region, 2020-2028 (USD Mllion)

6 Nuclear Imaging Market, By Region, 2020-2028 (USD Mllion)

7 Global Medical Imaging Market, By End-use, 2020-2028 (USD Mllion)

8 Hospitals Market, By Region, 2020-2028 (USD Mllion)

9 Diagnostic Imaging Centers Market, By Region, 2020-2028 (USD Mllion)

10 Others Market, By Region, 2020-2028 (USD Mllion)

11 Regional Analysis, 2020-2028 (USD Mllion)

12 North America Medical Imaging Market, By Product, 2020-2028 (USD Mllion)

13 North America Medical Imaging Market, By End-use, 2020-2028 (USD Mllion)

14 North America Medical Imaging Market, By country, 2020-2028 (USD Mllion)

15 U.S. Medical Imaging Market, By Product, 2020-2028 (USD Mllion)

16 U.S. Medical Imaging Market, By End-use, 2020-2028 (USD Mllion)

17 Canada Medical Imaging Market, By Product, 2020-2028 (USD Mllion)

18 Canada Medical Imaging Market, By End-use, 2020-2028 (USD Mllion)

19 Mexico Medical Imaging Market, By Product, 2020-2028 (USD Mllion)

20 Mexico Medical Imaging Market, By End-use, 2020-2028 (USD Mllion)

21 Europe Medical Imaging Market, By Product, 2020-2028 (USD Mllion)

22 Europe Medical Imaging Market, By End-use, 2020-2028 (USD Mllion)

23 Europe Medical Imaging Market, By country, 2020-2028 (USD Mllion)

24 Germany Medical Imaging Market, By Product, 2020-2028 (USD Mllion)

25 Germany Medical Imaging Market, By End-use, 2020-2028 (USD Mllion)

26 U.K. Medical Imaging Market, By Product, 2020-2028 (USD Mllion)

27 U.K. Medical Imaging Market, By End-use, 2020-2028 (USD Mllion)

28 France Medical Imaging Market, By Product, 2020-2028 (USD Mllion)

29 France Medical Imaging Market, By End-use, 2020-2028 (USD Mllion)

30 Italy Medical Imaging Market, By Product, 2020-2028 (USD Mllion)

31 Italy Medical Imaging Market, By End-use, 2020-2028 (USD Mllion)

32 Spain Medical Imaging Market, By Product, 2020-2028 (USD Mllion)

33 Spain Medical Imaging Market, By End-use, 2020-2028 (USD Mllion)

34 Netherlands Medical Imaging Market, By Product, 2020-2028 (USD Mllion)

35 Netherlands Medical Imaging Market, By End-use, 2020-2028 (USD Mllion)

36 Rest Of Europe Medical Imaging Market, By Product, 2020-2028 (USD Mllion)

37 Rest Of Europe Medical Imaging Market, By End-use, 2020-2028 (USD Mllion)

38 Asia Pacific Medical Imaging Market, By Product, 2020-2028 (USD Mllion)

39 Asia Pacific Medical Imaging Market, By End-use, 2020-2028 (USD Mllion)

40 Asia Pacific Medical Imaging Market, By country, 2020-2028 (USD Mllion)

41 China Medical Imaging Market, By Product, 2020-2028 (USD Mllion)

42 China Medical Imaging Market, By End-use, 2020-2028 (USD Mllion)

43 Japan Medical Imaging Market, By Product, 2020-2028 (USD Mllion)

44 Japan Medical Imaging Market, By End-use, 2020-2028 (USD Mllion)

45 India Medical Imaging Market, By Product, 2020-2028 (USD Mllion)

46 India Medical Imaging Market, By End-use, 2020-2028 (USD Mllion)

47 South Korea Medical Imaging Market, By Product, 2020-2028 (USD Mllion)

48 South Korea Medical Imaging Market, By End-use, 2020-2028 (USD Mllion)

49 Singapore Medical Imaging Market, By Product, 2020-2028 (USD Mllion)

50 Singapore Medical Imaging Market, By End-use, 2020-2028 (USD Mllion)

51 Thailand Medical Imaging Market, By Product, 2020-2028 (USD Mllion)

52 Thailand Medical Imaging Market, By End-use, 2020-2028 (USD Mllion)

53 Malaysia Medical Imaging Market, By Product, 2020-2028 (USD Mllion)

54 Malaysia Medical Imaging Market, By End-use, 2020-2028 (USD Mllion)

55 Indonesia Medical Imaging Market, By Product, 2020-2028 (USD Mllion)

56 Indonesia Medical Imaging Market, By End-use, 2020-2028 (USD Mllion)

57 Vietnam Medical Imaging Market, By Product, 2020-2028 (USD Mllion)

58 Vietnam Medical Imaging Market, By End-use, 2020-2028 (USD Mllion)

59 Taiwan Medical Imaging Market, By Product, 2020-2028 (USD Mllion)

60 Taiwan Medical Imaging Market, By End-use, 2020-2028 (USD Mllion)

61 Rest of APAC Medical Imaging Market, By Product, 2020-2028 (USD Mllion)

62 Rest of APAC Medical Imaging Market, By End-use, 2020-2028 (USD Mllion)

63 Middle East and Africa Medical Imaging Market, By Product, 2020-2028 (USD Mllion)

64 Middle East and Africa Medical Imaging Market, By End-use, 2020-2028 (USD Mllion)

65 Middle East and Africa Medical Imaging Market, By country, 2020-2028 (USD Mllion)

66 Saudi Arabia Medical Imaging Market, By Product, 2020-2028 (USD Mllion)

67 Saudi Arabia Medical Imaging Market, By End-use, 2020-2028 (USD Mllion)

68 UAE Medical Imaging Market, By Product, 2020-2028 (USD Mllion)

69 UAE Medical Imaging Market, By End-use, 2020-2028 (USD Mllion)

70 Israel Medical Imaging Market, By Product, 2020-2028 (USD Mllion)

71 Israel Medical Imaging Market, By End-use, 2020-2028 (USD Mllion)

72 South Africa Medical Imaging Market, By Product, 2020-2028 (USD Mllion)

73 South Africa Medical Imaging Market, By End-use, 2020-2028 (USD Mllion)

74 Rest Of Middle East and Africa Medical Imaging Market, By Product, 2020-2028 (USD Mllion)

75 Rest Of Middle East and Africa Medical Imaging Market, By End-use, 2020-2028 (USD Mllion)

76 Central and South America Medical Imaging Market, By Product, 2020-2028 (USD Mllion)

77 Central and South America Medical Imaging Market, By End-use, 2020-2028 (USD Mllion)

78 Central and South America Medical Imaging Market, By country, 2020-2028 (USD Mllion)

79 Brazil Medical Imaging Market, By Product, 2020-2028 (USD Mllion)

80 Brazil Medical Imaging Market, By End-use, 2020-2028 (USD Mllion)

81 Chile Medical Imaging Market, By Product, 2020-2028 (USD Mllion)

82 Chile Medical Imaging Market, By End-use, 2020-2028 (USD Mllion)

83 Argentina Medical Imaging Market, By Product, 2020-2028 (USD Mllion)

84 Argentina Medical Imaging Market, By End-use, 2020-2028 (USD Mllion)

85 Rest Of Central and South America Medical Imaging Market, By Product, 2020-2028 (USD Mllion)

86 Rest Of Central and South America Medical Imaging Market, By End-use, 2020-2028 (USD Mllion)

87 GE Healthcare: Products & Services Offering

88 Koninklijke Philips N.V.: Products & Services Offering

89 Siemens Healthineers: Products & Services Offering

90 Canon Medical Systems Corporation: Products & Services Offering

91 Mindray Medical International: Products & Services Offering

92 ESAOTE: Products & Services Offering

93 Hologic, Inc. : Products & Services Offering

94 Samsung Medison Co., Ltd.: Products & Services Offering

95 Koning Corporation, Inc: Products & Services Offering

96 PerkinElmer Inc.: Products & Services Offering

97 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Medical Imaging Market Overview

2 Global Medical Imaging Market Value From 2020-2028 (USD Mllion)

3 Global Medical Imaging Market Share, By Product (2022)

4 Global Medical Imaging Market Share, By End-use (2022)

5 Global Medical Imaging Market, By Region (Asia Pacific Market)

6 Technological Trends In Global Medical Imaging Market

7 Four Quadrant Competitor Positioning Matrix

8 Impact Of Macro & Micro Indicators On The Market

9 Impact Of Key Drivers On The Global Medical Imaging Market

10 Impact Of Challenges On The Global Medical Imaging Market

11 Porter’s Five Forces Analysis

12 Global Medical Imaging Market: By Product Scope Key Takeaways

13 Global Medical Imaging Market, By Product Segment: Revenue Growth Analysis

14 X-ray Devices Market, By Region, 2020-2028 (USD Mllion)

15 Magnetic Resonance Imaging Market, By Region, 2020-2028 (USD Mllion)

16 Computed Tomography Market, By Region, 2020-2028 (USD Mllion)

17 Ultrasound Market, By Region, 2020-2028 (USD Mllion)

18 Nuclear Imaging Market, By Region, 2020-2028 (USD Mllion)

19 Global Medical Imaging Market: By End-use Scope Key Takeaways

20 Global Medical Imaging Market, By End-use Segment: Revenue Growth Analysis

21 Hospitals Market, By Region, 2020-2028 (USD Mllion)

22 Diagnostic Imaging Centers Market, By Region, 2020-2028 (USD Mllion)

23 Others Market, By Region, 2020-2028 (USD Mllion)

24 Regional Segment: Revenue Growth Analysis

25 Global Medical Imaging Market: Regional Analysis

26 North America Medical Imaging Market Overview

27 North America Medical Imaging Market, By Product

28 North America Medical Imaging Market, By End-use

29 North America Medical Imaging Market, By Country

30 U.S. Medical Imaging Market, By Product

31 U.S. Medical Imaging Market, By End-use

32 Canada Medical Imaging Market, By Product

33 Canada Medical Imaging Market, By End-use

34 Mexico Medical Imaging Market, By Product

35 Mexico Medical Imaging Market, By End-use

36 Four Quadrant Positioning Matrix

37 Company Market Share Analysis

38 GE Healthcare: Company Snapshot

39 GE Healthcare: SWOT Analysis

40 GE Healthcare: Geographic Presence

41 Koninklijke Philips N.V.: Company Snapshot

42 Koninklijke Philips N.V.: SWOT Analysis

43 Koninklijke Philips N.V.: Geographic Presence

44 Siemens Healthineers: Company Snapshot

45 Siemens Healthineers: SWOT Analysis

46 Siemens Healthineers: Geographic Presence

47 Canon Medical Systems Corporation: Company Snapshot

48 Canon Medical Systems Corporation: Swot Analysis

49 Canon Medical Systems Corporation: Geographic Presence

50 Mindray Medical International: Company Snapshot

51 Mindray Medical International: SWOT Analysis

52 Mindray Medical International: Geographic Presence

53 Esaote: Company Snapshot

54 Esaote: SWOT Analysis

55 Esaote: Geographic Presence

56 Hologic, Inc. : Company Snapshot

57 Hologic, Inc. : SWOT Analysis

58 Hologic, Inc. : Geographic Presence

59 Samsung Medison Co., Ltd.: Company Snapshot

60 Samsung Medison Co., Ltd.: SWOT Analysis

61 Samsung Medison Co., Ltd.: Geographic Presence

62 Koning Corporation, Inc.: Company Snapshot

63 Koning Corporation, Inc.: SWOT Analysis

64 Koning Corporation, Inc.: Geographic Presence

65 PerkinElmer Inc.: Company Snapshot

66 PerkinElmer Inc.: SWOT Analysis

67 PerkinElmer Inc.: Geographic Presence

68 Other Companies: Company Snapshot

69 Other Companies: SWOT Analysis

70 Other Companies: Geographic Presence

The Global Medical Imaging Market has been studied from the year 2019 till 2028. However, the CAGR provided in the report is from the year 2023 to 2028. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Medical Imaging Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS