Global Medical Radioisotopes Market Size, Trends & Analysis - Forecasts to 2029 By Type (Tc-99m, Cobalt-60, Iodine Radioisotopes, and Others), By Application (Diagnostic Imaging, Therapeutic Procedures, and Research Application), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

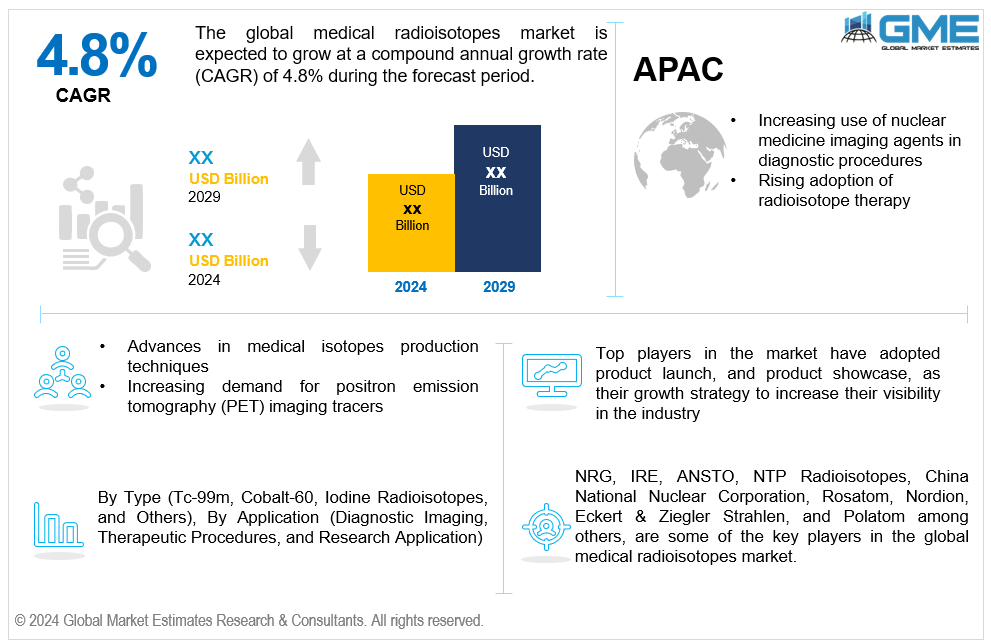

The global medical radioisotopes market is estimated to exhibit a CAGR of 4.8% from 2024 to 2029.

The primary factors propelling the market growth are the increasing use of nuclear medicine imaging agents in diagnostic procedures and the rising adoption of radioisotope therapy. Nuclear medicine imaging agents, including diagnostic radioisotopes, play a crucial role in diagnostic procedures, offering unparalleled insights into physiological processes and disease pathology. They help in the early diagnosis and treatment planning of various medical disorders by enabling doctors to identify and locate anomalies precisely. Moreover, the expanding applications of medical isotopes in diverse fields, including cardiology, oncology, and neurology, further propel market demand. Additionally, considering radioisotope half-life is pivotal in optimizing their use, ensuring sufficient imaging windows and diagnostic accuracy. As medical isotope applications evolve and diversify, the demand for radioisotopes in diagnostic imaging is expected to escalate, driving market growth and innovation in developing novel imaging agents and techniques. For instance, the World Nuclear Association (2024) reports that radioisotopes are used in medicine in over 10,000 hospitals worldwide, with diagnosis accounting for 90% of treatments.

Advances in medical isotope production techniques and the increasing demand for positron emission tomography (PET) imaging tracers are expected to support market growth. PET tracers, crucial for high-resolution imaging in oncology, neurology, and cardiology, drive the need for increased radiotracer production. Isotope production reactors are under pressure to meet this demand and maintain a sufficient and sustainable supply chain. Consequently, investments in optimizing the radioisotope supply chain become essential to meet the growing demand for PET imaging tracers worldwide. As the usage of PET imaging continues to expand across various medical disciplines, the market for medical radioisotopes experiences notable growth, stimulating innovation and efficiency in production and distribution processes.

The development of reliable and efficient radioisotope generator systems, coupled with the growing research and development efforts in therapeutic radiopharmaceuticals, propel market growth. Radioisotope generator systems are crucial in providing a continuous and on-demand supply of essential radioisotopes, such as technetium-99m. This reliability supports the scalability and sustainability of isotope production facilities and isotope production methods. Furthermore, advancements in radioisotope labeling techniques enable the synthesis of radiopharmaceuticals with enhanced specificity and functionality, expanding their medical applications. As the demand for diverse isotopes continues to grow, integrating efficient generator systems drives market growth by ensuring reliable access to critical radioisotopes for various diagnostic and therapeutic purposes.

The shift towards personalized medicine and targeted therapies creates opportunities for radioisotopes that selectively target specific biomarkers or molecular pathways associated with diseases. Moreover, ongoing research into new applications for medical radioisotopes, such as targeted alpha therapy (TAT) and theranostics, which combines therapy and diagnostic capabilities, are creating opportunities in the market.

However, stringent regulatory requirements and compliance standards required for the production of radioisotopes and raising concerns regarding radiation exposure for patients, healthcare workers, and the environment may impede market growth.

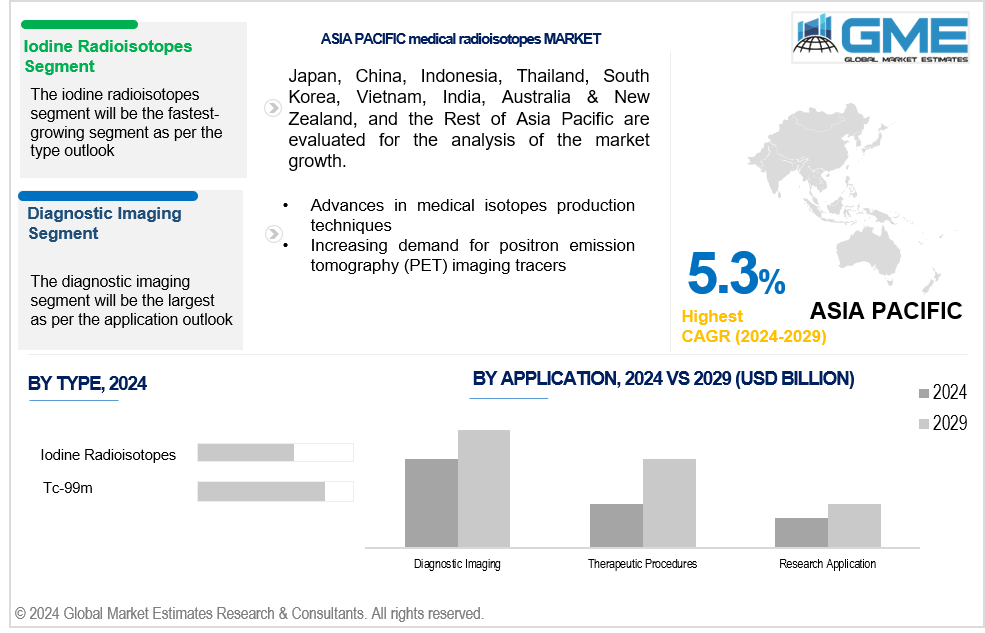

The Tc-99m segment is expected to hold the largest share of the market over the forecast period. Tc-99m is the radioisotope most commonly utilized in nuclear medicine imaging techniques. It is employed in a significant number of diagnostic scans performed globally. The Technetium-99m market dominates primarily because of Technetium-99m's versatility, relatively short half-life, and compatibility with various imaging techniques like single-photon emission computed tomography (SPECT).

The iodine radioisotopes segment is expected to be the fastest-growing segment in the market from 2024 to 2029. Iodine radioisotopes, particularly iodine-131 (I-131), are frequently used to diagnose and treat thyroid problems such as hyperthyroidism, thyroid cancer, and thyroid nodules. Globally, there is an increasing need for iodine-based imaging and treatment alternatives due to the increased prevalence of thyroid disorders.

The diagnostic imaging segment is expected to hold the largest share of the market over the forecast period. Medical radioisotope diagnostic imaging enables the early identification of anomalies and diseases before clinical symptoms appear. When diseases like cancer and cardiovascular disease are diagnosed early, therapy can be started promptly, improving patient outcomes and prognosis.

The therapeutic procedures segment is anticipated to be the fastest-growing segment in the market from 2024 to 2029. The increased global prevalence of chronic diseases, including cancer, is driving the need for efficient therapeutic approaches. Medical radioisotopes are essential to cancer treatment as they provide focused therapeutic alternatives that can kill cancer cells alone while causing the least harm to surrounding healthy tissues.

North America is expected to be the largest region in the global market. The market's growth is attributed to the region's increasing need for medical radioisotopes, which is driven by its sophisticated healthcare infrastructure, which includes cutting-edge hospitals, diagnostic facilities, and research institutes. Access to cutting-edge imaging technology and nuclear medicine facilities facilitates the extensive use of medical radioisotopes for diagnostic and therapeutic reasons.

Asia Pacific is anticipated to witness rapid growth during the forecast period. Technological developments in radioisotope manufacturing, imaging modalities, and therapeutic applications propel innovation in the medical radioisotopes market in Asia Pacific. Due to the growing use of modern imaging modalities like positron emission tomography (PET) and single-photon emission computed tomography (SPECT), there is an increasing need for the radioisotopes used in these procedures.

NRG, IRE, ANSTO, NTP Radioisotopes, China National Nuclear Corporation, Rosatom, Nordion, Eckert & Ziegler Strahlen, and Polatom, among others, are some of the key players in the global medical radioisotopes market.

Please note: This is not an exhaustive list of companies profiled in the report.

In January 023, Inhibrx, Inc., a biopharmaceutical company focused on developing therapeutics for oncology and rare diseases, and NorthStar Medical Radioisotopes, LLC, an international player in the development, production, and commercialization of radiopharmaceuticals used for therapeutic applications and medical imaging, announced a collaboration to create and produce innovative radiopharmaceuticals for the treatment of cancer.

In October 2023, for the first time, molybdenum-100 isotopes with an abundance of 99% were obtained at the kilogram level by the Research Institute of Physical and Chemical Engineering of Nuclear Industry/Company (IPCE) of the China National Nuclear Corporation (CNNC). High abundance molybdenum-98 and molybdenum-100 isotopes are pre-nuclides in nuclear medicine that yield radioactive isotope molybdenum-99, which decays further to generate technetium-99m.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL MEDICAL RADIOISOTOPES MARKET, BY Type

4.1 Introduction

4.2 Medical Radioisotopes Market: Type Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Tc-99m

4.4.1 Tc-99m Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 Cobalt-60

4.5.1 Cobalt-60 Market Estimates and Forecast, 2021-2029 (USD Million)

4.6 Iodine Radioisotopes

4.6.1 Iodine Radioisotopes Market Estimates and Forecast, 2021-2029 (USD Million)

4.7 Others

4.7.1 Others Market Estimates and Forecast, 2021-2029 (USD Million)

5 GLOBAL MEDICAL RADIOISOTOPES MARKET, BY APPLICATION

5.1 Introduction

5.2 Medical Radioisotopes Market: Application Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 Diagnostic Imaging

5.4.1 Diagnostic Imaging Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 Therapeutic Procedures

5.5.1 Therapeutic Procedures Market Estimates and Forecast, 2021-2029 (USD Million)

5.6 Research Application

5.6.1 Research Application Market Estimates and Forecast, 2021-2029 (USD Million)

6 GLOBAL MEDICAL RADIOISOTOPES MARKET, BY REGION

6.1 Introduction

6.2 North America Medical Radioisotopes Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.1 By Type

6.2.2 By Application

6.2.3 By Country

6.2.3.1 U.S. Medical Radioisotopes Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.1.1 By Type

6.2.3.1.2 By Application

6.2.3.2 Canada Medical Radioisotopes Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.2.1 By Type

6.2.3.2.2 By Application

6.2.3.3 Mexico Medical Radioisotopes Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.3.1 By Type

6.2.3.3.2 By Application

6.3 Europe Medical Radioisotopes Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.1 By Type

6.3.2 By Application

6.3.3 By Country

6.3.3.1 Germany Medical Radioisotopes Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.1.1 By Type

6.3.3.1.2 By Application

6.3.3.2 U.K. Medical Radioisotopes Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.2.1 By Type

6.3.3.2.2 By Application

6.3.3.3 France Medical Radioisotopes Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.3.1 By Type

6.3.3.3.2 By Application

6.3.3.4 Italy Medical Radioisotopes Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.4.1 By Type

6.3.3.4.2 By Application

6.3.3.5 Spain Medical Radioisotopes Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.5.1 By Type

6.3.3.5.2 By Application

6.3.3.6 Netherlands Medical Radioisotopes Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.6.1 By Type

6.3.3.6.2 By Application

6.3.3.7 Rest of Europe Medical Radioisotopes Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.6.1 By Type

6.3.3.6.2 By Application

6.4 Asia Pacific Medical Radioisotopes Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.1 By Type

6.4.2 By Application

6.4.3 By Country

6.4.3.1 China Medical Radioisotopes Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.1.1 By Type

6.4.3.1.2 By Application

6.4.3.2 Japan Medical Radioisotopes Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.2.1 By Type

6.4.3.2.2 By Application

6.4.3.3 India Medical Radioisotopes Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.3.1 By Type

6.4.3.3.2 By Application

6.4.3.4 South Korea Medical Radioisotopes Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.4.1 By Type

6.4.3.4.2 By Application

6.4.3.5 Singapore Medical Radioisotopes Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.5.1 By Type

6.4.3.5.2 By Application

6.4.3.6 Malaysia Medical Radioisotopes Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.6.1 By Type

6.4.3.6.2 By Application

6.4.3.7 Thailand Medical Radioisotopes Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.6.1 By Type

6.4.3.6.2 By Application

6.4.3.8 Indonesia Medical Radioisotopes Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.7.1 By Type

6.4.3.7.2 By Application

6.4.3.9 Vietnam Medical Radioisotopes Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.8.1 By Type

6.4.3.8.2 By Application

6.4.3.10 Taiwan Medical Radioisotopes Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.10.1 By Type

6.4.3.10.2 By Application

6.4.3.11 Rest of Asia Pacific Medical Radioisotopes Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.11.1 By Type

6.4.3.11.2 By Application

6.5 Middle East and Africa Medical Radioisotopes Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.1 By Type

6.5.2 By Application

6.5.3 By Country

6.5.3.1 Saudi Arabia Medical Radioisotopes Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.1.1 By Type

6.5.3.1.2 By Application

6.5.3.2 U.A.E. Medical Radioisotopes Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.2.1 By Type

6.5.3.2.2 By Application

6.5.3.3 Israel Medical Radioisotopes Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.3.1 By Type

6.5.3.3.2 By Application

6.5.3.4 South Africa Medical Radioisotopes Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.4.1 By Type

6.5.3.4.2 By Application

6.5.3.5 Rest of Middle East and Africa Medical Radioisotopes Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.5.1 By Type

6.5.3.5.2 By Application

6.6 Central and South America Medical Radioisotopes Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.1 By Type

6.6.2 By Application

6.6.3 By Country

6.6.3.1 Brazil Medical Radioisotopes Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.1.1 By Type

6.6.3.1.2 By Application

6.6.3.2 Argentina Medical Radioisotopes Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.2.1 By Type

6.6.3.2.2 By Application

6.6.3.3 Chile Medical Radioisotopes Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.3.1 By Type

6.6.3.3.2 By Application

6.6.3.3 Rest of Central and South America Medical Radioisotopes Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.3.1 By Type

6.6.3.3.2 By Application

7 COMPETITIVE LANDCAPE

7.1 Company Market Share Analysis

7.2 Four Quadrant Positioning Matrix

7.2.1 Market Leaders

7.2.2 Market Visionaries

7.2.3 Market Challengers

7.2.4 Niche Market Players

7.3 Vendor Landscape

7.3.1 North America

7.3.2 Europe

7.3.3 Asia Pacific

7.3.4 Rest of the World

7.4 Company Profiles

7.4.1 NRG

7.4.1.1 Business Description & Financial Analysis

7.4.1.2 SWOT Analysis

7.4.1.3 Products & Services Offered

7.4.1.4 Strategic Alliances between Business Partners

7.4.2 IRE

7.4.2.1 Business Description & Financial Analysis

7.4.2.2 SWOT Analysis

7.4.2.3 Products & Services Offered

7.4.2.4 Strategic Alliances between Business Partners

7.4.3 ANSTO

7.4.3.1 Business Description & Financial Analysis

7.4.3.2 SWOT Analysis

7.4.3.3 Products & Services Offered

7.4.3.4 Strategic Alliances between Business Partners

7.4.4 NTP Radioisotopes

7.4.4.1 Business Description & Financial Analysis

7.4.4.2 SWOT Analysis

7.4.4.3 Products & Services Offered

7.4.4.4 Strategic Alliances between Business Partners

7.4.5 China National Nuclear Corporation

7.4.5.1 Business Description & Financial Analysis

7.4.5.2 SWOT Analysis

7.4.5.3 Products & Services Offered

7.4.5.4 Strategic Alliances between Business Partners

7.4.6 ROSATOM

7.4.6.1 Business Description & Financial Analysis

7.4.6.2 SWOT Analysis

7.4.6.3 Products & Services Offered

7.4.6.4 Strategic Alliances between Business Partners

7.4.7 Nordion

7.4.7.1 Business Description & Financial Analysis

7.4.7.2 SWOT Analysis

7.4.7.3 Products & Services Offered

7.4.7.4 Strategic Alliances between Business Partners

7.4.8 Eckert & Ziegler Strahlen

7.4.8.1 Business Description & Financial Analysis

7.4.8.2 SWOT Analysis

7.4.8.3 Products & Services Offered

7.4.8.4 Strategic Alliances between Business Partners

7.4.9 Polatom

7.4.9.1 Business Description & Financial Analysis

7.4.9.2 SWOT Analysis

7.4.9.3 Products & Services Offered

7.4.9.4 Strategic Alliances between Business Partners

7.4.10 Other Companies

7.4.10.1 Business Description & Financial Analysis

7.4.10.2 SWOT Analysis

7.4.10.3 Products & Services Offered

7.4.10.4 Strategic Alliances between Business Partners

8 RESEARCH METHODOLOGY

8.1 Market Introduction

8.1.1 Market Definition

8.1.2 Market Scope & Segmentation

8.2 Information Procurement

8.2.1 Secondary Research

8.2.1.1 Purchased Databases

8.2.1.2 GMEs Internal Data Repository

8.2.1.3 Secondary Resources & Third Party Perspectives

8.2.1.4 Company Information Sources

8.2.2 Primary Research

8.2.2.1 Various Types of Respondents for Primary Interviews

8.2.2.2 Number of Interviews Conducted throughout the Research Process

8.2.2.3 Primary Stakeholders

8.2.2.4 Discussion Guide for Primary Participants

8.2.3 Expert Panels

8.2.3.1 Expert Panels Across 30+ Industry

8.2.4 Paid Local Experts

8.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

8.3 Market Estimation

8.3.1 Top-Down Approach

8.3.1.1 Macro-Economic Indicators Considered

8.3.1.2 Micro-Economic Indicators Considered

8.3.2 Bottom Up Approach

8.3.2.1 Company Share Analysis Approach

8.3.2.2 Estimation of Potential Product Sales

8.4 Data Triangulation

8.4.1 Data Collection

8.4.2 Time Series, Cross Sectional & Panel Data Analysis

8.4.3 Cluster Analysis

8.5 Analysis and Output

8.5.1 Inhouse AI Based Real Time Analytics Tool

8.5.2 Output From Desk & Primary Research

8.6 Research Assumptions & Limitations

8.6.1 Research Assumptions

8.6.2 Research Limitations

LIST OF TABLES

1 Global Medical Radioisotopes Market, By Type, 2021-2029 (USD Mllion)

2 Tc-99m Market, By Region, 2021-2029 (USD Mllion)

3 Cobalt-60 Market, By Region, 2021-2029 (USD Mllion)

4 Iodine Radioisotopes Market, By Region, 2021-2029 (USD Mllion)

5 Others Market, By Region, 2021-2029 (USD Mllion)

6 Global Medical Radioisotopes Market, By Application, 2021-2029 (USD Mllion)

7 Diagnostic Imaging Market, By Region, 2021-2029 (USD Mllion)

8 Therapeutic Procedures Market, By Region, 2021-2029 (USD Mllion)

9 Research Application Market, By Region, 2021-2029 (USD Mllion)

10 Regional Analysis, 2021-2029 (USD Mllion)

11 North America Medical Radioisotopes Market, By Type, 2021-2029 (USD Mllion)

12 North America Medical Radioisotopes Market, By Application, 2021-2029 (USD Mllion)

13 North America Medical Radioisotopes Market, By COUNTRY, 2021-2029 (USD Mllion)

14 U.S. Medical Radioisotopes Market, By Type, 2021-2029 (USD Mllion)

15 U.S. Medical Radioisotopes Market, By Application, 2021-2029 (USD Mllion)

16 Canada Medical Radioisotopes Market, By Type, 2021-2029 (USD Mllion)

17 Canada Medical Radioisotopes Market, By Application, 2021-2029 (USD Mllion)

18 Mexico Medical Radioisotopes Market, By Type, 2021-2029 (USD Mllion)

19 Mexico Medical Radioisotopes Market, By Application, 2021-2029 (USD Mllion)

20 Europe Medical Radioisotopes Market, By Type, 2021-2029 (USD Mllion)

21 Europe Medical Radioisotopes Market, By Application, 2021-2029 (USD Mllion)

22 EUROPE Medical Radioisotopes Market, By COUNTRY, 2021-2029 (USD Mllion)

23 Germany Medical Radioisotopes Market, By Type, 2021-2029 (USD Mllion)

24 Germany Medical Radioisotopes Market, By Application, 2021-2029 (USD Mllion)

25 U.K. Medical Radioisotopes Market, By Type, 2021-2029 (USD Mllion)

26 U.K. Medical Radioisotopes Market, By Application, 2021-2029 (USD Mllion)

27 France Medical Radioisotopes Market, By Type, 2021-2029 (USD Mllion)

28 France Medical Radioisotopes Market, By Application, 2021-2029 (USD Mllion)

29 Italy Medical Radioisotopes Market, By Type, 2021-2029 (USD Mllion)

30 Italy Medical Radioisotopes Market, By Application, 2021-2029 (USD Mllion)

31 Spain Medical Radioisotopes Market, By Type, 2021-2029 (USD Mllion)

32 Spain Medical Radioisotopes Market, By Application, 2021-2029 (USD Mllion)

33 Netherlands Medical Radioisotopes Market, By Type, 2021-2029 (USD Mllion)

34 Netherlands Medical Radioisotopes Market, By Application, 2021-2029 (USD Mllion)

35 Rest Of Europe Medical Radioisotopes Market, By Type, 2021-2029 (USD Mllion)

36 Rest Of Europe Medical Radioisotopes Market, By Application, 2021-2029 (USD Mllion)

37 Asia Pacific Medical Radioisotopes Market, By Type, 2021-2029 (USD Mllion)

38 Asia Pacific Medical Radioisotopes Market, By Application, 2021-2029 (USD Mllion)

39 ASIA PACIFIC Medical Radioisotopes Market, By COUNTRY, 2021-2029 (USD Mllion)

40 China Medical Radioisotopes Market, By Type, 2021-2029 (USD Mllion)

41 China Medical Radioisotopes Market, By Application, 2021-2029 (USD Mllion)

42 Japan Medical Radioisotopes Market, By Type, 2021-2029 (USD Mllion)

43 Japan Medical Radioisotopes Market, By Application, 2021-2029 (USD Mllion)

44 India Medical Radioisotopes Market, By Type, 2021-2029 (USD Mllion)

45 India Medical Radioisotopes Market, By Application, 2021-2029 (USD Mllion)

46 South Korea Medical Radioisotopes Market, By Type, 2021-2029 (USD Mllion)

47 South Korea Medical Radioisotopes Market, By Application, 2021-2029 (USD Mllion)

48 Singapore Medical Radioisotopes Market, By Type, 2021-2029 (USD Mllion)

49 Singapore Medical Radioisotopes Market, By Application, 2021-2029 (USD Mllion)

50 Thailand Medical Radioisotopes Market, By Type, 2021-2029 (USD Mllion)

51 Thailand Medical Radioisotopes Market, By Application, 2021-2029 (USD Mllion)

52 Malaysia Medical Radioisotopes Market, By Type, 2021-2029 (USD Mllion)

53 Malaysia Medical Radioisotopes Market, By Application, 2021-2029 (USD Mllion)

54 Indonesia Medical Radioisotopes Market, By Type, 2021-2029 (USD Mllion)

55 Indonesia Medical Radioisotopes Market, By Application, 2021-2029 (USD Mllion)

56 Vietnam Medical Radioisotopes Market, By Type, 2021-2029 (USD Mllion)

57 Vietnam Medical Radioisotopes Market, By Application, 2021-2029 (USD Mllion)

58 Taiwan Medical Radioisotopes Market, By Type, 2021-2029 (USD Mllion)

59 Taiwan Medical Radioisotopes Market, By Application, 2021-2029 (USD Mllion)

60 Rest of APAC Medical Radioisotopes Market, By Type, 2021-2029 (USD Mllion)

61 Rest of APAC Medical Radioisotopes Market, By Application, 2021-2029 (USD Mllion)

62 Middle East and Africa Medical Radioisotopes Market, By Type, 2021-2029 (USD Mllion)

63 Middle East and Africa Medical Radioisotopes Market, By Application, 2021-2029 (USD Mllion)

64 MIDDLE EAST & AFRICA Medical Radioisotopes Market, By COUNTRY, 2021-2029 (USD Mllion)

65 Saudi Arabia Medical Radioisotopes Market, By Type, 2021-2029 (USD Mllion)

66 Saudi Arabia Medical Radioisotopes Market, By Application, 2021-2029 (USD Mllion)

67 UAE Medical Radioisotopes Market, By Type, 2021-2029 (USD Mllion)

68 UAE Medical Radioisotopes Market, By Application, 2021-2029 (USD Mllion)

69 Israel Medical Radioisotopes Market, By Type, 2021-2029 (USD Mllion)

70 Israel Medical Radioisotopes Market, By Application, 2021-2029 (USD Mllion)

71 South Africa Medical Radioisotopes Market, By Type, 2021-2029 (USD Mllion)

72 South Africa Medical Radioisotopes Market, By Application, 2021-2029 (USD Mllion)

73 Rest Of Middle East and Africa Medical Radioisotopes Market, By Type, 2021-2029 (USD Mllion)

74 Rest Of Middle East and Africa Medical Radioisotopes Market, By Application, 2021-2029 (USD Mllion)

75 Central and South America Medical Radioisotopes Market, By Type, 2021-2029 (USD Mllion)

76 Central and South America Medical Radioisotopes Market, By Application, 2021-2029 (USD Mllion)

77 CENTRAL AND SOUTH AMERICA Medical Radioisotopes Market, By COUNTRY, 2021-2029 (USD Mllion)

78 Brazil Medical Radioisotopes Market, By Type, 2021-2029 (USD Mllion)

79 Brazil Medical Radioisotopes Market, By Application, 2021-2029 (USD Mllion)

80 Chile Medical Radioisotopes Market, By Type, 2021-2029 (USD Mllion)

81 Chile Medical Radioisotopes Market, By Application, 2021-2029 (USD Mllion)

82 Argentina Medical Radioisotopes Market, By Type, 2021-2029 (USD Mllion)

83 Argentina Medical Radioisotopes Market, By Application, 2021-2029 (USD Mllion)

84 Rest Of Central and South America Medical Radioisotopes Market, By Type, 2021-2029 (USD Mllion)

85 Rest Of Central and South America Medical Radioisotopes Market, By Application, 2021-2029 (USD Mllion)

86 NRG: Products & Services Offering

87 IRE: Products & Services Offering

88 ANSTO: Products & Services Offering

89 NTP Radioisotopes: Products & Services Offering

90 China National Nuclear Corporation: Products & Services Offering

91 ROSATOM: Products & Services Offering

92 Nordion: Products & Services Offering

93 Eckert & Ziegler Strahlen: Products & Services Offering

94 Polatom, Inc: Products & Services Offering

95 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Medical Radioisotopes Market Overview

2 Global Medical Radioisotopes Market Value From 2021-2029 (USD Mllion)

3 Global Medical Radioisotopes Market Share, By Type (2023)

4 Global Medical Radioisotopes Market Share, By Application (2023)

5 Global Medical Radioisotopes Market, By Region (Asia Pacific Market)

6 Technological Trends In Global Medical Radioisotopes Market

7 Four Quadrant Competitor Positioning Matrix

8 Impact Of Macro & Micro Indicators On The Market

9 Impact Of Key Drivers On The Global Medical Radioisotopes Market

10 Impact Of Challenges On The Global Medical Radioisotopes Market

11 Porter’s Five Forces Analysis

12 Global Medical Radioisotopes Market: By Type Scope Key Takeaways

13 Global Medical Radioisotopes Market, By Type Segment: Revenue Growth Analysis

14 Tc-99m Market, By Region, 2021-2029 (USD Mllion)

15 Cobalt-60 Market, By Region, 2021-2029 (USD Mllion)

16 Iodine Radioisotopes Market, By Region, 2021-2029 (USD Mllion)

17 Others Market, By Region, 2021-2029 (USD Mllion)

18 Global Medical Radioisotopes Market: By Application Scope Key Takeaways

19 Global Medical Radioisotopes Market, By Application Segment: Revenue Growth Analysis

20 Diagnostic Imaging Market, By Region, 2021-2029 (USD Mllion)

21 Therapeutic Procedures Market, By Region, 2021-2029 (USD Mllion)

22 Research Application Market, By Region, 2021-2029 (USD Mllion)

23 Regional Segment: Revenue Growth Analysis

24 Global Medical Radioisotopes Market: Regional Analysis

25 North America Medical Radioisotopes Market Overview

26 North America Medical Radioisotopes Market, By Type

27 North America Medical Radioisotopes Market, By Application

28 North America Medical Radioisotopes Market, By Country

29 U.S. Medical Radioisotopes Market, By Type

30 U.S. Medical Radioisotopes Market, By Application

31 Canada Medical Radioisotopes Market, By Type

32 Canada Medical Radioisotopes Market, By Application

33 Mexico Medical Radioisotopes Market, By Type

34 Mexico Medical Radioisotopes Market, By Application

35 Four Quadrant Positioning Matrix

36 Company Market Share Analysis

37 NRG: Company Snapshot

38 NRG: SWOT Analysis

39 NRG: Geographic Presence

40 IRE: Company Snapshot

41 IRE: SWOT Analysis

42 IRE: Geographic Presence

43 ANSTO: Company Snapshot

44 ANSTO: SWOT Analysis

45 ANSTO: Geographic Presence

46 NTP Radioisotopes: Company Snapshot

47 NTP Radioisotopes: Swot Analysis

48 NTP Radioisotopes: Geographic Presence

49 China National Nuclear Corporation: Company Snapshot

50 China National Nuclear Corporation: SWOT Analysis

51 China National Nuclear Corporation: Geographic Presence

52 ROSATOM: Company Snapshot

53 ROSATOM: SWOT Analysis

54 ROSATOM: Geographic Presence

55 Nordion : Company Snapshot

56 Nordion : SWOT Analysis

57 Nordion : Geographic Presence

58 Eckert & Ziegler Strahlen: Company Snapshot

59 Eckert & Ziegler Strahlen: SWOT Analysis

60 Eckert & Ziegler Strahlen: Geographic Presence

61 Polatom, Inc.: Company Snapshot

62 Polatom, Inc.: SWOT Analysis

63 Polatom, Inc.: Geographic Presence

64 Other Companies: Company Snapshot

65 Other Companies: SWOT Analysis

66 Other Companies: Geographic Presence

The Global Medical Radioisotopes Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Medical Radioisotopes Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS