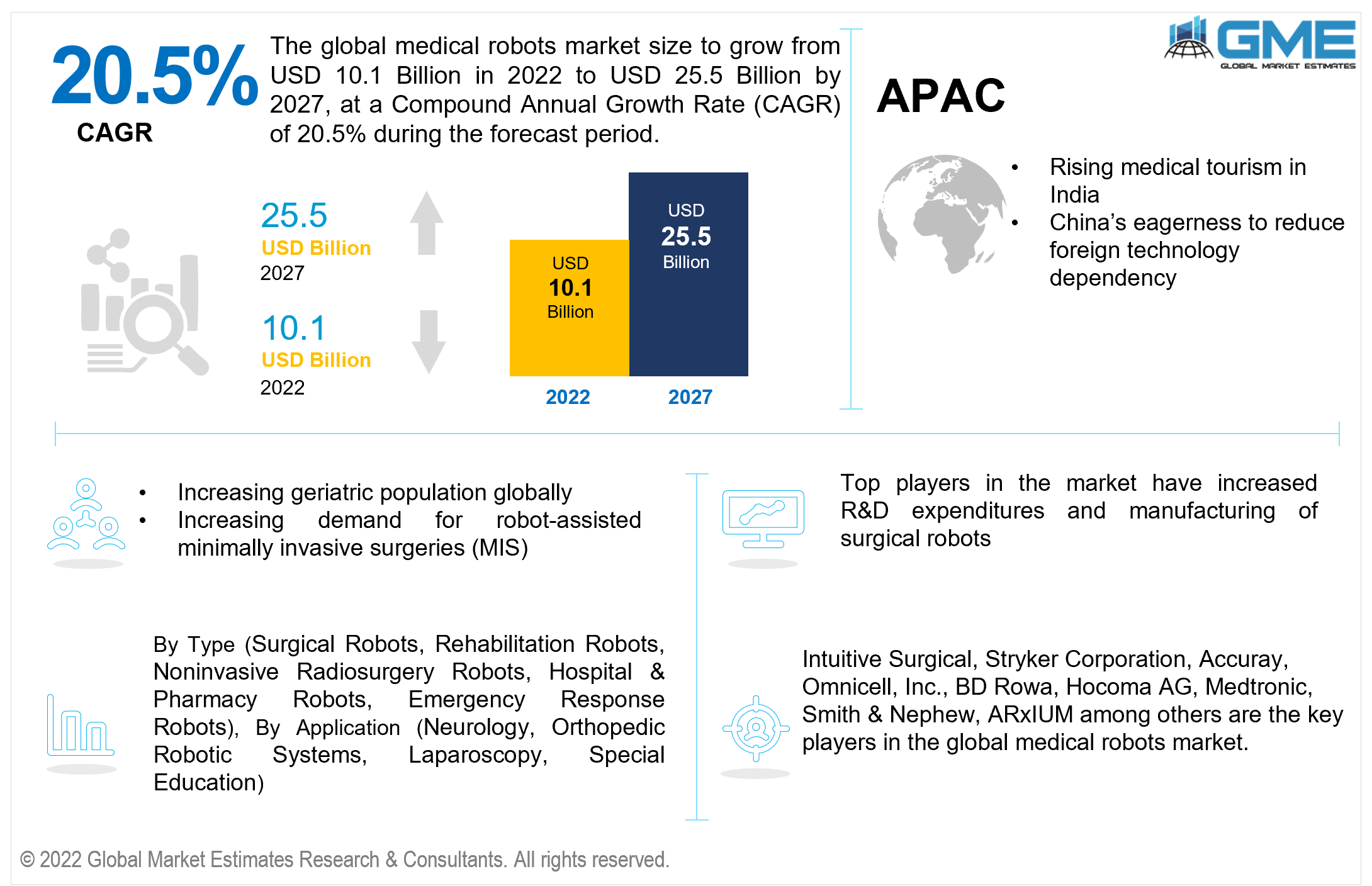

Global Medical Robots Market Size, Trends & Analysis - Forecasts to 2027 By Type (Surgical Robots, Rehabilitation Robots, Noninvasive Radiosurgery Robots, Hospital & Pharmacy Robots, Emergency Response Robots), By Application (Neurology, Orthopedics Robotic Systems, Laparoscopy, Special Education), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Company Market Share Analysis, and Competitor Analysis

The global medical robots market is projected to grow from USD 10.1 Billion in 2022 to USD 25.5 Billion in 2027, at a CAGR value of 20.5% in the forecast period.

Medical robots are robotic technology used in health sciences for varying purposes including medical care assistance, performing surgeries, maintaining hospital hygiene among others, and have been in use in the healthcare industry for the last three decades. With the increasing adoption of Artificial Intelligence (AI) in diverse industries, healthcare professionals are at the forefront of adopting medical robots due to the promising potential it holds such as reducing or eliminating human fatigue in healthcare, improved precision and capabilities of such professionals, and safer and less-invasive surgery, among others.

Furthermore, with the advent of the COVID-19 pandemic since 2020 and its preventive measures including such social distancing restrictions being imposed worldwide, such medical robots are becoming increasingly adopted to assist healthcare practitioners.

The market will be driven during the forecast period by a rising geriatric population worldwide, especially in developed countries like Japan and some European countries. Medical robots can assist such a population in several ways including medical as well as general physical assistance. They provide help to those with chronic ailments in such population demographics.

Furthermore, the worldwide increasing demand and preference for minimally invasive surgeries (MIS) also contribute to the growth of this market. Such surgeries are in great demand due to the various advantages it offers such as increased precision and accuracy, decreased scarring and recovery time, among others. All such reasons are expected to boost the global market.

The use of medical robots in rehabilitation therapy and their highly advanced visualization capabilities are also other market drivers. Such technology is in high demand by physiotherapists and in rehabilitation centers for those suffering from neurological and spinal cord injuries. In therapy, medical robots help increase the dose of movement training while also monitoring and controlling its quality. It eliminates the therapists’ burden by providing weight support and reliable test feedback.

Increased research projects on medical robots, investment in R&D, and emergence in per capita health expenditures especially in developed countries will all contribute to the market growth during the forecast period.

The COVID-19 pandemic has had a calamitous impact on the workings of hospitals and medical care centers, with an ever-increasing demand for healthcare workers. The pandemic has led to a severe rise in surgery cancellations as medical resources were diverted to cater to COVID-19 affected patients. This has proved to be of great burden to patients and economic loss to hospitals. Thus, in such a scenario medical robots are in great demand and are being adopted fast. This integration of robots helps to combat the virus and mitigate pathogen spread by separating the health care worker from affected patients while also avoiding disruption of the normal functioning of hospital procedures. Thus, there is a better division of work and doctors can cater to better patient care.

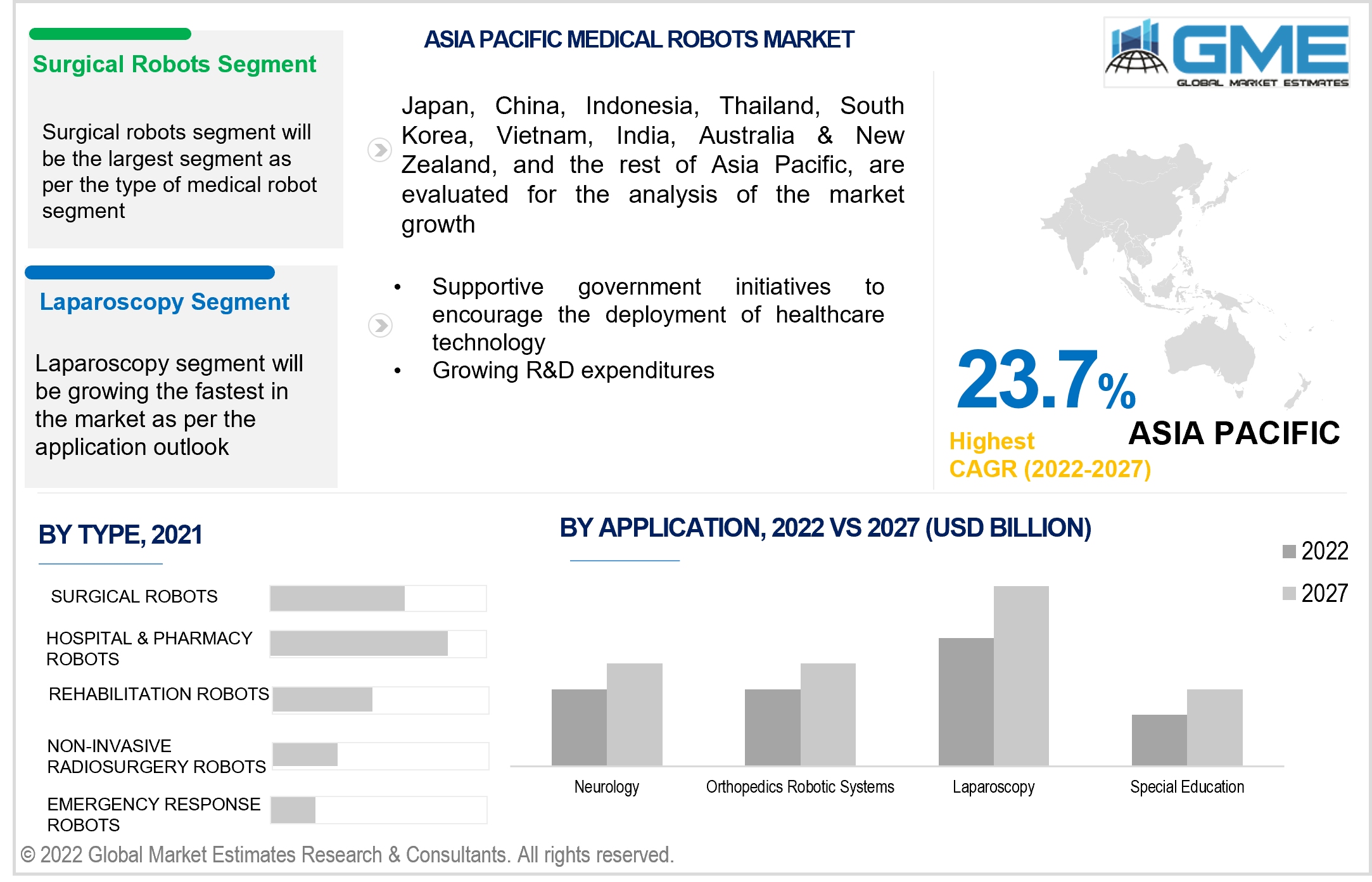

Based on the type, the global medical robots market is divided into surgical robots, rehabilitation robots, non-invasive radiosurgery robots, hospital & pharmacy robots, and emergency response robots. Among these, hospital robots are the fastest-growing robot type globally.

Hospital & pharmacy robots are among the most widely used medical robots that help reduce the work burden on healthcare workers, thus diverting their attention to patient care while such robots take over the delivery of medicines and laboratory specimens, disinfect hospital equipment. Surgical robots are in high demand globally as they are used for their mechanical arms and high visualization capabilities to perform complex procedures with great precision and control.

Based on the application, the global medical robots market is divided into neurology, orthopedics robotic systems, laparoscopy, and special education. The navigation assistance segment is expected to be the fastest-growing segment in the market.

Among these applications, the laparoscopy segment is expected to account for the largest market share due to the ever-increasing surgical laparoscopic procedures performed globally as well as it being the most active medical area for research and development of surgical robots. Usage of such technology in laparoscopic surgery helps improve the vision of the surgeon and avoid ‘camera shake’ due to human fatigue.

As per the geographical analysis, the global medical robots market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central & South America (Brazil, Argentina, and Rest of Central and South America).

North America (the United States, Canada, and Mexico) will have a dominant share in the global medical robots market. The major factor driving the growth of the market in the North American region is the increase in per capita healthcare expenditure along with increased funding for research projects in this area of study. The vast majority of the medical ailments that its citizens suffer from are of such neurological and cardiovascular nature that involve the usage of medical robots. Many of the top manufacturers of this industry are also based out of North America, thus increasing the accessibility to such technology.

Moreover, the Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific) region is expected to be the fastest-growing segment in the global medical robots market during the forecast period. In this region, China is expected to account for the largest market share for the usage of such medical robots due to its increased expenditure in healthcare infrastructure, eagerness to reduce dependency on foreign technology, and adopt instrument-based services. Japan is another growth driver in this region because of its significant R&D investments in this area and the country’s high proportion of geriatric population leading to high demand for medical robots. Other developing countries like India and its rise in medical tourism also contribute to the industry’s regional growth.

Intuitive Surgical, Stryker Corporation, Accuray, Omnicell, Inc., BD Rowa, Hocoma AG, Medtronic, Smith & Nephew, ARxIUM among others are the key players in the global medical robots market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Global Medical Robots Market Overview, 2020-2027

2.1.1 Industry Overview

2.1.2 Type Overview

2.1.3 Application Overview

2.1.4 Regional Overview

Chapter 3 Global Medical Robots Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2027

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Rise in Geriatric Population

3.3.2 Industry Challenges

3.3.2.1 Rise in Cost

3.4 Prospective Growth Scenario

3.4.1 Type Growth Scenario

3.4.2 Application Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Application Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Global Medical Robots Market, By Type

4.1 Type Outlook

4.2 Surgical Robots

4.2.1 Market Size, By Region, 2020-2027 (USD Million)

4.3 Rehabilitation Robots

4.3.1 Market Size, By Region, 2020-2027 (USD Million)

4.4 Noninvasive Radiosurgery Robots

4.4.1 Market Size, By Region, 2020-2027 (USD Million)

4.5 Hospital & Pharmacy Robots

4.5.1 Market Size, By Region, 2020-2027 (USD Million)

4.6 Emergency Response Robots

4.6.1 Market Size, By Region, 2020-2027 (USD Million)

Chapter 5 Global Medical Robots Market, By Application

5.1 Application Outlook

5.2 Neurology

5.2.1 Market Size, By Region, 2020-2027 (USD Million)

5.3 Orthopedics robotic systems

5.3.1 Market Size, By Region, 2020-2027 (USD Million)

5.4 Laparoscopy

5.4.1 Market Size, By Region, 2020-2027 (USD Million)

5.5 Special Education

5.5.1 Market Size, By Region, 2020-2027 (USD Million)

Chapter 6 Global Medical Robots Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2020-2027 (USD Million)

6.2.2 Market Size, By Type, 2020-2027 (USD Million)

6.2.3 Market Size, By Application, 2020-2027 (USD Million)

6.2.4 U.S.

6.2.4.1 Market Size, By Type, 2020-2027 (USD Million)

6.2.4.2 Market Size, By Application, 2020-2027 (USD Million)

6.2.5 Canada

6.2.5.1 Market Size, By Type, 2020-2027 (USD Million)

6.2.5.2 Market Size, By Application, 2020-2027 (USD Million)

6.3 Europe

6.3.1 Market Size, By Country 2020-2027 (USD Million)

6.3.2 Market Size, By Type, 2020-2027 (USD Million)

6.3.3 Market Size, By Application, 2020-2027 (USD Million)

6.3.4 Germany

6.3.4.1 Market Size, By Type, 2020-2027 (USD Million)

6.3.4.2 Market Size, By Application, 2020-2027 (USD Million)

6.3.5 UK

6.3.5.1 Market Size, By Type, 2020-2027 (USD Million)

6.3.5.2 Market Size, By Application, 2020-2027 (USD Million)

6.3.6 France

6.3.6.1 Market Size, By Type, 2020-2027 (USD Million)

6.3.6.2 Market Size, By Application, 2020-2027 (USD Million)

6.3.7 Italy

6.3.7.1 Market Size, By Type, 2020-2027 (USD Million)

6.3.7.2 Market Size, By Application, 2020-2027 (USD Million)

6.3.8 Spain

6.3.8.1 Market Size, By Type, 2020-2027 (USD Million)

6.3.8.2 Market Size, By Application, 2020-2027 (USD Million)

6.3.9 Russia

6.3.9.1 Market Size, By Type, 2020-2027 (USD Million)

6.3.9.2 Market Size, By Application, 2020-2027 (USD Million)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2020-2027 (USD Million)

6.4.2 Market Size, By Type, 2020-2027 (USD Million)

6.4.3 Market Size, By Application, 2020-2027 (USD Million)

6.4.4 China

6.4.4.1 Market Size, By Type, 2020-2027 (USD Million)

6.4.4.2 Market Size, By Application, 2020-2027 (USD Million)

6.4.5 India

6.4.5.1 Market Size, By Type, 2020-2027 (USD Million)

6.4.5.2 Market Size, By Application, 2020-2027 (USD Million)

6.4.6 Japan

6.4.6.1 Market Size, By Type, 2020-2027 (USD Million)

6.4.6.2 Market Size, By Application, 2020-2027 (USD Million)

6.4.7 Australia

6.4.7.1 Market Size, By Type, 2020-2027 (USD Million)

6.4.7.2 Market size, By Application, 2020-2027 (USD Million)

6.4.8 South Korea

6.4.8.1 Market Size, By Type, 2020-2027 (USD Million)

6.4.8.2 Market Size, By Application, 2020-2027 (USD Million)

6.5 Latin America

6.5.1 Market Size, By Country 2020-2027 (USD Million)

6.5.2 Market Size, By Type, 2020-2027 (USD Million)

6.5.3 Market Size, By Application, 2020-2027 (USD Million)

6.5.4 Brazil

6.5.4.1 Market Size, By Type, 2020-2027 (USD Million)

6.5.4.2 Market Size, By Application, 2020-2027 (USD Million)

6.5.5 Mexico

6.5.5.1 Market Size, By Type, 2020-2027 (USD Million)

6.5.5.2 Market Size, By Application, 2020-2027 (USD Million)

6.5.6 Argentina

6.5.6.1 Market Size, By Type, 2020-2027 (USD Million)

6.5.6.2 Market Size, By Application, 2020-2027 (USD Million)

6.6 MEA

6.6.1 Market Size, By Country 2020-2027 (USD Million)

6.6.2 Market Size, By Type, 2020-2027 (USD Million)

6.6.3 Market Size, By Application, 2020-2027 (USD Million)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Type, 2020-2027 (USD Million)

6.6.4.2 Market Size, By Application, 2020-2027 (USD Million)

6.6.5 UAE

6.6.5.1 Market Size, By Type, 2020-2027 (USD Million)

6.6.5.2 Market Size, By Application, 2020-2027 (USD Million)

6.6.6 South Africa

6.6.6.1 Market Size, By Type, 2020-2027 (USD Million)

6.6.6.2 Market Size, By Application, 2020-2027 (USD Million)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 Intuitive Surgical

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Info Graphic Analysis

7.3 Stryker Corporation

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Info Graphic Analysis

7.4 Accuray

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Info Graphic Analysis

7.5 Omnicell, Inc.

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Info Graphic Analysis

7.6 BD Rowa

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 Info Graphic Analysis

7.7 Hocoma AG

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info Graphic Analysis

7.8 Medtronic

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Info Graphic Analysis

7.9 Smith & Nephew

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Info Graphic Analysis

7.10 ARxIUM

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Info Graphic Analysis

The Global Medical Robots Market has been studied from the year 2019 till 2027. However, the CAGR provided in the report is from the year 2022 to 2027. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Medical Robots Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS