Global MEMS Microphone Market Size, Trends & Analysis - Forecasts to 2026 By Alloy Type (Digital, Analog), By Technology (Capacitive, Piezoelectric), By Application (Mobile Phones, Consumer Electronics, IoT & VR, Hearing Aids, Others), By Region (North America, Asia Pacific, Europe, Latin America, Middle East & Africa); End-User Landscape, Company Market Share Analysis, and Competitor Analysis

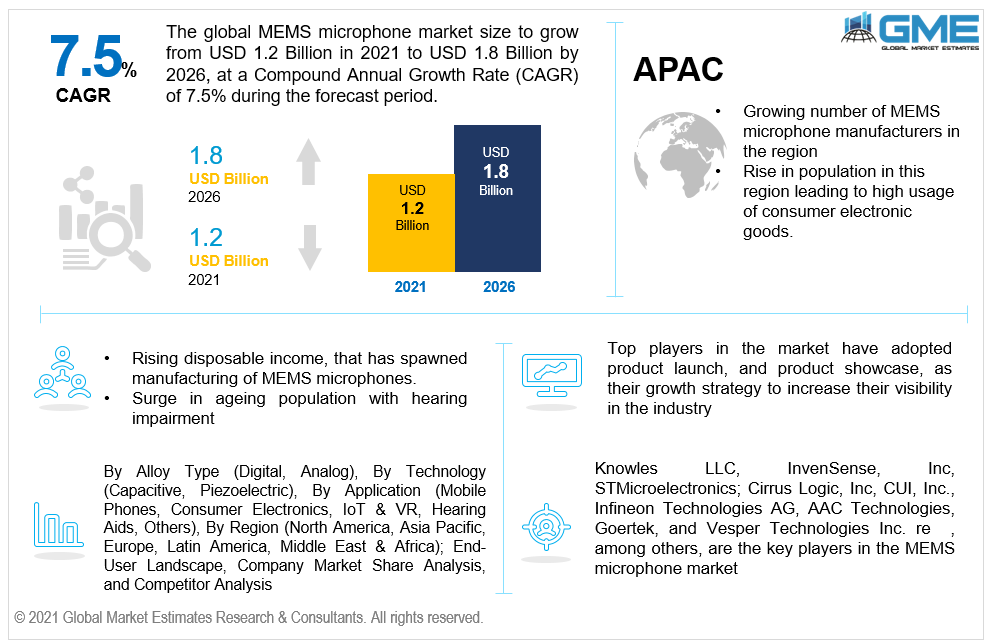

The global MEMS microphone market is projected to grow from USD 1.2 billion in 2021 to USD 1.8 billion by 2026 at a CAGR value of 7.5% from 2021 to 2026.

The application of MEMS (micro-electro-mechanical systems) technology has helped the market welcome latest developments related to small microphones with efficient performance. MEMS microphones offer high signal-to-noise ratio (SNR), low power consumption, good sensitivity, and are available in very small packages that are fully compatible with surface mount assembly processes. MEMS microphones exhibit almost no change in performance after reflow soldering and have exceptional temperature characteristics.

The rising adoption of voice-enabled smart assistants/phones, increasing trend of digitization in developing countries and rural areas, rising smartphone penetration in APAC countries, increasing demand and importance of data to conduct actionable strategies in various domains, and flourishing electric and electronic industry across the globe will help the market grow rapidly. The MEMS Microphone market forecast study explains that the rising electronics industry will support the growth of the microphones maket too. Hence, MEMS microphones will grow rapidly owing to the above trends of MEMS microphone market.

MEMS microphones are electret capsules with on-board preamps and analog-to-digital converters. Microelectromechanical systems (MEMS) microphones are often known as silicon microphones or mic chips. Like most MEMS technologies, MEMS microphones are manufactured utilizing semiconductor silicon wafers and highly automated production lines. On top of the silicon wafer, multiple layers of various materials are produced, and the unwanted material is etched away.

The global market for MEMS microphones is rapidly expanding. Smartphone microphones are used for more than just transmitting voice; they also support voice activation and function as audio sensors. These mics enable high-quality audio recording and voice calls on mobile devices. MEMS microphones are thinner than typical microphones, can withstand extreme temperatures, and produce high-quality audio. Cell phones, IoT-enabled devices, VR technology headsets, hearing aids, and other consumer electronics, as well as smart city projects underway all throughout world, are all aiding to the industry's growth.

One of the primary factors driving the demand for MEMS microphones is increased levels of disposable income, which has sparked a desire for smartphones. Concurrently, a population aging with hearing impairment has boosted demand for high-quality microphones in cochlear implants, which is likely to drive market expansion throughout the projection period.

However, the constant fluctuation of profit margins is hampering the global MEMS microphone market share in 2020. This is can be due to reduced raw material and ready product’s selling prices. Technical concerns like poor speech quality in a noisy environment are also challenges in the MEMS Microphone industry.

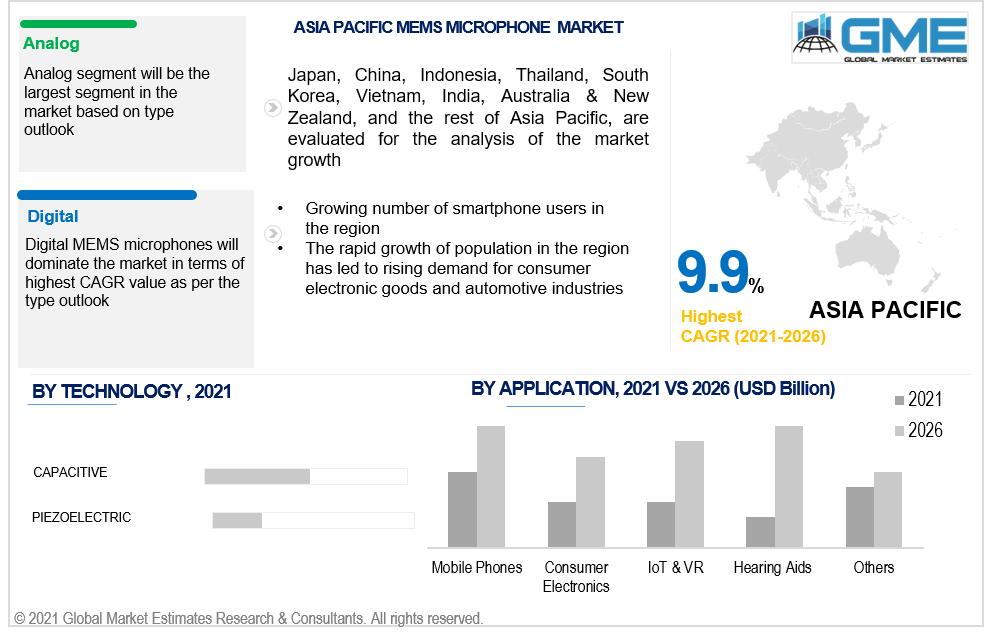

The MEMS Microphone market is divided into two types namely digital and analog. During the forecast period, the analog category is expected to develop steadily and acquire the largest MEMS mic market share.

Analog output-type microphones are in high demand for use in the majority of smartphones. These mics currently account for more than 50% of the global market share. Samsung is the only strong player for smartphones with digital MEMS microphones.

Based on technology, the MEMS microphone market has been split into capacitive and piezoelectric sectors. Capacitive technology is analyzed to be dominant in the market. This technology is widely regarded as the best option for high (>= 64dB) SNR MEMS microphones. Capacitive microphones use a capacitor made up of a rigid backplate and a flexible diaphragm to capture sound. However, the design permits the sound transducer to move freely due to high sound pressures, reducing the microphone's performance.

Due to the scandium-doped AIN layer, piezoelectric technology has a greater SNR, which helps to eliminate sound dampening. One of the most important characteristics of piezoelectric devices is that they contribute to consistent performance and are less prone to deterioration even after extended usage. They are also free of the capacitive gap, which is susceptible to dust and moisture, thus having a very quick pick-up time.

The market is grouped into five applications namely smartphones, other electronic goods, IoT & VR, hearing aids, and others. Hearing aids, other electronic goods, and IoT & VR segments are likely to grow rapidly throughout the forecast period. The demand for smartphones and other sophisticated devices has increased as disposable income has increased, particularly in emerging economies. As a result, MEMS microphones are likely to become more popular in mobile phones sector over the forecast period. Similarly, technical improvements have paved the way for seamless integration of IoT and VR platforms, resulting in an increase in demand for high-quality microphones.

The others segment covers industries and end-use verticals such as oil and natural gas, architecture, automation, remote monitoring, industrial, mechanisation, automobile, and healthcare telematics. In the automotive sector, MEMS microphones are used for beamforming, active noise cancellation, infotainment systems, and engine diagnosis. MEMS microphones are also employed in medical telemetry as part of wireless radio technology to remotely monitor patients' pulse and respiration rates and raise alerts in a medical emergency.

According to regional analysis, the market is bifurcated into North America, Europe, Asia Pacific, Latin America, and the Middle East. North American region is estimated to be the largest regional segment in the market.

Due to well-established production facilities in China, the Philippines, and Thailand, among other major regional markets included in the analysis, Asia Pacific is expected to be the fastest growing segment in the MEMS microphone market. As a consequence of the high proliferation of smartphone market in China, Japan, India; rising demand for smart phone based hearing aids, other consumer electronics, and rising integration of IoT & VR devices in the various verticals will support the growth of the APAC market.

The North American regional market is expected to grow significantly. Considering that virtual reality is still in its early stages, a number of programming events are hosted on a regular basis in this region to raise awareness.

The MEMS microphone manufacturers are Knowles LLC, InvenSense, Inc, STMicroelectronics; Cirrus Logic, Inc, CUI, Inc., Infineon Technologies AG, AAC Technologies, Goertek, and Vesper Technologies Inc. among others.

Please note: This is not an exhaustive list of companies profiled in the report.

To keep ahead of the competition, significant firms focus on research and development and form alliances with established players. They are also improving their distribution techniques by teaming up with distributors to expand their reach globally.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview And Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 MEMS Microphone Market Industry Overview, 2019-2026

2.1.1 Industry Overview

2.1.2 Type Overview

2.1.3 Technology Overview

2.1.4 Application Overview

2.1.5 Regional Overview

Chapter 3 Trends

3.1 Market Segmentation

3.2 Industry Background, 2019-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.2 Industry Challenges

3.4 Prospective Growth Scenario

3.5 COVID-19 Influence on Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 MEMS Microphone Market, By Type

4.1 Type Outlook

4.2 Digital

4.2.1 Market Size, by region, 2019-2026 (USD Billion)

4.3 Analog

4.3.1 Market Size, by region, 2019-2026 (USD Billion)

Chapter 5 MEMS Microphone Market, By Technology

5.1 Technology Outlook

5.2 Capacitive

5.2.1 Market Size, by region, 2019-2026 (USD Billion)

5.3 Piezoelectric

5.3.1 Market Size, by region, 2019-2026 (USD Billion)

Chapter 6 MEMS Microphone Market, By Application

6.1 Application Outlook

6.2 Mobile Phones

6.2.1 Market Size, by region, 2019-2026 (USD Billion)

6.3 Other Consumer Electronics

6.3.1 Market Size, by region, 2019-2026 (USD Billion)

6.4 IoT & VR

6.4.1 Market Size, by region, 2019-2026 (USD Billion)

6.5 Hearing Aids

6.5.1 Market Size, by region, 2019-2026 (USD Billion)

6.6 Others

6.6.1 Market Size, by region, 2019-2026 (USD Billion)

Chapter 7 MEMS Microphone Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, by Country 2019-2026 (USD Billion)

7.2.2 Market Size, by Type, 2019-2026 (USD Billion)

7.2.3 Market Size, by Technology, 2019-2026 (USD Billion)

7.2.4 Market Size, by Application, 2019-2026 (USD Billion)

7.2.5 U.S.

7.2.5.1 Market Size, by Type, 2019-2026 (USD Billion)

7.2.5.2 Market Size, by Technology, 2019-2026 (USD Billion)

7.2.5.3 Market Size, by Application, 2019-2026 (USD Billion)

7.2.6 Canada

7.2.6.1 Market Size, by Type, 2019-2026 (USD Billion)

7.2.6.2 Market Size, by Technology, 2019-2026 (USD Billion)

7.2.6.3 Market Size, by Application, 2019-2026 (USD Billion)

7.2.7 Mexico

7.2.7.1 Market Size, by Type, 2019-2026 (USD Billion)

7.2.7.2 Market Size, by Technology, 2019-2026 (USD Billion)

7.2.7.3 Market Size, by Application, 2019-2026 (USD Billion)

7.3 Europe

7.3.1 Market Size, by Country 2019-2026 (USD Billion)

7.3.2 Market Size, by Type, 2019-2026 (USD Billion)

7.3.3 Market Size, by Technology, 2019-2026 (USD Billion)

7.3.4 Market Size, by Application, 2019-2026 (USD Billion)

7.3.5 Germany

7.2.5.1 Market Size, by Type, 2019-2026 (USD Billion)

7.2.5.2 Market Size, by Technology, 2019-2026 (USD Billion)

7.2.5.3 Market Size, by Application, 2019-2026 (USD Billion)

7.3.6 Spain

7.3.6.1 Market Size, by Type, 2019-2026 (USD Billion)

7.3.6.2 Market Size, by Technology, 2019-2026 (USD Billion)

7.3.6.3 Market Size, by Application, 2019-2026 (USD Billion)

7.3.7 France

7.3.7.1 Market Size, by Type, 2019-2026 (USD Billion)

7.3.7.2 Market Size, by Technology, 2019-2026 (USD Billion)

7.3.7.3 Market Size, by Application, 2019-2026 (USD Billion)

7.3.8 Italy

7.3.8.1 Market Size, by Type, 2019-2026 (USD Billion)

7.3.8.2 Market Size, by Technology, 2019-2026 (USD Billion)

7.3.8.3 Market Size, by Application, 2019-2026 (USD Billion)

7.4 Asia Pacific

7.4.1 Market Size, by Country 2019-2026 (USD Billion)

7.4.2 Market Size, by Type, 2019-2026 (USD Billion)

7.4.3 Market Size, by Technology, 2019-2026 (USD Billion)

7.4.4 Market Size, by Application, 2019-2026 (USD Billion)

7.4.5 China

7.4.5.1 Market Size, by Type, 2019-2026 (USD Billion)

7.4.5.2 Market Size, by Technology, 2019-2026 (USD Billion)

7.4.5.3 Market Size, by Application, 2019-2026 (USD Billion)

7.4.6 India

7.4.6.1 Market Size, by Type, 2019-2026 (USD Billion)

7.4.6.2 Market Size, by Technology, 2019-2026 (USD Billion)

7.4.6.3 Market Size, by Application, 2019-2026 (USD Billion)

7.4.7 Malaysia

7.4.7.1 Market Size, by Type, 2019-2026 (USD Billion)

7.4.7.2 Market Size, by Technology, 2019-2026 (USD Billion)

7.4.7.3 Market Size, by Application, 2019-2026 (USD Billion)

7.4.8 Australia

7.4.8.1 Market Size, by Type, 2019-2026 (USD Billion)

7.4.8.2 Market Size, by Technology, 2019-2026 (USD Billion)

7.4.8.3 Market Size, by Application, 2019-2026 (USD Billion)

7.4.9 South Korea

7.4.9.1 Market Size, by Type, 2019-2026 (USD Billion)

7.4.9.2 Market Size, by Technology, 2019-2026 (USD Billion)

7.4.9.3 Market Size, by Application, 2019-2026 (USD Billion)

7.5 Central & South America

7.5.1 Market Size, by Country 2019-2026 (USD Billion)

7.5.2 Market Size, by Type, 2019-2026 (USD Billion)

7.5.3 Market Size, by Technology, 2019-2026 (USD Billion)

7.5.4 Market Size, by Application, 2019-2026 (USD Billion)

7.5.5 Brazil

7.5.5.1 Market Size, by Type, 2019-2026 (USD Billion)

7.5.5.2 Market Size, by Technology, 2019-2026 (USD Billion)

7.5.5.3 Market Size, by Application, 2019-2026 (USD Billion)

7.5.6 Argentina

7.5.6.1 Market Size, by Type, 2019-2026 (USD Billion)

7.5.6.2 Market Size, by Technology, 2019-2026 (USD Billion)

7.5.6.3 Market Size, by Application, 2019-2026 (USD Billion)

7.6 MEA

7.6.1 Market Size, by Country 2019-2026 (USD Billion)

7.6.2 Market Size, by Type, 2019-2026 (USD Billion)

7.6.3 Market Size, by Technology, 2019-2026 (USD Billion)

7.6.4 Market Size, by Application, 2019-2026 (USD Billion)

7.6.5 Saudi Arabia

7.6.5.1 Market Size, by Type, 2019-2026 (USD Billion)

7.6.5.2 Market Size, by Technology, 2019-2026 (USD Billion)

7.6.5.3 Market Size, by Application, 2019-2026 (USD Billion)

7.6.6 UAE

7.6.6.1 Market Size, by Type, 2019-2026 (USD Billion)

7.6.6.2 Market Size, by Technology, 2019-2026 (USD Billion)

7.6.6.3 Market Size, by Application, 2019-2026 (USD Billion)

7.6.7 South Africa

7.6.7.1 Market Size, by Type, 2019-2026 (USD Billion)

7.6.7.2 Market Size, by Technology, 2019-2026 (USD Billion)

7.6.7.3 Market Size, by Application, 2019-2026 (USD Billion)

Chapter 8 Company Landscape

8.1 Competitive analysis, 2020

8.2 AAC Technologies Holdings Ltd.

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Infographic Analysis

8.3 Analog Devices Inc.

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Infographic Analysis

8.4 Cirrus Logic Inc.

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Infographic Analysis

8.5 Goetrek

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Infographic Analysis

8.6 Infineon Technologies AG

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Infographic Analysis

8.7 Knowles Corp.

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Infographic Analysis

8.8 OMRON Corp.

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Infographic Analysis

8.9 Robert Bosch GmbH

8.9.1 Company Overview

8.9.2 Financial Analysis

8.9.3 Strategic Positioning

8.9.4 Infographic Analysis

8.10 STMicroelectronics NV

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Infographic Analysis

8.11 TDK Corp.

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Infographic Analysis

8.12 New Japan Radio Co Ltd

8.12.1 Company Overview

8.12.2 Financial Analysis

8.12.3 Strategic Positioning

8.12.4 Infographic Analysis

8.13 Projects Unlimited Inc

8.13.1 Company Overview

8.13.2 Financial Analysis

8.13.3 Strategic Positioning

8.13.4 Infographic Analysis

8.14 Sonion

8.14.1 Company Overview

8.14.2 Financial Analysis

8.14.3 Strategic Positioning

8.14.4 Infographic Analysis

8.15 Other Companies

8.15.1 Company Overview

8.15.2 Financial Analysis

8.15.3 Strategic Positioning

8.15.4 Infographic Analysis

The Global MEMS Microphone Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the MEMS Microphone Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS