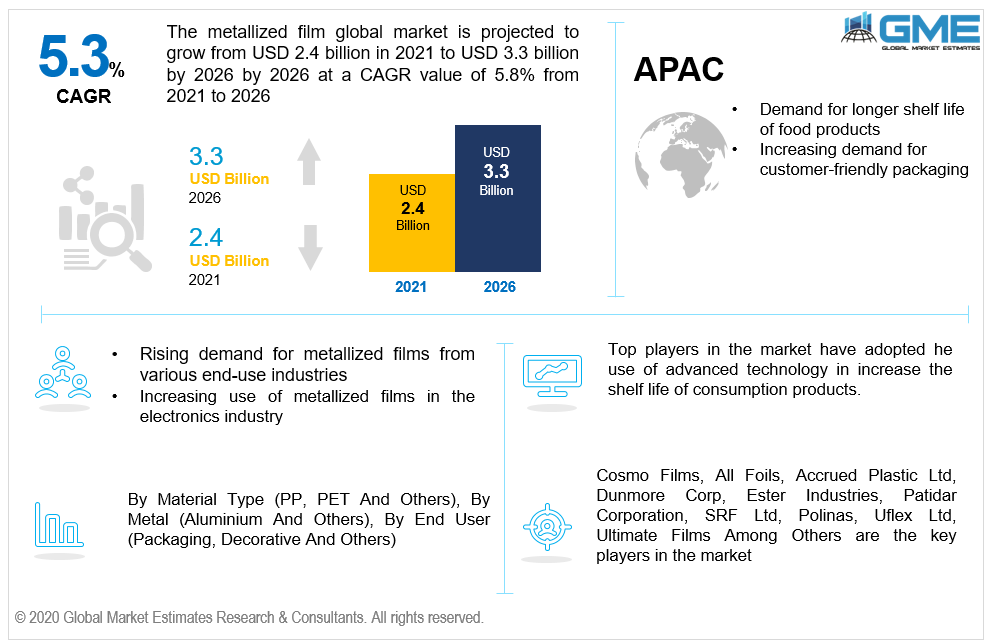

Global Metallized Film Market, Trends & Analysis - Forecasts to 2026 By Material Type (PP, PET And Others), By Metal (Aluminium And Others), By End User (Packaging, Decorative And Others), By Region (North America, Asia Pacific, Central & South America, Europe, and the Middle East & Africa), Competitive Landscape Company Market Share Analysis, and Competitor Analysis

The global metallized film market is projected to grow from USD 2.4 billion in 2020 to USD 3.3 billion by 2026, at a CAGR of 5.3% between 2021 and 2026. A thin metal layer which acts as a resistive element on a non-conducting body is known as metal film resister. Metal film resistors are made by depositing crystalline carbon on the ceramic rod skeleton. Carbon film resistors are low in cost with stable performance.

Metal based on packaging offers good barrier properties and hence are used as closure materials for glass bottles and composite cans. There has been a significant growth in the food & beverage industry and the same is expected to grow at faster rate. This would boost the demand for metallized film as it is widely used in food and beverage packaging industry.

Rising consumer demand for processed and packaged food items, increasing need for food items with longer shelf lives, increasing demand for customer-friendly packaging, rising demand for metallized films from various end-use industries and shifting preference for aesthetically appealing products are some of the factors supporting the growth of the market.

Many products have a small shelf life which in turn restricts the transportation or consumption by the end user, however metal film packing helps to enhance the same by providing cover from direct life thereby increasing the shelf life. Furthermore it helps to reduce wastage of food. Metallic sheet is also used to enhance the looks of the final product in case of canned products. Compared to the traditional plastic containers used globally, metal packaging is light in weight which is another advantage and helps to reduce transport and storage cost.

One of the major restraint for metallized film market is government restrictions in major developing countries related to the usage of metalized films.

COVID-19 has made a significant impact on the economies of the financial as well as industrial sectors, such as travel and tourism, food & beverage, manufacturing, and aviation. The worst economic recession was witnessed during the pandemic’s initial year. With the increasing number of countries imposing and extending lockdowns, economic activities were declining, which impacted the global economy greatly. In the recent past, the global economy became substantially more interconnected.

The adverse consequences of various steps related to the containment of COVID-19 had supported in the chain disruptions, weakened the demand for imported products and services, and increased the unemployment rate. Risk aversion increased in the financial market, with all-time low interest rates and sharp declines in equity and commodity prices.

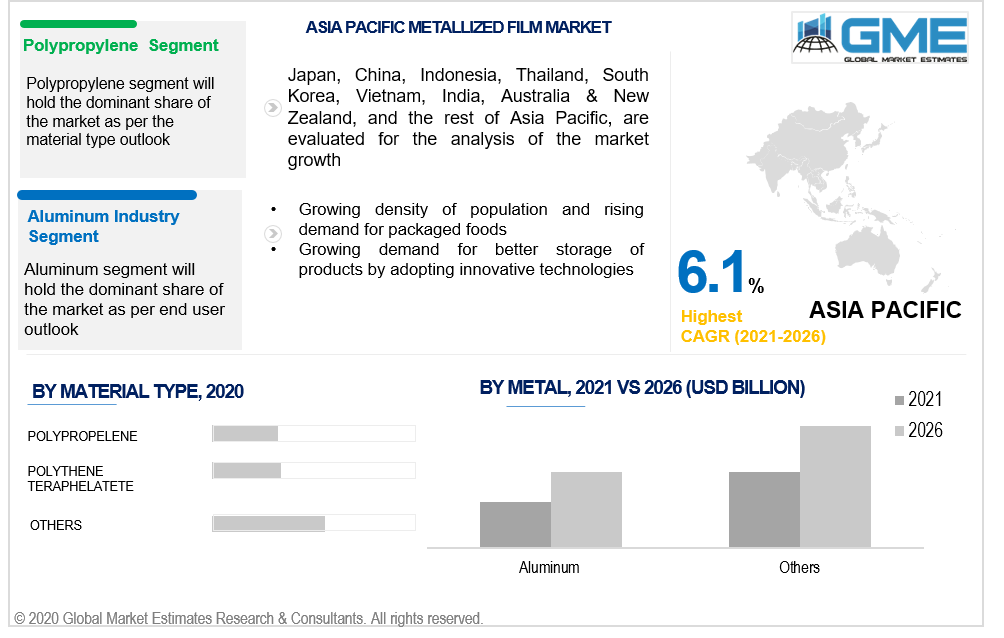

Based on the type, the market can be segmented into PP (polypropylene), PET (polyethylene terephthalate). The key difference between them is that PP is a saturated polymer and PET is an unsaturated polymer. PP holds the largest share of the market as it has higher resistance and can also help to preserve the taste and aroma of the packed product (for example–coffee related products). It is widely used in production of carpets and consumer goods and has the ability to absorb some amount of water content.

Based on the grade, the metallized film market is segmented into aluminium & others. Metal films are polymer films coated with a thin layer of metal which is usually aluminium. They offer glossy metallic appearance of an aluminium foil at a reduced weight and cost. Aluminium is expected to hold the largest market share during the forecast period of 2021 to 2026 due to increased usage in packaging industry and demand of easy to carry products.

Based on end user, the metallized film market can be segmented into packaging, decorative and others. Packaging is expected to the hold the largest share of the metalized film market and is expected to dominate the market during the forecast period of 2021 to 2026. This is mainly due to increased demand for films from the food industry as compared to decoration industry. Metallized film helps to increase shelf life of the packaged food item by providing protection during storage, and transportation and also helps the product to keep its taste and flavour entact. Decorative segment is expected to be growing the fastest in the market during the forecast period.

As per the geographical analysis, the market is classified into North America (the US, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (UAE, Saudi Arabia, Rest of MEA) and Central & South America (Brazil, Peru, Chile, and Rest of CSA).

The North American region (the US, Canada, and Mexico) holds the highest share in the metallized film market. This rank is then followed by Europe and Asia Pacific. Rising deamd for environmental friendly products and packaging has initiated many governments across the region to lay rules, norms and restrictions in order to curb the damage to natural resources and environment. This in turn has helped to reduce chemical hazards caused by plastic waste and led to increasing use of metalized films.

APAC region is analyzed to be the fastest growing region in the market from 2021 to 2026, mainly due to rapidly increasing population, rising demand for RTE foods and rising awareness regarding sustainable food packaging.

Cosmo Films, All Foils, Accrued Plastic Ltd, Dunmore Corp, Ester Industries, Patidar Corporation, SRF Ltd, Polinas, Uflex Ltd, Ultimate Films among others are the key players in the metallized film market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Metallized Film Industry Overview, 2021-2026

2.1.1 Industry Overview

2.1.2 Grade Type Overview

2.1.3 Material Type Overview

2.1.4 End-User Overview

2.1.6 Regional Overview

Chapter 3 Metallized Film Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2021-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Rising demand from food packaging industry

3.3.2 Industry Challenges

3.3.2.1 Impact of COVID-19 on raw material price and supply chain

3.4 Prospective Growth Scenario

3.4.1 Grade Type Growth Scenario

3.4.2 Material Type Growth Scenario

3.4.3 End-User Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 End-User Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Metallized Film Market, By Material Type

4.1 Material Type Outlook

4.2 PP

4.2.1 Market Size, By Region, 2021-2026 (USD Billion)

4.3 PET

4.3.1 Market Size, By Region, 2021-2026 (USD Billion)

4.4 Others

4.4.1 Market Size, By Region, 2021-2026 (USD Billion)

Chapter 5 Metallized Film Market, By Metal Type

5.1 Grade Type Outlook

5.2 Aluminium

5.2.1 Market Size, By Region, 2021-2026 (USD Billion)

5.3 Others

5.3.1 Market Size, By Region, 2021-2026 (USD Billion)

Chapter 6 Metallized Film Market, By End-User

6.1 Packaging

6.1.1 Market Size, By Region, 2021-2026 (USD Billion)

6.2 Decorative

6.2.1 Market Size, By Region, 2021-2026 (USD Billion)

6.3 Others

6.3.1 Market Size, By Region, 2021-2026 (USD Billion)

Chapter 7 Metallized Film Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2021-2026 (USD Billion)

7.2.2 Market Size, By Grade Type, 2021-2026 (USD Billion)

7.2.3 Market Size, By Material Type, 2021-2026 (USD Billion)

7.2.4 Market Size, By End-User, 2021-2026 (USD Billion)

7.2.6 U.S.

7.2.6.1 Market Size, By Grade Type, 2021-2026 (USD Billion)

7.2.4.2 Market Size, By Material Type, 2021-2026 (USD Billion)

7.2.4.3 Market Size, By End-User, 2021-2026 (USD Billion)

7.2.7 Canada

7.2.7.1 Market Size, By Grade Type, 2021-2026 (USD Billion)

7.2.7.2 Market Size, By Material Type, 2021-2026 (USD Billion)

7.2.7.3 Market Size, By End-User, 2021-2026 (USD Billion)

7.3 Europe

7.3.1 Market Size, By Country 2021-2026 (USD Billion)

7.3.2 Market Size, By Grade Type, 2021-2026 (USD Billion)

7.3.3 Market Size, By Material Type, 2021-2026 (USD Billion)

7.3.4 Market Size, By End-User, 2021-2026 (USD Billion)

7.3.6 Germany

7.3.6.1 Market Size, By Grade Type, 2021-2026 (USD Billion)

7.3.6.2 Market Size, By Material Type, 2021-2026 (USD Billion)

7.3.6.3 Market Size, By End-User, 2021-2026 (USD Billion)

7.3.7 UK

7.3.7.1 Market Size, By Grade Type, 2021-2026 (USD Billion)

7.3.7.2 Market Size, By Material Type, 2021-2026 (USD Billion)

7.3.7.3 Market Size, By End-User, 2021-2026 (USD Billion)

7.3.8 France

7.3.7.1 Market Size, By Grade Type, 2021-2026 (USD Billion)

7.3.7.2 Market Size, By Material Type, 2021-2026 (USD Billion)

7.3.7.3 Market Size, By End-User, 2021-2026 (USD Billion)

7.3.9 Italy

7.3.9.1 Market Size, By Grade Type, 2021-2026 (USD Billion)

7.3.9.2 Market Size, By Material Type, 2021-2026 (USD Billion)

7.3.9.3 Market Size, By End-User, 2021-2026 (USD Billion)

7.3.10 Spain

7.3.10.1 Market Size, By Grade Type, 2021-2026 (USD Billion)

7.3.10.2 Market Size, By Material Type, 2021-2026 (USD Billion)

7.3.10.3 Market Size, By End-User, 2021-2026 (USD Billion)

7.3.11 Russia

7.3.11.1 Market Size, By Grade Type, 2021-2026 (USD Billion)

7.3.11.2 Market Size, By Material Type, 2021-2026 (USD Billion)

7.3.11.3 Market Size, By End-User, 2021-2026 (USD Billion)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2021-2026 (USD Billion)

7.4.2 Market Size, By Grade Type, 2021-2026 (USD Billion)

7.4.3 Market Size, By Material Type, 2021-2026 (USD Billion)

7.4.4 Market Size, By End-User, 2021-2026 (USD Billion)

7.4.6 China

7.4.6.1 Market Size, By Grade Type, 2021-2026 (USD Billion)

7.4.6.2 Market Size, By Material Type, 2021-2026 (USD Billion)

7.4.6.3 Market Size, By End-User, 2021-2026 (USD Billion)

7.4.7 India

7.4.7.1 Market Size, By Grade Type, 2021-2026 (USD Billion)

7.4.7.2 Market Size, By Material Type, 2021-2026 (USD Billion)

7.4.7.3 Market Size, By End-User, 2021-2026 (USD Billion)

7.4.8 Japan

7.4.7.1 Market Size, By Grade Type, 2021-2026 (USD Billion)

7.4.7.2 Market Size, By Material Type, 2021-2026 (USD Billion)

7.4.7.3 Market Size, By End-User, 2021-2026 (USD Billion)

7.4.9 Australia

7.4.9.1 Market Size, By Grade Type, 2021-2026 (USD Billion)

7.4.9.2 Market size, By Material Type, 2021-2026 (USD Billion)

7.4.9.3 Market Size, By End-User, 2021-2026 (USD Billion)

7.4.10 South Korea

7.4.10.1 Market Size, By Grade Type, 2021-2026 (USD Billion)

7.4.10.2 Market Size, By Material Type, 2021-2026 (USD Billion)

7.4.10.3 Market Size, By End-User, 2021-2026 (USD Billion)

7.5 Latin America

7.5.1 Market Size, By Country 2021-2026 (USD Billion)

7.5.2 Market Size, By Grade Type, 2021-2026 (USD Billion)

7.5.3 Market Size, By Material Type, 2021-2026 (USD Billion)

7.5.4 Market Size, By End-User, 2021-2026 (USD Billion)

7.5.6 Brazil

7.5.6.1 Market Size, By Grade Type, 2021-2026 (USD Billion)

7.5.6.2 Market Size, By Material Type, 2021-2026 (USD Billion)

7.5.6.3 Market Size, By End-User, 2021-2026 (USD Billion)

7.5.7 Mexico

7.5.7.1 Market Size, By Grade Type, 2021-2026 (USD Billion)

7.5.7.2 Market Size, By Material Type, 2021-2026 (USD Billion)

7.5.7.3 Market Size, By End-User, 2021-2026 (USD Billion)

7.5.8 Argentina

7.5.7.1 Market Size, By Grade Type, 2021-2026 (USD Billion)

7.5.7.2 Market Size, By Material Type, 2021-2026 (USD Billion)

7.5.7.3 Market Size, By End-User, 2021-2026 (USD Billion)

7.6 MEA

7.6.1 Market Size, By Country 2021-2026 (USD Billion)

7.6.2 Market Size, By Grade Type, 2021-2026 (USD Billion)

7.6.3 Market Size, By Material Type, 2021-2026 (USD Billion)

7.6.4 Market Size, By End-User, 2021-2026 (USD Billion)

7.6.6 Saudi Arabia

7.6.6.1 Market Size, By Grade Type, 2021-2026 (USD Billion)

7.6.6.2 Market Size, By Material Type, 2021-2026 (USD Billion)

7.6.6.3 Market Size, By End-User, 2021-2026 (USD Billion)

7.6.7 UAE

7.6.7.1 Market Size, By Grade Type, 2021-2026 (USD Billion)

7.6.7.2 Market Size, By Material Type, 2021-2026 (USD Billion)

7.6.7.3 Market Size, By End-User, 2021-2026 (USD Billion)

7.6.8 South Africa

7.6.7.1 Market Size, By Grade Type, 2021-2026 (USD Billion)

7.6.7.2 Market Size, By Material Type, 2021-2026 (USD Billion)

7.6.7.3 Market Size, By End-User, 2021-2026 (USD Billion)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 Cosmo Films

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Info Graphic Analysis

8.3 All Foils Ltd

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info Graphic Analysis

8.4 Accrued Plastic Ltd

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info Graphic Analysis

8.5 Dunmore Corp Ltd

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info Graphic Analysis

8.6 Ester Industries

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info Graphic Analysis

8.7 SRF Ltd

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info Graphic Analysis

8.8 Uflex Ltd

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

7.8.4 Info Graphic Analysis

8.9 Other Companies

8.9.1 Company Overview

8.9.2 Financial Analysis

8.9.3 Strategic Positioning

8.9.4 Info Graphic Analysis

The Global Metallized Film Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Metallized Film Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS