Global Methane Capturing Services Market Size, Trends & Analysis - Forecasts to 2029 By Capture Technology (Anaerobic Digestion, Landfill Gas Collection, and Biological Methane Oxidation), By End-use Industry (Oil and Gas Agriculture, Waste Management, and Renewable Energy), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

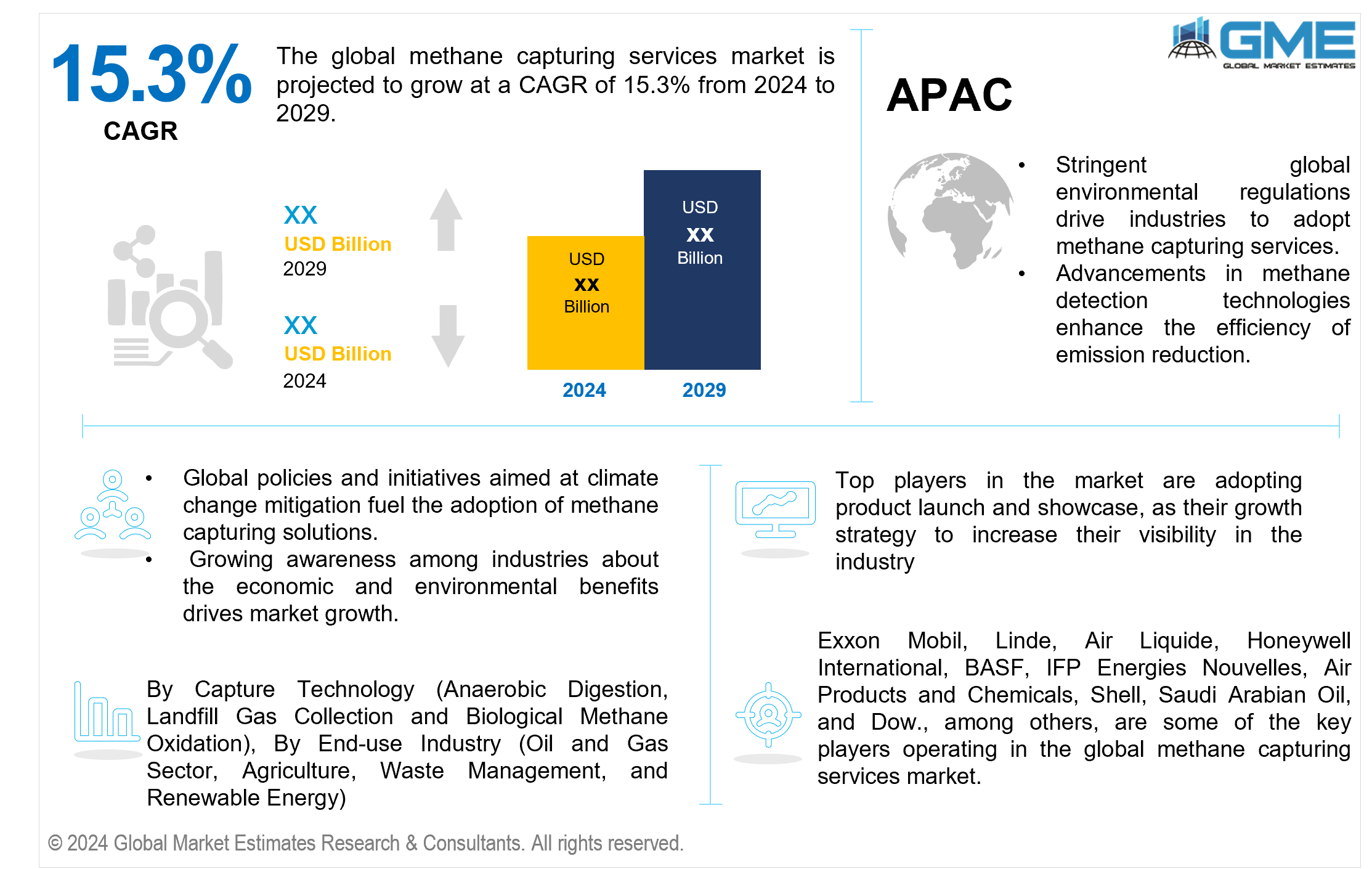

The global methane capturing services market is projected to grow at a CAGR of 15.3% from 2024 to 2029.

The growing public awareness and concern about climate change and environmental sustainability has prompted governments, businesses, and communities to seek measures to reduce greenhouse gas emissions. Methane capture services address these problems by lowering methane emissions, a potent greenhouse gas.

Governments worldwide are implementing severe environmental regulations and policies, forcing industries to adopt technology and services with a lower environmental effect. Methane capture services assist businesses in complying with emission reduction targets and requirements. For example, the Global Methane Pledge (GMP) is a collective initiative to address and reduce methane emissions, a potent greenhouse gas that significantly contributes to climate change. Launched at COP26, or the Conference of the Parties, it is the 26th meeting of the parties to the United Nations climate convention (UNFCCC) in November 2021, the GMP is led by the United States and the European Union, and it has gained significant momentum with the participation of 150 countries collectively responsible for over half of the global methane emissions from human activities.

The emphasis on switching to renewable energy sources has heightened interest in extracting methane from garbage and converting it into biogas. Methane capture services help to generate renewable energy, which aligns with the global trend towards cleaner and more sustainable energy sources. According to the International Energy Agency, the energy sector, encompassing activities related to oil, natural gas, coal, and bioenergy, accounts for nearly 40% of human-caused methane emissions. Addressing emissions from this sector becomes crucial in achieving overall methane reduction goals.

However, implementing methane capture systems, such as gas collection infrastructure and anaerobic digestion plants, frequently necessitates a considerable initial financial expenditure. The initial costs can be prohibitive, particularly for smaller businesses or regions with limited financial means.

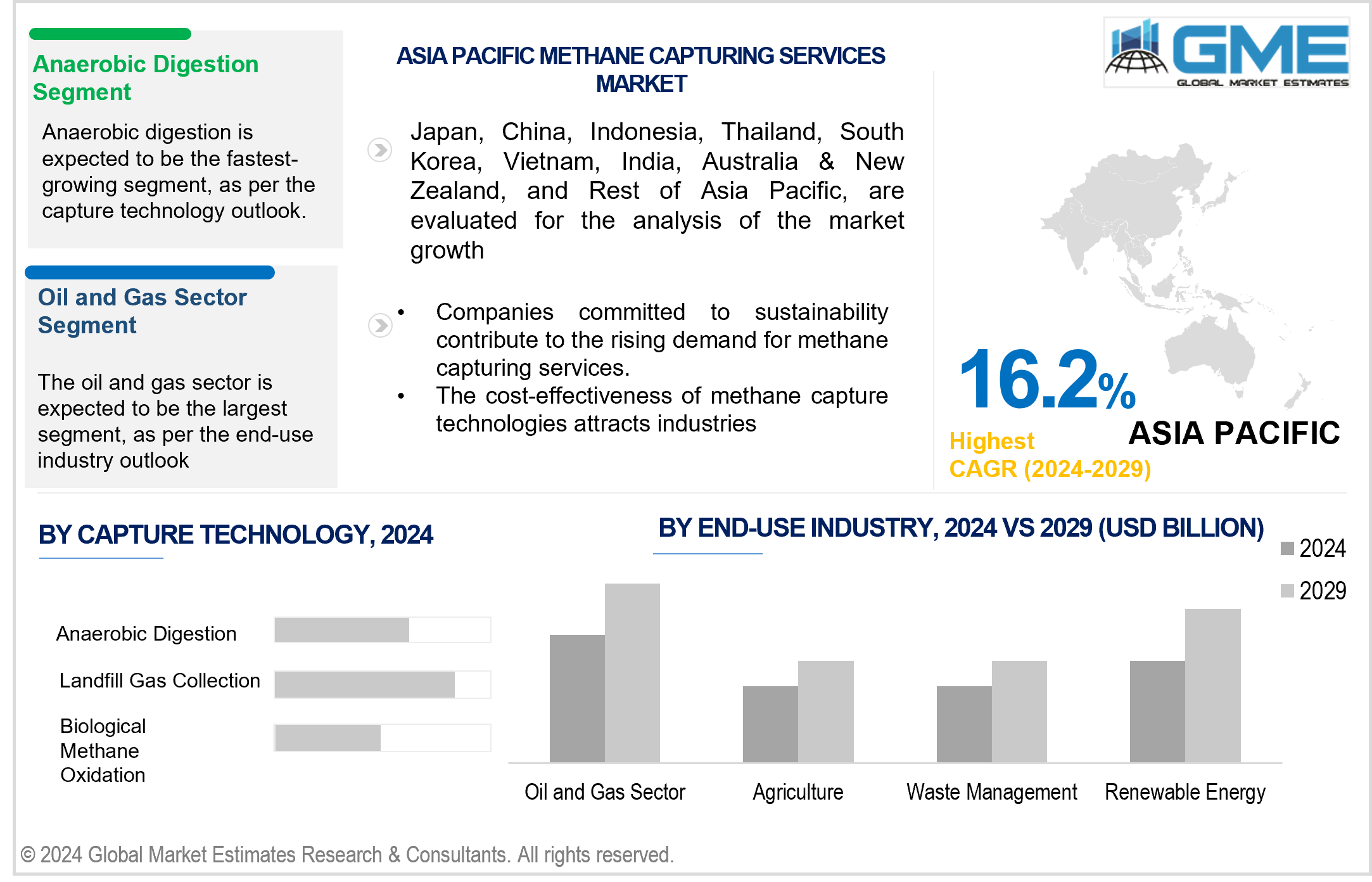

The anaerobic digestion segment is anticipated to be the fastest-growing segment in the market from 2024-2029. The anticipated growth of the segment is due to its eco-friendly waste management approach. This technique not only minimizes methane emissions from organic waste but also generates biogas, a green energy source. The rising emphasis on sustainable waste management by governments and the growing understanding of the economic and environmental benefits of anaerobic digestion all contribute to the segment growth. According to the International Energy Agency (IEA), the world's capacity for generating electricity from renewable sources is expected to accelerate. By 2026, global renewable electricity capacity is predicted to rise over 60% from 2020, reaching over 4,800 gigawatts.

The landfill gas collection segment is expected to hold the largest share of the market over the forecast period. The segment's expected dominance is due to the enormous methane emissions produced by decomposing organic waste in landfills. According to the United States Environmental Protection Agency, municipal solid waste (MSW) landfills are a significant source of methane emissions in the United States, constituting around 14.3% of human-related methane emissions in 2021. This share positions MSW landfills as the third-largest contributor to methane emissions. Landfill gas collection methods are focused on capturing and utilizing methane, which addresses both environmental concerns and the potential for energy generation.

The agriculture segment is anticipated to be the fastest-growing segment in the market from 2024-2029. Agricultural activities, such as livestock husbandry and manure management, emit considerable amounts of methane. As environmental consciousness grows and governments establish legislation to decrease greenhouse gas emissions, the agriculture industry is expected to look into methane capture methods to lower its carbon footprint.

The oil and gas segment is anticipated to hold the largest share of the market over the forecast period. The oil and gas sector substantially contributes to methane emissions, which leads to the expected dominance of the sector in the methane capturing services market. Methane is produced during the extraction, processing, and transport of oil and natural gas. Addressing emissions from this sector is crucial for environmental sustainability, aligning with the industry's increasing focus on reducing its carbon footprint.

North America is expected to be the largest region in the market. The primary reasons boosting the market growth in this region include stringent environmental legislation, growing awareness of climate change, and a proactive attitude to sustainability. The region's commitment to reducing greenhouse gas emissions and advances in methane capture technologies drives market growth.

Asia Pacific is predicted to witness rapid growth during the forecast period. The regional market growth is attributed to the increased industry, urbanization, and government programs supporting sustainable practices. The region's growing awareness of environmental issues and its commitment to addressing climate change drives the adoption of methane capturing services.

Exxon Mobil, Linde, Air Liquide, Honeywell International, BASF, IFP Energies Nouvelles, Air Products and Chemicals, Shell, Saudi Arabian Oil, and Dow., among others, are some of the key players operating in the global methane capturing services market.

Please note: This is not an exhaustive list of companies profiled in the report.

In March 2022, Air Liquide opened a steam methane reformation (SMR) plant powered by renewable natural gas (RNG) in Las Vegas, Nevada. The hydrogen plant, utilizing methane captured from biological wastes, can produce 30 tonnes per day of hydrogen at full capacity.

In April 2021, Honeywell introduced its gas cloud imaging (GCI) system in Europe, designed for automated and continuous monitoring of hazardous gas leaks such as methane at oil and gas, chemical, and power generation facilities. The Mini GCI system, part of the Honeywell Rebellion gas cloud imaging product portfolio, is compact and suitable for congested areas and small sites.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL METHANE CAPTURING SERVICES MARKET, BY END-USE INDUSTRY

4.1 Introduction

4.2 Methane Capturing Services Market: End-use Industry Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Oil and Gas Sector

4.4.1 Oil and Gas Sector Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 Agriculture

4.5.1 Agriculture Market Estimates and Forecast, 2021-2029 (USD Million)

4.6 Waste Management

4.6.1 Waste Management Market Estimates and Forecast, 2021-2029 (USD Million)

4.7 Renewable Energy

4.7.1 Renewable Energy Market Estimates and Forecast, 2021-2029 (USD Million)

5 GLOBAL METHANE CAPTURING SERVICES MARKET, BY CAPTURE TECHNOLOGY

5.1 Introduction

5.2 Methane Capturing Services Market: Application Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 Anaerobic Digestion

5.4.1 Anaerobic Digestion Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 Landfill Gas Collection

5.5.1 Landfill Gas Collection Market Estimates and Forecast, 2021-2029 (USD Million)

5.6 Biological Methane Oxidation

5.6.1 Biological Methane Oxidation Market Estimates and Forecast, 2021-2029 (USD Million)

6 GLOBAL METHANE CAPTURING SERVICES MARKET, BY REGION

6.1 Introduction

6.2 North America Methane Capturing Services Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.1 By End-use Industry

6.2.2 By Capture Technology

6.2.3 By Country

6.2.3.1 U.S. Methane Capturing Services Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.1.1 By End-use Industry

6.2.3.1.2 By Capture Technology

6.2.3.2 Canada Methane Capturing Services Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.2.1 By End-use Industry

6.2.3.2.2 By Capture Technology

6.2.3.3 Mexico Methane Capturing Services Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.3.1 By End-use Industry

6.2.3.3.2 By Capture Technology

6.3 Europe Methane Capturing Services Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.1 By End-use Industry

6.3.2 By Capture Technology

6.3.3 By Country

6.3.3.1 Germany Methane Capturing Services Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.1.1 By End-use Industry

6.3.3.1.2 By Capture Technology

6.3.3.2 U.K. Methane Capturing Services Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.2.1 By End-use Industry

6.3.3.2.2 By Capture Technology

6.3.3.3 France Methane Capturing Services Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.3.1 By End-use Industry

6.3.3.3.2 By Capture Technology

6.3.3.4 Italy Methane Capturing Services Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.4.1 By End-use Industry

6.3.3.4.2 By Capture Technology

6.3.3.5 Spain Methane Capturing Services Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.5.1 By End-use Industry

6.3.3.5.2 By Capture Technology

6.3.3.6 Netherlands Methane Capturing Services Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.6.1 By End-use Industry

6.3.3.6.2 By Capture Technology

6.3.3.7 Rest of Europe Methane Capturing Services Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.6.1 By End-use Industry

6.3.3.6.2 By Capture Technology

6.4 Asia Pacific Methane Capturing Services Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.1 By End-use Industry

6.4.2 By Capture Technology

6.4.3 By Country

6.4.3.1 China Methane Capturing Services Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.1.1 By End-use Industry

6.4.3.1.2 By Capture Technology

6.4.3.2 Japan Methane Capturing Services Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.2.1 By End-use Industry

6.4.3.2.2 By Capture Technology

6.4.3.3 India Methane Capturing Services Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.3.1 By End-use Industry

6.4.3.3.2 By Capture Technology

6.4.3.4 South Korea Methane Capturing Services Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.4.1 By End-use Industry

6.4.3.4.2 By Capture Technology

6.4.3.5 Singapore Methane Capturing Services Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.5.1 By End-use Industry

6.4.3.5.2 By Capture Technology

6.4.3.6 Malaysia Methane Capturing Services Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.6.1 By End-use Industry

6.4.3.6.2 By Capture Technology

6.4.3.7 Thailand Methane Capturing Services Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.6.1 By End-use Industry

6.4.3.6.2 By Capture Technology

6.4.3.8 Indonesia Methane Capturing Services Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.7.1 By End-use Industry

6.4.3.7.2 By Capture Technology

6.4.3.9 Vietnam Methane Capturing Services Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.8.1 By End-use Industry

6.4.3.8.2 By Capture Technology

6.4.3.10 Taiwan Methane Capturing Services Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.10.1 By End-use Industry

6.4.3.10.2 By Capture Technology

6.4.3.11 Rest of Asia Pacific Methane Capturing Services Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.11.1 By End-use Industry

6.4.3.11.2 By Capture Technology

6.5 Middle East and Africa Methane Capturing Services Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.1 By End-use Industry

6.5.2 By Capture Technology

6.5.3 By Country

6.5.3.1 Saudi Arabia Methane Capturing Services Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.1.1 By End-use Industry

6.5.3.1.2 By Capture Technology

6.5.3.2 U.A.E. Methane Capturing Services Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.2.1 By End-use Industry

6.5.3.2.2 By Capture Technology

6.5.3.3 Israel Methane Capturing Services Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.3.1 By End-use Industry

6.5.3.3.2 By Capture Technology

6.5.3.4 South Africa Methane Capturing Services Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.4.1 By End-use Industry

6.5.3.4.2 By Capture Technology

6.5.3.5 Rest of Middle East and Africa Methane Capturing Services Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.5.1 By End-use Industry

6.5.3.5.2 By Capture Technology

6.6 Central and South America Methane Capturing Services Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.1 By End-use Industry

6.6.2 By Capture Technology

6.6.3 By Country

6.6.3.1 Brazil Methane Capturing Services Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.1.1 By End-use Industry

6.6.3.1.2 By Capture Technology

6.6.3.2 Argentina Methane Capturing Services Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.2.1 By End-use Industry

6.6.3.2.2 By Capture Technology

6.6.3.3 Chile Methane Capturing Services Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.3.1 By End-use Industry

6.6.3.3.2 By Capture Technology

6.6.3.3 Rest of Central and South America Methane Capturing Services Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.3.1 By End-use Industry

6.6.3.3.2 By Capture Technology

7 COMPETITIVE LANDCAPE

7.1 Company Market Share Analysis

7.2 Four Quadrant Positioning Matrix

7.2.1 Market Leaders

7.2.2 Market Visionaries

7.2.3 Market Challengers

7.2.4 Niche Market Players

7.3 Vendor Landscape

7.3.1 North America

7.3.2 Europe

7.3.3 Asia Pacific

7.3.4 Rest of the World

7.4 Company Profiles

7.4.1 Dow

7.4.1.1 Business Description & Financial Analysis

7.4.1.2 SWOT Analysis

7.4.1.3 Products & Services Offered

7.4.1.4 Strategic Alliances between Business Partners

7.4.2 Exxon Mobil

7.4.2.1 Business Description & Financial Analysis

7.4.2.2 SWOT Analysis

7.4.2.3 Products & Services Offered

7.4.2.4 Strategic Alliances between Business Partners

7.4.3 Linde

7.4.3.1 Business Description & Financial Analysis

7.4.3.2 SWOT Analysis

7.4.3.3 Products & Services Offered

7.4.3.4 Strategic Alliances between Business Partners

7.4.4 Air Liquide

7.4.4.1 Business Description & Financial Analysis

7.4.4.2 SWOT Analysis

7.4.4.3 Products & Services Offered

7.4.4.4 Strategic Alliances between Business Partners

7.4.5 Honeywell International

7.4.5.1 Business Description & Financial Analysis

7.4.5.2 SWOT Analysis

7.4.5.3 Products & Services Offered

7.4.5.4 Strategic Alliances between Business Partners

7.4.6 BASF

7.4.6.1 Business Description & Financial Analysis

7.4.6.2 SWOT Analysis

7.4.6.3 Products & Services Offered

7.4.6.4 Strategic Alliances between Business Partners

7.4.7 IFP Energies Nouvelles

7.4.7.1 Business Description & Financial Analysis

7.4.7.2 SWOT Analysis

7.4.7.3 Products & Services Offered

7.4.7.4 Strategic Alliances between Business Partners

7.4.8 Air Products and Chemicals

7.4.8.1 Business Description & Financial Analysis

7.4.8.2 SWOT Analysis

7.4.8.3 Products & Services Offered

7.4.8.4 Strategic Alliances between Business Partners

7.4.9 Shell

7.4.9.1 Business Description & Financial Analysis

7.4.9.2 SWOT Analysis

7.4.9.3 Products & Services Offered

7.4.9.4 Strategic Alliances between Business Partners

7.4.10 Saudi Arabian Oil

7.4.10.1 Business Description & Financial Analysis

7.4.10.2 SWOT Analysis

7.4.10.3 Products & Services Offered

7.4.10.4 Strategic Alliances between Business Partners

7.4.11 Other Companies

7.4.11.1 Business Description & Financial Analysis

7.4.11.2 SWOT Analysis

7.4.11.3 Products & Services Offered

7.4.11.4 Strategic Alliances between Business Partners

8 RESEARCH METHODOLOGY

8.1 Market Introduction

8.1.1 Market Definition

8.1.2 Market Scope & Segmentation

8.2 Information Procurement

8.2.1 Secondary Research

8.2.1.1 Purchased Databases

8.2.1.2 GMEs Internal Data Repository

8.2.1.3 Secondary Resources & Third Party Perspectives

8.2.1.4 Company Information Sources

8.2.2 Primary Research

8.2.2.1 Various Types of Respondents for Primary Interviews

8.2.2.2 Number of Interviews Conducted throughout the Research Process

8.2.2.3 Primary Stakeholders

8.2.2.4 Discussion Guide for Primary Participants

8.2.3 Expert Panels

8.2.3.1 Expert Panels Across 30+ Industry

8.2.4 Paid Local Experts

8.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

8.3 Market Estimation

8.3.1 Top-Down Approach

8.3.1.1 Macro-Economic Indicators Considered

8.3.1.2 Micro-Economic Indicators Considered

8.3.2 Bottom Up Approach

8.3.2.1 Company Share Analysis Approach

8.3.2.2 Estimation of Potential Product Sales

8.4 Data Triangulation

8.4.1 Data Collection

8.4.2 Time Series, Cross Sectional & Panel Data Analysis

8.4.3 Cluster Analysis

8.5 Analysis and Output

8.5.1 Inhouse AI Based Real Time Analytics Tool

8.5.2 Output From Desk & Primary Research

8.6 Research Assumptions & Limitations

8.6.1 Research Assumptions

8.6.2 Research Limitations

LIST OF TABLES

1 Global Methane Capturing Services Market, By End-use Industry, 2021-2029 (USD Mllion)

2 Oil and Gas Sector Market, By Region, 2021-2029 (USD Mllion)

3 Agriculture Market, By Region, 2021-2029 (USD Mllion)

4 Waste Management Market, By Region, 2021-2029 (USD Mllion)

5 Renewable Energy Market, By Region, 2021-2029 (USD Mllion)

6 Global Methane Capturing Services Market, By Capture Technology, 2021-2029 (USD Mllion)

7 Anaerobic Digestion Market, By Region, 2021-2029 (USD Mllion)

8 Landfill Gas Collection Market, By Region, 2021-2029 (USD Mllion)

9 Biological Methane Oxidation Market, By Region, 2021-2029 (USD Mllion)

10 Regional Analysis, 2021-2029 (USD Mllion)

11 North America Methane Capturing Services Market, By End-use Industry, 2021-2029 (USD Mllion)

12 North America Methane Capturing Services Market, By Capture Technology, 2021-2029 (USD Mllion)

13 North America Methane Capturing Services Market, By COUNTRY, 2021-2029 (USD Mllion)

14 U.S. Methane Capturing Services Market, By End-use Industry, 2021-2029 (USD Mllion)

15 U.S. Methane Capturing Services Market, By Capture Technology, 2021-2029 (USD Mllion)

16 Canada Methane Capturing Services Market, By End-use Industry, 2021-2029 (USD Mllion)

17 Canada Methane Capturing Services Market, By Capture Technology, 2021-2029 (USD Mllion)

18 Mexico Methane Capturing Services Market, By End-use Industry, 2021-2029 (USD Mllion)

19 Mexico Methane Capturing Services Market, By Capture Technology, 2021-2029 (USD Mllion)

20 Europe Methane Capturing Services Market, By End-use Industry, 2021-2029 (USD Mllion)

21 Europe Methane Capturing Services Market, By Capture Technology, 2021-2029 (USD Mllion)

22 Europe Methane Capturing Services Market, By Country, 2021-2029 (USD Mllion)

23 Germany Methane Capturing Services Market, By End-use Industry, 2021-2029 (USD Mllion)

24 Germany Methane Capturing Services Market, By Capture Technology, 2021-2029 (USD Mllion)

25 U.K. Methane Capturing Services Market, By End-use Industry, 2021-2029 (USD Mllion)

26 U.K. Methane Capturing Services Market, By Capture Technology, 2021-2029 (USD Mllion)

27 France Methane Capturing Services Market, By End-use Industry, 2021-2029 (USD Mllion)

28 France Methane Capturing Services Market, By Capture Technology, 2021-2029 (USD Mllion)

29 Italy Methane Capturing Services Market, By End-use Industry, 2021-2029 (USD Mllion)

30 Italy Methane Capturing Services Market, By Capture Technology, 2021-2029 (USD Mllion)

31 Spain Methane Capturing Services Market, By End-use Industry, 2021-2029 (USD Mllion)

32 Spain Methane Capturing Services Market, By Capture Technology, 2021-2029 (USD Mllion)

33 Netherlands Methane Capturing Services Market, By End-use Industry, 2021-2029 (USD Mllion)

34 Netherlands Methane Capturing Services Market, By Capture Technology, 2021-2029 (USD Mllion)

35 Rest Of Europe Methane Capturing Services Market, By End-use Industry, 2021-2029 (USD Mllion)

36 Rest Of Europe Methane Capturing Services Market, By Capture Technology, 2021-2029 (USD Mllion)

37 Asia Pacific Methane Capturing Services Market, By End-use Industry, 2021-2029 (USD Mllion)

38 Asia Pacific Methane Capturing Services Market, By Capture Technology, 2021-2029 (USD Mllion)

39 Asia Pacific Methane Capturing Services Market, By Country, 2021-2029 (USD Mllion)

40 China Methane Capturing Services Market, By End-use Industry, 2021-2029 (USD Mllion)

41 China Methane Capturing Services Market, By Capture Technology, 2021-2029 (USD Mllion)

42 Japan Methane Capturing Services Market, By End-use Industry, 2021-2029 (USD Mllion)

43 Japan Methane Capturing Services Market, By Capture Technology, 2021-2029 (USD Mllion)

44 India Methane Capturing Services Market, By End-use Industry, 2021-2029 (USD Mllion)

45 India Methane Capturing Services Market, By Capture Technology, 2021-2029 (USD Mllion)

46 South Korea Methane Capturing Services Market, By End-use Industry, 2021-2029 (USD Mllion)

47 South Korea Methane Capturing Services Market, By Capture Technology, 2021-2029 (USD Mllion)

48 Singapore Methane Capturing Services Market, By End-use Industry, 2021-2029 (USD Mllion)

49 Singapore Methane Capturing Services Market, By Capture Technology, 2021-2029 (USD Mllion)

50 Thailand Methane Capturing Services Market, By End-use Industry, 2021-2029 (USD Mllion)

51 Thailand Methane Capturing Services Market, By Capture Technology, 2021-2029 (USD Mllion)

52 Malaysia Methane Capturing Services Market, By End-use Industry, 2021-2029 (USD Mllion)

53 Malaysia Methane Capturing Services Market, By Capture Technology, 2021-2029 (USD Mllion)

54 Indonesia Methane Capturing Services Market, By End-use Industry, 2021-2029 (USD Mllion)

55 Indonesia Methane Capturing Services Market, By Capture Technology, 2021-2029 (USD Mllion)

56 Vietnam Methane Capturing Services Market, By End-use Industry, 2021-2029 (USD Mllion)

57 Vietnam Methane Capturing Services Market, By Capture Technology, 2021-2029 (USD Mllion)

58 Taiwan Methane Capturing Services Market, By End-use Industry, 2021-2029 (USD Mllion)

59 Taiwan Methane Capturing Services Market, By Capture Technology, 2021-2029 (USD Mllion)

60 Rest of APAC Methane Capturing Services Market, By End-use Industry, 2021-2029 (USD Mllion)

61 Rest of APAC Methane Capturing Services Market, By Capture Technology, 2021-2029 (USD Mllion)

62 Middle East and Africa Methane Capturing Services Market, By End-use Industry, 2021-2029 (USD Mllion)

63 Middle East and Africa Methane Capturing Services Market, By Capture Technology, 2021-2029 (USD Mllion)

64 Middle East and Africa Methane Capturing Services Market, By Country, 2021-2029 (USD Mllion)

65 Saudi Arabia Methane Capturing Services Market, By End-use Industry, 2021-2029 (USD Mllion)

66 Saudi Arabia Methane Capturing Services Market, By Capture Technology, 2021-2029 (USD Mllion)

67 UAE Methane Capturing Services Market, By End-use Industry, 2021-2029 (USD Mllion)

68 UAE Methane Capturing Services Market, By Capture Technology, 2021-2029 (USD Mllion)

69 Israel Methane Capturing Services Market, By End-use Industry, 2021-2029 (USD Mllion)

70 Israel Methane Capturing Services Market, By Capture Technology, 2021-2029 (USD Mllion)

71 South Africa Methane Capturing Services Market, By End-use Industry, 2021-2029 (USD Mllion)

72 South Africa Methane Capturing Services Market, By Capture Technology, 2021-2029 (USD Mllion)

73 Rest Of Middle East and Africa Methane Capturing Services Market, By End-use Industry, 2021-2029 (USD Mllion)

74 Rest Of Middle East and Africa Methane Capturing Services Market, By Capture Technology, 2021-2029 (USD Mllion)

75 Central and South America Methane Capturing Services Market, By End-use Industry, 2021-2029 (USD Mllion)

76 Central and South America Methane Capturing Services Market, By Capture Technology, 2021-2029 (USD Mllion)

77 Central and South America Methane Capturing Services Market, By Country, 2021-2029 (USD Mllion)

78 Brazil Methane Capturing Services Market, By End-use Industry, 2021-2029 (USD Mllion)

79 Brazil Methane Capturing Services Market, By Capture Technology, 2021-2029 (USD Mllion)

80 Chile Methane Capturing Services Market, By End-use Industry, 2021-2029 (USD Mllion)

81 Chile Methane Capturing Services Market, By Capture Technology, 2021-2029 (USD Mllion)

82 Argentina Methane Capturing Services Market, By End-use Industry, 2021-2029 (USD Mllion)

83 Argentina Methane Capturing Services Market, By Capture Technology, 2021-2029 (USD Mllion)

84 Rest Of Central and South America Methane Capturing Services Market, By End-use Industry, 2021-2029 (USD Mllion)

85 Rest Of Central and South America Methane Capturing Services Market, By Capture Technology, 2021-2029 (USD Mllion)

86 Dow: Products & Services Offering

87 Exxon Mobil: Products & Services Offering

88 Linde: Products & Services Offering

89 Air Liquide: Products & Services Offering

90 Honeywell International: Products & Services Offering

91 BASF: Products & Services Offering

92 IFP Energies nouvelles : Products & Services Offering

93 Air Products and Chemicals: Products & Services Offering

94 Shell, Inc: Products & Services Offering

95 Saudi Arabian Oil : Products & Services Offering

96 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Methane Capturing Services Market Overview

2 Global Methane Capturing Services Market Value From 2021-2029 (USD Mllion)

3 Global Methane Capturing Services Market Share, By End-use Industry (2023)

4 Global Methane Capturing Services Market Share, By Capture Technology (2023)

5 Global Methane Capturing Services Market, By Region (Asia Pacific Market)

6 Technological Trends In Global Methane Capturing Services Market

7 Four Quadrant Competitor Positioning Matrix

8 Impact Of Macro & Micro Indicators On The Market

9 Impact Of Key Drivers On The Global Methane Capturing Services Market

10 Impact Of Challenges On The Global Methane Capturing Services Market

11 Porter’s Five Forces Analysis

12 Global Methane Capturing Services Market: By End-use Industry Scope Key Takeaways

13 Global Methane Capturing Services Market, By End-use Industry Segment: Revenue Growth Analysis

14 Oil and Gas Sector Market, By Region, 2021-2029 (USD Mllion)

15 Agriculture Market, By Region, 2021-2029 (USD Mllion)

16 Waste Management Market, By Region, 2021-2029 (USD Mllion)

17 Renewable Energy Market, By Region, 2021-2029 (USD Mllion)

18 Global Methane Capturing Services Market: By Capture Technology Scope Key Takeaways

19 Global Methane Capturing Services Market, By Capture Technology Segment: Revenue Growth Analysis

20 Anaerobic Digestion Market, By Region, 2021-2029 (USD Mllion)

21 Landfill Gas Collection Market, By Region, 2021-2029 (USD Mllion)

22 Biological Methane Oxidation Market, By Region, 2021-2029 (USD Mllion)

23 Regional Segment: Revenue Growth Analysis

24 Global Methane Capturing Services Market: Regional Analysis

25 North America Methane Capturing Services Market Overview

26 North America Methane Capturing Services Market, By End-use Industry

27 North America Methane Capturing Services Market, By Capture Technology

28 North America Methane Capturing Services Market, By Country

29 U.S. Methane Capturing Services Market, By End-use Industry

30 U.S. Methane Capturing Services Market, By Capture Technology

31 Canada Methane Capturing Services Market, By End-use Industry

32 Canada Methane Capturing Services Market, By Capture Technology

33 Mexico Methane Capturing Services Market, By End-use Industry

34 Mexico Methane Capturing Services Market, By Capture Technology

35 Four Quadrant Positioning Matrix

36 Company Market Share Analysis

37 Dow: Company Snapshot

38 Dow: SWOT Analysis

39 Dow: Geographic Presence

40 Exxon Mobil: Company Snapshot

41 Exxon Mobil: SWOT Analysis

42 Exxon Mobil: Geographic Presence

43 Linde: Company Snapshot

44 Linde: SWOT Analysis

45 Linde: Geographic Presence

46 Air Liquide: Company Snapshot

47 Air Liquide: Swot Analysis

48 Air Liquide: Geographic Presence

49 Honeywell International: Company Snapshot

50 Honeywell International: SWOT Analysis

51 Honeywell International: Geographic Presence

52 BASF: Company Snapshot

53 BASF: SWOT Analysis

54 BASF: Geographic Presence

55 IFP Energies Nouvelles : Company Snapshot

56 IFP Energies Nouvelles : SWOT Analysis

57 IFP Energies Nouvelles : Geographic Presence

58 Air Products and Chemicals: Company Snapshot

59 Air Products and Chemicals: SWOT Analysis

60 Air Products and Chemicals: Geographic Presence

61 Shell, Inc.: Company Snapshot

62 Shell, Inc.: SWOT Analysis

63 Shell, Inc.: Geographic Presence

64 Saudi Arabian Oil : Company Snapshot

65 Saudi Arabian Oil : SWOT Analysis

66 Saudi Arabian Oil : Geographic Presence

67 Other Companies: Company Snapshot

68 Other Companies: SWOT Analysis

69 Other Companies: Geographic Presence

The Global Methane Capturing Services Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Methane Capturing Services Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS