Global Microbiome Cosmetics Market Size, Trends & Analysis - Forecasts to 2026 By Type (Probiotics, Prebiotics, Postbiotics), By Application (Creams & Moisturizers, Toner, Oil, Mist, Serum), By Distribution Channel (Hypermarket/Supermarket, Multi-brand Store, Specialty Store, Online), By Region (North America, Asia Pacific, Europe, Latin America, Middle East & Africa); End-User Landscape, Company Market Share Analysis, and Competitor Analysis

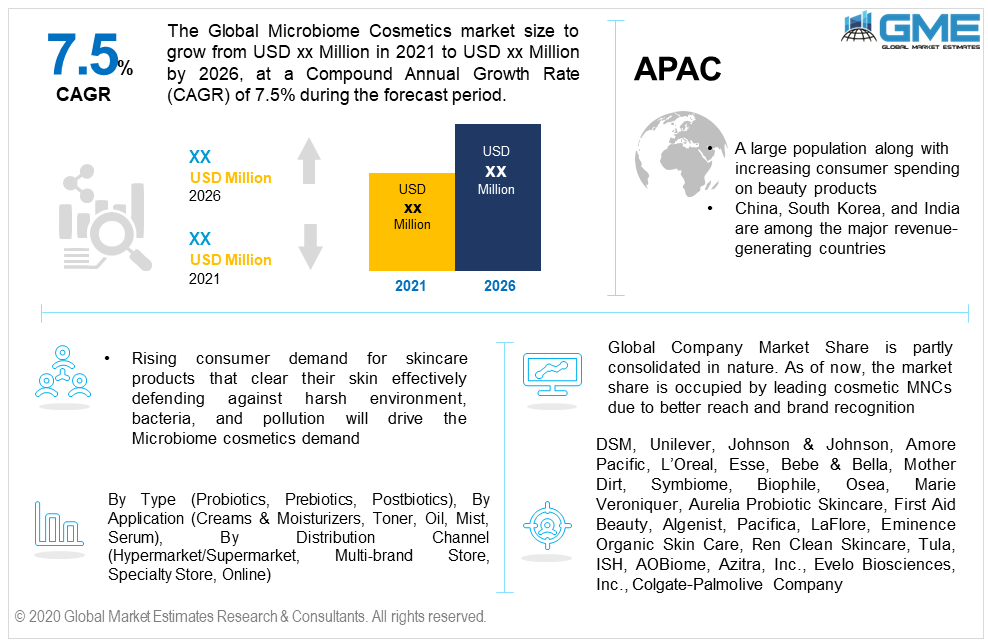

Rising consumer demand for skincare products that clear the skin effectively defending against harsh environment, bacteria, and pollution will drive the microbiome cosmetics demand. These products are a reliable solution to solve various skin problems related to a toxic environment, bacteria, hormonal imbalances, and other external factors. The global microbiome cosmetics market is projected to witness over 7.5% CAGR from 2021 to 2026, with APAC leading the demand and accounted for the maximum share.

Changing skincare products’ dynamics along with increasing competition among producers to launch more sustainable products will positively influence the market growth. Increasing consumer consciousness to use the right and appropriate products will lead to the high penetration of cause-specific skin products. Also, changing consumer perspective and willingness to pay premium prices for high-quality ingredient products will support the market growth.

Probiotics, prebiotics, and postbiotics are key compound types used in the industry. Customers spend a large amount of money on skincare products annually. However, the chemical-based products are not made for every skin type which leads to other skin problems. Thus, the introduction of probiotics, prebiotics, and postbiotics skincare products is a reasonable solution to a sustainable skincare routine. These products are safer, natural, and less harmful to the skin. Probiotics are among the highly utilized compound in the industry and are expected to lead its dominance in the coming years.

By application, the market is segregated into creams & moisturizers, toner, oil, mist, and serum. Creams & moisturizers led the application segment and accounted for more than 35% of the share in 2019. Large product availability along with higher suitability with most of the skincare purposes related to aging and hormone will induce the demand in this segment.

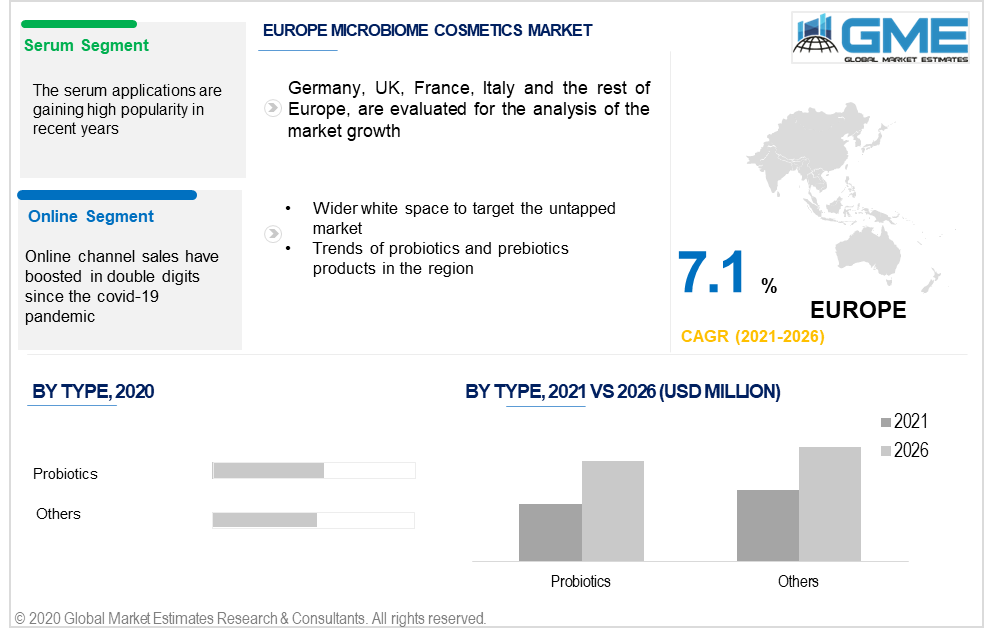

Improved skin texture, better complexion, and a long-term impact on the skin are the key reasons to drive high sales in this segment. The serum applications are gaining high popularity in recent years due to their effective results on the skin and light weightiness after applying. This segment is expected to witness the highest gains during the forecast period.

By distribution channel, the industry is categorized into hypermarket/supermarket, specialty store, multi-brand store, and online stores. Multi-brand stores dominated the distribution channel segment. The presence of a large variety of products along with ease in choosing the right product is a key factor to drive sales in multi-brand stores. These stores are exclusively for beauty and personal care products and have high shelf visibility of each product type, which makes it highly achievable for consumers to see, try, and compare the product.

The other prospective distribution channel is the online stores. Online channel sales have boosted in double digits since the covid-19 pandemic. Ease in buying, price reduction, and product comparison are the major success factors to drive sales through this segment. Another key trend noticed is the company’s online store. Various companies are now exclusively selling products on their website.

The Asia Pacific microbiome cosmetics market dominated global consumption and accounted for more than 30% of the revenue share in 2019. A large population along with increasing consumer spending on beauty products will proliferate the regional industry growth. The presence of multiple brands with diversified product portfolios is another key success factor to drive product penetration. China, South Korea, and India are among the major revenue-generating countries due to their high per capita spending on personal care products.

North America will foresee high gains up to 2026. High spending on skincare products along with increasing sales of products enriched with prebiotics & postbiotics will fuel the product adoption in this region. Moreover, the presence of multiple products to target different skin problems will induce market growth.

The European consumption of skincare products is majorly inclined towards sustainable solutions. These skincare modulators are the best suitable products for people opting for natural products. Thus, the commercialization of these products in Europe will result in high demand during the forecast period. Germany, Italy, the UK, and France are expected to be the leading countries in terms of revenue generation.

Global microbiome cosmetics company market share is partly consolidated in nature. As of now, the market share is occupied by leading cosmetic MNCs due to better reach and brand recognition. The majority of the companies are concentrating on international product reach and brand loyalty. However, the emergence of new products by startup companies along with increasing consumer interest to try new products will positively influence the profitability of the new market entrants.

Key notable market participants include DSM, Unilever, Johnson & Johnson, Amore Pacific, L’Oreal, Esse, Bebe & Bella, Mother Dirt, Symbiome, Biophile, Osea, Marie Veroniquer, Aurelia Probiotic Skincare, First Aid Beauty, Algenist, Pacifica, LaFlore, Eminence Organic Skin Care, Ren Clean Skincare, Tula, ISH, AOBiome, Azitra, Inc., Evelo Biosciences, Inc., Colgate-Palmolive Company, GALLINEE, MATRISYS BIOSCIENCE, Glowbiotics, Inc., Quorum Innovations, Siolta Therapeutics, Revlon, The Estee Lauder Companies Inc., and Yakult Honsha Co. Ltd.

Please note: This is not an exhaustive list of companies profiled in the report.

Partnering with the stores to enhance product visibility accompanied by the introduction of an exclusive online store on the company website are major strategies witnessed in the industry.

Chapter 1 Methodology

1.1 Market scope & definitions

1.2 Estimates & forecast calculation

1.3 Historical data overview and validation

1.4 Data sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Microbiome cosmetics industry overview, 2019-2026

2.1.1 Industry overview

2.1.2 Type overview

2.1.3 Application overview

2.1.4 Distribution channel overview

2.1.5 Regional overview

Chapter 3 Microbiome cosmetics Market Trends

3.1 Market segmentation

3.2 Industry background, 2019-2026

3.3 Market key trends

3.3.1 Positive trends

3.3.2 Industry challenges

3.4 Prospective growth scenario

3.5 COVID-19 influence over industry growth

3.6 Porter’s analysis

3.7 PESTEL analysis

3.8 Value chain & supply chain analysis

3.9 Regulatory framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Production technology overview

3.11 Market share analysis, 2020

3.11.1 Company positioning overview, 2020

Chapter 4 Microbiome Cosmetics Market, By Type

4.1 Type Outlook

4.2 Probiotics

4.2.1 Market size, by region, 2019-2026 (USD Million)

4.3 Prebiotics

4.3.1 Market size, by region, 2019-2026 (USD Million)

4.4 Postbiotics

4.4.1 Market size, by region, 2019-2026 (USD Million)

Chapter 5 Microbiome Cosmetics Market, By Application

5.1 Application Outlook

5.2 Creams & moisturizer

5.2.1 Market size, by region, 2019-2026 (USD Million)

5.3 Toner

5.3.1 Market size, by region, 2019-2026 (USD Million)

5.4 Oil

5.4.1 Market size, by region, 2019-2026 (USD Million)

5.5 Mist

5.5.1 Market size, by region, 2019-2026 (USD Million)

5.6 Serum

5.6.1 Market size, by region, 2019-2026 (USD Million)

5.7 Others

5.7.1 Market size, by region, 2019-2026 (USD Million)

Chapter 6 Microbiome Cosmetics Market, By Distribution channel

6.1 Distribution channel Outlook

6.2 Hypermarket/supermarket

6.2.1 Market size, by region, 2019-2026 (USD Million)

6.3 Multi brand store

6.3.1 Market size, by region, 2019-2026 (USD Million)

6.4 Specialty stores

6.4.1 Market size, by region, 2019-2026 (USD Million)

6.5 Online

6.5.1 Market size, by region, 2019-2026 (USD Million)

6.6 Others

6.6.1 Market size, by region, 2019-2026 (USD Million)

Chapter 7 Microbiome Cosmetics Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market size, by country 2019-2026 (USD Million)

7.2.2 Market size, by Type, 2019-2026 (USD Million)

7.2.3 Market size, by Application, 2019-2026 (USD Million)

7.2.4 Market size, by Distribution channel, 2019-2026 (USD Million)

7.2.5 U.S.

7.2.5.1 Market size, by Type, 2019-2026 (USD Million)

7.2.5.2 Market size, by Application, 2019-2026 (USD Million)

7.2.5.3 Market size, by Distribution channel, 2019-2026 (USD Million)

7.2.6 Canada

7.2.6.1 Market size, by Type, 2019-2026 (USD Million)

7.2.6.2 Market size, by Application, 2019-2026 (USD Million)

7.2.6.3 Market size, by Distribution channel, 2019-2026 (USD Million)

7.2.7 Mexico

7.2.7.1 Market size, by Type, 2019-2026 (USD Million)

7.2.7.2 Market size, by Application, 2019-2026 (USD Million)

7.2.7.3 Market size, by Distribution channel, 2019-2026 (USD Million)

7.3 Europe

7.3.1 Market size, by country 2019-2026 (USD Million)

7.3.2 Market size, by Type, 2019-2026 (USD Million)

7.3.3 Market size, by Application, 2019-2026 (USD Million)

7.3.4 Market size, by Distribution channel, 2019-2026 (USD Million)

7.3.5 Germany

7.2.5.1 Market size, by Type, 2019-2026 (USD Million)

7.2.5.2 Market size, by Application, 2019-2026 (USD Million)

7.2.5.3 Market size, by Distribution channel, 2019-2026 (USD Million)

7.3.6 Spain

7.3.6.1 Market size, by Type, 2019-2026 (USD Million)

7.3.6.2 Market size, by Application, 2019-2026 (USD Million)

7.3.6.3 Market size, by Distribution channel, 2019-2026 (USD Million)

7.3.7 France

7.3.7.1 Market size, by Type, 2019-2026 (USD Million)

7.3.7.2 Market size, by Application, 2019-2026 (USD Million)

7.3.7.3 Market size, by Distribution channel, 2019-2026 (USD Million)

7.3.8 Italy

7.3.8.1 Market size, by Type, 2019-2026 (USD Million)

7.3.8.2 Market size, by Application, 2019-2026 (USD Million)

7.3.8.3 Market size, by Distribution channel, 2019-2026 (USD Million)

7.4 Asia Pacific

7.4.1 Market size, by country 2019-2026 (USD Million)

7.4.2 Market size, by Type, 2019-2026 (USD Million)

7.4.3 Market size, by Application, 2019-2026 (USD Million)

7.4.4 Market size, by Distribution channel, 2019-2026 (USD Million)

7.4.5 China

7.4.5.1 Market size, by Type, 2019-2026 (USD Million)

7.4.5.2 Market size, by Application, 2019-2026 (USD Million)

7.4.5.3 Market size, by Distribution channel, 2019-2026 (USD Million)

7.4.6 India

7.4.6.1 Market size, by Type, 2019-2026 (USD Million)

7.4.6.2 Market size, by Application, 2019-2026 (USD Million)

7.4.6.3 Market size, by Distribution channel, 2019-2026 (USD Million)

7.4.7 Malaysia

7.4.7.1 Market size, by Type, 2019-2026 (USD Million)

7.4.7.2 Market size, by Application, 2019-2026 (USD Million)

7.4.7.3 Market size, by Distribution channel, 2019-2026 (USD Million)

7.4.8 Australia

7.4.8.1 Market size, by Type, 2019-2026 (USD Million)

7.4.8.2 Market size, by Application, 2019-2026 (USD Million)

7.4.8.3 Market size, by Distribution channel, 2019-2026 (USD Million)

7.4.9 South Korea

7.4.9.1 Market size, by Type, 2019-2026 (USD Million)

7.4.9.2 Market size, by Application, 2019-2026 (USD Million)

7.4.9.3 Market size, by Distribution channel, 2019-2026 (USD Million)

7.5 Central & South America

7.5.1 Market size, by country 2019-2026 (USD Million)

7.5.2 Market size, by Type, 2019-2026 (USD Million)

7.5.3 Market size, by Application, 2019-2026 (USD Million)

7.5.4 Market size, by Distribution channel, 2019-2026 (USD Million)

7.5.5 Brazil

7.5.5.1 Market size, by Type, 2019-2026 (USD Million)

7.5.5.2 Market size, by Application, 2019-2026 (USD Million)

7.5.5.3 Market size, by Distribution channel, 2019-2026 (USD Million)

7.5.6 Argentina

7.5.6.1 Market size, by Type, 2019-2026 (USD Million)

7.5.6.2 Market size, by Application, 2019-2026 (USD Million)

7.5.6.3 Market size, by Distribution channel, 2019-2026 (USD Million)

7.6 MEA

7.6.1 Market size, by country 2019-2026 (USD Million)

7.6.2 Market size, by Type, 2019-2026 (USD Million)

7.6.3 Market size, by Application, 2019-2026 (USD Million)

7.6.4 Market size, by Distribution channel, 2019-2026 (USD Million)

7.6.5 Saudi Arabia

7.6.5.1 Market size, by Type, 2019-2026 (USD Million)

7.6.5.2 Market size, by Application, 2019-2026 (USD Million)

7.6.5.3 Market size, by Distribution channel, 2019-2026 (USD Million)

7.6.6 UAE

7.6.6.1 Market size, by Type, 2019-2026 (USD Million)

7.6.6.2 Market size, by Application, 2019-2026 (USD Million)

7.6.6.3 Market size, by Distribution channel, 2019-2026 (USD Million)

7.6.7 South Africa

7.6.7.1 Market size, by Type, 2019-2026 (USD Million)

7.6.7.2 Market size, by Application, 2019-2026 (USD Million)

7.6.7.3 Market size, by Distribution channel, 2019-2026 (USD Million)

Chapter 8 Company Landscape

8.1 Competitive analysis, 2020

8.2 DSM

8.2.1 Company overview

8.2.2 Financial analysis

8.2.3 Strategic positioning

8.2.4 Info graphic analysis

8.3 Unilever

8.3.1 Company overview

8.3.2 Financial analysis

8.3.3 Strategic positioning

8.3.4 Info graphic analysis

8.4 Johnson & Johnson

8.4.1 Company overview

8.4.2 Financial analysis

8.4.3 Strategic positioning

8.4.4 Info graphic analysis

8.5 Amore Pacific

8.5.1 Company overview

8.5.2 Financial analysis

8.5.3 Strategic positioning

8.5.4 Info graphic analysis

8.6 L’Oreal

8.6.1 Company overview

8.6.2 Financial analysis

8.6.3 Strategic positioning

8.6.4 Info graphic analysis

8.7 Esse

8.7.1 Company overview

8.7.2 Financial analysis

8.7.3 Strategic positioning

8.7.4 Info graphic analysis

8.8 Bebe & Bella

8.8.1 Company overview

8.8.2 Financial analysis

8.8.3 Strategic positioning

8.8.4 Info graphic analysis

8.9 Mother Dirt

8.9.1 Company overview

8.9.2 Financial analysis

8.9.3 Strategic positioning

8.9.4 Info graphic analysis

8.10 Symbiome

8.10.1 Company overview

8.10.2 Financial analysis

8.10.3 Strategic positioning

8.10.4 Info graphic analysis

8.11 Biophile

8.11.1 Company overview

8.11.2 Financial analysis

8.11.3 Strategic positioning

8.11.4 Info graphic analysis

8.12 Osea

8.12.1 Company overview

8.12.2 Financial analysis

8.12.3 Strategic positioning

8.12.4 Info graphic analysis

8.13 Marie Veroniquer

8.13.1 Company overview

8.13.2 Financial analysis

8.13.3 Strategic positioning

8.13.4 Info graphic analysis

8.14 Aurelia Probiotic Skincare

8.14.1 Company overview

8.14.2 Financial analysis

8.14.3 Strategic positioning

8.14.4 Info graphic analysis

8.15 First Aid Beauty

8.15.1 Company overview

8.15.2 Financial analysis

8.15.3 Strategic positioning

8.15.4 Info graphic analysis

8.16 Algenist

8.16.1 Company overview

8.16.2 Financial analysis

8.16.3 Strategic positioning

8.16.4 Info graphic analysis

8.17 Pacifica

8.17.1 Company overview

8.17.2 Financial analysis

8.17.3 Strategic positioning

8.17.4 Info graphic analysis

8.18 LaFlore

8.18.1 Company overview

8.18.2 Financial analysis

8.18.3 Strategic positioning

8.18.4 Info graphic analysis

8.19 Eminence Organic Skin Care

8.19.1 Company overview

8.19.2 Financial analysis

8.19.3 Strategic positioning

8.19.4 Info graphic analysis

8.20 Ren Clean Skincare

8.20.1 Company overview

8.20.2 Financial analysis

8.20.3 Strategic positioning

8.20.4 Info graphic analysis

8.21 Tula

8.21.1 Company overview

8.21.2 Financial analysis

8.21.3 Strategic positioning

8.21.4 Info graphic analysis

8.22 ISH

8.22.1 Company overview

8.22.2 Financial analysis

8.22.3 Strategic positioning

8.22.4 Info graphic analysis

8.23 AOBiome

8.23.1 Company overview

8.23.2 Financial analysis

8.23.3 Strategic positioning

8.23.4 Info graphic analysis

8.24 Azitra, Inc.

8.24.1 Company overview

8.24.2 Financial analysis

8.24.3 Strategic positioning

8.19.4 Info graphic analysis

8.25 Colgate-Palmolive Company

8.25.1 Company overview

8.25.2 Financial analysis

8.25.3 Strategic positioning

8.25.4 Info graphic analysis

8.26 Evelo Biosciences, Inc.

8.26.1 Company overview

8.26.2 Financial analysis

8.26.3 Strategic positioning

8.26.4 Info graphic analysis

8.27 GALLINEE

8.27.1 Company overview

8.27.2 Financial analysis

8.27.3 Strategic positioning

8.27.4 Info graphic analysis

8.28 Glowbiotics, Inc.

8.28.1 Company overview

8.28.2 Financial analysis

8.28.3 Strategic positioning

8.28.4 Info graphic analysis

8.29 MATRISYS BIOSCIENCE

8.29.1 Company overview

8.29.2 Financial analysis

8.29.3 Strategic positioning

8.29.4 Info graphic analysis

8.30 Quorum Innovations

8.30.1 Company overview

8.30.2 Financial analysis

8.30.3 Strategic positioning

8.30.4 Info graphic analysis

8.31 Revlon

8.31.1 Company overview

8.31.2 Financial analysis

8.31.3 Strategic positioning

8.31.4 Info graphic analysis

8.32 Siolta Therapeutics

8.32.1 Company overview

8.32.2 Financial analysis

8.32.3 Strategic positioning

8.32.4 Info graphic analysis

8.33 The Estee Lauder Companies Inc.

8.33.1 Company overview

8.33.2 Financial analysis

8.33.3 Strategic positioning

8.33.4 Info graphic analysis

8.34 Yakult Honsha Co. Ltd.

8.34.1 Company overview

8.34.2 Financial analysis

8.34.3 Strategic positioning

8.34.4 Info graphic analysis

The Global Microbiome Cosmetics Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Microbiome Cosmetics Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS