Global Microfinance Market Size, Trends & Analysis - Forecasts to 2028 By Provider (Banks, Micro Finance Institute, Non-Banking Financial Institutions, and Others), By End User (Small Enterprises, Micro Enterprises, and Solo Entrepreneurs or Self-Employed), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

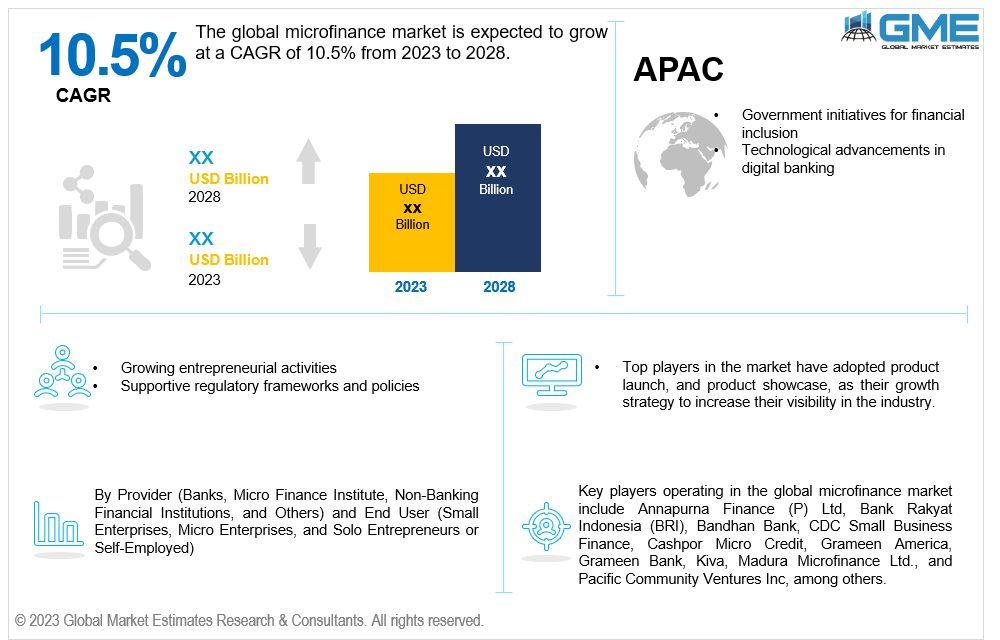

The global microfinance market is expected to grow at a CAGR of 10.5% from 2023 to 2028. Microfinance represents a form of financial assistance extended to unemployed or low-income individuals and underserved communities lacking access to conventional financial services. It focuses on providing micro-loans, savings, insurance, and payment products to the unbanked, promoting self-sufficiency, and improving living standards. The growing number of microfinance organizations in emerging economies aids in poverty reduction, although high interest rates and short repayment periods hinder market growth. Conversely, integrating advanced technologies like mobile banking and ATMs within the microfinance sector presents potential avenues for market expansion alongside the transition from traditional lending and reduced operational costs.

The microfinance market is driven by several key factors contributing to its growth and development. One of the key drivers is the increasing emphasis on financial inclusion and the provision of essential financial services to underserved and marginalized populations, enabling them to access the necessary capital for entrepreneurship and livelihood enhancement. The rise of microfinance institutions and their focus on providing microloans, savings, and insurance products to the unbanked and underprivileged segments have played a significant role in driving market expansion and fostering economic empowerment.

Furthermore, the growing adoption of advanced technologies, such as mobile banking, digital payment solutions, and automated teller machines (ATMs), within the microfinance sector has facilitated greater accessibility to financial services in remote and underserved areas. The integration of these technologies has improved the efficiency and reach of microfinance services, thereby driving financial inclusion and market growth.

Additionally, the increasing support from governments, regulatory authorities, and international organizations through policy initiatives and funding programs has further propelled the growth of the microfinance market. These initiatives aim to create a conducive regulatory environment, encourage responsible lending practices, and promote sustainable financial inclusion, fostering the growth and stability of the microfinance sector.

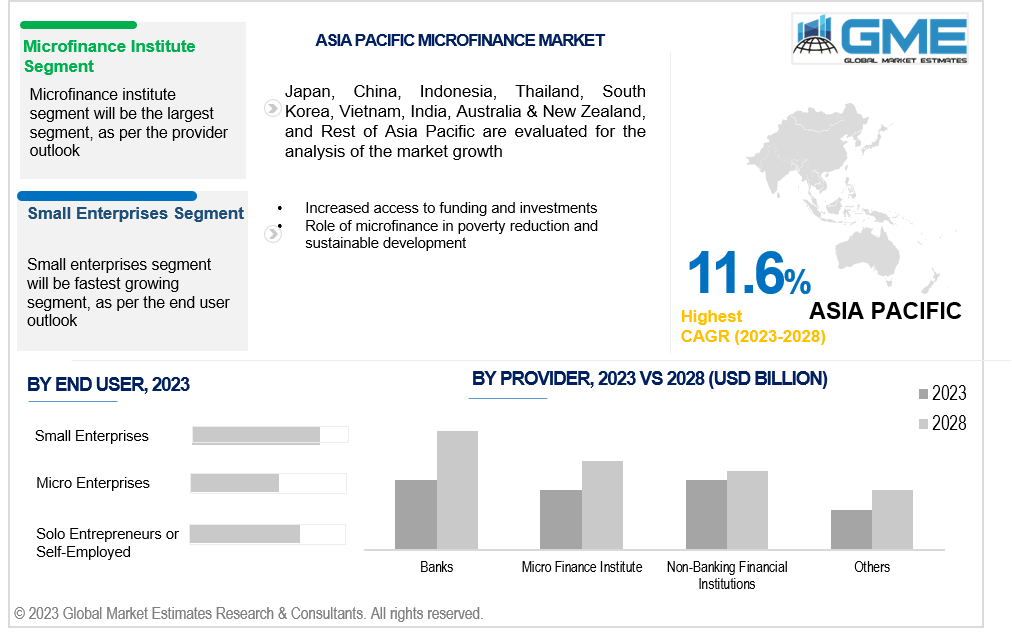

Based on provider, the market is segmented into banks, microfinance institute (MFI), non-banking financial institutions, and others. The microfinance institute segment is expected to be the largest segment in the market during the forecast period due to its specialized focus on providing financial services tailored to the needs of low-income individuals and underserved communities. MFIs often offer microloans, savings, and insurance products specifically designed for the unbanked population, enabling them to access essential financial services that are otherwise unavailable through traditional banking channels.

The non-banking financial institution (NBFI) segment is expected to be the fastest-growing segment in the global microfinance market. NBFIs, including microcredit organizations, cooperatives, and community-based financial institutions, have rapidly grown by leveraging technological advancements and innovative financial solutions to reach underserved populations. Their agility and flexibility in catering to the financial needs of marginalized communities have contributed to their accelerated expansion in the microfinance market.

On the basis of end user, the market is segmented into small enterprises, microenterprises, and solo entrepreneurs or self-employed. Small enterprises constitute the largest segment in the global microfinance market, primarily due to their significant contribution to employment generation and economic development. These enterprises often require financial assistance for expansion, working capital, and investment in infrastructure, making them a key target for microfinance services. The accessibility of microloans and financial products tailored to the needs of small businesses has led to the significant adoption of microfinance solutions within this segment.

The solo entrepreneurs or self-employed segment is expected to be the fastest-growing segment in the global microfinance market over the forecast period. This growth is propelled by the increasing trend of entrepreneurship and self-employment, particularly in emerging economies. Microfinance institutions have played a crucial role in supporting the financial needs of microenterprises and self-employed individuals, providing them access to microloans and financial services that enable business expansion, product diversification, and income generation. The rising focus on inclusive financial services and the empowerment of individual entrepreneurs has led to the rapid expansion of microfinance solutions within this end user segment.

North America stands out as the largest region due to its robust financial infrastructure, well-established regulatory framework, and a diverse range of microfinance providers catering to the needs of small businesses and underserved communities. The region's strong economic development and stable financial services sector have facilitated the growth of microfinance institutions, banks, and non-banking financial institutions, thereby contributing to North America's dominance in the global microfinance market. Moreover, the region's focus on technological innovation and digital financial solutions has further strengthened its position, enabling efficient delivery of microfinance services and fostering financial inclusion among various population segments.

In addition, Asia Pacific (APAC) is identified as the fastest-growing region in the global microfinance market, primarily driven by significant economic development, a growing population, and an increasing focus on financial inclusion across diverse economies. APAC's emerging markets, characterized by a large unbanked population and a growing entrepreneurial culture, have presented substantial opportunities for microfinance institutions and non-banking financial institutions to expand their services and reach previously underserved communities. The rapid adoption of mobile banking, digital payment solutions, and other technological advancements has further accelerated the growth of the microfinance market in the APAC region, facilitating greater accessibility to financial services and fostering inclusive economic development. The strong support from governments and regulatory authorities in promoting financial literacy and entrepreneurship has also played a pivotal role in driving the rapid expansion of the microfinance market across the Asia Pacific.

Key players operating in the global microfinance market include Annapurna Finance (P) Ltd, Bank Rakyat Indonesia (BRI), Bandhan Bank, CDC Small Business Finance, Cashpor Micro Credit, Grameen America, Grameen Bank, Kiva, Madura Microfinance Ltd., and Pacific Community Ventures Inc, among others.

Please note: This is not an exhaustive list of companies profiled in the report.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market OpportunIties: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL MICROFINANCE MARKET, BY PROVIDER

4.1 Introduction

4.2 Global Microfinance Market: Provider Scope Key Takeaways

4.3 Revenue Growth Analysis, 2022 & 2028

4.4 Banks

4.4.1 Banks Market Estimates and Forecast, 2020-2028 (USD Billion)

4.5 Micro Finance Institute

4.5.1 Micro Finance Institute Market Estimates and Forecast, 2020-2028 (USD Billion)

4.6 Non-Banking Financial Institutions

4.6.1 Non-Banking Financial Institutions Market Estimates and Forecast, 2020-2028 (USD Billion)

4.6 Others

4.6.1 Others Market Estimates and Forecast, 2020-2028 (USD Billion)

5 GLOBAL MICROFINANCE MARKET, BY END USER

5.1 Introduction

5.2 Global Microfinance Market: End User Scope Key Takeaways

5.3 Revenue Growth Analysis, 2022 & 2028

5.4 Small Enterprises

5.4.1 Small Enterprises Market Estimates And Forecast, 2020-2028 (USD Billion)

5.5 Micro Enterprises

5.5.1 Micro Enterprises Market Estimates And Forecast, 2020-2028 (USD Billion)

5.6 Solo Entrepreneurs or Self-Employed

5.6.1 Solo Entrepreneurs or Self-Employed Market Estimates And Forecast, 2020-2028 (USD Billion)

6 GLOBAL MICROFINANCE MARKET, BY REGION

6.1 Introduction

6.2 North America Microfinance Market Estimates and Forecast, 2020-2028 (USD Billion)

6.2.1 By Provider

6.2.2 By End User

6.2.3 By Country

6.2.3.1 U.S. Microfinance Market Estimates and Forecast, 2020-2028 (USD Billion)

6.2.3.1.1 By Provider

6.2.3.1.2 By End User

6.2.3.2 Canada Microfinance Market Estimates and Forecast, 2020-2028 (USD Billion)

6.2.3.2.1 By Provider

6.2.3.2.2 By End User

6.2.3.3 Mexico Microfinance Market Estimates and Forecast, 2020-2028 (USD Billion)

6.2.3.3.1 By Provider

6.2.3.3.2 By End User

6.3 Europe Microfinance Market Estimates and Forecast, 2020-2028 (USD Billion)

6.3.1 By Provider

6.3.2 By End User

6.3.3 By Country

6.3.3.1 Germany Microfinance Market Estimates and Forecast, 2020-2028 (USD Billion)

6.3.3.1.1 By Provider

6.3.3.1.2 By End User

6.3.3.2 U.K. Microfinance Market Estimates and Forecast, 2020-2028 (USD Billion)

6.3.3.2.1 By Provider

6.3.3.2.2 By End User

6.3.3.3 France Microfinance Market Estimates and Forecast, 2020-2028 (USD Billion)

6.3.3.3.1 By Provider

6.3.3.3.2 By End User

6.3.3.4 Italy Microfinance Market Estimates and Forecast, 2020-2028 (USD Billion)

6.3.3.4.1 By Provider

6.3.3.4.2 By End User

6.3.3.5 Spain Microfinance Market Estimates and Forecast, 2020-2028 (USD Billion)

6.3.3.5.1 By Provider

6.3.3.5.2 By End User

6.3.3.6 Netherlands Microfinance Market Estimates and Forecast, 2020-2028 (USD Billion)

6.3.3.6.1 By Provider

6.3.3.6.2 By End User

6.3.3.7 Rest of Europe Microfinance Market Estimates and Forecast, 2020-2028 (USD Billion)

6.3.3.6.1 By Provider

6.3.3.6.2 By End User

6.4 Asia Pacific Microfinance Market Estimates and Forecast, 2020-2028 (USD Billion)

6.4.1 By Provider

6.4.2 By End User

6.4.3 By Country

6.4.3.1 China Microfinance Market Estimates and Forecast, 2020-2028 (USD Billion)

6.4.3.1.1 By Provider

6.4.3.1.2 By End User

6.4.3.2 Japan Microfinance Market Estimates and Forecast, 2020-2028 (USD Billion)

6.4.3.2.1 By Provider

6.4.3.2.2 By End User

6.4.3.3 India Microfinance Market Estimates and Forecast, 2020-2028 (USD Billion)

6.4.3.3.1 By Provider

6.4.3.3.2 By End User

6.4.3.4 South Korea Microfinance Market Estimates and Forecast, 2020-2028 (USD Billion)

6.4.3.4.1 By Provider

6.4.3.4.2 By End User

6.4.3.5 Singapore Microfinance Market Estimates and Forecast, 2020-2028 (USD Billion)

6.4.3.5.1 By Provider

6.4.3.5.2 By End User

6.4.3.6 Malaysia Microfinance Market Estimates and Forecast, 2020-2028 (USD Billion)

6.4.3.6.1 By Provider

6.4.3.6.2 By End User

6.4.3.7 Thailand Microfinance Market Estimates and Forecast, 2020-2028 (USD Billion)

6.4.3.6.1 By Provider

6.4.3.6.2 By End User

6.4.3.8 Indonesia Microfinance Market Estimates and Forecast, 2020-2028 (USD Billion)

6.4.3.7.1 By Provider

6.4.3.7.2 By End User

6.4.3.9 Vietnam Microfinance Market Estimates and Forecast, 2020-2028 (USD Billion)

6.4.3.8.1 By Provider

6.4.3.8.2 By End User

6.4.3.10 Taiwan Microfinance Market Estimates and Forecast, 2020-2028 (USD Billion)

6.4.3.10.1 By Provider

6.4.3.10.2 By End User

6.4.3.11 Rest of Asia Pacific Microfinance Market Estimates and Forecast, 2020-2028 (USD Billion)

6.4.3.11.1 By Provider

6.4.3.11.2 By End User

6.5 Middle East and Africa Microfinance Market Estimates and Forecast, 2020-2028 (USD Billion)

6.5.1 By Provider

6.5.2 By End User

6.5.3 By Country

6.5.3.1 Saudi Arabia Microfinance Market Estimates and Forecast, 2020-2028 (USD Billion)

6.5.3.1.1 By Provider

6.5.3.1.2 By End User

6.5.3.2 U.A.E. Microfinance Market Estimates and Forecast, 2020-2028 (USD Billion)

6.5.3.2.1 By Provider

6.5.3.2.2 By End User

6.5.3.3 Israel Microfinance Market Estimates and Forecast, 2020-2028 (USD Billion)

6.5.3.3.1 By Provider

6.5.3.3.2 By End User

6.5.3.4 South Africa Microfinance Market Estimates and Forecast, 2020-2028 (USD Billion)

6.5.3.4.1 By Provider

6.5.3.4.2 By End User

6.5.3.5 Rest of Middle East and Africa Microfinance Market Estimates and Forecast, 2020-2028 (USD Billion)

6.5.3.5.1 By Provider

6.5.3.5.2 By End User

6.6 Central and South America Microfinance Market Estimates and Forecast, 2020-2028 (USD Billion)

6.6.1 By Provider

6.6.2 By End User

6.6.3 By Country

6.6.3.1 Brazil Microfinance Market Estimates and Forecast, 2020-2028 (USD Billion)

6.6.3.1.1 By Provider

6.6.3.1.2 By End User

6.6.3.2 Argentina Microfinance Market Estimates and Forecast, 2020-2028 (USD Billion)

6.6.3.2.1 By Provider

6.6.3.2.2 By End User

6.6.3.3 Chile Microfinance Market Estimates and Forecast, 2020-2028 (USD Billion)

6.6.3.3.1 By Provider

6.6.3.3.2 By End User

6.6.3.3 Rest of Central and South America Microfinance Market Estimates and Forecast, 2020-2028 (USD Billion)

6.6.3.3.1 By Provider

6.6.3.3.2 By End User

7 COMPETITIVE LANDCAPE

7.1 Company Market Share Analysis

7.2 Four Quadrant Positioning Matrix

7.2.1 Market Leaders

7.2.2 Market Visionaries

7.2.3 Market Challengers

7.2.4 Niche Market Players

7.3 Vendor Landscape

7.3.1 North America

7.3.2 Europe

7.3.3 Asia Pacific

7.3.4 Rest of the World

7.4 Company Profiles

7.4.1 Annapurna Finance (P) Ltd

7.4.1.1 Business Description & Financial Analysis

7.4.1.2 SWOT Analysis

7.4.1.3 Products & Services Offered

7.4.1.4 Strategic Alliances between Business Partners

7.4.2 Bank Rakyat Indonesia (BRI)

7.4.2.1 Business Description & Financial Analysis

7.4.2.2 SWOT Analysis

7.4.2.3 Products & Services Offered

7.4.2.4 Strategic Alliances between Business Partners

7.4.3 Bandhan Bank

7.4.3.1 Business Description & Financial Analysis

7.4.3.2 SWOT Analysis

7.4.3.3 Products & Services Offered

7.4.3.4 Strategic Alliances between Business Partners

7.4.4 CDC SMALL BUSINESS FINANCE

7.4.4.1 Business Description & Financial Analysis

7.4.4.2 SWOT Analysis

7.4.4.3 Products & Services Offered

7.4.4.4 Strategic Alliances between Business Partners

7.4.5 Cashpor Micro Credit

7.4.5.1 Business Description & Financial Analysis

7.4.5.2 SWOT Analysis

7.4.5.3 Products & Services Offered

7.4.5.4 Strategic Alliances between Business Partners

7.4.6 Grameen America

7.4.6.1 Business Description & Financial Analysis

7.4.6.2 SWOT Analysis

7.4.6.3 Products & Services Offered

7.4.6.4 Strategic Alliances between Business Partners

7.4.7 Grameen Bank

7.4.7.1 Business Description & Financial Analysis

7.4.7.2 SWOT Analysis

7.4.7.3 Products & Services Offered

7.4.7.4 Strategic Alliances between Business Partners

7.4.8 Kiva

7.4.8.1 Business Description & Financial Analysis

7.4.8.2 SWOT Analysis

7.4.8.3 Products & Services Offered

7.4.8.4 Strategic Alliances between Business Partners

7.4.9 Madura Microfinance Ltd.

7.4.9.1 Business Description & Financial Analysis

7.4.9.2 SWOT Analysis

7.4.9.3 Products & Services Offered

7.4.9.4 Strategic Alliances between Business Partners

7.4.10 Pacific Community Ventures Inc

7.4.10.1 Business Description & Financial Analysis

7.4.10.2 SWOT Analysis

7.4.10.3 Products & Services Offered

7.4.10.4 Strategic Alliances between Business Partners

7.4.11 Other Companies

7.4.11.1 Business Description & Financial Analysis

7.4.11.2 SWOT Analysis

7.4.11.3 Products & Services Offered

7.4.11.4 Strategic Alliances between Business Partners

8 RESEARCH METHODOLOGY

8.1 Market Introduction

8.1.1 Market Definition

8.1.2 Market Scope & Segmentation

8.2 Information Procurement

8.2.1 Secondary Research

8.2.1.1 Purchased Databases

8.2.1.2 GMEs Internal Data Repository

8.2.1.3 Secondary Resources & Third Party Perspectives

8.2.1.4 Company Information Sources

8.2.2 Primary Research

8.2.2.1 Various Types of Respondents for Primary Interviews

8.2.2.2 Number of Interviews Conducted throughout the Research Process

8.2.2.3 Primary Stakeholders

8.2.2.4 Discussion Guide for Primary Participants

8.2.3 Expert Panels

8.2.3.1 Expert Panels Across 30+ Industry

8.2.4 Paid Local Experts

8.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

8.3 Market Estimation

8.3.1 Top-Down Approach

8.3.1.1 Macro-Economic Indicators Considered

8.3.1.2 Micro-Economic Indicators Considered

8.3.2 Bottom Up Approach

8.3.2.1 Company Share Analysis Approach

8.3.2.2 Estimation of Potential Product Sales

8.4 Data Triangulation

8.4.1 Data Collection

8.4.2 Time Series, Cross Sectional & Panel Data Analysis

8.4.3 Cluster Analysis

8.5 Analysis and Output

8.5.1 Inhouse AI Based Real Time Analytics Tool

8.5.2 Output From Desk & Primary Research

8.6 Research Assumptions & Limitations

8.6.1 Research Assumptions

8.6.2 Research Limitations

LIST OF TABLES

1 Global Microfinance Market, By Provider, 2020-2028 (USD Billion)

2 Banks Market, By Region, 2020-2028 (USD Billion)

3 Micro Finance Institute Market, By Region, 2020-2028 (USD Billion)

4 Non-Banking Financial Institutions Market, By Region, 2020-2028 (USD Billion)

5 Others Market, By Region, 2020-2028 (USD Billion)

6 Global Microfinance Market, By End User, 2020-2028 (USD Billion)

7 Small Enterprises Market, By Region, 2020-2028 (USD Billion)

8 Micro Enterprises Market, By Region, 2020-2028 (USD Billion)

9 Solo Entrepreneurs or Self-Employed Market, By Region, 2020-2028 (USD Billion)

10 Regional Analysis, 2020-2028 (USD Billion)

11 North America Microfinance Market, By Provider, 2020-2028 (USD Billion)

12 North America Microfinance Market, By End User, 2020-2028 (USD Billion)

13 U.S. Microfinance Market, By Provider, 2020-2028 (USD Billion)

14 U.S. Microfinance Market, By End User, 2020-2028 (USD Billion)

15 Canada Microfinance Market, By Provider, 2020-2028 (USD Billion)

16 Canada Microfinance Market, By End User, 2020-2028 (USD Billion)

17 Mexico Microfinance Market, By Provider, 2020-2028 (USD Billion)

18 Mexico Microfinance Market, By End User, 2020-2028 (USD Billion)

19 Europe Microfinance Market, By Provider, 2020-2028 (USD Billion)

20 Europe Microfinance Market, By End User, 2020-2028 (USD Billion)

21 Germany Microfinance Market, By Provider, 2020-2028 (USD Billion)

22 Germany Microfinance Market, By End User, 2020-2028 (USD Billion)

23 U.K. Microfinance Market, By Provider, 2020-2028 (USD Billion)

24 U.K. Microfinance Market, By End User, 2020-2028 (USD Billion)

25 France Microfinance Market, By Provider, 2020-2028 (USD Billion)

26 France Microfinance Market, By End User, 2020-2028 (USD Billion)

27 Italy Microfinance Market, By Provider, 2020-2028 (USD Billion)

28 Italy Microfinance Market, By End User, 2020-2028 (USD Billion)

29 Spain Microfinance Market, By Provider, 2020-2028 (USD Billion)

30 Spain Microfinance Market, By End User, 2020-2028 (USD Billion)

31 Netherlands Microfinance Market, By Provider, 2020-2028 (USD Billion)

32 Netherlands Microfinance Market, By End User, 2020-2028 (USD Billion)

33 Rest Of Europe Microfinance Market, By Provider, 2020-2028 (USD Billion)

34 Rest Of Europe Microfinance Market, By End User, 2020-2028 (USD Billion)

35 Asia Pacific Microfinance Market, By Provider, 2020-2028 (USD Billion)

36 Asia Pacific Microfinance Market, By End User, 2020-2028 (USD Billion)

37 China Microfinance Market, By Provider, 2020-2028 (USD Billion)

38 China Microfinance Market, By End User, 2020-2028 (USD Billion)

39 Japan Microfinance Market, By Provider, 2020-2028 (USD Billion)

40 Japan Microfinance Market, By End User, 2020-2028 (USD Billion)

41 India Microfinance Market, By Provider, 2020-2028 (USD Billion)

42 India Microfinance Market, By End User, 2020-2028 (USD Billion)

43 South Korea Microfinance Market, By Provider, 2020-2028 (USD Billion)

44 South Korea Microfinance Market, By End User, 2020-2028 (USD Billion)

45 Singapore Microfinance Market, By Provider, 2020-2028 (USD Billion)

46 Singapore Microfinance Market, By End User, 2020-2028 (USD Billion)

47 Thailand Microfinance Market, By Provider, 2020-2028 (USD Billion)

48 Thailand Microfinance Market, By End User, 2020-2028 (USD Billion)

49 Malaysia Microfinance Market, By Provider, 2020-2028 (USD Billion)

50 Malaysia Microfinance Market, By End User, 2020-2028 (USD Billion)

51 Indonesia Microfinance Market, By Provider, 2020-2028 (USD Billion)

52 Indonesia Microfinance Market, By End User, 2020-2028 (USD Billion)

53 Vietnam Microfinance Market, By Provider, 2020-2028 (USD Billion)

54 Vietnam Microfinance Market, By End User, 2020-2028 (USD Billion)

55 Taiwan Microfinance Market, By Provider, 2020-2028 (USD Billion)

56 Taiwan Microfinance Market, By End User, 2020-2028 (USD Billion)

57 Rest of APAC Global Microfinance Market, By Provider, 2020-2028 (USD Billion)

58 Rest of APAC Global Microfinance Market, By End User, 2020-2028 (USD Billion)

59 Middle East and Africa Microfinance Market, By Provider, 2020-2028 (USD Billion)

60 Middle East and Africa Microfinance Market, By End User, 2020-2028 (USD Billion)

61 Saudi Arabia Microfinance Market, By Provider, 2020-2028 (USD Billion)

62 Saudi Arabia Microfinance Market, By End User, 2020-2028 (USD Billion)

63 UAE Global Microfinance Market, By Provider, 2020-2028 (USD Billion)

64 UAE Global Microfinance Market, By End User, 2020-2028 (USD Billion)

65 Israel Microfinance Market, By Provider, 2020-2028 (USD Billion)

66 Israel Microfinance Market, By End User, 2020-2028 (USD Billion)

67 South Africa Microfinance Market, By Provider, 2020-2028 (USD Billion)

68 South Africa Microfinance Market, By End User, 2020-2028 (USD Billion)

69 Rest Of Middle East and Africa Microfinance Market, By Provider, 2020-2028 (USD Billion)

70 Rest Of Middle East and Africa Microfinance Market, By End User, 2020-2028 (USD Billion)

71 Central and South America Microfinance Market, By Provider, 2020-2028 (USD Billion)

72 Central and South America Microfinance Market, By End User, 2020-2028 (USD Billion)

73 Brazil Microfinance Market, By Provider, 2020-2028 (USD Billion)

74 Brazil Microfinance Market, By End User, 2020-2028 (USD Billion)

75 Chile Microfinance Market, By Provider, 2020-2028 (USD Billion)

76 Chile Microfinance Market, By End User, 2020-2028 (USD Billion)

77 Argentina Microfinance Market, By Provider, 2020-2028 (USD Billion)

78 Argentina Microfinance Market, By End User, 2020-2028 (USD Billion)

79 Rest Of Central and South America Microfinance Market, By Provider, 2020-2028 (USD Billion)

80 Rest Of Central and South America Microfinance Market, By End User, 2020-2028 (USD Billion)

81 Annapurna Finance (P) Ltd: Products & Services Offering

82 Bank Rakyat Indonesia (BRI): Products & Services Offering

83 Bandhan Bank: Products & Services Offering

84 CDC SMALL BUSINESS FINANCE: Products & Services Offering

85 Cashpor Micro Credit: Products & Services Offering

86 GRAMEEN AMERICA: Products & Services Offering

87 Grameen Bank: Products & Services Offering

88 Kiva: Products & Services Offering

89 Madura Microfinance Ltd.: Products & Services Offering

90 Pacific Community Ventures Inc: Products & Services Offering

91 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Microfinance Market Overview

2 Global Microfinance Market Value From 2020-2028 (USD Billion)

3 Global Microfinance Market Share, By Provider (2022)

4 Global Microfinance Market Share, By End User (2022)

5 Global Microfinance Market, By Region (Asia Pacific Market)

6 Technological Trends In Global Microfinance Market

7 Four Quadrant Competitor Positioning Matrix

8 Impact Of Macro & Micro Indicators On The Market

9 Impact Of Key Drivers On The Global Microfinance Market

10 Impact Of Challenges On The Global Microfinance Market

11 Porter’s Five Forces Analysis

12 Global Microfinance Market: By Provider Scope Key Takeaways

13 Global Microfinance Market, By Provider Segment: Revenue Growth Analysis

14 Banks Market, By Region, 2020-2028 (USD Billion)

15 Micro Finance Institute Market, By Region, 2020-2028 (USD Billion)

16 Non-Banking Financial Institutions Market, By Region, 2020-2028 (USD Billion)

17 Others Market, By Region, 2020-2028 (USD Billion)

18 Global Microfinance Market: By End User Scope Key Takeaways

19 Global Microfinance Market, By End User Segment: Revenue Growth Analysis

20 Small Enterprises Market, By Region, 2020-2028 (USD Billion)

21 Micro Enterprises Market, By Region, 2020-2028 (USD Billion)

22 Solo Entrepreneurs or Self-Employed Market, By Region, 2020-2028 (USD Billion)

23 Regional Segment: Revenue Growth Analysis

24 Global Microfinance Market: Regional Analysis

25 North America Microfinance Market Overview

26 North America Microfinance Market, By Provider

27 North America Microfinance Market, By End User

28 North America Microfinance Market, By Country

29 U.S. Microfinance Market, By Provider

30 U.S. Microfinance Market, By End User

31 Canada Microfinance Market, By Provider

32 Canada Microfinance Market, By End User

33 Mexico Microfinance Market, By Provider

34 Mexico Microfinance Market, By End User

35 Four Quadrant Positioning Matrix

36 Company Market Share Analysis

37 Annapurna Finance (P) Ltd: Company Snapshot

38 Annapurna Finance (P) Ltd: SWOT Analysis

39 Annapurna Finance (P) Ltd: Geographic Presence

40 Bank Rakyat Indonesia (BRI): Company Snapshot

41 Bank Rakyat Indonesia (BRI): SWOT Analysis

42 Bank Rakyat Indonesia (BRI): Geographic Presence

43 Bandhan Bank: Company Snapshot

44 Bandhan Bank: SWOT Analysis

45 Bandhan Bank: Geographic Presence

46 CDC SMALL BUSINESS FINANCE: Company Snapshot

47 CDC SMALL BUSINESS FINANCE: SWOT Analysis

48 CDC SMALL BUSINESS FINANCE: Geographic Presence

49 Cashpor Micro Credit: Company Snapshot

50 Cashpor Micro Credit: SWOT Analysis

51 Cashpor Micro Credit: Geographic Presence

52 Grameen America: Company Snapshot

53 Grameen America: SWOT Analysis

54 Grameen America: Geographic Presence

55 Grameen Bank: Company Snapshot

56 Grameen Bank: SWOT Analysis

57 Grameen Bank: Geographic Presence

58 Kiva: Company Snapshot

59 Kiva: SWOT Analysis

60 Kiva: Geographic Presence

61 Madura Microfinance Ltd.: Company Snapshot

62 Madura Microfinance Ltd.: SWOT Analysis

63 Madura Microfinance Ltd.: Geographic Presence

64 Pacific Community Ventures Inc: Company Snapshot

65 Pacific Community Ventures Inc: SWOT Analysis

66 Pacific Community Ventures Inc: Geographic Presence

67 Other Companies: Company Snapshot

68 Other Companies: SWOT Analysis

69 Other Companies: Geographic Presence

The Global Microfinance Market has been studied from the year 2019 till 2028. However, the CAGR provided in the report is from the year 2023 to 2028. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Microfinance Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS