Middle East and Asia Pacific Antibody Drugs Market Size, Trends & Analysis - Forecasts to 2028 By Type (Monoclonal Antibodies, Polyclonal Antibody, Bispecific Antibody, Biosimilars, Single Domain Antibody, CAR-T, and Anti-idiotype Antibody), By Disease Indication (Oncology, Neurology, Autoimmune Disorders, and Others), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

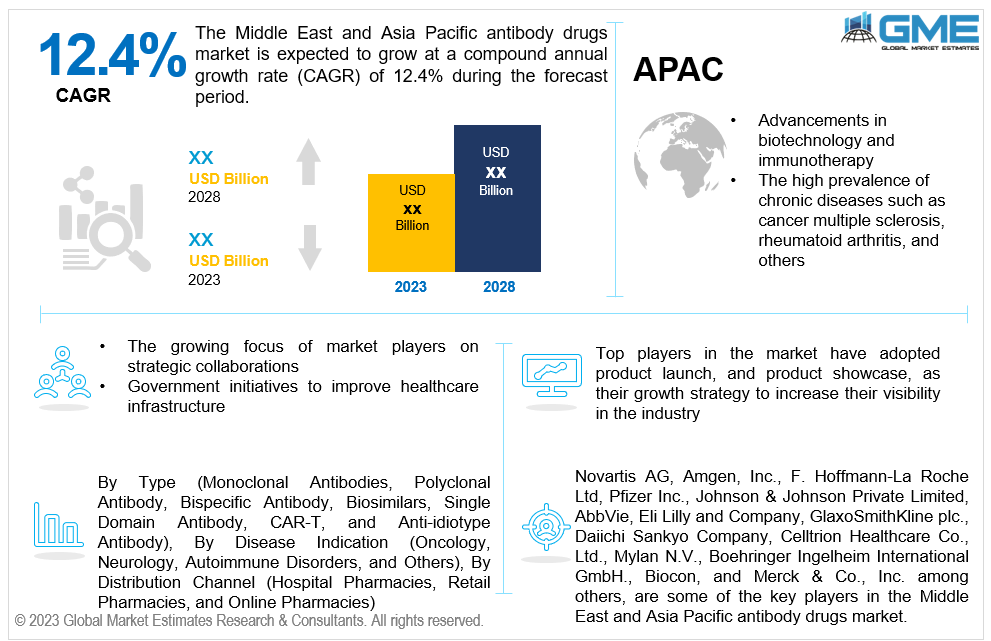

The Middle East and Asia Pacific antibody drugs market is estimated to exhibit a CAGR of 12.4% from 2023 to 2028.

The primary factors propelling the market growth are advancements in biotechnology and immunotherapy and the high prevalence of chronic diseases such as cancer, multiple sclerosis, rheumatoid arthritis, and others. An increasing number of patients need long-term, sometimes complicated care due to the increased frequency of chronic diseases. Since antibody drugs precisely target disease-related pathways, they are instrumental as targeted therapy for managing chronic disorders. The body's immune system attacks its tissues in autoimmune diseases, including multiple sclerosis and rheumatoid arthritis. Antibody drugs can help treat various ailments and regulate immunological responses, relieving patients and stimulating market growth. For instance, in the Tibet Autonomous Region (China), the age-standardized prevalence of rheumatoid arthritis (RA) was approximately 6.30% in 2020, with a prevalence of 2.46% in women and 9.59% in men, according to a Journal of Orthopaedic Surgery and Research article published in August 2020.

The growing focus of market players on strategic collaborations and government initiatives to improve healthcare infrastructure is expected to support the market growth throughout the forecast period. Market players in the therapeutic monoclonal antibodies sector in the Middle East and Asia Pacific are forming strategic collaborations to pool resources for research and development. Collaborations among academic institutions, research centers, and pharmaceutical corporations facilitate the development of novel antibody medicines. For instance, a collaborative venture and exclusive licensing agreement for anti-CTLA-4 mAb CS1002 in the Greater China region were announced in November 2021 by CStone Pharmaceuticals, a prominent biopharmaceutical business, and Jiangsu Hengrui Pharmaceuticals, a multinational pharmaceutical company.

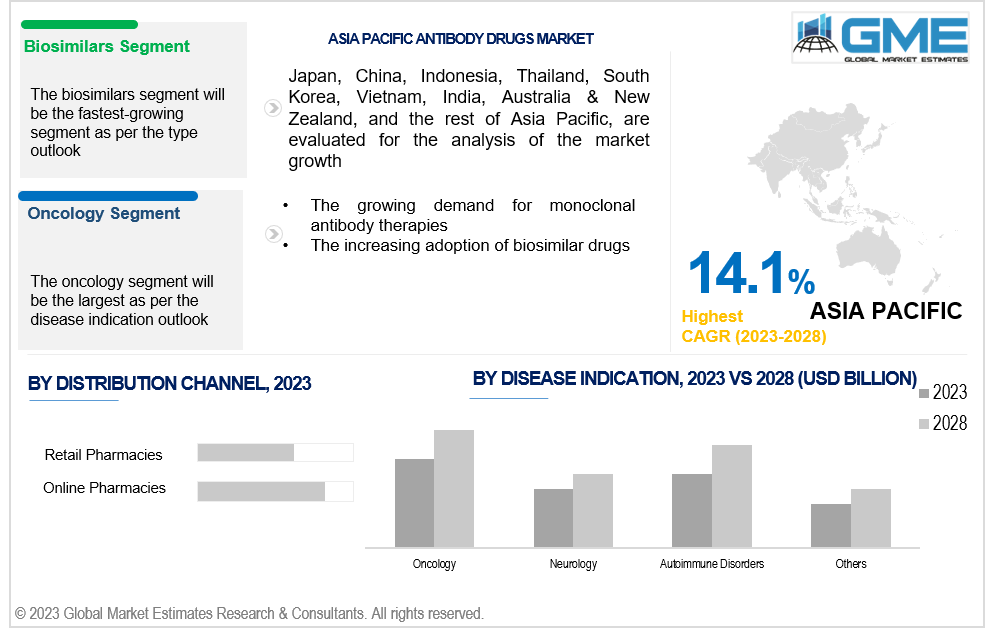

The growing demand for monoclonal antibody therapies and the increasing adoption of biosimilar drugs are propelling the market growth. Growing acceptance and usage of monoclonal antibody therapies in treating numerous diseases can be attributed to patients and healthcare professionals' increased understanding of the benefits of these treatments. Moreover, China's monoclonal antibodies production sector is witnessing substantial investments in research and development, manufacturing infrastructure, and technology upgrades. In addition to meeting local demand, this strategic focus on improving manufacturing capacities establishes China as a major supplier of monoclonal antibodies to the Middle East and Asia Pacific.

The Middle East biotechnology market is witnessing notable advancements, creating opportunities for the research, development, and commercialization of innovative antibody drugs, including monoclonal antibodies. Moreover, companies looking to increase their market share in the Middle East for autoimmune therapy antibodies can use strategic measures such as alliances, mergers, and acquisitions. Working with regional distributors and medical providers can make it easier to enter the market.

However, stringent regulatory requirements and the high cost of antibody drugs are expected to hinder market growth.

The monoclonal antibody segment is expected to hold the largest share of the market. Since monoclonal antibodies (mAbs) are made to target proteins involved in disease processes specifically, they are incredibly accurate and useful in treating a wide range of diseases. Compared to other treatment methods, their specificity enables tailored therapy, increasing therapeutic efficacy and decreasing adverse effects. Many monoclonal antibodies have received regulatory approvals for various indications, providing a level of confidence in their safety and efficacy. The market share of this segment is influenced by the regulatory support that healthcare providers receive for using monoclonal antibodies in their treatment methods.

The biosimilars segment is expected to be the fastest-growing segment in the market from 2023-2028. When compared to their reference biologics, biosimilars are frequently more economical. Cost becomes critical in regions where healthcare requirements are increasing. Governments and healthcare providers can prefer biosimilars to save costs while maintaining the quality of care. Biologics are becoming increasingly in demand as chronic illnesses, including cancer, rheumatoid arthritis, and autoimmune disorders, become more common. Biosimilars provide a way to meet this demand at a lower cost.

The oncology segment is expected to hold the largest share of the market. Cancer is a leading cause of mortality globally, and the incidence of cancer is often high in many regions, including the Middle East and Asia Pacific. The need for oncology medications, particularly antibody drugs, is mainly driven by the rising incidence of different cancer types. Antibody drugs, such as monoclonal antibodies, have shown remarkable efficacy in treating various cancers. New and more specific antibody treatments have been discovered due to ongoing oncology research and development, making them a favored option for cancer treatment.

The autoimmune disorders segment is expected to be the fastest-growing segment in the market from 2023-2028. In autoimmune diseases, including psoriasis, lupus, and rheumatoid arthritis, the immune system unintentionally attacks the body's tissues. The Middle East and Asia Pacific regions are witnessing an increase in the prevalence of autoimmune diseases, which has led to a rise in the need for therapies. Moreover, many autoimmune disorders pose significant challenges in terms of effective treatment. The creation of antibody medications addresses unmet medical requirements, offers a focused and frequently more acceptable method of treating specific diseases, and propels market growth in this segment.

The retail pharmacies segment is expected to hold the largest share of the market. The general public can easily access retail pharmacies, which provide patients a quick way to purchase prescription prescriptions, including antibody drugs. Accessibility to retail pharmacies improves patient adherence and increases market share overall.

The online pharmacies segment is expected to be the fastest-growing segment in the market from 2023-2028. E-commerce operations have increased and there has been a significant digital revolution in the Middle East and Asia Pacific regions. Online pharmacies are an extension of this trend, providing a convenient platform for consumers to order and receive medications, including antibody drugs, from the comfort of their homes.

Asia Pacific is expected to be the largest region in the Middle East and Asia Pacific antibody drugs market. Many new antibody drugs are designed to be more targeted and personalized, considering individual patient characteristics such as genetics and disease biomarkers. By focusing on personalized medicine, Asia Pacific can witness a rise in treatment efficacy as it follows the trend of customizing medications to individual patient profiles. For instance, Janssen Pharmaceutical Companies of Johnson & Johnson released new results from the MonumenTAL-1 Phase 1 first-in-human talquetamab dose-escalation trial in December 2021.

The Middle East is anticipated to witness rapid growth during the forecast period. Cancer is a significant component of NCDs, and the Middle East has observed a rising incidence of cancer. As they target particular cancer cells or proteins, minimize adverse effects, and enhance overall treatment results, antibody drugs are essential to the fight against cancer. For instance, Saudi Arabia has the highest prevalence of non-communicable diseases (NCDs), which include cancer, cardiovascular disease, and others, accounting for 73% of the country's mortality, according to data from a 2021 article published in the Journal of Clinical Medicine.

Novartis AG, Amgen, Inc., F. Hoffmann-La Roche Ltd, Pfizer Inc., Johnson & Johnson Private Limited, AbbVie, Eli Lilly and Company, GlaxoSmithKline plc., Daiichi Sankyo Company, Celltrion Healthcare Co., Ltd., Mylan N.V., Boehringer Ingelheim International GmbH., Biocon, and Merck & Co., Inc. among others, are some of the key players in the Middle East and Asia Pacific antibody drugs market.

Please note: This is not an exhaustive list of companies profiled in the report.

In 2023, Novartis, a global leader in immuno-dermatology and rheumatology, announced that the U.S. Food and Drug Administration (FDA) approved Novartis Cosentyx as the first new biologic treatment option for hidradenitis suppurativa patients.

In 2020, Eli Lilly & Company and Amgen entered into a global partnership for the production of antibodies, in order to greatly expand the supply capacity available for Lilly's perspective COVID-19 therapies.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Middle East and Asia Pacific Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 MIDDLE EAST AND ASIA PACIFIC ANTIBODY DRUGS MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 MIDDLE EAST AND ASIA PACIFIC ANTIBODY DRUGS MARKET, BY TYPE

4.1 Introduction

4.2 Antibody Drugs Market: Type Scope Key Takeaways

4.3 Revenue Growth Analysis, 2022 & 2028

4.4 Monoclonal Antibodies

4.4.1 Monoclonal Antibodies Market Estimates and Forecast, 2020-2028 (USD Million)

4.5 Polyclonal Antibody

4.5.1 Polyclonal Antibody Market Estimates and Forecast, 2020-2028 (USD Million)

4.6 Bispecific Antibody

4.6.1 Bispecific Antibody Market Estimates and Forecast, 2020-2028 (USD Million)

4.7 Biosimilars

4.7.1 Biosimilars Market Estimates and Forecast, 2020-2028 (USD Million)

4.8 Single Domain Antibody

4.8.1 Single Domain Antibody Market Estimates and Forecast, 2020-2028 (USD Million)

4.9 CAR-T

4.9.1 CAR-T Market Estimates and Forecast, 2020-2028 (USD Million)

4.10 Anti-idiotype Antibody

4.10.1 Anti-idiotype Antibody Market Estimates and Forecast, 2020-2028 (USD Million)

5 MIDDLE EAST AND ASIA PACIFIC ANTIBODY DRUGS MARKET, BY DISEASE INDICATION

5.1 Introduction

5.2 Antibody Drugs Market: Disease Indication Scope Key Takeaways

5.3 Revenue Growth Analysis, 2022 & 2028

5.4 Oncology

5.4.1 Oncology Market Estimates and Forecast, 2020-2028 (USD Million)

5.5 Neurology

5.5.1 Neurology Market Estimates and Forecast, 2020-2028 (USD Million)

5.6 Autoimmune Disorders

5.6.1 Autoimmune Disorders Market Estimates and Forecast, 2020-2028 (USD Million)

5.7 Others

5.7.1 Others Market Estimates and Forecast, 2020-2028 (USD Million)

6 MIDDLE EAST AND ASIA PACIFIC ANTIBODY DRUGS MARKET, BY DISTRIBUTION CHANNEL

6.1 Introduction

6.2 Antibody Drugs Market: Distribution Channel Scope Key Takeaways

6.3 Revenue Growth Analysis, 2022 & 2028

6.4 Hospital Pharmacies

6.4.1 Hospital Pharmacies Market Estimates and Forecast, 2020-2028 (USD Million)

6.5 Retail Pharmacies

6.5.1 Retail Pharmacies Market Estimates and Forecast, 2020-2028 (USD Million)

6.6 Online Pharmacies

6.6.1 Online Pharmacies Market Estimates and Forecast, 2020-2028 (USD Million)

7 MIDDLE EAST AND ASIA PACIFIC ANTIBODY DRUGS MARKET, BY REGION

7.1 Introduction

7.2 Asia Pacific Antibody Drugs Market Estimates and Forecast, 2020-2028 (USD Million)

7.2.1 By Type

7.2.2 By Disease Indication

7.2.3 By Distribution Channel

7.2.4 By Country

7.2.4.1 China Antibody Drugs Market Estimates and Forecast, 2020-2028 (USD Million)

7.2.4.1.1 By Type

7.2.4.1.2 By Disease Indication

7.2.4.1.3 By Distribution Channel

7.2.4.2 Japan Antibody Drugs Market Estimates and Forecast, 2020-2028 (USD Million)

7.2.4.2.1 By Type

7.2.4.2.2 By Disease Indication

7.2.4.2.3 By Distribution Channel

7.2.4.3 India Antibody Drugs Market Estimates and Forecast, 2020-2028 (USD Million)

7.2.4.3.1 By Type

7.2.4.3.2 By Disease Indication

7.2.4.3.3 By Distribution Channel

7.2.4.4 South Korea Antibody Drugs Market Estimates and Forecast, 2020-2028 (USD Million)

7.2.4.4.1 By Type

7.2.4.4.2 By Disease Indication

7.2.4.4.3 By Distribution Channel

7.2.4.5 Singapore Antibody Drugs Market Estimates and Forecast, 2020-2028 (USD Million)

7.2.4.5.1 By Type

7.2.4.5.2 By Disease Indication

7.2.4.5.3 By Distribution Channel

7.2.4.6 Malaysia Antibody Drugs Market Estimates and Forecast, 2020-2028 (USD Million)

7.2.4.6.1 By Type

7.2.4.6.2 By Disease Indication

7.2.4.6.3 By Distribution Channel

7.2.4.7 Thailand Antibody Drugs Market Estimates and Forecast, 2020-2028 (USD Million)

7.2.4.7.1 By Type

7.2.4.7.2 By Disease Indication

7.2.4.7.3 By Distribution Channel

7.2.4.8 Indonesia Antibody Drugs Market Estimates and Forecast, 2020-2028 (USD Million)

7.2.4.8.1 By Type

7.2.4.8.2 By Disease Indication

7.2.4.8.3 By Distribution Channel

7.2.4.9 Vietnam Antibody Drugs Market Estimates and Forecast, 2020-2028 (USD Million)

7.2.4.9.1 By Type

7.2.4.9.2 By Disease Indication

7.2.4.9.3 By Distribution Channel

7.2.4.10 Taiwan Antibody Drugs Market Estimates and Forecast, 2020-2028 (USD Million)

7.2.4.10.1 By Type

7.2.4.10.2 By Disease Indication

7.2.4.10.3 By Distribution Channel

7.2.4.11 Rest of Asia Pacific Antibody Drugs Market Estimates and Forecast, 2020-2028 (USD Million)

7.2.4.11.1 By Type

7.2.4.11.2 By Disease Indication

7.2.4.11.3 By Distribution Channel

7.3 Middle East Antibody Drugs Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.1 By Type

7.3.2 By Disease Indication

7.3.3 By Distribution Channel

7.3.4 By Country

7.3.4.1 Saudi Arabia Antibody Drugs Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.4.1.1 By Type

7.3.4.1.2 By Disease Indication

7.3.4.1.3 By Distribution Channel

7.3.4.2 U.A.E. Antibody Drugs Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.4.2.1 By Type

7.3.4.2.2 By Disease Indication

7.3.4.2.3 By Distribution Channel

7.3.4.3 Israel Antibody Drugs Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.4.3.1 By Type

7.3.4.3.2 By Disease Indication

7.3.4.3.3 By Distribution Channel

7.3.4.4 Rest of Middle East Antibody Drugs Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.4.4.1 By Type

7.3.4.4.2 By Disease Indication

7.3.4.4.2 By Distribution Channel

8 COMPETITIVE LANDCAPE

8.1 Company Market Share Analysis

8.2 Four Quadrant Positioning Matrix

8.2.1 Market Leaders

8.2.2 Market Visionaries

8.2.3 Market Challengers

8.2.4 Niche Market Players

8.3 Vendor Landscape

8.3.2 Asia Pacific

8.3.3 Middle East

8.4 Company Profiles

8.4.1 Novartis AG

8.4.1.1 Business Description & Financial Analysis

8.4.1.2 SWOT Analysis

8.4.1.3 Products & Services Offered

8.4.1.4 Strategic Alliances between Business Partners

8.4.2 AMGEN, INC.

8.4.2.1 Business Description & Financial Analysis

8.4.2.2 SWOT Analysis

8.4.2.3 Products & Services Offered

8.4.2.4 Strategic Alliances between Business Partners

8.4.3 F. Hoffmann-La Roche Ltd

8.4.3.1 Business Description & Financial Analysis

8.4.3.2 SWOT Analysis

8.4.3.3 Products & Services Offered

8.4.3.4 Strategic Alliances between Business Partners

8.4.4 Pfizer Inc.

8.4.4.1 Business Description & Financial Analysis

8.4.4.2 SWOT Analysis

8.4.4.3 Products & Services Offered

8.4.4.4 Strategic Alliances between Business Partners

8.4.5 Johnson & Johnson Private Limited

8.4.5.1 Business Description & Financial Analysis

8.4.5.2 SWOT Analysis

8.4.5.3 Products & Services Offered

8.4.5.4 Strategic Alliances between Business Partners

8.4.6 ABBVIE

8.4.6.1 Business Description & Financial Analysis

8.4.6.2 SWOT Analysis

8.4.6.3 Products & Services Offered

8.4.6.4 Strategic Alliances between Business Partners

8.4.7 Eli Lilly and Company

8.4.7.1 Business Description & Financial Analysis

8.4.7.2 SWOT Analysis

8.4.7.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.8 GlaxoSmithKline plc.

8.4.8.1 Business Description & Financial Analysis

8.4.8.2 SWOT Analysis

8.4.8.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.9 Daiichi Sankyo Company

8.4.9.1 Business Description & Financial Analysis

8.4.9.2 SWOT Analysis

8.4.9.3 Products & Services Offered

8.4.9.4 Strategic Alliances between Business Partners

8.4.10 Celltrion Healthcare Co., Ltd.

8.4.10.1 Business Description & Financial Analysis

8.4.10.2 SWOT Analysis

8.4.10.3 Products & Services Offered

8.4.10.4 Strategic Alliances between Business Partners

8.4.11 Other Companies

8.4.11.1 Business Description & Financial Analysis

8.4.11.2 SWOT Analysis

8.4.11.3 Products & Services Offered

8.4.11.4 Strategic Alliances between Business Partners

9 RESEARCH METHODOLOGY

9.1 Market Introduction

9.1.1 Market Definition

9.1.2 Market Scope & Segmentation

9.2 Information Procurement

9.2.1 Secondary Research

9.2.1.1 Purchased Databases

9.2.1.2 GMEs Internal Data Repository

9.2.1.3 Secondary Resources & Third Party Perspectives

9.2.1.4 Company Information Sources

9.2.2 Primary Research

9.2.2.1 Various Types of Respondents for Primary Interviews

9.2.2.2 Number of Interviews Conducted throughout the Research Process

9.2.2.3 Primary Stakeholders

9.2.2.4 Discussion Guide for Primary Participants

9.2.3 Expert Panels

9.2.3.1 Expert Panels Across 30+ Industry

9.2.4 Paid Local Experts

9.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

9.3 Market Estimation

9.3.1 Top-Down Approach

9.3.1.1 Macro-Economic Indicators Considered

9.3.1.2 Micro-Economic Indicators Considered

9.3.2 Bottom Up Approach

9.3.2.1 Company Share Analysis Approach

9.3.2.2 Estimation of Potential Product Sales

9.4 Data Triangulation

9.4.1 Data Collection

9.4.2 Time Series, Cross Sectional & Panel Data Analysis

9.4.3 Cluster Analysis

9.5 Analysis and Output

9.5.1 Inhouse AI Based Real Time Analytics Tool

9.5.2 Output From Desk & Primary Research

9.6 Research Assumptions & Limitations

9.7.1 Research Assumptions

9.7.2 Research Limitations

LIST OF TABLES

1 Middle East and Asia Pacific Antibody Drugs Market, By Type, 2020-2028 (USD Million)

2 Monoclonal Antibodies Market, By Region, 2020-2028 (USD Million)

3 Polyclonal Antibody Market, By Region, 2020-2028 (USD Million)

4 Bispecific Antibody Market, By Region, 2020-2028 (USD Million)

5 Biosimilars Market, By Region, 2020-2028 (USD Million)

6 Single Domain Antibody Market, By Region, 2020-2028 (USD Million)

7 CAR-T Market, By Region, 2020-2028 (USD Million)

8 Anti-idiotype Antibody Market, By Region, 2020-2028 (USD Million)

9 Middle East and Asia Pacific Antibody Drugs Market, By Disease Indication, 2020-2028 (USD Million)

10 Oncology Market, By Region, 2020-2028 (USD Million)

11 Neurology Market, By Region, 2020-2028 (USD Million)

12 Autoimmune Disorders Market, By Region, 2020-2028 (USD Million)

13 Others Market, By Region, 2020-2028 (USD Million)

14 Middle East and Asia Pacific Antibody Drugs Market, By Distribution Channel, 2020-2028 (USD Million)

15 Hospital Pharmacies Market, By Region, 2020-2028 (USD Million)

16 Retail Pharmacies Market, By Region, 2020-2028 (USD Million)

17 Online Pharmacies Market, By Region, 2020-2028 (USD Million)

18 Regional Analysis, 2020-2028 (USD Million)

19 Asia Pacific Antibody Drugs Market, By Type, 2020-2028 (USD Million)

20 Asia Pacific Antibody Drugs Market, By Disease Indication, 2020-2028 (USD Million)

21 Asia Pacific Antibody Drugs Market, By Distribution Channel, 2020-2028 (USD Million)

22 Asia Pacific Antibody Drugs Market, By Country, 2020-2028 (USD Million)

23 China Antibody Drugs Market, By Type, 2020-2028 (USD Million)

24 China Antibody Drugs Market, By Disease Indication, 2020-2028 (USD Million)

25 China Antibody Drugs Market, By Distribution Channel, 2020-2028 (USD Million)

26 India Antibody Drugs Market, By Type, 2020-2028 (USD Million)

27 India Antibody Drugs Market, By Disease Indication, 2020-2028 (USD Million)

28 India Antibody Drugs Market, By Distribution Channel, 2020-2028 (USD Million)

29 Japan Antibody Drugs Market, By Type, 2020-2028 (USD Million)

30 Japan Antibody Drugs Market, By Disease Indication, 2020-2028 (USD Million)

31 Japan Antibody Drugs Market, By Distribution Channel, 2020-2028 (USD Million)

32 South Korea Antibody Drugs Market, By Type, 2020-2028 (USD Million)

33 South Korea Antibody Drugs Market, By Disease Indication, 2020-2028 (USD Million)

34 South Korea Antibody Drugs Market, By Distribution Channel, 2020-2028 (USD Million)

35 Middle East Antibody Drugs Market, By Type, 2020-2028 (USD Million)

36 Middle East Antibody Drugs Market, By Disease Indication, 2020-2028 (USD Million)

37 Middle East Antibody Drugs Market, By Distribution Channel, 2020-2028 (USD Million)

38 Middle East Antibody Drugs Market, By Country, 2020-2028 (USD Million)

39 Saudi Arabia Antibody Drugs Market, By Type, 2020-2028 (USD Million)

40 Saudi Arabia Antibody Drugs Market, By Disease Indication, 2020-2028 (USD Million)

41 Saudi Arabia Antibody Drugs Market, By Distribution Channel, 2020-2028 (USD Million)

42 UAE Antibody Drugs Market, By Type, 2020-2028 (USD Million)

43 UAE Antibody Drugs Market, By Disease Indication, 2020-2028 (USD Million)

44 UAE Antibody Drugs Market, By Distribution Channel, 2020-2028 (USD Million)

45 Novartis AG: Products & Services Offering

46 AMGEN, INC.: Products & Services Offering

47 F. Hoffmann-La Roche Ltd: Products & Services Offering

48 Pfizer Inc.: Products & Services Offering

49 Johnson & Johnson Private Limited: Products & Services Offering

50 ABBVIE: Products & Services Offering

51 Eli Lilly and Company : Products & Services Offering

52 GlaxoSmithKline plc.: Products & Services Offering

53 Daiichi Sankyo Company, Inc: Products & Services Offering

54 Celltrion Healthcare Co., Ltd.: Products & Services Offering

55 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Middle East and Asia Pacific Antibody Drugs Market Overview

2 Middle East and Asia Pacific Antibody Drugs Market Value From 2020-2028 (USD Million)

3 Middle East and Asia Pacific Antibody Drugs Market Share, By Type (2022)

4 Middle East and Asia Pacific Antibody Drugs Market Share, By Disease Indication (2022)

5 Middle East and Asia Pacific Antibody Drugs Market Share, By Distribution Channel (2022)

6 Middle East and Asia Pacific Antibody Drugs Market, By Region (Asia Pacific Market)

7 Technological Trends In Middle East and Asia Pacific Antibody Drugs Market

8 Four Quadrant Competitor Positioning Matrix

9 Impact Of Macro & Micro Indicators On The Market

10 Impact Of Key Drivers On The Middle East and Asia Pacific Antibody Drugs Market

11 Impact Of Challenges On The Middle East and Asia Pacific Antibody Drugs Market

12 Porter’s Five Forces Analysis

13 Middle East and Asia Pacific Antibody Drugs Market: By Type Scope Key Takeaways

14 Middle East and Asia Pacific Antibody Drugs Market, By Type Segment: Revenue Growth Analysis

15 Monoclonal Antibodies Market, By Region, 2020-2028 (USD Million)

16 Polyclonal Antibody Market, By Region, 2020-2028 (USD Million)

17 Bispecific Antibody Market, By Region, 2020-2028 (USD Million)

18 Biosimilars Market, By Region, 2020-2028 (USD Million)

19 Single Domain Antibody Market, By Region, 2020-2028 (USD Million)

20 CAR-T Market, By Region, 2020-2028 (USD Million)

21 Anti-idiotype Antibody Market, By Region, 2020-2028 (USD Million)

22 Middle East and Asia Pacific Antibody Drugs Market: By Disease Indication Scope Key Takeaways

23 Middle East and Asia Pacific Antibody Drugs Market, By Disease Indication Segment: Revenue Growth Analysis

24 Oncology Market, By Region, 2020-2028 (USD Million)

25 Neurology Market, By Region, 2020-2028 (USD Million)

26 Autoimmune Disorders Market, By Region, 2020-2028 (USD Million)

27 Others Market, By Region, 2020-2028 (USD Million)

28 Middle East and Asia Pacific Antibody Drugs Market: By Distribution Channel Scope Key Takeaways

29 Middle East and Asia Pacific Antibody Drugs Market, By Distribution Channel Segment: Revenue Growth Analysis

30 Hospital Pharmacies Market, By Region, 2020-2028 (USD Million)

31 Retail Pharmacies Market, By Region, 2020-2028 (USD Million)

32 Online Pharmacies Market, By Region, 2020-2028 (USD Million)

33 Regional Segment: Revenue Growth Analysis

34 Middle East and Asia Pacific Antibody Drugs Market: Regional Analysis

35 Asia Pacific Antibody Drugs Market Overview

36 Asia Pacific Antibody Drugs Market, By Type

37 Asia Pacific Antibody Drugs Market, By Disease Indication

38 Asia Pacific Antibody Drugs Market, By Distribution Channel

39 Asia Pacific Antibody Drugs Market, By Country

40 Middle East Antibody Drugs Market, By Type

41 Middle East Antibody Drugs Market, By Disease Indication

42 Middle East Antibody Drugs Market, By Distribution Channel

43 Four Quadrant Positioning Matrix

44 Company Market Share Analysis

45 Novartis AG: Company Snapshot

46 Novartis AG: SWOT Analysis

47 Novartis AG: Geographic Presence

48 AMGEN, INC.: Company Snapshot

49 AMGEN, INC.: SWOT Analysis

50 AMGEN, INC.: Geographic Presence

51 F. Hoffmann-La Roche Ltd: Company Snapshot

52 F. Hoffmann-La Roche Ltd: SWOT Analysis

53 F. Hoffmann-La Roche Ltd: Geographic Presence

54 Pfizer Inc.: Company Snapshot

55 Pfizer Inc.: Swot Analysis

56 Pfizer Inc.: Geographic Presence

57 Johnson & Johnson Private Limited: Company Snapshot

58 Johnson & Johnson Private Limited: SWOT Analysis

59 Johnson & Johnson Private Limited: Geographic Presence

60 ABBVIE: Company Snapshot

61 ABBVIE: SWOT Analysis

62 ABBVIE: Geographic Presence

63 Eli Lilly and Company : Company Snapshot

64 Eli Lilly and Company : SWOT Analysis

65 Eli Lilly and Company : Geographic Presence

66 GlaxoSmithKline plc.: Company Snapshot

67 GlaxoSmithKline plc.: SWOT Analysis

68 GlaxoSmithKline plc.: Geographic Presence

69 Daiichi Sankyo Company, Inc.: Company Snapshot

70 Daiichi Sankyo Company, Inc.: SWOT Analysis

71 Daiichi Sankyo Company, Inc.: Geographic Presence

72 Celltrion Healthcare Co., Ltd.: Company Snapshot

73 Celltrion Healthcare Co., Ltd.: SWOT Analysis

74 Celltrion Healthcare Co., Ltd.: Geographic Presence

75 Other Companies: Company Snapshot

76 Other Companies: SWOT Analysis

77 Other Companies: Geographic Presence

The Middle East and Asia Pacific Antibody Drugs Market has been studied from the year 2019 till 2028. However, the CAGR provided in the report is from the year 2023 to 2028. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Middle East and Asia Pacific Antibody Drugs Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS