Netherlands Public Sector Market Size, Trends & Analysis - Forecasts to 2029 By Service Type (Infrastructure Development and Management, Healthcare Services, Education Services, Social Services, Public Safety and Security, Transportation Services, and Others), By Industries Served (Government Agencies and Ministries, Healthcare Institutions, Educational Institutions, Municipalities and Local Authorities, Public Safety Organizations, Transportation Authorities, and Others), and Competitive Landscape, Company Market Share Analysis, and End User Analysis

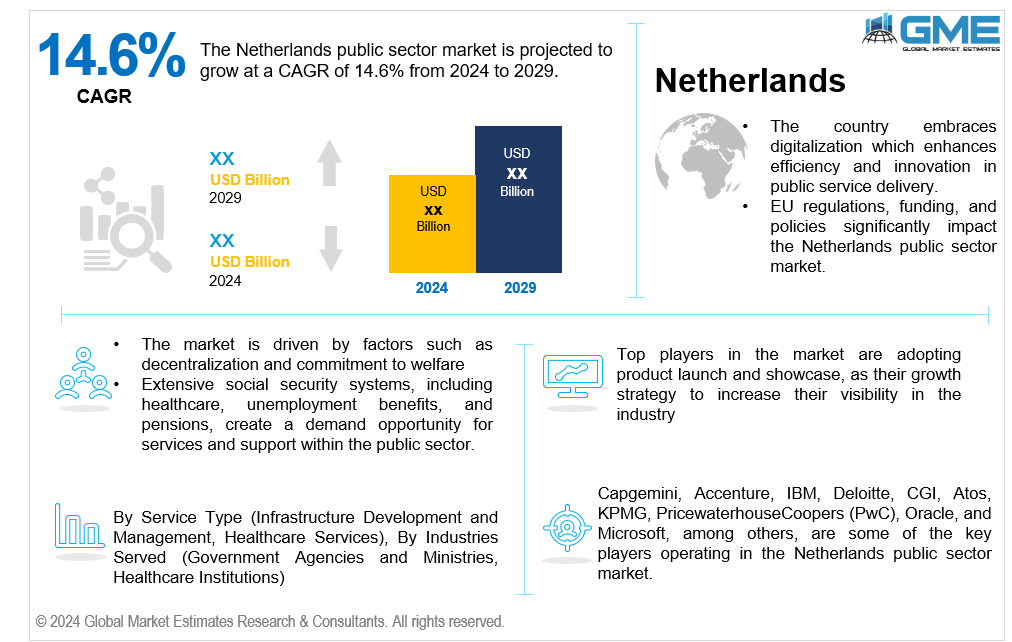

The Netherlands public sector market is estimated to exhibit a CAGR of 14.6% from 2024 to 2029. The Netherlands has a notable history of decentralization, granting considerable authority to local administrations. With 12 provinces and many municipalities, each with its own elected council and mayor, the country embraces a robust tradition of local governance. Furthermore, it is a well-established welfare country with comprehensive social security programs encompassing healthcare, unemployment benefits, and pensions.

The Netherlands public sector market is mainly driven by factors such as decentralization and commitment to welfare. The Netherlands has a strong tradition of decentralization, which empowers local governments to make decisions and implement policies that cater to the specific needs of their communities. This decentralization fosters innovation, responsiveness, and efficiency in public service delivery, driving the growth and development of the public sector market. The Dutch government's commitment to maintaining a robust welfare state is another driving force in the public sector market. Extensive social security systems, including healthcare, unemployment benefits, and pensions, create a demand for services and support within the public sector. The opportunity lies in embracing digital transformation to enhance efficiency, accessibility, and innovation in public service delivery. Investing in digital infrastructure, e-governance platforms, and digital literacy initiatives can improve citizen engagement, streamline administrative processes, and optimize resource allocation. As an EU member state, the Netherlands is subject to EU regulations and directives that influence its public sector policies and practices.

One of the major restraints that the public sector faces is balancing fiscal responsibility with the demand for expanded services and investments in infrastructure, public services, and workforce development, hindering the ability of the public sector to meet evolving needs and challenges.

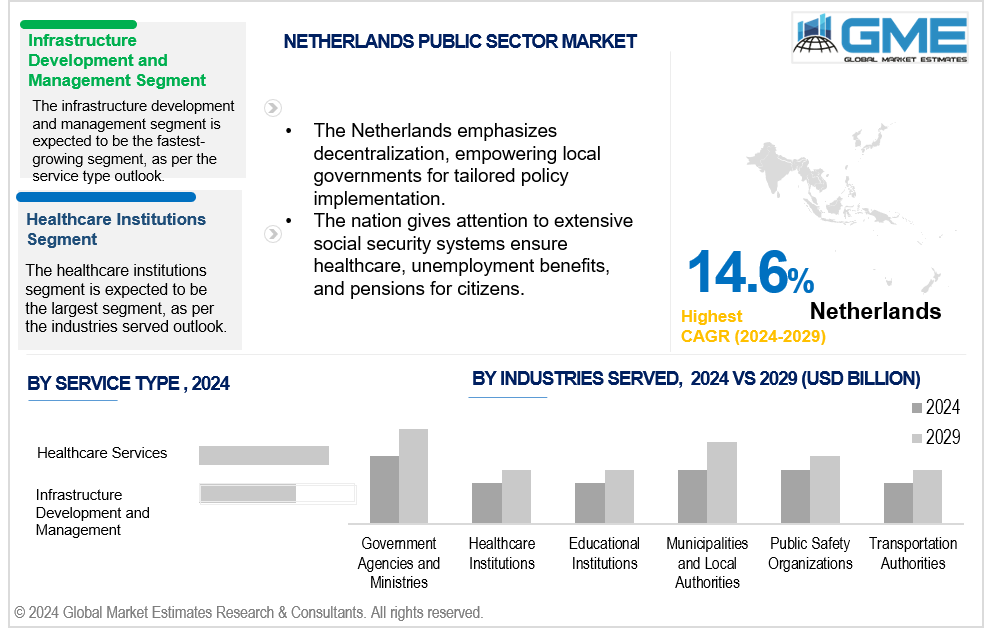

On the basis of service type, the market is segmented into infrastructure development and management, healthcare services, education services, social services, public safety and security, transportation services, and others. The healthcare services segment is expected to be the dominant segment during the forecast period. Factors such as population aging, advancements in medical technology, and rising healthcare expenditures are driving growth in this sector. As people prioritize their health and well-being, the demand for healthcare services is expected to remain high, making it the dominant segment in the forecasted period.

The infrastructure development and management segment is expected to be the fastest-growing segment in the Netherlands public sector market during the forecast period. This growth is driven by increasing investments in transportation, utilities, and digital infrastructure projects. As the government prioritizes modernizing and expanding critical infrastructure networks, demand for related services such as construction, maintenance, and technology integration is expected to surge, fuelling growth in this segment.

On the basis of industries served, the market is segmented into government agencies and ministries, healthcare institutions, educational institutions, municipalities and local authorities, public safety organizations, transportation authorities, and others. The healthcare institutions segment is expected to hold the largest share of the market during the forecast period. The Netherlands' dedication to delivering top-notch, readily available healthcare is a key reason behind its substantial government funding and influence on the public. This stems from the considerable infrastructure requirements, large workforce, and substantial budget allotments to enhance population health and welfare. The country has a mandatory health insurance policy for all its citizens and offers a 'regulated competition' for private health insurance providers.

The government agencies and ministries segment is anticipated to be the fastest-growing in the Netherlands public sector market during the forecast period. Government agencies and ministries play vital roles in a nation's governance, managing essential functions like economic policy, social welfare, education, infrastructure development, and environmental regulation. They control a substantial share of public sector resources and workforce due to their diverse responsibilities, resource management, regulatory supervision, and service provision, demanding significant organizational capacity and infrastructure.

The key market players in the Capgemini, Accenture, IBM, Deloitte, CGI, Atos, KPMG, PricewaterhouseCoopers (PwC), Oracle, and Microsoft, among others.

Please note: This is not an exhaustive list of companies profiled in the report.

In October 2023, Deloitte and Google Public Sector announced a major expansion of their strategic alliance to accelerate innovation and harness new technologies like generative AI (GenAI) to help government and higher education clients solve complex problems. With deep experience at the federal, state, and local levels, Deloitte and Google Public Sector launched a portfolio of new solutions that combine Google Cloud’s leading AI/ML, GenAI, and data analytics capabilities with Deloitte’s deep mission experience and engineering capabilities to enhance constituent engagement, improve geospatial planning, and drive better mission insights.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 NETHERLANDS MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 NETHERLANDS PUBLIC SECTOR MARKET, BY SERVICE TYPE

4.1 Introduction

4.2 Public Sector Market: Service Type Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Infrastructure Development and Management

4.4.1 Infrastructure Development and Management Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 Healthcare Services

4.5.1 Healthcare Services Market Estimates and Forecast, 2021-2029 (USD Million)

4.6 Education Services

4.6.1 Education Services Market Estimates and Forecast, 2021-2029 (USD Million)

4.7 Social Services

4.7.1 Social Services Market Estimates and Forecast, 2021-2029 (USD Million)

4.8 Public Safety and Security

4.8.1 Public Safety and Security Market Estimates and Forecast, 2021-2029 (USD Million)

4.9 Transportation Services

4.9.1 Transportation Services Market Estimates and Forecast, 2021-2029 (USD Million)

4.10 Others

4.10.1 Others Market Estimates and Forecast, 2021-2029 (USD Million)

5 NETHERLANDS PUBLIC SECTOR MARKET, BY INDUSTRIES SERVED

5.1 Introduction

5.2 Public Sector Market: Distribution Channel Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 Government Agencies and Ministries

5.4.1 Government Agencies and Ministries Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 Healthcare Institutions

5.5.1 Healthcare Institutions Market Estimates and Forecast, 2021-2029 (USD Million)

5.6 Educational Institutions

5.6.1 Educational Institutions Market Estimates and Forecast, 2021-2029 (USD Million)

5.7 Municipalities and Local Authorities

5.7.1 Municipalities and Local Authorities Market Estimates and Forecast, 2021-2029 (USD Million)

5.8 Public Safety Organizations

5.8.1 Public Safety Organizations Market Estimates and Forecast, 2021-2029 (USD Million)

5.9 Transportation Authorities

5.9.1 Transportation Authorities Market Estimates and Forecast, 2021-2029 (USD Million)

5.10 Others

5.10.1 Others Market Estimates and Forecast, 2021-2029 (USD Million)

7 COMPETITIVE LANDCAPE

7.1 Company Market Share Analysis

7.2 Four Quadrant Positioning Matrix

7.2.1 Market Leaders

7.2.2 Market Visionaries

7.2.3 Market Challengers

7.2.4 Niche Market Players

7.3 Vendor Landscape

7.3.1 Netherlands

7.4 Company Profiles

7.4.1 Capgemini

7.4.1.1 Business Description & Financial Analysis

7.4.1.2 SWOT Analysis

7.4.1.3 Products & Service Types Offered

7.4.1.4 Strategic Alliances between Business Partners

7.4.2 Accenture

7.4.2.1 Business Description & Financial Analysis

7.4.2.2 SWOT Analysis

7.4.2.3 Products & Service Types Offered

7.4.2.4 Strategic Alliances between Business Partners

7.4.3 IBM

7.4.3.1 Business Description & Financial Analysis

7.4.3.2 SWOT Analysis

7.4.3.3 Products & Service Types Offered

7.4.3.4 Strategic Alliances between Business Partners

7.4.4 Deloitte

7.4.4.1 Business Description & Financial Analysis

7.4.4.2 SWOT Analysis

7.4.4.3 Products & Service Types Offered

7.4.4.4 Strategic Alliances between Business Partners

7.4.5 CGI

7.4.5.1 Business Description & Financial Analysis

7.4.5.2 SWOT Analysis

7.4.5.3 Products & Service Types Offered

7.4.5.4 Strategic Alliances between Business Partners

7.4.6 Atos

7.4.6.1 Business Description & Financial Analysis

7.4.6.2 SWOT Analysis

7.4.6.3 Products & Service Types Offered

7.4.6.4 Strategic Alliances between Business Partners

7.4.7 KPMG

7.4.7.1 Business Description & Financial Analysis

7.4.7.2 SWOT Analysis

7.4.7.3 Products & Service Types Offered

7.4.7.4 Strategic Alliances between Business Partners

7.4.8 PricewaterhouseCoopers (PwC)

7.4.8.1 Business Description & Financial Analysis

7.4.8.2 SWOT Analysis

7.4.8.3 Products & Service Types Offered

7.4.8.4 Strategic Alliances between Business Partners

7.4.9 Oracle

7.4.9.1 Business Description & Financial Analysis

7.4.9.2 SWOT Analysis

7.4.9.3 Products & Service Types Offered

7.4.9.4 Strategic Alliances between Business Partners

7.4.10 Microsoft

7.4.10.1 Business Description & Financial Analysis

7.4.10.2 SWOT Analysis

7.4.10.3 Products & Service Types Offered

7.4.10.4 Strategic Alliances between Business Partners

7.4.11 Other Companies

7.4.11.1 Business Description & Financial Analysis

7.4.11.2 SWOT Analysis

7.4.11.3 Products & Service Types Offered

7.4.11.4 Strategic Alliances between Business Partners

8 RESEARCH METHODOLOGY

8.1 Market Introduction

8.1.1 Market Definition

8.1.2 Market Scope & Segmentation

8.2 Information Procurement

8.2.1 Secondary Research

8.2.1.1 Purchased Databases

8.2.1.2 GMEs Internal Data Repository

8.2.1.3 Secondary Resources & Third Party Perspectives

8.2.1.4 Company Information Sources

8.2.2 Primary Research

8.2.2.1 Various Types of Respondents for Primary Interviews

8.2.2.2 Number of Interviews Conducted throughout the Research Process

8.2.2.3 Primary Stakeholders

8.2.2.4 Discussion Guide for Primary Participants

8.2.3 Expert Panels

8.2.3.1 Expert Panels Across 30+ Industry

8.2.4 Paid Local Experts

8.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

8.3 Market Estimation

8.3.1 Top-Down Approach

8.3.1.1 Macro-Economic Indicators Considered

8.3.1.2 Micro-Economic Indicators Considered

8.3.2 Bottom Up Approach

8.3.2.1 Company Share Analysis Approach

8.3.2.2 Estimation of Potential Product Sales

8.4 Data Triangulation

8.4.1 Data Collection

8.4.2 Time Series, Cross Sectional & Panel Data Analysis

8.4.3 Cluster Analysis

8.5 Analysis and Output

8.5.1 Inhouse AI Based Real Time Analytics Tool

8.5.2 Output From Desk & Primary Research

8.6 Research Assumptions & Limitations

8.7.1 Research Assumptions

8.7.2 Research Limitations

LIST OF TABLES

1 Netherlands Public Sector Market, By Service Type, 2021-2029 (USD Million)

2 Infrastructure Development and Management Market, By Country, 2021-2029 (USD Million)

3 Healthcare Services Market, By Country, 2021-2029 (USD Million)

4 Education Services Market, By Country, 2021-2029 (USD Million)

5 Social Services Market, By Country, 2021-2029 (USD Million)

6 Public Safety and Security Market, By Country, 2021-2029 (USD Million)

7 Transportation Services Market, By Country, 2021-2029 (USD Million)

8 Others Market, By Country, 2021-2029 (USD Million)

9 Netherlands Public Sector Market, By Industries Served, 2021-2029 (USD Million)

10 Government Agencies and Ministries Market, By Country, 2021-2029 (USD Million)

11 Healthcare Institutions Market, By Country, 2021-2029 (USD Million)

12 Educational Institutions Market, By Country, 2021-2029 (USD Million)

13 Municipalities and Local Authorities Market, By Country, 2021-2029 (USD Million)

14 Public Safety Organizations Market, By Country, 2021-2029 (USD Million)

15 Transportation Authorities Market, By Country, 2021-2029 (USD Million)

16 Others Market, By Country, 2021-2029 (USD Million)

17 Capgemini: Products & Service Types Offering

18 Accenture: Products & Service Types Offering

19 IBM: Products & Service Types Offering

20 Deloitte: Products & Service Types Offering

21 CGI: Products & Service Types Offering

22 ATOS: Products & Service Types Offering

23 KPMG: Products & Service Types Offering

24 PricewaterhouseCoopers (PwC): Products & Service Types Offering

25 Oracle: Products & Service Types Offering

26 Microsoft: Products & Service Types Offering

27 Other Companies: Products & Service Types Offering

LIST OF FIGURES

1 Netherlands Public Sector Market Overview

2 Netherlands Public Sector Market Value From 2021-2029 (USD Million)

3 Netherlands Public Sector Market Share, By Service Type (2023)

4 Netherlands Public Sector Market Share, By Industries Served (2023)

5 Technological Trends In Netherlands Public Sector Market

6 Four Quadrant Competitor Positioning Matrix

7 Impact Of Macro & Micro Indicators On The Market

8 Impact Of Key Drivers On The Netherlands Public Sector Market

9 Impact Of Challenges On The Netherlands Public Sector Market

10 Porter’s Five Forces Analysis

11 Netherlands Public Sector Market: By Service Type Scope Key Takeaways

12 Netherlands Public Sector Market, By Service Type Segment: Revenue Growth Analysis

13 Infrastructure Development and Management Market, By Country, 2021-2029 (USD Million)

14 Healthcare Services Market, By Country, 2021-2029 (USD Million)

15 Education Services Market, By Country, 2021-2029 (USD Million)

16 Social Services Market, By Country, 2021-2029 (USD Million)

17 Public Safety and Security Market, By Country, 2021-2029 (USD Million)

18 Transportation Services Market, By Country, 2021-2029 (USD Million)

19 Others Market, By Country, 2021-2029 (USD Million)

20 Netherlands Public Sector Market: By Industries Served Scope Key Takeaways

21 Netherlands Public Sector Market, By Industries Served Segment: Revenue Growth Analysis

22 Government Agencies and Ministries Market, By Country, 2021-2029 (USD Million)

23 Healthcare Institutions Market, By Country, 2021-2029 (USD Million)

24 Educational Institutions Market, By Country, 2021-2029 (USD Million)

25 Municipalities and Local Authorities Market, By Country, 2021-2029 (USD Million)

26 Public Safety Organizations Market, By Country, 2021-2029 (USD Million)

27 Transportation Authorities Market, By Country, 2021-2029 (USD Million)

28 Others Market, By Country, 2021-2029 (USD Million)

29 Four Quadrant Positioning Matrix

30 Company Market Share Analysis

31 Capgemini: Company Snapshot

32 Capgemini: SWOT Analysis

33 Capgemini: Geographic Presence

34 Accenture: Company Snapshot

35 Accenture: SWOT Analysis

36 Accenture: Geographic Presence

37 IBM: Company Snapshot

38 IBM: SWOT Analysis

39 IBM: Geographic Presence

40 Deloitte: Company Snapshot

41 Deloitte: Swot Analysis

42 Deloitte: Geographic Presence

43 CGI: Company Snapshot

44 CGI: SWOT Analysis

45 CGI: Geographic Presence

46 Atos: Company Snapshot

47 Atos: SWOT Analysis

48 Atos: Geographic Presence

49 KPMG: Company Snapshot

50 KPMG: SWOT Analysis

51 KPMG: Geographic Presence

52 PricewaterhouseCoopers (PwC): Company Snapshot

53 PricewaterhouseCoopers (PwC): SWOT Analysis

54 PricewaterhouseCoopers (PwC): Geographic Presence

55 Oracle.: Company Snapshot

56 Oracle.: SWOT Analysis

57 Oracle.: Geographic Presence

58 Microsoft: Company Snapshot

59 Microsoft: SWOT Analysis

60 Microsoft: Geographic Presence

61 Other Companies: Company Snapshot

62 Other Companies: SWOT Analysis

63 Other Companies: Geographic Presence

The Netherlands Public Sector Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Netherlands Public Sector Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS